Professional Documents

Culture Documents

Financial Services: India's Emerging Universal Banks: Size Does Matter

Financial Services: India's Emerging Universal Banks: Size Does Matter

Uploaded by

Anirban HalderCopyright:

Available Formats

You might also like

- JK Bank Project ReportDocument74 pagesJK Bank Project ReportSurbhi Nargotra43% (7)

- Equity Research Report HDFC BankDocument4 pagesEquity Research Report HDFC BankNikhil KumarNo ratings yet

- HDFC HR PracticeDocument21 pagesHDFC HR Practicejacobmathew1706No ratings yet

- A Study On Financial Services of Commercial Bank With Reference To ICICI Bank (Final)Document56 pagesA Study On Financial Services of Commercial Bank With Reference To ICICI Bank (Final)geetha_kannan32No ratings yet

- An Overview of Mergers and Acquisitions in Indian Banking IndustryDocument8 pagesAn Overview of Mergers and Acquisitions in Indian Banking IndustryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- KunalDocument66 pagesKunalRahul VarmaNo ratings yet

- Icici & HDFCDocument108 pagesIcici & HDFCindia20000No ratings yet

- Case Study 2011Document7 pagesCase Study 2011Momi DuttaNo ratings yet

- NBFC Edelweise Retail FinanceDocument14 pagesNBFC Edelweise Retail FinancesunitaNo ratings yet

- Universal Banking in India: You Are HereDocument4 pagesUniversal Banking in India: You Are HereRupesh MorajkarNo ratings yet

- Introduction To Banking IndustryDocument35 pagesIntroduction To Banking IndustrySindhuja SridharNo ratings yet

- Financial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)Document6 pagesFinancial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)International Journal of Innovative Science and Research Technology100% (1)

- Preface: Indian Banking System 201Document60 pagesPreface: Indian Banking System 201akashrajput020304100% (1)

- Introduction To SbiDocument4 pagesIntroduction To Sbisamy7541100% (2)

- The Hindu Review September 2017Document21 pagesThe Hindu Review September 2017rajanNo ratings yet

- A Study On The Imc Standards Icici Bank FollowsDocument47 pagesA Study On The Imc Standards Icici Bank FollowsShazs EnterprisesNo ratings yet

- Chapter-2 Organization Profile: BackgroundDocument5 pagesChapter-2 Organization Profile: BackgroundAcchu RNo ratings yet

- Jayesh Gupta PDF 1Document12 pagesJayesh Gupta PDF 1Jayesh GuptaNo ratings yet

- Homeloans IciciDocument83 pagesHomeloans Icicitajju_121No ratings yet

- BankDocument94 pagesBankNaren JangirNo ratings yet

- Id BiDocument2 pagesId BisagarssssNo ratings yet

- Financial Institutions - Entrepreneurship AssignmentDocument17 pagesFinancial Institutions - Entrepreneurship AssignmentDevikaKhareNo ratings yet

- Tybms Sem V Project 2017-18Document54 pagesTybms Sem V Project 2017-18sagarNo ratings yet

- Finanical MKT IFSDocument5 pagesFinanical MKT IFSharshita khadayteNo ratings yet

- SAPM ICICI BankDocument9 pagesSAPM ICICI BankRushikesh ChouguleNo ratings yet

- Project Report ON: Financial Statement Analysis OFDocument34 pagesProject Report ON: Financial Statement Analysis OFsherrinmaryaliyas23No ratings yet

- (51,52) SEBI Controlled NBFCsDocument43 pages(51,52) SEBI Controlled NBFCsYadwinder SinghNo ratings yet

- Credit Risk Management On HDFC BankDocument17 pagesCredit Risk Management On HDFC BankAhemad 12No ratings yet

- Financial MarketDocument27 pagesFinancial MarketVaibhav MawalNo ratings yet

- Jayesh Gupta PDF 1Document21 pagesJayesh Gupta PDF 1Jayesh GuptaNo ratings yet

- Id BiDocument16 pagesId BiBhanu DadwalNo ratings yet

- NBFC in IndiaDocument19 pagesNBFC in IndiaBharath ReddyNo ratings yet

- Development Financial Institutions or Development BanksDocument23 pagesDevelopment Financial Institutions or Development BanksSaurabh TiwariNo ratings yet

