Professional Documents

Culture Documents

Capital Gains and Losses: Ebook Summary - Chapter 12

Capital Gains and Losses: Ebook Summary - Chapter 12

Uploaded by

arianxxx0 ratings0% found this document useful (0 votes)

40 views1 pageOriginal Title

OR0322E_TXN_Capital_Gains_and_Losses_SUM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

40 views1 pageCapital Gains and Losses: Ebook Summary - Chapter 12

Capital Gains and Losses: Ebook Summary - Chapter 12

Uploaded by

arianxxxCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

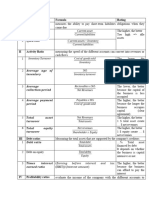

eBook Summary – Chapter 12

Capital Gains and Losses

Three-step process

Step 1: Situation Step 2: Analyze Step 3: Conclude and advise

Determine the facts Apply each case fact to the court Conclude on whether the profit

specific to the case. factors* to determine if the asset from selling the asset is a capital

sold is a capital asset or inventory. gain or business income. Discuss

the tax implications of the

conclusion.

Definitions Capital vs. income factors Special topics

Capital property: *Factors to consider: 1. ACB of identical properties — moving

a property acquired with the intention of Intention at time of acquisition weighted average

holding it to earn income through its use. Relationship of the transaction to the 2. Superficial losses — not deductible in the

taxpayer’s business period (added to cost base of remaining

Capital gain:

properties)

difference between the proceeds of Nature of the asset

3. Capital gains reserve — lesser of:

disposal and the ACB of the asset Number and frequency of similar

- Capital gain × (proceeds not yet due /total

Taxable capital gain: transactions

proceeds)

capital gain multiplied by the inclusion Length of period of ownership

- 20% of capital gain × (4-number of

rate (currently ½). Feasibility of taxpayer’s intention preceding years ending after the

Disposition of property: Reason for sale disposition)

entitles taxpayer to proceeds of 4. Business investment loss — disposition of

disposition (sale, change in use, death shares or debt of a small business corporation

of a taxpayer, ceasing residency, - ½ is an allowable business investment loss

gifting). (ABIL), which can offset any source of

income (not restricted to taxable capital

gains)

© 2019 Chartered Professional Accountants of Canada

You might also like

- Affidavit of OptionDocument1 pageAffidavit of OptionAjay Ann De La CruzNo ratings yet

- Module 2 - RevisedDocument31 pagesModule 2 - RevisedAries Gonzales Caragan25% (4)

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Accounting FM NotesDocument2 pagesAccounting FM NotessapbuwaNo ratings yet

- Follow Up QuestionsDocument27 pagesFollow Up QuestionsVishal PoduriNo ratings yet

- Accounting Equation & Accounting Classification: Prepared By: Nurul Hassanah Binti HamzahDocument12 pagesAccounting Equation & Accounting Classification: Prepared By: Nurul Hassanah Binti HamzahNur Amira NadiaNo ratings yet

- SDFDDocument3 pagesSDFDVel JuneNo ratings yet

- Finance NotesDocument23 pagesFinance NoteschamilasNo ratings yet

- Simulation Income MemoDocument1 pageSimulation Income MemoLaity FinchamNo ratings yet

- CLWTAXN Module 4 Principles of Income Taxation (Income Tax Notes) v012024-1Document7 pagesCLWTAXN Module 4 Principles of Income Taxation (Income Tax Notes) v012024-1kdcngan162No ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- Company Name: (In Rs CRS) (In Rs CRS)Document9 pagesCompany Name: (In Rs CRS) (In Rs CRS)DineshNo ratings yet

- Financial Reporting and Analysis - Session 1 Revision of Financial Statements Construction (Chapter No 1)Document35 pagesFinancial Reporting and Analysis - Session 1 Revision of Financial Statements Construction (Chapter No 1)Saurabh AwatiNo ratings yet

- Accounting For Business: Asso. Prof. Dr. Nguyen Thi Phuong HoaDocument37 pagesAccounting For Business: Asso. Prof. Dr. Nguyen Thi Phuong HoaTam DoNo ratings yet

- Accounting:: Recording, Analysing and SummarisingDocument37 pagesAccounting:: Recording, Analysing and SummarisingNguyen Ngoc MaiNo ratings yet

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- Financial Accounting NotesDocument7 pagesFinancial Accounting NotesGan JessieNo ratings yet

- Corporate Financial Reporting: Session 2: PGP 2018-19 Introduction and Accounting EquationDocument30 pagesCorporate Financial Reporting: Session 2: PGP 2018-19 Introduction and Accounting EquationArty DrillNo ratings yet

