Professional Documents

Culture Documents

4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

TalionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

TalionCopyright:

Available Formats

Expand Your Critical Thinking 4-57

Comparative Analysis Problem: Amazon.com, Inc. vs. Wal-Mart Stores, Inc.

CT4.3 Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements

of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and

Wal-Mart, including the notes to the financial statements, are available at each company’s respective

website.

Instructions

a. Based on the information contained in these financial statements, determine the following for

Amazon at December 31, 2015, and Wal-Mart at January 31, 2016.

1. Total current assets.

2. Net amount of property and equipment (fixed assets), net.

3. Total current liabilities.

4. Total equity.

b. What conclusions concerning these two companies can be drawn from these data?

Real-World Focus

CT4.4 Most companies have established home pages on the Internet, but each might offer different

types of information.

Instructions

Examine the home pages of any two companies and then answer the following questions.

a. What type of information is available?

b. Is any accounting-related information presented?

c. Would you describe the home page as informative, promotional, or both? Why?

Decision-Making Across the Organization

CT4.5 Whitegloves Janitorial Service was started 2 years ago by Jenna Olson. Because business

has been exceptionally good, Jenna decided on July 1, 2020, to expand operations by acquiring an

additional truck and hiring two more assistants. To finance the expansion, Jenna obtained on July 1,

2020, a $25,000, 10% bank loan, payable $10,000 on July 1, 2021, and the balance on July 1, 2022.

The terms of the loan require the borrower to have $10,000 more current assets than current liabilities

at December 31, 2020. If these terms are not met, the bank loan will be refinanced at 15% interest. At

December 31, 2020, the accountant for Whitegloves Janitorial Service prepared the balance sheet shown

below.

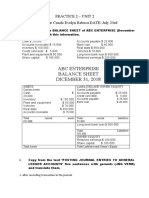

Whitegloves Janitorial Service

Balance Sheet

December 31, 2020

Assets Liabilities and Owner’s Equity

Current assets Current liabilities

Cash $ 6,500 Notes payable $10,000

Accounts receivable 9,000 Accounts payable 2,500

Supplies 5,200 Total current liabilities 12,500

Prepaid insurance 4,800 Long-term liability

Total current assets 25,500 Notes payable 15,000

Property, plant, and equipment Total liabilities 27,500

Equipment (net) 22,000 Owner’s equity

Delivery trucks (net) 34,000 Owner’s capital 54,000

Total property, plant, and

equipment 56,000

Total assets $81,500 Total liabilities and owner’s equity $81,500

You might also like

- Case 21Document14 pagesCase 21Gabriela LueiroNo ratings yet

- AssignmentDocument2 pagesAssignmentsunrise foods0% (1)

- Comparative Study of The Public Sector & Private Sector BankDocument68 pagesComparative Study of The Public Sector & Private Sector Bankviraniyan81% (64)

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Topic 2 ExercisesDocument6 pagesTopic 2 ExercisesRaniel Pamatmat0% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Acct CH1Document10 pagesAcct CH1j8noelNo ratings yet

- Chapter 5 Class ExercisesDocument13 pagesChapter 5 Class ExercisesSky GatdulaNo ratings yet

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- Basic Financial StatementsDocument20 pagesBasic Financial StatementsRumel DeyNo ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- Chapter 4 Question Review 11th EdDocument9 pagesChapter 4 Question Review 11th EdEmiraslan MhrrovNo ratings yet

- How To Read, Analyze, and Interpret Financial ReportsDocument26 pagesHow To Read, Analyze, and Interpret Financial ReportsManish ChaudhariNo ratings yet

- Balance Sheet Practice WorkbookDocument7 pagesBalance Sheet Practice WorkbookBJNo ratings yet

- How To Read, Analyze, and Interpret Financial ReportsDocument23 pagesHow To Read, Analyze, and Interpret Financial ReportspotatookunNo ratings yet

- Practice 2 ........Document2 pagesPractice 2 ........Agustín CusiNo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Week 5 Topic Tutorial QuestionsDocument6 pagesWeek 5 Topic Tutorial QuestionsJessica KristyNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Solutions 2021 MockExamDocument15 pagesSolutions 2021 MockExamdayeyoutai779No ratings yet

