Professional Documents

Culture Documents

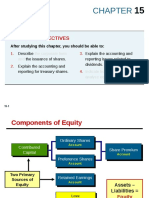

Ch.15 Equity: Chapter Learning Objectives

Ch.15 Equity: Chapter Learning Objectives

Uploaded by

Faishal Alghi FariCopyright:

Available Formats

You might also like

- Heart To Heart Volume 1 - Kathryn Kuhlman PDFDocument99 pagesHeart To Heart Volume 1 - Kathryn Kuhlman PDFanita83% (6)

- ch15 2e Kieso TBDocument46 pagesch15 2e Kieso TBMohammed Khouli100% (3)

- Accounting Lecture 10 Annotated 1114Document10 pagesAccounting Lecture 10 Annotated 1114KrisztiNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Case Study Private Fitness, Inc (S1)Document8 pagesCase Study Private Fitness, Inc (S1)Faishal Alghi FariNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Final Exam - FA2 (Shareholders Equity) With QuestionsDocument10 pagesFinal Exam - FA2 (Shareholders Equity) With Questionsjanus lopezNo ratings yet

- Sheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingDocument28 pagesSheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingMagdy KamelNo ratings yet

- Chapter 10 Solutions StudentsDocument33 pagesChapter 10 Solutions StudentsKelvin AidooNo ratings yet

- Accounting For Corporation: Shareholder's Equity and Retained Earnings I. Write T Is The Statement Is Correct, Otherwise Write FDocument9 pagesAccounting For Corporation: Shareholder's Equity and Retained Earnings I. Write T Is The Statement Is Correct, Otherwise Write FJonalyn Lastimado0% (1)

- Agile Project Charter Template ExampleDocument5 pagesAgile Project Charter Template ExampleOmair Gull100% (1)

- AGoT2 Illustrated Cheat SheetDocument2 pagesAGoT2 Illustrated Cheat SheetIgor Silva100% (1)

- Chapter 10 Corporations - Retained Earnings Exercises T3AY2021Document6 pagesChapter 10 Corporations - Retained Earnings Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Accounting For and Reporting of Preference SharesDocument19 pagesAccounting For and Reporting of Preference SharesAis Syang DyaNo ratings yet

- Chapter 10 Equity Part 2Document27 pagesChapter 10 Equity Part 2LEE WEI LONGNo ratings yet

- Retained EarningsDocument18 pagesRetained EarningsAngelie Bancale100% (1)

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Partial Text 2Document7 pagesPartial Text 2Spring000No ratings yet

- Chapter 15 ExrecisesDocument7 pagesChapter 15 ExrecisesZain MajaliNo ratings yet

- Ch15 UpdatedDocument94 pagesCh15 Updatedkokmunwai717No ratings yet

- Ch15 UpdatedDocument90 pagesCh15 Updatedkokmunwai717No ratings yet

- Module 15 Eps BvpsDocument10 pagesModule 15 Eps BvpsLilyNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Additional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionDocument36 pagesAdditional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionAiiny Nurul 'sinepot'No ratings yet

- Accounting For DividendsDocument6 pagesAccounting For DividendsAgatha Apolinario100% (1)

- Adv FA II - Worksheet - EditedDocument25 pagesAdv FA II - Worksheet - EditedYared GirmaNo ratings yet

- Equity: Learning ObjectivesDocument62 pagesEquity: Learning ObjectivesElaine Lingx100% (1)

- Chp15 InstructorDocument65 pagesChp15 InstructorElaine LingxNo ratings yet

- CFAB Accounting Chapter 11. Company Financial StatementsDocument43 pagesCFAB Accounting Chapter 11. Company Financial StatementsHuy NguyenNo ratings yet

- Chapter 13 SolutionsDocument45 pagesChapter 13 Solutionsaboodyuae2000No ratings yet

- Module 2 2 Eps BVPSDocument9 pagesModule 2 2 Eps BVPSFujoshi BeeNo ratings yet

- Financial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFDocument67 pagesFinancial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFKristieKelleyenfm100% (14)

- Chap012 2Document125 pagesChap012 2Aai NurrNo ratings yet

- ValuationDocument20 pagesValuationNirmal Shrestha100% (1)

- Topic 5 - Sukokokopplemental Tasks and Exercises (Week 17)Document2 pagesTopic 5 - Sukokokopplemental Tasks and Exercises (Week 17)Taylor Kongitti PraditNo ratings yet

