Professional Documents

Culture Documents

LankFord - Tradeoffs For Long Term Care

LankFord - Tradeoffs For Long Term Care

Uploaded by

Bernardo Cielo IIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LankFord - Tradeoffs For Long Term Care

LankFord - Tradeoffs For Long Term Care

Uploaded by

Bernardo Cielo IICopyright:

Available Formats

» MONEY

INSURANCE»

Trade-Offs to Pay

for Long-Term Care

Buffeted by huge rate hikes, most policyholders are choosing

to trim their coverage. BY KIMBERLY LANKFORD

KEN WITTY, A RETIRED policyholders are facing the as Alzheimer’s. “Advances

television news producer same tough decision: Pay a in medicine are changing

in New York City, thought steep rate increase, cut back the insurance companies’

he had done everything on coverage or let the policy experience, and they have

right. After spending a lapse and lose the benefits to constantly incorporate

career in financial news, they were counting on. that into pricing,” says Jan

Witty, 75, understood how Almost all long-term-care Graeber, chief life and

the unpredictable costs of insurance companies have health insurance actuary

long-term care could devas- raised customers’ premiums for the Texas Department

tate his retirement plan, so years after they bought of Insurance. Plus, insurers

he bought a long-term-care their policies, with average did not anticipate low inter-

insurance policy from Gen- increases of 50% to 60% est rates that would stunt

worth when he was 65. For over the past decade, says their own investment re-

coverage that would pro- Kevin McCarty, the former turns, which they depend

vide a $250 daily benefit commissioner of the Florida on to pay future claims.

for three years and grow by Office of Insurance Regula- Policyholders usually end says McCarty. “But if

5% per year, he paid about tion. More rate hikes are up on the hook. Premium a company is insolvent, it

$3,600 a year. on the way in several states increases vary by company, can’t pay claims.” Regula-

But earlier this year, he when the policies renew. age, policy version, coverage tors may deny insurers’

received a letter from Gen- “When people bought this specifics and the state requests to raise rates

worth notifying him that product, they bought it on where you bought the pol- altogether, or require them

his premiums would jump the assumption that the icy. Policies with lifetime to spread out the increase

to more than $5,800 annu- price would be stable,” says benefits and 5% compound over several years, or ap-

ally—more than 60% McCarty. “But the assump- inflation adjustment, which prove a smaller amount than

higher—unless he made ma- tions the companies made have ended up being ex- requested. And you can usu-

jor changes to his coverage. turned out to be wrong.” traordinarily expensive for ally choose among several

Witty says he could under- insurers, tend to have the options to lessen an increase

stand a modest increase, ■ SHIFTING THE BURDEN biggest rate hikes. (see the box on page 30 for

“but not this sort of rate Insurers underestimated State insurance regula- advice on choosing the best

hike.” He chose to reduce the number and length of tors must approve the rate alternative).

future adjustments from 5% claims, and they assumed increases, and they have to Policyholders feel trapped

to 3.5%, which cut his rate that more people would weigh consumer protection because they don’t want to

hike in half. For the time drop their policies before against each company’s fi- lose the coverage they’ve

being, at least, he’ll pay they’d have to pay out. But nancial stability. “Most of been paying for over many

DAN PAGE

$4,780 per year. people are now living longer the time, the rate increase years—especially as they get

Many long-term-care with chronic diseases such as asked for isn’t approved,” closer to the age at which

28 KIPLINGER’S PERSONAL FINANCE 07/2016

K7M-LTC.a.indd 28 5/11/16 5:09 PM

cial planner in St. Augus-

tine, Fla., helps his clients

walk through the calcula-

tions, looking at the cost

of care in their area and

figuring out how much they

could afford. “We talk about

how much risk they want to

shoulder themselves and

how much they want to

transfer to an insurance

company,” says Draughon.

Sheryl and John Maguire,

of Kansas City, Kan., retired

last year, when they were

both 62. They worked with

their financial planner to

figure out how they could

pay for care. “It’s like a puz-

zle,” says Sheryl. They have

enough money from their

pensions, Social Security

and savings to cover some of

the potential costs, but they

wanted insurance to help

pay for care at home if

needed and protect some

assets for their children.