- ACCT71210-Group Assignment - S20Document6 pagesACCT71210-Group Assignment - S20AmishaNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- BSMM 8110 First Quiz Winter 2020 SolutionsDocument4 pagesBSMM 8110 First Quiz Winter 2020 SolutionsHibibiNo ratings yet

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- AP W1 Correction of ErrorsDocument4 pagesAP W1 Correction of ErrorsALYZA ANGELA ORNEDONo ratings yet

- Deferred Income TaxesDocument3 pagesDeferred Income TaxesFEBRI IRAWANNo ratings yet

- BUS FPX4060 - Assessment1 1Document17 pagesBUS FPX4060 - Assessment1 1AA TsolScholarNo ratings yet

- Corporate LiquidationDocument15 pagesCorporate LiquidationLil ConicNo ratings yet

- Discussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsDocument7 pagesDiscussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsRijul DUbeyNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- Problem: 1Document8 pagesProblem: 1PRIYA SHARMA EPGDIB (On Campus) 2019-20No ratings yet

- Jagran Lakecity University, Bhopal: Course Code: BC10002, Course Name: FINANCIAL ACCOUNTINGDocument4 pagesJagran Lakecity University, Bhopal: Course Code: BC10002, Course Name: FINANCIAL ACCOUNTINGAdarsh JaiswalNo ratings yet

- Accounting I Lecture #2Document16 pagesAccounting I Lecture #2Mohammed mostafaNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- FMA Assignment 2Document2 pagesFMA Assignment 2situtiya shimelisNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Cash Flow - HandoutDocument3 pagesCash Flow - HandoutMichelle ManuelNo ratings yet

- Chapter 2 Question ReviewDocument7 pagesChapter 2 Question ReviewRicky Lloyd TerrenalNo ratings yet

- Final Exam Practice - Comprehensive (With Answers)Document22 pagesFinal Exam Practice - Comprehensive (With Answers)Brandon ErbNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Basic Financial StatementsDocument14 pagesBasic Financial StatementssajjadNo ratings yet

- Revision No AnswerDocument12 pagesRevision No AnswerQuang Nguyễn ThếNo ratings yet

- Financial&managerialaccounting - 15e Williams Haka Bettner Chap2Document14 pagesFinancial&managerialaccounting - 15e Williams Haka Bettner Chap2mzqace100% (1)

- DeVry University Walmart ProjectDocument12 pagesDeVry University Walmart ProjectKristin ParkerNo ratings yet

- Accounting Hawk - FAR - Incoming 3rd and 4th YearDocument27 pagesAccounting Hawk - FAR - Incoming 3rd and 4th YearClaire BarbaNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- MajorProjectandrewbest2023 7185726792842775Document9 pagesMajorProjectandrewbest2023 7185726792842775ronny nyagakaNo ratings yet

- Practice Questions (CH 2)Document6 pagesPractice Questions (CH 2)enkeltvrelseNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- ACCT 2500 Test 2 Format, Instructions and ReviewDocument17 pagesACCT 2500 Test 2 Format, Instructions and Reviewyahye ahmedNo ratings yet

- Review Questions Financial Accounting 1 StudentsDocument5 pagesReview Questions Financial Accounting 1 StudentsNancy VõNo ratings yet

- Midterm Fin 254 Summer 2020Document5 pagesMidterm Fin 254 Summer 2020Salauddin Imran MumitNo ratings yet

- Liquidity, Leverage, Coverage and Activity (LLCA) RatiosDocument91 pagesLiquidity, Leverage, Coverage and Activity (LLCA) RatiosJess AlexNo ratings yet

- Chap002 - William Et Al 2 Old VerDocument40 pagesChap002 - William Et Al 2 Old Verwinslow.harlekinNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- Valix Book Chapt 1 5 Probs PDFDocument34 pagesValix Book Chapt 1 5 Probs PDFRengeline LucasNo ratings yet

- Ratio AnalysisDocument22 pagesRatio AnalysisrafiiiiidNo ratings yet

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- IFRS Practice: IFRS Self-Test QuestionsDocument1 pageIFRS Practice: IFRS Self-Test QuestionsTalionNo ratings yet

