Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

401 viewsChapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)

Chapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)

Uploaded by

Asi Cas JavThe document discusses the disclosure requirements for operating segments under PFRS 8. It provides 5 multiple choice questions that test understanding of these requirements. Specifically:

1. All of the listed disclosures are required, including general segment information, segment profit/loss, assets/liabilities, and reconciliations to entity totals.

2. General information on factors used to identify reportable segments and types of products/services must be disclosed.

3. The total number of major customers is not required to be reconciled across reportable segments and the entity total.

4. Information on major external customers, including those providing 10% or more of a segment's revenue, must be disclosed on an enterprise-

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- South-Western Workbook, TeacherDocument288 pagesSouth-Western Workbook, TeacherJack Jack100% (4)

- Ch.1 Questions & AnswersDocument4 pagesCh.1 Questions & Answersgdghf0% (2)

- LECTURE 2 Intellectual Revolutions That Defined SocietyDocument53 pagesLECTURE 2 Intellectual Revolutions That Defined SocietyAsi Cas Jav73% (11)

- Because Natalie Has Had Such A Successful First Few MonthsDocument3 pagesBecause Natalie Has Had Such A Successful First Few MonthsDoreenNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisDocument126 pagesTest Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisJessa De GuzmanNo ratings yet

- Chapter 11&12 QuestionsDocument8 pagesChapter 11&12 QuestionsMya B. Walker100% (1)

- Pas 17Document6 pagesPas 17AngelicaNo ratings yet

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1lc100% (1)

- Chapter 20 - Operating Segments: QUESTION 20-15 Multiple Choice (PFRS 8)Document7 pagesChapter 20 - Operating Segments: QUESTION 20-15 Multiple Choice (PFRS 8)Cyrus IsanaNo ratings yet

- Quiz - Operating Segments With QuestionsDocument5 pagesQuiz - Operating Segments With Questionsjanus lopezNo ratings yet

- Chapter 3: Business Combination: Based On IFRS 3Document38 pagesChapter 3: Business Combination: Based On IFRS 3ሔርሞን ይድነቃቸውNo ratings yet

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- AFA II ModuleDocument71 pagesAFA II ModulefageenyakaraaNo ratings yet

- Chapter 4 - Joint Arrangements-PROFE01Document6 pagesChapter 4 - Joint Arrangements-PROFE01Steffany RoqueNo ratings yet

- True FalseDocument2 pagesTrue Falsewaiting4y100% (1)

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- Afa Ii Assignment IiDocument2 pagesAfa Ii Assignment Iiworkiemelkamu400100% (1)

- Chapter 17Document37 pagesChapter 17Kad Saad100% (2)

- Notes in Preferential TaxationDocument57 pagesNotes in Preferential TaxationJeremae Ann Ceriaco100% (1)

- Actg 216 Reviwer Part 2 Without AnswerDocument5 pagesActg 216 Reviwer Part 2 Without Answercute meNo ratings yet

- MAS Final ExamDocument1 pageMAS Final ExamMae CruzNo ratings yet

- Exam Chap 13Document59 pagesExam Chap 13oscarv89100% (2)

- IAS 16 QuestionsDocument2 pagesIAS 16 QuestionsMauhammad NajamNo ratings yet

- Test Bank Financial Accounting and Reporting TheoryDocument58 pagesTest Bank Financial Accounting and Reporting TheoryAngelie De LeonNo ratings yet

- Ifrs 5 Acca AnswersDocument2 pagesIfrs 5 Acca AnswersMonirul Islam MoniirrNo ratings yet

- PFRS 1 9Document22 pagesPFRS 1 9Apol AsusNo ratings yet

- Session 3 - Deductions From Gross Income - Principles and Regular Itemized DeductionsDocument9 pagesSession 3 - Deductions From Gross Income - Principles and Regular Itemized DeductionsMitzi WamarNo ratings yet

- Tax MidtermDocument6 pagesTax MidtermJessa Gay Cartagena TorresNo ratings yet

- PFRS 17 - Insurance ContractsDocument28 pagesPFRS 17 - Insurance ContractsHannah TaduranNo ratings yet

