Professional Documents

Culture Documents

The Statement of Comprehensive Income or Income Statement Shows The

The Statement of Comprehensive Income or Income Statement Shows The

Uploaded by

ZsazsaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Statement of Comprehensive Income or Income Statement Shows The

The Statement of Comprehensive Income or Income Statement Shows The

Uploaded by

ZsazsaCopyright:

Available Formats

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

The Statement of

Comprehensive

Income or Income

Statement shows the

result of operations for

a given period of time.

It consists of the

revenue, Cost

and Expenses

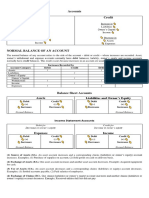

1. Natural Form- otherwise called the nature of expense method, it

presents expenses according to nature, this type of income

statement is used in a service business. It is also called the single-

step income statement since a single-step of deducting expenses

from revenue is performed to arrive at the net income or net loss.

2. Functional Form- otherwise known as the cost of sales method,

it presents expenses according to function (e.g., cost of sales,

selling expenses, administrative expenses). this type is used in a

merchandising business. It is also called the multiple-step income

statement since a series of steps is performed to arrive at the net

income or net loss.

Fundamentals of Accountancy, Business and Management

Module 1 Page 16

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

Comparison of the Natural Form and the Functional Form of Income Statements.

NATURAL FORM

Income from services xxx

Less: Operating Expenses xxx

Net Income/Loss xxx

FUNCTIONAL FORM

Net Sales xxx

Less: Cost of Sales xxx

Gross Profit xxx

Less: Operating Expenses xxx

Net Income/Loss xxx

Notice that in the natural form, income statement,

a single-step of deducting total expenses from total

revenues was done to get the net income/loss from

operations. However, in the functional form income

statement, a series of steps was done showing

several activities of the business before finally

arriving at the net income/loss from operations.

Fundamentals of Accountancy, Business and Management

Module 1 Page 17

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

includes revenues earned or generated by the business

service in performing services for a customer or client. The

income following are different examples of income and the a

ccounting term used to describe the income.

includes all payments made to employees or workers

salaries or for rendering services to the company. Examples are

wages expense salaries or wages, 13th month pay, cost of living allowance

and other related benefits given to them.

Utilities is an expense related to the use of electricity,

expense fuel, water and telecommunications facilities.

sUpplies 1. covers office supplies used by the business in the

expense conduct of its daily operations.

is the expired portion of premiums paid on

insUrance

insurance coverage such as premium paid for health or

expense life insurance, motor vehicles or other properties.

Depreciation is the annual portion of the cost of a tangible asset

such as buildings, machineries, and equipment

expense

charged as expense for the year.

means the amount of receivables charged as

Uncollectible

expense for the period because they are

accoUnts expense

estimated to be doubtful of collection.

interest a) is the amount of money charged to the borrower

for the use of borrowed funds.

expense

Fundamentals of Accountancy, Business and Management

Module 1 Page 18

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

natUral Form income statement

Alex Bern Spa

Income Statement

For Year Ended December 31, 201x

NOTE

Service Revenue 454, 000

Other Income 1 61, 000

Total Income 515, 000

Expenses

Salaries 155, 000

Rent 85, 000

Depreciation 2 20, 000

Supplies 5, 000

Insurance 2, 000

Other Expenses 3 4, 000

Finance Cost 4 4, 000 275, 000

Net Income 240, 000

NOTES TO FINANCIAL STATEMENT

NOTE 1 - OTHER INCOME

Rent Income 30, 000 NOTE 3 - OTHER EXPENSES

Dividends Income 15, 000 Loss on Sale of Furniture 4, 000

Gain on Sale on Equipment 10, 000

Interest Income 6, 000

Total 61, 000 NOTE 4 - FINANCE COST

Interest Expense - Mortgage 3, 000

NOTE 2 - DEPRECIATION EXPENSE

Depreciation Expense-Building 15, 000 Interest Expense - Loan 1, 000

Total 4, 000

Depreciation Expense-Equipment 5, 000

Total 20, 000

Fundamentals of Accountancy, Business and Management

Module 1 Page 19

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

Components of multi-step income statement

Ren Ren Merchandising

Income Statement

For year ended December 31, 2017

Note

Net Sales 1 xxx

Cost of Sales 2 xxx

Gross Profit xxx

Other Income 3 xxx

Total Income xxx

Operating Expenses

Distribution Expenses 4 xxx

Administrative Expenses 5 xxx

Other Expenses 6 xxx

Finance Cost xxx xxx

Net Income xxx

Net Sales

He first line after the heading of the income statement is the net sales. To show the details of its

computation, it is supported by a note to financial statement. Net sales is computed as follows:

Gross Sales xxx

Less: Sales Return and Allowances xxx

Sales Discounts xxx xxx

Net Sales xxx

Cost of Sales

The cost of sales or cost of goods sold represents the cost of merchandise inventory sold by the

business to its customers. This comprises the company’s biggest expense and is deducted from net

sales to arrive at the gross profit. Computation of cost of sales is as follows.

