Professional Documents

Culture Documents

4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

Talion0 ratings0% found this document useful (0 votes)

8 views1 pageAfter closing entries are made, a post-closing trial balance is prepared from the ledger to prove the equality of permanent account balances carried forward to the next period. The post-closing trial balance for Pioneer Advertising shows account balances after closing and contains only permanent balance sheet accounts, as all temporary accounts now have zero balances.

Original Description:

Original Title

4 Completing the Accounting Cycle Part (16)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAfter closing entries are made, a post-closing trial balance is prepared from the ledger to prove the equality of permanent account balances carried forward to the next period. The post-closing trial balance for Pioneer Advertising shows account balances after closing and contains only permanent balance sheet accounts, as all temporary accounts now have zero balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views1 page4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

TalionAfter closing entries are made, a post-closing trial balance is prepared from the ledger to prove the equality of permanent account balances carried forward to the next period. The post-closing trial balance for Pioneer Advertising shows account balances after closing and contains only permanent balance sheet accounts, as all temporary accounts now have zero balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

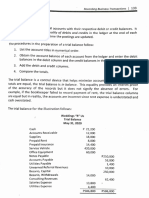

4-16 CH A PT E R 4 Completing the Accounting Cycle

Preparing a Post-Closing Trial Balance

After Pioneer Advertising has journalized and posted all closing entries, it prepares another

trial balance, called a post-closing trial balance, from the ledger. The post-closing trial

balance lists permanent accounts and their balances after the journalizing and posting of

closing entries. The purpose of the post-closing trial balance is to prove the equality of the

permanent account balances carried forward into the next accounting period. Since all

temporary accounts will have zero balances, the post-closing trial balance will contain only

permanent—balance sheet—accounts.

Illustration 4.12 shows the post-closing trial balance for Pioneer Advertising.

ILLUSTRATION 4.12 Pioneer Advertising

Post-closing trial balance Post-Closing Trial Balance

October 31, 2020

Debit Credit

Cash $15,200

Accounts Receivable 200

Supplies 1,000

Prepaid Insurance 550

Equipment 5,000

Accumulated Depreciation—Equipment $ 40

Notes Payable 5,000

Accounts Payable 2,500

Unearned Service Revenue 800

Salaries and Wages Payable 1,200

Interest Payable 50

Owner’s Capital 12,360

$21,950 $21,950

Pioneer prepares the post-closing trial balance from the permanent accounts in the ledger.

Illustration 4.13 shows the permanent accounts in Pioneer’s general ledger.

You might also like

- Barnes Wallis Enterprises WRKSHT Blank For Students F2021 EditedDocument1 pageBarnes Wallis Enterprises WRKSHT Blank For Students F2021 EditedPawan MoryaniNo ratings yet

- CH 04Document7 pagesCH 04Tien Thanh Dang50% (2)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Bpact Activity 5Document1 pageBpact Activity 5Cherry Ann OlasimanNo ratings yet

- Midterm - Le Nhat Linh - 11202143Document3 pagesMidterm - Le Nhat Linh - 11202143moon loverNo ratings yet

- B Exercises: E3-1B (Transaction Analysis-Service Company)Document8 pagesB Exercises: E3-1B (Transaction Analysis-Service Company)Saleh RaoufNo ratings yet

- Closing EntsDocument20 pagesClosing EntsEmma Ria100% (1)

- Tugas 7 - ELRISKA TIFFANI - 142200111Document8 pagesTugas 7 - ELRISKA TIFFANI - 142200111Elriska Tiffani50% (2)

- Financial Accounting: Completing The Accounting CycleDocument82 pagesFinancial Accounting: Completing The Accounting CycleIsmadth2918388No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion0% (1)

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- Ch04 240113 184214Document15 pagesCh04 240113 184214hggfghhadNo ratings yet

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Jonaxx Trading Corporation 1ST PageDocument1 pageJonaxx Trading Corporation 1ST PageRona Karylle Pamaran DeCastroNo ratings yet

- PA1-Sesi 5 (Worksheet Dan LK)Document16 pagesPA1-Sesi 5 (Worksheet Dan LK)Qeis HabitNo ratings yet

- واجب محاسبة ٢Document1 pageواجب محاسبة ٢sp.shield.01No ratings yet

- Principles of Accounting Chapter 4Document43 pagesPrinciples of Accounting Chapter 4hgiang2308No ratings yet

- Day 8 10DaysAccountingChallengeDocument4 pagesDay 8 10DaysAccountingChallengeElisa LandinginNo ratings yet

- Completing The Accounting Cycle StudentDocument2 pagesCompleting The Accounting Cycle Studentacem16098No ratings yet

