Professional Documents

Culture Documents

Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Facts

Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Facts

Uploaded by

audrich carlo agustinCopyright:

Available Formats

You might also like

- The First 100 Days in Office of Barangay OfficialsDocument2 pagesThe First 100 Days in Office of Barangay OfficialsShy Pantinople87% (15)

- Sanders vs. Veridiano Case DigestsDocument4 pagesSanders vs. Veridiano Case DigestsBrian Balio50% (2)

- CONSTI Occena Vs ComelecDocument3 pagesCONSTI Occena Vs ComelecPafra BariuanNo ratings yet

- BCDA v. COA, G.R. No. 178160, February 26, 2009.Document7 pagesBCDA v. COA, G.R. No. 178160, February 26, 2009.Emerson NunezNo ratings yet

- Department of Health vs. Phil. Pharmawealth, Inc., 691 SCRA 421, G.R. No. 182358 February 20, 2013Document18 pagesDepartment of Health vs. Phil. Pharmawealth, Inc., 691 SCRA 421, G.R. No. 182358 February 20, 2013Marl Dela ROsaNo ratings yet

- Consti Digested NewDocument17 pagesConsti Digested NewCarol Jacinto100% (1)

- #78 Lozano V NogralesDocument1 page#78 Lozano V NogralesAngelo Raphael B. DelmundoNo ratings yet

- Air Transportation Office V Sps Ramos DigestDocument1 pageAir Transportation Office V Sps Ramos DigestCieloMarieNo ratings yet

- BFAR v. COA - Consti 1Document13 pagesBFAR v. COA - Consti 1rafNo ratings yet

- (Digest) Phil. Agila Satellite v. Lichauco6666Document1 page(Digest) Phil. Agila Satellite v. Lichauco6666Harold Q. GardonNo ratings yet

- Govt of The Phil Island Vs Monte de PiedadDocument7 pagesGovt of The Phil Island Vs Monte de PiedadAlessiah S. PAGAYON100% (1)

- 2 Vasquez Vilas vs. City of Manila Etc PDFDocument17 pages2 Vasquez Vilas vs. City of Manila Etc PDFCelina GonzalesNo ratings yet

- Notes On Judicial DepartmentDocument16 pagesNotes On Judicial DepartmentGeelleanne L UbaldeNo ratings yet

- Digest - Almario Vs AlbaDocument1 pageDigest - Almario Vs AlbakvnjnNo ratings yet

- DA Vs NLRCDocument13 pagesDA Vs NLRCJona ReyesNo ratings yet

- Dreamwork Construction V JaniolaDocument2 pagesDreamwork Construction V JaniolaCedricNo ratings yet

- Tolentino v. COMELECDocument1 pageTolentino v. COMELECSheena Reyes-BellenNo ratings yet

- State Immunity Case DigestsDocument35 pagesState Immunity Case DigestsA Paula Cruz Francisco100% (1)

- Ondoy Vs IgnacioDocument1 pageOndoy Vs IgnacioAly RzNo ratings yet

- Francisco vs. House of Representatives, G.R. No. 160261, Nov. 10, 2003Document34 pagesFrancisco vs. House of Representatives, G.R. No. 160261, Nov. 10, 2003Inez PadsNo ratings yet

- Lyons V US DigestDocument2 pagesLyons V US DigestEmrys PendragonNo ratings yet

- Syquia V Almeda LopezDocument1 pageSyquia V Almeda LopezJolo RomanNo ratings yet

- CONSTI DIGEST - Concept of The StateDocument5 pagesCONSTI DIGEST - Concept of The StateKim ZayatNo ratings yet

- Case Digest HOWDocument6 pagesCase Digest HOWCar JoNo ratings yet

- Javellana Vs Executive SecretaryDocument2 pagesJavellana Vs Executive SecretaryLeitz Camyll Ang-AwNo ratings yet

- Macalintal Vs PETDocument10 pagesMacalintal Vs PETVina LangidenNo ratings yet

- Choa Vs BeldiaDocument2 pagesChoa Vs BeldiaKoko KwikKwakNo ratings yet

- Lambino Vs COMELECDocument2 pagesLambino Vs COMELECDianne ComonNo ratings yet

- Case Digest ConstiDocument120 pagesCase Digest ConstidanecjvNo ratings yet

- Consti Batch 2 Case DigestDocument55 pagesConsti Batch 2 Case Digestayasue100% (2)