Fundamentals of Accountancy, Business and Management

Module 1 Page 20

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

Merchandise Inventory, Beginning xxx

Add: Net Cost of Purchases

Purchases xxx

Less: Purchase Returns and allowances xxx

Purchase Discount xxx xxx

Net Purchases xxx

Add: Freight-in xxx xxx

Goods Available for Sales xxx

Less: Merchandise Inventory, End xxx

Cost of Sales xxx

Other Income

Other income is income derived from sources other than the company’s main line of business.

Examples are interest income, dividends income, commissions income, rent income, and gain on sale

of assets. To show the details of this income account, it is supported by a note to financial

statement.

Distribution Expenses/ Selling Expenses

Selling expenses are those incurred In directly selling the merchandise. This includes salaries of

sales personnel, expenses incurred in promoting or advertising the product, commissions on sales,

store supplies used, utilities used in the store, depreciation expenses of assets used in the store and

the cost of transporting the merchandise to the customer’s place of business under he account title

freight-out or delivery expense.

General /Administrative Expenses

General or administrative expenses are expenses necessary in the management of the office. This

includes the salaries of office personnel, office supplies used, utilities used in the office, depreciation

of office assets and the provision for bad debts or uncollectible accounts.

Note: If the business has a small office, does not maintain a store, and sales are also made in the

office, operating expenses need not be categorized under selling and administrative expenses.

Other expenses

Other expenses are expenses not connected to the operating activities of the business. An example

of this is loss on sale of assets and discount lost.

Finance Cost

Finance Cost are the interest expense paid for the use of borrowed funds.

Fundamentals of Accountancy, Business and Management

Module 1 Page 21

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

Illustrative Problem

The following account balances are taken from the books of Ren Ren Merchandising on December

31, 2016.

