Professional Documents

Culture Documents

4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

TalionCopyright:

Available Formats

You might also like

- ACC 308 Final Project WorkbookDocument45 pagesACC 308 Final Project WorkbookBREANNA JOHNSON0% (2)

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- Chapter 11Document60 pagesChapter 11Ey EmNo ratings yet

- CH 04Document7 pagesCH 04Tien Thanh Dang50% (2)

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionDocument44 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionSumit Kumar Dam33% (3)

- Carlos CompanyDocument5 pagesCarlos Companymohitgaba19No ratings yet

- CH 9-BEV GymDocument2 pagesCH 9-BEV Gymxuanfei liuNo ratings yet

- Midterm Analysis TestDocument33 pagesMidterm Analysis TestDan Andrei BongoNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Uas Komp AkuntansiDocument3 pagesUas Komp AkuntansiDesy manurungNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Chapter 4, AccountingDocument13 pagesChapter 4, AccountingIyadAitHou100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- CH 04Document6 pagesCH 04Rabie Haroun0% (1)

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- Exercise 2BDocument2 pagesExercise 2Bmytu261105No ratings yet

- JEROME LEGASPI Activity Sheet 10Document3 pagesJEROME LEGASPI Activity Sheet 10RICARDO JOSE VALENCIANo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Chapter 4 Problems Evaluating A Firm'S Financial PerformanceDocument22 pagesChapter 4 Problems Evaluating A Firm'S Financial Performancerony_naiduNo ratings yet

- Statement of Cash Flow: A Teaching NoteDocument6 pagesStatement of Cash Flow: A Teaching NoteMichealNo ratings yet

- Ex Chapter03Document5 pagesEx Chapter03buikimhoangoanhtqkNo ratings yet

- Rayhan Dewangga Saputra - Tugas AKL TM 4Document6 pagesRayhan Dewangga Saputra - Tugas AKL TM 4Rayhan Dewangga SaputraNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- A 4Document5 pagesA 4Thùy NguyễnNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Messa Adi SaputraDocument3 pagesMessa Adi SaputraMessa Adi SaputraNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- NLKTDocument15 pagesNLKTYến Hoàng HảiNo ratings yet

- BX2011 Topic06 Workshop Solutions 2022Document10 pagesBX2011 Topic06 Workshop Solutions 2022yanboliu96No ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowTrisha Monique VillaNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowMohammed AkramNo ratings yet

- Asm NLKTDocument4 pagesAsm NLKTK59 DAM NGOC MINH ANHNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Birla Institute of Technology and Science, PilaniDocument3 pagesBirla Institute of Technology and Science, PilaniArjun Jaideep BhatnagarNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- 2021 Tutorial 9 Nov26 Problem SheetDocument7 pages2021 Tutorial 9 Nov26 Problem SheetdsfghNo ratings yet

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Financial Ratios IIDocument27 pagesFinancial Ratios IIMohamad Gammaz0% (1)

- Q Financial RatiosDocument5 pagesQ Financial RatiosUmmi KalthumNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- Financial Accounting - Assignment #1#Document5 pagesFinancial Accounting - Assignment #1#Hasan NajiNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Accounting Chapter 4 SolutionsDocument14 pagesAccounting Chapter 4 Solutionsali sherNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Universitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Document3 pagesUniversitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Yoga SiahaanNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Cash Flow QuestionsDocument5 pagesCash Flow QuestionssigiryaNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- Take Home Quiz 3Document3 pagesTake Home Quiz 3Sergio NicolasNo ratings yet

- Assignment #1 BADM 1050 Emily KiaraDocument5 pagesAssignment #1 BADM 1050 Emily Kiaraemilynelson1429No ratings yet

- At 4Document4 pagesAt 4Thùy NguyễnNo ratings yet

- FINMAN1 Module3&4Document10 pagesFINMAN1 Module3&4Jayron NonguiNo ratings yet

- Principles of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceDocument2 pagesPrinciples of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceCindy SweNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- IFRS Practice: IFRS Self-Test QuestionsDocument1 pageIFRS Practice: IFRS Self-Test QuestionsTalionNo ratings yet

- Ather Energy Series E Round of 128mnDocument2 pagesAther Energy Series E Round of 128mnManojNo ratings yet

- Kenya WarehouseDocument1 pageKenya WarehouseCharlene De AsisNo ratings yet

- Life Cycle Costing Q&ADocument2 pagesLife Cycle Costing Q&AanjNo ratings yet

- Bancassurance: Problems and Challenges in India: Journal of Management June 2012Document13 pagesBancassurance: Problems and Challenges in India: Journal of Management June 2012Rahat SorathiyaNo ratings yet

