Professional Documents

Culture Documents

Agung Ariwibowo: Assistant Tax Accountant Senior Manager

Agung Ariwibowo: Assistant Tax Accountant Senior Manager

Uploaded by

Green Sustain EnergyCopyright:

Available Formats

You might also like

- Unsolved Problems 1-8Document26 pagesUnsolved Problems 1-8AsħîŞĥLøÝå60% (5)

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDocument3 pagesSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiNo ratings yet

- Edi Safe'I, S.Ak: BiodataDocument3 pagesEdi Safe'I, S.Ak: BiodataDenny Teguh HerlambangNo ratings yet

- Prinoti-Resume (Update)Document4 pagesPrinoti-Resume (Update)humanresources.ssgroupNo ratings yet

- Tengku Mona Mia: Personal DetailsDocument5 pagesTengku Mona Mia: Personal Detailsdanang setiawanNo ratings yet

- Acc - CV - Gregorius RahadianDocument11 pagesAcc - CV - Gregorius Rahadianlestari simorangkirNo ratings yet

- CV Fikri Islami UPDATE - Fikri IslamiDocument3 pagesCV Fikri Islami UPDATE - Fikri Islamihumanresourcesdept.tcaNo ratings yet

- Muzafar Resume Accounts SpecialistDocument3 pagesMuzafar Resume Accounts Specialistmuzafar.takeyNo ratings yet

- ACCA Taxation & FinanceDocument2 pagesACCA Taxation & Financetalent.house1985No ratings yet

- Muzafar Resume Tax SpecialistDocument3 pagesMuzafar Resume Tax Specialistmuzafar.takeyNo ratings yet

- Arif Sukendar: Summary of QualificationsDocument4 pagesArif Sukendar: Summary of QualificationsMANAGER HRDNo ratings yet

- F & A S - B M 2018 - P: Inance Ccounting Uperintendent Olok Plant AR ResentDocument6 pagesF & A S - B M 2018 - P: Inance Ccounting Uperintendent Olok Plant AR ResentGreen Sustain EnergyNo ratings yet

- Dickfan Multazam CVDocument4 pagesDickfan Multazam CVroby robyNo ratings yet

- Setyo Anung Dewantoko: Astra Graphia TBK Jakarta - 09/2012 To 07/2019Document2 pagesSetyo Anung Dewantoko: Astra Graphia TBK Jakarta - 09/2012 To 07/2019Green Sustain EnergyNo ratings yet

- CV Update GhafarDocument9 pagesCV Update GhafarGhafar MuzanniNo ratings yet

- Wa0003.Document2 pagesWa0003.bhoomika rathodNo ratings yet

- Ricardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityDocument2 pagesRicardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityRic Dela CruzNo ratings yet

- Gani Hartanto M Comm.: ExperienceDocument6 pagesGani Hartanto M Comm.: ExperienceGreen Sustain EnergyNo ratings yet

- Qualifications Profile Contac T: Phone: 01136618576 Address: No 2, JLN NB2 8/7, TamanDocument4 pagesQualifications Profile Contac T: Phone: 01136618576 Address: No 2, JLN NB2 8/7, TamanMeena RajagopalNo ratings yet

- CV Kinanti-Dikonversi 2Document3 pagesCV Kinanti-Dikonversi 2Salma JuwitaNo ratings yet

- Bernard Kinyua CVDocument3 pagesBernard Kinyua CVbrian karuNo ratings yet

- Siddharth Basa Resume - 240226 - 121502-2 - 240326 - 221347Document2 pagesSiddharth Basa Resume - 240226 - 121502-2 - 240326 - 221347caezarcodmNo ratings yet

- Ricky Yusman ResumeDocument2 pagesRicky Yusman ResumeRicky YusmanNo ratings yet

- Resume Swati Sap Fico FresherDocument2 pagesResume Swati Sap Fico FresheraravintharkNo ratings yet

- Enrico Leonardo: Professional Summary SkillsDocument2 pagesEnrico Leonardo: Professional Summary SkillsAprilia SilalahiNo ratings yet

- CA Sunil Kumar Bommisetty ResumeDocument2 pagesCA Sunil Kumar Bommisetty Resumedileep.jcmNo ratings yet

- CV DodiDocument1 pageCV DodiDenise SonyaNo ratings yet

- Arif KurniawanDocument4 pagesArif KurniawanBDE Eko PurmintoNo ratings yet

- CV - Abhishek SinglaDocument4 pagesCV - Abhishek SinglaMoHiT chaudharyNo ratings yet

- Mobile: +91-xxx E-Mail: XX: Accomplished Indirect Taxation ProfessionalDocument2 pagesMobile: +91-xxx E-Mail: XX: Accomplished Indirect Taxation ProfessionalSunilDoraNo ratings yet

- FIN - Resume - Anshul Gupta - CA - 1st Attempt - 2004..Document3 pagesFIN - Resume - Anshul Gupta - CA - 1st Attempt - 2004..hrNo ratings yet