Sales 782 000

Sales Returns Allowances 32 000

Sales Discounts 48 000

Purchases 220 000

Purchase Returns And Allowances 34 000

Purchase Discounts 26 000

Freight In 10 000

Merchandise Inventory, Beginning 180 000

Merchandise Inventory, End 120 000

Sales Salaries Expense 52 000

Depreciation Expense - Store Equipment 7 800

Utilities Expense - Store 6 000

Office Salaries Expense 34 000

Utilities Expense - Office 4 400

Office Supplies 3 000

Bad Debts Expense 2 000

Interest Expense 2 400

Loss On Sale Of Equipment 1 600

Discount Lost 1 000

Interest Income 30 000

Rent Income 20 000

Fundamentals of Accountancy, Business and Management

Module 1 Page 22

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

Ren Ren Merchandising

Income Statement

For year ended December 31, 2016

Note

Net Sales 1 702, 000

Cost of Sales 2 230, 000

Gross Profit 472, 000

Other Income 3 50, 000

Total Income 522, 000

Operating Expenses

Distribution Expenses 4 65, 800

Administrative Expenses 5 43, 400

Other Expenses 6 2, 600

Finance Cost 7 2, 400 114, 200

Net Income 407, 800

Note 1 - Net Sales

Gross Sales 782, 000

Less: Sales Returns and Allowances 32, 000

Sales Discount 48, 000 80, 000

Net Sales 702, 000

Note 2 - Cost of Sales

Merchandise Inventory, Beginning 180, 000

Add: Net Cost

Purchases 220, 000

Less: Purchase Returns and Allowances 34, 000

Purchase Discount 26, 000 60, 000

Net Purchases 160, 000

Add: Freight-in 10, 000 170, 000

Goods Available for Sales 350, 000

Less: Merchandise Inventory, End 120, 000

Fundamentals of Accountancy, Business and Management

Module 1 Page 23

NORTHWESTERN UNIVERSITY

Basic Education Department

Junior and Senior High School

Cost of Sales 230, 000

Note 3 - Other Income

Interest Income 30, 000

Rent Income 20, 000

Total 50, 000

Note 4 - Distribution Expense

Sales Salaries Expense 52, 000

Depreciation Expense - Store Equipment 7, 800

Utilities Expense -Store 6, 000

Total 65, 800

Note 5 - Administrative Expenses

Office Salaries Expense 34, 000

Utilities Expense - Office 4, 400

Office Supplies 3, 000

Bad Debts Expense 2, 000

Total 43, 300

Note 6- Other Expenses

Loss on Saleof Equipment 1, 600

Discount Loss 1, 000

Total 2, 600

Fundamentals of Accountancy, Business and Management

Module 1 Page 24

You might also like

- Six Month Merchandise Plan1Document28 pagesSix Month Merchandise Plan1api-370599683% (12)

- Apollo Shoes, Inc.: Prepared by Reviewed byDocument3 pagesApollo Shoes, Inc.: Prepared by Reviewed byArista Yuliana SariNo ratings yet

- An Inclusive Research On Bharat PeDocument7 pagesAn Inclusive Research On Bharat PesimranNo ratings yet

- Format of Reflection PaperDocument1 pageFormat of Reflection PaperAsher MileyNo ratings yet

- Module 1 Introduction To AccountingDocument8 pagesModule 1 Introduction To AccountingShårmāinë Iniégø DimâänōNo ratings yet

- Capital Investment Decisions and The Time Value of Money PDFDocument89 pagesCapital Investment Decisions and The Time Value of Money PDFKelvin Tey Kai WenNo ratings yet

- Activity-Financial AnalysisDocument2 pagesActivity-Financial AnalysisXienaNo ratings yet

- Chapter 5 Macay Holding Inc Group 4Document5 pagesChapter 5 Macay Holding Inc Group 4ivy melgarNo ratings yet

- Sicam v. JorgeDocument2 pagesSicam v. JorgeEcnerolAicnelavNo ratings yet

- Accounts Debit Credit: Normal Balance Normal BalanceDocument4 pagesAccounts Debit Credit: Normal Balance Normal BalanceVG R1NG3RNo ratings yet

- Purposive CommunicationDocument3 pagesPurposive CommunicationElmarie J'Anne MicuNo ratings yet

- 01 FabmDocument32 pages01 FabmMavs MadriagaNo ratings yet

- Midterm Exam FADocument7 pagesMidterm Exam FARes GosanNo ratings yet

- Cfas SummaryDocument4 pagesCfas Summaryfatima airis aradaisNo ratings yet

- Type (Introduction To Corporate Governance)Document11 pagesType (Introduction To Corporate Governance)Alvin VidalNo ratings yet

- Lesson 4 ArtDocument4 pagesLesson 4 ArtrojiNo ratings yet

- Financial Accounting and Reporting - Property, Plant and EquipmentDocument7 pagesFinancial Accounting and Reporting - Property, Plant and EquipmentLuisitoNo ratings yet

- FAR 2 NotesDocument3 pagesFAR 2 NotesMARK RANIEL ANTAZONo ratings yet

- Module For ACC 206 Understanding ExpensesDocument12 pagesModule For ACC 206 Understanding ExpensesMerecci Angela De ChavezNo ratings yet

- Activity 4 Name: Course & Section: Assets Transaction Cash Supplies Equipment Accounts ReceivableDocument18 pagesActivity 4 Name: Course & Section: Assets Transaction Cash Supplies Equipment Accounts ReceivableJoshua Sta AnaNo ratings yet

- Financial Statements PLDT and GLobeDocument18 pagesFinancial Statements PLDT and GLobeArnelli GregorioNo ratings yet

- Accounting Concepts and PrinciplesDocument4 pagesAccounting Concepts and Principlesdane alvarezNo ratings yet

- Definition and Characteristics of PartnershipDocument2 pagesDefinition and Characteristics of PartnershipShan SicatNo ratings yet

- Module in Financial Management - 02Document9 pagesModule in Financial Management - 02Karen DammogNo ratings yet

- UnfaircompetitionDocument4 pagesUnfaircompetitionJamNo ratings yet

- Depreciation Accounting PDFDocument42 pagesDepreciation Accounting PDFASIFNo ratings yet

- Module 2-Art Through The AgesDocument16 pagesModule 2-Art Through The AgesJamel RayoNo ratings yet

