Professional Documents

Culture Documents

BMS-FC-Corporate Failure

BMS-FC-Corporate Failure

Uploaded by

Danish SheikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BMS-FC-Corporate Failure

BMS-FC-Corporate Failure

Uploaded by

Danish SheikhCopyright:

Available Formats

PREDICTING FAILURE

OVERVIEW

Objective

! To discuss corporate failure and the impact of this on strategic planning.

CORPORATE

FAILURE

PREDICTING STRATEGIC

FAILURE REVIEW

! Limitations of ratios ! Periodicity

! Failure indicators ! Dynamic environments

! Z-scores

! Applying z-scores

! Icarus

Copyright Accountancy Tuition Centre Ltd 2001 2401

PREDICTING FAILURE

1 PREDICTING CORPORATE FAILURE

1.1 Introduction

Corporate failure defies precise definition (Altman, 1989).

Causes and symptoms of failure, as will be seen later, come in various forms and it is

up to management to deal with each situation as it arises.

Financial failure occurs when the enterprise has chronic and serious losses or when the

firm becomes insolvent with liabilities disproportionate to the assets. The generally

accepted reasons for corporate bankruptcy are poor management, autocratic leaders,

failure to operate successfully in the market place, or inability to pay debts when due.

These factors have all been implicated in the collapse of many companies.

1.2 The limitations of ratios

Altman et al, (1990) in their study point out that the following are some of the pitfalls

of financial accounting ratio analysis:

! Ratio analysis are based on historical data which are only relevant to the

period under investigation. They are therefore common-size reductive

devices which allows analysts to reduce both extremely small and large

financial data to lowest numbers or multiples. For example, a comparison of

£345, 678 to £567, 902 would be expressed by the ratio 0.6. Ratio analysis

simply summarises but is not capable of generalising (Argenti, 1975).

! The grouping of ratios and their interpretation is time consuming and costly.

The interpretation would normally be done on a piecemeal basis by human

experts because human experts lack the capacity to interpret financial trends

over say, a five year period all at once. This daunting exercise makes

analysts slow thus forcing management to employ more external professional

staff to handle financial information thus increasing the cost of granting

credit.

1.3 Failure indicators

It is clear that there is no one single cause of corporate failure. Many factors have been

implicated in the collapse of major companies or in the need for restructuring and re-

organisations. Often these factors occur in combination with one another. However,

given the complexity of business operations and influence of the external environment,

a simple model which considers these factors as predictors of corporate failure is

unlikely to be reliable. Indeed, if it were that simple, techniques such as ratio analysis

and multivariate analysis would be adequate.

1.4 The Z-score model (Altman)

Altman (1968) improved on Beaver's univariate method of analysis by introducing the

multivariate approach, which allows for the simultaneous consideration of several

Copyright Accountancy Tuition Centre Ltd 2001 2402

PREDICTING FAILURE

variables in the prediction of business failure. The approach is that of the multivariate

discriminant analysis (MDA). Discriminant analysis is a statistical technique used to

construct classification schemes so as to assign previous unclassified observations to

the appropriate group. Altman based his work on groups of appropriate financial

reports extracted from company accounting statements.

1.5 Applying the Z-score model

Z = 0.012X1 + 0.014X2 +.0033X3 + .006X4 + .999X5

In which Z = the overall solvency index and

X1 to X5 are the independent variables. (ie the ratios)

X1= Working Capital

Total Assets

X2= Retained Earnings

Total Assets

X3= Earnings before interest and tax

Total Assets

X4= Market value of Equity

Total Debt book value

X5= Total Sales

Total Assets

Altman used a MDA programme to calculate the numeric values as shown above. The

Z values were used to classify firms as either bankrupt or non bankrupt. Where the Z-

score was below 1.81, the firm was considered to be failing; where it was above 2.99 it

was healthy.

It was soon noted, however, that the differences between market capitalisation of US

corporations and UK counterparts varied significantly to make Altman's original model

predictively inaccurate when applied to UK companies in the same sector. These

results were later shown by Beaver (1966) to be less suitable under conditions different

from those used by Altman.

Bathory (1984) found that Altman's model could not be applied to UK based

companies and this led to further research being carried out.

1.5 Strategic drift – the Icarus paradox

Recall the Greek story of Daedalus and Icarus. The father, Daedalus, invented flight by

gluing bird feathers to the back and arms of himself and his son, Icarus. Icarus, taken

by his new ability flew too close to the sun, which melted the wax glue, and he fell to

his death. The moral: don't go too far with what you're good at.