- Basic Concepts of Financial AccountingDocument6 pagesBasic Concepts of Financial AccountingMary Joanne PatolilicNo ratings yet

- SAP Financial Planning v1.0Document42 pagesSAP Financial Planning v1.0edoardo.dellaferreraNo ratings yet

- Lecture Slides - Chapter 1 & 2Document66 pagesLecture Slides - Chapter 1 & 2Phan Đỗ QuỳnhNo ratings yet

- Lecture Slides - Chapter 1 2Document66 pagesLecture Slides - Chapter 1 2Van Dat100% (1)

- GROSS INCOME DEDUCTIONS Advance NotesDocument13 pagesGROSS INCOME DEDUCTIONS Advance NotesMary Angeline SalvaneraNo ratings yet

- CGT - Fundamentals: Currency: 30 August 2017 (v006.5)Document59 pagesCGT - Fundamentals: Currency: 30 August 2017 (v006.5)Jessica YuNo ratings yet

- Seminar On Direct Tax Code: Corporate Tax: Vishal ShahDocument23 pagesSeminar On Direct Tax Code: Corporate Tax: Vishal ShahKoushik BalajiNo ratings yet

- ICAEW Chapter 2 The Accounting EquationDocument20 pagesICAEW Chapter 2 The Accounting Equationvothituongnhi7703No ratings yet

- Financial Statements As A Management ToolDocument20 pagesFinancial Statements As A Management TooldavidimolaNo ratings yet

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- FIA 141 - Introduction To Financial Accounting-1 - 2Document20 pagesFIA 141 - Introduction To Financial Accounting-1 - 24313256No ratings yet

- Recent Developments in RE Laws Taxation by CA. Jayesh Kariya 1 PDFDocument55 pagesRecent Developments in RE Laws Taxation by CA. Jayesh Kariya 1 PDFManu IttinaNo ratings yet

- ACC525 Week 1 AssignmentDocument3 pagesACC525 Week 1 AssignmentRung'Minoz KittiNo ratings yet

- Profit or Loss PriorDocument6 pagesProfit or Loss PriorHitanshu KumarNo ratings yet

- 2Q - Fabm 2Document7 pages2Q - Fabm 2Alexandra Norin RodriguezNo ratings yet

- Chapter 2Document27 pagesChapter 2Mohamad SyafiqNo ratings yet

- Corporate Financial Reporting: Session 2: PGP 2020-21 Introduction and Accounting EquationDocument21 pagesCorporate Financial Reporting: Session 2: PGP 2020-21 Introduction and Accounting EquationMansi aggarwal 171050No ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsAnthony DyNo ratings yet

- Kimmel, Weygandt, Kieso: Tools For Business Decision Making, 3rd EdDocument46 pagesKimmel, Weygandt, Kieso: Tools For Business Decision Making, 3rd Edujjval10No ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- ACT201 Chap001 NBNDocument18 pagesACT201 Chap001 NBNAudity PaulNo ratings yet

- Module 8 Reviewer ENTDocument6 pagesModule 8 Reviewer ENTZai TvNo ratings yet

- Chapters 1 and 2Document36 pagesChapters 1 and 2Qing ShiNo ratings yet

- MODULE 2 NotesDocument2 pagesMODULE 2 NotesJoshua AlvarezNo ratings yet

- 1st Quarter DiscussionDocument10 pages1st Quarter DiscussionThea Gwyneth RodriguezNo ratings yet

- Topic 3 - Accounting Classification and Accounting Equation LatestDocument28 pagesTopic 3 - Accounting Classification and Accounting Equation LatestKhairul AkmalNo ratings yet

- Chapter 2 - Financial StatementsDocument4 pagesChapter 2 - Financial StatementsMASSO CALINTAANNo ratings yet

- COEB442 Notes For CH 1 2Document12 pagesCOEB442 Notes For CH 1 2Fatin Nur Annisa Mohammad YusoffNo ratings yet

- Financial ManagementDocument6 pagesFinancial Managementwofete9689No ratings yet

- Accounting RatiosDocument3 pagesAccounting RatiosAnkit RoyNo ratings yet

- financial_ratios summary copyDocument2 pagesfinancial_ratios summary copyHeDi DNo ratings yet

- Accounting Measures & Firm Performance: Ratio CalculationDocument7 pagesAccounting Measures & Firm Performance: Ratio CalculationVítor Gularte de OliveiraNo ratings yet

- Leon - Lai@cityu - Edu.hk: Accounting - DefinitionDocument2 pagesLeon - Lai@cityu - Edu.hk: Accounting - Definition5D25 Wong Yuen HeeNo ratings yet

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Accounting BasicsDocument10 pagesAccounting BasicsMitanshi ShahNo ratings yet