- BSMA PrE 417 PERFORMANCE MANAGEMENT SYSTEMDocument8 pagesBSMA PrE 417 PERFORMANCE MANAGEMENT SYSTEMDonna ZanduetaNo ratings yet

- Managerial Economics in The 21st CenturyDocument14 pagesManagerial Economics in The 21st CenturyMaevel CantigaNo ratings yet

- 2 Inventory Cost Flow Intermediate Accounting ReviewerDocument3 pages2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- Dissolution, Winding Up, Termination p2Document8 pagesDissolution, Winding Up, Termination p2lord kwantoniumNo ratings yet

- ABM Accounting Firm 1Document37 pagesABM Accounting Firm 1Beat KarbNo ratings yet

- Chapter 2 - Evolution of International TradeDocument37 pagesChapter 2 - Evolution of International TradeIrvan Ohorella100% (1)

- Discounting Notes ReceivableDocument3 pagesDiscounting Notes ReceivablerockerNo ratings yet

- Fabm 2 q3 Week 5 Module 4 Statement of Cash Flows For ReproductionDocument23 pagesFabm 2 q3 Week 5 Module 4 Statement of Cash Flows For ReproductionFranzen GabianaNo ratings yet

- UNIT III-Financial Aspects of Inventory StrategyDocument17 pagesUNIT III-Financial Aspects of Inventory StrategyMonica Lorevella NegreNo ratings yet

- Week 3 Module 3 Chapter 3 Statement of Changes in Owners Equity 3Document7 pagesWeek 3 Module 3 Chapter 3 Statement of Changes in Owners Equity 3Joyce TanNo ratings yet

- Fabm Module4Document50 pagesFabm Module4Paulo VisitacionNo ratings yet

- Approved CAE BSA ACP 311 PetalcorinDocument132 pagesApproved CAE BSA ACP 311 PetalcorinFRAULIEN GLINKA FANUGAONo ratings yet

- Financial Reporting in Hyperinflationary EconomiesDocument7 pagesFinancial Reporting in Hyperinflationary EconomiesangbabaeNo ratings yet

- CBM 4 - Let's Check Activity 1 ULO A & B (1-20)Document2 pagesCBM 4 - Let's Check Activity 1 ULO A & B (1-20)CHARLYN MAE SALASNo ratings yet

- Activities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerDocument9 pagesActivities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerEfril Joy AlbitoNo ratings yet

- AIS 01 - Handout - 1Document7 pagesAIS 01 - Handout - 1Melchie RepospoloNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- Quiz On Sce and SFPDocument2 pagesQuiz On Sce and SFPMounicha AmbayecNo ratings yet

- Chapter 10 Special JournalsDocument5 pagesChapter 10 Special JournalsPaw VerdilloNo ratings yet

- What Is Art History NotesDocument6 pagesWhat Is Art History NotesJorge Anton Lorena AmargaNo ratings yet

- Lesson 1 Statement of Financial PositionDocument22 pagesLesson 1 Statement of Financial PositionMylene SantiagoNo ratings yet

- Fundamentals of Accounting I The Accounting EquationDocument10 pagesFundamentals of Accounting I The Accounting EquationericacadagoNo ratings yet

- 03 - Partnership DissolutionDocument38 pages03 - Partnership DissolutionDonise Ronadel SantosNo ratings yet

- Accounting Process of A Services BusinessDocument9 pagesAccounting Process of A Services BusinessFiverr RallNo ratings yet

- Revised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementDocument149 pagesRevised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementCabatingan Alecza JadeNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- Fabm1 PPT Q2W1Document62 pagesFabm1 PPT Q2W1giselle100% (1)

- Diamond Trading CuasayDocument2 pagesDiamond Trading CuasayBhabes M. TuralloNo ratings yet

- VRTS 112-Activity Number 1Document1 pageVRTS 112-Activity Number 1Gina PrancelisoNo ratings yet

- Notes For Merchandising Business - 1Document2 pagesNotes For Merchandising Business - 1Ruab PlosNo ratings yet

- Adjusting Process ValixDocument28 pagesAdjusting Process ValixjepsyutNo ratings yet

- Gate 3 - Execution - Machinery, Methods, and Management SkillsDocument35 pagesGate 3 - Execution - Machinery, Methods, and Management SkillsJohn Nelo MorataNo ratings yet

- Merchandising Comprrehensive ProblemDocument3 pagesMerchandising Comprrehensive ProblemJalod Hadji AmerNo ratings yet

