Professional Documents

Culture Documents

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Uploaded by

Rahul AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Uploaded by

Rahul AgrawalCopyright:

Available Formats

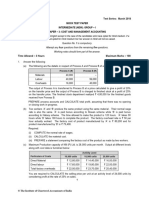

Test Series: May, 2020

MOCK TEST PAPER –1

INTERMEDIATE (NEW): GROUP – I

PAPER – 3: COST AND MANAGEMENT ACCOUNTING

Answers are to be given only in English except in the case of the candidates who have opted for Hindi medium. If a

candidate has not opted for Hindi medium his/ her answer in Hindi will not be valued.

Question No. 1 is compulsory.

Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. Answer the following:

(a) A company gives the following information:

Margin of Safety Rs.7,50,000

Total Cost Rs.7,75,000

Margin of Safety (Qty.) 15,000 units

Break Even Sales in Units 5,000 units

You are required to CALCULATE:

(i) Selling price per unit

(ii) Profit

(iii) Profit/ Volume Ratio

(iv) Break Even Sales (in Rupees)

(v) Fixed Cost

(b) ZX Ltd. has furnished the following information:

Budgeted Actual March 2020

Number of working days 25 27

Production (in units) 20,000 22,000

Fixed Overheads Rs. 3,00,000 Rs. 3,10,000

Budgeted fixed overhead rate is Rs. 10.00 per hour. In March 2020, the actual hours worked

were 31,500. In relation to fixed overheads, CALCULATE:

(i) Efficiency Variance

(ii) Capacity Variance

(iii) Calendar Variance

(iv) Volume Variance

(v) Expenditure Variance

(c) A company is undecided as to what kind of wage scheme should be introduced. The following

particulars have been compiled in respect of three workers, which are under consideration of the

management.

© The Institute of Chartered Accountants of India

I II III

Actual hours worked 380 100 540

Hourly rate of wages (in Rs.) 40 50 60

Productions in units:

- Product A 210 - 600

- Product B 360 - 1350

- Product C 460 250 -

Standard time allowed per unit of each product is:

A B C

Minutes 15 20 30

For the purpose of piece rate, each minute is valued at Rs. 1/-

You are required to COMPUTE the wages of each worker under:

(i) Guaranteed hourly rate basis.

(ii) Piece work earning basis, but guaranteed at 75% of basic pay (Guaranteed hourly rate if his

earnings are less than 50% of basic pay.)

(iii) Premium bonus basis where the worker received bonus based on Rowan scheme.

(d) A Ltd has calculated a predetermined overhead rate of Rs.22 per machine hour for its Quality

Check (QC) department. This rate has been calculated for the budgeted level of activity and is

considered as appropriate for absorbing overheads. The following overhead expenditures at

various activity levels had been estimated.

Total overheads Number of machine hours

Rs.3,38,875 14,500

Rs.3,47,625 15,500

Rs.3,56,375 16,500

You are required to:

(i) CALCULATE the variable overhead absorption rate per machine hour.

(ii) CALCULATE the estimated total fixed overheads.

(iii) CALCULATE the budgeted level of activity in machine hours.

(iv) CALCULATE the amount of under/over absorption of overheads if the actual machine hours

were 14,970 and actual overheads were Rs.3,22,000.

(v) ANALYSE the arguments for and against using departmental absorption rates as opposed

to a single or blanket factory wide rate. (4 × 5 Marks = 20 Marks)

2. (a) ZA Ltd. is a manufacturer of a range of goods. The cost structure of its different products is as

follows:

Product Product Product

Particulars

A B C

Direct Materials 100 80 80 Rs./u

Direct Labour @Rs.10/ hour 30 40 50 Rs./u

Production Overheads 30 40 50 Rs./u

Total Cost 160 160 180 Rs./u

Quantity Produced 20,000 40,000 60,000 Units

2

© The Institute of Chartered Accountants of India

ZA Ltd. was absorbing overheads on the basis of direct labour hours. A newly appointed

management accountant has suggested that the company should introduce ABC system and has

identified cost drivers and cost pools as follows:

Activity Cost Pool Cost Driver Associated Cost (Rs.)

Stores Receiving Purchase Requisitions 5,92,000

Inspection Number of Production Runs 17,88,000

Dispatch Orders Executed 4,20,000

Machine Setup Number of Setups 24,00,000

The following information is also supplied:

Details Product A Product B Product C

No. of Setups 360 390 450

No. of Orders Executed 180 270 300

No. of Production Runs 750 1,050 1,200

No. of Purchase Requisitions 300 450 500

Required:

CALCULATE activity based production cost of all the three products. (10 Marks)

(b) Following figures has been extracted from the books of M/s A&R Brothers:

Amount (Rs.)