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Accounting EntriesDocument3 pagesAccounting EntriesShashankSinghNo ratings yet

- Menagement of ReceiveableDocument5 pagesMenagement of ReceiveableMuhammad Furqan AkramNo ratings yet

- What Is The Purpose of PDIC Law? 4. Define A. DepositDocument5 pagesWhat Is The Purpose of PDIC Law? 4. Define A. DepositJoshel MaeNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- CORPFIN 7040: Fixed Income Securities (M) Embedded Research ProjectDocument12 pagesCORPFIN 7040: Fixed Income Securities (M) Embedded Research Project邓媛No ratings yet

- Customer Name Card Account No MR Siddharth Das 4315 XXXX XXXX 8005Document8 pagesCustomer Name Card Account No MR Siddharth Das 4315 XXXX XXXX 8005Siddharth DasNo ratings yet

- Treasury Management in Banks - CAIIBDocument157 pagesTreasury Management in Banks - CAIIBAparnaBhattNo ratings yet

- Swaps Cms CMTDocument7 pagesSwaps Cms CMTmarketfolly.comNo ratings yet

- Final CP ProjectDocument79 pagesFinal CP ProjectIranshah MakerNo ratings yet

- What Is An Automated Teller MachineDocument7 pagesWhat Is An Automated Teller MachineNeha SoningraNo ratings yet

- Absa Personal Share Portfolio One PDFDocument2 pagesAbsa Personal Share Portfolio One PDFmarko joosteNo ratings yet

- Indian Economy 3 LPGDocument68 pagesIndian Economy 3 LPGAlans TechnicalNo ratings yet

- Exam For Quiz BeeDocument2 pagesExam For Quiz Beealie tolentinoNo ratings yet

- Unit 1 FMDocument14 pagesUnit 1 FMRICKY KALITANo ratings yet

- Collection Defense Feb 2010Document67 pagesCollection Defense Feb 2010Brad Warner100% (1)

- Energy Industry Team To Launch Crypto Mining FundDocument3 pagesEnergy Industry Team To Launch Crypto Mining FundPR.comNo ratings yet

- Pandey 2021Document10 pagesPandey 2021abhinavatripathiNo ratings yet

- Appraisal of Bank Verification Number (BVN) in Nigeria Banking SystemDocument37 pagesAppraisal of Bank Verification Number (BVN) in Nigeria Banking SystemABDULRAZAQNo ratings yet

- History of EXIM BankDocument54 pagesHistory of EXIM BankMasood PervezNo ratings yet

- East India CompanyDocument27 pagesEast India CompanyShubho BoseNo ratings yet

- Kieso Inter 13e Ch13Document67 pagesKieso Inter 13e Ch13mikeafriedmanNo ratings yet

- Plant Assets: Created by Ina IndrianaDocument23 pagesPlant Assets: Created by Ina IndrianadewiestiNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- LIC Claim Form 3825 Discharge Voucher For Pollicy Maturity PDFDocument3 pagesLIC Claim Form 3825 Discharge Voucher For Pollicy Maturity PDFVasudeva AcharyaNo ratings yet

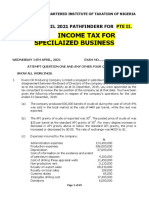

- April 2021 Pathfinder For PTE 2 LevelDocument65 pagesApril 2021 Pathfinder For PTE 2 LevelAdedotun OmonijoNo ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- GGP Dip OrderDocument525 pagesGGP Dip OrderChris AllevaNo ratings yet

- Solution Manual For Bond Markets Analysis and Strategies 9th Edition by Fabozzi ISBN 0133796779 9780133796773Document25 pagesSolution Manual For Bond Markets Analysis and Strategies 9th Edition by Fabozzi ISBN 0133796779 9780133796773allenwoodonktbqdway100% (31)

- Crystal Crop Protection LTD Quotation Ga Qo 22-23-10Document1 pageCrystal Crop Protection LTD Quotation Ga Qo 22-23-10Gati AutomobilesNo ratings yet