Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsEngineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)

Engineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)

Uploaded by

Lahiru Kosala Bandara LindamullaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Hardship COVIDTenant AttestationDocument1 pageHardship COVIDTenant AttestationFormatNo ratings yet

- CH Rate of Return AnalysisDocument31 pagesCH Rate of Return Analysiseclipseband7gmailcom100% (1)

- Unit 4B - Appraisal Techniques ContinuedDocument37 pagesUnit 4B - Appraisal Techniques ContinuedDavid KNo ratings yet

- Inde232 Chapter 1Document39 pagesInde232 Chapter 1Abdullah AfefNo ratings yet

- Chapter 3 - Cash Flow, Interest and EquivalenceDocument9 pagesChapter 3 - Cash Flow, Interest and EquivalenceSandip100% (1)

- Assignment of Financial Management 2Document31 pagesAssignment of Financial Management 2Hafizur RahmanNo ratings yet

- Module 2Document60 pagesModule 2lizNo ratings yet

- 1.0 Interest and Equivalence Part IDocument19 pages1.0 Interest and Equivalence Part ICelestialbearNo ratings yet

- Finance L4Document48 pagesFinance L4Rida RehmanNo ratings yet

- Homework Questions For Tutorial in Week 4 With SolutionDocument10 pagesHomework Questions For Tutorial in Week 4 With SolutionrickNo ratings yet

- Indian Financial Markets - IITBHU Unit1 Oct 2023 Ver f4Document120 pagesIndian Financial Markets - IITBHU Unit1 Oct 2023 Ver f4rajatprajapati2121No ratings yet

- Accounting & Financial Management: Session - 12 Capital Budgeting Decision RulesDocument40 pagesAccounting & Financial Management: Session - 12 Capital Budgeting Decision RulesahmedNo ratings yet

- Engineeringeconomics1 180421045801Document19 pagesEngineeringeconomics1 180421045801vielleshantelleNo ratings yet

- Week 2 Lecture Slides - Ch02Document39 pagesWeek 2 Lecture Slides - Ch02LuanNo ratings yet

- Unit 3 Capital BudgetingDocument34 pagesUnit 3 Capital BudgetingRishikesh MundekarNo ratings yet

- Engineering EconomyDocument87 pagesEngineering EconomyAbhishek KumarNo ratings yet

- Corporate Finance: Zan YangDocument38 pagesCorporate Finance: Zan YangMochtar SulaimanNo ratings yet

- Business Valuation: Rajiv Bhutani IIM Sambalpur 2018Document17 pagesBusiness Valuation: Rajiv Bhutani IIM Sambalpur 2018Aninda DuttaNo ratings yet

- Investment ApprasialDocument24 pagesInvestment ApprasialUsamaNo ratings yet

- Time Value of MoneyDocument38 pagesTime Value of MoneyVasanth Kumar100% (1)

- Chapter 3 Engineering EconomicsDocument27 pagesChapter 3 Engineering EconomicsharoonNo ratings yet

- Project Appraisal TechniquesDocument11 pagesProject Appraisal TechniquesChristineNo ratings yet

- Slideset.1.Economics CourseDocument34 pagesSlideset.1.Economics Courseيوسف عادل حسانينNo ratings yet

- Chapter - 4 - Cash Flow and InterestDocument19 pagesChapter - 4 - Cash Flow and InterestAhmed freshekNo ratings yet

- Learning Unit 6Document46 pagesLearning Unit 6Hazimah HasanNo ratings yet

- Revison CF 13.07.2023 (All)Document116 pagesRevison CF 13.07.2023 (All)seyon sithamparanathanNo ratings yet

- MODULE #2 Topic 1Document13 pagesMODULE #2 Topic 1Alen Genesis CoronelNo ratings yet

- Graham3e ppt10Document39 pagesGraham3e ppt10Lim Yu ChengNo ratings yet

- Lecture 10 - Capital Investment Decisions - JJDocument28 pagesLecture 10 - Capital Investment Decisions - JJTariq KhanNo ratings yet