- Final Blackbook PalakDocument96 pagesFinal Blackbook PalakPalak MehtaNo ratings yet

- B.B.A., L.L.B. (Hons.) / Third Semester-2021Document17 pagesB.B.A., L.L.B. (Hons.) / Third Semester-2021Anoushka SudNo ratings yet

- KPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaDocument52 pagesKPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaNekta PinchaNo ratings yet

- Comparative Study of Top 5 Banks in IndiaDocument11 pagesComparative Study of Top 5 Banks in Indiajakharpardeepjakhar_No ratings yet

- 2 A Study On Financial Performance of ICICI and IDBIDocument5 pages2 A Study On Financial Performance of ICICI and IDBIGUDDUNo ratings yet

- IDBI Bank - WikipediaDocument20 pagesIDBI Bank - WikipediaPrajakta NaikNo ratings yet

- The Growth of Merchant Banking in IndiaDocument7 pagesThe Growth of Merchant Banking in IndiamgajenNo ratings yet

- The End of Development FinanceDocument5 pagesThe End of Development FinanceravichandrankkNo ratings yet

- Market AnomaliesDocument9 pagesMarket AnomaliesVerma ChandanNo ratings yet

- History of IDBIDocument43 pagesHistory of IDBIanuragchandrajhaNo ratings yet

- Finance Major ProjectDocument16 pagesFinance Major ProjectVarshini KrishnaNo ratings yet

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- Service Marketing of Icici BankDocument41 pagesService Marketing of Icici BankIshan VyasNo ratings yet

- Chapter 1DFVDocument21 pagesChapter 1DFVAsif KhanNo ratings yet

- History: Working Capital ManagementDocument3 pagesHistory: Working Capital ManagementamitNo ratings yet

- Team Members Alagammai .R Nimmi Georrianna .E.W Pragruthaa Varshini .R Rizwan Asif.S Swarnapriya .T Sriram .MDocument20 pagesTeam Members Alagammai .R Nimmi Georrianna .E.W Pragruthaa Varshini .R Rizwan Asif.S Swarnapriya .T Sriram .MriznasifNo ratings yet

- Term Loan ProcedureDocument8 pagesTerm Loan ProcedureSunita More0% (2)

- Jayesh GuptaDocument40 pagesJayesh GuptaJayesh GuptaNo ratings yet

- Jayesh GuptaDocument31 pagesJayesh GuptaJayesh GuptaNo ratings yet

- The Industrial Development Bank of India Limited Commonly Known by Its Acronym IDBI Is One of IndiaDocument11 pagesThe Industrial Development Bank of India Limited Commonly Known by Its Acronym IDBI Is One of IndiaPranav ViraNo ratings yet

- The Industrial Development Bank of India LimitedDocument5 pagesThe Industrial Development Bank of India LimitedPranav ShahNo ratings yet

- Case Study On Meregers & Acquisition of Banks - Shaikh Sahil (6215)Document15 pagesCase Study On Meregers & Acquisition of Banks - Shaikh Sahil (6215)S4 InsaneNo ratings yet

- Executive SummaryDocument41 pagesExecutive Summarysee2vickyNo ratings yet

- (Batch 2020 - 2022) : Prestige Institute of Management and Research, IndoreDocument14 pages(Batch 2020 - 2022) : Prestige Institute of Management and Research, IndoreanjaliNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Company Profile - HDFC LTDDocument8 pagesCompany Profile - HDFC LTDVivek NairNo ratings yet

- Certificate From The Internal Guide: A Project Report ON "Customers Perception Towards HDFC Standard Life"Document70 pagesCertificate From The Internal Guide: A Project Report ON "Customers Perception Towards HDFC Standard Life"Pooja HemnaniNo ratings yet

- Optima Restore ProspectusDocument18 pagesOptima Restore Prospectussanjay4u4allNo ratings yet

- Sarv Suraksha Plus Group ProspectusDocument53 pagesSarv Suraksha Plus Group ProspectusAbhishek MalakarNo ratings yet

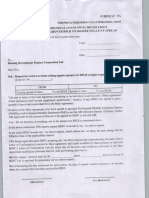

- Format 9A: Applicable For Individual Loans Switchover From Existing Negative Spreadover RPLR To Higher Negative SpreadDocument1 pageFormat 9A: Applicable For Individual Loans Switchover From Existing Negative Spreadover RPLR To Higher Negative SpreadANANDARAJNo ratings yet

