Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

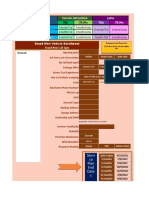

3 viewsTax Cases Distribution

Tax Cases Distribution

Uploaded by

Nigel GarciaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- To Be Sent AdvisorsDocument28 pagesTo Be Sent AdvisorsNigel GarciaNo ratings yet

- To God Be All The GloryDocument2 pagesTo God Be All The GloryNigel GarciaNo ratings yet

- Performance Task in Mathematics 10: A R 3 N ADocument2 pagesPerformance Task in Mathematics 10: A R 3 N ANigel GarciaNo ratings yet

- AsdasdasdasdDocument2 pagesAsdasdasdasdNigel GarciaNo ratings yet

- Parts of A Composite VolcanoDocument3 pagesParts of A Composite VolcanoNigel GarciaNo ratings yet

- Overview of Banquet Function and Catering Service ProceduresDocument13 pagesOverview of Banquet Function and Catering Service ProceduresNigel GarciaNo ratings yet

- Nature of The PetitionDocument8 pagesNature of The PetitionNigel GarciaNo ratings yet

- Legal Writing Finals, Garcia NigelDocument7 pagesLegal Writing Finals, Garcia NigelNigel GarciaNo ratings yet

- Legal Research MidtermsDocument1 pageLegal Research MidtermsNigel GarciaNo ratings yet

- In Re David P. Krasner FactsDocument2 pagesIn Re David P. Krasner FactsNigel GarciaNo ratings yet

- Did PCIJ Have Jurisdiction Over The Case? YESDocument4 pagesDid PCIJ Have Jurisdiction Over The Case? YESNigel GarciaNo ratings yet

- Respondent.: Petition For Review On CertiorariDocument6 pagesRespondent.: Petition For Review On CertiorariNigel GarciaNo ratings yet

- LogDocument4 pagesLogNigel GarciaNo ratings yet

- 1120 UN Avenue Barangay 661 Ermita, City of Manila, NCR, Philippines, 1000Document31 pages1120 UN Avenue Barangay 661 Ermita, City of Manila, NCR, Philippines, 1000Nigel GarciaNo ratings yet

- Articles of Partnership Limited SecDocument5 pagesArticles of Partnership Limited SecNigel GarciaNo ratings yet

Tax Cases Distribution

Tax Cases Distribution

Uploaded by

Nigel Garcia0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

Tax Cases Distribution (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesTax Cases Distribution

Tax Cases Distribution

Uploaded by

Nigel GarciaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

Ablaza CIR v American Express

Aclan CIR v Burmeister and Wain

Alfonso CIR v Acesite

Añonuevo CIR v Seagate

Asuncion CIR v Toshiba Information

Bautista CIR v Cebu Toyo Corp

Domalanta Fort Bonifacio Development v CIR

Dumaual Contex v CIR

Estrada Altas Consolidated Mining v CIR

Eucogco CIR v Mirant Pagbilao Corp

Grana Nothern Mini Hydro v CIR

Kalugdan China Banking Corp. v CA, CTA, CA

Kudarat Separate Opinion of Justice Bersamin in CIR v Pilipinas Shell

Lazo CIR v Campos Rueda

Manikad CIR v Fisher

Martinez Dizon v CTA

Mateo Estate of Vda. Gabriel v CIR

Mendiola CIR v Pineda

Noble Marcos II v CA

Orda PNB v Santos

Pinili Lladoc v CIR

Placino Pirovano v CIR

Repalda Abello v CIR

Sandoval Philamlife v SOF

Sarreal Sps. Evono CTA EB Case 205 dated 4 June 2012

Suzuki CIR v Sony Phils. Inc

Templonuevo CIR v De La Salle

Tendenilla Medicard Philippines v CIR

Trimor CIR v Pascor Realty

Tumindog SMI-ED Technology Corporation v CIR

Viernes CIR v Fitness by Design

Yu

On Automatic Zero-rate v effectively zero rate AND Exempt persons v exempt transactions

On period

Seen in Part B. III. d.

Seend in Part C. II. A (4)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- To Be Sent AdvisorsDocument28 pagesTo Be Sent AdvisorsNigel GarciaNo ratings yet

- To God Be All The GloryDocument2 pagesTo God Be All The GloryNigel GarciaNo ratings yet

- Performance Task in Mathematics 10: A R 3 N ADocument2 pagesPerformance Task in Mathematics 10: A R 3 N ANigel GarciaNo ratings yet

- AsdasdasdasdDocument2 pagesAsdasdasdasdNigel GarciaNo ratings yet

- Parts of A Composite VolcanoDocument3 pagesParts of A Composite VolcanoNigel GarciaNo ratings yet

- Overview of Banquet Function and Catering Service ProceduresDocument13 pagesOverview of Banquet Function and Catering Service ProceduresNigel GarciaNo ratings yet

- Nature of The PetitionDocument8 pagesNature of The PetitionNigel GarciaNo ratings yet

- Legal Writing Finals, Garcia NigelDocument7 pagesLegal Writing Finals, Garcia NigelNigel GarciaNo ratings yet

- Legal Research MidtermsDocument1 pageLegal Research MidtermsNigel GarciaNo ratings yet

- In Re David P. Krasner FactsDocument2 pagesIn Re David P. Krasner FactsNigel GarciaNo ratings yet

- Did PCIJ Have Jurisdiction Over The Case? YESDocument4 pagesDid PCIJ Have Jurisdiction Over The Case? YESNigel GarciaNo ratings yet

- Respondent.: Petition For Review On CertiorariDocument6 pagesRespondent.: Petition For Review On CertiorariNigel GarciaNo ratings yet

- LogDocument4 pagesLogNigel GarciaNo ratings yet

- 1120 UN Avenue Barangay 661 Ermita, City of Manila, NCR, Philippines, 1000Document31 pages1120 UN Avenue Barangay 661 Ermita, City of Manila, NCR, Philippines, 1000Nigel GarciaNo ratings yet

- Articles of Partnership Limited SecDocument5 pagesArticles of Partnership Limited SecNigel GarciaNo ratings yet