- CV Nicoleta Vasile 2165828-3-1Document3 pagesCV Nicoleta Vasile 2165828-3-1Nicoleta NiculaeNo ratings yet

- Contoh CV 1Document10 pagesContoh CV 1BDE Eko PurmintoNo ratings yet

- Suchendra N. Chandan: GAAP, Auditing Finalization of AccountsDocument4 pagesSuchendra N. Chandan: GAAP, Auditing Finalization of AccountsBhavesh PopatNo ratings yet

- Teresa L. Zhou MSTDocument2 pagesTeresa L. Zhou MSTLin ZhouNo ratings yet

- Torang Shakespeare Siagian - Assistant Tax Manager - Prime ConsultDocument5 pagesTorang Shakespeare Siagian - Assistant Tax Manager - Prime ConsultTorang Shakespeare SiagianNo ratings yet

- Resume YULIARONAAYUDocument2 pagesResume YULIARONAAYUsandy fumyNo ratings yet

- CV May Nurul Isnawati - PT NCE IndonesiaDocument5 pagesCV May Nurul Isnawati - PT NCE IndonesiaPaulina SitompulNo ratings yet

- Resume - Sikander - Gupta - (Accounts and Finance)Document2 pagesResume - Sikander - Gupta - (Accounts and Finance)Phanindra GaddeNo ratings yet

- CV TangSelDocument1 pageCV TangSelLathifah Wulandari SNo ratings yet

- JOBSTREETEXPRESS IndahDwiCahyani Resume 20240331Document1 pageJOBSTREETEXPRESS IndahDwiCahyani Resume 20240331Vania Valencia DavidNo ratings yet

- Aplication and CVDocument5 pagesAplication and CVGlad MbaleNo ratings yet

- CV Waleska Silva SantanaDocument3 pagesCV Waleska Silva SantanaWaleska SantanaNo ratings yet

- CV BukittinggiDocument1 pageCV BukittinggiLathifah Wulandari SNo ratings yet

- 1 - CV - TaxDocument3 pages1 - CV - TaxFaisal MehmoodNo ratings yet

- Cma NivasDocument4 pagesCma NivaskasyapNo ratings yet

- CV Lilis Suryani OkkDocument2 pagesCV Lilis Suryani Okkalvian katiwandaNo ratings yet

- Jayesh Khate CV 2024Document2 pagesJayesh Khate CV 2024Niraj HNo ratings yet

- Dimas Irawan ManagerDocument4 pagesDimas Irawan Managerhendra gunawanNo ratings yet

- CV - Okechukwu A MbachuDocument2 pagesCV - Okechukwu A MbachuOKECHUKWU MBACHUNo ratings yet

- Updated CV - Ruchira PereraDocument5 pagesUpdated CV - Ruchira Pereraayaz akhtarNo ratings yet

- Abhishek GuptaDocument3 pagesAbhishek Guptadr_shaikhfaisalNo ratings yet

- CV Wildan Updated 02092022Document6 pagesCV Wildan Updated 02092022Jan SangadjiNo ratings yet

- Jitendra Prasad: Finance & Accounts ProfessionalDocument2 pagesJitendra Prasad: Finance & Accounts ProfessionalshannabyNo ratings yet

- CV Jelsi (English)Document1 pageCV Jelsi (English)ahmad khaeruzzadNo ratings yet

- CV Lakshya GuptaDocument3 pagesCV Lakshya Guptapuneetaswani1234No ratings yet

- Accounts and Finance ProfessionalDocument3 pagesAccounts and Finance ProfessionalFahad Ahmad Khan100% (1)

- Resume ShahabDocument2 pagesResume Shahabnasir elahiNo ratings yet

- Ats Uli AuliaDocument3 pagesAts Uli Aulia0900797046No ratings yet

- CA Keshav Acharya CVDocument2 pagesCA Keshav Acharya CVka.keshavacharya12No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Circular Economy and Bioeconomy: ISCC Technical Stakeholder MeetingDocument3 pagesCircular Economy and Bioeconomy: ISCC Technical Stakeholder MeetingGreen Sustain EnergyNo ratings yet

- Melky Ernest Tumigolung, Se.: Personal DataDocument18 pagesMelky Ernest Tumigolung, Se.: Personal DataGreen Sustain EnergyNo ratings yet

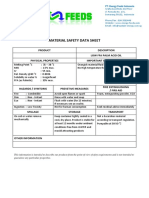

- Msds Low Ffa PaoDocument1 pageMsds Low Ffa PaoGreen Sustain Energy0% (1)

- KEPUTUSAN SIRKULER - TranslatedDocument5 pagesKEPUTUSAN SIRKULER - TranslatedGreen Sustain EnergyNo ratings yet