- Customer Satisfaction Regarding HDFC BankDocument104 pagesCustomer Satisfaction Regarding HDFC BankAmarkant0% (1)

- Mutual Fund Investment InternshipDocument69 pagesMutual Fund Investment InternshipSv KhanNo ratings yet

- Computer Age Management Services Limited: Our Promoter: Great Terrain Investment LTDDocument275 pagesComputer Age Management Services Limited: Our Promoter: Great Terrain Investment LTDÂj AjithNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Certificate: OF MUTUAL FUND OF HDFC & ICICI". This Report Has Not Been Submitted Earlier AnyDocument51 pagesCertificate: OF MUTUAL FUND OF HDFC & ICICI". This Report Has Not Been Submitted Earlier AnyAmarjit PriyadarshanNo ratings yet

- 1108 - Addendum - Introduction of HDFC DREAM SIP FacilityDocument3 pages1108 - Addendum - Introduction of HDFC DREAM SIP FacilityIshan AarushNo ratings yet

- HDFC Bank StrategyDocument214 pagesHDFC Bank StrategyMukul Yadav0% (1)

- Comparative Study of Mutual Funds Between HDFC and ICICI BANKSDocument63 pagesComparative Study of Mutual Funds Between HDFC and ICICI BANKSChintan PatelNo ratings yet

- Prepared By: Harsh Bhutada (4) Jeenal Karani (16) Kanav Karol (17) Shubham Misra (27) Rohit SawantDocument37 pagesPrepared By: Harsh Bhutada (4) Jeenal Karani (16) Kanav Karol (17) Shubham Misra (27) Rohit SawantRohit SawantNo ratings yet

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra67% (3)

- Project Ameer Draft For PrintDocument124 pagesProject Ameer Draft For PrintameerashnaNo ratings yet

- Screenshot 2021-10-03 at 3.48.02 PMDocument72 pagesScreenshot 2021-10-03 at 3.48.02 PMRajiv PalNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- Smart 16-01Document58 pagesSmart 16-01humbleNo ratings yet

- HDFC Children's Gift Fund Leaflet (As On 31st March 2023)Document4 pagesHDFC Children's Gift Fund Leaflet (As On 31st March 2023)DeepakNo ratings yet

- Iop HDFC LTDDocument72 pagesIop HDFC LTDSimreen HuddaNo ratings yet

- Project Report On Personal Loan CompressDocument62 pagesProject Report On Personal Loan CompressSudhakar GuntukaNo ratings yet

- HDFC FD FormDocument5 pagesHDFC FD FormMohitNo ratings yet

- Mba Project Report On HDFC Bank - PDF - ConvertDocument97 pagesMba Project Report On HDFC Bank - PDF - ConvertKumar ShettyNo ratings yet

- Smart Investment - English - May 16 - 22, 2021Document53 pagesSmart Investment - English - May 16 - 22, 2021Devashish SahasrabudheNo ratings yet

- A Project Report HDFC Standard Life Insu ZaidDocument79 pagesA Project Report HDFC Standard Life Insu Zaidrishiisingh90472No ratings yet

- Comparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .Document85 pagesComparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .meenakshi dange100% (1)

- Boi and HDFCDocument24 pagesBoi and HDFCDharmikNo ratings yet

Financial Services: India's Emerging Universal Banks: Size Does Matter

Financial Services: India's Emerging Universal Banks: Size Does Matter

Uploaded by

Anirban HalderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Services: India's Emerging Universal Banks: Size Does Matter

Financial Services: India's Emerging Universal Banks: Size Does Matter

Uploaded by

Anirban HalderCopyright:

Available Formats

INDIA

FASTEST GROWING

FREE MARKET DEMOCRACY

FINANCIAL SERVICES

India’s emerging universal banks :

Size does matter

www.ibef.org India Brand Equity Foundation

P A G E 2

F I N A N C I A L S E R V I C E S

INDIA’S EMERGING UNIVERSAL BANKS :

SIZE DOES MATTER

A decade of financial sector reforms has led to the creation of financial

conglomerates in India. Unlike China, where there are huge risks

The strong regula- associated with letting banks get into other businesses, the strong

tory framework in regulatory framework in India has actually spurred India’s financial

India has actually companies to bigger, better things.

spurred India’s

Ten years ago, when Kundapur Vaman Kamath, the CEO of ICICI Bank,

financial companies

spoke about his ambitions to make his bank (then called just ICICI) a

to bigger, better

universal bank, selling every conceivable financial product, he created a

things. flutter. Financial sector reforms in India had just kicked in, but even the

biggest players in financial services were confined to neatly fenced

territories. Was Kamath ahead of his time?