- Chapter 4-Differential AnalysisDocument16 pagesChapter 4-Differential AnalysisVanessa HaliliNo ratings yet

- Practice QuestionDocument4 pagesPractice QuestionnabayeelNo ratings yet

- IAS 33: Earnings Per ShareDocument15 pagesIAS 33: Earnings Per SharecolleenyuNo ratings yet

- Chapter 15 - Working CapitalDocument19 pagesChapter 15 - Working CapitalAmjad J AliNo ratings yet

- Module 4 PFRS 11 Joint ArrangementDocument30 pagesModule 4 PFRS 11 Joint Arrangementjulia4razoNo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- Sample Problem of Corporation LiquidationDocument11 pagesSample Problem of Corporation LiquidationAnne Camille Alfonso50% (4)

- Investment in Equity Securities Intacc1Document3 pagesInvestment in Equity Securities Intacc1GIRLNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Final ExamDocument13 pagesFinal ExamddddddaaaaeeeeNo ratings yet

- Got Acctg Rie PDF FreeDocument118 pagesGot Acctg Rie PDF FreeBrian Torres100% (1)

- Chapter 21 and 22 (Complete)Document6 pagesChapter 21 and 22 (Complete)Leah ValdezNo ratings yet

- Local Taxes, Preferential Taxation - QuestionnaireDocument7 pagesLocal Taxes, Preferential Taxation - Questionnaireacctg.files1231No ratings yet

- Ch11 Impairment of AssetsDocument6 pagesCh11 Impairment of AssetsralphalonzoNo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- @2016 CH 3 - Agricultural AccountingDocument35 pages@2016 CH 3 - Agricultural AccountingALEMU TADESSENo ratings yet

- IFRS 15 New FridayDocument73 pagesIFRS 15 New Fridaynati67% (3)

- Multiple Choice Questions: Financial Statements and AnalysisDocument29 pagesMultiple Choice Questions: Financial Statements and AnalysisHarvey PeraltaNo ratings yet

- Master Budget ProblemDocument2 pagesMaster Budget ProblemCillian ReevesNo ratings yet

- Topic 9 Ziha Audit of Purchase and Payment Cycle + Acc PayablesDocument42 pagesTopic 9 Ziha Audit of Purchase and Payment Cycle + Acc PayablesNelin Nisha MohseinNo ratings yet

- A Company Sells and Services Photocopying Machines Its Sales DepartmentDocument2 pagesA Company Sells and Services Photocopying Machines Its Sales DepartmentAmit Pandey0% (1)

- Presentation of Financial StatementsDocument40 pagesPresentation of Financial StatementsQuinta NovitaNo ratings yet

- Chapter 1 The Government and Not-For-Profit Environment TBDocument12 pagesChapter 1 The Government and Not-For-Profit Environment TBGG0% (1)

- Finman ReviewerDocument17 pagesFinman ReviewerSheila Mae Guerta LaceronaNo ratings yet

- Elements of Strategic AuditDocument2 pagesElements of Strategic AuditMae ann LomugdaNo ratings yet

- MAS Quiz BeeDocument37 pagesMAS Quiz BeeRose Gwenn VillanuevaNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Strategic Management Ch14Document15 pagesStrategic Management Ch14Pé IuNo ratings yet

- Unit Two: Branch AccountingDocument17 pagesUnit Two: Branch Accountingtemedebere100% (2)

- Pure TheoriesDocument5 pagesPure Theorieschristine angla100% (1)

- Chapter 08 Translation of Foreign Currency Financial StatementsDocument11 pagesChapter 08 Translation of Foreign Currency Financial StatementsDiana100% (1)

- Accounting For Governmental / Chapter 4Document9 pagesAccounting For Governmental / Chapter 4Kenneth BunnarkNo ratings yet

- Single Entry & ErrorsDocument3 pagesSingle Entry & ErrorsAlellie Khay D JordanNo ratings yet

- IT 101 Midterm Exam Part 2 Hands OnDocument4 pagesIT 101 Midterm Exam Part 2 Hands OnAsi Cas JavNo ratings yet