- According To Cooke and RomweberDocument2 pagesAccording To Cooke and RomweberSheldon BazingaNo ratings yet

- Project Scope Management - Class NoteDocument64 pagesProject Scope Management - Class NoteBESTIN0% (1)

- Multibagger: Topic: The Hunt For MultibaggersDocument28 pagesMultibagger: Topic: The Hunt For Multibaggersmbts.14014cm020No ratings yet

- CASE 65 - Supra Multi Services V TambuntingDocument7 pagesCASE 65 - Supra Multi Services V Tambuntingbernadeth ranolaNo ratings yet

- Description (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Document3 pagesDescription (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Elliot RichardNo ratings yet

- Acknowledgement ReceiptDocument6 pagesAcknowledgement ReceiptPRINCESSGRACE BERMUDEZNo ratings yet

- Activity Sheets AE Week 2Document5 pagesActivity Sheets AE Week 2Dotecho Jzo EyNo ratings yet

- Lawtons Drugs Project ReportDocument21 pagesLawtons Drugs Project ReportinderNo ratings yet

- Xpacoac A101 5 8Document33 pagesXpacoac A101 5 8TeamACEsPH Back-up AccountNo ratings yet

- 2020 TAPP Water PitchDeckDocument16 pages2020 TAPP Water PitchDeckNinad SankheNo ratings yet

- UntitledDocument11 pagesUntitledSonia KousarNo ratings yet

- Mandem Mandem: Outline Business Plan Outline Business PlanDocument15 pagesMandem Mandem: Outline Business Plan Outline Business PlanAndrew MwesigyeNo ratings yet

- Form 10 Cash Advances For Field Activity and Intelligence - Confidential ExpensesDocument1 pageForm 10 Cash Advances For Field Activity and Intelligence - Confidential ExpensesShaira BalindongNo ratings yet

- SEBI Order in PWC Satyam CaseDocument108 pagesSEBI Order in PWC Satyam Casebhupendra barhatNo ratings yet

- Mining Materials ManagementDocument20 pagesMining Materials ManagementUDHAYAKUMAR ANo ratings yet

- Strategic Alliances For Corporate Sustainability Innovation - 2022 - Long RangeDocument20 pagesStrategic Alliances For Corporate Sustainability Innovation - 2022 - Long RangeHisham HeedaNo ratings yet

- 09Document8 pages09asnairahNo ratings yet

- Data Analyst - AssignmentDocument3 pagesData Analyst - AssignmentChandrakant Babar50% (2)

- An Assessment On The Practice and Challenges of Project Monitoring and EvaluationDocument72 pagesAn Assessment On The Practice and Challenges of Project Monitoring and EvaluationbenNo ratings yet

- Portfolio Management - AnswersDocument3 pagesPortfolio Management - AnswersCharu KokraNo ratings yet

- Pavan Project On Equity Derivatives 2222222222222222222222222222Document55 pagesPavan Project On Equity Derivatives 2222222222222222222222222222ravan vlogsNo ratings yet

- Heavy Maintenance ExecutionDocument29 pagesHeavy Maintenance ExecutionNavin rudraNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- University Support Form FillableDocument1 pageUniversity Support Form FillableManoj AmithaNo ratings yet

4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

TalionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 Completing The Accounting Cycle Part

4 Completing The Accounting Cycle Part

Uploaded by

TalionCopyright:

Available Formats

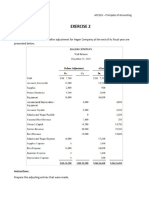

Questions 4-39

Liabilities and Owner’s Equity

Current liabilities

Notes payable $ 5,000

Accounts payable 2,400

Interest payable 500

Total current liabilities $ 7,900

Long-term liabilities

Notes payable 35,000

Total liabilities 42,900

Owner’s equity

Owner’s capital 27,600*

Total liabilities and owner’s equity $70,500

*Owner’s capital $30,000 less drawings $1,000 and net loss $1,400.

c.

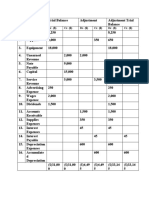

Aug. 31 Service Revenue 4,900

Income Summary 4,900

(To close revenue account)

31 Income Summary 6,300

Salaries and Wages Expense 3,200

Depreciation Expense 900

Utilities Expense 800

Interest Expense 500

Advertising Expense 400

Supplies Expense 300

Insurance Expense 200

(To close expense accounts)

31 Owner’s Capital ($6,300 − $4,900) 1,400

Income Summary 1,400

(To close net loss to capital)

31 Owner’s Capital 1,000

Owner’s Drawings 1,000

(To close drawings to capital)

Brief Exercises, DO IT! Exercises, Exercises, Problems, and many additional resources are

available for practice in WileyPLUS.

