Professional Documents

Culture Documents

Basic Financial Statements Chapter Number 2

Basic Financial Statements Chapter Number 2

Uploaded by

Muhammad UsamaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Financial Statements Chapter Number 2

Basic Financial Statements Chapter Number 2

Uploaded by

Muhammad UsamaCopyright:

Available Formats

Basic financial statements

Financial statements show the result of business in terms of monetary units in dollar or rupees the

result may be profit or loss of business financial position of the business and the position of cash in

business.

There are three basic financial statements which are prepared in business

1. Balance sheet or statement of financial position

2. Income statement or statement of profit or loss

3. Statement of cash flows

Balance sheet or statement of financial position

It is a financial statement that describes where the enterprise stands at a specific date. It is sometimes

described as snapshot of the business in financial or dollar terms.

Balance sheet talk about the assets liabilities and owner's equity. Balance sheet is prepared at a

particular date.

The balance sheet displays the company's total assets, and how these assets are financed, through

either debt or equity. ... The balance sheet is based on the fundamental equation: Assets = Liabilities +

Equity.

How to Prepare a Basic Balance Sheet

Determine the Reporting Date and Period. ...

Identify Your Assets. ...

Identify Your Liabilities. ...

Calculate Shareholders' Equity. ...

Add Total Liabilities to Total Shareholders' Equity and Compare to Assets

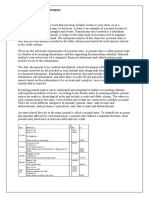

Format of the balance sheet is as follow

Income statement

Statement of business which is prepared to show the profit or loss of

business by matching the expenses and revenues of a particular period

income statement show us the operating performance of business

Unlike the balance sheet, the income statement calculates net income or loss over a range of time.

For example annual statements use revenues and expenses over a 12-month period, while

quarterly statements focus on revenues and expenses incurred during a 3-month period

Format of the income statement is as follow

Statement of cash flows

Statement of cash flows shows the increase and decrease in cash of business during a particular period

of time.

There are three activities due to which the cash of the business increase or decrease Which are as

follows

operating activities

These activities talks about the changes in cash due to expenses and revenues. expenses caused

negative cash flows and revenues cause positive cash flows.

Positive cash flow means cash comes in business and negative cash flow means cash goes out from

business

Investing activities

These activities talk about the changes in cash due to purchasing and selling of assets purchasing of

assets causes negative cash flows and selling of assets causes positive cash flows

Financing activities

These activities talks about the owners investment in business and obtaining loan by business from its

creditors

You might also like

- Advanced Financial Accounting & Reporting (Afar) : The Cpa Licensure Examination SyllabusDocument4 pagesAdvanced Financial Accounting & Reporting (Afar) : The Cpa Licensure Examination SyllabusFeem Operario100% (1)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document60 pagesFundamentals of Accountancy, Business and Management 2JayMoralesNo ratings yet

- Iacademy Basicfin: Basic Finance and Financial Management Final RequirementDocument5 pagesIacademy Basicfin: Basic Finance and Financial Management Final RequirementClarisse AlimotNo ratings yet

- Prelim AccountingDocument19 pagesPrelim AccountingNadiaIssabellaNo ratings yet

- Business Finance Revision Kit As at 25 April 2006Document239 pagesBusiness Finance Revision Kit As at 25 April 2006dnlkaba88% (16)

- Basic Accounting Concepts: Financial Accountancy (Or Financial Accounting) Is The Field ofDocument8 pagesBasic Accounting Concepts: Financial Accountancy (Or Financial Accounting) Is The Field ofGenerose Iyah SykesNo ratings yet

- Introduction To AccountingDocument34 pagesIntroduction To AccountingBianca Mhae De LeonNo ratings yet

- Preparation TB and BSDocument21 pagesPreparation TB and BSMarites Domingo - Paquibulan100% (1)

- Financial Accounting Is The Process of Preparing Financial Statements For A BusinessDocument11 pagesFinancial Accounting Is The Process of Preparing Financial Statements For A Businesshemanth727100% (1)

- Financial Statement Preparation: A TutorialDocument79 pagesFinancial Statement Preparation: A TutorialSanyln AclaNo ratings yet

- Introduction To Accoutning: Student Name Name of Instructor Course Number DateDocument11 pagesIntroduction To Accoutning: Student Name Name of Instructor Course Number DateMica BaylonNo ratings yet

- Financial Statement Preparation: A TutorialDocument79 pagesFinancial Statement Preparation: A TutorialKhatlene AclaNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingHaseebNo ratings yet

- Financial Analysis and ReportingDocument2 pagesFinancial Analysis and ReportingHelmy VenNo ratings yet

- Financial Accounting Reporting: Time. in Accounting, We Measure Profitability For A Period, Such As A Month or YearDocument2 pagesFinancial Accounting Reporting: Time. in Accounting, We Measure Profitability For A Period, Such As A Month or YearMuneebAhmedNo ratings yet

- Definition of AccountingDocument3 pagesDefinition of AccountingtpequitNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document8 pagesFundamentals of Accountancy, Business and Management 2janina marie francisco100% (1)

