Professional Documents

Culture Documents

Problem 28: Investments, by Bodie, Kane, and Marcus, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 21

Problem 28: Investments, by Bodie, Kane, and Marcus, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 21

Uploaded by

Bona Christanto SiahaanCopyright:

Available Formats

You might also like

- Chapter 5 - Build A Model SpreadsheetDocument6 pagesChapter 5 - Build A Model SpreadsheetUdit Agrawal100% (1)

- E0311 Hallstead JewelersDocument2 pagesE0311 Hallstead Jewelersaltemurcan kursunlu100% (1)

- Expert AnswerDocument5 pagesExpert AnswerEmmanuel Kibaya OmbiroNo ratings yet

- Credit Suisse - SkewDocument11 pagesCredit Suisse - Skewhc87No ratings yet

- Ch05 P24 Build A ModelDocument5 pagesCh05 P24 Build A ModelCristianoF7No ratings yet

- 15profit Maximization Past PaperDocument6 pages15profit Maximization Past PaperJacquelyn ChungNo ratings yet

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- Assignment 5.4 Exercises: Calculation of The Holding Period Return?Document32 pagesAssignment 5.4 Exercises: Calculation of The Holding Period Return?Joel Christian Mascariña0% (1)

- Mock Exam Portfolio Theory 2020 With AnswersDocument10 pagesMock Exam Portfolio Theory 2020 With AnswersSamir Ismail100% (1)

- Ba0508 19-20 1Document8 pagesBa0508 19-20 1ccNo ratings yet

- Jun18l1equ-C02 Qa PDFDocument3 pagesJun18l1equ-C02 Qa PDFjuanNo ratings yet

- Final Exam Financial Management Antonius Cliff Setiawan 29119033Document20 pagesFinal Exam Financial Management Antonius Cliff Setiawan 29119033Antonius CliffSetiawan100% (4)

- Asignacion Unidad 2Document6 pagesAsignacion Unidad 2Angel L Rolon TorresNo ratings yet

- Chapter 7Document11 pagesChapter 7Muhammad WaqasNo ratings yet

- A Project Report On Online Trading FinalDocument96 pagesA Project Report On Online Trading FinalAnuj Bansal75% (8)

- Extra-Credit DerivativesDocument14 pagesExtra-Credit DerivativeschaabanifediNo ratings yet

- FINC600 Homework Template Week 3 Jan2013Document16 pagesFINC600 Homework Template Week 3 Jan2013joeNo ratings yet

- Ch.14 AnsDocument9 pagesCh.14 AnsWaSx3lyNo ratings yet

- Sensitivity Analysis Using Excel PDFDocument8 pagesSensitivity Analysis Using Excel PDFvxspidy100% (1)

- Chapter 3Document12 pagesChapter 3Thea BacsaNo ratings yet

- Quick Tour of Microsoft Excel Solver: Color CodingDocument6 pagesQuick Tour of Microsoft Excel Solver: Color CodingKhalid EurekaNo ratings yet

- SolvsampDocument15 pagesSolvsampHello WorldNo ratings yet

- SolvsampDocument12 pagesSolvsampTabassum AkhtarNo ratings yet

- Jun18l1equ-C01 QaDocument5 pagesJun18l1equ-C01 Qarafav10No ratings yet

- Week 5 Take Home Assignment Questions-Semester 1 2024-3 Jaime DurkinDocument13 pagesWeek 5 Take Home Assignment Questions-Semester 1 2024-3 Jaime DurkinMr Christ101No ratings yet

- 15 Comm 308 Final Exam (Fall 2012) SolutionsDocument18 pages15 Comm 308 Final Exam (Fall 2012) SolutionsAfafe ElNo ratings yet

- ACCA Performance Management (PM) Dec 22 AsDocument12 pagesACCA Performance Management (PM) Dec 22 AskaterinayasinskyNo ratings yet

- Question: The Total Market Value of The Common Stock of The OkefenokeDocument4 pagesQuestion: The Total Market Value of The Common Stock of The OkefenokeUzair Ahmed SoomroNo ratings yet