This story characterises a fatal flaw in many leaders and organisations: they exaggerate

a strength to a fault.

Copyright Accountancy Tuition Centre Ltd 2001 2403

PREDICTING FAILURE

The Icarus Paradox: Miller (1990) proposed that many companies becomes so dazzled

by their early success that they believe more of the same type of effort is the way to

future success. The four categories of these companies are: craftsmen (concentrate too

much on engineering excellence), builders (diversify), pioneers (innovations), salesmen

(marketing)

After lengthy intervals of continued success, firms exhibit increased inertia and

insularity and fail to adapt to changing environments. Not only do resources

accumulated over time buffer the organisation from variation in the environment

(reducing the perceived need for change), but also the open and eager commitment of

powerful leaders to what have been proclaimed to be successful policies, makes

challenges by lower ranking members in the organisation less likely, even if the latter's

position “in the field” or “at the heart of the action” might uniquely qualify them to

offer such a critique.

Consider IBM and the losses it endured early this decade. Despite being the inventor

of the personal computer, IBM sat back and allowed others to reinvent that industry,

losing control over the direction and pace of technical change. “Big Blue went into

denial, channelling its massive resources into bucking the market rather than facing it”

(Economist, 6 June 1998, p. 66). Not only did it lose talented people, but the loyal

who remained were frustrated and disheartened. The radical transformation required

and eventually implemented by Lou Gerstner was in fact an organisational “cultural

revolution” (Allaire and Firsirotu, 1985) that revised the assumptions, terminology, and

normative aspects of organisational discourse at the highest levels of the cognitive

hierarchy (doctrine and ideology). “Products” became “services” and “sales” became

“solutions.” The newly empowered Global Services division acts as an efficient

intelligence and information gathering mechanism, “out there” with customers and

having an incentive structure encouraging brutal honesty when IBM products do not

meet its clients' needs.

Copyright Accountancy Tuition Centre Ltd 2001 2404

PREDICTING FAILURE

2 STRATEGIC REVIEW

2.1 Introduction

One of the ways to avoid, or at least lessen the risk of, corporate failure is to revise the

strategy.

2.2 Periodicity

There are many different arguments about how frequently a strategic plan should be

revised. In many organisations, planning is an annual process that is carried out

towards the end of the financial year and the first year of the plan becomes the next

year’s budget. This approach seems flawed for two reasons:

! Strategic variables do not conveniently change on an annual basis

! Knowing that they will be translating the strategic plan into a budget leads

planners to concentrate on the financial aspects of the plan and ignore the

qualitative (and often more strategically significant) aspects.

2.3 Dynamic environments

Because of the rate of change in the business environment, a number of different

approaches have been developed to cope with the problem of obsolescence in planning.

These are:

! Adaptive planning

! Interpretative planning

! Contingency planning

! Chaos theory

Each of these is outlined below.

2.3.1 Adaptive planning

Adaptive approaches to strategy formulation suggest that the organisation should be

continually on the lookout for changes in the strategic business environment, and

should change their plans as key variables change.

2.3.2 Interpretative planning

Interpretative planning suggests that the organisation should try to predict changes in

their environment and plan in advance of them.

2.3.3 Contingency planning

In this approach, the organisation prepares a number of plans, each based on a different

scenario or relating to a specific “contingency” or possible event. The most

appropriate plan, or plans, is then implemented and the remainder discarded.

Copyright Accountancy Tuition Centre Ltd 2001 2405

PREDICTING FAILURE

2.3.4 Chaos theory

In Thriving on Chaos, Tom Peters suggested that , due to the chaotic nature of the

business environment, organisations should plan to be equally chaotic. His view (and it

is somewhat extreme!) is that organisations should “destroy and reinvent themselves

every day”.

FOCUS

You should now be able to:

! understand indicators of failure

! discuss Z scores: Altman

! assess strategic drift: the Icarus Paradox

! analyse weak or inappropriate strategic leadership.