Stock on 1st March, 2020

- Raw materials 6,06,000

- Finished goods 3,59,000

Stock on 31st March, 2020

- Raw materials 7,50,000

- Finished goods 3,09,000

Work-in-process:

- On 1st March, 2020 12,56,000

- On 31st March, 2020 14,22,000

Purchase of raw materials 28,57,000

Sale of finished goods 1,34,00,000

Direct wages 37,50,000

Factory expenses 21,25,000

Office and administration expenses 10,34,000

Selling and distribution expenses 7,50,000

Sale of scrap 26,000

You are required to COMPUTE:

(i) Value of material consumed

(ii) Prime cost

(iii) Cost of production

(iv) Cost of goods sold

© The Institute of Chartered Accountants of India

(v) Cost of sales

(vi) Profit/ loss (10 Marks)

3. (a) A company manufactures a product from a raw material, which is purchased at Rs.180 per kg.

The company incurs a handling cost of Rs.1,460 plus freight of Rs.940 per order. The

incremental carrying cost of inventory of raw material is Rs.2.5 per kg per month. In addition, the

cost of working capital finance on the investment in inventory of raw material is Rs.18per kg per

annum. The annual production of the product is 1,00,000 units and 2.5 units are obtained from

one kg. of raw material.

Required:

(i) CALCULATE the economic order quantity of raw materials.

(ii) DETERMINE, how frequently company should order for procurement be placed.

(iii) If the company proposes to rationalize placement of orders on quarterly basis, DETERMINE

the percentage of discount in the price of raw materials should be negotiated?

Assume 360 days in a year. (10 Marks)

(b) G K Ltd. produces a product "XYZ" which passes through two processes, viz. Process-A and

Process-B. The details for the year ending 31st March, 2020 are as follows:

Process A Process - B

40,000 units introduced at a cost of Rs. 3,60,000 -

Material consumed Rs. 2,42,000 2,25,000

Direct wages Rs. 2,58,000 1,90,000

Manufacturing expenses Rs. 1,96,000 1,23,720

Output in units 37,000 27,000

Normal wastage of inputs 5% 10%

Scrap value (per unit) Rs. 15 20

Selling price (per unit) Rs. 37 61

Additional Information:

(a) 80% of the output of Process-A, was passed on to the next process and the balance was

sold. The entire output of Process- B was sold.

(b) Indirect expenses for the year was Rs. 4,48,080.

(c) It is assumed that Process-A and Process-B are not responsibility centre.

Required:

(i) PREPARE Process-A and Process-B Account.

(ii) PREPARE Costing Profit & Loss Account showing the net profit/ net loss for the year.

(10 Marks)

4. (a) The Trading and Profit and Loss Account of a company for the year ended 31-03-2020 is as

under:

Trading and Profit and Loss Account

Particulars Rs. Particulars Rs.

To Materials 26,80,000 By Sales (50,000 units) 62,00,000

To Wages 17,80,000 By Closing stock (2,000 units) 1,50,000

To Factory expenses 9,50,000 By Dividend received 80,000

4

© The Institute of Chartered Accountants of India

To General administrative expenses 4,80,200

To Selling Expenses 2,50,000

To Preliminary expenses written off 70,000

To Net profit 2,19,800

64,30,000 64,30,000

In the Cost Accounts:

(i) Factory expenses have been allocated to production at 20% of Prime Cost.

(ii) General administrative expenses absorbed at 10% of factory cost.

(iii) Selling expenses charged at Rs.10 per unit sold.

Required:

PREPARE the Costing Profit and Loss Account of the company and RECONCILE the Profit/Loss

with the profit as shown in the Financial Accounts. (10 Marks)

(b) During the FY 2019-20, GP Limited has produced 30,000 units operating at 50% capacity level.

The cost structure at the 50% level of activity is as under:

Particulars Rs.

Direct Material 150 per unit

Direct Wages 50 per unit

Variable Overheads 50 per unit

Direct Expenses 30 per unit

Factory Expenses (25% fixed) 40 per unit

Selling and Distribution Exp. (80% variable) 20 per unit

Office and Administrative Exp. (100% fixed) 10 per unit

The company anticipates that in FY 2020-21, the variable costs will go up by 10% and fixed costs

will go up by 15%.

The selling price per unit will remain unchanged at Rs.400.

Required:

(i) CALCULATE the budgeted profit/ loss for the FY 2019-20.