- C. Maximize ProfitDocument5 pagesC. Maximize ProfitSeyoum LeulNo ratings yet

- Mês Total Sazonalidade Valor Das VendasDocument6 pagesMês Total Sazonalidade Valor Das VendasEmerson CesarNo ratings yet

- SMM200 Derivatives and Risk Management 2021 QuestionsDocument5 pagesSMM200 Derivatives and Risk Management 2021 Questionsminh daoNo ratings yet

- 03 PS7 PTDocument2 pages03 PS7 PThatemNo ratings yet

- JUN18L1EQU/C01: Accurate About The Index?Document3 pagesJUN18L1EQU/C01: Accurate About The Index?rafav10No ratings yet

- Scenario Sensitivity Analysis in Excel Cfi AnswersDocument6 pagesScenario Sensitivity Analysis in Excel Cfi AnswersAbduselam AliyiNo ratings yet

- 3.EF232.FIMIL II Question CMA September 2022 Exam.Document8 pages3.EF232.FIMIL II Question CMA September 2022 Exam.nobiNo ratings yet

- Spreadsheet NotesDocument3 pagesSpreadsheet NotesTakudzwa MuperiNo ratings yet

- Seminar 1Document5 pagesSeminar 1EnnyNo ratings yet

- Ch05 P24 Build A ModelDocument6 pagesCh05 P24 Build A ModelРоман УдовичкоNo ratings yet

- Practice Questions AnswersDocument5 pagesPractice Questions Answersyida chenNo ratings yet

- Homework 4Document7 pagesHomework 4Liam100% (1)

- You Have To Answer in The Question PaperDocument6 pagesYou Have To Answer in The Question PaperDavid ViksarNo ratings yet

- Managemnt AssigmnetDocument19 pagesManagemnt AssigmnetSAMUEL DEBEBENo ratings yet

- Chapter 2 - AFM - UEH - F2023 - ExercicesDocument3 pagesChapter 2 - AFM - UEH - F2023 - Exercicestoantran.31211025392No ratings yet

- Practice Exam 2020 2.0 in Corporate FinanceDocument5 pagesPractice Exam 2020 2.0 in Corporate FinanceNikolai PriessNo ratings yet

- (C-3.1) SpreadsheetsDocument5 pages(C-3.1) SpreadsheetsRomail QaziNo ratings yet

- ......... May 22 QPDocument32 pages......... May 22 QPYuvipro gidwaniNo ratings yet

- Lab-5 Journal Template-26032020-074026amDocument8 pagesLab-5 Journal Template-26032020-074026amFadi KhanNo ratings yet

- 8725377Document8 pages8725377Ashish BhallaNo ratings yet

- Session 5 - Cost of CapitalDocument49 pagesSession 5 - Cost of CapitalMuhammad HanafiNo ratings yet

- Review Guide For Exam 2 of BUS 172C (SP 2018)Document16 pagesReview Guide For Exam 2 of BUS 172C (SP 2018)Erwin SantosoNo ratings yet

- WORD & ExcelDocument11 pagesWORD & Exceldennistom.chackoNo ratings yet

- Quick Tour of Microsoft Excel Solver: 419525239Document15 pagesQuick Tour of Microsoft Excel Solver: 419525239Yl Wong100% (1)

- Eco 389 Corporate Finance / Tutorialoutlet Dot ComDocument13 pagesEco 389 Corporate Finance / Tutorialoutlet Dot Comalbert0077No ratings yet

- 9708_w02_qp_4Document3 pages9708_w02_qp_4aadya.shrestha1206No ratings yet

- PDF Test Bank For Exploring Microsoft Office Excel 2019 Comprehensive 1St Edition Mary Anne Poatsy Online Ebook Full ChapterDocument45 pagesPDF Test Bank For Exploring Microsoft Office Excel 2019 Comprehensive 1St Edition Mary Anne Poatsy Online Ebook Full Chaptersarah.brown558100% (7)

- JUNIOR AUDITOR (POST CODE-759) PaperDocument32 pagesJUNIOR AUDITOR (POST CODE-759) Paperrishab bhagtaNo ratings yet

- Business Mathematics & Statistics (MTH 302)Document10 pagesBusiness Mathematics & Statistics (MTH 302)John WickNo ratings yet