- For Chapter 4-5-6 Discussion On IT-101Document160 pagesFor Chapter 4-5-6 Discussion On IT-101Asi Cas JavNo ratings yet

- Batangas State University Rizal Avenue, Batangas City Batangas City, 4200Document1 pageBatangas State University Rizal Avenue, Batangas City Batangas City, 4200Asi Cas JavNo ratings yet

- It Solution 1-7Document13 pagesIt Solution 1-7Asi Cas JavNo ratings yet

- Science, Technology and Nation BuildingDocument54 pagesScience, Technology and Nation BuildingAsi Cas JavNo ratings yet

- Patricia Nicole Castillo - Chapter 1 TestsDocument8 pagesPatricia Nicole Castillo - Chapter 1 TestsAsi Cas JavNo ratings yet

- STS Compiled FinalDocument40 pagesSTS Compiled FinalAsi Cas JavNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Chapte r3: Science, Technolog y and Nation BuildingDocument54 pagesChapte r3: Science, Technolog y and Nation BuildingAsi Cas JavNo ratings yet

- STS CompiledDocument61 pagesSTS CompiledAsi Cas JavNo ratings yet

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- STS CompiledDocument60 pagesSTS CompiledAsi Cas JavNo ratings yet

- Chapter 1 BDocument13 pagesChapter 1 BAsi Cas JavNo ratings yet

- Bfin TempDocument21 pagesBfin TempAsi Cas JavNo ratings yet

- Marcom FinalsDocument8 pagesMarcom FinalsAsi Cas JavNo ratings yet

- Financial Analysis: Investment Proposal For Zapatoes IncDocument11 pagesFinancial Analysis: Investment Proposal For Zapatoes IncAsi Cas JavNo ratings yet

- Midterm Exam PointersDocument3 pagesMidterm Exam PointersAsi Cas JavNo ratings yet

- Proposed Topics For SCI Tech PageDocument2 pagesProposed Topics For SCI Tech PageAsi Cas JavNo ratings yet

- Patricia Nicole Castillo: PUV Modernization It Isn't About What You ThinkDocument4 pagesPatricia Nicole Castillo: PUV Modernization It Isn't About What You ThinkAsi Cas JavNo ratings yet

- Transactions of MUTSDocument14 pagesTransactions of MUTSAsi Cas JavNo ratings yet

- Sarahah Got No ChillDocument4 pagesSarahah Got No ChillAsi Cas JavNo ratings yet

- Risk of Continious Usage of Microplasti1Document2 pagesRisk of Continious Usage of Microplasti1Asi Cas JavNo ratings yet

- Peer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Document2 pagesPeer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Asi Cas JavNo ratings yet

- Peer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Document6 pagesPeer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Asi Cas JavNo ratings yet

- Case BackgroundDocument1 pageCase BackgroundAsi Cas JavNo ratings yet

- 74730bos60488 m1 cp2Document82 pages74730bos60488 m1 cp2LalithaJyothiNo ratings yet

- 10.cap+budgeting Cash Flows-1Document20 pages10.cap+budgeting Cash Flows-1Navid GodilNo ratings yet

- Acc203 Conceptual Framework and Accounting StandardsDocument128 pagesAcc203 Conceptual Framework and Accounting StandardsLee TeukNo ratings yet

- Solution Manual For Principles of Managerial Finance Brief 8th Edition ZutterDocument36 pagesSolution Manual For Principles of Managerial Finance Brief 8th Edition Zutterkatevargasqrkbk100% (29)

- MGMT Ad MCQ 2ndDocument10 pagesMGMT Ad MCQ 2ndHiraya ManawariNo ratings yet

- ProfileDocument4 pagesProfileJose FilippiniNo ratings yet

- Chapter 14 Multiple Choices: PROB. 14 - 1 (IAS)Document12 pagesChapter 14 Multiple Choices: PROB. 14 - 1 (IAS)jek vinNo ratings yet

- Lecture 3 Overview of Bond Sectors and InstrumentsDocument98 pagesLecture 3 Overview of Bond Sectors and InstrumentsAsadNo ratings yet