Banking@2005

Today, State Bank of India offers life insurance covers of its subsidiary, SBI

Life, to all its saving account holders for a small fee. This strategy is paying

rich dividends. SBI Life – the insurance arm of State Bank--derives close to

70 per cent of its premium income through this route. With over 100

million customers in the books of State Bank and the seven associate

banks in the SBI group, SBI Life has huge potential to notch up volumes.

Even in areas where foreign banks seemed to have an unassailable

advantage for decades, Indian universal banks are making serious inroads.

On January 1 this year, barely five years after entering retail lending, ICICI

Bank touched the 3 million mark in terms of number of credit cards,

racing ahead of incumbent Citibank (2.5 million cards), which was the

leader in the business for a decade and a half.

Encouraged by the inroads made by SBI and ICICI, more players are

jumping on to the bandwagon.

√ India’s largest insurance company Life Insurance Corporation (LIC)

offers home loans and mutual funds beyond life insurance. Though

it is not into banking yet, it has made a foray by picking up

substantial stake in a state-run bank, Corporation Bank. It is only a

matter of time before the life insurance giant started banking

services through an acquisition or on its own.

√ IDBI, which has a mutual fund operation, is planning a reverse

merger with its subsidiary, IDBI Bank, which is heavily into retail

lending. Before long, IDBI can be expected to get into insurance as

well. The company is now in the process of deploying banking

software across more than 100 locations to help it access retail

customers.

www.ibef.org India Brand Equity Foundation

P A G E 3

F I N A N C I A L S E R V I C E S

INDIA’S EMERGING UNIVERSAL BANKS :

SIZE DOES MATTER

√ With the government considering mergers of other state-run

banks – for example, that of Bank of India and Union Bank of

In fourteen years of India, more universal banks could appear on India’s financial terra

financial sector firma.

reforms, there is little

What’s more, the recent success of universal banks has made some

doubt that India’s

foreign banks -- which had shut business divisions in India in the last

banks and development

decade to focus on a single business -- to consider a rethink. For

finance institutions example, Bank of America (BankAm), sold its retail banking business in

have successfully made India to ABN AMRO Bank and shut its investment banking business to

it to the next level; focus on treasury operations. According to Vishwavir Ahuja, MD & CEO,

they have made the BankAm (India), now the bank is evaluating the opportunities for a

transition from being presence in retail banking. BankAm has already resumed investment

basic lenders to banking in the country which it had closed in 2001.

emerging as financial

In fourteen years of financial sector reforms, there is little doubt that

conglomerates.

India’s banks and development finance institutions have successfully made

it to the next level; they have made the transition from being basic

lenders to emerging as financial conglomerates. They have bulldozed

away all the artificial barriers that separated segments in financial

services. On their part, India’s financial sector regulators have rewritten

rules to make it possible for any institution, as long as it had sound

financials and a good track record, to venture into any area of financial

services. And institutions have matched the regulators’ enthusiasm by

revving up their performances impressively.

State Bank of India, for example, has managed to shed 10% of its

headcount in a tightly unionized environment and has brought its cost-

to-income ratio down from 64% to 50% in less than six years.

The past: separate compartments

All this is a far cry from the past. Till the late nineties in India, trespassing

was seldom, and mostly frowned upon. The country’s largest bank, State

Bank of India, along with other commercial banks, was hardly interested

in anything except lending to the corporate sector for operational

expenses. Firms requiring funds for capital expenditure, went to one of

the three ‘development banks’ - ICICI, the Industrial Development Bank

of India (IDBI) or Industrial Financial Corporation of India (IFCI). India’s

only retail housing finance, company, Housing Development and Finance

Corporation (HDFC) was known only for helping people buy homes. On

the other hand, private sector players like Kotak Mahindra Finance

focused on niche products like car loans.

