Professional Documents

Culture Documents

Solve 111

Solve 111

Uploaded by

lalalalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solve 111

Solve 111

Uploaded by

lalalalaCopyright:

Available Formats

Ex.

189

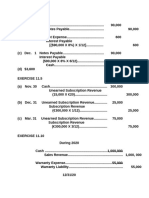

Prepare the necessary journal entries for the following transactions for Presley Co.

May 25 Presley Co. received a $25,000, 2-month, 6% note from Durler Company in settlement

of an account receivable.

June 25 Presley Co. received payment on the Durler note.

Solution 189 (5 min.)

May 25 Notes Receivable .............................................................. 25,000

Accounts Receivable................................................ 25,0

00

June 25 Cash.................................................................................. 25,250

Notes Receivable ..................................................... 25,0

00

Interest Revenue ($25,000 × .06 × 2/12).................. 250

Ex. 190

Record the following transactions in general journal form for Klein Company.

July 1 Received a $10,000, 8%, 3-month note, dated July 1, from Ann Howe in payment of

her open account.

Oct. 1 Received notification from Ann Howe that she was unable to honor her note at this

time. It is expected that Howe will pay at a later date.

Nov. 15 Received full payment from Ann Howe for her note receivable previously dishonored.

Solution 190 (15 min.)

July 1 Notes Receivable................................................................. 10,000

Accounts Receivable— Ann Howe.............................. 10,0

00

(To record acceptance of Ann Howe note as

payment on account)

Oct. 1 Accounts Receivable—Ann Howe........................................ 10,200

Notes Receivable ........................................................ 10,0

00

Interest Revenue ($10,000 × 8% × 1/4) ..................... 200

(To record dishonored note, $10,000, plus interest)

Solution 190 (cont.)

Nov. 15 Cash .................................................................................... 10,200

Accounts Receivable—Ann Howe.............................. 10,200

(To record payment on account)

You might also like

- CH 9 Part 1 RevisionDocument5 pagesCH 9 Part 1 Revisiondima sinnoNo ratings yet

- IF2 - Practice ProblemsDocument320 pagesIF2 - Practice ProblemssaikrishnavnNo ratings yet

- 100 Q&A of GCE O'Level Economics 2281Document32 pages100 Q&A of GCE O'Level Economics 2281Hassan Asghar100% (4)

- Chapter 9 TestbankDocument34 pagesChapter 9 Testbankvx8550_373384312100% (5)

- Review Questions For Test #1 ACC210Document14 pagesReview Questions For Test #1 ACC210Aaa0% (1)

- Solution 191 (15 Min.)Document1 pageSolution 191 (15 Min.)lalalalaNo ratings yet

- E7 25Document2 pagesE7 25Muhammad Syafiq RamadhanNo ratings yet

- Example 1: SolutionDocument7 pagesExample 1: SolutionalemayehuNo ratings yet

- Chapter 9.docpart 1 FinalDocument15 pagesChapter 9.docpart 1 FinalRabie HarounNo ratings yet

- 2-1A, 2A SolnDocument5 pages2-1A, 2A SolnA.K.M. Rubyat Hasan ApuNo ratings yet

- Chapt 13 QuestionsDocument19 pagesChapt 13 Questionssabrina danteNo ratings yet

- Review CH 08Document7 pagesReview CH 08Lalala100% (1)

- Review CH 08Document7 pagesReview CH 08Martin Putra100% (1)

- 193 15 13357 ACT AssignmentDocument14 pages193 15 13357 ACT AssignmentSaif UR RahmanNo ratings yet

- Jawaban PR CHP 2Document8 pagesJawaban PR CHP 2erzalisnawati2002No ratings yet

- Solve 10Document2 pagesSolve 10lalalalaNo ratings yet

- Chapter 6 ReceivablesDocument8 pagesChapter 6 ReceivablesHaileluel WondimnehNo ratings yet

- Solution Tutorial 2Document3 pagesSolution Tutorial 2KHANH Du NgocNo ratings yet

- Definition of ReceivableDocument9 pagesDefinition of Receivableegram2022No ratings yet

- Workbook International Acc1 - C.06Document7 pagesWorkbook International Acc1 - C.06Lam HoàngNo ratings yet

