Professional Documents

Culture Documents

Memo Circular On The Guidelines of COVID Related Transactions

Memo Circular On The Guidelines of COVID Related Transactions

Uploaded by

SJ Limin0 ratings0% found this document useful (0 votes)

8 views1 pageThe Revenue Memorandum Circular No. 2-2020 requires all gasoline stations nationwide to submit a sworn declaration statement to the BIR by January 15, 2020 detailing their inventory volumes of diesel, gasoline and kerosene as of December 31, 2019. The concerned Revenue District Office must then consolidate these reports, note whether the inventory has been marked or not, and transmit the information to the Excise LT Field Operations Divisions by January 31, 2020 to create an initial database for monitoring and field testing related to the Fuel Marking Program.

Original Description:

Original Title

Memo Circular on the Guidelines of COVID Related Transactions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Revenue Memorandum Circular No. 2-2020 requires all gasoline stations nationwide to submit a sworn declaration statement to the BIR by January 15, 2020 detailing their inventory volumes of diesel, gasoline and kerosene as of December 31, 2019. The concerned Revenue District Office must then consolidate these reports, note whether the inventory has been marked or not, and transmit the information to the Excise LT Field Operations Divisions by January 31, 2020 to create an initial database for monitoring and field testing related to the Fuel Marking Program.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views1 pageMemo Circular On The Guidelines of COVID Related Transactions

Memo Circular On The Guidelines of COVID Related Transactions

Uploaded by

SJ LiminThe Revenue Memorandum Circular No. 2-2020 requires all gasoline stations nationwide to submit a sworn declaration statement to the BIR by January 15, 2020 detailing their inventory volumes of diesel, gasoline and kerosene as of December 31, 2019. The concerned Revenue District Office must then consolidate these reports, note whether the inventory has been marked or not, and transmit the information to the Excise LT Field Operations Divisions by January 31, 2020 to create an initial database for monitoring and field testing related to the Fuel Marking Program.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

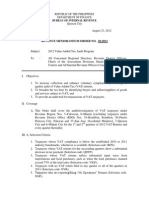

REVENUE MEMORANDUM CIRCULAR NO.

2-2020 issued on January 2, 2020 mandates

all Revenue District Offices to require all gasoline stations nationwide to submit to the BIR a sworn

declaration statement of inventory identified per branch as of December 31, 2019, specifying the

volume and type of petroleum products, namely: diesel, gasoline and kerosene. Said sworn

declaration shall be submitted to the Revenue District Office (RDO)/Large Taxpayers (LT)

Division where the principal place of business is registered, on or before January 15, 2020, in

preparation for the Field Testing aspect of the Fuel Marking Program.

The concerned RDO shall consolidate the submitted report, which shall state whether the

inventory has been marked or not, and transmit the same to the Excise LT Field Operations

Divisions on or before January 31, 2020 to serve as the initial database for monitoring and field

testing.

You might also like

- Inventory List SubmissionDocument2 pagesInventory List SubmissionLevi Lazareno EugenioNo ratings yet

- Revenue Memorandum CircularDocument2 pagesRevenue Memorandum CircularIsmael NogoyNo ratings yet

- Fuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandFuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Submission of Sworn Declaration of Inventory by All Gasoline StationsDocument1 pageSubmission of Sworn Declaration of Inventory by All Gasoline Stationsarnelo sarmientoNo ratings yet

- Supplement CAB 2020 002B 1Document8 pagesSupplement CAB 2020 002B 1Bella San JuanNo ratings yet

- Quarterly Income A5 EngDocument4 pagesQuarterly Income A5 EngKasendereNo ratings yet

- KPMG-Technical Update May 22 enDocument3 pagesKPMG-Technical Update May 22 enbryanmark2512No ratings yet

- Notifications Gist Upto 30.09.2020Document2 pagesNotifications Gist Upto 30.09.2020NishthaNo ratings yet

- (2021 Tax Memo) Year-End Tax Compliance RemindersDocument2 pages(2021 Tax Memo) Year-End Tax Compliance RemindersMary Joy BautistaNo ratings yet