Cut to 2005. Extensive cross-selling of products has resulted in a

www.ibef.org India Brand Equity Foundation

P A G E 4

F I N A N C I A L S E R V I C E S

INDIA’S EMERGING UNIVERSAL BANKS :

SIZE DOES MATTER

business boom in universal banks, and entities like SBI, ICICI, HDFC and

Kotak Mahindra have all become one-stop departmental stores for

It is estimated that mutual funds, loans, insurance and much else (see chart).

India’s total foot-

The spinoffs

wear market size is

at 1 billion pairs a For savvy institutions, the appeal of becoming a universal bank is now

irresistible. Institutions like ICICI, SBI and HDFC have realised that it

year, most of it in

helps to spread risks among different segments. They are also waking up

the form of casual

to the sheer potential for growth: life insurance premium to GDP in India

footwear, ethnic is estimated at less than 2%; retail loans are less than 3% of GDP; and

footwear, slippers, more than 70% of mutual fund collections are only from the major

sandals. metros.

Besides, with more and more middle class customers wanting to spread

their wealth across banking products, equity, mutual funds, pension

products and insurance— leading banks see sense in becoming one-stop

shops—so they can capture the consumer completely.

In fact, changing consumer preferences has clearly been the biggest driver

of universal banking in India. A retail customer would have been quite

content with a bank deposit about 20 years ago. Today he spreads his

wealth around: equities, mutual funds, pension products and insurance,

for example. A bank either has to offer it all to him, or lose him.

The right regulatory balance

Meanwhile, to create the right environment for universal banking, India’s

banking regulator the Reserve Bank of India (RBI), capital markets

regulator the Securities Exchange Board of India (SEBI) and insurance

regulator the Insurance Regulatory Authority of India (IRDA) are

carefully putting together a set of templates for universal banks to follow,

so they don’t stray out of line. These are at par with the best in the

world in terms of protecting all the stakeholders’ interests.

For example, only an ‘arms-length’ relationship between a bank and an

insurance entity has been allowed by India’s insurance regulator. This

means that commercial banks can enter insurance business either by

acting as agents or by setting up joint ventures with insurance companies.

Also, India’s Reserve Bank allows banks to only marginally invest in equity

(5 per cent of their outstanding credit). Similarly, development financial

institutions can turn themselves into banks, but have to adhere to the

statutory liquidity ratio and cash reserve requirements meant for banks.

Universal banking: India’s headstart

There is no doubt that the carefully calibrated financial sector reforms

www.ibef.org India Brand Equity Foundation

P A G E 5

F I N A N C I A L S E R V I C E S

INDIA’S EMERGING UNIVERSAL BANKS :

SIZE DOES MATTER

has created an environment that has allowed the country’s leading

finance companies to grow up. This has given the country a head start

Profits of Indian over China’s banking sector. China opted for a compartmental approach

universal banks to banking when authorities passed the Commercial Bank Law in 1995.

can grow unfet-

However, unlike India, the rigid implementation of this law will not help

tered since they

Chinese banks compete with global financial powerhouses backed by

will not have to be

financial holding companies. Even if regulators in China now want to opt

ploughed back into

for universal banking, the high proportion of bad loans in the books of

the balance sheet China’s banks comes in the way dismantling restrictions because it will

for filling holes. lead to an enormous systemic risk.

That makes sound

business sense. In addition, non-performing assets of China’s banks are conservatively

estimated to be at a high 40% of GDP compared to a low 13% in India.

In stark contrast, profits of Indian universal banks can grow unfettered

since they will not have to be ploughed back into the balance sheet for

filling holes. That makes sound business sense.