Copyright Accountancy Tuition Centre Ltd 2001 2406

You might also like

- Management by Objectives at Coca-ColaDocument3 pagesManagement by Objectives at Coca-ColaAlessandra MihaelaNo ratings yet

- Solution Manual of Chapter 1 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDocument22 pagesSolution Manual of Chapter 1 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerSEHA ÖZTÜRKNo ratings yet

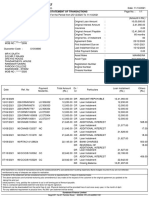

- Statement of Transactions: Sundaram Finance LimitedDocument1 pageStatement of Transactions: Sundaram Finance LimitedBhavin SagarNo ratings yet

- Smith and Graves Turnaround StrategiesDocument17 pagesSmith and Graves Turnaround StrategiesDr. Ehsan ul HassanNo ratings yet

- Bankruptcy Prediction Models-ArtikelDocument5 pagesBankruptcy Prediction Models-ArtikelLjiljana SorakNo ratings yet

- QuantConnect US Equities Asset ListDocument365 pagesQuantConnect US Equities Asset ListYannPascalNo ratings yet

- What Were The Challenges CTCC Encountered While Adopting BI? Consider The Management, Organization, and Technology FactorsDocument2 pagesWhat Were The Challenges CTCC Encountered While Adopting BI? Consider The Management, Organization, and Technology FactorsNarinderNo ratings yet

- Prediction of Financial Distress:-: Dr. N. S. RaoDocument19 pagesPrediction of Financial Distress:-: Dr. N. S. RaoAnkit KothariNo ratings yet

- Planning Reporting: Financial AnalysisDocument5 pagesPlanning Reporting: Financial Analysisriz2010No ratings yet

- Bussiness Failure in Construction IndustryDocument13 pagesBussiness Failure in Construction Industryhimanshu guptaNo ratings yet

- Strategic ManagementDocument25 pagesStrategic ManagementCMNo ratings yet

- Strategic Jet Blue UpdatedDocument28 pagesStrategic Jet Blue UpdatedSakshi SharmaNo ratings yet

- Grammatical Evolution and Corporate Failure Prediction: Anthony Brabazon Michael O'NeillDocument8 pagesGrammatical Evolution and Corporate Failure Prediction: Anthony Brabazon Michael O'NeillNebiyu SamuelNo ratings yet

- Business Failure Prediction 18 Sept 2010Document41 pagesBusiness Failure Prediction 18 Sept 2010Shariff MohamedNo ratings yet

- Exemplu Big BathDocument16 pagesExemplu Big BathValentin BurcaNo ratings yet

- Dwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFDocument35 pagesDwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFashermats100% (13)

- Full Download At:: Operations Management Operations and Supply Chain Management 14th Edition JacobsDocument12 pagesFull Download At:: Operations Management Operations and Supply Chain Management 14th Edition JacobsHoàng Thiên LamNo ratings yet

- Critical Analysis of Creative AccountingDocument17 pagesCritical Analysis of Creative AccountingRuben AragonNo ratings yet

- Business Failure: Prediction and PreventionDocument4 pagesBusiness Failure: Prediction and Preventionbibs213No ratings yet

- Sharma & Mahajan (1980) Early Warning Indicators of Business FailureDocument11 pagesSharma & Mahajan (1980) Early Warning Indicators of Business FailureLeDzungNo ratings yet

- Financial Statement FraudDocument19 pagesFinancial Statement FraudAulia HidayatNo ratings yet

- Predicting Corporate FailureDocument52 pagesPredicting Corporate FailureAutorix Investments100% (2)

- Bacc 402 Financial Stat 1Document9 pagesBacc 402 Financial Stat 1ItdarareNo ratings yet

- Identification of The Problems That Cause Organization Structure CollapseDocument16 pagesIdentification of The Problems That Cause Organization Structure CollapseFatiima Tuz ZahraNo ratings yet

- Uts Iqbal Maulana - 31602300049Document3 pagesUts Iqbal Maulana - 31602300049inianal69No ratings yet

- 3.0. Corpotate FailureDocument28 pages3.0. Corpotate Failurebac22-pdzinkambaniNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosMomal KhawajaNo ratings yet

- Emmanuel 1990Document28 pagesEmmanuel 1990LamssarbiNo ratings yet

- Determinants of Capital Structure ThesisDocument8 pagesDeterminants of Capital Structure Thesisgbwygt8n100% (1)

- What Makes A New Business Start-Up Successful? : Gavin C. Reid Julia A. SmithDocument18 pagesWhat Makes A New Business Start-Up Successful? : Gavin C. Reid Julia A. SmithNickNo ratings yet

- Failure MergersDocument23 pagesFailure MergersBrijesh Sarkar100% (1)

- SSRN Id2888365Document19 pagesSSRN Id2888365LeilaNo ratings yet

- Internal Control 1Document13 pagesInternal Control 1Natala WillzNo ratings yet

- Master of Business Administration-MBA Semester 4 MB0052 - Strategic Management and Business Policy (Book ID:)Document7 pagesMaster of Business Administration-MBA Semester 4 MB0052 - Strategic Management and Business Policy (Book ID:)Robins SaxenaNo ratings yet