- The Statement of Comprehensive Income: Lesson 1Document8 pagesThe Statement of Comprehensive Income: Lesson 1Kim CortezNo ratings yet

- Chapter 3 - The Accounting EquationDocument10 pagesChapter 3 - The Accounting Equationgeyb away100% (1)

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Lesson 7 Position PaperDocument3 pagesLesson 7 Position PaperZsazsa100% (1)

- Group 1 Business Advocacy ScriptDocument3 pagesGroup 1 Business Advocacy ScriptZsazsaNo ratings yet

- MODULE in PRDocument34 pagesMODULE in PRZsazsaNo ratings yet

- RRL AuthorsDocument1 pageRRL AuthorsZsazsaNo ratings yet

- Lesson 8 Writing The Concept Paper-1Document3 pagesLesson 8 Writing The Concept Paper-1ZsazsaNo ratings yet

- Lesson 6 Reaction Paper-Critique-ReviewDocument7 pagesLesson 6 Reaction Paper-Critique-ReviewZsazsaNo ratings yet

- Topic - DISCUSSION 3 (TRADITIONAL DANCES)Document16 pagesTopic - DISCUSSION 3 (TRADITIONAL DANCES)ZsazsaNo ratings yet

- Res 2 Chapter II RRLDocument17 pagesRes 2 Chapter II RRLZsazsaNo ratings yet

- REVIEW OF RELATED LITERATURE AND STUDIES (Revised 2)Document6 pagesREVIEW OF RELATED LITERATURE AND STUDIES (Revised 2)ZsazsaNo ratings yet

- Research - CHAPTER 1Document6 pagesResearch - CHAPTER 1ZsazsaNo ratings yet

- Activity in LiteratureDocument1 pageActivity in LiteratureZsazsaNo ratings yet

- Identifying The Inquiry and Stating The ProblemDocument50 pagesIdentifying The Inquiry and Stating The ProblemZsazsaNo ratings yet

- Plato, Aristotle, DescartesDocument3 pagesPlato, Aristotle, DescartesZsazsa100% (1)

- Subject Guide: Basic Education DepartmentDocument9 pagesSubject Guide: Basic Education DepartmentZsazsaNo ratings yet

- Subject Guide: Northwestern UniversityDocument7 pagesSubject Guide: Northwestern UniversityZsazsaNo ratings yet

- Lesson 1.4Document12 pagesLesson 1.4ZsazsaNo ratings yet

- Topic - DISCUSSION 2 (TOPIC 2 ELEMENTS OF DANCES)Document6 pagesTopic - DISCUSSION 2 (TOPIC 2 ELEMENTS OF DANCES)ZsazsaNo ratings yet

- Topic - DICUSSION 4 (TOPIC 4 - Modern and Contemporary Dance)Document12 pagesTopic - DICUSSION 4 (TOPIC 4 - Modern and Contemporary Dance)ZsazsaNo ratings yet

- To Ask Some of Your Older Family Members and Draw A Simple Depiction of The Story On The Space BelowDocument1 pageTo Ask Some of Your Older Family Members and Draw A Simple Depiction of The Story On The Space BelowZsazsaNo ratings yet

- Take ActionDocument1 pageTake ActionZsazsaNo ratings yet

- Legal Counseling: Therese Zsa R. Torres J.D. IvDocument29 pagesLegal Counseling: Therese Zsa R. Torres J.D. IvZsazsaNo ratings yet

- LESSON 2: Philippine Literature During The Spanish PeriodDocument5 pagesLESSON 2: Philippine Literature During The Spanish PeriodZsazsaNo ratings yet

- Week 2Document7 pagesWeek 2ZsazsaNo ratings yet

- Junior and Senior High School: Northwestern University Basic Education DepartmentDocument9 pagesJunior and Senior High School: Northwestern University Basic Education DepartmentZsazsaNo ratings yet

- Junior and Senior High School: Northwestern UniversityDocument6 pagesJunior and Senior High School: Northwestern UniversityZsazsaNo ratings yet

- FT-Herrera vs. Barreto (1913)Document14 pagesFT-Herrera vs. Barreto (1913)ZsazsaNo ratings yet

- How Are You Going To Learn?: Junior and Senior High SchoolDocument4 pagesHow Are You Going To Learn?: Junior and Senior High SchoolZsazsa100% (1)

- Pedro L. Linsangan, A.C. No. 6672 Complainant,: W/ Financial AssistanceDocument54 pagesPedro L. Linsangan, A.C. No. 6672 Complainant,: W/ Financial AssistanceZsazsaNo ratings yet