- Financial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFinancial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFClaudiaAdamsfowp100% (14)

- ACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesDocument2 pagesACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesAli Zain ParharNo ratings yet

- CH 1Document11 pagesCH 1alemayehuNo ratings yet

- Solutions To Exercises - Chap 3Document27 pagesSolutions To Exercises - Chap 3InciaNo ratings yet

- Statement Number FEDocument1 pageStatement Number FECEALU moonNo ratings yet

- ch08 - JADocument12 pagesch08 - JAAntonios FahedNo ratings yet

- Cash Flow 1Document3 pagesCash Flow 1Percy JacksonNo ratings yet

- Solve 6Document2 pagesSolve 6lalalalaNo ratings yet

- Topics: General Journal and LedgerDocument13 pagesTopics: General Journal and LedgersalwaburiroNo ratings yet

- Warren SM ch.09 FinalDocument46 pagesWarren SM ch.09 FinalLidya Silvia RahmaNo ratings yet

- Exercises 2b SolutionsDocument8 pagesExercises 2b SolutionsDionisius TriNo ratings yet

- Liabilities SolutionDocument6 pagesLiabilities SolutionHuỳnh Thị Thu BaNo ratings yet

- TUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Document24 pagesTUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Samuel PurbaNo ratings yet

- Government FundDocument23 pagesGovernment Fund20211211017 SKOLASTIKA ANABELNo ratings yet

- Chapter 2 Questions and SolutionsDocument6 pagesChapter 2 Questions and SolutionsKhem Raj GyawaliNo ratings yet

- CHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Document6 pagesCHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Maurice AgbayaniNo ratings yet

- Accounting AssDocument30 pagesAccounting AssAkmel JihadNo ratings yet

- Reporting and Analyzing Receivables: QuestionsDocument25 pagesReporting and Analyzing Receivables: QuestionsAstrid LimónNo ratings yet

- Chapter 9Document1 pageChapter 9fasdfaNo ratings yet

- Ch8 AR Test 9902Document7 pagesCh8 AR Test 9902ايهاب غزالةNo ratings yet

- Solutions To ProblemsDocument2 pagesSolutions To ProblemsPonleu KinNo ratings yet

- Warren SM - Ch.09 - Final PDFDocument46 pagesWarren SM - Ch.09 - Final PDFFarhan FarhanNo ratings yet

- A. Lifo B. Fifo C. Lifo D. Fifo E. Average CostDocument3 pagesA. Lifo B. Fifo C. Lifo D. Fifo E. Average CostWesNo ratings yet

- Problem 5 2aDocument6 pagesProblem 5 2aChintya YunaNo ratings yet

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocument45 pagesFinancial and Managerial Accounting 11th Edition Warren Solutions Manualalmonryartful8qs4v100% (28)

- Advanced Scenario 7: Quincy and Marian Pike (2017)Document10 pagesAdvanced Scenario 7: Quincy and Marian Pike (2017)Center for Economic Progress100% (1)

- Chapter 7Document28 pagesChapter 7Shibly SadikNo ratings yet

- Key Chapter 11Document3 pagesKey Chapter 11JinAe NaNo ratings yet

- Fac1502 - Study Unit 7 - Etutor QuestionDocument2 pagesFac1502 - Study Unit 7 - Etutor Questionjwick5346No ratings yet

- Ch10 ExercisesDocument15 pagesCh10 Exercisesjamiahamdard001No ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource Wasyes yesnoNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 01 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 01 - AKM IInisha nuraini100% (1)

- Q.21.solve PageDocument1 pageQ.21.solve PageRanaNo ratings yet

- CH 10 PA 2Document2 pagesCH 10 PA 2lisahuang2032No ratings yet

- Tugas 4 - Mukhlasin S 142170091Document10 pagesTugas 4 - Mukhlasin S 142170091Mukhlasin SyaifullahNo ratings yet

- Key Chapter 8Document6 pagesKey Chapter 8JinAe NaNo ratings yet

- Class Exercise CH 5 - 6Document10 pagesClass Exercise CH 5 - 6Iftekhar AhmedNo ratings yet