- Mayanja Yasin ProposalDocument15 pagesMayanja Yasin ProposalSuleiman AbdulNo ratings yet

- Corporate Failure and Earning ManagementDocument21 pagesCorporate Failure and Earning ManagementKirtee EtwaraNo ratings yet

- Insead: How To Understand Financial AnalysisDocument9 pagesInsead: How To Understand Financial Analysis0asdf4No ratings yet

- Chapter 1 PDFDocument22 pagesChapter 1 PDFAftarur Rahaman AnikNo ratings yet

- Logistic Regression Model For Business Failures PRDocument6 pagesLogistic Regression Model For Business Failures PRSagar KansalNo ratings yet

- Chapter10 STRATEGIC MARKETING PLANNINGDocument17 pagesChapter10 STRATEGIC MARKETING PLANNINGKalkidanNo ratings yet

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimNo ratings yet

- Introduction To Dynamic Financial AnalysisDocument32 pagesIntroduction To Dynamic Financial AnalysisspectramindNo ratings yet

- Paper: SSRN-id900284Document37 pagesPaper: SSRN-id900284Alvira FajriNo ratings yet

- Class 1 - The Bigger PictureDocument33 pagesClass 1 - The Bigger PictureTae-Jin ParkNo ratings yet

- Z ScoreDocument6 pagesZ ScoreKapil JainNo ratings yet

- FM471 Sample ICA 20220407 - GF Sample Answers VsDocument4 pagesFM471 Sample ICA 20220407 - GF Sample Answers VsHan XiaNo ratings yet

- Contemporary Issues in Accounting: Solution ManualDocument12 pagesContemporary Issues in Accounting: Solution ManualDamien SmithNo ratings yet

- Case 3Document19 pagesCase 3Mafel LabadanNo ratings yet

- MB0052Document9 pagesMB0052RiazAboobackerNo ratings yet

- BI Case Issues AE-TeachingnotesDocument9 pagesBI Case Issues AE-TeachingnotesizzaNo ratings yet

- Five Key Asset Management StrategiesDocument6 pagesFive Key Asset Management StrategiesFemi ObiomahNo ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapNaveen RaajNo ratings yet

- Solutions - Chapter 5Document21 pagesSolutions - Chapter 5Dre ThathipNo ratings yet

- Corporate Failure AssignmentDocument12 pagesCorporate Failure AssignmentBaboulall BeckamNo ratings yet

- Maximizing The Value of G and ADocument5 pagesMaximizing The Value of G and AjrmachareNo ratings yet

- June 2011Document19 pagesJune 2011Murugesh Kasivel EnjoyNo ratings yet

- Capital Budgeting Decisions: Fadi Alkaraan and Trevor HopperDocument32 pagesCapital Budgeting Decisions: Fadi Alkaraan and Trevor Hopperh417d1k4No ratings yet

- Loss Distribution Approach For Operational RiskDocument43 pagesLoss Distribution Approach For Operational RiskC.R. SilvaNo ratings yet

- RM April 2021 MTP SDocument7 pagesRM April 2021 MTP SdsdsNo ratings yet

- The Macro Impact of Short-Termism15420-4Document45 pagesThe Macro Impact of Short-Termism15420-4dk773No ratings yet

- Christian Montgomery Johns Hopkins University-Carey Business School Business Communication - 120.601 (86) 5.8.2012Document11 pagesChristian Montgomery Johns Hopkins University-Carey Business School Business Communication - 120.601 (86) 5.8.2012xouyang3No ratings yet

- Cae07 All Chapter PDFDocument108 pagesCae07 All Chapter PDFJocelyn Sta AnaNo ratings yet

- Chapter 10 - Financial Performance and Investment AppraisalDocument10 pagesChapter 10 - Financial Performance and Investment AppraisalSteffany RoqueNo ratings yet

- Chapter 1 CompleteDocument34 pagesChapter 1 CompleteDanish SheikhNo ratings yet

- Chapter 2 CompleteDocument20 pagesChapter 2 CompleteDanish SheikhNo ratings yet

- Chapter 3 CompleteDocument31 pagesChapter 3 CompleteDanish SheikhNo ratings yet

- To Discuss The Major Issues in Human Resource Management (HRM)Document20 pagesTo Discuss The Major Issues in Human Resource Management (HRM)Danish SheikhNo ratings yet

