Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

43 viewsBonus Concept

Bonus Concept

Uploaded by

Viñas, Diana L.This document discusses four different ways that a bonus can be calculated as a percentage of income and taxes:

1. As a percentage of income before bonus and before taxes.

2. As a percentage of income after bonus but before taxes.

3. As a percentage of income after bonus and after taxes.

4. As a percentage of income before bonus but after taxes.

For each method, an example calculation is shown using an income of $6,550,000, a 5% bonus rate, and a 30% tax rate to demonstrate how the bonus and tax amounts would be determined.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Proulx Et Al (Eds.) - The Wiley Handbook of What Works With Sexual Offenders. Contemporary Perspectives in Theory, Assessment, Treatment, (2020)Document530 pagesProulx Et Al (Eds.) - The Wiley Handbook of What Works With Sexual Offenders. Contemporary Perspectives in Theory, Assessment, Treatment, (2020)willl100% (1)

- Unlocking The World's Largest Financial Secret - by Mario SinghDocument348 pagesUnlocking The World's Largest Financial Secret - by Mario Singhwofuru innocentNo ratings yet

- (2018) Garcia Notes - Criminal Law Book 1Document83 pages(2018) Garcia Notes - Criminal Law Book 1Enzo Baranda50% (2)

- Financial Management Solution ZHJJJJJJJZBBZBZBBZDocument4 pagesFinancial Management Solution ZHJJJJJJJZBBZBZBBZJoylyn CombongNo ratings yet

- Legend:: Bonus Computation (Shortcut) ExampleDocument4 pagesLegend:: Bonus Computation (Shortcut) ExampleJeremyDream LimNo ratings yet

- BEM LAD March-May10 Facility Asset Management PDFDocument58 pagesBEM LAD March-May10 Facility Asset Management PDFKo Ka KunNo ratings yet

- Bonus Calculation NameDocument3 pagesBonus Calculation NameambiNo ratings yet

- Illustration: Income Before Bonus and Before Tax (Y)Document2 pagesIllustration: Income Before Bonus and Before Tax (Y)Monette DellosaNo ratings yet

- Lesson 3 - Bonus ComputationDocument7 pagesLesson 3 - Bonus ComputationDaryl FernandezNo ratings yet

- Sadoy-Provisions Contengiences Exercise 3-Garfield CompanyDocument6 pagesSadoy-Provisions Contengiences Exercise 3-Garfield CompanyReymark SadoyNo ratings yet

- Schedule or CalculationDocument6 pagesSchedule or CalculationkateNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Chapter 1 - Liabilities - Intermediate Accounting II PDFDocument4 pagesChapter 1 - Liabilities - Intermediate Accounting II PDFJaypee Verzo SaltaNo ratings yet

- Bonus DiscussionDocument1 pageBonus DiscussionfharnizaparasanNo ratings yet

- Bonus With SolutionDocument8 pagesBonus With SolutionRica RegorisNo ratings yet

- Sol. Man. Chapter 5 Employee Benefits Part 1 2021Document9 pagesSol. Man. Chapter 5 Employee Benefits Part 1 2021Kim HanbinNo ratings yet

- Bonus ComputationDocument2 pagesBonus ComputationJPNo ratings yet

- ACCRUED LIABILITIES (Other Non Financial Liab)Document5 pagesACCRUED LIABILITIES (Other Non Financial Liab)Dianne TorresNo ratings yet

- Sol. Man. - Chapter 5 Employee Benefits 1Document2 pagesSol. Man. - Chapter 5 Employee Benefits 1Nikky Bless LeonarNo ratings yet

- Bonusliability SollanoDocument2 pagesBonusliability SollanokathNo ratings yet

- Sol. Man. - Chapter 5 Employee Benefits 1Document10 pagesSol. Man. - Chapter 5 Employee Benefits 1Einez B. CarilloNo ratings yet

- Chapter 1 LiabilitiesDocument5 pagesChapter 1 LiabilitiesAwish FernNo ratings yet

- Bonus ComputationDocument4 pagesBonus ComputationSarah GNo ratings yet

- AfstDocument15 pagesAfstAEDRIAN LEE DERECHONo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Assignment#1Document4 pagesAssignment#1Kristine Esplana ToraldeNo ratings yet