- PVTA Vs CIRDocument1 pagePVTA Vs CIRRochelle Ann ReyesNo ratings yet

- Ruiz Vs CabahugDocument4 pagesRuiz Vs CabahugDiane UyNo ratings yet

- Kawanakoa v. Polybank, 205 US 349Document2 pagesKawanakoa v. Polybank, 205 US 349norzeNo ratings yet

- Consti CasesDocument25 pagesConsti CasesAGLD100% (3)

- Book Iv Obligations and Contracts Title. I. - Obligations General ProvisionsDocument149 pagesBook Iv Obligations and Contracts Title. I. - Obligations General ProvisionsDak KoykoyNo ratings yet

- MANILA PRINCE HOTEL vs. GSISDocument3 pagesMANILA PRINCE HOTEL vs. GSISJen75% (4)

- CYNTHIA BOLOS V DANILO BOLOSDocument2 pagesCYNTHIA BOLOS V DANILO BOLOSNichole Lustica100% (1)

- 43 Scra 360 - Amigable Vs CuencaDocument6 pages43 Scra 360 - Amigable Vs CuencaMj GarciaNo ratings yet

- Laurel vs. Misa (G.R. No.L-409) (January 30, 1947)Document1 pageLaurel vs. Misa (G.R. No.L-409) (January 30, 1947)Benedicto PintorNo ratings yet

- Magallona vs. Ermita G.R. No 187167Document23 pagesMagallona vs. Ermita G.R. No 187167ChristianneDominiqueGravosoNo ratings yet

- Art XVI Notes From Fr. BDocument5 pagesArt XVI Notes From Fr. BMandy Mercado AndersonNo ratings yet

- Accfa VS Cugco Case DigestDocument17 pagesAccfa VS Cugco Case DigestJey Rhy100% (1)

- Sevilla v. Cardenas, GR 167684Document7 pagesSevilla v. Cardenas, GR 167684Peter RojasNo ratings yet

- Merritt V Government of The Philippine IslandsDocument2 pagesMerritt V Government of The Philippine IslandsAngelie FloresNo ratings yet

- Salonga v. FarralesDocument4 pagesSalonga v. FarralesKim LaguardiaNo ratings yet

- Digest Lozano v. NogralesDocument1 pageDigest Lozano v. NogralesAbby EvangelistaNo ratings yet

- Imbong V ComelecDocument3 pagesImbong V ComelecDong OnyongNo ratings yet

- Aisporna V CA DigestDocument3 pagesAisporna V CA DigestJRMNo ratings yet

- II C Agustin V Court of Appeals 338 Phil 171 1997Document2 pagesII C Agustin V Court of Appeals 338 Phil 171 1997Kristell FerrerNo ratings yet

- IMBONG vs. COMELEC 35 SCRA 28 G.R No. L-32432, SEPTEMBER 11, 1970Document15 pagesIMBONG vs. COMELEC 35 SCRA 28 G.R No. L-32432, SEPTEMBER 11, 1970EriyunaNo ratings yet

- 45 - Oposa v. Factoran - BacinaDocument4 pages45 - Oposa v. Factoran - BacinaChaNo ratings yet

- Digest-Statcon Sept 23, 2017Document7 pagesDigest-Statcon Sept 23, 2017Anthony Arcilla PulhinNo ratings yet

- De Haber Vs Queen of PortugalDocument2 pagesDe Haber Vs Queen of PortugalthesarahkristinNo ratings yet

- Sanders Vs Veridiano G R No l-46930Document2 pagesSanders Vs Veridiano G R No l-46930Aina SyNo ratings yet

- 5 Sanidad v. Comelec 1976Document1 page5 Sanidad v. Comelec 1976Carlota Nicolas VillaromanNo ratings yet

- 3 Lambino v. Comelec DigestDocument2 pages3 Lambino v. Comelec DigestArianneParalisanNo ratings yet

- State Immunity - Day 3 - DigestsDocument17 pagesState Immunity - Day 3 - DigestsDEAN JASPERNo ratings yet