- BMS-FC-Competitive ForcesDocument14 pagesBMS-FC-Competitive ForcesDanish SheikhNo ratings yet

- BMS-FC-Culture and Change CH # 8Document18 pagesBMS-FC-Culture and Change CH # 8Danish SheikhNo ratings yet

- The Future of Supply ChainDocument52 pagesThe Future of Supply ChainNoe SolanoNo ratings yet

- G12-Media-Ppt 17-Reading Printed and Visual MediaDocument22 pagesG12-Media-Ppt 17-Reading Printed and Visual MediaRICHY MARCELINONo ratings yet

- GRADE 10 Updated Core Notes 2022 Paper 2Document55 pagesGRADE 10 Updated Core Notes 2022 Paper 2cyonela5No ratings yet

- Sample Problems With Suggested Answers 2Document9 pagesSample Problems With Suggested Answers 2AnthonyNo ratings yet

- Cañete Midterm ExamDocument4 pagesCañete Midterm ExamPark WangjaNo ratings yet

- Cebu Country Club vs. Elizagaque (542 SCRA 65)Document2 pagesCebu Country Club vs. Elizagaque (542 SCRA 65)G SNo ratings yet

- Hospitality ServiceDocument13 pagesHospitality Serviceajit26scribdNo ratings yet

- Website Owners Guide To Stock PhotographyDocument37 pagesWebsite Owners Guide To Stock PhotographyCarolNideyNo ratings yet

- (Palgrave Macmillan Studies in Banking and Financial Institutions) Franco Fiordelisi, Philip Molyneux (Auth.) - Shareholder Value in Banking-Palgrave Macmillan UK (2006) PDFDocument359 pages(Palgrave Macmillan Studies in Banking and Financial Institutions) Franco Fiordelisi, Philip Molyneux (Auth.) - Shareholder Value in Banking-Palgrave Macmillan UK (2006) PDFAbouDickyNo ratings yet

- Appendix 6 - KPI and Supplier Performance Scorecard: ContextDocument4 pagesAppendix 6 - KPI and Supplier Performance Scorecard: ContextDewala KutaNo ratings yet

- 21PDM102L GA Worksheet1Document15 pages21PDM102L GA Worksheet1Yuvan Krishnan VNo ratings yet

- Lecture Note 1 - BSB315 - ASSET MANAGENT IN BUILDING SURVEYING PRACTICESDocument13 pagesLecture Note 1 - BSB315 - ASSET MANAGENT IN BUILDING SURVEYING PRACTICESnad normanNo ratings yet

- Klipen Packing and Palletizing Standard 2022Document35 pagesKlipen Packing and Palletizing Standard 2022Roger Manrrique NinaNo ratings yet

- Writing 10 Complex Sentences of The Topic Using A Social NetworkDocument4 pagesWriting 10 Complex Sentences of The Topic Using A Social NetworkQuyen29 MNo ratings yet

- Income Tax Part ADocument23 pagesIncome Tax Part AVishwas AgarwalNo ratings yet

- Silka (Lotion) AssignmentDocument3 pagesSilka (Lotion) AssignmentRhen Mae OsorioNo ratings yet

- Annex F - Sample Notes To FSDocument44 pagesAnnex F - Sample Notes To FSjaymark canayaNo ratings yet

- Chapter 21-Debt Restructuring, Corporate ReorDocument2 pagesChapter 21-Debt Restructuring, Corporate ReorLouiza Kyla AridaNo ratings yet

- Final Report Impact Evaluation Awang-Upi-Kalamansig-Palimbang-Sarangani Road-CompressedDocument152 pagesFinal Report Impact Evaluation Awang-Upi-Kalamansig-Palimbang-Sarangani Road-CompressedAnthonyNo ratings yet

- Revista de Venta de NegociosDocument60 pagesRevista de Venta de NegociosjjruttiNo ratings yet

- Memo Skeletal WorkforceDocument1 pageMemo Skeletal WorkforceFrancine Monte VerdeNo ratings yet

- Stice18e TB Ch11Document33 pagesStice18e TB Ch11Kate PimentelNo ratings yet

- Formulas: Volkswagen GroupDocument23 pagesFormulas: Volkswagen GroupMian MafeezNo ratings yet

- 5.1) BILL OF LADING ChileDocument1 page5.1) BILL OF LADING ChileARTURO BOYACANo ratings yet

- For MandateDocument3 pagesFor MandateCA KUSHAL JAISWALNo ratings yet

- Abm105 Module 1Document6 pagesAbm105 Module 1Neil CutterNo ratings yet