- Assign 2 Answer Partnership Operations Millan 2021Document5 pagesAssign 2 Answer Partnership Operations Millan 2021mhikeedelantarNo ratings yet

- Assign 2 Answer Partnership Operations Millan 2021Document5 pagesAssign 2 Answer Partnership Operations Millan 2021mhikeedelantarNo ratings yet

- Assign 2 Answer Partnership Operations Millan 2021Document5 pagesAssign 2 Answer Partnership Operations Millan 2021mhikeedelantarNo ratings yet

- 03 Task Performance 1Document3 pages03 Task Performance 1Millania ThanaNo ratings yet

- Chapter 5 Employee Benefits 1Document9 pagesChapter 5 Employee Benefits 1Thalia Rhine AberteNo ratings yet

- Lobrigas Unit1 AssessmentDocument5 pagesLobrigas Unit1 AssessmentClaudine LobrigasNo ratings yet

- Tejano - Finals FMDocument4 pagesTejano - Finals FMMe CarlJNo ratings yet

- Income Tax Individual Sample ProblemsDocument13 pagesIncome Tax Individual Sample Problemscharlene marie goNo ratings yet

- BonusDocument3 pagesBonusTricia Mae JabelNo ratings yet

- 7 Partnership Bonus ComputationDocument18 pages7 Partnership Bonus Computationgiodarine0814No ratings yet

- Bonus ComputationsDocument2 pagesBonus ComputationsEdmund JuanitasNo ratings yet

- Problem With SolutionDocument2 pagesProblem With SolutionPhilip Jhon BayoNo ratings yet

- Partnership OperationDocument12 pagesPartnership OperationIce Voltaire Buban GuiangNo ratings yet

- Salary Mock Solution - March-24Document2 pagesSalary Mock Solution - March-24syedameerhamza762No ratings yet

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Stone Tax NovemberDocument3 pagesStone Tax Novemberarsenali damuNo ratings yet

- 1.20PP Partnership Formation and DissolutionDocument16 pages1.20PP Partnership Formation and DissolutionMarcley BataoilNo ratings yet

- MAE - P5 Chapter 6Document2 pagesMAE - P5 Chapter 6Leah Mae NolascoNo ratings yet

- PDF Actos y Condiciones Inseguras Soporte Cap CompressDocument16 pagesPDF Actos y Condiciones Inseguras Soporte Cap CompressDaniel SotoNo ratings yet

- Business Mathematics 4TH Quarter Week 3Document4 pagesBusiness Mathematics 4TH Quarter Week 3John Calvin GerolaoNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- RECEIVABLESDocument3 pagesRECEIVABLESJACQUELYN PABLITONo ratings yet

- Discussion Problems and SolutionsDocument33 pagesDiscussion Problems and SolutionsBella De LiañoNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- Examples PayrollDocument10 pagesExamples PayrollAlliana Nicole Masalta TorrefrancaNo ratings yet

- Partnership Operations Name: Date: Professor: Section: Score: QuizDocument8 pagesPartnership Operations Name: Date: Professor: Section: Score: QuizNahwi Kimpa100% (1)

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Calculate Foreign Currency Credit - Effective Rate - Tax PayableDocument4 pagesCalculate Foreign Currency Credit - Effective Rate - Tax PayablepuddinsouseNo ratings yet

- Solution To Problem 1-3: Liability For BonusesDocument16 pagesSolution To Problem 1-3: Liability For BonusesNaddieNo ratings yet

- Income Tax Seatwork - Answers Ver 2 PartialDocument3 pagesIncome Tax Seatwork - Answers Ver 2 PartialgillianNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- Afar SolutionDocument2 pagesAfar SolutionTk KimNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Total Income - Total Expenses Net ProfitDocument5 pagesTotal Income - Total Expenses Net ProfitViñas, Diana L.No ratings yet

- Problem and Its Background IDocument3 pagesProblem and Its Background IViñas, Diana L.No ratings yet

- Colegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalDocument11 pagesColegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalViñas, Diana L.No ratings yet

- Problem and Its Background IDocument2 pagesProblem and Its Background IViñas, Diana L.No ratings yet