- Longer-Run Decisions: Capital Budgeting: Changes From Eleventh EditionDocument19 pagesLonger-Run Decisions: Capital Budgeting: Changes From Eleventh EditionAlka NarayanNo ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- EMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Document4 pagesEMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Sheraz KhalilNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- #9499Document1 page#9499lalalalaNo ratings yet

- #9002Document2 pages#9002lalalalaNo ratings yet

- #9498Document1 page#9498lalalalaNo ratings yet

- #9004Document1 page#9004lalalalaNo ratings yet

- PRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2CDocument2 pagesPRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2ClalalalaNo ratings yet

- Lab 5 Virtual Local Area Network (VLAN)Document16 pagesLab 5 Virtual Local Area Network (VLAN)Programming CodingNo ratings yet

- Lathe Machine and Its ComponentsDocument13 pagesLathe Machine and Its ComponentsEinstein RahatNo ratings yet

- Recognition, Signaling, and Repair of DNA Double-Strand Breaks Produced by Ionizing Radiation in Mammalian Cells - The Molecular ChoreographyDocument89 pagesRecognition, Signaling, and Repair of DNA Double-Strand Breaks Produced by Ionizing Radiation in Mammalian Cells - The Molecular ChoreographyMaria ClaraNo ratings yet

- Explore (As) : Types of Commission and InterestsDocument4 pagesExplore (As) : Types of Commission and InterestsTiffany Joy Lencioco GambalanNo ratings yet

- Ruq Abdominal PainDocument55 pagesRuq Abdominal PainriphqaNo ratings yet

- Audio Phile 2496Document5 pagesAudio Phile 2496Antonio FernandesNo ratings yet

- Reading PashtoDocument17 pagesReading PashtoUmer Khan0% (1)

- Cordlife BrochureDocument16 pagesCordlife BrochureMelodie YlaganNo ratings yet

- ReadrDocument34 pagesReadrSceptic GrannyNo ratings yet

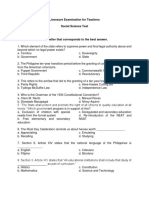

- Licensure Examination For TeachersDocument14 pagesLicensure Examination For Teachersonin saspaNo ratings yet

- TRP 8750DDocument276 pagesTRP 8750DKentNo ratings yet

- Lucies Farm Data Protection ComplaintDocument186 pagesLucies Farm Data Protection ComplaintcraigwalshNo ratings yet

- RunEco EP600 Datasheet 2018Document2 pagesRunEco EP600 Datasheet 2018widnu wirasetiaNo ratings yet

- Module 4Document5 pagesModule 4Engelbert RespuestoNo ratings yet

- HetzerDocument4 pagesHetzerGustavo Urueña ANo ratings yet

- LAS - Week 3 FunctionsDocument15 pagesLAS - Week 3 FunctionsLeywila Mae Yo BianesNo ratings yet

- Workshop Manual: Engine Series 3 - 4 LDDocument48 pagesWorkshop Manual: Engine Series 3 - 4 LDNenadStojicNo ratings yet

- (Lovebook care - Anh) Đề thi thử THPTQG trường THPT Chuyên Cao Bằng lần 1Document16 pages(Lovebook care - Anh) Đề thi thử THPTQG trường THPT Chuyên Cao Bằng lần 1Dương Viết ĐạtNo ratings yet

- B1.1-Self-Study Đã Sài XongDocument5 pagesB1.1-Self-Study Đã Sài XongVy CẩmNo ratings yet

- 85th BSC AgendaDocument61 pages85th BSC AgendaSiddharth MohantyNo ratings yet

- 2 The Origin of LifeDocument39 pages2 The Origin of LifeRydel GreyNo ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- Body Repair: SectionDocument425 pagesBody Repair: SectionnyanhtunlimNo ratings yet

- Solid Edge Mold ToolingDocument3 pagesSolid Edge Mold ToolingVetrivendhan SathiyamoorthyNo ratings yet

- Abcp Offering CircularDocument2 pagesAbcp Offering Circulartom99922No ratings yet

- Before Reading: An Encyclopedia EntryDocument6 pagesBefore Reading: An Encyclopedia EntryĐào Nguyễn Duy TùngNo ratings yet

- TD OPTISONIC7300 en 180907 4001344705 R05Document40 pagesTD OPTISONIC7300 en 180907 4001344705 R05Didik WahyudiNo ratings yet