- Urriculum Itae: A. Malino Kurniawan, SE. AKDocument4 pagesUrriculum Itae: A. Malino Kurniawan, SE. AKGreen Sustain EnergyNo ratings yet

- Curriculum Vitae: Personal Information Ermansyah ZulkarnainiDocument5 pagesCurriculum Vitae: Personal Information Ermansyah ZulkarnainiGreen Sustain EnergyNo ratings yet

- Johannes Sianturi: Personal DetailsDocument3 pagesJohannes Sianturi: Personal DetailsGreen Sustain EnergyNo ratings yet

- Angelo Wardana 349655122Document5 pagesAngelo Wardana 349655122Green Sustain EnergyNo ratings yet

- Johnny D. - Harijanto - 349655122Document1 pageJohnny D. - Harijanto - 349655122Green Sustain EnergyNo ratings yet

- Fathun Nur Day: - A Senior Management For Strategic and Tactical ManagementDocument7 pagesFathun Nur Day: - A Senior Management For Strategic and Tactical ManagementGreen Sustain EnergyNo ratings yet

- RM Denny Wahyu Priyakurniawan: June 2013 - December 2017Document2 pagesRM Denny Wahyu Priyakurniawan: June 2013 - December 2017Green Sustain EnergyNo ratings yet

- Iwan Kurniawan, Se, Ak, Mba, Ca: Finance Director/CFO/GM Finance/Financial ControllerDocument6 pagesIwan Kurniawan, Se, Ak, Mba, Ca: Finance Director/CFO/GM Finance/Financial ControllerGreen Sustain EnergyNo ratings yet

- Husin Cipto: JL Lombok No.57, Menteng Jakarta Pusat 10350Document3 pagesHusin Cipto: JL Lombok No.57, Menteng Jakarta Pusat 10350Green Sustain EnergyNo ratings yet

- Bhayu H. 349655122Document16 pagesBhayu H. 349655122Green Sustain EnergyNo ratings yet

- Hendry Setiabudi 349655122Document7 pagesHendry Setiabudi 349655122Green Sustain EnergyNo ratings yet

- Ferdinand Tarigan: Personal DetailsDocument4 pagesFerdinand Tarigan: Personal DetailsGreen Sustain EnergyNo ratings yet

- Dimas Wijil Parikesit: Perum Rose Garden Blok C No. 2 - Sukatani, Tapos, 1 6 9 5 4Document10 pagesDimas Wijil Parikesit: Perum Rose Garden Blok C No. 2 - Sukatani, Tapos, 1 6 9 5 4Green Sustain EnergyNo ratings yet

- Standards: ASTM D4929 ASTM D5808 ASTM D6721 ISO 9562 UOP 779Document3 pagesStandards: ASTM D4929 ASTM D5808 ASTM D6721 ISO 9562 UOP 779Green Sustain EnergyNo ratings yet

- Key Skills: Ship Management Expertise HSE & ISM Code ExpertiseDocument4 pagesKey Skills: Ship Management Expertise HSE & ISM Code ExpertiseGreen Sustain EnergyNo ratings yet

- Cboa Friend & Guide Dec2022 PDFDocument37 pagesCboa Friend & Guide Dec2022 PDFswapnilexNo ratings yet

- Maureen Woodhall - Student LoansDocument16 pagesMaureen Woodhall - Student LoansOwlCakeNo ratings yet

- HBR IntroDocument3 pagesHBR IntroNeo4u44No ratings yet

- Mid-Term Review: MIX & MATCH: Find The Matching Definitions Know Each of These !Document3 pagesMid-Term Review: MIX & MATCH: Find The Matching Definitions Know Each of These !Selvakumar MurugesanNo ratings yet

- Your Freedom Number Cheat Sheet PDFDocument4 pagesYour Freedom Number Cheat Sheet PDFJiggaWhaa100% (1)

- NewsPib May - 2023Document140 pagesNewsPib May - 2023Aditya DwivediNo ratings yet

- Presentation Product PLC240228 A02Document8 pagesPresentation Product PLC240228 A02Crazed NinjaNo ratings yet

- The Impact of Great Depression On The American Accounting PracticeDocument5 pagesThe Impact of Great Depression On The American Accounting PracticeMuhammad Dio ViandraNo ratings yet

- 4a-India Case StudyDocument16 pages4a-India Case StudydarpanshuklaNo ratings yet

- RSRM Bank Branch CodeDocument13 pagesRSRM Bank Branch Coderockerboy61No ratings yet

- A Note On Islamic Economics-Abbas Mirakhor PDFDocument56 pagesA Note On Islamic Economics-Abbas Mirakhor PDFPurnama PutraNo ratings yet

- MIS Mini ProjectDocument38 pagesMIS Mini ProjectPrem RaviNo ratings yet

- Ashish Gupta 09DM026 IffcoLtd FertilizersDocument128 pagesAshish Gupta 09DM026 IffcoLtd FertilizersAzra ShaikhNo ratings yet