- Ias/Ifrs - Equity: Ing. Jana HINKE, PH.DDocument25 pagesIas/Ifrs - Equity: Ing. Jana HINKE, PH.DUna FirstNo ratings yet

- Chapter23 - Earningspershare2008 - Gripping IFRS 2008 by ICAPDocument30 pagesChapter23 - Earningspershare2008 - Gripping IFRS 2008 by ICAPFalah Ud Din SheryarNo ratings yet

- Unit 8 WB SolutionDocument11 pagesUnit 8 WB SolutionEthanChiongson0% (2)

- Corporation QuizDocument13 pagesCorporation Quizjano_art21No ratings yet

- R33 Residual Income Valuation IFT NotesDocument17 pagesR33 Residual Income Valuation IFT NotesAdnan MasoodNo ratings yet

- EveuwinwnwDocument114 pagesEveuwinwnwFrancesca HernandezNo ratings yet

- Ch15 EquityDocument7 pagesCh15 EquitykonyatanNo ratings yet

- Dividends PDFDocument41 pagesDividends PDFHarold EspirituNo ratings yet

- IA2 Shareholders Equity ActivityDocument4 pagesIA2 Shareholders Equity Activitydianarosesarsalejo19No ratings yet

- متوسطه 2 خيارات الواجب الثالثDocument3 pagesمتوسطه 2 خيارات الواجب الثالثmode.xp.jamelNo ratings yet

- Accounting Chapter 9Document7 pagesAccounting Chapter 9Angelica Faye DuroNo ratings yet

- True or FalseDocument7 pagesTrue or FalseColline ZoletaNo ratings yet

- Stockholders' Equity: Overview of Exercises, Problems, and CasesDocument50 pagesStockholders' Equity: Overview of Exercises, Problems, and Casesginish12No ratings yet

- Chap 015Document43 pagesChap 015OilandGas IndependentProjectNo ratings yet

- Ch.17 Investments: Chapter Learning ObjectivesDocument7 pagesCh.17 Investments: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Document From Adhu PDFDocument46 pagesDocument From Adhu PDFBasavaraj S PNo ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- Earnings Per Share by JSSDocument29 pagesEarnings Per Share by JSSJoseph LangitNo ratings yet

- Assignment - Doc 301 Advanced Financial Accounting II - 24042016112440Document4 pagesAssignment - Doc 301 Advanced Financial Accounting II - 24042016112440waresh36No ratings yet

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingDocument39 pagesWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooNo ratings yet

- Accounting For Retained EarningsDocument3 pagesAccounting For Retained EarningsCamille BacaresNo ratings yet

- Chapter 18 IRMDocument33 pagesChapter 18 IRMWissamMouakNo ratings yet

- Gen Math Q2 Las2Document2 pagesGen Math Q2 Las2Genesis MilitarNo ratings yet

- Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions ManualDocument26 pagesIntermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions Manualseteepupeuritor100% (19)

- Intermediate Accounting Vol 2 Canadian 2Nd Edition Lo Solutions Manual Full Chapter PDFDocument68 pagesIntermediate Accounting Vol 2 Canadian 2Nd Edition Lo Solutions Manual Full Chapter PDFwilliambrowntdoypjmnrc100% (10)

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Faishal Alghi Fari (2019104715) - Office Solutions Inc.Document7 pagesFaishal Alghi Fari (2019104715) - Office Solutions Inc.Faishal Alghi FariNo ratings yet

- Ch.20 Accounting For Pension and Post-Retirement BenefitDocument25 pagesCh.20 Accounting For Pension and Post-Retirement BenefitFaishal Alghi FariNo ratings yet

- Ch.13 Current Liabilities: Exercise 13.01 True or FalseDocument6 pagesCh.13 Current Liabilities: Exercise 13.01 True or FalseFaishal Alghi FariNo ratings yet

- Ch.14 Current Liabilities: Exercise 14.01 True or FalseDocument5 pagesCh.14 Current Liabilities: Exercise 14.01 True or FalseFaishal Alghi FariNo ratings yet

- Ch.17 Investments: Chapter Learning ObjectivesDocument7 pagesCh.17 Investments: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Ch.18 Revenue Recognition: Chapter Learning ObjectiveDocument5 pagesCh.18 Revenue Recognition: Chapter Learning ObjectiveFaishal Alghi FariNo ratings yet