- Topic 1 - Homework1 SoluntionDocument5 pagesTopic 1 - Homework1 SoluntionTsz Wei CHANNo ratings yet

- Microeconomics 9th Edition Boyes Test Bank instant download all chapterDocument52 pagesMicroeconomics 9th Edition Boyes Test Bank instant download all chapterwalideliljon83100% (5)

- Numerical Test 1 SolutionsDocument16 pagesNumerical Test 1 SolutionsBARUWA tomiNo ratings yet

- Investments Ch.9 QuizDocument3 pagesInvestments Ch.9 Quizmh_jusbreal0% (1)

- Challenge 2Document4 pagesChallenge 2Vortex Coaching ShannonNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Indonesia COVIDBukalapak SurveyDocument37 pagesIndonesia COVIDBukalapak SurveyBona Christanto SiahaanNo ratings yet

- Big Data New Tricks For EconometricsDocument26 pagesBig Data New Tricks For EconometricsBona Christanto SiahaanNo ratings yet

- Disruption and Innovation in Us Auto FinancingDocument8 pagesDisruption and Innovation in Us Auto FinancingBona Christanto SiahaanNo ratings yet

- Accelerating The Transition To Net Zero Travel Strategies For ActionDocument35 pagesAccelerating The Transition To Net Zero Travel Strategies For ActionBona Christanto SiahaanNo ratings yet

- Building A Green Business Lessons From Sustainability Start Ups - VFDocument8 pagesBuilding A Green Business Lessons From Sustainability Start Ups - VFBona Christanto SiahaanNo ratings yet

- Problem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesDocument6 pagesProblem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesBona Christanto SiahaanNo ratings yet

- The Economics of Kenneth J. ArrowDocument29 pagesThe Economics of Kenneth J. ArrowBona Christanto SiahaanNo ratings yet

- 185 PDFDocument150 pages185 PDFBona Christanto SiahaanNo ratings yet

- CH 14 Bond Pricing2Document2 pagesCH 14 Bond Pricing2Bona Christanto SiahaanNo ratings yet

- Problem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Document4 pagesProblem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Bona Christanto SiahaanNo ratings yet

- COICOP 2018 - Pre-Edited White Cover Version - 2018-12-26Document265 pagesCOICOP 2018 - Pre-Edited White Cover Version - 2018-12-26Bona Christanto SiahaanNo ratings yet

- Classification of Individual Consumption According To Purpose (COICOP) - ExtractDocument18 pagesClassification of Individual Consumption According To Purpose (COICOP) - ExtractBona Christanto SiahaanNo ratings yet

- How To Use and Apply Human Capital Metrics in Your Company-Palgrave Macmillan UK (2015)Document195 pagesHow To Use and Apply Human Capital Metrics in Your Company-Palgrave Macmillan UK (2015)Bona Christanto SiahaanNo ratings yet

- Chapter 5Document4 pagesChapter 5vandung19100% (1)

- Finance 21 QuestionsDocument10 pagesFinance 21 QuestionsAmol Bagul100% (1)

- Faqs On Forward Contracts Regulation Act (FC (R) A) AmendmentDocument24 pagesFaqs On Forward Contracts Regulation Act (FC (R) A) AmendmentmailrahulrajNo ratings yet

- 7-5. (Inna Corporation)Document3 pages7-5. (Inna Corporation)Gray JavierNo ratings yet

- Discounts For Lack of Marketability (DLOM) : Liquidity Refers To The Ease With Which An Asset or Security CanDocument3 pagesDiscounts For Lack of Marketability (DLOM) : Liquidity Refers To The Ease With Which An Asset or Security Canchakshu chawla100% (1)

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Executive Summery: Page - 1Document7 pagesExecutive Summery: Page - 1Ahsan Habib JimonNo ratings yet

- Week 11 Chapter 15Document35 pagesWeek 11 Chapter 15No PromisesNo ratings yet

- TOPIC 4 Discussion Questions APRIL 2023Document2 pagesTOPIC 4 Discussion Questions APRIL 2023Miera FrnhNo ratings yet

- Amisignals - ULTIMATEDocument11 pagesAmisignals - ULTIMATEpndymrigankarkaNo ratings yet