- Busi 2401 Week 2 (CH 6)Document48 pagesBusi 2401 Week 2 (CH 6)Jason LeeNo ratings yet

- Chapter 5Document25 pagesChapter 5Ephrem ChernetNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- BF3326 Corporate Finance: Deciding Capital InvestmentDocument33 pagesBF3326 Corporate Finance: Deciding Capital InvestmentAmy LimnaNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- FE Review - EconomyDocument26 pagesFE Review - EconomylonerstarNo ratings yet

- 9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerDocument15 pages9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerMd SaifulNo ratings yet

- Spmunit 2 UpeerDocument36 pagesSpmunit 2 UpeerMayank TutejaNo ratings yet

- Capital InvestmentDocument34 pagesCapital InvestmentVincent WariwaNo ratings yet

- Engineering Economics CH 2Document81 pagesEngineering Economics CH 2karim kobeissiNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- Dani IFM AssignmentDocument9 pagesDani IFM AssignmentdanielNo ratings yet

- IpDocument11 pagesIpMd TariqueNo ratings yet

- Estimation of Project Cash FlowsDocument27 pagesEstimation of Project Cash Flowsdpu_bansal83241No ratings yet

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANNo ratings yet

- Engineering Economy_Rate of ReturnDocument31 pagesEngineering Economy_Rate of ReturnLinda KurniasariNo ratings yet

- FM Ch-3 Time Value of MoneyDocument40 pagesFM Ch-3 Time Value of MoneyMifta ShemsuNo ratings yet

- Project Viability FinalDocument79 pagesProject Viability FinalkapilNo ratings yet

- FM SemesterDocument19 pagesFM SemesterSanjay VNo ratings yet

- Financial Management-Lecture 6Document21 pagesFinancial Management-Lecture 6TinoManhangaNo ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- UNIT - 4-2 - Gursamey....Document27 pagesUNIT - 4-2 - Gursamey....demeketeme2013No ratings yet

- Chap 2Document51 pagesChap 2Eba GetachewNo ratings yet

- Lecture 2Document21 pagesLecture 2Samantha YuNo ratings yet

- Rate of Return Analysis: Week 11Document25 pagesRate of Return Analysis: Week 11Sonia FausaNo ratings yet

- Principal of Money - Time RelationshipsDocument26 pagesPrincipal of Money - Time RelationshipsAli TreeshNo ratings yet

- Ins3007 S4 SVDocument32 pagesIns3007 S4 SVnguyễnthùy dươngNo ratings yet

- Turki Home Assignmen٣t # 1 (chapters 1, 9, 10 and 13)Document4 pagesTurki Home Assignmen٣t # 1 (chapters 1, 9, 10 and 13)Miss AlbulaihedNo ratings yet

- 9 Capital Budgeting KirimDocument51 pages9 Capital Budgeting KirimMas SamiNo ratings yet

- Pitt - Edu Schlinge Fall99 L7docDocument40 pagesPitt - Edu Schlinge Fall99 L7docCheryl GanitNo ratings yet

- Lecture - Runoff 2 - SCS-CNDocument11 pagesLecture - Runoff 2 - SCS-CNLahiru Kosala Bandara LindamullaNo ratings yet

- Chapter 4 ProblemsDocument11 pagesChapter 4 ProblemsLahiru Kosala Bandara LindamullaNo ratings yet

- Sunlock Manual PDFDocument30 pagesSunlock Manual PDFLahiru Kosala Bandara LindamullaNo ratings yet

- Engineering Economics: Lectures 2 TopicsDocument46 pagesEngineering Economics: Lectures 2 TopicsLahiru Kosala Bandara LindamullaNo ratings yet

- Roof Specification For Solar PAnel Fixing PDFDocument2 pagesRoof Specification For Solar PAnel Fixing PDFLahiru Kosala Bandara LindamullaNo ratings yet

- Solid Waste Management in Srilanka: 1. Legislation On SWMDocument6 pagesSolid Waste Management in Srilanka: 1. Legislation On SWMLahiru Kosala Bandara LindamullaNo ratings yet