They’re paying about

$4,050 per year total for pol-

icies that pay each of them

up to $3,000 per month for

four years, with the benefits

they may need care. And it rate increases since then of increasingly popular increasing by 3% per year.

doesn’t make sense to drop 38% each, boosting his pre- option, has a median cost They also have shared bene-

the coverage and buy a new miums to $1,547 per year. of $3,628 per month (more fits (an option that typically

policy; because you’re older But today, a 52-year-old man than $43,500 per year). And increases premiums by

and may have health issues, would pay $2,944 per year you could pay more than about 12%), which lets them

you’ll pay more. Plus, new for a comparable policy with $40,000 per year for a home share the eight-year benefit

policies are a lot more ex- only a five-year benefit pe- health aide to come to your period between them.

pensive these days, even riod (insurers have stopped house for eight hours per Because the average long-

for younger, healthy buyers. selling new policies with day. (You can find costs in term-care claim is just less

Mike Ashley, president of lifetime benefits). your area at www.genworth than three years, most peo-

an independent insurance .com/costofcare.) ple buy policies with a

agency, Senior Benefits ■ FILLING THE GAPS For most people, the three- or four-year benefit

Consultants, in Prairie Vil- The median cost of a private answer is not to cover the period, 3% compound infla-

lage, Kan., bought a Gen- room in a nursing home is entire cost with long-term- tion protection and a 90-day

worth policy 17 years ago, $253 per day (more than care insurance, but rather waiting period before bene-

when he was 52. He paid $92,000 per year), according to calculate how much of fits kick in. Compare policy

$879 per year for a $70 daily to the 2016 Genworth Cost the cost they could handle nuances, such as how the

benefit, 50-day waiting pe- of Care study, but you could with retirement income and insurer calculates the wait-

riod, 5% compound inflation pay $350 a day or more in savings, then look for ways ing period. The best policies

protection and lifetime ben- high-cost areas. Assisted to fill any gap. Chris start the clock ticking as

efits. He has received two living, which has become an Draughon, a certified finan- soon as you need help with

07/2016 KIPLINGER’S PERSONAL FINANCE 29

K7M-LTC.a.indd 29 5/11/16 5:09 PM

» MONEY

two activities of daily living up to 50% of the home-care competitive rates for single 10 years and lets you file

(such as bathing and dress- benefit to pay for care by women in several states, a claim even if you are

ing) or are certified to have family members or neigh- says Dian Haider, a long- still making payments. A

cognitive impairment. But bors, whereas some insurers term-care specialist for 55-year-old man who pays

others count only those require 100% of home care Ryan Insurance Strategy $10,000 per year for 10 years

days on which you receive to be provided by licensed Consultants, in Greenwood could get a monthly long-

care. If you need home care providers who are hired Village, Colo. Otherwise, term-care benefit of $5,500

just a few days a week, a through an agency. “That most companies charge 50% for up to six years, growing

policy that counts only “ser- gave us a lot of freedom to more for single women than at 3% compounded per year.

vice days” can take several hire whoever we want,” for single men. If he didn’t need long-term

more months to pay out. Sheryl says. Insurers can also charge care, his heirs would receive

The Maguires chose a Premiums can vary sig- very different rates based a $130,000 death benefit, or

policy from LifeSecure pri- nificantly by insurer, and on your health. A few now he could cash in the policy

marily because of its gener- each insurer has its own charge more if someone in and get back 80% of his pre-

ous home-care benefits. sweet spots. MassMutual, your family had cognitive miums. A woman would get

Their policy lets them use for example, tends to have impairment before age 70. $5,100 per month for long-

Some reject applicants with term care or a $122,000

diabetes, but others may death benefit.

KipTip

issue a policy at a standard If your primary need is

How to Lower Premiums rate (not the lowest-cost

preferred rate) if you’ve had

life insurance, you can add

a chronic-care rider to a

diabetes for fewer than 20 permanent policy when you

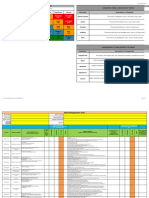

IF YOU CAN AFFORD A PREMIUM INCREASE, PAYING IT IS OFTEN years and control it with buy it, which lets you use up

your best option. If you don’t want to or can’t pay the higher certain levels of insulin. to 2% of the death benefit

premiums, insurers usually give you ways to reduce them. Coverage for cancer sur- per month for long-term

vivors can vary widely, too. care, with a $340 daily

Cut inflation protection. Cutting back from 5% protection “It depends on the stage, the maximum. This rider tends

to about 3% can reduce your premiums significantly and is type of cancer, the type of to add 10% to 12% to the

often a good choice, depending on your age and how much the treatment and how long ago premiums, says Byron Udell,

coverage has increased. See how much your policy has grown; it took place,” says Haider. CEO of AccuQuote.com.