- Major Project Report ON: Share Khan's Marketing and Promotion of Online Trading Account and Equity ResearchDocument12 pagesMajor Project Report ON: Share Khan's Marketing and Promotion of Online Trading Account and Equity Research9910933523No ratings yet

- Mid Test IB1708 SE161403 Nguyễn Trọng BằngDocument14 pagesMid Test IB1708 SE161403 Nguyễn Trọng BằngNguyen Trong Bang (K16HCM)No ratings yet

- Final Exam FarDocument7 pagesFinal Exam FarReyna Joy SebialNo ratings yet

- The Beauty of Put Option Selling: by Joe RossDocument60 pagesThe Beauty of Put Option Selling: by Joe RossŞamil CeyhanNo ratings yet

- Problem Set 3Document10 pagesProblem Set 3Carol VarelaNo ratings yet

- KRX+Indices FinalDocument26 pagesKRX+Indices FinalPrashantKumarNo ratings yet

- Event Driven Hedge Funds PresentationDocument77 pagesEvent Driven Hedge Funds Presentationchuff6675No ratings yet

- Most Market Roundup: Dealer'S DiaryDocument7 pagesMost Market Roundup: Dealer'S DiaryAnkur RohiraNo ratings yet

- Unit-3 Options: Call OptionDocument25 pagesUnit-3 Options: Call OptionUthra PandianNo ratings yet

- Far160 Pyq TQ3 Co Intro IssueDocument6 pagesFar160 Pyq TQ3 Co Intro IssueFauziah MustaphaNo ratings yet

- Prob 14Document3 pagesProb 14Abegail DuhanNo ratings yet

- File 1675671050219Document26 pagesFile 1675671050219Tamzid Ahmed AnikNo ratings yet

- 5-4 Greek LettersDocument30 pages5-4 Greek LettersNainam SeedoyalNo ratings yet

- Transaction Confirmation: 9th Floor 107 Cheapside London UK EC2V 6DNDocument2 pagesTransaction Confirmation: 9th Floor 107 Cheapside London UK EC2V 6DNSartaj SinghNo ratings yet

- Equity Valuation and Analysis ManualDocument147 pagesEquity Valuation and Analysis ManualHarsh Kedia100% (1)

- Private & Public CompanyDocument9 pagesPrivate & Public CompanyrajatNo ratings yet

- Chapter 23 Hedging With Financial DerivativesDocument15 pagesChapter 23 Hedging With Financial DerivativesGiang Dandelion100% (1)

Problem 28: Investments, by Bodie, Kane, and Marcus, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 21

Problem 28: Investments, by Bodie, Kane, and Marcus, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 21

Uploaded by

Bona Christanto SiahaanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 28: Investments, by Bodie, Kane, and Marcus, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 21

Problem 28: Investments, by Bodie, Kane, and Marcus, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 21

Uploaded by

Bona Christanto SiahaanCopyright:

Available Formats

Investments, by Bodie, Kane, and Marcus, 8th Edition

Spreadsheet Templates

MAIN MENU -- Chapter 21

SOLUTION

Problem 28

Copyright © 2009 McGraw-Hill/Irwin

Edition

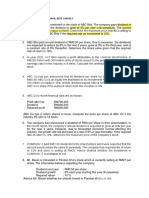

OUTPUTS FORMULA FOR OUTPUT IN COLUMN E

Standard deviation (annual) 0.3213 d1 0.0089 (LN(B5/B6)+(B4-B7+.5*B2^2)*B3)/(B2*SQRT(B3))

Maturity (in years) 0.5 d2 -0.2183 E2-B2*SQRT(B3)

Risk-free rate (annual) 0.05 N(d1) 0.5035 NORMSDIST(E2)

Stock Price 100 N(d2) 0.4136 NORMSDIST(E3)

Exercise price 105 B/S call value 8.00 B5*EXP(-B7*B3)*E4 - B6*EXP(-B4*B3)*E5

Dividend yield (annual) 0 B/S put value 10.41 B6*EXP(-B4*B3)*(1-E5) - B5*EXP(-B7*B3)*(1-E4)