- Mata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Document52 pagesMata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Faishal Alghi FariNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Acquisition and Disposition of Property, Plant, and EquipmentDocument24 pagesAcquisition and Disposition of Property, Plant, and EquipmentFaishal Alghi FariNo ratings yet

- 2.2 - Concrete Cracked Elastic Stresses StageDocument12 pages2.2 - Concrete Cracked Elastic Stresses StageMarcelo AbreraNo ratings yet

- Ship49417 - en - Economic Impact of Cruise Ports - Case of MiamiDocument33 pagesShip49417 - en - Economic Impact of Cruise Ports - Case of MiamiRebeca Paz Aguilar MundacaNo ratings yet

- Korea IT TimesDocument76 pagesKorea IT TimesDilek KarahocaNo ratings yet

- (1912) Book of Home Building & DecorationDocument264 pages(1912) Book of Home Building & DecorationHerbert Hillary Booker 2nd100% (2)

- Grail Quest 4Document123 pagesGrail Quest 4Tamás Viktor TariNo ratings yet

- Eric Moses Et AlDocument7 pagesEric Moses Et AlEmily BabayNo ratings yet

- Kathmandu Travel GuideDocument7 pagesKathmandu Travel GuidepeepgunNo ratings yet

- Unit 5: Implications of Developmental Biology: Teratogenesis: Types and Teratogenic AgentsDocument12 pagesUnit 5: Implications of Developmental Biology: Teratogenesis: Types and Teratogenic AgentsAmar Kant JhaNo ratings yet

- Standard Precautions Knowledge and Practice Among Radiographers in Sri LankaDocument8 pagesStandard Precautions Knowledge and Practice Among Radiographers in Sri LankaSachin ParamashettiNo ratings yet

- Parish Priest of Roman Catholic Church of Victoria, Tarlac vs. RigorDocument8 pagesParish Priest of Roman Catholic Church of Victoria, Tarlac vs. RigorRachel GreeneNo ratings yet

- Law - Lesson 9-10Document8 pagesLaw - Lesson 9-10Stephanie AndalNo ratings yet

- Medical Importance of CulicoidesDocument15 pagesMedical Importance of Culicoidesadira64100% (1)

- Subcontract Agreement (Jenesis) V.1.1Document4 pagesSubcontract Agreement (Jenesis) V.1.1sigit l.prabowoNo ratings yet

- Course Title Understanding Culture, Society, & Politics Instructor Mieca Aguinaldo Course Code Course DescriptionDocument6 pagesCourse Title Understanding Culture, Society, & Politics Instructor Mieca Aguinaldo Course Code Course DescriptionSJHC 21No ratings yet

- ThinkCentre E73 Tower SpecDocument1 pageThinkCentre E73 Tower SpecNalendra WibowoNo ratings yet

- Chapter04.pdf - How To Write A Project Report - ResearchDocument8 pagesChapter04.pdf - How To Write A Project Report - Researchbrownsugar26No ratings yet

- 20 Century Cases Where No Finding of Gross Immorality Was MadeDocument6 pages20 Century Cases Where No Finding of Gross Immorality Was MadeLeonel OcanaNo ratings yet

- Parliament Denies Amidu's AllegationsDocument3 pagesParliament Denies Amidu's Allegationsmyjoyonline.comNo ratings yet

- Practicas Discursivas IIDocument84 pagesPracticas Discursivas IIPau PerezNo ratings yet

- Car Sales Cover LetterDocument8 pagesCar Sales Cover Letterf5de9mre100% (2)

- BF Necromancer Supplement r11Document13 pagesBF Necromancer Supplement r11Michael KirchnerNo ratings yet

- Reviewer For Statcon QuizDocument18 pagesReviewer For Statcon QuizShella Hannah SalihNo ratings yet

- Republic of Kenya: Ministry of Interior and National AdministrationDocument2 pagesRepublic of Kenya: Ministry of Interior and National AdministrationWanNo ratings yet

- El Educador Como Gestor de Conflictos 13 To 74Document62 pagesEl Educador Como Gestor de Conflictos 13 To 74AlExa Garzón100% (1)

- G11 - LAS - Q3 - Week4 - Creative WritingDocument14 pagesG11 - LAS - Q3 - Week4 - Creative WritingRubenNo ratings yet

- Algo Trading BasicsDocument15 pagesAlgo Trading BasicsRajvin DongaNo ratings yet

- Boat and StreamDocument4 pagesBoat and StreamAllin 1No ratings yet

Ch.15 Equity: Chapter Learning Objectives

Ch.15 Equity: Chapter Learning Objectives

Uploaded by

Faishal Alghi FariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch.15 Equity: Chapter Learning Objectives

Ch.15 Equity: Chapter Learning Objectives

Uploaded by

Faishal Alghi FariCopyright:

Available Formats

Week 03 – Ch.