- Definitive Information StatementDocument148 pagesDefinitive Information StatementWiam-Oyok B. AmerolNo ratings yet

- Devaraj: Achievement & QualificationDocument2 pagesDevaraj: Achievement & QualificationDaniel IsaacNo ratings yet

- Lloyd PDFDocument30 pagesLloyd PDFRaul Hernan Villacorta GarciaNo ratings yet

- Answer For Take Home Essay Macro (Pika)Document3 pagesAnswer For Take Home Essay Macro (Pika)shapika masmudNo ratings yet

- Value Added TaxDocument20 pagesValue Added TaxKhen HannaNo ratings yet

- Assignment Topics 2023 PDFDocument5 pagesAssignment Topics 2023 PDFABIZ SHAHNo ratings yet

- Managerial Accounting: BUS 5110 Unit 3 Written Assignment Term 2, 2022Document5 pagesManagerial Accounting: BUS 5110 Unit 3 Written Assignment Term 2, 2022seles23734No ratings yet

- Republic Act No. 11954Document16 pagesRepublic Act No. 11954najaisisusuNo ratings yet

- Standing Order 2020Document2 pagesStanding Order 2020Marilyn Radukana100% (3)

- (Haitao Et Al 2013) Lean Transformation in A Modular Building Company A Case For ImplementationDocument9 pages(Haitao Et Al 2013) Lean Transformation in A Modular Building Company A Case For ImplementationShanil ShahNo ratings yet

- Morning Fresh (Saud Afzal)Document7 pagesMorning Fresh (Saud Afzal)Ismail LoneNo ratings yet

- MIDCDocument5 pagesMIDCAtharvaNo ratings yet

- Monitoring Report 2020: European Declaration On Paper Recycling 2016-2020Document12 pagesMonitoring Report 2020: European Declaration On Paper Recycling 2016-2020bogdan marianNo ratings yet

- Case 2 McDonald'sDocument13 pagesCase 2 McDonald'smdvikralNo ratings yet

- Full Download Advanced Accounting Beams 12th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Advanced Accounting Beams 12th Edition Solutions Manual PDF Full Chapterbeatencadiemha94100% (21)

- Internal Reconstruction - ProblemsDocument8 pagesInternal Reconstruction - ProblemsNaomi SaldanhaNo ratings yet

Agung Ariwibowo: Assistant Tax Accountant Senior Manager

Agung Ariwibowo: Assistant Tax Accountant Senior Manager

Uploaded by

Green Sustain EnergyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agung Ariwibowo: Assistant Tax Accountant Senior Manager

Agung Ariwibowo: Assistant Tax Accountant Senior Manager

Uploaded by

Green Sustain EnergyCopyright:

Available Formats

Agung Ariwibowo

Assistant Tax Accountant Senior Manager

Address Jakarta, JK, 12940

Phone 081311963471

E-mail for1arwi@yahoo.com

Tax Accountant Professional - Experienced in tax for more than 13 years. Managed tax compliance, planning,

audit, and transfer pricing of several multi-state operating companies.

Work History

2019-09 - Current Assistant Tax Accountant Senior Manager

PT Pelita Samudera Shipping Tbk, Jakarta, Indonesia

Manage Accounting and Tax complexities and risks, Fiscal and Customs Audit,

objection, and appeal coordination, refund of VAT, WHT, and CIT, review and monitor

Transfer Price policy.

Implemented budget and expense controls and financial policies by analyzing income

and expenditures.

Reported financial data and updated financial records in ledgers, journals, and

reconciliation..

2017-11 - 2019-09 Senior Tax

PT Siemens Indonesia, Jakarta, Indonesia

To deliver full range of tax services in compliance with Indonesia tax laws and

regulations for all related taxes such as custom and VAT and its supporting

documentation.

To manage all monthly/annual tax payment and returns.

To manage company's tax audit process.

To support Tax manager to provide completely transfer pricing documentation.

To manage and control technical tax issues to ensure accurate reporting in line with

company guidelines.

2015-06 - 2017-10 Tax Accountant Intermediate

PT Exterran Indonesia, Jakarta, DKI Jakarta

Monitor outstanding balances in balance sheet accounts.

Monitor transactions in profit loss and ensure correct classification of transactions.

Maintain fixed asset register and perform tagging for newly purchase fixed asset.

Generate reports and handling inquiries from auditors during year-end audit.

Assisting accounting manager in doing closing.

Performing daily accounting jobs.

Prepare and review all Indonesian tax compliance matters including; managing filing

deadlines, estimated payment calculations, and management of external tax

consultants.

Assist Financial Controller in relation with tax assessments, assisting as necessary during

tax audits and reviews.

Identify and assist with customs issues on behalf of organization.

Prepare and review of Indonesian income tax expense including, preparing / reviewing

supporting calculations and work papers, effective rate analysis.