- Financial StatementDocument11 pagesFinancial StatementGurneet Singh7113No ratings yet

- Balance SheetDocument23 pagesBalance Sheetdeepakpareek143No ratings yet

- Common Financial Reports: Income StatementDocument2 pagesCommon Financial Reports: Income StatementFiantiayu efandiNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementAyaz Raza100% (1)

- ACCTG 1 Week 2-3 - Accounting in BusinessDocument13 pagesACCTG 1 Week 2-3 - Accounting in BusinessReygie FabrigaNo ratings yet

- Prepare Basic Financial StatementsDocument6 pagesPrepare Basic Financial StatementsMujieh NkengNo ratings yet

- 5.financial StatementsDocument15 pages5.financial StatementsUlinaro BuatonNo ratings yet

- ACC321Document6 pagesACC321Allysa Del MundoNo ratings yet

- Financial Accounting Assignment 1Document3 pagesFinancial Accounting Assignment 1Mr Chaitanya Valiveti IPENo ratings yet

- bd4769edd615cbff9a10b93d43ba3972Document17 pagesbd4769edd615cbff9a10b93d43ba3972Tanish HandaNo ratings yet

- Journal Entries Reflection-WPS OfficeDocument9 pagesJournal Entries Reflection-WPS OfficelenjiexrysNo ratings yet

- Financial Modelling: Types of Financial ModelsDocument7 pagesFinancial Modelling: Types of Financial ModelsNavyaRaoNo ratings yet

- Assignment No. 1 (Business Finance)Document7 pagesAssignment No. 1 (Business Finance)Abijane Ilagan DarucaNo ratings yet

- Objectives of Preparing Financial StatementDocument13 pagesObjectives of Preparing Financial StatementJhesnil SabundoNo ratings yet

- Financial Staement AnalysisDocument17 pagesFinancial Staement Analysis4555177No ratings yet

- Learning Tally Erp 9Document385 pagesLearning Tally Erp 9Samuel Zodingliana100% (2)

- MTTM 05 2021Document10 pagesMTTM 05 2021Rajni KumariNo ratings yet

- Finance For Non-Financial ManagerDocument23 pagesFinance For Non-Financial ManagerMahrous100% (7)

- AccountingDocument22 pagesAccountingBushra HaqueNo ratings yet

- 01 Lecture - MT - ch01 - 0607-082023 - Acctg Concepts 01Document22 pages01 Lecture - MT - ch01 - 0607-082023 - Acctg Concepts 01JIM KYRONE GENOBISANo ratings yet

- Intro 3Document7 pagesIntro 3nouhasedki99No ratings yet

- Fs Components: CSD GDocument4 pagesFs Components: CSD GshaiNo ratings yet

- Tally Erp.9Document50 pagesTally Erp.9Jancy Sunish100% (1)

- Financial Statement Sivaswathi TEXTILESDocument103 pagesFinancial Statement Sivaswathi TEXTILESSakhamuri Ram'sNo ratings yet

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- What Is AccountingDocument49 pagesWhat Is AccountingMay Myoe KhinNo ratings yet

- FM TermpaoerDocument34 pagesFM TermpaoerFilmona YonasNo ratings yet

- Financial Analysis: Submitted byDocument18 pagesFinancial Analysis: Submitted bybernie john bernabeNo ratings yet

- Understanding AccountingDocument20 pagesUnderstanding Accountingrainman54321No ratings yet

- Types of Financial Statements: Statement of Profit or Loss (Income Statement)Document4 pagesTypes of Financial Statements: Statement of Profit or Loss (Income Statement)LouiseNo ratings yet

- So, You Want To Learn Bookkeeping! Lesson 5: The General Ledger and JournalsDocument15 pagesSo, You Want To Learn Bookkeeping! Lesson 5: The General Ledger and JournalsJamelenFloroCodillaGuzonNo ratings yet

- Finma 4 Prelim ResearchDocument10 pagesFinma 4 Prelim Researchfrescy mosterNo ratings yet

- Accounting ReportDocument23 pagesAccounting ReportAreeba FatimaNo ratings yet

- Who Are The Users of AccountingDocument20 pagesWho Are The Users of AccountingMohammad KamranNo ratings yet

- Acconting Eqn and Types AccntDocument12 pagesAcconting Eqn and Types AccntZaid SiddiquiNo ratings yet

- Muzzamil Janjua SAP ID 42618Document9 pagesMuzzamil Janjua SAP ID 42618Muzzamil JanjuaNo ratings yet

- Principles of Finance Chapter07 BlackDocument115 pagesPrinciples of Finance Chapter07 BlackLim Mei Suok100% (1)

- Beginners' Guide To Financial StatementsDocument7 pagesBeginners' Guide To Financial StatementsIbrahim El-nagarNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsYasir ABNo ratings yet

- Financial Accounting and Analysis June 2022Document10 pagesFinancial Accounting and Analysis June 2022Rajni KumariNo ratings yet