- 42.GST New Returns E Flyer 180919Document2 pages42.GST New Returns E Flyer 180919rejin.auditorNo ratings yet

- Budget 2018 Exhaustive Analysis of Changes in Custom DutyDocument27 pagesBudget 2018 Exhaustive Analysis of Changes in Custom Dutynovalogisticsdel1No ratings yet

- Important GST Compliances As On April 1, 2021Document3 pagesImportant GST Compliances As On April 1, 2021Mohammed suhail.sNo ratings yet

- GO Salary Related HOADocument2 pagesGO Salary Related HOALiving LifeNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Revenue Memorandum Order No. 20-2012: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Order No. 20-2012: Bureau of Internal RevenueGedan TanNo ratings yet

- RMO No.26-2018Document4 pagesRMO No.26-2018James Salviejo PinedaNo ratings yet

- Motor Vehicles Registration Tax StatisticDocument8 pagesMotor Vehicles Registration Tax StatisticSermored Relocation ServicesNo ratings yet

- 1 STP Q E, 0: MemorandumDocument1 page1 STP Q E, 0: MemorandumQuinciano MorilloNo ratings yet

- Compliance Calendar For June 2020Document8 pagesCompliance Calendar For June 2020corporate partnersNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadNo ratings yet

- Taxflash 2019 01Document4 pagesTaxflash 2019 01Haryo BagaskaraNo ratings yet

- Vat Questions: GARFIELD (Mar/Jun 16)Document3 pagesVat Questions: GARFIELD (Mar/Jun 16)Rabi HashimNo ratings yet

- Circular Letter No. 2020-7Document2 pagesCircular Letter No. 2020-7VAT CLIENTSNo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 3-2022 Issued On January 14, 2022 ClarifiesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 3-2022 Issued On January 14, 2022 ClarifiesKatherine SyNo ratings yet

- Tax AmnestyDocument38 pagesTax AmnestyElsha dela penaNo ratings yet

- Closing Circular 30.09.2013Document53 pagesClosing Circular 30.09.2013umesh39No ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2JejomarNo ratings yet

- RMO No 19-2015Document10 pagesRMO No 19-2015gelskNo ratings yet

- Budget Call Circular 2020 21Document26 pagesBudget Call Circular 2020 21KAMRAN ALINo ratings yet

- Manual Instruction - 1770 - 2010 - English PDFDocument46 pagesManual Instruction - 1770 - 2010 - English PDFHafiedz SNo ratings yet

- WWF Taxation Order FOrmatDocument6 pagesWWF Taxation Order FOrmatSohaib ZafarNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument10 pagesSupplement Executive Programme: For June, 2021 ExaminationSP CONTRACTORNo ratings yet

- MoF IT Extension PR 24.10.2020Document2 pagesMoF IT Extension PR 24.10.2020CA Poonam WaghNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- PICPA Webinar - Tax Updates 07152020Document2 pagesPICPA Webinar - Tax Updates 07152020Kirt Russelle PeconadaNo ratings yet

- Guide On GSTR 1 Filing On GST PortalDocument53 pagesGuide On GSTR 1 Filing On GST PortalCA Naveen Kumar BalanNo ratings yet

- Fin e 224 2020 PDFDocument8 pagesFin e 224 2020 PDFGowtham RajNo ratings yet

- News 10: New Module For Application of Exemption For Schedule ADocument4 pagesNews 10: New Module For Application of Exemption For Schedule ASyed AzrieNo ratings yet

- RMC No. 10-2020Document2 pagesRMC No. 10-2020Volt LozadaNo ratings yet

- Submission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesDocument8 pagesSubmission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesBijiNo ratings yet

- Executive Programme (New Syllabus) Supplement FOR Tax LawsDocument14 pagesExecutive Programme (New Syllabus) Supplement FOR Tax Lawsgopika mundraNo ratings yet

- Tax Laws - Direct TaxDocument45 pagesTax Laws - Direct TaxAnubha PriyaNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Summary of Notifications & Circular Under GSTDocument2 pagesSummary of Notifications & Circular Under GSTNishthaNo ratings yet

- My Tax Espresso Jan 2023Document20 pagesMy Tax Espresso Jan 2023Claudine TanNo ratings yet