Assist with tax planning/legal entity planning project

2009-04 - 2015-05 Tax Officer

PT Mitsui Indonesia, Jakarta, DKI Jakarta

To deliver full range of tax compliance with Indonesia tax laws and regulations

including; local VAT, withholding tax art 22, 23, final 4 (2), 26, 21, and CIT.

Conducted reviews both internal and external tax documentations, ensure that it is in

line with finance and tax perspective.

Prepare VAT and CIT refunds smoothly and timely manner.

Ensure and maintain complete tax documentation of company reports in secures area.

Assess and mitigate future tax liabilities, also give advice to tax manager to reduce tax

liabilities purposes.

Maintained thorough and current understanding of applicable tax laws.

To work together with tax consultant to prepare tax letters responses related to tax

audit, objection, and appeal results.

Provide NPWP for all Japanese staff from collect IKTA / IMTA, POA, Passport, and form of

NPWP both registration and revocation to submitted to tax office BADORA, and

involved in withholding tax art 21 tax audit until closing.

2007-03 - 2009-03 Assistant Tax Officer

PT Kelly Services Indonesia For PT Kraft Indonesia, Jakarta, Indonesia

Prepare monthly tax equalization such as VAT in with sales and VAT out with expenses,

withholding tax art 22,23,final 4(2),26, and withholding tax art 21.

Prepare monthly tax report for submitted to tax office smoothly and timely manner.

To support tax officer in tax audit, objection, and appeal process.

To ensure all of tax documentation has been neatly and completely arranged.

Support tax officer to conduct training of Basic taxation for Sales Administration.

Conducted reviews of internal tax documentation, reducing errors related to missed tax

benefits.

Skills

Finance, Tax, and Accounting, Audit

Leadership, Communication, Problem Solving, Negotiation,

Hardworking

Time Schedule Management, Organization, Team Work,

Process Improvement, Detail Oriented,

Project Management, Supply Chain Management, and

Logistics

Education

2018-08 - 2020-03 MBA: Master Business Administration

University Of South Wales - Cardiff UK

2011-08 - 2015-01 BBA: Fiscal Administration

University Of Indonesia - Depok

Thesis: Safeguard measures in casing and tubing from the Indonesia Government for

seamless pipes in year 2008 - 2011.

Graduated with GPA 3.14 / 4.00

2003-08 - 2006-11 Diploma: Accounting

State Polytechnic Of Jakarta - Depok

Awarded: Rank 2nd in Chess Competition at State polytechnic of Jakarta, in the event

of PNJ Olympiad (2004-2005).

Graduated with GPA 3.25 / 4.00

Affiliations

Association Diploma in International Taxation

Asosiasi Konsultan Pajak Publik Indonesia

Ikatan Konsultan Pajak Indonesia

Software

Office

SAP

Oracle

Certifications

2018-07 Financial Modeling Valuation Analyst - Corporate Finance Institute

2008-04 Tax Brevet ABC - University of Indonesia

Languages

English

German

Interests

Reading, Sport, and Traveling

You might also like

- Unsolved Problems 1-8Document26 pagesUnsolved Problems 1-8AsħîŞĥLøÝå60% (5)

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDocument3 pagesSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiNo ratings yet

- Edi Safe'I, S.Ak: BiodataDocument3 pagesEdi Safe'I, S.Ak: BiodataDenny Teguh HerlambangNo ratings yet

- Prinoti-Resume (Update)Document4 pagesPrinoti-Resume (Update)humanresources.ssgroupNo ratings yet

- Tengku Mona Mia: Personal DetailsDocument5 pagesTengku Mona Mia: Personal Detailsdanang setiawanNo ratings yet

- Acc - CV - Gregorius RahadianDocument11 pagesAcc - CV - Gregorius Rahadianlestari simorangkirNo ratings yet

- CV Fikri Islami UPDATE - Fikri IslamiDocument3 pagesCV Fikri Islami UPDATE - Fikri Islamihumanresourcesdept.tcaNo ratings yet

- Muzafar Resume Accounts SpecialistDocument3 pagesMuzafar Resume Accounts Specialistmuzafar.takeyNo ratings yet

- ACCA Taxation & FinanceDocument2 pagesACCA Taxation & Financetalent.house1985No ratings yet

- Muzafar Resume Tax SpecialistDocument3 pagesMuzafar Resume Tax Specialistmuzafar.takeyNo ratings yet

- Arif Sukendar: Summary of QualificationsDocument4 pagesArif Sukendar: Summary of QualificationsMANAGER HRDNo ratings yet

- F & A S - B M 2018 - P: Inance Ccounting Uperintendent Olok Plant AR ResentDocument6 pagesF & A S - B M 2018 - P: Inance Ccounting Uperintendent Olok Plant AR ResentGreen Sustain EnergyNo ratings yet