- Poli Rev - GarciaVsDrilonDocument2 pagesPoli Rev - GarciaVsDrilonKarolM.No ratings yet

- G.R. No. 178160Document5 pagesG.R. No. 178160Joshua Buenaobra CapispisanNo ratings yet

- BCDA v. COA (G.R. No. 178160)Document7 pagesBCDA v. COA (G.R. No. 178160)shallyNo ratings yet

- 003 - BCDA v. COA (2009)Document8 pages003 - BCDA v. COA (2009)Cheska VergaraNo ratings yet

- Republic Represented by DAR Vs CA and Green City Estate and Development Corporation (GR No. 139592, October 5, 2000)Document1 pageRepublic Represented by DAR Vs CA and Green City Estate and Development Corporation (GR No. 139592, October 5, 2000)audrich carlo agustinNo ratings yet

- 9 GPI Vs Monte de PiedadDocument1 page9 GPI Vs Monte de Piedadaudrich carlo agustinNo ratings yet

- BFAR Employees Union Issued Resolution No. 01 Requesting The BFAR CentralDocument1 pageBFAR Employees Union Issued Resolution No. 01 Requesting The BFAR Centralaudrich carlo agustinNo ratings yet

- Soriano Vs Laguardia G.R. No. 164785, 29 April 2009 FactsDocument1 pageSoriano Vs Laguardia G.R. No. 164785, 29 April 2009 Factsaudrich carlo agustinNo ratings yet

- 14 LLBP Vs AquinoDocument1 page14 LLBP Vs Aquinoaudrich carlo agustinNo ratings yet

- Audrich Carlo R. AgustinDocument3 pagesAudrich Carlo R. Agustinaudrich carlo agustinNo ratings yet

- Chapter 2 Lesson 2 (Part 1)Document3 pagesChapter 2 Lesson 2 (Part 1)audrich carlo agustinNo ratings yet

- Ex Post Facto Law - Case 5 TITLE: FRANK MEKIN, Petitioner and Appellee, vs. GEORGE N. WOLFE, Respondent and AppellantDocument6 pagesEx Post Facto Law - Case 5 TITLE: FRANK MEKIN, Petitioner and Appellee, vs. GEORGE N. WOLFE, Respondent and Appellantaudrich carlo agustinNo ratings yet

- Case Digest Crim 1Document8 pagesCase Digest Crim 1audrich carlo agustinNo ratings yet

- California Judicial Conduct Handbook Excerpt: David M. Rothman California Judges Association - California Commission On Judicial Performance - California Supreme CourtDocument24 pagesCalifornia Judicial Conduct Handbook Excerpt: David M. Rothman California Judges Association - California Commission On Judicial Performance - California Supreme CourtCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Oblicon Reviewer (Final Exam)Document4 pagesOblicon Reviewer (Final Exam)von vidorNo ratings yet

- Apostille (Format) Word and PicDocument2 pagesApostille (Format) Word and PicBee ValentineNo ratings yet

- Company Law RESEARCH PAPERDocument17 pagesCompany Law RESEARCH PAPERKislay TarunNo ratings yet

- Do Patents Matter For Commercialization - SSRN-id3952317Document34 pagesDo Patents Matter For Commercialization - SSRN-id3952317Alex ENo ratings yet

- Asian Terminal v. Simon Enterprises (177116)Document6 pagesAsian Terminal v. Simon Enterprises (177116)Josef MacanasNo ratings yet

- Isl V League RulesDocument3 pagesIsl V League Rulesron samanteNo ratings yet

- Case Digests For Atty. Ranada's ATAP ClassDocument106 pagesCase Digests For Atty. Ranada's ATAP ClassAntonio DelgadoNo ratings yet

- Curt Meltzer v. Kentucky High-Tech Greenhouses, Et Al. - Defendants' Memorandum of Law in OppositionDocument25 pagesCurt Meltzer v. Kentucky High-Tech Greenhouses, Et Al. - Defendants' Memorandum of Law in OppositionLOPRESTI PLLCNo ratings yet

- Calida Petition Vs Senate ProbeDocument39 pagesCalida Petition Vs Senate ProbeNami Buan100% (1)