- FLSmidth LUDOFLEX Rubber and Ceramic Lined Material Handling HosesBrochure ExternalDocument7 pagesFLSmidth LUDOFLEX Rubber and Ceramic Lined Material Handling HosesBrochure ExternalAbhi SinghNo ratings yet

- Sag DRG-1Document6 pagesSag DRG-1rupesh417No ratings yet

- BS 6004-12Document34 pagesBS 6004-12jamilNo ratings yet

- Customer Based Brand Equity PyramidDocument21 pagesCustomer Based Brand Equity Pyramidsaritaon_1985100% (1)

- Chapter 4 Why Do Interest Rates ChangeDocument13 pagesChapter 4 Why Do Interest Rates ChangeJay Ann DomeNo ratings yet

- Adopted Consultative Dialogue Framework - Nov.2012Document72 pagesAdopted Consultative Dialogue Framework - Nov.2012SundayNo ratings yet

- Anna University: Centre For Distance EducationDocument1 pageAnna University: Centre For Distance EducationMeghal SivanNo ratings yet

- Kolotan 5A - DeEDDocument14 pagesKolotan 5A - DeEDAl Mahmud HasanNo ratings yet

- 2.5 Economic Growth: DefinitionsDocument4 pages2.5 Economic Growth: DefinitionsAryan KalyanamNo ratings yet

- ASME P NumberDocument4 pagesASME P NumberZariq BahrinNo ratings yet

- Apollo Medicine InvoiceMay 19 2022 15 11Document1 pageApollo Medicine InvoiceMay 19 2022 15 11CA Sumit GargNo ratings yet

- Financial MathDocument50 pagesFinancial Mathfabricioace1978No ratings yet

- MONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDocument47 pagesMONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDDE1964100% (1)

- Unit 5 Acceptance Sampling Plans: StructureDocument18 pagesUnit 5 Acceptance Sampling Plans: Structurevinay100% (2)

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- Critical SolvingDocument76 pagesCritical SolvingAdner CabaloNo ratings yet

- MAE - Pratice - Cost Sheet - SolutionDocument12 pagesMAE - Pratice - Cost Sheet - SolutionDhairya MudgalNo ratings yet

- New QC MPR Format, Oct.22,09.11.2022Document14 pagesNew QC MPR Format, Oct.22,09.11.2022Devendra SinghNo ratings yet

- Jasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiDocument4 pagesJasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiGogot YuliyantoNo ratings yet

- Risk Management in ConstructionDocument10 pagesRisk Management in ConstructionNiharika SharmaNo ratings yet

- Oleh:: Jutawan Dua LogamDocument42 pagesOleh:: Jutawan Dua LogamMustaffa Bin HashimNo ratings yet

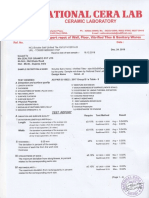

- 12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Document3 pages12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Shaikh MohammedHanifSultanNo ratings yet

- Activity Based CostingDocument37 pagesActivity Based CostingnuraidaNo ratings yet

- Housing Price TrackerDocument14 pagesHousing Price Trackervenu4u498No ratings yet

- 065 Sco 18072023 Icumsa 45 JordanDocument6 pages065 Sco 18072023 Icumsa 45 JordanRehmat KaurNo ratings yet

- Optimal Portfolio Strategy To Control Maximum DrawdownDocument35 pagesOptimal Portfolio Strategy To Control Maximum DrawdownLoulou DePanamNo ratings yet

- RFP2Document122 pagesRFP2RAMKRIPAL SINGH CONSTRUCTION PVT. LTD.No ratings yet

- List of Registered MSBs As of September 2020Document24 pagesList of Registered MSBs As of September 2020Leonard Alfred BadongNo ratings yet

- Liquidity Grab With Support & Resistance IndicatorDocument6 pagesLiquidity Grab With Support & Resistance Indicatorst augusNo ratings yet

Engineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)

Engineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)

Uploaded by

Lahiru Kosala Bandara Lindamulla0 ratings0% found this document useful (0 votes)

14 views21 pagesOriginal Title

Lecture 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views21 pagesEngineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)

Engineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)

Uploaded by

Lahiru Kosala Bandara LindamullaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 21

Engineering Economics

Lectures 3 Topics:

1) Time value of money

2) Interest concepts

3) Cash Flow Diagram (CFD)

Saleh Abu Dabous 0401301 1

Time Value of Money

• Money is a valuable asset that can be

rented and the charge is called interest.