- Corporation Tax - AnnotatedDocument64 pagesCorporation Tax - AnnotatedDr SafaNo ratings yet

- Chapter 6 Financial Statement Analysis Balance SheetDocument30 pagesChapter 6 Financial Statement Analysis Balance SheetKhadija YaqoobNo ratings yet

- Poa ReviewerDocument4 pagesPoa Reviewerdevora aveNo ratings yet

- Financial StatementDocument37 pagesFinancial Statementbenjamin.labayenNo ratings yet

- Afar - Partnership AccountingDocument3 pagesAfar - Partnership Accountingfarah mae raquinioNo ratings yet

- Accounting 2Document7 pagesAccounting 2Valentina SerratoreNo ratings yet

- Fundamentals of AccountingDocument27 pagesFundamentals of AccountingMajariya Sahar SabladNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Invoice MA18-193260Document2 pagesInvoice MA18-193260Geek AlertNo ratings yet

- Donation Case DigestDocument22 pagesDonation Case DigestRUBY JAN CASASNo ratings yet

- Business Plan: CRMT Industrial Services, IncDocument50 pagesBusiness Plan: CRMT Industrial Services, IncSyed Majeed100% (1)

- Corrected Final Research PaperDocument37 pagesCorrected Final Research PaperNesru SirajNo ratings yet

- Corporate Taxation IntroductionDocument48 pagesCorporate Taxation IntroductionSatyajeet MohantyNo ratings yet

- Acta6 (4of4)Document167 pagesActa6 (4of4)The VaticanNo ratings yet

- PWC Sci 112008Document48 pagesPWC Sci 112008lovologisticsNo ratings yet

- Goldwater Institute Letter On Uber Lyft Airport FeesDocument4 pagesGoldwater Institute Letter On Uber Lyft Airport FeesKevin StoneNo ratings yet

- Unit 1 - Starting A BusinessDocument9 pagesUnit 1 - Starting A BusinessDiêu Bông Đặng Nguyễn ThịNo ratings yet

- Lexus Configuration and Pricing 2022 NX 250 2022-07-31Document2 pagesLexus Configuration and Pricing 2022 NX 250 2022-07-31Parag PadubidriNo ratings yet

- Introduction To Taxation-UCTDocument41 pagesIntroduction To Taxation-UCTArvish RamseebaluckNo ratings yet

- Positive Externalities of Production and ConsumptionDocument20 pagesPositive Externalities of Production and ConsumptionMandeep KaurNo ratings yet

- Allen 2000Document38 pagesAllen 2000meri annisaNo ratings yet

- Engineering Projects (India) LTDDocument80 pagesEngineering Projects (India) LTDआदित्य रॉयNo ratings yet

- Cash BudgetDocument3 pagesCash Budgetmanoj kumarNo ratings yet

- Samsung Invoice 12357051967-7156716887-27W0I0234223Document1 pageSamsung Invoice 12357051967-7156716887-27W0I0234223BarunMondalNo ratings yet

- Geothermal Energy in IndonesiaDocument13 pagesGeothermal Energy in IndonesiaIlham AbroriNo ratings yet

- Jardine Davies V AliposaDocument1 pageJardine Davies V AliposaCharles DavisNo ratings yet

- Lecture NotesDocument10 pagesLecture NotesShubhendu ChauhanNo ratings yet

- Activity 1.3.1Document1 pageActivity 1.3.1De Nev OelNo ratings yet

- RIBAYADocument86 pagesRIBAYACristina SurchNo ratings yet

- 193-CBK Power Co. Ltd. v. CIR G.R. No. 198729-30 January 15, 2014Document5 pages193-CBK Power Co. Ltd. v. CIR G.R. No. 198729-30 January 15, 2014Jopan SJNo ratings yet

- A. Nature, Scope, Classification, and Essential CharacteristicsDocument14 pagesA. Nature, Scope, Classification, and Essential CharacteristicsClariña VirataNo ratings yet

- United States v. Felix Benitez Rexach, 482 F.2d 10, 1st Cir. (1973)Document28 pagesUnited States v. Felix Benitez Rexach, 482 F.2d 10, 1st Cir. (1973)Scribd Government Docs100% (1)

- Algo Trading Agreement: Know All Men by These Presents: DATEDocument3 pagesAlgo Trading Agreement: Know All Men by These Presents: DATEPrashant MahadikNo ratings yet

- Filed: Patrick FisherDocument12 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Ogl 347901676355685668 PDFDocument5 pagesOgl 347901676355685668 PDFBHUSHAN DahaleNo ratings yet

- Orca Share Media1681431711029 7052435751300456049Document2 pagesOrca Share Media1681431711029 7052435751300456049JESSELNo ratings yet