- Property, Plant and EquipmentDocument45 pagesProperty, Plant and EquipmentRiyah ParasNo ratings yet

- Math9 Q4mod6 SineLaw Gey-Steve Ana-Ao Bgo v2Document25 pagesMath9 Q4mod6 SineLaw Gey-Steve Ana-Ao Bgo v2benjamingapayNo ratings yet

- Subject: Instructions For Submitting Expenditure Reports For NGIRI IGNITE Funded ProjectsDocument1 pageSubject: Instructions For Submitting Expenditure Reports For NGIRI IGNITE Funded Projectsiffi khanNo ratings yet

- Francisco Lao Lim vs. CA GR No. 87407, Oct 31, 1990Document7 pagesFrancisco Lao Lim vs. CA GR No. 87407, Oct 31, 1990Charles BayNo ratings yet

- Salient Changes Under The Revised Corporation Code - Cruz Marcelo & TenefranciaDocument4 pagesSalient Changes Under The Revised Corporation Code - Cruz Marcelo & TenefranciaCorey RemetreNo ratings yet

- U.S Culture Key TermsDocument2 pagesU.S Culture Key Termslinae0830No ratings yet

- In The Matter of The South China Sea ArbitrationDocument5 pagesIn The Matter of The South China Sea ArbitrationCiara De Leon100% (1)

- E-Governance Police Prison PSUsDocument4 pagesE-Governance Police Prison PSUssh LaksNo ratings yet

- OCA Circular No. 157-2023Document2 pagesOCA Circular No. 157-2023Melford MirasolNo ratings yet

- Case of Cuban Pyjamas at Wal-Mart Stores in CanadaDocument2 pagesCase of Cuban Pyjamas at Wal-Mart Stores in CanadaJubin PradhanNo ratings yet

- AutomobileDocument3 pagesAutomobileSivaji Kakarla KNo ratings yet

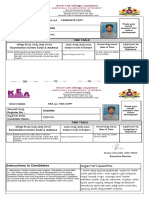

- Keaapplicationpd KPJC1106500 18072022 120323Document2 pagesKeaapplicationpd KPJC1106500 18072022 120323pavanNo ratings yet

- Name: Charlotte Cabading Subject: ENG 111 Course/Year/Set: BSDRM SET ADocument10 pagesName: Charlotte Cabading Subject: ENG 111 Course/Year/Set: BSDRM SET AJudeza Jaira B. LabadanNo ratings yet

- People V Adriano GR 205228 CDDocument2 pagesPeople V Adriano GR 205228 CDLester Fiel Panopio100% (1)

- Q94. Sycamore Vs Metropolitan BankDocument2 pagesQ94. Sycamore Vs Metropolitan BankCarmz SumileNo ratings yet

- Chrisimm Sentimo Kumon Accounting and Bookkeeping ServicesDocument7 pagesChrisimm Sentimo Kumon Accounting and Bookkeeping ServicesHannahbea LindoNo ratings yet

- Capital Gains Tax Acknowledgment ReceiptDocument1 pageCapital Gains Tax Acknowledgment ReceiptDavid MugambiNo ratings yet

- STATCON Case ListDocument6 pagesSTATCON Case ListJj SantosNo ratings yet

- Velarde vs. Social Justice SocietyDocument16 pagesVelarde vs. Social Justice SocietyMarife Tubilag ManejaNo ratings yet

Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Facts

Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Facts

Uploaded by

audrich carlo agustinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Facts

Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Facts

Uploaded by

audrich carlo agustinCopyright:

Available Formats

Bases Conversion and Development Authority vs.

Commission on Audit

G.R. No. 178160, 26 February 2009

Facts:

On March 13, 1992, RA No. 7227 was approved, creating the Bases Conversion and

Development Authority (BCDA). Section 9 states that the BCDA Board of Directors (Board)

shall exercise the powers and functions of BCDA. Section 10 then states that function of the

Board also includes the adoption of a compensation and benefit scheme at least equivalent to

the Banko Sentral ng Pilipinas.

On 20 Dec. 1996, the Board adopted a new compensation and benefit scheme that grants

year-end benefits to each contractual employee, regular employee, and Board member. Aside

from this, they also granted it to full-time consultant later on.