15 Equity

Ch.15 Equity

CHAPTER LEARNING OBJECTIVES

1. Describe the corporate form and the issuance of shares.

2. Explain the accounting and reporting for treasury shares.

3. Explain the accounting and reporting issues related to dividends.

4. Indicate how to present and analyze equity.

*5. Discuss the different types of preference share dividends and their effect on book

value per share.

Exercise 15.01 True or False

1. A corporation is incorporated in only one country regardless of the number of

countries in which it operates.

2. The preemptive right allows shareholders the right to vote for directors of the

company.

3. Ordinary shares is the residual corporate interest that bears the ultimate risks of loss.

4. Earned capital consists of contributed capital and retained earnings.

5. True no-par shares should be carried in the accounts at issue price without any share

premium reported.

6. Companies allocate the proceeds received from a lump-sum sale of securities based

on the securities’ par values.

7. Companies should record shares issued for services or noncash property at either the

fair value of the shares issued or the fair value of the consideration received.

8. Treasury shares are a company’s own shares that have been reacquired and retired.

9. The cost method records all transactions in treasury shares at their cost and reports the

treasury shares as a deduction from ordinary shares.

10. When a corporation sells treasury shares below its cost, it usually debits the difference

between cost and selling price to Share Premium—Treasury.

11. Participating preference shares require that if a company fails to pay a dividend in any

year, it must make it up in a later year before paying any ordinary dividends.

12. Callable preference shares permit the corporation at its option to redeem the

outstanding preference shares at stipulated prices.

13. The laws of some jurisdictions require that corporations restrict their contributed

capital from distribution to shareholders

14. Many companies pay dividends in amounts equal to their legally available retained

earnings.

15. All dividends, except for liquidating dividends, reduce the total shareholders’ equity

of a corporation.

16. Dividends payable in assets of the corporation other than cash are called property

dividends or dividends in kind.

17. When a share dividend is declared on the ordinary shares outstanding, a company is

required to transfer the par value of the shares issued from retained earnings.

18. Share splits and share dividends have the same effect on a company’s retained earnings

and total shareholders’ equity

Intermediate Accounting 02 – last update February 2021 1

Week 03 – Ch.15 Equity

19. The return on ordinary share equity is computed by dividing net income by the average

ordinary equity.

20. The payout ratio is determined by dividing cash dividends paid to ordinary

shareholders by net income available to ordinary shareholders.

Exercise 15.02 - Lump sum issuance of shares.

Parker Corporation has issued 2,000 ordinary shares and 400 preference shares for a lump sum of

€72,000 cash.

Instructions

(a) Give the entry for the issuance assuming the par value of the ordinary shares was €5 and the

fair value €30, and the par value of the preference shares was €40 and the fair value €50. (Each

valuation is on a per share basis and there are ready markets for each class of shares.)

(b) Give the entry for the issuance assuming the same facts as (a) above except the preference

shares have no ready market and the ordinary shares have a fair value of €25 per share.

Exercise 15.03 - Treasury shares.

For numerous reasons, a corporation may reacquire shares of its own shares. When a company

purchases treasury shares, it usually accounts for the shares using the cost method.

Instructions

Explain how a company would account for each of the following:

1. Purchase of shares at a price less than par value.

2. Subsequent resale of treasury shares at a price less than purchase price, but more than par

value.

3. Subsequent resale of treasury shares at a price greater than both purchase price and par value.

4. Effect on net income.

Exercise 15.04 - Treasury shares.

Agler Corporation’s statement of financial position reported the following:

Share capital—ordinary outstanding, 5,000 shares, par €30 per share €150,000

share premium—ordinary 80,000

Retained earnings 100,000

The following transactions occurred this year:

(a) Purchased 120 ordinary shares of to be held as treasury shares, paying €60 per share.

(b) Sold 90 of the treasury shares at €65 per share.

(c) Sold the remaining treasury shares at €50 per share.

Instructions

Prepare the journal entry for these transactions under the cost method of accounting for treasury

shares.

Intermediate Accounting 02 – last update February 2021 2

Week 03 – Ch.15 Equity

Exercise 15.05 - Treasury shares.