- Aurum India Market PE Update - As of 1 April 2023Document1 pageAurum India Market PE Update - As of 1 April 2023Uppiliappan GopalanNo ratings yet

- Car & BaselDocument7 pagesCar & BaselParimal MaldhureNo ratings yet

- Aaconapps2 00-C91pb2aDocument21 pagesAaconapps2 00-C91pb2aJane DizonNo ratings yet

- Updated - Growbal Player Briefing Paper On Line-V1.1Document21 pagesUpdated - Growbal Player Briefing Paper On Line-V1.1akiyama madokaNo ratings yet

- Ma1 Villamor Finals - ModuleDocument13 pagesMa1 Villamor Finals - ModuleDanielNo ratings yet

- Module - I PDFDocument35 pagesModule - I PDFVarada RajaNo ratings yet

- DUPONT Analysis of Some Selected Indian Companies: Ronw Pat/NwDocument19 pagesDUPONT Analysis of Some Selected Indian Companies: Ronw Pat/NwSandeep HoraNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- 4202 Basic Interview Questions Financial Statement Analysis 14thDocument45 pages4202 Basic Interview Questions Financial Statement Analysis 14thSarkar SahebNo ratings yet

- Ifrs Challenges PDFDocument8 pagesIfrs Challenges PDFMehak AyoubNo ratings yet

- QuizzersDocument4 pagesQuizzersJulie ann EgiptoNo ratings yet

- Company Law IDocument13 pagesCompany Law IAyush AgrawalNo ratings yet

- Formulas #1: Future Value of A Single Cash FlowDocument4 pagesFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanNo ratings yet

- Shareholder Value Analysis: A Review: Dr. Megha Pandey, Deeksha AroraDocument4 pagesShareholder Value Analysis: A Review: Dr. Megha Pandey, Deeksha AroraSumant AlagawadiNo ratings yet

- Audit of Receivables - AuditingDocument9 pagesAudit of Receivables - AuditingTara WelshNo ratings yet

- Exercises (Adjusting)Document7 pagesExercises (Adjusting)Joey G. SantosNo ratings yet

- Tutorial 9 - Dividend and Dividend PolicyDocument2 pagesTutorial 9 - Dividend and Dividend PolicyAmy LimnaNo ratings yet

- An Introduction To Consolidated Financial StatementDocument27 pagesAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNo ratings yet

- Sail Pay RevisionDocument4 pagesSail Pay Revisionhimanshu2010swNo ratings yet

Chapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)

Chapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)

Uploaded by

Asi Cas Jav0 ratings0% found this document useful (0 votes)

401 views2 pagesThe document discusses the disclosure requirements for operating segments under PFRS 8. It provides 5 multiple choice questions that test understanding of these requirements. Specifically:

1. All of the listed disclosures are required, including general segment information, segment profit/loss, assets/liabilities, and reconciliations to entity totals.

2. General information on factors used to identify reportable segments and types of products/services must be disclosed.

3. The total number of major customers is not required to be reconciled across reportable segments and the entity total.

4. Information on major external customers, including those providing 10% or more of a segment's revenue, must be disclosed on an enterprise-

Original Description:

Theory of Financial Accounting Chap 16 solutions

Original Title

CFAS- TFA 20-16

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the disclosure requirements for operating segments under PFRS 8. It provides 5 multiple choice questions that test understanding of these requirements. Specifically:

1. All of the listed disclosures are required, including general segment information, segment profit/loss, assets/liabilities, and reconciliations to entity totals.

2. General information on factors used to identify reportable segments and types of products/services must be disclosed.

3. The total number of major customers is not required to be reconciled across reportable segments and the entity total.

4. Information on major external customers, including those providing 10% or more of a segment's revenue, must be disclosed on an enterprise-

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

401 views2 pagesChapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)

Chapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)

Uploaded by

Asi Cas JavThe document discusses the disclosure requirements for operating segments under PFRS 8. It provides 5 multiple choice questions that test understanding of these requirements. Specifically:

1. All of the listed disclosures are required, including general segment information, segment profit/loss, assets/liabilities, and reconciliations to entity totals.