Universal Banks in India: Size does matter

HDFC

Loans $ 10.7 billion

Insurance $ 74.6 million

Mutual Funds $ 3.2 billion

ICICI Bank

Loans $ 14.4 billion

Insurance $ 292.5 million

Mutual Funds $3.7 billion

State Bank of India

Loans $ 36.7 billion

Insurance $ 45.5 million

Mutual Funds $1.2 billion

Resources

1. To learn more about consolidation in the Indian banking industry, read:

http://www.valuenotes.com/krc/

krc_weekender_08jan05.pdf?ArtCd=34618&Cat=&Id=

2. Also visit the following link http://papers.ssrn.com/sol3/

papers.cfm?abstract_id=649855 for a deeper understanding of banking

reforms in India, and how India’s financial sector compares with the

rest of the world.

www.ibef.org India Brand Equity Foundation

JANUARY 2005 P A G E 6

F I N A N C I A L S E R V I C E S

The India Brand Equity Foundation is a public - private partnership

between the Ministry of Commerce, Government of India and

the Confederation of Indian Industry. The Foundation's primary objective

is to build positive economic perceptions of India globally.

India Brand Equity Foundation

c/o Confederation of Indian Industry

249-F Sector 18

Udyog Vihar Phase IV

Gurgaon 122015 Haryana

INDIA

Tel +91 124 501 4087 Fax +91 124 501 3873

E-mail india-now@ibef.org

Web www.ibef.org

www.ibef.org India Brand Equity Foundation

You might also like

- JK Bank Project ReportDocument74 pagesJK Bank Project ReportSurbhi Nargotra43% (7)

- Equity Research Report HDFC BankDocument4 pagesEquity Research Report HDFC BankNikhil KumarNo ratings yet

- HDFC HR PracticeDocument21 pagesHDFC HR Practicejacobmathew1706No ratings yet

- A Study On Financial Services of Commercial Bank With Reference To ICICI Bank (Final)Document56 pagesA Study On Financial Services of Commercial Bank With Reference To ICICI Bank (Final)geetha_kannan32No ratings yet

- An Overview of Mergers and Acquisitions in Indian Banking IndustryDocument8 pagesAn Overview of Mergers and Acquisitions in Indian Banking IndustryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- KunalDocument66 pagesKunalRahul VarmaNo ratings yet

- Icici & HDFCDocument108 pagesIcici & HDFCindia20000No ratings yet

- Case Study 2011Document7 pagesCase Study 2011Momi DuttaNo ratings yet

- NBFC Edelweise Retail FinanceDocument14 pagesNBFC Edelweise Retail FinancesunitaNo ratings yet

- Universal Banking in India: You Are HereDocument4 pagesUniversal Banking in India: You Are HereRupesh MorajkarNo ratings yet

- Introduction To Banking IndustryDocument35 pagesIntroduction To Banking IndustrySindhuja SridharNo ratings yet

- Financial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)Document6 pagesFinancial KYE Performance Analysis of SBI and HDFC Bank (Year 2016-17 To 2019-20)International Journal of Innovative Science and Research Technology100% (1)

- Preface: Indian Banking System 201Document60 pagesPreface: Indian Banking System 201akashrajput020304100% (1)

- Introduction To SbiDocument4 pagesIntroduction To Sbisamy7541100% (2)

- The Hindu Review September 2017Document21 pagesThe Hindu Review September 2017rajanNo ratings yet

- A Study On The Imc Standards Icici Bank FollowsDocument47 pagesA Study On The Imc Standards Icici Bank FollowsShazs EnterprisesNo ratings yet

- Chapter-2 Organization Profile: BackgroundDocument5 pagesChapter-2 Organization Profile: BackgroundAcchu RNo ratings yet

- Jayesh Gupta PDF 1Document12 pagesJayesh Gupta PDF 1Jayesh GuptaNo ratings yet

- Homeloans IciciDocument83 pagesHomeloans Icicitajju_121No ratings yet

- BankDocument94 pagesBankNaren JangirNo ratings yet

- Id BiDocument2 pagesId BisagarssssNo ratings yet

- Financial Institutions - Entrepreneurship AssignmentDocument17 pagesFinancial Institutions - Entrepreneurship AssignmentDevikaKhareNo ratings yet

- Tybms Sem V Project 2017-18Document54 pagesTybms Sem V Project 2017-18sagarNo ratings yet

- Finanical MKT IFSDocument5 pagesFinanical MKT IFSharshita khadayteNo ratings yet

- SAPM ICICI BankDocument9 pagesSAPM ICICI BankRushikesh ChouguleNo ratings yet

- Project Report ON: Financial Statement Analysis OFDocument34 pagesProject Report ON: Financial Statement Analysis OFsherrinmaryaliyas23No ratings yet