- Closing EntriesDocument22 pagesClosing EntriesAzhar LatiefNo ratings yet

- Chapter 8 Bsa01 LectureDocument12 pagesChapter 8 Bsa01 LectureImogen EveNo ratings yet

- 05 - Completion of The Accounting Cycle (Notes) PDFDocument3 pages05 - Completion of The Accounting Cycle (Notes) PDFJamie ToriagaNo ratings yet

- Completing The Accounting CycleDocument37 pagesCompleting The Accounting CycleTasim IshraqueNo ratings yet

- Accounting Cycle Week 2 ReviewerDocument11 pagesAccounting Cycle Week 2 ReviewerVinz Danzel BialaNo ratings yet

- CH-4: Completing The Accounting Cycle: Using A WorksheetDocument18 pagesCH-4: Completing The Accounting Cycle: Using A WorksheetMohammed Merajul IslamNo ratings yet

- Accounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesDocument7 pagesAccounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesRio GardoceNo ratings yet

- CH 04Document6 pagesCH 04Rabie Haroun0% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Accounting 1 - Lesson 4Document5 pagesAccounting 1 - Lesson 4Vhetty May PosadasNo ratings yet

- Completion of The Accounting CycleDocument54 pagesCompletion of The Accounting CycleSayed Farrukh AhmedNo ratings yet

- Completion of The Accounting CycleDocument54 pagesCompletion of The Accounting Cycledwi studyNo ratings yet

- AssignmentDocument3 pagesAssignmentstefhannyhallegado913No ratings yet

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- Principles of Accounts I Lesson Four Completing The Accounting CycleDocument9 pagesPrinciples of Accounts I Lesson Four Completing The Accounting CycleStephan Mpundu (T4 enick)No ratings yet

- Chap 004Document16 pagesChap 004Ela PelariNo ratings yet

- Module 5 Packet: AE 111 - Financial Accounting & ReportingDocument13 pagesModule 5 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- Written Assignment Unit 1 BUS 5110Document7 pagesWritten Assignment Unit 1 BUS 5110Joseph KamaraNo ratings yet

- CosmanDocument8 pagesCosmanNatalie SerranoNo ratings yet

- Completion of The Accounting Cycle: Weygandt - Kieso - KimmelDocument54 pagesCompletion of The Accounting Cycle: Weygandt - Kieso - Kimmelatia fariaNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Completing The Accounting CycleDocument8 pagesCompleting The Accounting CycleMark Imel ManriqueNo ratings yet

- Ebd Real Estate ServicesDocument8 pagesEbd Real Estate ServicesShari Ann DatahanNo ratings yet

- Addams&Family Inc.Document5 pagesAddams&Family Inc.Trisha Mae CorpuzNo ratings yet

- Wey IFRS 4e PPT Ch04 Completing The Accounting CycleDocument81 pagesWey IFRS 4e PPT Ch04 Completing The Accounting CyclemarcofrfamNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Accounting Problems and Exercises5 Case 5 Kabayan StorageDocument1 pageAccounting Problems and Exercises5 Case 5 Kabayan StorageMario AgoncilloNo ratings yet

- Lecture04B-Adjusting AC CycleDocument61 pagesLecture04B-Adjusting AC Cycle錢永健No ratings yet

- DBM Corporation-Acco CycleDocument9 pagesDBM Corporation-Acco CycleJasmine ActaNo ratings yet

- Final Accounts QuesDocument2 pagesFinal Accounts QuesJiller GgNo ratings yet

- What Is The Worksheet?: Fabm Week 6: Accounting Cycle of A Service Business (Part II-B)Document10 pagesWhat Is The Worksheet?: Fabm Week 6: Accounting Cycle of A Service Business (Part II-B)Tumamudtamud, JenaNo ratings yet

- Financial Accounting: Weygandt KimmelDocument82 pagesFinancial Accounting: Weygandt Kimmelclarysage13100% (1)

- Key To Correction FABM2Document4 pagesKey To Correction FABM2Jomar Villena100% (1)

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- Chap 004Document39 pagesChap 004Ali SaloNo ratings yet

- Adjusted Trial BalanceDocument4 pagesAdjusted Trial BalanceMonir HossainNo ratings yet

- Unit 10 - Assignment LO2Document11 pagesUnit 10 - Assignment LO2Yasser ZayedNo ratings yet

- Completion of The Accounting Cycle: Weygandt - Kieso - KimmelDocument51 pagesCompletion of The Accounting Cycle: Weygandt - Kieso - KimmelAbdullah Al AminNo ratings yet