if you bought a policy with a $150 daily benefit 10 years ago, She asks a lot of medical You can also cover care

the daily benefit would now be about $244. Compare that questions before identifying costs by buying a deferred-

with the current cost of care in your area and the portion of the which insurers are likely to income annuity in your

costs you’re able to cover. The older you are now, the better offer the best rates. (You can fifties or sixties that starts

this option will be. Someone in his or her seventies, for exam- find a long-term-care spe- to pay out in your eighties,

ple, may have already built up a big enough daily benefit at 5% cialist at www.aaltci.org.) when you’re more likely

inflation protection so that reducing the rate to 3% or lower to need care (although you

will be enough in the future. But make sure you’ve locked in the ■ OTHER OPTIONS can use the money for any-

inflation adjustment you’ve already earned. Some advisers have turned thing). For example, a

their back on traditional 60-year-old man who in-

Reduce the coverage term. Reducing the coverage term is an long-term-care insurance. vests $125,000 in a New

easy way to reduce premiums. If you have lifetime benefits, Draughon prefers policies York Life deferred-income

you can usually reduce coverage to three or five years, which that combine long-term-care annuity will receive $72,279

would encompass the average claim period. But you are giving and life insurance. These a year for life starting at age

up some coverage you’ve been paying for over many years, and policies pay out whether or 85 (or $54,712 if he gets a

the reduced term may fall short of what you need if you de- not you need care, and the version that pays his heirs

velop Alzheimer’s or another chronic disease. premiums stay the same. the $125,000 minus any

They also tend to offer a bet- payouts he received). You

Take the paid-up option. Regulators in some states require ter deal for single women. can invest up to 25% of your

insurers to offer this option to policyholders who drop their For example, Lincoln IRA or 401(k) balance, up

insurance. Instead of losing all the coverage you paid for, you’d Financial offers a combo to $125,000, in a deferred-

get a benefit equal to the premiums paid to that point (the policy called MoneyGuard, income annuity called a

calculation varies by state). which allows you to spread QLAC, or qualified longev-

payments over as long as ity annuity contract. ■

30 KIPLINGER’S PERSONAL FINANCE 07/2016

K7M-LTC.a.indd 30 5/11/16 5:09 PM

Copyright of Kiplinger's Personal Finance is the property of Kiplinger Washington Editors

Inc. and its content may not be copied or emailed to multiple sites or posted to a listserv

without the copyright holder's express written permission. However, users may print,

download, or email articles for individual use.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ASC 450 20 Loss Contingencies OrigDocument54 pagesASC 450 20 Loss Contingencies OrigBolsheviceNo ratings yet

- Fantasy Football, Opportunity Cost, and Comparative AdvantageDocument3 pagesFantasy Football, Opportunity Cost, and Comparative AdvantageBernardo Cielo IINo ratings yet

- Capabilities and Health P AnandDocument5 pagesCapabilities and Health P AnandBernardo Cielo IINo ratings yet

- EQ-5D-5L User GuideDocument36 pagesEQ-5D-5L User GuideBernardo Cielo IINo ratings yet

- Stanford University School of Medicine, Division of Immunology & RheumatologyDocument2 pagesStanford University School of Medicine, Division of Immunology & RheumatologyBernardo Cielo IINo ratings yet

- InformalityDevelopmentandGrowth PDFDocument49 pagesInformalityDevelopmentandGrowth PDFBernardo Cielo IINo ratings yet

- Social Movements and The Transformation of American Health CareDocument3 pagesSocial Movements and The Transformation of American Health CareBernardo Cielo IINo ratings yet

- Interpersonal SkillsDocument4 pagesInterpersonal Skillssooner123456No ratings yet

- The Democratic SocietyDocument11 pagesThe Democratic SocietyBernardo Cielo IINo ratings yet