- (51,52) SEBI Controlled NBFCsDocument43 pages(51,52) SEBI Controlled NBFCsYadwinder SinghNo ratings yet

- Credit Risk Management On HDFC BankDocument17 pagesCredit Risk Management On HDFC BankAhemad 12No ratings yet

- Financial MarketDocument27 pagesFinancial MarketVaibhav MawalNo ratings yet

- Jayesh Gupta PDF 1Document21 pagesJayesh Gupta PDF 1Jayesh GuptaNo ratings yet

- Id BiDocument16 pagesId BiBhanu DadwalNo ratings yet

- NBFC in IndiaDocument19 pagesNBFC in IndiaBharath ReddyNo ratings yet

- Development Financial Institutions or Development BanksDocument23 pagesDevelopment Financial Institutions or Development BanksSaurabh TiwariNo ratings yet

- Final Blackbook PalakDocument96 pagesFinal Blackbook PalakPalak MehtaNo ratings yet

- B.B.A., L.L.B. (Hons.) / Third Semester-2021Document17 pagesB.B.A., L.L.B. (Hons.) / Third Semester-2021Anoushka SudNo ratings yet

- KPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaDocument52 pagesKPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaNekta PinchaNo ratings yet

- Comparative Study of Top 5 Banks in IndiaDocument11 pagesComparative Study of Top 5 Banks in Indiajakharpardeepjakhar_No ratings yet

- 2 A Study On Financial Performance of ICICI and IDBIDocument5 pages2 A Study On Financial Performance of ICICI and IDBIGUDDUNo ratings yet

- IDBI Bank - WikipediaDocument20 pagesIDBI Bank - WikipediaPrajakta NaikNo ratings yet

- The Growth of Merchant Banking in IndiaDocument7 pagesThe Growth of Merchant Banking in IndiamgajenNo ratings yet

- The End of Development FinanceDocument5 pagesThe End of Development FinanceravichandrankkNo ratings yet

- Market AnomaliesDocument9 pagesMarket AnomaliesVerma ChandanNo ratings yet

- History of IDBIDocument43 pagesHistory of IDBIanuragchandrajhaNo ratings yet

- Finance Major ProjectDocument16 pagesFinance Major ProjectVarshini KrishnaNo ratings yet

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- Service Marketing of Icici BankDocument41 pagesService Marketing of Icici BankIshan VyasNo ratings yet

- Chapter 1DFVDocument21 pagesChapter 1DFVAsif KhanNo ratings yet

- History: Working Capital ManagementDocument3 pagesHistory: Working Capital ManagementamitNo ratings yet

- Team Members Alagammai .R Nimmi Georrianna .E.W Pragruthaa Varshini .R Rizwan Asif.S Swarnapriya .T Sriram .MDocument20 pagesTeam Members Alagammai .R Nimmi Georrianna .E.W Pragruthaa Varshini .R Rizwan Asif.S Swarnapriya .T Sriram .MriznasifNo ratings yet

- Term Loan ProcedureDocument8 pagesTerm Loan ProcedureSunita More0% (2)

- Jayesh GuptaDocument40 pagesJayesh GuptaJayesh GuptaNo ratings yet

- Jayesh GuptaDocument31 pagesJayesh GuptaJayesh GuptaNo ratings yet

- The Industrial Development Bank of India Limited Commonly Known by Its Acronym IDBI Is One of IndiaDocument11 pagesThe Industrial Development Bank of India Limited Commonly Known by Its Acronym IDBI Is One of IndiaPranav ViraNo ratings yet

- The Industrial Development Bank of India LimitedDocument5 pagesThe Industrial Development Bank of India LimitedPranav ShahNo ratings yet

- Case Study On Meregers & Acquisition of Banks - Shaikh Sahil (6215)Document15 pagesCase Study On Meregers & Acquisition of Banks - Shaikh Sahil (6215)S4 InsaneNo ratings yet

- Executive SummaryDocument41 pagesExecutive Summarysee2vickyNo ratings yet

- (Batch 2020 - 2022) : Prestige Institute of Management and Research, IndoreDocument14 pages(Batch 2020 - 2022) : Prestige Institute of Management and Research, IndoreanjaliNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Company Profile - HDFC LTDDocument8 pagesCompany Profile - HDFC LTDVivek NairNo ratings yet