- Chapter 1Document13 pagesChapter 1Viñas, Diana L.No ratings yet

- Colegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalDocument10 pagesColegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalViñas, Diana L.No ratings yet

- Colegio de Montalban: Presentation, Analysis and Interpretation of DataDocument15 pagesColegio de Montalban: Presentation, Analysis and Interpretation of DataViñas, Diana L.No ratings yet

- Colegio de Montalban: The Problem and Its BackgroundDocument10 pagesColegio de Montalban: The Problem and Its BackgroundViñas, Diana L.No ratings yet

- Ang Guro Kong Di Marunong MagbasaDocument3 pagesAng Guro Kong Di Marunong MagbasaViñas, Diana L.No ratings yet

- Philippine Politics Governance MODULE 9&10 WEEK1&2Document11 pagesPhilippine Politics Governance MODULE 9&10 WEEK1&2Viñas, Diana L.No ratings yet

- Pencak Silat Qutuz InfoDocument4 pagesPencak Silat Qutuz InfoYasinDaudNo ratings yet

- Lecture 1 Eighteenth Century LiteratureDocument15 pagesLecture 1 Eighteenth Century LiteratureBlue AlmonnaieyNo ratings yet

- Wish SentencesDocument7 pagesWish SentencesNguyễn QuyênNo ratings yet

- AGMU IAS IPS Civil Lists As On 1.12.2009 PDFDocument86 pagesAGMU IAS IPS Civil Lists As On 1.12.2009 PDFShivcharan MeenaNo ratings yet

- Mirajul Islam - Internship ReportDocument41 pagesMirajul Islam - Internship ReportThomas HarveyNo ratings yet

- Annie Bultman ResumeDocument1 pageAnnie Bultman Resumeapi-298787915No ratings yet

- Critical Thinking Skills For The 21 Century (4IR: 4 Industrial Revolution)Document22 pagesCritical Thinking Skills For The 21 Century (4IR: 4 Industrial Revolution)Jayson PagulongNo ratings yet

- Air ClientDocument114 pagesAir Clientbeemer3No ratings yet

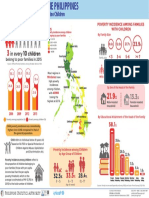

- Eradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesDocument1 pageEradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesJoulesNo ratings yet

- (C) San Antonio Home Furnishings Company-1Document3 pages(C) San Antonio Home Furnishings Company-1Mark OteroNo ratings yet

- NOTES CH2 (P - S) Class 10Document4 pagesNOTES CH2 (P - S) Class 10Divyam VatsNo ratings yet

- Griswold v. ConnecticutDocument2 pagesGriswold v. ConnecticutAdin Zachary GreensteinNo ratings yet

- Effects of Smoking Answer Key PDFDocument1 pageEffects of Smoking Answer Key PDFnellytusiimeNo ratings yet

- East & Southeast Asia: BackgroundDocument16 pagesEast & Southeast Asia: BackgroundSenthil KumarNo ratings yet

- Fundamental Analysis in Banking SectorDocument84 pagesFundamental Analysis in Banking SectorNandhiniNo ratings yet

- Focus On Philanthropy - Beverly Hills Weekly, Issue #650Document2 pagesFocus On Philanthropy - Beverly Hills Weekly, Issue #650BeverlyHillsWeeklyNo ratings yet

- Programme Notes: I Mourn As A Dove (From St. Peter) Julius Benedict (1804 - 1885)Document9 pagesProgramme Notes: I Mourn As A Dove (From St. Peter) Julius Benedict (1804 - 1885)melisa_cambaNo ratings yet

- Ba178 FdiDocument18 pagesBa178 Fdiimi10No ratings yet

- AME - 2022 - Tutorial 6 - SolutionsDocument17 pagesAME - 2022 - Tutorial 6 - SolutionsjjpasemperNo ratings yet

- The Dark Side of HalloweenDocument15 pagesThe Dark Side of HalloweenLawrence Garner100% (1)

- Managerial AccountingDocument11 pagesManagerial AccountingKalyan MukkamulaNo ratings yet

- The Tell-Tale HeartDocument11 pagesThe Tell-Tale HeartAlexandra Elena100% (1)

- Business Ethics and Social ResponsibilitiesDocument22 pagesBusiness Ethics and Social ResponsibilitiesZeeshan AfzalNo ratings yet