Note: All asterisked Questions, Exercises, and Problems relate to material in the appendix to the chapter.

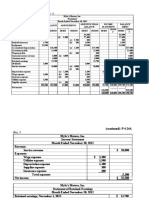

Questions

1. “A worksheet is a permanent accounting record and its use is the net income of $12,000 appear? When expenses exceed revenues,

required in the accounting cycle.” Do you agree? Explain. in which columns will the difference appear?

2. Explain the purpose of the worksheet. 5. Why is it necessary to prepare formal financial statements if all of

3. What is the relationship, if any, between the amount shown in the the data are in the statement columns of the worksheet?

adjusted trial balance column for an account and that account’s ledger 6. Identify the account(s) debited and credited in each of the four

balance? closing entries, assuming the company has net income for the year.

4. If a company’s revenues are $125,000 and its expenses are 7. Describe the nature of the Income Summary account and identify

$113,000, in which financial statement columns of the worksheet will the types of summary data that may be posted to this account.

You might also like

- ACC 308 Final Project WorkbookDocument45 pagesACC 308 Final Project WorkbookBREANNA JOHNSON0% (2)

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- Chapter 11Document60 pagesChapter 11Ey EmNo ratings yet

- CH 04Document7 pagesCH 04Tien Thanh Dang50% (2)

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionDocument44 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionSumit Kumar Dam33% (3)

- Carlos CompanyDocument5 pagesCarlos Companymohitgaba19No ratings yet

- CH 9-BEV GymDocument2 pagesCH 9-BEV Gymxuanfei liuNo ratings yet

- Midterm Analysis TestDocument33 pagesMidterm Analysis TestDan Andrei BongoNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Uas Komp AkuntansiDocument3 pagesUas Komp AkuntansiDesy manurungNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Chapter 4, AccountingDocument13 pagesChapter 4, AccountingIyadAitHou100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- CH 04Document6 pagesCH 04Rabie Haroun0% (1)

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- Exercise 2BDocument2 pagesExercise 2Bmytu261105No ratings yet

- JEROME LEGASPI Activity Sheet 10Document3 pagesJEROME LEGASPI Activity Sheet 10RICARDO JOSE VALENCIANo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Chapter 4 Problems Evaluating A Firm'S Financial PerformanceDocument22 pagesChapter 4 Problems Evaluating A Firm'S Financial Performancerony_naiduNo ratings yet

- Statement of Cash Flow: A Teaching NoteDocument6 pagesStatement of Cash Flow: A Teaching NoteMichealNo ratings yet

- Ex Chapter03Document5 pagesEx Chapter03buikimhoangoanhtqkNo ratings yet

- Rayhan Dewangga Saputra - Tugas AKL TM 4Document6 pagesRayhan Dewangga Saputra - Tugas AKL TM 4Rayhan Dewangga SaputraNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- A 4Document5 pagesA 4Thùy NguyễnNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Messa Adi SaputraDocument3 pagesMessa Adi SaputraMessa Adi SaputraNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- NLKTDocument15 pagesNLKTYến Hoàng HảiNo ratings yet

- BX2011 Topic06 Workshop Solutions 2022Document10 pagesBX2011 Topic06 Workshop Solutions 2022yanboliu96No ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowTrisha Monique VillaNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowMohammed AkramNo ratings yet

- Asm NLKTDocument4 pagesAsm NLKTK59 DAM NGOC MINH ANHNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Birla Institute of Technology and Science, PilaniDocument3 pagesBirla Institute of Technology and Science, PilaniArjun Jaideep BhatnagarNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- 2021 Tutorial 9 Nov26 Problem SheetDocument7 pages2021 Tutorial 9 Nov26 Problem SheetdsfghNo ratings yet

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Financial Ratios IIDocument27 pagesFinancial Ratios IIMohamad Gammaz0% (1)

- Q Financial RatiosDocument5 pagesQ Financial RatiosUmmi KalthumNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- Financial Accounting - Assignment #1#Document5 pagesFinancial Accounting - Assignment #1#Hasan NajiNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Accounting Chapter 4 SolutionsDocument14 pagesAccounting Chapter 4 Solutionsali sherNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Universitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Document3 pagesUniversitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Yoga SiahaanNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Cash Flow QuestionsDocument5 pagesCash Flow QuestionssigiryaNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- Take Home Quiz 3Document3 pagesTake Home Quiz 3Sergio NicolasNo ratings yet