Ellison Company’s statement of financial position shows:

Share capital—ordinary, €20 par €3,000,000

Share premium—ordinary 1,050,000

Retained earnings 750,000

Instructions

Record the following transactions by the cost method.

(a) Bought 5,000 ordinary shares at €29 a share.

(b) Sold 2,500 treasury shares at €30 a share.

(c) Sold 1,000 shares of treasury shares at €26 a share.

Exercise 15.06 - Treasury shares.

In 2018, Mordica Co. issued 200,000 of its 500,000 authorized shares of £10 par value ordinary

shares at £35 per share. In January, 2019, Mordica repurchased 15,000 shares at £30 per share.

Assume these are the only share transactions the company has ever had.

Instructions

(a) What are the two methods of accounting for treasury shares?

(b) Prepare the journal entry to record the purchase of treasury shares by the cost method.

(c) 5,000 treasury shares are reissued at £33 per share. Prepare the journal entry to record the

reissuance by the cost method.

Exercise 15.07 - Equity transactions.

Indicate the effect of each of the following transactions on total equity by placing an “X” in the

appropriate column.

Increase Decrease No Effect

1. Treasury shares are resold at more than cost. ________ ________ ________

2. Operating loss for the period. ________ ________ ________

3. Retirement of bonds payable at more than

book value. ________ ________ ________

4. Declaration of a share dividend. ________ ________ ________

5. Acquisition of machinery for ordinary shares. ________ ________ ________

6. Conversion of bonds payable into ordinary

shares. ________ ________ ________

7. Not declaring a dividend on cumulative

preference shares. ________ ________ ________

8. Declaration of cash dividend. ________ ________ ________

9. Payment of cash dividend. ________ ________ ________

Exercise 15.08 - Share dividends.

Describe the journal entry for a share dividend on ordinary shares (which has a par value).

Intermediate Accounting 02 – last update February 2021 3

Week 03 – Ch.15 Equity

Exercise 15.09 - Share dividends and share splits.

Indicate the principal effects of a share dividend versus a share split as they affect the issuing

corporation. Respond in the spaces as follows: “C” for change; “NC” for no change.

Share Dividend Share Split

Number of Shares Outstanding ________ _______

Par Value per Share ________ _______

Total Par Outstanding ________ _______

Retained Earnings ________ _______

Total Equity ________ _______

Composition of Equity ________ _______

Exercise 15.10 - Computation of selected financial ratios.

The following information pertains to Parsons Co.:

Preference shares, cumulative:

Par per share €100

Dividend rate 8%

Shares outstanding 5,000

Dividends in arrears none

Ordinary shares:

Par per share €10

Shares issued 60,000

Dividends paid per share €2.70

Market price per share €48.00

Share premium—ordinary €200,000

Unappropriated retained earnings (after closing) €135,000

Retained earnings appropriated for contingencies €150,000

Ordinary treasury shares:

Number of shares 5,000

Total cost €125,000

Net income €370,000

Instructions

Compute (assume no changes in balances during the past year):

(a) Total amount of equity in the statement of financial position

(b) Earnings per share

(c) Book value per ordinary share

(d) Payout ratio

(e) Return on ordinary share equity

Exercise 15.11- Dividends on preference shares.

The equity section of Lemay Corporation shows the following on December 31, 2019:

Share capital—preference—6%, €100 par, 4,000 shares outstanding € 400,000

Share capital—ordinary—€10 par, 60,000 shares outstanding 600,000

Share premium—ordinary 200,000

Retained earnings 114,000

Total equity €1,314,000

Instructions

Assuming that all of the company’s retained earnings are to be paid out in dividends on 12/31/19

and that preference dividends were last paid on 12/31/17, show how much the preference and

ordinary shareholders should receive if the preference share are cumulative and fully participating.

Intermediate Accounting 02 – last update February 2021 4

Week 03 – Ch.15 Equity

Exercise 15.12 - Dividends on preference shares.

In each of the following independent cases, it is assumed that the corporation has $400,000 of 6%

preference shares and £1,600,000 of ordinary shares outstanding, each having a par value of £10.

No dividends have been declared for 2017 and 2018.

(a) As of 12/31/19, it is desired to distribute £250,000 in dividends. How much will the preference

shareholders receive if their shares are cumulative and nonparticipating?

(b) As of 12/31/19, it is desired to distribute £400,000 in dividends. How much will the preference

shareholders receive if their shares are cumulative and participating up to 11% in total?