- BJMPDocument12 pagesBJMPKrystal GapangNo ratings yet

- Beauty 2 DIgital PDFDocument22 pagesBeauty 2 DIgital PDFharshNo ratings yet

- Retail July 2021Document35 pagesRetail July 2021digen parikhNo ratings yet

Bonus Concept

Bonus Concept

Uploaded by

Viñas, Diana L.0 ratings0% found this document useful (0 votes)

43 views2 pagesThis document discusses four different ways that a bonus can be calculated as a percentage of income and taxes:

1. As a percentage of income before bonus and before taxes.

2. As a percentage of income after bonus but before taxes.

3. As a percentage of income after bonus and after taxes.

4. As a percentage of income before bonus but after taxes.

For each method, an example calculation is shown using an income of $6,550,000, a 5% bonus rate, and a 30% tax rate to demonstrate how the bonus and tax amounts would be determined.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses four different ways that a bonus can be calculated as a percentage of income and taxes:

1. As a percentage of income before bonus and before taxes.

2. As a percentage of income after bonus but before taxes.

3. As a percentage of income after bonus and after taxes.

4. As a percentage of income before bonus but after taxes.

For each method, an example calculation is shown using an income of $6,550,000, a 5% bonus rate, and a 30% tax rate to demonstrate how the bonus and tax amounts would be determined.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

43 views2 pagesBonus Concept

Bonus Concept

Uploaded by

Viñas, Diana L.This document discusses four different ways that a bonus can be calculated as a percentage of income and taxes:

1. As a percentage of income before bonus and before taxes.

2. As a percentage of income after bonus but before taxes.

3. As a percentage of income after bonus and after taxes.

4. As a percentage of income before bonus but after taxes.

For each method, an example calculation is shown using an income of $6,550,000, a 5% bonus rate, and a 30% tax rate to demonstrate how the bonus and tax amounts would be determined.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

BONUS CONCEPT

1. Bonus is expressed as a certain percent of income before bonus and before tax.

2. Bonus is expressed as a certain percent of income after bonus and before tax.

3. Bonus is expressed as a certain percent of income after bonus and after tax.

4. Bonus is expressed as a certain percent of income before bonus and after tax.

Income before tax and before Bonus 6,550,000

Bonus 5%

Income tax rate 30%

1. BEFORE BONUS AND BEFORE TAX.

Income before tax and before bonus 6,550,000

× Bonus rate 5%

BONUS 327,500

2. AFTER BONUS AND BEFORE TAX.

B = B% (Y – B) PROOF:

B = .05 (6,550,000 – B) Income before tax and before bonus 6,550,000

B = 327,500 – 0.05B

Bonus (311,904.76)

0.05B + B = 327,500

1.05B = 327,500 Income after bonus and before tax 6,238,095.24

B = 311,904.76 Bonus (x5%) 311,904.762

3. AFTER BONUS AND AFTER TAX.

B = B% (Y – B – T)

T = T% (Y – B) PROOF:

T = 0.30 (6,550,000 – B) Income before tax and before bonus 6,550,000

B = 0.05 [6,550,000 – B – 0.30 (6,550,000 – B)]

Bonus (221,497.58)

B = 0.05 (6,550,000 – B – 1,965,000 + 0.30B)

B = 327,500 – 0.05B – 98,250 + 0.015B Tax (1,898,550.73)

B = 229,250 – 0.035B Income after bonus and after tax 4,429,951.69

1.035B = 229,250

Bonus (x5%) 221,497.58

B = 221,497.58

T = 0.30 (6,550,000 – 221,497.58)

T = 0.30 (6,328,502.42)

T = 1,898,550.73

4. BEFORE BONUS AND AFTER TAX.

B = B% (Y – T)

B = .05 (6,550,000 – T)

T = T% (Y – B) PROOF:

T = 0.30 (6,550,000 – B)

Income before tax and before bonus 6,550,000

B = 0.05 [6,550,000 – 0.30 (6,550,000 – B)]

B = 0.05 (6,550,000 – 1,965,000 + 0.30B) Tax (1,895,177.66)