- AuthCC PDFDocument1 pageAuthCC PDFBernardo Cielo IINo ratings yet

- 2k8-9 Cult ElecMarketing Cielo 1stEICDocument3 pages2k8-9 Cult ElecMarketing Cielo 1stEICBernardo Cielo IINo ratings yet

- Due Diligence - ChecklistDocument7 pagesDue Diligence - ChecklistAlex YanNo ratings yet

- Changes in ITR 2024-25AYDocument28 pagesChanges in ITR 2024-25AYMAYANK AGRAWALNo ratings yet

- New Joinee Handbook FlowDocument21 pagesNew Joinee Handbook Flowakash agarwalNo ratings yet

- Frequently Asked Questions by RTI ApplicantsDocument12 pagesFrequently Asked Questions by RTI ApplicantsPiyushNo ratings yet

- CHAPTER 3 Corrent LiabilityDocument25 pagesCHAPTER 3 Corrent LiabilityTesfaye Megiso BegajoNo ratings yet

- Forensic Accounting Activity (US Based) Nasol and SalonDocument3 pagesForensic Accounting Activity (US Based) Nasol and SalonEizel NasolNo ratings yet

- Caef Anubhav MishraDocument41 pagesCaef Anubhav Mishramessisingh1706No ratings yet

- Policy 555839668 1899087538702Document5 pagesPolicy 555839668 1899087538702utkarsh ambreNo ratings yet

- High Impact Risk Management Plan TemplateDocument11 pagesHigh Impact Risk Management Plan Templatesaeed ghafoori100% (1)

- An Investigation Into The Effects of Bancassurance Development On Insurance Brokers in Harare-ZimbabweDocument74 pagesAn Investigation Into The Effects of Bancassurance Development On Insurance Brokers in Harare-ZimbabweTawandaZimhambaNo ratings yet

- KAIA PresentationDocument7 pagesKAIA PresentationGanapathi BhatNo ratings yet

- Cpa Review School of The Philippines ManilaDocument14 pagesCpa Review School of The Philippines ManilaVanessa Anne Acuña DavisNo ratings yet

- Karnataka Milk Federation Deepak MB 1 Report 1Document37 pagesKarnataka Milk Federation Deepak MB 1 Report 1nithinnick66No ratings yet

- AR Billing Manual - V1212-1Document14 pagesAR Billing Manual - V1212-1spicypoova_899586184100% (1)

- Insurance Law Claims Settlement and Subrogation NotesDocument5 pagesInsurance Law Claims Settlement and Subrogation NotesTenten ConanNo ratings yet

- Chapter Five: Life and Health InsuranceDocument36 pagesChapter Five: Life and Health InsuranceMewded DelelegnNo ratings yet

- 2023-07-06 St. Mary's County TimesDocument32 pages2023-07-06 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- BBA Project List 2020-21Document10 pagesBBA Project List 2020-21RANJAN kumarNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Financial Derivatives Assignment - MridulDocument8 pagesFinancial Derivatives Assignment - MridulsahilNo ratings yet

- Plan Comparison ChartDocument3 pagesPlan Comparison ChartBassoNo ratings yet

- Annex 4 Lsit of Scheduled Bank and NBFIs, InsuranceDocument7 pagesAnnex 4 Lsit of Scheduled Bank and NBFIs, InsuranceAijaz Mustafa HashmiNo ratings yet

- Personnel Information System: Presented by Ms. Jyoti Waghela MBA-HR 13 Sub-HRIS Ref No - KHR2018EMBA13P067Document21 pagesPersonnel Information System: Presented by Ms. Jyoti Waghela MBA-HR 13 Sub-HRIS Ref No - KHR2018EMBA13P067jyoti chauhanNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsPrince KhajaNo ratings yet

- UNIT 3 InsuranceDocument10 pagesUNIT 3 InsuranceAroop PalNo ratings yet

- Simplified Group Application Form - FillableDocument4 pagesSimplified Group Application Form - FillableblissNo ratings yet

- ACME Shoe Rubber Plastic Corp. vs. CADocument6 pagesACME Shoe Rubber Plastic Corp. vs. CAMarkey MarqueeNo ratings yet

- P03319158 ApplicationFormDocument6 pagesP03319158 ApplicationFormParesh MehtaNo ratings yet

- PolicyconfirmationDocument1 pagePolicyconfirmationjaxsoncooper31No ratings yet