2. General information on factors used to identify reportable segments and types of products/services must be disclosed.

3. The total number of major customers is not required to be reconciled across reportable segments and the entity total.

4. Information on major external customers, including those providing 10% or more of a segment's revenue, must be disclosed on an enterprise-

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

TFA 1

Chapter 20 – Operating Segments

Princess Rachelle Anne M. Tisbe

Question 20-16 Multiple Choice (PFRS 8)

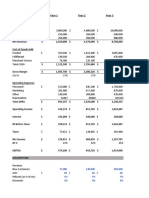

1. What are the disclosures required in relation to operating segments?

a. General information about the operating segment.

b. Information about segment profit or loss, including specified revenue and

expenses included in profit or loss, segment assets and segment liabilities.

c. Reconciliation of total segment revenue, total segment profit or loss, total

segment assets and total segment liabilities to the corresponding amounts in the

entity’s financial statements.

d. All of these are required to be disclosed.

2. An entity shall disclose which of the following general information?

a. Factors used to identify the reportable segments

b. Types of products and services

c. Factors used to identify the reportable segments and types of products and

services

d. Names of the board of directors

3. Segment reporting requires that an entity should provide reconciliations of

segment information. Which is not a required reconciliation?

a. The total of the reportable segments’ revenue to the entity revenue

b. The total of the reportable segments’ profit or loss to the entity profit or loss

before tax expense and discontinued operations

c. The total number of major customers of all segments to the total number of

major customers of the entity

d. The total of the reportable segments’ assets to the entity assets

4. Which of the following is a required enterprises-wide disclosure regarding

external customers?

a. The identify of any external customer considered to be major by management

b. The identify of any external customer providing 10% or more of a particular

operating segment revenue

c. Information on major customers is not required in segment reporting

d. The fact that transactions with a particular external customer constitute at

least 10% of the total entity’ revenue

5. An operating segment is considered reportable when any of the following

conditions is met, except

a. Segment revenue is 10% or more of the combined revenue of all of the entity’s

segments

b. Segments assets are 10% or more of the combined assets of all segments

c. Segments liabilities are 10% or more of the combined liabilities of all

segments

d. Segment’s profit or loss is 10% or more of the combined profit of all segments

that did not incur a loss

You might also like

- South-Western Workbook, TeacherDocument288 pagesSouth-Western Workbook, TeacherJack Jack100% (4)

- Ch.1 Questions & AnswersDocument4 pagesCh.1 Questions & Answersgdghf0% (2)

- LECTURE 2 Intellectual Revolutions That Defined SocietyDocument53 pagesLECTURE 2 Intellectual Revolutions That Defined SocietyAsi Cas Jav73% (11)

- Because Natalie Has Had Such A Successful First Few MonthsDocument3 pagesBecause Natalie Has Had Such A Successful First Few MonthsDoreenNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisDocument126 pagesTest Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisJessa De GuzmanNo ratings yet

- Chapter 11&12 QuestionsDocument8 pagesChapter 11&12 QuestionsMya B. Walker100% (1)

- Pas 17Document6 pagesPas 17AngelicaNo ratings yet

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1lc100% (1)

- Chapter 20 - Operating Segments: QUESTION 20-15 Multiple Choice (PFRS 8)Document7 pagesChapter 20 - Operating Segments: QUESTION 20-15 Multiple Choice (PFRS 8)Cyrus IsanaNo ratings yet

- Quiz - Operating Segments With QuestionsDocument5 pagesQuiz - Operating Segments With Questionsjanus lopezNo ratings yet

- Chapter 3: Business Combination: Based On IFRS 3Document38 pagesChapter 3: Business Combination: Based On IFRS 3ሔርሞን ይድነቃቸውNo ratings yet

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- AFA II ModuleDocument71 pagesAFA II ModulefageenyakaraaNo ratings yet

- Chapter 4 - Joint Arrangements-PROFE01Document6 pagesChapter 4 - Joint Arrangements-PROFE01Steffany RoqueNo ratings yet

- True FalseDocument2 pagesTrue Falsewaiting4y100% (1)