(c) On 12/31/19, the preference shareholders received a £120,000 dividend on their shares which

are cumulative and fully participating. How much money was distributed in total for dividends

during 2019?

Intermediate Accounting 02 – last update February 2021 5

You might also like

- Heart To Heart Volume 1 - Kathryn Kuhlman PDFDocument99 pagesHeart To Heart Volume 1 - Kathryn Kuhlman PDFanita83% (6)

- ch15 2e Kieso TBDocument46 pagesch15 2e Kieso TBMohammed Khouli100% (3)

- Accounting Lecture 10 Annotated 1114Document10 pagesAccounting Lecture 10 Annotated 1114KrisztiNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Case Study Private Fitness, Inc (S1)Document8 pagesCase Study Private Fitness, Inc (S1)Faishal Alghi FariNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Final Exam - FA2 (Shareholders Equity) With QuestionsDocument10 pagesFinal Exam - FA2 (Shareholders Equity) With Questionsjanus lopezNo ratings yet

- Sheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingDocument28 pagesSheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingMagdy KamelNo ratings yet

- Chapter 10 Solutions StudentsDocument33 pagesChapter 10 Solutions StudentsKelvin AidooNo ratings yet

- Accounting For Corporation: Shareholder's Equity and Retained Earnings I. Write T Is The Statement Is Correct, Otherwise Write FDocument9 pagesAccounting For Corporation: Shareholder's Equity and Retained Earnings I. Write T Is The Statement Is Correct, Otherwise Write FJonalyn Lastimado0% (1)

- Agile Project Charter Template ExampleDocument5 pagesAgile Project Charter Template ExampleOmair Gull100% (1)

- AGoT2 Illustrated Cheat SheetDocument2 pagesAGoT2 Illustrated Cheat SheetIgor Silva100% (1)

- Chapter 10 Corporations - Retained Earnings Exercises T3AY2021Document6 pagesChapter 10 Corporations - Retained Earnings Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Accounting For and Reporting of Preference SharesDocument19 pagesAccounting For and Reporting of Preference SharesAis Syang DyaNo ratings yet

- Chapter 10 Equity Part 2Document27 pagesChapter 10 Equity Part 2LEE WEI LONGNo ratings yet

- Retained EarningsDocument18 pagesRetained EarningsAngelie Bancale100% (1)

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Partial Text 2Document7 pagesPartial Text 2Spring000No ratings yet

- Chapter 15 ExrecisesDocument7 pagesChapter 15 ExrecisesZain MajaliNo ratings yet

- Ch15 UpdatedDocument94 pagesCh15 Updatedkokmunwai717No ratings yet

- Ch15 UpdatedDocument90 pagesCh15 Updatedkokmunwai717No ratings yet

- Module 15 Eps BvpsDocument10 pagesModule 15 Eps BvpsLilyNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Additional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionDocument36 pagesAdditional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionAiiny Nurul 'sinepot'No ratings yet

- Accounting For DividendsDocument6 pagesAccounting For DividendsAgatha Apolinario100% (1)

- Adv FA II - Worksheet - EditedDocument25 pagesAdv FA II - Worksheet - EditedYared GirmaNo ratings yet

- Equity: Learning ObjectivesDocument62 pagesEquity: Learning ObjectivesElaine Lingx100% (1)

- Chp15 InstructorDocument65 pagesChp15 InstructorElaine LingxNo ratings yet

- CFAB Accounting Chapter 11. Company Financial StatementsDocument43 pagesCFAB Accounting Chapter 11. Company Financial StatementsHuy NguyenNo ratings yet

- Chapter 13 SolutionsDocument45 pagesChapter 13 Solutionsaboodyuae2000No ratings yet

- Module 2 2 Eps BVPSDocument9 pagesModule 2 2 Eps BVPSFujoshi BeeNo ratings yet

- Financial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFDocument67 pagesFinancial Accounting A Business Process Approach 3Rd Edition Reimers Solutions Manual Full Chapter PDFKristieKelleyenfm100% (14)

- Chap012 2Document125 pagesChap012 2Aai NurrNo ratings yet

- ValuationDocument20 pagesValuationNirmal Shrestha100% (1)

- Topic 5 - Sukokokopplemental Tasks and Exercises (Week 17)Document2 pagesTopic 5 - Sukokokopplemental Tasks and Exercises (Week 17)Taylor Kongitti PraditNo ratings yet