- Dickfan Multazam CVDocument4 pagesDickfan Multazam CVroby robyNo ratings yet

- Setyo Anung Dewantoko: Astra Graphia TBK Jakarta - 09/2012 To 07/2019Document2 pagesSetyo Anung Dewantoko: Astra Graphia TBK Jakarta - 09/2012 To 07/2019Green Sustain EnergyNo ratings yet

- CV Update GhafarDocument9 pagesCV Update GhafarGhafar MuzanniNo ratings yet

- Wa0003.Document2 pagesWa0003.bhoomika rathodNo ratings yet

- Ricardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityDocument2 pagesRicardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityRic Dela CruzNo ratings yet

- Gani Hartanto M Comm.: ExperienceDocument6 pagesGani Hartanto M Comm.: ExperienceGreen Sustain EnergyNo ratings yet

- Qualifications Profile Contac T: Phone: 01136618576 Address: No 2, JLN NB2 8/7, TamanDocument4 pagesQualifications Profile Contac T: Phone: 01136618576 Address: No 2, JLN NB2 8/7, TamanMeena RajagopalNo ratings yet

- CV Kinanti-Dikonversi 2Document3 pagesCV Kinanti-Dikonversi 2Salma JuwitaNo ratings yet

- Bernard Kinyua CVDocument3 pagesBernard Kinyua CVbrian karuNo ratings yet

- Siddharth Basa Resume - 240226 - 121502-2 - 240326 - 221347Document2 pagesSiddharth Basa Resume - 240226 - 121502-2 - 240326 - 221347caezarcodmNo ratings yet

- Ricky Yusman ResumeDocument2 pagesRicky Yusman ResumeRicky YusmanNo ratings yet

- Resume Swati Sap Fico FresherDocument2 pagesResume Swati Sap Fico FresheraravintharkNo ratings yet

- Enrico Leonardo: Professional Summary SkillsDocument2 pagesEnrico Leonardo: Professional Summary SkillsAprilia SilalahiNo ratings yet

- CA Sunil Kumar Bommisetty ResumeDocument2 pagesCA Sunil Kumar Bommisetty Resumedileep.jcmNo ratings yet

- CV DodiDocument1 pageCV DodiDenise SonyaNo ratings yet

- Arif KurniawanDocument4 pagesArif KurniawanBDE Eko PurmintoNo ratings yet

- CV - Abhishek SinglaDocument4 pagesCV - Abhishek SinglaMoHiT chaudharyNo ratings yet

- Mobile: +91-xxx E-Mail: XX: Accomplished Indirect Taxation ProfessionalDocument2 pagesMobile: +91-xxx E-Mail: XX: Accomplished Indirect Taxation ProfessionalSunilDoraNo ratings yet

- FIN - Resume - Anshul Gupta - CA - 1st Attempt - 2004..Document3 pagesFIN - Resume - Anshul Gupta - CA - 1st Attempt - 2004..hrNo ratings yet

- CV Nicoleta Vasile 2165828-3-1Document3 pagesCV Nicoleta Vasile 2165828-3-1Nicoleta NiculaeNo ratings yet

- Contoh CV 1Document10 pagesContoh CV 1BDE Eko PurmintoNo ratings yet

- Suchendra N. Chandan: GAAP, Auditing Finalization of AccountsDocument4 pagesSuchendra N. Chandan: GAAP, Auditing Finalization of AccountsBhavesh PopatNo ratings yet

- Teresa L. Zhou MSTDocument2 pagesTeresa L. Zhou MSTLin ZhouNo ratings yet

- Torang Shakespeare Siagian - Assistant Tax Manager - Prime ConsultDocument5 pagesTorang Shakespeare Siagian - Assistant Tax Manager - Prime ConsultTorang Shakespeare SiagianNo ratings yet

- Resume YULIARONAAYUDocument2 pagesResume YULIARONAAYUsandy fumyNo ratings yet

- CV May Nurul Isnawati - PT NCE IndonesiaDocument5 pagesCV May Nurul Isnawati - PT NCE IndonesiaPaulina SitompulNo ratings yet

- Resume - Sikander - Gupta - (Accounts and Finance)Document2 pagesResume - Sikander - Gupta - (Accounts and Finance)Phanindra GaddeNo ratings yet

- CV TangSelDocument1 pageCV TangSelLathifah Wulandari SNo ratings yet

- JOBSTREETEXPRESS IndahDwiCahyani Resume 20240331Document1 pageJOBSTREETEXPRESS IndahDwiCahyani Resume 20240331Vania Valencia DavidNo ratings yet

- Aplication and CVDocument5 pagesAplication and CVGlad MbaleNo ratings yet

- CV Waleska Silva SantanaDocument3 pagesCV Waleska Silva SantanaWaleska SantanaNo ratings yet

- CV BukittinggiDocument1 pageCV BukittinggiLathifah Wulandari SNo ratings yet

- 1 - CV - TaxDocument3 pages1 - CV - TaxFaisal MehmoodNo ratings yet

- Cma NivasDocument4 pagesCma NivaskasyapNo ratings yet

- CV Lilis Suryani OkkDocument2 pagesCV Lilis Suryani Okkalvian katiwandaNo ratings yet