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- Afa Ii Assignment IiDocument2 pagesAfa Ii Assignment Iiworkiemelkamu400100% (1)

- Chapter 17Document37 pagesChapter 17Kad Saad100% (2)

- Notes in Preferential TaxationDocument57 pagesNotes in Preferential TaxationJeremae Ann Ceriaco100% (1)

- Actg 216 Reviwer Part 2 Without AnswerDocument5 pagesActg 216 Reviwer Part 2 Without Answercute meNo ratings yet

- MAS Final ExamDocument1 pageMAS Final ExamMae CruzNo ratings yet

- Exam Chap 13Document59 pagesExam Chap 13oscarv89100% (2)

- IAS 16 QuestionsDocument2 pagesIAS 16 QuestionsMauhammad NajamNo ratings yet

- Test Bank Financial Accounting and Reporting TheoryDocument58 pagesTest Bank Financial Accounting and Reporting TheoryAngelie De LeonNo ratings yet

- Ifrs 5 Acca AnswersDocument2 pagesIfrs 5 Acca AnswersMonirul Islam MoniirrNo ratings yet

- PFRS 1 9Document22 pagesPFRS 1 9Apol AsusNo ratings yet

- Session 3 - Deductions From Gross Income - Principles and Regular Itemized DeductionsDocument9 pagesSession 3 - Deductions From Gross Income - Principles and Regular Itemized DeductionsMitzi WamarNo ratings yet

- Tax MidtermDocument6 pagesTax MidtermJessa Gay Cartagena TorresNo ratings yet

- PFRS 17 - Insurance ContractsDocument28 pagesPFRS 17 - Insurance ContractsHannah TaduranNo ratings yet

- Chapter 4-Differential AnalysisDocument16 pagesChapter 4-Differential AnalysisVanessa HaliliNo ratings yet

- Practice QuestionDocument4 pagesPractice QuestionnabayeelNo ratings yet

- IAS 33: Earnings Per ShareDocument15 pagesIAS 33: Earnings Per SharecolleenyuNo ratings yet

- Chapter 15 - Working CapitalDocument19 pagesChapter 15 - Working CapitalAmjad J AliNo ratings yet

- Module 4 PFRS 11 Joint ArrangementDocument30 pagesModule 4 PFRS 11 Joint Arrangementjulia4razoNo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- Sample Problem of Corporation LiquidationDocument11 pagesSample Problem of Corporation LiquidationAnne Camille Alfonso50% (4)

- Investment in Equity Securities Intacc1Document3 pagesInvestment in Equity Securities Intacc1GIRLNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Final ExamDocument13 pagesFinal ExamddddddaaaaeeeeNo ratings yet

- Got Acctg Rie PDF FreeDocument118 pagesGot Acctg Rie PDF FreeBrian Torres100% (1)

- Chapter 21 and 22 (Complete)Document6 pagesChapter 21 and 22 (Complete)Leah ValdezNo ratings yet

- Local Taxes, Preferential Taxation - QuestionnaireDocument7 pagesLocal Taxes, Preferential Taxation - Questionnaireacctg.files1231No ratings yet

- Ch11 Impairment of AssetsDocument6 pagesCh11 Impairment of AssetsralphalonzoNo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- @2016 CH 3 - Agricultural AccountingDocument35 pages@2016 CH 3 - Agricultural AccountingALEMU TADESSENo ratings yet

- IFRS 15 New FridayDocument73 pagesIFRS 15 New Fridaynati67% (3)

- Multiple Choice Questions: Financial Statements and AnalysisDocument29 pagesMultiple Choice Questions: Financial Statements and AnalysisHarvey PeraltaNo ratings yet

- Master Budget ProblemDocument2 pagesMaster Budget ProblemCillian ReevesNo ratings yet

- Topic 9 Ziha Audit of Purchase and Payment Cycle + Acc PayablesDocument42 pagesTopic 9 Ziha Audit of Purchase and Payment Cycle + Acc PayablesNelin Nisha MohseinNo ratings yet

- A Company Sells and Services Photocopying Machines Its Sales DepartmentDocument2 pagesA Company Sells and Services Photocopying Machines Its Sales DepartmentAmit Pandey0% (1)