- Assignment #1 BADM 1050 Emily KiaraDocument5 pagesAssignment #1 BADM 1050 Emily Kiaraemilynelson1429No ratings yet

- At 4Document4 pagesAt 4Thùy NguyễnNo ratings yet

- FINMAN1 Module3&4Document10 pagesFINMAN1 Module3&4Jayron NonguiNo ratings yet

- Principles of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceDocument2 pagesPrinciples of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceCindy SweNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- IFRS Practice: IFRS Self-Test QuestionsDocument1 pageIFRS Practice: IFRS Self-Test QuestionsTalionNo ratings yet

- Ather Energy Series E Round of 128mnDocument2 pagesAther Energy Series E Round of 128mnManojNo ratings yet

- Kenya WarehouseDocument1 pageKenya WarehouseCharlene De AsisNo ratings yet

- Life Cycle Costing Q&ADocument2 pagesLife Cycle Costing Q&AanjNo ratings yet

- Bancassurance: Problems and Challenges in India: Journal of Management June 2012Document13 pagesBancassurance: Problems and Challenges in India: Journal of Management June 2012Rahat SorathiyaNo ratings yet

- According To Cooke and RomweberDocument2 pagesAccording To Cooke and RomweberSheldon BazingaNo ratings yet

- Project Scope Management - Class NoteDocument64 pagesProject Scope Management - Class NoteBESTIN0% (1)

- Multibagger: Topic: The Hunt For MultibaggersDocument28 pagesMultibagger: Topic: The Hunt For Multibaggersmbts.14014cm020No ratings yet

- CASE 65 - Supra Multi Services V TambuntingDocument7 pagesCASE 65 - Supra Multi Services V Tambuntingbernadeth ranolaNo ratings yet

- Description (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Document3 pagesDescription (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Elliot RichardNo ratings yet

- Acknowledgement ReceiptDocument6 pagesAcknowledgement ReceiptPRINCESSGRACE BERMUDEZNo ratings yet

- Activity Sheets AE Week 2Document5 pagesActivity Sheets AE Week 2Dotecho Jzo EyNo ratings yet

- Lawtons Drugs Project ReportDocument21 pagesLawtons Drugs Project ReportinderNo ratings yet

- Xpacoac A101 5 8Document33 pagesXpacoac A101 5 8TeamACEsPH Back-up AccountNo ratings yet

- 2020 TAPP Water PitchDeckDocument16 pages2020 TAPP Water PitchDeckNinad SankheNo ratings yet

- UntitledDocument11 pagesUntitledSonia KousarNo ratings yet

- Mandem Mandem: Outline Business Plan Outline Business PlanDocument15 pagesMandem Mandem: Outline Business Plan Outline Business PlanAndrew MwesigyeNo ratings yet

- Form 10 Cash Advances For Field Activity and Intelligence - Confidential ExpensesDocument1 pageForm 10 Cash Advances For Field Activity and Intelligence - Confidential ExpensesShaira BalindongNo ratings yet

- SEBI Order in PWC Satyam CaseDocument108 pagesSEBI Order in PWC Satyam Casebhupendra barhatNo ratings yet

- Mining Materials ManagementDocument20 pagesMining Materials ManagementUDHAYAKUMAR ANo ratings yet

- Strategic Alliances For Corporate Sustainability Innovation - 2022 - Long RangeDocument20 pagesStrategic Alliances For Corporate Sustainability Innovation - 2022 - Long RangeHisham HeedaNo ratings yet

- 09Document8 pages09asnairahNo ratings yet

- Data Analyst - AssignmentDocument3 pagesData Analyst - AssignmentChandrakant Babar50% (2)

- An Assessment On The Practice and Challenges of Project Monitoring and EvaluationDocument72 pagesAn Assessment On The Practice and Challenges of Project Monitoring and EvaluationbenNo ratings yet

- Portfolio Management - AnswersDocument3 pagesPortfolio Management - AnswersCharu KokraNo ratings yet

- Pavan Project On Equity Derivatives 2222222222222222222222222222Document55 pagesPavan Project On Equity Derivatives 2222222222222222222222222222ravan vlogsNo ratings yet

- Heavy Maintenance ExecutionDocument29 pagesHeavy Maintenance ExecutionNavin rudraNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- University Support Form FillableDocument1 pageUniversity Support Form FillableManoj AmithaNo ratings yet