- Jayesh Khate CV 2024Document2 pagesJayesh Khate CV 2024Niraj HNo ratings yet

- Dimas Irawan ManagerDocument4 pagesDimas Irawan Managerhendra gunawanNo ratings yet

- CV - Okechukwu A MbachuDocument2 pagesCV - Okechukwu A MbachuOKECHUKWU MBACHUNo ratings yet

- Updated CV - Ruchira PereraDocument5 pagesUpdated CV - Ruchira Pereraayaz akhtarNo ratings yet

- Abhishek GuptaDocument3 pagesAbhishek Guptadr_shaikhfaisalNo ratings yet

- CV Wildan Updated 02092022Document6 pagesCV Wildan Updated 02092022Jan SangadjiNo ratings yet

- Jitendra Prasad: Finance & Accounts ProfessionalDocument2 pagesJitendra Prasad: Finance & Accounts ProfessionalshannabyNo ratings yet

- CV Jelsi (English)Document1 pageCV Jelsi (English)ahmad khaeruzzadNo ratings yet

- CV Lakshya GuptaDocument3 pagesCV Lakshya Guptapuneetaswani1234No ratings yet

- Accounts and Finance ProfessionalDocument3 pagesAccounts and Finance ProfessionalFahad Ahmad Khan100% (1)

- Resume ShahabDocument2 pagesResume Shahabnasir elahiNo ratings yet

- Ats Uli AuliaDocument3 pagesAts Uli Aulia0900797046No ratings yet

- CA Keshav Acharya CVDocument2 pagesCA Keshav Acharya CVka.keshavacharya12No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Circular Economy and Bioeconomy: ISCC Technical Stakeholder MeetingDocument3 pagesCircular Economy and Bioeconomy: ISCC Technical Stakeholder MeetingGreen Sustain EnergyNo ratings yet

- Melky Ernest Tumigolung, Se.: Personal DataDocument18 pagesMelky Ernest Tumigolung, Se.: Personal DataGreen Sustain EnergyNo ratings yet

- Msds Low Ffa PaoDocument1 pageMsds Low Ffa PaoGreen Sustain Energy0% (1)

- KEPUTUSAN SIRKULER - TranslatedDocument5 pagesKEPUTUSAN SIRKULER - TranslatedGreen Sustain EnergyNo ratings yet

- Urriculum Itae: A. Malino Kurniawan, SE. AKDocument4 pagesUrriculum Itae: A. Malino Kurniawan, SE. AKGreen Sustain EnergyNo ratings yet

- Curriculum Vitae: Personal Information Ermansyah ZulkarnainiDocument5 pagesCurriculum Vitae: Personal Information Ermansyah ZulkarnainiGreen Sustain EnergyNo ratings yet

- Johannes Sianturi: Personal DetailsDocument3 pagesJohannes Sianturi: Personal DetailsGreen Sustain EnergyNo ratings yet

- Angelo Wardana 349655122Document5 pagesAngelo Wardana 349655122Green Sustain EnergyNo ratings yet

- Johnny D. - Harijanto - 349655122Document1 pageJohnny D. - Harijanto - 349655122Green Sustain EnergyNo ratings yet

- Fathun Nur Day: - A Senior Management For Strategic and Tactical ManagementDocument7 pagesFathun Nur Day: - A Senior Management For Strategic and Tactical ManagementGreen Sustain EnergyNo ratings yet

- RM Denny Wahyu Priyakurniawan: June 2013 - December 2017Document2 pagesRM Denny Wahyu Priyakurniawan: June 2013 - December 2017Green Sustain EnergyNo ratings yet

- Iwan Kurniawan, Se, Ak, Mba, Ca: Finance Director/CFO/GM Finance/Financial ControllerDocument6 pagesIwan Kurniawan, Se, Ak, Mba, Ca: Finance Director/CFO/GM Finance/Financial ControllerGreen Sustain EnergyNo ratings yet

- Husin Cipto: JL Lombok No.57, Menteng Jakarta Pusat 10350Document3 pagesHusin Cipto: JL Lombok No.57, Menteng Jakarta Pusat 10350Green Sustain EnergyNo ratings yet

- Bhayu H. 349655122Document16 pagesBhayu H. 349655122Green Sustain EnergyNo ratings yet

- Hendry Setiabudi 349655122Document7 pagesHendry Setiabudi 349655122Green Sustain EnergyNo ratings yet

- Ferdinand Tarigan: Personal DetailsDocument4 pagesFerdinand Tarigan: Personal DetailsGreen Sustain EnergyNo ratings yet