- Presentation of Financial StatementsDocument40 pagesPresentation of Financial StatementsQuinta NovitaNo ratings yet

- Chapter 1 The Government and Not-For-Profit Environment TBDocument12 pagesChapter 1 The Government and Not-For-Profit Environment TBGG0% (1)

- Finman ReviewerDocument17 pagesFinman ReviewerSheila Mae Guerta LaceronaNo ratings yet

- Elements of Strategic AuditDocument2 pagesElements of Strategic AuditMae ann LomugdaNo ratings yet

- MAS Quiz BeeDocument37 pagesMAS Quiz BeeRose Gwenn VillanuevaNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Strategic Management Ch14Document15 pagesStrategic Management Ch14Pé IuNo ratings yet

- Unit Two: Branch AccountingDocument17 pagesUnit Two: Branch Accountingtemedebere100% (2)

- Pure TheoriesDocument5 pagesPure Theorieschristine angla100% (1)

- Chapter 08 Translation of Foreign Currency Financial StatementsDocument11 pagesChapter 08 Translation of Foreign Currency Financial StatementsDiana100% (1)

- Accounting For Governmental / Chapter 4Document9 pagesAccounting For Governmental / Chapter 4Kenneth BunnarkNo ratings yet

- Single Entry & ErrorsDocument3 pagesSingle Entry & ErrorsAlellie Khay D JordanNo ratings yet

- IT 101 Midterm Exam Part 2 Hands OnDocument4 pagesIT 101 Midterm Exam Part 2 Hands OnAsi Cas JavNo ratings yet

- For Chapter 4-5-6 Discussion On IT-101Document160 pagesFor Chapter 4-5-6 Discussion On IT-101Asi Cas JavNo ratings yet

- Batangas State University Rizal Avenue, Batangas City Batangas City, 4200Document1 pageBatangas State University Rizal Avenue, Batangas City Batangas City, 4200Asi Cas JavNo ratings yet

- It Solution 1-7Document13 pagesIt Solution 1-7Asi Cas JavNo ratings yet

- Science, Technology and Nation BuildingDocument54 pagesScience, Technology and Nation BuildingAsi Cas JavNo ratings yet

- Patricia Nicole Castillo - Chapter 1 TestsDocument8 pagesPatricia Nicole Castillo - Chapter 1 TestsAsi Cas JavNo ratings yet

- STS Compiled FinalDocument40 pagesSTS Compiled FinalAsi Cas JavNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Chapte r3: Science, Technolog y and Nation BuildingDocument54 pagesChapte r3: Science, Technolog y and Nation BuildingAsi Cas JavNo ratings yet

- STS CompiledDocument61 pagesSTS CompiledAsi Cas JavNo ratings yet

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- STS CompiledDocument60 pagesSTS CompiledAsi Cas JavNo ratings yet

- Chapter 1 BDocument13 pagesChapter 1 BAsi Cas JavNo ratings yet

- Bfin TempDocument21 pagesBfin TempAsi Cas JavNo ratings yet

- Marcom FinalsDocument8 pagesMarcom FinalsAsi Cas JavNo ratings yet

- Financial Analysis: Investment Proposal For Zapatoes IncDocument11 pagesFinancial Analysis: Investment Proposal For Zapatoes IncAsi Cas JavNo ratings yet

- Midterm Exam PointersDocument3 pagesMidterm Exam PointersAsi Cas JavNo ratings yet

- Proposed Topics For SCI Tech PageDocument2 pagesProposed Topics For SCI Tech PageAsi Cas JavNo ratings yet

- Patricia Nicole Castillo: PUV Modernization It Isn't About What You ThinkDocument4 pagesPatricia Nicole Castillo: PUV Modernization It Isn't About What You ThinkAsi Cas JavNo ratings yet

- Transactions of MUTSDocument14 pagesTransactions of MUTSAsi Cas JavNo ratings yet

- Sarahah Got No ChillDocument4 pagesSarahah Got No ChillAsi Cas JavNo ratings yet

- Risk of Continious Usage of Microplasti1Document2 pagesRisk of Continious Usage of Microplasti1Asi Cas JavNo ratings yet