- Ias/Ifrs - Equity: Ing. Jana HINKE, PH.DDocument25 pagesIas/Ifrs - Equity: Ing. Jana HINKE, PH.DUna FirstNo ratings yet

- Chapter23 - Earningspershare2008 - Gripping IFRS 2008 by ICAPDocument30 pagesChapter23 - Earningspershare2008 - Gripping IFRS 2008 by ICAPFalah Ud Din SheryarNo ratings yet

- Unit 8 WB SolutionDocument11 pagesUnit 8 WB SolutionEthanChiongson0% (2)

- Corporation QuizDocument13 pagesCorporation Quizjano_art21No ratings yet

- R33 Residual Income Valuation IFT NotesDocument17 pagesR33 Residual Income Valuation IFT NotesAdnan MasoodNo ratings yet

- EveuwinwnwDocument114 pagesEveuwinwnwFrancesca HernandezNo ratings yet

- Ch15 EquityDocument7 pagesCh15 EquitykonyatanNo ratings yet

- Dividends PDFDocument41 pagesDividends PDFHarold EspirituNo ratings yet

- IA2 Shareholders Equity ActivityDocument4 pagesIA2 Shareholders Equity Activitydianarosesarsalejo19No ratings yet

- متوسطه 2 خيارات الواجب الثالثDocument3 pagesمتوسطه 2 خيارات الواجب الثالثmode.xp.jamelNo ratings yet

- Accounting Chapter 9Document7 pagesAccounting Chapter 9Angelica Faye DuroNo ratings yet

- True or FalseDocument7 pagesTrue or FalseColline ZoletaNo ratings yet

- Stockholders' Equity: Overview of Exercises, Problems, and CasesDocument50 pagesStockholders' Equity: Overview of Exercises, Problems, and Casesginish12No ratings yet

- Chap 015Document43 pagesChap 015OilandGas IndependentProjectNo ratings yet

- Ch.17 Investments: Chapter Learning ObjectivesDocument7 pagesCh.17 Investments: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Document From Adhu PDFDocument46 pagesDocument From Adhu PDFBasavaraj S PNo ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- Earnings Per Share by JSSDocument29 pagesEarnings Per Share by JSSJoseph LangitNo ratings yet

- Assignment - Doc 301 Advanced Financial Accounting II - 24042016112440Document4 pagesAssignment - Doc 301 Advanced Financial Accounting II - 24042016112440waresh36No ratings yet

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingDocument39 pagesWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooNo ratings yet

- Accounting For Retained EarningsDocument3 pagesAccounting For Retained EarningsCamille BacaresNo ratings yet

- Chapter 18 IRMDocument33 pagesChapter 18 IRMWissamMouakNo ratings yet

- Gen Math Q2 Las2Document2 pagesGen Math Q2 Las2Genesis MilitarNo ratings yet

- Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions ManualDocument26 pagesIntermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions Manualseteepupeuritor100% (19)

- Intermediate Accounting Vol 2 Canadian 2Nd Edition Lo Solutions Manual Full Chapter PDFDocument68 pagesIntermediate Accounting Vol 2 Canadian 2Nd Edition Lo Solutions Manual Full Chapter PDFwilliambrowntdoypjmnrc100% (10)

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Faishal Alghi Fari (2019104715) - Office Solutions Inc.Document7 pagesFaishal Alghi Fari (2019104715) - Office Solutions Inc.Faishal Alghi FariNo ratings yet

- Ch.20 Accounting For Pension and Post-Retirement BenefitDocument25 pagesCh.20 Accounting For Pension and Post-Retirement BenefitFaishal Alghi FariNo ratings yet

- Ch.13 Current Liabilities: Exercise 13.01 True or FalseDocument6 pagesCh.13 Current Liabilities: Exercise 13.01 True or FalseFaishal Alghi FariNo ratings yet

- Ch.14 Current Liabilities: Exercise 14.01 True or FalseDocument5 pagesCh.14 Current Liabilities: Exercise 14.01 True or FalseFaishal Alghi FariNo ratings yet

- Ch.17 Investments: Chapter Learning ObjectivesDocument7 pagesCh.17 Investments: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Ch.18 Revenue Recognition: Chapter Learning ObjectiveDocument5 pagesCh.18 Revenue Recognition: Chapter Learning ObjectiveFaishal Alghi FariNo ratings yet