28. Consider a 6-month expiration European call option with an exercise price of $105. The

underlying stock sells for $100 a share and pays no dividends. The risk-free rate is 5%. What is

the implied volatility of the option if the option currently sells for $8? Use Spreadsheet 21.1

(copied above) to answer this question. Return to Main Menu

Go to the Tools menu of the spreadsheet and select "Goal Seek." The dialogue box will ask you

for three pieces of information. In that dialogue box, you should set cell E6 to value 8 by

changing cell B2. In other words, you ask the spreadsheet to find the value of standard deviation

(which appears in cell B2) that forces the value of the option (in cell E6) equal to $8. Then, click

"OK" and you should find that the call is now worth $8, and the entry for standard deviation has

been changed to a level consistent with this value. This is the call’s implied standard deviation at

a price of $8.

a. What is the implied volatility of the option if the option currently sells for $8? Answer: 0.3213

b. What happens to implied volatility if the option is selling at $9? Why has implied volatility

increased? Answer: Implied volatility has increased because the value of an option increases

with greater volatility.

c. What happens to implied volatility if the option price is unchanged at $8, but option maturity is

lower, say only 4 months? Why? Answer: Implied volatility increases to 0.4087 when maturity

decreases to four months. The shorter maturity decreases the value of the option; therefore, in

order for the option price to remain unchanged at $8, implied volatility must increase.

d. What happens to implied volatility if the option price is unchanged at $8, but the exercise price

is lower, say only $100? Why? Answer: Implied volatility decreases to 0.2406 when exercise

price decreases to $100. The decrease in exercise price increases the value of the call, so that,

in order to the option price to remain at $8, implied volatility decreases.

e. What happens to implied volatility if the option price is unchanged at $8, but the stock is lower,

say only $98? Why? Answer: The decrease in stock price decreases the value of the call. In

order for the option price to remain at $8, implied volatility increases.

Copyright © 2009 McGraw-Hill/Irwin

You might also like

- Chapter 5 - Build A Model SpreadsheetDocument6 pagesChapter 5 - Build A Model SpreadsheetUdit Agrawal100% (1)

- E0311 Hallstead JewelersDocument2 pagesE0311 Hallstead Jewelersaltemurcan kursunlu100% (1)

- Expert AnswerDocument5 pagesExpert AnswerEmmanuel Kibaya OmbiroNo ratings yet

- Credit Suisse - SkewDocument11 pagesCredit Suisse - Skewhc87No ratings yet

- Ch05 P24 Build A ModelDocument5 pagesCh05 P24 Build A ModelCristianoF7No ratings yet

- 15profit Maximization Past PaperDocument6 pages15profit Maximization Past PaperJacquelyn ChungNo ratings yet

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- Assignment 5.4 Exercises: Calculation of The Holding Period Return?Document32 pagesAssignment 5.4 Exercises: Calculation of The Holding Period Return?Joel Christian Mascariña0% (1)

- Mock Exam Portfolio Theory 2020 With AnswersDocument10 pagesMock Exam Portfolio Theory 2020 With AnswersSamir Ismail100% (1)

- Ba0508 19-20 1Document8 pagesBa0508 19-20 1ccNo ratings yet

- Jun18l1equ-C02 Qa PDFDocument3 pagesJun18l1equ-C02 Qa PDFjuanNo ratings yet

- Final Exam Financial Management Antonius Cliff Setiawan 29119033Document20 pagesFinal Exam Financial Management Antonius Cliff Setiawan 29119033Antonius CliffSetiawan100% (4)

- Asignacion Unidad 2Document6 pagesAsignacion Unidad 2Angel L Rolon TorresNo ratings yet

- Chapter 7Document11 pagesChapter 7Muhammad WaqasNo ratings yet

- A Project Report On Online Trading FinalDocument96 pagesA Project Report On Online Trading FinalAnuj Bansal75% (8)

- Extra-Credit DerivativesDocument14 pagesExtra-Credit DerivativeschaabanifediNo ratings yet

- FINC600 Homework Template Week 3 Jan2013Document16 pagesFINC600 Homework Template Week 3 Jan2013joeNo ratings yet

- Ch.14 AnsDocument9 pagesCh.14 AnsWaSx3lyNo ratings yet

- Sensitivity Analysis Using Excel PDFDocument8 pagesSensitivity Analysis Using Excel PDFvxspidy100% (1)