- Lesson 4 Thesis StatementDocument7 pagesLesson 4 Thesis StatementZsazsa100% (1)

- Junior and Senior High School: Northwestern UniversityDocument4 pagesJunior and Senior High School: Northwestern UniversityZsazsaNo ratings yet

- CPAR AUD 2205 1st Final Preboard 140Document32 pagesCPAR AUD 2205 1st Final Preboard 140Norman Louie SenadosNo ratings yet

- Financial Management Unit 3 DR Ashok KumarDocument65 pagesFinancial Management Unit 3 DR Ashok Kumarsk tanNo ratings yet

- 5-Money Growth and Inflation 2020Document85 pages5-Money Growth and Inflation 2020Việt HươngNo ratings yet

- HOBA Practice Problems - Inter-Branch TransactionsDocument1 pageHOBA Practice Problems - Inter-Branch TransactionsJefferson ArayNo ratings yet

- Salam and Parallel SalamDocument3 pagesSalam and Parallel SalamMuhammad SalmanNo ratings yet

- SIP Report - TAX & FINANCIAL PLANNING FOR SALIRIED INDIVIDUAL''Document71 pagesSIP Report - TAX & FINANCIAL PLANNING FOR SALIRIED INDIVIDUAL''Amit SharmaNo ratings yet

- Companies - Dealroom - Co - 01Document1 pageCompanies - Dealroom - Co - 01Tyler JohnsonNo ratings yet

- Cracking Mba Finance InterviewDocument41 pagesCracking Mba Finance InterviewJITHIN PADINCHARE RAMATH KANDIYIL100% (2)

- Current Acct Statement - XX0388 - 12092023Document10 pagesCurrent Acct Statement - XX0388 - 12092023Ashwani KumarNo ratings yet

- Publication FileDocument17 pagesPublication FileAng SHNo ratings yet

- An Application Under Section 60 (5) of The Insolvency and Bankruptcy Code, 2016 Filed byDocument30 pagesAn Application Under Section 60 (5) of The Insolvency and Bankruptcy Code, 2016 Filed byNivasNo ratings yet

- Greenhouse Economics: January 1990Document12 pagesGreenhouse Economics: January 1990Vincent John RigorNo ratings yet

- Biswana TH Guha: I. R. Technology Services Pvt. LTDDocument1 pageBiswana TH Guha: I. R. Technology Services Pvt. LTDRoma BeheraNo ratings yet

- Cost and Management AccountingDocument5 pagesCost and Management AccountingZaib Khan0% (1)

- MC No. 03 s.2017: Consolidated Schedule of Fees and ChargesDocument3 pagesMC No. 03 s.2017: Consolidated Schedule of Fees and ChargesMae Richelle Dizon DacaraNo ratings yet

- Ifrs Edition: Preview ofDocument33 pagesIfrs Edition: Preview ofwtfNo ratings yet

- DIB Question Apr 18Document17 pagesDIB Question Apr 18Engr. Thanvir AhmadNo ratings yet

- Ratios AssignmentDocument3 pagesRatios AssignmentDiana SaidNo ratings yet

- GIC Stock PitchDocument9 pagesGIC Stock Pitchbenjim123No ratings yet

- Gsis Ra 8291Document2 pagesGsis Ra 8291Karen Faith MallariNo ratings yet

- DLF - Annual Report 2015 16 Final PDFDocument232 pagesDLF - Annual Report 2015 16 Final PDFKfernsNo ratings yet

- Director Finance in New York NY Resume Charles RebisDocument2 pagesDirector Finance in New York NY Resume Charles RebisCharlesRebisNo ratings yet

- ACFN 631 Self - Test Question No 4 PDFDocument3 pagesACFN 631 Self - Test Question No 4 PDFEsubalew GinbarNo ratings yet

- 17 - Conclusion and SuggestionDocument39 pages17 - Conclusion and SuggestionJay upadhyayNo ratings yet

- Administrative Order No. 23 Compliance Report TemplateDocument11 pagesAdministrative Order No. 23 Compliance Report TemplateVILMA BASENo ratings yet

- Cargo Insurance PolicyDocument14 pagesCargo Insurance PolicyGabriela PaunaNo ratings yet

- Please Complete Buyer Closing Package - EscroDocument33 pagesPlease Complete Buyer Closing Package - EscroJuan Luis AlarconNo ratings yet