(ii) PREPARE an Expense budget on marginal cost basis for the FY 2020-21 for the company

at 50% and 60% level of activity and FIND OUT the profits at respective levels. (10 Marks)

5. (a) KR Resorts (P) Ltd. offers three types of rooms to its guests, viz deluxe room, super deluxe room

and luxury suite. You are required to DETERMINE the tariff to be charged to the customers for

different types of rooms on the basis of following information:

Types of Room Number of Rooms Occupancy

Deluxe Room 100 90%

Super Deluxe Room 60 75%

Luxury Suite 40 60%

Rent of ‘super deluxe’ room is to be fixed at 2 times of ‘deluxe room’ and that of ‘luxury suite’ is 3

times of ‘deluxe room’. Annual expenses are as follows:

© The Institute of Chartered Accountants of India

Particulars Amount (Rs. lakhs)

Staff salaries 780.00

Lighting, Heating and Power 350.00

Repairs, Maintenance and Renovation 220.00

Linen 60.00

Laundry charges 34.00

Interior decoration 85.00

Sundries 36.28

An attendant for each room was provided when the room was occupied and he was paid Rs. 500

per day towards wages. Further, depreciation is to be provided on building @ 5% on Rs. 900

lakhs, furniture and fixtures @ 10% on Rs. 90 lakhs and air conditioners @ 10% on Rs. 75 lakhs.

Profit is to be provided @ 25% on total taking and assume 360 days in a year. (10 Marks)

(b) (i) SHOW Journal entries for the following transactions assuming cost and financial accounts

are integrated:

(1) Materials issued:

Direct Rs. 6,50,000

Indirect (to factory) Rs. 2,30,000

(2) Allocation of wages (25% indirect) Rs. 9,00,000

(3) Under/Over absorbed overheads:

Factory (Over) Rs. 60,000

Administration (Under) Rs. 50,000

(4) Payment to Creditors (Trade payables) Rs. 9,00,000

(5) Collection from Debtors (Trade receivables) Rs. 8,00,000

(ii) A company can make any one of the 3 products X, Y or Z in a year. It can exercise its option

only at the beginning of each year.

Relevant information about the products for the next year is given below.

X Y Z

Selling Price (Rs. / unit) 100 120 120

Variable Costs (Rs. / unit) 60 90 70

Market Demand (unit) 3,000 2,000 1,000

Production Capacity (unit) 2,000 3,000 900

Fixed Costs (Rs.) 3,00,000

Required

COMPUTE the opportunity costs for each of the products. (2 × 5 = 10 Marks)

6. (a) DISCUSS the accounting treatment of Idle time and overtime wages.

(b) EXPLAIN the stages in Zero-based budgeting.

(c) STATE the differences between Job costing and Batch costing.

(d) EXPLAIN the treatment of by-product cost in cost accounting. (4 × 5 =20 Marks)

© The Institute of Chartered Accountants of India

You might also like

- BAO1101 Assignment Sem 1 2021 KLDocument12 pagesBAO1101 Assignment Sem 1 2021 KLFat-hiya AllyNo ratings yet

- C.FM QDocument7 pagesC.FM QcawinnersofficialNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETNo ratings yet

- Overheads & ABC - Questions Test 1Document4 pagesOverheads & ABC - Questions Test 1jj4223062003No ratings yet

- Paper - 3: Cost Accounting and Financial Management Part-I: Cost Accounting Questions MaterialDocument45 pagesPaper - 3: Cost Accounting and Financial Management Part-I: Cost Accounting Questions MaterialRoshinisai VuppalaNo ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Costing (New) MTP Question Paper Mar2021Document8 pagesCosting (New) MTP Question Paper Mar2021ADITYA JAINNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument3 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- D12 Cac PDFDocument6 pagesD12 Cac PDFsecret studentNo ratings yet

- ABC CostingDocument17 pagesABC CostingHameed Ullah KhanNo ratings yet

- May 2021 G1 Test2Document4 pagesMay 2021 G1 Test2Dipak UgaleNo ratings yet

- Managerial Accounting - Mid Term Exam PDFDocument4 pagesManagerial Accounting - Mid Term Exam PDFNavya AgrawalNo ratings yet

- 51624bos41275inter QDocument5 pages51624bos41275inter QvarunNo ratings yet

- 3) CostingDocument19 pages3) CostingKrushna MateNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument4 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- Activity Based Cost Accounting ProblemsDocument3 pagesActivity Based Cost Accounting ProblemsVicky VigneshNo ratings yet