- Chapter 3Document12 pagesChapter 3Thea BacsaNo ratings yet

- Quick Tour of Microsoft Excel Solver: Color CodingDocument6 pagesQuick Tour of Microsoft Excel Solver: Color CodingKhalid EurekaNo ratings yet

- SolvsampDocument15 pagesSolvsampHello WorldNo ratings yet

- SolvsampDocument12 pagesSolvsampTabassum AkhtarNo ratings yet

- Jun18l1equ-C01 QaDocument5 pagesJun18l1equ-C01 Qarafav10No ratings yet

- Week 5 Take Home Assignment Questions-Semester 1 2024-3 Jaime DurkinDocument13 pagesWeek 5 Take Home Assignment Questions-Semester 1 2024-3 Jaime DurkinMr Christ101No ratings yet

- 15 Comm 308 Final Exam (Fall 2012) SolutionsDocument18 pages15 Comm 308 Final Exam (Fall 2012) SolutionsAfafe ElNo ratings yet

- ACCA Performance Management (PM) Dec 22 AsDocument12 pagesACCA Performance Management (PM) Dec 22 AskaterinayasinskyNo ratings yet

- Question: The Total Market Value of The Common Stock of The OkefenokeDocument4 pagesQuestion: The Total Market Value of The Common Stock of The OkefenokeUzair Ahmed SoomroNo ratings yet

- C. Maximize ProfitDocument5 pagesC. Maximize ProfitSeyoum LeulNo ratings yet

- Mês Total Sazonalidade Valor Das VendasDocument6 pagesMês Total Sazonalidade Valor Das VendasEmerson CesarNo ratings yet

- SMM200 Derivatives and Risk Management 2021 QuestionsDocument5 pagesSMM200 Derivatives and Risk Management 2021 Questionsminh daoNo ratings yet

- 03 PS7 PTDocument2 pages03 PS7 PThatemNo ratings yet

- JUN18L1EQU/C01: Accurate About The Index?Document3 pagesJUN18L1EQU/C01: Accurate About The Index?rafav10No ratings yet

- Scenario Sensitivity Analysis in Excel Cfi AnswersDocument6 pagesScenario Sensitivity Analysis in Excel Cfi AnswersAbduselam AliyiNo ratings yet

- 3.EF232.FIMIL II Question CMA September 2022 Exam.Document8 pages3.EF232.FIMIL II Question CMA September 2022 Exam.nobiNo ratings yet

- Spreadsheet NotesDocument3 pagesSpreadsheet NotesTakudzwa MuperiNo ratings yet

- Seminar 1Document5 pagesSeminar 1EnnyNo ratings yet

- Ch05 P24 Build A ModelDocument6 pagesCh05 P24 Build A ModelРоман УдовичкоNo ratings yet

- Practice Questions AnswersDocument5 pagesPractice Questions Answersyida chenNo ratings yet

- Homework 4Document7 pagesHomework 4Liam100% (1)

- You Have To Answer in The Question PaperDocument6 pagesYou Have To Answer in The Question PaperDavid ViksarNo ratings yet

- Managemnt AssigmnetDocument19 pagesManagemnt AssigmnetSAMUEL DEBEBENo ratings yet

- Chapter 2 - AFM - UEH - F2023 - ExercicesDocument3 pagesChapter 2 - AFM - UEH - F2023 - Exercicestoantran.31211025392No ratings yet

- Practice Exam 2020 2.0 in Corporate FinanceDocument5 pagesPractice Exam 2020 2.0 in Corporate FinanceNikolai PriessNo ratings yet

- (C-3.1) SpreadsheetsDocument5 pages(C-3.1) SpreadsheetsRomail QaziNo ratings yet

- ......... May 22 QPDocument32 pages......... May 22 QPYuvipro gidwaniNo ratings yet

- Lab-5 Journal Template-26032020-074026amDocument8 pagesLab-5 Journal Template-26032020-074026amFadi KhanNo ratings yet

- 8725377Document8 pages8725377Ashish BhallaNo ratings yet

- Session 5 - Cost of CapitalDocument49 pagesSession 5 - Cost of CapitalMuhammad HanafiNo ratings yet