B = 229,250 + 0.015B Income before bonus and after tax 4,654,822.34

0.985B = 229,250

B = 232,741.12 Bonus (x5%) 232,741.12

T = 0.30 (6,550,000 – 232,741.12)

T = 0.30 (6,317,258.88)

T = 1,895,177.66

You might also like

- Proulx Et Al (Eds.) - The Wiley Handbook of What Works With Sexual Offenders. Contemporary Perspectives in Theory, Assessment, Treatment, (2020)Document530 pagesProulx Et Al (Eds.) - The Wiley Handbook of What Works With Sexual Offenders. Contemporary Perspectives in Theory, Assessment, Treatment, (2020)willl100% (1)

- Unlocking The World's Largest Financial Secret - by Mario SinghDocument348 pagesUnlocking The World's Largest Financial Secret - by Mario Singhwofuru innocentNo ratings yet

- (2018) Garcia Notes - Criminal Law Book 1Document83 pages(2018) Garcia Notes - Criminal Law Book 1Enzo Baranda50% (2)

- Financial Management Solution ZHJJJJJJJZBBZBZBBZDocument4 pagesFinancial Management Solution ZHJJJJJJJZBBZBZBBZJoylyn CombongNo ratings yet

- Legend:: Bonus Computation (Shortcut) ExampleDocument4 pagesLegend:: Bonus Computation (Shortcut) ExampleJeremyDream LimNo ratings yet

- BEM LAD March-May10 Facility Asset Management PDFDocument58 pagesBEM LAD March-May10 Facility Asset Management PDFKo Ka KunNo ratings yet

- Bonus Calculation NameDocument3 pagesBonus Calculation NameambiNo ratings yet

- Illustration: Income Before Bonus and Before Tax (Y)Document2 pagesIllustration: Income Before Bonus and Before Tax (Y)Monette DellosaNo ratings yet

- Lesson 3 - Bonus ComputationDocument7 pagesLesson 3 - Bonus ComputationDaryl FernandezNo ratings yet

- Sadoy-Provisions Contengiences Exercise 3-Garfield CompanyDocument6 pagesSadoy-Provisions Contengiences Exercise 3-Garfield CompanyReymark SadoyNo ratings yet

- Schedule or CalculationDocument6 pagesSchedule or CalculationkateNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Chapter 1 - Liabilities - Intermediate Accounting II PDFDocument4 pagesChapter 1 - Liabilities - Intermediate Accounting II PDFJaypee Verzo SaltaNo ratings yet

- Bonus DiscussionDocument1 pageBonus DiscussionfharnizaparasanNo ratings yet

- Bonus With SolutionDocument8 pagesBonus With SolutionRica RegorisNo ratings yet

- Sol. Man. Chapter 5 Employee Benefits Part 1 2021Document9 pagesSol. Man. Chapter 5 Employee Benefits Part 1 2021Kim HanbinNo ratings yet

- Bonus ComputationDocument2 pagesBonus ComputationJPNo ratings yet

- ACCRUED LIABILITIES (Other Non Financial Liab)Document5 pagesACCRUED LIABILITIES (Other Non Financial Liab)Dianne TorresNo ratings yet

- Sol. Man. - Chapter 5 Employee Benefits 1Document2 pagesSol. Man. - Chapter 5 Employee Benefits 1Nikky Bless LeonarNo ratings yet

- Bonusliability SollanoDocument2 pagesBonusliability SollanokathNo ratings yet

- Sol. Man. - Chapter 5 Employee Benefits 1Document10 pagesSol. Man. - Chapter 5 Employee Benefits 1Einez B. CarilloNo ratings yet

- Chapter 1 LiabilitiesDocument5 pagesChapter 1 LiabilitiesAwish FernNo ratings yet

- Bonus ComputationDocument4 pagesBonus ComputationSarah GNo ratings yet

- AfstDocument15 pagesAfstAEDRIAN LEE DERECHONo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Assignment#1Document4 pagesAssignment#1Kristine Esplana ToraldeNo ratings yet

- Assign 2 Answer Partnership Operations Millan 2021Document5 pagesAssign 2 Answer Partnership Operations Millan 2021mhikeedelantarNo ratings yet

- Assign 2 Answer Partnership Operations Millan 2021Document5 pagesAssign 2 Answer Partnership Operations Millan 2021mhikeedelantarNo ratings yet