- Peer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Document2 pagesPeer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Asi Cas JavNo ratings yet

- Peer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Document6 pagesPeer Assesment For Performance Task (Booth Set Up) Fundamentals of Abm1Asi Cas JavNo ratings yet

- Case BackgroundDocument1 pageCase BackgroundAsi Cas JavNo ratings yet

- 74730bos60488 m1 cp2Document82 pages74730bos60488 m1 cp2LalithaJyothiNo ratings yet

- 10.cap+budgeting Cash Flows-1Document20 pages10.cap+budgeting Cash Flows-1Navid GodilNo ratings yet

- Acc203 Conceptual Framework and Accounting StandardsDocument128 pagesAcc203 Conceptual Framework and Accounting StandardsLee TeukNo ratings yet

- Solution Manual For Principles of Managerial Finance Brief 8th Edition ZutterDocument36 pagesSolution Manual For Principles of Managerial Finance Brief 8th Edition Zutterkatevargasqrkbk100% (29)

- MGMT Ad MCQ 2ndDocument10 pagesMGMT Ad MCQ 2ndHiraya ManawariNo ratings yet

- ProfileDocument4 pagesProfileJose FilippiniNo ratings yet

- Chapter 14 Multiple Choices: PROB. 14 - 1 (IAS)Document12 pagesChapter 14 Multiple Choices: PROB. 14 - 1 (IAS)jek vinNo ratings yet

- Lecture 3 Overview of Bond Sectors and InstrumentsDocument98 pagesLecture 3 Overview of Bond Sectors and InstrumentsAsadNo ratings yet

- Aurum India Market PE Update - As of 1 April 2023Document1 pageAurum India Market PE Update - As of 1 April 2023Uppiliappan GopalanNo ratings yet

- Car & BaselDocument7 pagesCar & BaselParimal MaldhureNo ratings yet

- Aaconapps2 00-C91pb2aDocument21 pagesAaconapps2 00-C91pb2aJane DizonNo ratings yet

- Updated - Growbal Player Briefing Paper On Line-V1.1Document21 pagesUpdated - Growbal Player Briefing Paper On Line-V1.1akiyama madokaNo ratings yet

- Ma1 Villamor Finals - ModuleDocument13 pagesMa1 Villamor Finals - ModuleDanielNo ratings yet

- Module - I PDFDocument35 pagesModule - I PDFVarada RajaNo ratings yet

- DUPONT Analysis of Some Selected Indian Companies: Ronw Pat/NwDocument19 pagesDUPONT Analysis of Some Selected Indian Companies: Ronw Pat/NwSandeep HoraNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- 4202 Basic Interview Questions Financial Statement Analysis 14thDocument45 pages4202 Basic Interview Questions Financial Statement Analysis 14thSarkar SahebNo ratings yet

- Ifrs Challenges PDFDocument8 pagesIfrs Challenges PDFMehak AyoubNo ratings yet

- QuizzersDocument4 pagesQuizzersJulie ann EgiptoNo ratings yet

- Company Law IDocument13 pagesCompany Law IAyush AgrawalNo ratings yet

- Formulas #1: Future Value of A Single Cash FlowDocument4 pagesFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanNo ratings yet

- Shareholder Value Analysis: A Review: Dr. Megha Pandey, Deeksha AroraDocument4 pagesShareholder Value Analysis: A Review: Dr. Megha Pandey, Deeksha AroraSumant AlagawadiNo ratings yet

- Audit of Receivables - AuditingDocument9 pagesAudit of Receivables - AuditingTara WelshNo ratings yet

- Exercises (Adjusting)Document7 pagesExercises (Adjusting)Joey G. SantosNo ratings yet

- Tutorial 9 - Dividend and Dividend PolicyDocument2 pagesTutorial 9 - Dividend and Dividend PolicyAmy LimnaNo ratings yet

- An Introduction To Consolidated Financial StatementDocument27 pagesAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNo ratings yet

- Sail Pay RevisionDocument4 pagesSail Pay Revisionhimanshu2010swNo ratings yet