- Review Guide For Exam 2 of BUS 172C (SP 2018)Document16 pagesReview Guide For Exam 2 of BUS 172C (SP 2018)Erwin SantosoNo ratings yet

- WORD & ExcelDocument11 pagesWORD & Exceldennistom.chackoNo ratings yet

- Quick Tour of Microsoft Excel Solver: 419525239Document15 pagesQuick Tour of Microsoft Excel Solver: 419525239Yl Wong100% (1)

- Eco 389 Corporate Finance / Tutorialoutlet Dot ComDocument13 pagesEco 389 Corporate Finance / Tutorialoutlet Dot Comalbert0077No ratings yet

- 9708_w02_qp_4Document3 pages9708_w02_qp_4aadya.shrestha1206No ratings yet

- PDF Test Bank For Exploring Microsoft Office Excel 2019 Comprehensive 1St Edition Mary Anne Poatsy Online Ebook Full ChapterDocument45 pagesPDF Test Bank For Exploring Microsoft Office Excel 2019 Comprehensive 1St Edition Mary Anne Poatsy Online Ebook Full Chaptersarah.brown558100% (7)

- JUNIOR AUDITOR (POST CODE-759) PaperDocument32 pagesJUNIOR AUDITOR (POST CODE-759) Paperrishab bhagtaNo ratings yet

- Business Mathematics & Statistics (MTH 302)Document10 pagesBusiness Mathematics & Statistics (MTH 302)John WickNo ratings yet

- Topic 1 - Homework1 SoluntionDocument5 pagesTopic 1 - Homework1 SoluntionTsz Wei CHANNo ratings yet

- Microeconomics 9th Edition Boyes Test Bank instant download all chapterDocument52 pagesMicroeconomics 9th Edition Boyes Test Bank instant download all chapterwalideliljon83100% (5)

- Numerical Test 1 SolutionsDocument16 pagesNumerical Test 1 SolutionsBARUWA tomiNo ratings yet

- Investments Ch.9 QuizDocument3 pagesInvestments Ch.9 Quizmh_jusbreal0% (1)

- Challenge 2Document4 pagesChallenge 2Vortex Coaching ShannonNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Indonesia COVIDBukalapak SurveyDocument37 pagesIndonesia COVIDBukalapak SurveyBona Christanto SiahaanNo ratings yet

- Big Data New Tricks For EconometricsDocument26 pagesBig Data New Tricks For EconometricsBona Christanto SiahaanNo ratings yet

- Disruption and Innovation in Us Auto FinancingDocument8 pagesDisruption and Innovation in Us Auto FinancingBona Christanto SiahaanNo ratings yet

- Accelerating The Transition To Net Zero Travel Strategies For ActionDocument35 pagesAccelerating The Transition To Net Zero Travel Strategies For ActionBona Christanto SiahaanNo ratings yet

- Building A Green Business Lessons From Sustainability Start Ups - VFDocument8 pagesBuilding A Green Business Lessons From Sustainability Start Ups - VFBona Christanto SiahaanNo ratings yet

- Problem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesDocument6 pagesProblem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesBona Christanto SiahaanNo ratings yet

- The Economics of Kenneth J. ArrowDocument29 pagesThe Economics of Kenneth J. ArrowBona Christanto SiahaanNo ratings yet

- 185 PDFDocument150 pages185 PDFBona Christanto SiahaanNo ratings yet

- CH 14 Bond Pricing2Document2 pagesCH 14 Bond Pricing2Bona Christanto SiahaanNo ratings yet

- Problem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Document4 pagesProblem 15 Problem 16: Investments, by Bodie, Kane, and Marcus, 9th Edition Spreadsheet Templates MAIN MENU - Chapter 18Bona Christanto SiahaanNo ratings yet

- COICOP 2018 - Pre-Edited White Cover Version - 2018-12-26Document265 pagesCOICOP 2018 - Pre-Edited White Cover Version - 2018-12-26Bona Christanto SiahaanNo ratings yet

- Classification of Individual Consumption According To Purpose (COICOP) - ExtractDocument18 pagesClassification of Individual Consumption According To Purpose (COICOP) - ExtractBona Christanto SiahaanNo ratings yet