• Money can “make” money if Invested at a

specific interest rate.

The change in the amount of money over a

given time period is called the time value of

money; by far, the most important concept in

engineering economy.

Saleh Abu Dabous 0401301 2

• Would you rather receiving $1000 today or

$1000 one year from now?

• If interest rate = 9% per year and you

invest $1000.

At the end of the year you will get:

– original amount of $1000.

– Interest of $90

• Receiving $1000 now better alternative

than receiving $1000 after one year.

– This because time value of money.

Saleh Abu Dabous 0401301 3

Interest:

• Interest is manifestation of the time value

of money.

– The amount paid to use money.

• Two prospective:

– Interest paid: When a person or organization

borrowed money (loan) and repays larger

amount.

– Interest earned: When a person or

organization saved (invested or lent) money

and obtains a return of larger amount

Saleh Abu Dabous 0401301 4

• Interest amount to date can be estimated

as:

Interest = amount owed – original amount

interest per unit time

Interest rate (%) = 100%

original amount

Example

You borrow $10,000 for one full year and you must

pay back $10,700 at the end of one year. Estimate

the interest amount and the interest rate.

The interest amount is $700 and the rate is 7%.

Saleh Abu Dabous 0401301 5

Rate of Return:

• Interest earned over a specific period of

time is expressed as a percentage of the

original amount is called Rate of Return

(ROR).

• Investors (individuals and corporations)

expect to receive more money than the

amount initially invested.

– Some reasonable ROR can be defined for this

purpose. This ROR is defined as the Minimum

Attractive Rate of Return (MARR).

Saleh Abu Dabous 0401301 6

Example:

If your MARR on your investments is 5%. I asked

you to lend me $5000 and I will pay you back

$5150 after 1 year. Would you accept?

ROR = (5150 – 5000) / 5000 = 3% < 5%

So you reject the request.

• Two types of interest exist:

– Simple interest

– Compound interest

Saleh Abu Dabous 0401301 7

1) Simple Interest:

• Interest that is computed only on the

original sum or principal.

• Total interest earned = P x i x n

– Where:

• P – present sum of money.

• i – interest rate.

• n – number of periods (years).

• Future worth (F) after n periods is the

present worth (P) plus the interest and

equals: F = P + P x i x n

Saleh Abu Dabous 0401301 8

Example:

You lend a friend $5000 for 5 years at a simple

interest rate of 8% per year.

1)How much interest will you receive?

2)How much will your friend pay you at the end of

The 5 years?

Solution: (See the following table)

1) Total interest earned = P x i x n

= ($5000)(0.08)(5 yrs) = $2000

2) Amount due at the end of the loan =P+P x i x n

= 5000 + 2000 = $7000

Saleh Abu Dabous 0401301 9

Total Principal Interest owed Total amount

on which at the end of due at the end

Year interest is year n of year n

calculated in

year n

1 $5000 $5000 x 0.08 = 5000 + 400

400 = 5400

2 5000 $5000 x 0.08 = 5400 + 400

400 = 5800

3 5000 $5000 x 0.08 = 5800 + 400

400 = 6200

4 5000 $5000 x 0.08 6200 + 400

= 400 = 6600

5 5000 $5000 x 0.08 6600 + 400

= 400 = 7000

Saleh Abu Dabous 0401301 10

2) Compound Interest

• Interest that is computed on the original

principal plus the incurred interest from the

previous years.

• In practice, interest is computed by the

compound interest method.

Saleh Abu Dabous 0401301 11

Example:

You lend a friend $5000 for 5 years at a compound

interest rate of 8% per year.