- Analysis of Financial Statements: Muhammad SarwarDocument41 pagesAnalysis of Financial Statements: Muhammad SarwarawaischeemaNo ratings yet

- Acc201 Su6Document15 pagesAcc201 Su6Gwyneth LimNo ratings yet

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDocument24 pagesTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- Contabilitate COURSE 4Document47 pagesContabilitate COURSE 4Raluca ToneNo ratings yet

- Sialkot College of Commerce & Science: A PhraseDocument5 pagesSialkot College of Commerce & Science: A PhraseMuhammad UsamaNo ratings yet

- Study Skills, Note Taking in Reading, Techniques & TipsDocument6 pagesStudy Skills, Note Taking in Reading, Techniques & TipsMuhammad UsamaNo ratings yet

- Cover Page PDFDocument7 pagesCover Page PDFMuhammad UsamaNo ratings yet

- Calculas MCQ'SDocument9 pagesCalculas MCQ'SMuhammad UsamaNo ratings yet

- MCQsDocument5 pagesMCQsMuhammad UsamaNo ratings yet

- Von Nuemann ArchitectureDocument3 pagesVon Nuemann ArchitectureMuhammad UsamaNo ratings yet

- Chapter 01: The Role and Objective of Financial Management: Answer: ADocument17 pagesChapter 01: The Role and Objective of Financial Management: Answer: AKyla Ramos DiamsayNo ratings yet

- MCHF 2 Investment MemorandumDocument44 pagesMCHF 2 Investment MemorandumwutNo ratings yet

- Riskometer - SEBI CircularDocument23 pagesRiskometer - SEBI CircularT SrinivasanNo ratings yet

- Final Exam Theories ValuationDocument6 pagesFinal Exam Theories ValuationBLN-Hulo- Ronaldo M. Valdez SRNo ratings yet

- ACCT 2102: Principles of Management AccountingDocument55 pagesACCT 2102: Principles of Management AccountingSihua ChengNo ratings yet

- Discussion No. 3 Conceptual Framework and The Accounting ProcessDocument3 pagesDiscussion No. 3 Conceptual Framework and The Accounting ProcessJullianneBalaseNo ratings yet

- Financial Statement Analysis of Nestle IndiaDocument43 pagesFinancial Statement Analysis of Nestle IndiaAmanNo ratings yet

- Patient Capital - A Study On The Outperformance of Infrequent TradersDocument72 pagesPatient Capital - A Study On The Outperformance of Infrequent TradersCanadianValueNo ratings yet

- Management Accounting Session 2 Cost Terms & Purposes: Indian Institute of Management RohtakDocument58 pagesManagement Accounting Session 2 Cost Terms & Purposes: Indian Institute of Management RohtakSiddharthNo ratings yet

- 3.management of Business Logistics - Demand ManagementDocument59 pages3.management of Business Logistics - Demand ManagementBẢO ĐẶNG QUỐCNo ratings yet

- BLD 416 Budgeting and Financial Control 1 Lecture Note 2Document9 pagesBLD 416 Budgeting and Financial Control 1 Lecture Note 2Oluwayomi MalomoNo ratings yet

- Cont Assessment - Indv AssignmentDocument3 pagesCont Assessment - Indv AssignmentMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- Ebook Investments 13Th Edition PDF Full Chapter PDFDocument65 pagesEbook Investments 13Th Edition PDF Full Chapter PDFjuanita.diaz864100% (35)

- Ae 112 Prelim Assessment 1Document7 pagesAe 112 Prelim Assessment 1Chelssy ParadoNo ratings yet

- Group 15 Merger ProposalDocument41 pagesGroup 15 Merger ProposalJohnny LamNo ratings yet

- Acc 205 Ca2Document11 pagesAcc 205 Ca2Nidhi SharmaNo ratings yet

- Muhammad Mustafa 19051 Cherat Cement Company Limited Research ReportDocument16 pagesMuhammad Mustafa 19051 Cherat Cement Company Limited Research ReportMuhammad “Muhack” MustafaNo ratings yet

- Course Code COM-402 Advanced Accounting-Ii Credit Hours 3Document4 pagesCourse Code COM-402 Advanced Accounting-Ii Credit Hours 3goharmahmood203No ratings yet

- Investment Analyst Resume SampleDocument3 pagesInvestment Analyst Resume SampleTipu SultanNo ratings yet

- Financial Statements, Taxes, and Cash FlowDocument32 pagesFinancial Statements, Taxes, and Cash Flowhafsa salmanNo ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingMelissa Kayla ManiulitNo ratings yet

- Cfas NotesDocument3 pagesCfas NotesUyara LeisbergNo ratings yet

- Revenue From Contracts With Customers: Global EditionDocument283 pagesRevenue From Contracts With Customers: Global EditionAmitesh100% (1)

- Accounts Revision QuestionsDocument293 pagesAccounts Revision QuestionsRishab Gupta100% (1)

- EShares Series A DeckDocument41 pagesEShares Series A DeckJaap FrölichNo ratings yet

- Case 1 MarriottDocument14 pagesCase 1 Marriotthimanshu sagar100% (1)