Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsLeverage

Leverage

Uploaded by

Rishabh jainSjjsiejefbjriskakaleorifnxnzkalworjdnnfnckrorkrnfnftjjtjdnxndjakalsldifjrklwortifn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

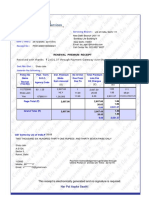

- Veg Silver New MenuDocument4 pagesVeg Silver New MenuRishabh jainNo ratings yet

- Received With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromDocument3 pagesReceived With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Received With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromDocument2 pagesReceived With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Chapter - 4 Research MethodologyDocument16 pagesChapter - 4 Research MethodologyRishabh jainNo ratings yet

- Research Project Report FinalDocument31 pagesResearch Project Report FinalRishabh jainNo ratings yet

- Registration Motor VehicleDocument3 pagesRegistration Motor VehicleRishabh jainNo ratings yet

- ,3333. Crossing of ChequesDocument13 pages,3333. Crossing of ChequesRishabh jainNo ratings yet

- Directors and Remuneration, Managing Directors-Their Appointment, Qualifications, Powers and Limits On Their RemunerationDocument12 pagesDirectors and Remuneration, Managing Directors-Their Appointment, Qualifications, Powers and Limits On Their RemunerationRishabh jainNo ratings yet

- 08 - Chapter 5Document72 pages08 - Chapter 5Rishabh jainNo ratings yet

- Examination Form Filling CircularDocument4 pagesExamination Form Filling CircularRishabh jainNo ratings yet

- ,14. Types of CompaniesDocument12 pages,14. Types of CompaniesRishabh jainNo ratings yet

- Debenture of Market of The: ValueDocument5 pagesDebenture of Market of The: ValueRishabh jainNo ratings yet

- ,13 Companies Act, 2013Document21 pages,13 Companies Act, 2013Rishabh jainNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyRishabh jainNo ratings yet

- Capl Tusgeling1Telaiquss Amie: Ttluigu Epilal Kud Ghuj TlanetDocument4 pagesCapl Tusgeling1Telaiquss Amie: Ttluigu Epilal Kud Ghuj TlanetRishabh jainNo ratings yet

Leverage

Leverage

Uploaded by

Rishabh jain0 ratings0% found this document useful (0 votes)

3 views5 pagesSjjsiejefbjriskakaleorifnxnzkalworjdnnfnckrorkrnfnftjjtjdnxndjakalsldifjrklwortifn

Original Title

leverage

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSjjsiejefbjriskakaleorifnxnzkalworjdnnfnckrorkrnfnftjjtjdnxndjakalsldifjrklwortifn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

3 views5 pagesLeverage

Leverage

Uploaded by

Rishabh jainSjjsiejefbjriskakaleorifnxnzkalworjdnnfnckrorkrnfnftjjtjdnxndjakalsldifjrklwortifn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 5

a = Pe vere, it Verage ob » b UE tO a relativel:

‘ge in sales and vice versa. However, a higher leverage obvious — tively

coal MABE TP ene riskier if the sales of the firm take a sudden di eat es Hher ae

ine or isthe risk and higher is dhe retum to equity shareholders, en" Me Hesree of

Types of Leverages

crerage is af three types ¢

(o) Operating Leverage,

| qi) Financial Leverage, and

| (i Combined Leverage.

‘5 operating Leverage : Operating leverage may be defined asthe tendency ofthe operating pric

Ghovonomionately with the volume of sales. It occurs whem a firm has faed costs that ent be

yesn OM fess of volume of sales. In other words, with fixed costs, the percentage change in operating

nities greater than the percentage change in sales. This tendency is called operating leverage. The

(et of operating leverage depends upon the proportion of fixed costs as compared to variable costs,

ire proportion of fixed costs is higher than the variable costs, it will have a higher degree of operating

ee retOn the other hand, if the proportion of fixed costs is lower than the variable costs, it wll have

id

~-------~ LR

St SE aaah i erage, the operating or,

a lower operating leverage. In case of higher degree of Tae ere iain: erating pr

increase at a higher rate as compared to the rate of increase in sal sa,

Computation :

The operatin® leverage can be calculated as :

___ Contribution

~ Operating Profit

Contribution = Sales — Variable Cost

Operating Profit Sales — Variable Cost — Fixed Cost

Operating profit here means “Eamings before interest and tax”’ (BIT).

Operating leverage may be favourable or unfavourable. It will be fayourable when contribiaica)

sales less variable cost) exceeds the fixed cost and it will be unfavourable when contribution iso

than the fixed cost.

iperating Leverage

Degree perating Leverage :

€ degree of operating leverage may be defined as the percentage change in operating pu!