- Dimas Wijil Parikesit: Perum Rose Garden Blok C No. 2 - Sukatani, Tapos, 1 6 9 5 4Document10 pagesDimas Wijil Parikesit: Perum Rose Garden Blok C No. 2 - Sukatani, Tapos, 1 6 9 5 4Green Sustain EnergyNo ratings yet

- Standards: ASTM D4929 ASTM D5808 ASTM D6721 ISO 9562 UOP 779Document3 pagesStandards: ASTM D4929 ASTM D5808 ASTM D6721 ISO 9562 UOP 779Green Sustain EnergyNo ratings yet

- Key Skills: Ship Management Expertise HSE & ISM Code ExpertiseDocument4 pagesKey Skills: Ship Management Expertise HSE & ISM Code ExpertiseGreen Sustain EnergyNo ratings yet

- Cboa Friend & Guide Dec2022 PDFDocument37 pagesCboa Friend & Guide Dec2022 PDFswapnilexNo ratings yet

- Maureen Woodhall - Student LoansDocument16 pagesMaureen Woodhall - Student LoansOwlCakeNo ratings yet

- HBR IntroDocument3 pagesHBR IntroNeo4u44No ratings yet

- Mid-Term Review: MIX & MATCH: Find The Matching Definitions Know Each of These !Document3 pagesMid-Term Review: MIX & MATCH: Find The Matching Definitions Know Each of These !Selvakumar MurugesanNo ratings yet

- Your Freedom Number Cheat Sheet PDFDocument4 pagesYour Freedom Number Cheat Sheet PDFJiggaWhaa100% (1)

- NewsPib May - 2023Document140 pagesNewsPib May - 2023Aditya DwivediNo ratings yet

- Presentation Product PLC240228 A02Document8 pagesPresentation Product PLC240228 A02Crazed NinjaNo ratings yet

- The Impact of Great Depression On The American Accounting PracticeDocument5 pagesThe Impact of Great Depression On The American Accounting PracticeMuhammad Dio ViandraNo ratings yet

- 4a-India Case StudyDocument16 pages4a-India Case StudydarpanshuklaNo ratings yet

- RSRM Bank Branch CodeDocument13 pagesRSRM Bank Branch Coderockerboy61No ratings yet

- A Note On Islamic Economics-Abbas Mirakhor PDFDocument56 pagesA Note On Islamic Economics-Abbas Mirakhor PDFPurnama PutraNo ratings yet

- MIS Mini ProjectDocument38 pagesMIS Mini ProjectPrem RaviNo ratings yet

- Ashish Gupta 09DM026 IffcoLtd FertilizersDocument128 pagesAshish Gupta 09DM026 IffcoLtd FertilizersAzra ShaikhNo ratings yet

- Definitive Information StatementDocument148 pagesDefinitive Information StatementWiam-Oyok B. AmerolNo ratings yet

- Devaraj: Achievement & QualificationDocument2 pagesDevaraj: Achievement & QualificationDaniel IsaacNo ratings yet

- Lloyd PDFDocument30 pagesLloyd PDFRaul Hernan Villacorta GarciaNo ratings yet

- Answer For Take Home Essay Macro (Pika)Document3 pagesAnswer For Take Home Essay Macro (Pika)shapika masmudNo ratings yet

- Value Added TaxDocument20 pagesValue Added TaxKhen HannaNo ratings yet

- Assignment Topics 2023 PDFDocument5 pagesAssignment Topics 2023 PDFABIZ SHAHNo ratings yet

- Managerial Accounting: BUS 5110 Unit 3 Written Assignment Term 2, 2022Document5 pagesManagerial Accounting: BUS 5110 Unit 3 Written Assignment Term 2, 2022seles23734No ratings yet

- Republic Act No. 11954Document16 pagesRepublic Act No. 11954najaisisusuNo ratings yet

- Standing Order 2020Document2 pagesStanding Order 2020Marilyn Radukana100% (3)

- (Haitao Et Al 2013) Lean Transformation in A Modular Building Company A Case For ImplementationDocument9 pages(Haitao Et Al 2013) Lean Transformation in A Modular Building Company A Case For ImplementationShanil ShahNo ratings yet

- Morning Fresh (Saud Afzal)Document7 pagesMorning Fresh (Saud Afzal)Ismail LoneNo ratings yet

- MIDCDocument5 pagesMIDCAtharvaNo ratings yet

- Monitoring Report 2020: European Declaration On Paper Recycling 2016-2020Document12 pagesMonitoring Report 2020: European Declaration On Paper Recycling 2016-2020bogdan marianNo ratings yet

- Case 2 McDonald'sDocument13 pagesCase 2 McDonald'smdvikralNo ratings yet

- Full Download Advanced Accounting Beams 12th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Advanced Accounting Beams 12th Edition Solutions Manual PDF Full Chapterbeatencadiemha94100% (21)

- Internal Reconstruction - ProblemsDocument8 pagesInternal Reconstruction - ProblemsNaomi SaldanhaNo ratings yet