- How To Use and Apply Human Capital Metrics in Your Company-Palgrave Macmillan UK (2015)Document195 pagesHow To Use and Apply Human Capital Metrics in Your Company-Palgrave Macmillan UK (2015)Bona Christanto SiahaanNo ratings yet

- Chapter 5Document4 pagesChapter 5vandung19100% (1)

- Finance 21 QuestionsDocument10 pagesFinance 21 QuestionsAmol Bagul100% (1)

- Faqs On Forward Contracts Regulation Act (FC (R) A) AmendmentDocument24 pagesFaqs On Forward Contracts Regulation Act (FC (R) A) AmendmentmailrahulrajNo ratings yet

- 7-5. (Inna Corporation)Document3 pages7-5. (Inna Corporation)Gray JavierNo ratings yet

- Discounts For Lack of Marketability (DLOM) : Liquidity Refers To The Ease With Which An Asset or Security CanDocument3 pagesDiscounts For Lack of Marketability (DLOM) : Liquidity Refers To The Ease With Which An Asset or Security Canchakshu chawla100% (1)

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Executive Summery: Page - 1Document7 pagesExecutive Summery: Page - 1Ahsan Habib JimonNo ratings yet

- Week 11 Chapter 15Document35 pagesWeek 11 Chapter 15No PromisesNo ratings yet

- TOPIC 4 Discussion Questions APRIL 2023Document2 pagesTOPIC 4 Discussion Questions APRIL 2023Miera FrnhNo ratings yet

- Amisignals - ULTIMATEDocument11 pagesAmisignals - ULTIMATEpndymrigankarkaNo ratings yet

- Major Project Report ON: Share Khan's Marketing and Promotion of Online Trading Account and Equity ResearchDocument12 pagesMajor Project Report ON: Share Khan's Marketing and Promotion of Online Trading Account and Equity Research9910933523No ratings yet

- Mid Test IB1708 SE161403 Nguyễn Trọng BằngDocument14 pagesMid Test IB1708 SE161403 Nguyễn Trọng BằngNguyen Trong Bang (K16HCM)No ratings yet

- Final Exam FarDocument7 pagesFinal Exam FarReyna Joy SebialNo ratings yet

- The Beauty of Put Option Selling: by Joe RossDocument60 pagesThe Beauty of Put Option Selling: by Joe RossŞamil CeyhanNo ratings yet

- Problem Set 3Document10 pagesProblem Set 3Carol VarelaNo ratings yet

- KRX+Indices FinalDocument26 pagesKRX+Indices FinalPrashantKumarNo ratings yet

- Event Driven Hedge Funds PresentationDocument77 pagesEvent Driven Hedge Funds Presentationchuff6675No ratings yet

- Most Market Roundup: Dealer'S DiaryDocument7 pagesMost Market Roundup: Dealer'S DiaryAnkur RohiraNo ratings yet

- Unit-3 Options: Call OptionDocument25 pagesUnit-3 Options: Call OptionUthra PandianNo ratings yet

- Far160 Pyq TQ3 Co Intro IssueDocument6 pagesFar160 Pyq TQ3 Co Intro IssueFauziah MustaphaNo ratings yet

- Prob 14Document3 pagesProb 14Abegail DuhanNo ratings yet

- File 1675671050219Document26 pagesFile 1675671050219Tamzid Ahmed AnikNo ratings yet

- 5-4 Greek LettersDocument30 pages5-4 Greek LettersNainam SeedoyalNo ratings yet

- Transaction Confirmation: 9th Floor 107 Cheapside London UK EC2V 6DNDocument2 pagesTransaction Confirmation: 9th Floor 107 Cheapside London UK EC2V 6DNSartaj SinghNo ratings yet

- Equity Valuation and Analysis ManualDocument147 pagesEquity Valuation and Analysis ManualHarsh Kedia100% (1)

- Private & Public CompanyDocument9 pagesPrivate & Public CompanyrajatNo ratings yet

- Chapter 23 Hedging With Financial DerivativesDocument15 pagesChapter 23 Hedging With Financial DerivativesGiang Dandelion100% (1)