- Mata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Document52 pagesMata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Faishal Alghi FariNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Acquisition and Disposition of Property, Plant, and EquipmentDocument24 pagesAcquisition and Disposition of Property, Plant, and EquipmentFaishal Alghi FariNo ratings yet

- 2.2 - Concrete Cracked Elastic Stresses StageDocument12 pages2.2 - Concrete Cracked Elastic Stresses StageMarcelo AbreraNo ratings yet

- Ship49417 - en - Economic Impact of Cruise Ports - Case of MiamiDocument33 pagesShip49417 - en - Economic Impact of Cruise Ports - Case of MiamiRebeca Paz Aguilar MundacaNo ratings yet

- Korea IT TimesDocument76 pagesKorea IT TimesDilek KarahocaNo ratings yet

- (1912) Book of Home Building & DecorationDocument264 pages(1912) Book of Home Building & DecorationHerbert Hillary Booker 2nd100% (2)

- Grail Quest 4Document123 pagesGrail Quest 4Tamás Viktor TariNo ratings yet

- Eric Moses Et AlDocument7 pagesEric Moses Et AlEmily BabayNo ratings yet

- Kathmandu Travel GuideDocument7 pagesKathmandu Travel GuidepeepgunNo ratings yet

- Unit 5: Implications of Developmental Biology: Teratogenesis: Types and Teratogenic AgentsDocument12 pagesUnit 5: Implications of Developmental Biology: Teratogenesis: Types and Teratogenic AgentsAmar Kant JhaNo ratings yet

- Standard Precautions Knowledge and Practice Among Radiographers in Sri LankaDocument8 pagesStandard Precautions Knowledge and Practice Among Radiographers in Sri LankaSachin ParamashettiNo ratings yet

- Parish Priest of Roman Catholic Church of Victoria, Tarlac vs. RigorDocument8 pagesParish Priest of Roman Catholic Church of Victoria, Tarlac vs. RigorRachel GreeneNo ratings yet

- Law - Lesson 9-10Document8 pagesLaw - Lesson 9-10Stephanie AndalNo ratings yet

- Medical Importance of CulicoidesDocument15 pagesMedical Importance of Culicoidesadira64100% (1)

- Subcontract Agreement (Jenesis) V.1.1Document4 pagesSubcontract Agreement (Jenesis) V.1.1sigit l.prabowoNo ratings yet

- Course Title Understanding Culture, Society, & Politics Instructor Mieca Aguinaldo Course Code Course DescriptionDocument6 pagesCourse Title Understanding Culture, Society, & Politics Instructor Mieca Aguinaldo Course Code Course DescriptionSJHC 21No ratings yet

- ThinkCentre E73 Tower SpecDocument1 pageThinkCentre E73 Tower SpecNalendra WibowoNo ratings yet

- Chapter04.pdf - How To Write A Project Report - ResearchDocument8 pagesChapter04.pdf - How To Write A Project Report - Researchbrownsugar26No ratings yet

- 20 Century Cases Where No Finding of Gross Immorality Was MadeDocument6 pages20 Century Cases Where No Finding of Gross Immorality Was MadeLeonel OcanaNo ratings yet

- Parliament Denies Amidu's AllegationsDocument3 pagesParliament Denies Amidu's Allegationsmyjoyonline.comNo ratings yet

- Practicas Discursivas IIDocument84 pagesPracticas Discursivas IIPau PerezNo ratings yet

- Car Sales Cover LetterDocument8 pagesCar Sales Cover Letterf5de9mre100% (2)

- BF Necromancer Supplement r11Document13 pagesBF Necromancer Supplement r11Michael KirchnerNo ratings yet

- Reviewer For Statcon QuizDocument18 pagesReviewer For Statcon QuizShella Hannah SalihNo ratings yet

- Republic of Kenya: Ministry of Interior and National AdministrationDocument2 pagesRepublic of Kenya: Ministry of Interior and National AdministrationWanNo ratings yet

- El Educador Como Gestor de Conflictos 13 To 74Document62 pagesEl Educador Como Gestor de Conflictos 13 To 74AlExa Garzón100% (1)

- G11 - LAS - Q3 - Week4 - Creative WritingDocument14 pagesG11 - LAS - Q3 - Week4 - Creative WritingRubenNo ratings yet

- Algo Trading BasicsDocument15 pagesAlgo Trading BasicsRajvin DongaNo ratings yet

- Boat and StreamDocument4 pagesBoat and StreamAllin 1No ratings yet