1) How much will your friend pay you at the end of

year 5?

2) How much interest will you receive?

Solution: (See the following table)

1) Amount due at the end of the loan = $7347

2) Total interest earned = 7347 – 5000 = $2347

Saleh Abu Dabous 0401301 12

Total Principal Interest owed Total amount

on which at the end of due at the end

Year interest is year n of year n

calculated in

year n

1 $5000 $5000 x 0.08 = 5000 + 400

400 = 5400

2 5400 5400 x 0.08 = 5400 + 432

432 = 5832

3 5832 5832 x 0.08 = 5832 + 467

467 = 6299

4 6299 6299 x 0.08 = 6299 + 504

504 = 6803

5 6803 6803 x 0.08 = 6803 + 544

544 = 7347

Saleh Abu Dabous 0401301 13

• Classification of the different cost

concepts:

– Fixed costs are constant regardless of the level of output

or productivity. In contrast variable costs depend on the

level of output or activity.

– Marginal cost is the cost for one more unit, while average

cost is the total cost divided by the number of units.

– Sunk cost is money already spent as a result of past

decision.

• Sunk cost should be disregarded in our engineering

economic analysis because current decisions cannot

change the past.

Saleh Abu Dabous ENGR301/AB 14

• Classification of the different cost

concepts:

– Opportunity cost is associated with using a

resource in one activity instead of another.

• Every time we use a business resource (equipment,

dollar, manpower, etc.) in one activity we give up the

opportunity to use the same resource in that time in

some other activity.

– Incremental costs refer to the principle that when

one makes a choice among a set of competing

alternatives, the emphasis should be on the

differences between those alternatives.

Saleh Abu Dabous ENGR301/AB 15

Cash Flow Diagram (CFD):

• Evaluating a set of feasible alternatives

requires understanding of the costs and

benefits concepts.

• Cash Flow Diagrams are used to model

benefits and costs (inflow and outflow)

through out the life cycle of engineering

projects or potential alternatives.

• CFD is the basis for engineering economic

analysis.

Saleh Abu Dabous 0401301 16

Cash Flow Diagram (CFD):

• CFD illustrates:

– Size of each individual cash flow

– Sign (+ Receipts=Inflow; - Expense=outflow)

– Timing.

• CFD is based on end-of-period convention

that means all cash flows are assumed to

occur at the end of an interest period.

Saleh Abu Dabous 0401301 17

FIGURE: An example cash flow diagram (CFD).

Timing of Cash Flow Size of Cash Flow

At time zero (today) A positive cash flow of $100

1 time period from today A negative cash flow of $100

2 time periods from today A positive cash flow of $100

3 time periods from today A negative cash flow of $150

4 time periods from today A negative cash flow of $150

5 time periods from today A positive cash flow of $50

Saleh Abu Dabous 0401301 18

Categories of Cash Flows:

• Expense and receipts for engineering

project fall into one of the following

categories:

• First cost: expense to build or buy.

• Operation and maintenance (O&M): annual

expense such as electricity, labour, and repair.

• Revenues: annual receipts due to sale of products

or services.

• Overhaul: major expenditure during the life of the

asset.

Saleh Abu Dabous 0401301 19

Example:

The manager has decided to purchase a new $30,000 machine. The

machine may be paid for in one of two ways:

1) Pay the full price now minus 3% discount.

2) Pay $5000 now; at the end of one year, pay 8000; at the end of

the next four years, pay $6000.

List the alternatives in form of table cash flow and cash flow diagram.