- Assign 2 Answer Partnership Operations Millan 2021Document5 pagesAssign 2 Answer Partnership Operations Millan 2021mhikeedelantarNo ratings yet

- 03 Task Performance 1Document3 pages03 Task Performance 1Millania ThanaNo ratings yet

- Chapter 5 Employee Benefits 1Document9 pagesChapter 5 Employee Benefits 1Thalia Rhine AberteNo ratings yet

- Lobrigas Unit1 AssessmentDocument5 pagesLobrigas Unit1 AssessmentClaudine LobrigasNo ratings yet

- Tejano - Finals FMDocument4 pagesTejano - Finals FMMe CarlJNo ratings yet

- Income Tax Individual Sample ProblemsDocument13 pagesIncome Tax Individual Sample Problemscharlene marie goNo ratings yet

- BonusDocument3 pagesBonusTricia Mae JabelNo ratings yet

- 7 Partnership Bonus ComputationDocument18 pages7 Partnership Bonus Computationgiodarine0814No ratings yet

- Bonus ComputationsDocument2 pagesBonus ComputationsEdmund JuanitasNo ratings yet

- Problem With SolutionDocument2 pagesProblem With SolutionPhilip Jhon BayoNo ratings yet

- Partnership OperationDocument12 pagesPartnership OperationIce Voltaire Buban GuiangNo ratings yet

- Salary Mock Solution - March-24Document2 pagesSalary Mock Solution - March-24syedameerhamza762No ratings yet

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Stone Tax NovemberDocument3 pagesStone Tax Novemberarsenali damuNo ratings yet

- 1.20PP Partnership Formation and DissolutionDocument16 pages1.20PP Partnership Formation and DissolutionMarcley BataoilNo ratings yet

- MAE - P5 Chapter 6Document2 pagesMAE - P5 Chapter 6Leah Mae NolascoNo ratings yet

- PDF Actos y Condiciones Inseguras Soporte Cap CompressDocument16 pagesPDF Actos y Condiciones Inseguras Soporte Cap CompressDaniel SotoNo ratings yet

- Business Mathematics 4TH Quarter Week 3Document4 pagesBusiness Mathematics 4TH Quarter Week 3John Calvin GerolaoNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- RECEIVABLESDocument3 pagesRECEIVABLESJACQUELYN PABLITONo ratings yet

- Discussion Problems and SolutionsDocument33 pagesDiscussion Problems and SolutionsBella De LiañoNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- Examples PayrollDocument10 pagesExamples PayrollAlliana Nicole Masalta TorrefrancaNo ratings yet

- Partnership Operations Name: Date: Professor: Section: Score: QuizDocument8 pagesPartnership Operations Name: Date: Professor: Section: Score: QuizNahwi Kimpa100% (1)

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Calculate Foreign Currency Credit - Effective Rate - Tax PayableDocument4 pagesCalculate Foreign Currency Credit - Effective Rate - Tax PayablepuddinsouseNo ratings yet

- Solution To Problem 1-3: Liability For BonusesDocument16 pagesSolution To Problem 1-3: Liability For BonusesNaddieNo ratings yet

- Income Tax Seatwork - Answers Ver 2 PartialDocument3 pagesIncome Tax Seatwork - Answers Ver 2 PartialgillianNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- Afar SolutionDocument2 pagesAfar SolutionTk KimNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Total Income - Total Expenses Net ProfitDocument5 pagesTotal Income - Total Expenses Net ProfitViñas, Diana L.No ratings yet

- Problem and Its Background IDocument3 pagesProblem and Its Background IViñas, Diana L.No ratings yet

- Colegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalDocument11 pagesColegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalViñas, Diana L.No ratings yet

- Problem and Its Background IDocument2 pagesProblem and Its Background IViñas, Diana L.No ratings yet

- Chapter 1Document13 pagesChapter 1Viñas, Diana L.No ratings yet

- Colegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalDocument10 pagesColegio de Montalban: Kasiglahan Village, San Jose, Rodriguez, RizalViñas, Diana L.No ratings yet

- Colegio de Montalban: Presentation, Analysis and Interpretation of DataDocument15 pagesColegio de Montalban: Presentation, Analysis and Interpretation of DataViñas, Diana L.No ratings yet