- Bini General Merchandise 1st PageDocument1 pageBini General Merchandise 1st Pageworkwithericajane100% (1)

- Advising Entrepreneurs: Dynamic Strategies for Financial GrowthFrom EverandAdvising Entrepreneurs: Dynamic Strategies for Financial GrowthNo ratings yet

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- IFRS Practice: IFRS Self-Test QuestionsDocument1 pageIFRS Practice: IFRS Self-Test QuestionsTalionNo ratings yet

- Igacc0903 Ab CDocument43 pagesIgacc0903 Ab CMarcel JonathanNo ratings yet

- Fundamentals of Accounting ReviewerDocument84 pagesFundamentals of Accounting ReviewerAB CloydNo ratings yet

- 74607bos60479 FND cp2 U2Document111 pages74607bos60479 FND cp2 U2adityatiwari122006No ratings yet

- Chapter 6.5 Accounting 1201Document1 pageChapter 6.5 Accounting 1201marianne raelNo ratings yet

- Journal Ledger Trial BalanceDocument22 pagesJournal Ledger Trial BalanceWilliam C JacobNo ratings yet

- REVIEWER ACCOUNTING TUTORIAL Chapter 1-4Document20 pagesREVIEWER ACCOUNTING TUTORIAL Chapter 1-4bae joohyunNo ratings yet

- Accounting Principle - Ujian NasionalDocument115 pagesAccounting Principle - Ujian Nasionalosusant0100% (1)

- Chap 4Document15 pagesChap 4Tran Pham Quoc ThuyNo ratings yet

- Chapter-4 Rectification of ErrorsDocument19 pagesChapter-4 Rectification of Errorslenovo lenovo100% (1)

- UOH FA I Group Assignment Feb22 PDFDocument8 pagesUOH FA I Group Assignment Feb22 PDFidiris OmerNo ratings yet

- ST Rec Multiple Authors With AnswerDocument15 pagesST Rec Multiple Authors With AnswerKen-Ei BautistaNo ratings yet

- Accounting CycleDocument32 pagesAccounting CyclePhill SamonteNo ratings yet

- Financial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreDocument15 pagesFinancial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreCUSTODIO, JUSTINE A.No ratings yet

- Chapter 4 Prepating Financial ReportsDocument18 pagesChapter 4 Prepating Financial ReportsGedion100% (1)

- Accountancy Project On Trial BalanceDocument13 pagesAccountancy Project On Trial BalanceBiplab Swain67% (3)

- CH 4 - SolnDocument126 pagesCH 4 - SolnMuhammad RehmanNo ratings yet

- Suspense Accounts and Error Correction Are Popular Topics For Examiners Because They Test Understanding of Bookkeeping Principles So WellDocument12 pagesSuspense Accounts and Error Correction Are Popular Topics For Examiners Because They Test Understanding of Bookkeeping Principles So WellocalmaviliNo ratings yet

- CH 2 and Ch. 3 Basic Theory and Final AccountsDocument53 pagesCH 2 and Ch. 3 Basic Theory and Final AccountssagarnarayanmundadaNo ratings yet

- Chapter 7 QuizDocument4 pagesChapter 7 QuizMarcellana ArianeNo ratings yet

- Account MCQDocument8 pagesAccount MCQRubina HannureNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Quarter 2 - LAS 19Document20 pagesFundamentals of Accountancy, Business and Management 1: Quarter 2 - LAS 19Althea MorseNo ratings yet

- Accounting Calculations - Learning of FundamentalsDocument7 pagesAccounting Calculations - Learning of FundamentalsRobinHood TiwariNo ratings yet

- TS Grewal Accountancy Class 11 Solution Chapter 12 Accounting of Goods and Services Tax (GST)Document21 pagesTS Grewal Accountancy Class 11 Solution Chapter 12 Accounting of Goods and Services Tax (GST)ATUL GUPTANo ratings yet

- FS Preparation and Correcting A TBDocument11 pagesFS Preparation and Correcting A TBJulia Mae AlbanoNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document15 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica Paras0% (1)

- Problem 3-7:worksheet PreparationDocument3 pagesProblem 3-7:worksheet PreparationMaria Erica AligamNo ratings yet

- Rectification of Errors - MBADocument13 pagesRectification of Errors - MBAChaitanya MunagaNo ratings yet

- CLASS 11 ACCOUNTANCY LESSON PLANDocument26 pagesCLASS 11 ACCOUNTANCY LESSON PLANAFRAH JALEELANo ratings yet

- Finaco1 Mid Term ExaminationDocument11 pagesFinaco1 Mid Term ExaminationbLaXe AssassinNo ratings yet