Solution:

-Table cash flow:

End of Year Pay in Full Now Pay over 5 Years

0 (Now) -$29,100 -$5000

1 0 -8000

2 0 -6000

3 0 -6000

4 0 -6000

5 0 -6000

Saleh Abu Dabous 0401301 20

Cash Flow Diagram:

-Pay in full now:

0 1 2 3 4 5

29,100

- Pay over 5 years:

0 1 2 3 4 5

5000 6000 6000 6000 6000

8000

Saleh Abu Dabous 0401301 21

You might also like

- Hardship COVIDTenant AttestationDocument1 pageHardship COVIDTenant AttestationFormatNo ratings yet

- CH Rate of Return AnalysisDocument31 pagesCH Rate of Return Analysiseclipseband7gmailcom100% (1)

- Unit 4B - Appraisal Techniques ContinuedDocument37 pagesUnit 4B - Appraisal Techniques ContinuedDavid KNo ratings yet

- Inde232 Chapter 1Document39 pagesInde232 Chapter 1Abdullah AfefNo ratings yet

- Chapter 3 - Cash Flow, Interest and EquivalenceDocument9 pagesChapter 3 - Cash Flow, Interest and EquivalenceSandip100% (1)

- Assignment of Financial Management 2Document31 pagesAssignment of Financial Management 2Hafizur RahmanNo ratings yet

- Module 2Document60 pagesModule 2lizNo ratings yet

- 1.0 Interest and Equivalence Part IDocument19 pages1.0 Interest and Equivalence Part ICelestialbearNo ratings yet

- Finance L4Document48 pagesFinance L4Rida RehmanNo ratings yet

- Homework Questions For Tutorial in Week 4 With SolutionDocument10 pagesHomework Questions For Tutorial in Week 4 With SolutionrickNo ratings yet

- Indian Financial Markets - IITBHU Unit1 Oct 2023 Ver f4Document120 pagesIndian Financial Markets - IITBHU Unit1 Oct 2023 Ver f4rajatprajapati2121No ratings yet

- Accounting & Financial Management: Session - 12 Capital Budgeting Decision RulesDocument40 pagesAccounting & Financial Management: Session - 12 Capital Budgeting Decision RulesahmedNo ratings yet

- Engineeringeconomics1 180421045801Document19 pagesEngineeringeconomics1 180421045801vielleshantelleNo ratings yet

- Week 2 Lecture Slides - Ch02Document39 pagesWeek 2 Lecture Slides - Ch02LuanNo ratings yet

- Unit 3 Capital BudgetingDocument34 pagesUnit 3 Capital BudgetingRishikesh MundekarNo ratings yet

- Engineering EconomyDocument87 pagesEngineering EconomyAbhishek KumarNo ratings yet

- Corporate Finance: Zan YangDocument38 pagesCorporate Finance: Zan YangMochtar SulaimanNo ratings yet

- Business Valuation: Rajiv Bhutani IIM Sambalpur 2018Document17 pagesBusiness Valuation: Rajiv Bhutani IIM Sambalpur 2018Aninda DuttaNo ratings yet

- Investment ApprasialDocument24 pagesInvestment ApprasialUsamaNo ratings yet

- Time Value of MoneyDocument38 pagesTime Value of MoneyVasanth Kumar100% (1)

- Chapter 3 Engineering EconomicsDocument27 pagesChapter 3 Engineering EconomicsharoonNo ratings yet

- Project Appraisal TechniquesDocument11 pagesProject Appraisal TechniquesChristineNo ratings yet

- Slideset.1.Economics CourseDocument34 pagesSlideset.1.Economics Courseيوسف عادل حسانينNo ratings yet

- Chapter - 4 - Cash Flow and InterestDocument19 pagesChapter - 4 - Cash Flow and InterestAhmed freshekNo ratings yet

- Learning Unit 6Document46 pagesLearning Unit 6Hazimah HasanNo ratings yet

- Revison CF 13.07.2023 (All)Document116 pagesRevison CF 13.07.2023 (All)seyon sithamparanathanNo ratings yet

- MODULE #2 Topic 1Document13 pagesMODULE #2 Topic 1Alen Genesis CoronelNo ratings yet

- Graham3e ppt10Document39 pagesGraham3e ppt10Lim Yu ChengNo ratings yet

- Lecture 10 - Capital Investment Decisions - JJDocument28 pagesLecture 10 - Capital Investment Decisions - JJTariq KhanNo ratings yet