- Certificate From The Internal Guide: A Project Report ON "Customers Perception Towards HDFC Standard Life"Document70 pagesCertificate From The Internal Guide: A Project Report ON "Customers Perception Towards HDFC Standard Life"Pooja HemnaniNo ratings yet

- Optima Restore ProspectusDocument18 pagesOptima Restore Prospectussanjay4u4allNo ratings yet

- Sarv Suraksha Plus Group ProspectusDocument53 pagesSarv Suraksha Plus Group ProspectusAbhishek MalakarNo ratings yet

- Format 9A: Applicable For Individual Loans Switchover From Existing Negative Spreadover RPLR To Higher Negative SpreadDocument1 pageFormat 9A: Applicable For Individual Loans Switchover From Existing Negative Spreadover RPLR To Higher Negative SpreadANANDARAJNo ratings yet

- Customer Satisfaction Regarding HDFC BankDocument104 pagesCustomer Satisfaction Regarding HDFC BankAmarkant0% (1)

- Mutual Fund Investment InternshipDocument69 pagesMutual Fund Investment InternshipSv KhanNo ratings yet

- Computer Age Management Services Limited: Our Promoter: Great Terrain Investment LTDDocument275 pagesComputer Age Management Services Limited: Our Promoter: Great Terrain Investment LTDÂj AjithNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Certificate: OF MUTUAL FUND OF HDFC & ICICI". This Report Has Not Been Submitted Earlier AnyDocument51 pagesCertificate: OF MUTUAL FUND OF HDFC & ICICI". This Report Has Not Been Submitted Earlier AnyAmarjit PriyadarshanNo ratings yet

- 1108 - Addendum - Introduction of HDFC DREAM SIP FacilityDocument3 pages1108 - Addendum - Introduction of HDFC DREAM SIP FacilityIshan AarushNo ratings yet

- HDFC Bank StrategyDocument214 pagesHDFC Bank StrategyMukul Yadav0% (1)

- Comparative Study of Mutual Funds Between HDFC and ICICI BANKSDocument63 pagesComparative Study of Mutual Funds Between HDFC and ICICI BANKSChintan PatelNo ratings yet

- Prepared By: Harsh Bhutada (4) Jeenal Karani (16) Kanav Karol (17) Shubham Misra (27) Rohit SawantDocument37 pagesPrepared By: Harsh Bhutada (4) Jeenal Karani (16) Kanav Karol (17) Shubham Misra (27) Rohit SawantRohit SawantNo ratings yet

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra67% (3)

- Project Ameer Draft For PrintDocument124 pagesProject Ameer Draft For PrintameerashnaNo ratings yet

- Screenshot 2021-10-03 at 3.48.02 PMDocument72 pagesScreenshot 2021-10-03 at 3.48.02 PMRajiv PalNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- Smart 16-01Document58 pagesSmart 16-01humbleNo ratings yet

- HDFC Children's Gift Fund Leaflet (As On 31st March 2023)Document4 pagesHDFC Children's Gift Fund Leaflet (As On 31st March 2023)DeepakNo ratings yet

- Iop HDFC LTDDocument72 pagesIop HDFC LTDSimreen HuddaNo ratings yet

- Project Report On Personal Loan CompressDocument62 pagesProject Report On Personal Loan CompressSudhakar GuntukaNo ratings yet

- HDFC FD FormDocument5 pagesHDFC FD FormMohitNo ratings yet

- Mba Project Report On HDFC Bank - PDF - ConvertDocument97 pagesMba Project Report On HDFC Bank - PDF - ConvertKumar ShettyNo ratings yet

- Smart Investment - English - May 16 - 22, 2021Document53 pagesSmart Investment - English - May 16 - 22, 2021Devashish SahasrabudheNo ratings yet

- A Project Report HDFC Standard Life Insu ZaidDocument79 pagesA Project Report HDFC Standard Life Insu Zaidrishiisingh90472No ratings yet

- Comparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .Document85 pagesComparative Study of Home Loans of Abhyudaya Co-Operative Bank and NKGSB Co-Operative Bank .meenakshi dange100% (1)

- Boi and HDFCDocument24 pagesBoi and HDFCDharmikNo ratings yet