Sulting from a percentage change in sales,

Deitee of Operating Leverage = Refeentaue Change in Operating Profits

Percentage Change in Sales

ated

ai

re ST a

LEVERAGES

ce of financial risk. Both these leverazes, a

rages an -

ed costs (both operating and finangialy mae med wih

; ; . ath the leverag '

jet the effect of change in Sales level on the caning belmeter cent are combined, the

Therefore, combined leverage depicts the telationship between revenu;

contribution or sales Less variable cost) and the eaming before tae tegen om Se Tales (

Th other y

aring belore tax on account of change in contribution. It may be cale eee me

fol

Combined, 2 ——Lontribution

7 Eaming before tax (EBT)

OR

Combined Leverage = Operating Leverage x Financial Leverage

Degree of Combined Leverage may be calculated as follo’

- Pereentage Change in EPS

Percentage Change in Sales

iow

Degree of Combined Leverage

‘cnificance of Combined Leverage : . = z

') Understanding Changes in EPS : Combined leverage explains the combined ees ne

ave and financial leverage of a firm on its earnings per share (EPS). Thus, it expl

Financial leverage of 2 indicates that every |e change Im hit) will result

“Suit in 2% chang

change in EBT,

ror example. in the above case if EBIT increases by 50%, impact on EBT will be

as follows

EBIT (after $0% increase) 80,000 a 7

120,000,

Less : Interest on Debt

EBT 10.000,

~so000

EBT has increased from 40,000 to £80,000 ie. 100% increase. Thus financial leverage of 2

‘es that 50% inerease in EBIT has resulted in 100% increase in EBT. a

Degree of peel Leverage :

It, may“be defined as percentage change in earning per share (EPS) that results from a given

percentage change in earnings before interest and tax (EBIT). It is calculated as follows

_— __ Percentage Change in EPS

¢ of Financial Leverage ~ percentage Change in EI

De

Significance of Financial Leverage :

(1) Understanding Changes in Earning before Tax (EBT)

ee. ery) aga result of changes

+ Financial leverage helps 1

n Eaming before interest

"+ CRIT will result

ti) FINANCIAL LEVERAGE :

Financial leverage arises on account of existence of fixed interest or fixed pref

urities in the total capital structure of the firm. In other words, financial ley

Praising of capital from those sources on which fixed return has to be paid, su.

f along with owner's equity in the capital structure. The fixed return op

on debt or preference capital do not vary with the earnings before interest ang

iless of the amount of EBIT. After paying fixed charges ou

dinary shareholders.

ge may be defined as the tendency of the residual net ine

th EBIT. In other words, the financial leverage indicates the chaig:

result of change in EBIT. The ratio is expressed as tolly

ing before interest & tax (EBIT)

Earning before tax (EBT)

)

akinancisl-teVerag

EBT - EBIT — Fixed Interest Charges!

Favourable and unfavourable fimancial leverage = Financial leverage may be

dep upon whether the eamings made by the use of fixed cost securities

ch the firm has to pay on them. For example, if'a company borrows ©1004! Ii"

rn of 12%, the leverage will be considered favourable. LUinfavourable wn

,¢ firm does not earn as much as the cost of debt. Favourable une ut

‘trading on equity’.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Veg Silver New MenuDocument4 pagesVeg Silver New MenuRishabh jainNo ratings yet

- Received With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromDocument3 pagesReceived With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Received With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromDocument2 pagesReceived With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Chapter - 4 Research MethodologyDocument16 pagesChapter - 4 Research MethodologyRishabh jainNo ratings yet

- Research Project Report FinalDocument31 pagesResearch Project Report FinalRishabh jainNo ratings yet

- Registration Motor VehicleDocument3 pagesRegistration Motor VehicleRishabh jainNo ratings yet

- ,3333. Crossing of ChequesDocument13 pages,3333. Crossing of ChequesRishabh jainNo ratings yet

- Directors and Remuneration, Managing Directors-Their Appointment, Qualifications, Powers and Limits On Their RemunerationDocument12 pagesDirectors and Remuneration, Managing Directors-Their Appointment, Qualifications, Powers and Limits On Their RemunerationRishabh jainNo ratings yet

- 08 - Chapter 5Document72 pages08 - Chapter 5Rishabh jainNo ratings yet

- Examination Form Filling CircularDocument4 pagesExamination Form Filling CircularRishabh jainNo ratings yet

- ,14. Types of CompaniesDocument12 pages,14. Types of CompaniesRishabh jainNo ratings yet

- Debenture of Market of The: ValueDocument5 pagesDebenture of Market of The: ValueRishabh jainNo ratings yet

- ,13 Companies Act, 2013Document21 pages,13 Companies Act, 2013Rishabh jainNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyRishabh jainNo ratings yet

- Capl Tusgeling1Telaiquss Amie: Ttluigu Epilal Kud Ghuj TlanetDocument4 pagesCapl Tusgeling1Telaiquss Amie: Ttluigu Epilal Kud Ghuj TlanetRishabh jainNo ratings yet