- Busi 2401 Week 2 (CH 6)Document48 pagesBusi 2401 Week 2 (CH 6)Jason LeeNo ratings yet

- Chapter 5Document25 pagesChapter 5Ephrem ChernetNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- BF3326 Corporate Finance: Deciding Capital InvestmentDocument33 pagesBF3326 Corporate Finance: Deciding Capital InvestmentAmy LimnaNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- FE Review - EconomyDocument26 pagesFE Review - EconomylonerstarNo ratings yet

- 9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerDocument15 pages9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerMd SaifulNo ratings yet

- Spmunit 2 UpeerDocument36 pagesSpmunit 2 UpeerMayank TutejaNo ratings yet

- Capital InvestmentDocument34 pagesCapital InvestmentVincent WariwaNo ratings yet

- Engineering Economics CH 2Document81 pagesEngineering Economics CH 2karim kobeissiNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- Dani IFM AssignmentDocument9 pagesDani IFM AssignmentdanielNo ratings yet

- IpDocument11 pagesIpMd TariqueNo ratings yet

- Estimation of Project Cash FlowsDocument27 pagesEstimation of Project Cash Flowsdpu_bansal83241No ratings yet

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANNo ratings yet

- Engineering Economy_Rate of ReturnDocument31 pagesEngineering Economy_Rate of ReturnLinda KurniasariNo ratings yet

- FM Ch-3 Time Value of MoneyDocument40 pagesFM Ch-3 Time Value of MoneyMifta ShemsuNo ratings yet

- Project Viability FinalDocument79 pagesProject Viability FinalkapilNo ratings yet

- FM SemesterDocument19 pagesFM SemesterSanjay VNo ratings yet

- Financial Management-Lecture 6Document21 pagesFinancial Management-Lecture 6TinoManhangaNo ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- UNIT - 4-2 - Gursamey....Document27 pagesUNIT - 4-2 - Gursamey....demeketeme2013No ratings yet

- Chap 2Document51 pagesChap 2Eba GetachewNo ratings yet

- Lecture 2Document21 pagesLecture 2Samantha YuNo ratings yet

- Rate of Return Analysis: Week 11Document25 pagesRate of Return Analysis: Week 11Sonia FausaNo ratings yet

- Principal of Money - Time RelationshipsDocument26 pagesPrincipal of Money - Time RelationshipsAli TreeshNo ratings yet

- Ins3007 S4 SVDocument32 pagesIns3007 S4 SVnguyễnthùy dươngNo ratings yet

- Turki Home Assignmen٣t # 1 (chapters 1, 9, 10 and 13)Document4 pagesTurki Home Assignmen٣t # 1 (chapters 1, 9, 10 and 13)Miss AlbulaihedNo ratings yet

- 9 Capital Budgeting KirimDocument51 pages9 Capital Budgeting KirimMas SamiNo ratings yet

- Pitt - Edu Schlinge Fall99 L7docDocument40 pagesPitt - Edu Schlinge Fall99 L7docCheryl GanitNo ratings yet

- Lecture - Runoff 2 - SCS-CNDocument11 pagesLecture - Runoff 2 - SCS-CNLahiru Kosala Bandara LindamullaNo ratings yet

- Chapter 4 ProblemsDocument11 pagesChapter 4 ProblemsLahiru Kosala Bandara LindamullaNo ratings yet

- Sunlock Manual PDFDocument30 pagesSunlock Manual PDFLahiru Kosala Bandara LindamullaNo ratings yet

- Engineering Economics: Lectures 2 TopicsDocument46 pagesEngineering Economics: Lectures 2 TopicsLahiru Kosala Bandara LindamullaNo ratings yet

- Roof Specification For Solar PAnel Fixing PDFDocument2 pagesRoof Specification For Solar PAnel Fixing PDFLahiru Kosala Bandara LindamullaNo ratings yet

- Solid Waste Management in Srilanka: 1. Legislation On SWMDocument6 pagesSolid Waste Management in Srilanka: 1. Legislation On SWMLahiru Kosala Bandara LindamullaNo ratings yet