- Colegio de Montalban: The Problem and Its BackgroundDocument10 pagesColegio de Montalban: The Problem and Its BackgroundViñas, Diana L.No ratings yet

- Ang Guro Kong Di Marunong MagbasaDocument3 pagesAng Guro Kong Di Marunong MagbasaViñas, Diana L.No ratings yet

- Philippine Politics Governance MODULE 9&10 WEEK1&2Document11 pagesPhilippine Politics Governance MODULE 9&10 WEEK1&2Viñas, Diana L.No ratings yet

- Pencak Silat Qutuz InfoDocument4 pagesPencak Silat Qutuz InfoYasinDaudNo ratings yet

- Lecture 1 Eighteenth Century LiteratureDocument15 pagesLecture 1 Eighteenth Century LiteratureBlue AlmonnaieyNo ratings yet

- Wish SentencesDocument7 pagesWish SentencesNguyễn QuyênNo ratings yet

- AGMU IAS IPS Civil Lists As On 1.12.2009 PDFDocument86 pagesAGMU IAS IPS Civil Lists As On 1.12.2009 PDFShivcharan MeenaNo ratings yet

- Mirajul Islam - Internship ReportDocument41 pagesMirajul Islam - Internship ReportThomas HarveyNo ratings yet

- Annie Bultman ResumeDocument1 pageAnnie Bultman Resumeapi-298787915No ratings yet

- Critical Thinking Skills For The 21 Century (4IR: 4 Industrial Revolution)Document22 pagesCritical Thinking Skills For The 21 Century (4IR: 4 Industrial Revolution)Jayson PagulongNo ratings yet

- Air ClientDocument114 pagesAir Clientbeemer3No ratings yet

- Eradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesDocument1 pageEradicating Poverty Among Filipino Children: Child Poverty in The PhilippinesJoulesNo ratings yet

- (C) San Antonio Home Furnishings Company-1Document3 pages(C) San Antonio Home Furnishings Company-1Mark OteroNo ratings yet

- NOTES CH2 (P - S) Class 10Document4 pagesNOTES CH2 (P - S) Class 10Divyam VatsNo ratings yet

- Griswold v. ConnecticutDocument2 pagesGriswold v. ConnecticutAdin Zachary GreensteinNo ratings yet

- Effects of Smoking Answer Key PDFDocument1 pageEffects of Smoking Answer Key PDFnellytusiimeNo ratings yet

- East & Southeast Asia: BackgroundDocument16 pagesEast & Southeast Asia: BackgroundSenthil KumarNo ratings yet

- Fundamental Analysis in Banking SectorDocument84 pagesFundamental Analysis in Banking SectorNandhiniNo ratings yet

- Focus On Philanthropy - Beverly Hills Weekly, Issue #650Document2 pagesFocus On Philanthropy - Beverly Hills Weekly, Issue #650BeverlyHillsWeeklyNo ratings yet

- Programme Notes: I Mourn As A Dove (From St. Peter) Julius Benedict (1804 - 1885)Document9 pagesProgramme Notes: I Mourn As A Dove (From St. Peter) Julius Benedict (1804 - 1885)melisa_cambaNo ratings yet

- Ba178 FdiDocument18 pagesBa178 Fdiimi10No ratings yet

- AME - 2022 - Tutorial 6 - SolutionsDocument17 pagesAME - 2022 - Tutorial 6 - SolutionsjjpasemperNo ratings yet

- The Dark Side of HalloweenDocument15 pagesThe Dark Side of HalloweenLawrence Garner100% (1)

- Managerial AccountingDocument11 pagesManagerial AccountingKalyan MukkamulaNo ratings yet

- The Tell-Tale HeartDocument11 pagesThe Tell-Tale HeartAlexandra Elena100% (1)

- Business Ethics and Social ResponsibilitiesDocument22 pagesBusiness Ethics and Social ResponsibilitiesZeeshan AfzalNo ratings yet

- BJMPDocument12 pagesBJMPKrystal GapangNo ratings yet

- Beauty 2 DIgital PDFDocument22 pagesBeauty 2 DIgital PDFharshNo ratings yet

- Retail July 2021Document35 pagesRetail July 2021digen parikhNo ratings yet