- 2020PressRelease - SEC Extends Deadline For Annual Quarterly Reports For Companies With Fiscal Years Ending Amid PandemicDocument2 pages2020PressRelease - SEC Extends Deadline For Annual Quarterly Reports For Companies With Fiscal Years Ending Amid PandemicFauTahudAmparoNo ratings yet

- Rush of Expenditure in The Last Quarter of Financial Year 2019-20 - Central Government Employees NewsDocument2 pagesRush of Expenditure in The Last Quarter of Financial Year 2019-20 - Central Government Employees NewsbimlapalNo ratings yet

- Chilean Instruction of Offshore VAT Withhold v2Document13 pagesChilean Instruction of Offshore VAT Withhold v2Ian Franco SebastianNo ratings yet

- E InvoiceDocument23 pagesE Invoicenallarahul86No ratings yet

- Highlights For August 2020: Supreme Court DecisionDocument6 pagesHighlights For August 2020: Supreme Court DecisionshakiraNo ratings yet

- Bir Updates - GacpaDocument38 pagesBir Updates - GacpaAngelo GasatanNo ratings yet

- Budget Call Circular 2020 21Document26 pagesBudget Call Circular 2020 21National Highway AuthorityNo ratings yet

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDocument3 pagesTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNo ratings yet

- Tax Alert - CBC Filing Portals in UAE and KSA Go LIVE!-4Document5 pagesTax Alert - CBC Filing Portals in UAE and KSA Go LIVE!-4ahmed.aliNo ratings yet

- GST Expense Breakup in Tax Audit Report - Taxguru - inDocument3 pagesGST Expense Breakup in Tax Audit Report - Taxguru - inmanoj shahNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- GST Update124Document6 pagesGST Update124suhani singhNo ratings yet

- Regulatory Update To BF - Feb2021 v1Document3 pagesRegulatory Update To BF - Feb2021 v1SJ LiminNo ratings yet

- Regulatory Update February 2021Document3 pagesRegulatory Update February 2021SJ LiminNo ratings yet

- Modified Enhanced Community Quarantine in Taguig in Times of COVID 19Document31 pagesModified Enhanced Community Quarantine in Taguig in Times of COVID 19SJ LiminNo ratings yet

- Revenue Regulations Digest Issued On October 15, 2020Document2 pagesRevenue Regulations Digest Issued On October 15, 2020SJ LiminNo ratings yet

- PCU 2018 Political Law Reviewer PDFDocument37 pagesPCU 2018 Political Law Reviewer PDFSJ LiminNo ratings yet

- PCU - LMT - Civil Law - 2019Document24 pagesPCU - LMT - Civil Law - 2019SJ LiminNo ratings yet

- Living and Doing Business in Taguig in Times of COVID 19Document1 pageLiving and Doing Business in Taguig in Times of COVID 19SJ LiminNo ratings yet

- PCU - LMT - Taxation Law - 2019Document4 pagesPCU - LMT - Taxation Law - 2019SJ LiminNo ratings yet

- PCU 2018 Remedial Law Reviewer PDFDocument63 pagesPCU 2018 Remedial Law Reviewer PDFSJ LiminNo ratings yet

- PCU 2018 Criminal Law ReviewerDocument22 pagesPCU 2018 Criminal Law ReviewerSJ LiminNo ratings yet

- PCU 2018 Labor Law ReviewerDocument78 pagesPCU 2018 Labor Law ReviewerSJ Limin100% (1)

- PCU 2018 Civil Law ReviewerDocument43 pagesPCU 2018 Civil Law ReviewerSJ LiminNo ratings yet

- PCU 2018 Mercantile Law ReviewerDocument76 pagesPCU 2018 Mercantile Law ReviewerSJ LiminNo ratings yet

- PCU 2018 Legal Ethics ReviewerDocument43 pagesPCU 2018 Legal Ethics ReviewerSJ LiminNo ratings yet

- PALE Course SyllabusDocument9 pagesPALE Course SyllabusSJ LiminNo ratings yet

- PALE Quiz # 1Document3 pagesPALE Quiz # 1SJ LiminNo ratings yet