- Cost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingDocument4 pagesCost Per Unit Rs. Rs. Rs. RS.: M. Azeem/Activity Based CostingKamran ArifNo ratings yet

- Acct 321 - Managerial AccountingDocument6 pagesAcct 321 - Managerial AccountingNodeh Deh SpartaNo ratings yet

- Cost Management Accounting Question Paper MTP Series II New SyllabusDocument7 pagesCost Management Accounting Question Paper MTP Series II New SyllabusMadhav KhandelwalNo ratings yet

- Combinepdf 2Document6 pagesCombinepdf 2saisandeepNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument30 pagesPaper - 3: Cost and Management Accounting Questions Material CostADITYA JAINNo ratings yet

- Sugested May 2019 Group 2Document86 pagesSugested May 2019 Group 2priyanka jainNo ratings yet

- Cost Suggested Answer May 19Document28 pagesCost Suggested Answer May 19Saurabh sharmaNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- First Time Login Guide MsDocument6 pagesFirst Time Login Guide MskonosubaNo ratings yet

- AMA Terminal Fall 20Document3 pagesAMA Terminal Fall 20Ibrahim IbrahimchNo ratings yet

- 4 2 Sma 2018Document5 pages4 2 Sma 2018Nawoda SamarasingheNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)gulzar ahmadNo ratings yet

- Caf 8 Cma Autumn 2015Document4 pagesCaf 8 Cma Autumn 2015mary50% (2)

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Accountancy and Management ACADEMIC YEAR 2020/2021 Bachelor of Accounting (Hons.)Document4 pagesUniversiti Tunku Abdul Rahman Faculty of Accountancy and Management ACADEMIC YEAR 2020/2021 Bachelor of Accounting (Hons.)Shi Yan LNo ratings yet

- Activity Based Costing Notes and ExerciseDocument6 pagesActivity Based Costing Notes and Exercisefrancis MagobaNo ratings yet

- Advanced Management Accounting RTPDocument25 pagesAdvanced Management Accounting RTPSamir Raihan ChowdhuryNo ratings yet

- Costing QN PaperDocument5 pagesCosting QN PaperAJNo ratings yet

- Costing English Question 14.07.2020Document7 pagesCosting English Question 14.07.2020Prathmesh JambhulkarNo ratings yet

- SCM Unit 2 ProblemsDocument6 pagesSCM Unit 2 ProblemsAASTHA BAJAJ 2117013No ratings yet

- Tutorial Topic 3 Overhead CostingDocument5 pagesTutorial Topic 3 Overhead CostingPuneetNo ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- Cma Mid TermDocument7 pagesCma Mid TermMehak RasheedNo ratings yet

- Costing English Question 31.12.2020Document6 pagesCosting English Question 31.12.2020mayoogha1407No ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- AC411 Practice QuestionsDocument44 pagesAC411 Practice QuestionsTiya AmuNo ratings yet

- Finance RTP Nov 2023Document25 pagesFinance RTP Nov 2023Bijay AgrawalNo ratings yet

- BhaDocument25 pagesBharishu jainNo ratings yet

- Cost Accounting: T I C A PDocument6 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 3: Cost and Management AccountingDocument9 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 3: Cost and Management AccountingAJNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Cost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Document12 pagesCost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Anshul BajajNo ratings yet

- Cost Mock Test Paper 2Document7 pagesCost Mock Test Paper 2Soul of honeyNo ratings yet

- ABC Costing 2Document4 pagesABC Costing 2محمد شہبازNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument32 pagesPaper - 3: Cost and Management Accounting Questions Material CostNiyi SeiduNo ratings yet

- VM Costing ImpDocument22 pagesVM Costing ImpSinsNo ratings yet

- Alpa Bravo 123Document16 pagesAlpa Bravo 123adnan khanNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Job CostingDocument4 pagesJob CostingZoya RehmanNo ratings yet

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet

- Cost and Management Accounting IpcnDocument20 pagesCost and Management Accounting IpcnlahotishreyanshNo ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- Example - ABCDocument7 pagesExample - ABCFelicia ChinNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- Course Book - OC Integrated Course On IT and Soft SkillsDocument216 pagesCourse Book - OC Integrated Course On IT and Soft SkillsRahul AgrawalNo ratings yet

- Bos 050121 Interp 2 CDocument155 pagesBos 050121 Interp 2 CRahul AgrawalNo ratings yet

- CA Inter Compact Books For May 21Document216 pagesCA Inter Compact Books For May 21Rahul AgrawalNo ratings yet