- FLSmidth LUDOFLEX Rubber and Ceramic Lined Material Handling HosesBrochure ExternalDocument7 pagesFLSmidth LUDOFLEX Rubber and Ceramic Lined Material Handling HosesBrochure ExternalAbhi SinghNo ratings yet

- Sag DRG-1Document6 pagesSag DRG-1rupesh417No ratings yet

- BS 6004-12Document34 pagesBS 6004-12jamilNo ratings yet

- Customer Based Brand Equity PyramidDocument21 pagesCustomer Based Brand Equity Pyramidsaritaon_1985100% (1)

- Chapter 4 Why Do Interest Rates ChangeDocument13 pagesChapter 4 Why Do Interest Rates ChangeJay Ann DomeNo ratings yet

- Adopted Consultative Dialogue Framework - Nov.2012Document72 pagesAdopted Consultative Dialogue Framework - Nov.2012SundayNo ratings yet

- Anna University: Centre For Distance EducationDocument1 pageAnna University: Centre For Distance EducationMeghal SivanNo ratings yet

- Kolotan 5A - DeEDDocument14 pagesKolotan 5A - DeEDAl Mahmud HasanNo ratings yet

- 2.5 Economic Growth: DefinitionsDocument4 pages2.5 Economic Growth: DefinitionsAryan KalyanamNo ratings yet

- ASME P NumberDocument4 pagesASME P NumberZariq BahrinNo ratings yet

- Apollo Medicine InvoiceMay 19 2022 15 11Document1 pageApollo Medicine InvoiceMay 19 2022 15 11CA Sumit GargNo ratings yet

- Financial MathDocument50 pagesFinancial Mathfabricioace1978No ratings yet

- MONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDocument47 pagesMONITORING AND EVALUATION FOR RESULTS - PSNP Presentation - For Woreda-AdamaDDE1964100% (1)

- Unit 5 Acceptance Sampling Plans: StructureDocument18 pagesUnit 5 Acceptance Sampling Plans: Structurevinay100% (2)

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- Critical SolvingDocument76 pagesCritical SolvingAdner CabaloNo ratings yet

- MAE - Pratice - Cost Sheet - SolutionDocument12 pagesMAE - Pratice - Cost Sheet - SolutionDhairya MudgalNo ratings yet

- New QC MPR Format, Oct.22,09.11.2022Document14 pagesNew QC MPR Format, Oct.22,09.11.2022Devendra SinghNo ratings yet

- Jasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiDocument4 pagesJasa & Part Dozer Wira Doni Trakindo Medan Quot - V2 - D6R2 - XL - TTT00306 - Repair - Maintenance - Brake - PT. - Aruan - Cipta - EnergiGogot YuliyantoNo ratings yet

- Risk Management in ConstructionDocument10 pagesRisk Management in ConstructionNiharika SharmaNo ratings yet

- Oleh:: Jutawan Dua LogamDocument42 pagesOleh:: Jutawan Dua LogamMustaffa Bin HashimNo ratings yet

- 12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Document3 pages12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Shaikh MohammedHanifSultanNo ratings yet

- Activity Based CostingDocument37 pagesActivity Based CostingnuraidaNo ratings yet

- Housing Price TrackerDocument14 pagesHousing Price Trackervenu4u498No ratings yet

- 065 Sco 18072023 Icumsa 45 JordanDocument6 pages065 Sco 18072023 Icumsa 45 JordanRehmat KaurNo ratings yet

- Optimal Portfolio Strategy To Control Maximum DrawdownDocument35 pagesOptimal Portfolio Strategy To Control Maximum DrawdownLoulou DePanamNo ratings yet

- RFP2Document122 pagesRFP2RAMKRIPAL SINGH CONSTRUCTION PVT. LTD.No ratings yet

- List of Registered MSBs As of September 2020Document24 pagesList of Registered MSBs As of September 2020Leonard Alfred BadongNo ratings yet

- Liquidity Grab With Support & Resistance IndicatorDocument6 pagesLiquidity Grab With Support & Resistance Indicatorst augusNo ratings yet