- CA Inter Amendment Book For May 21Document34 pagesCA Inter Amendment Book For May 21Rahul AgrawalNo ratings yet

- Imran Shehzad Tax Lectures and MaterialDocument9 pagesImran Shehzad Tax Lectures and Materialsheraz akramNo ratings yet

- Math Project 22-23Document3 pagesMath Project 22-23Nayan ArutlaNo ratings yet

- Corporate FinanceDocument42 pagesCorporate FinanceNguyễn Thụy Ngọc HânNo ratings yet

- Planning: 7. Outsourcing and Risk ManagementDocument20 pagesPlanning: 7. Outsourcing and Risk ManagementJoão PedroNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsAshly MateoNo ratings yet

- Appendix Notice 138Document2 pagesAppendix Notice 138Mrīgendra Narayan UpadhyayNo ratings yet

- The Impact of Customer Services On Customer Satisfaction in The Food Industry: A Case Study of Mcdonald'SDocument15 pagesThe Impact of Customer Services On Customer Satisfaction in The Food Industry: A Case Study of Mcdonald'SMofy AllyNo ratings yet

- From The Following Particulars Compute Gross Annual Value MRV: 18000 FRV: 21000 ARV:36000 SRV: 24000 Urr (In MonthsDocument5 pagesFrom The Following Particulars Compute Gross Annual Value MRV: 18000 FRV: 21000 ARV:36000 SRV: 24000 Urr (In Monthsrathison neonNo ratings yet

- Supreme IP May 2021Document41 pagesSupreme IP May 2021Denish GalaNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Nature of ManagementDocument33 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Nature of ManagementEva QuarcoopomeNo ratings yet

- Financial Statement Analysis of OSCBDocument55 pagesFinancial Statement Analysis of OSCBSunil ShekharNo ratings yet

- RoutledgeHandbooks 9780203713303 Chapter3Document57 pagesRoutledgeHandbooks 9780203713303 Chapter3samyghallabNo ratings yet

- Eighteenth Edition, Global Edition: Customer Value-Driven Marketing Strategy: Creating Value For Target CustomersDocument41 pagesEighteenth Edition, Global Edition: Customer Value-Driven Marketing Strategy: Creating Value For Target CustomersIrene Elfrida SNo ratings yet

- Asset Reconstruction Companies (Arcs) : Tax and Regulatory FrameworkDocument34 pagesAsset Reconstruction Companies (Arcs) : Tax and Regulatory Frameworksumit guptaNo ratings yet

- Government and NFP Accounting Assignment IIDocument3 pagesGovernment and NFP Accounting Assignment IIeferemNo ratings yet

- SEBI Portfolio - Feb 2020Document347 pagesSEBI Portfolio - Feb 2020Tapan LahaNo ratings yet

- Annual Report: Stock Code: 1398Document315 pagesAnnual Report: Stock Code: 1398张凯莉No ratings yet

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Document2 pagesPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamNo ratings yet

- Foreign Exchange Arithmetic Worksheet (With Answers)Document4 pagesForeign Exchange Arithmetic Worksheet (With Answers)Viresh YadavNo ratings yet

- Pusha Sales Audit ReportDocument8 pagesPusha Sales Audit ReportAllan K WalusimbiNo ratings yet

- Audit of InvestmentsDocument6 pagesAudit of InvestmentsDestiny LazarteNo ratings yet

- 26.recent Changes in BankingDocument2 pages26.recent Changes in BankingVIKASH ARYANNo ratings yet

- Zomato LTD.: Investing Key To Compounding Long Term GrowthDocument5 pagesZomato LTD.: Investing Key To Compounding Long Term GrowthAvinash GollaNo ratings yet

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- Fin 365 Individual Assignment Muhd Sharizan (2020453984)Document3 pagesFin 365 Individual Assignment Muhd Sharizan (2020453984)mohd ChanNo ratings yet

- Ebook PDF Cornerstones of Financial Accounting 2nd Canadian Edition PDFDocument41 pagesEbook PDF Cornerstones of Financial Accounting 2nd Canadian Edition PDFcathy.mccann98798% (48)

- International Finance First Exam GuidelinesDocument12 pagesInternational Finance First Exam GuidelinesHernanNo ratings yet

- GMM LafargeHolcim Merger (Stefanny Ariza)Document9 pagesGMM LafargeHolcim Merger (Stefanny Ariza)Stef ArizaNo ratings yet

- BCIF - Ver7 Back With SignatureDocument1 pageBCIF - Ver7 Back With SignatureKatrina JarabejoNo ratings yet