On 25 Aug. 1997, Board Chairman Basco recommended to President Ramos the approval

of the new scheme. It was approved on 9 Oct. 1997.

On 20 Feb 2003, COA issued Audit Observation Memorandum No. 2003-004 stating that

the grant of year-end benefits to Board members was contrary to Department of Budget and

Management Circular Letter No. 2002-2. On 8 Jan. 2004, COA issued a Notice of Disallowance

No. 03-001-BCDA-(02) to disallow the year-end benefit to the Board members and Full Time

Consultants. BCDA filed a notice of appeal dated 8 Sept. 2004 and an appeal memorandum

dated 23 Dec. 2004 to COA.

In Decision No. 2007-020, the COA affirmed the disallowance of the year-end benefit

granted to Board members and full-time consultants and held that good faith did not apply to

them. As stated in DBM Circular letter No. 2002-02, the members and ex officio members of the

Board of Directors are not entitled to YEB, they being not salaried officials of the government.

Good faith is in question because despite the prior notice, the BCDA still enacted a new

benefit scheme including them in it.

Thus the petition for certiorari is filed. It seeks to nullify Decision No. 2007-020 dated 12

April 2007 of COA.

Issue:

Whether or not Art.2, Sec. 5 and 18 of the constitution are binding as a legal basis for the

claim of granting year-end benefit?

Held:

No. The court dismissed the claim. Article 2, based on its title, is only a statement of

general ideological principles and policies. The said provision of Article 2 is not a source of

enforceable rights. Ina previous similar case (Tondo Medical Center Employees Association v.

Court of Appeals), the court held that Sec. 5 and 18, Art. 2 of the Constitution are not self-

executing provisions. Thus, the said provisions are not a legal basis for the said claim

https://pdfslide.net/documents/bcda-v-coa-case-digest.html

You might also like

- The First 100 Days in Office of Barangay OfficialsDocument2 pagesThe First 100 Days in Office of Barangay OfficialsShy Pantinople87% (15)

- Sanders vs. Veridiano Case DigestsDocument4 pagesSanders vs. Veridiano Case DigestsBrian Balio50% (2)

- CONSTI Occena Vs ComelecDocument3 pagesCONSTI Occena Vs ComelecPafra BariuanNo ratings yet

- BCDA v. COA, G.R. No. 178160, February 26, 2009.Document7 pagesBCDA v. COA, G.R. No. 178160, February 26, 2009.Emerson NunezNo ratings yet

- Department of Health vs. Phil. Pharmawealth, Inc., 691 SCRA 421, G.R. No. 182358 February 20, 2013Document18 pagesDepartment of Health vs. Phil. Pharmawealth, Inc., 691 SCRA 421, G.R. No. 182358 February 20, 2013Marl Dela ROsaNo ratings yet

- Consti Digested NewDocument17 pagesConsti Digested NewCarol Jacinto100% (1)

- #78 Lozano V NogralesDocument1 page#78 Lozano V NogralesAngelo Raphael B. DelmundoNo ratings yet

- Air Transportation Office V Sps Ramos DigestDocument1 pageAir Transportation Office V Sps Ramos DigestCieloMarieNo ratings yet

- BFAR v. COA - Consti 1Document13 pagesBFAR v. COA - Consti 1rafNo ratings yet

- (Digest) Phil. Agila Satellite v. Lichauco6666Document1 page(Digest) Phil. Agila Satellite v. Lichauco6666Harold Q. GardonNo ratings yet

- Govt of The Phil Island Vs Monte de PiedadDocument7 pagesGovt of The Phil Island Vs Monte de PiedadAlessiah S. PAGAYON100% (1)

- 2 Vasquez Vilas vs. City of Manila Etc PDFDocument17 pages2 Vasquez Vilas vs. City of Manila Etc PDFCelina GonzalesNo ratings yet

- Notes On Judicial DepartmentDocument16 pagesNotes On Judicial DepartmentGeelleanne L UbaldeNo ratings yet

- Digest - Almario Vs AlbaDocument1 pageDigest - Almario Vs AlbakvnjnNo ratings yet

- DA Vs NLRCDocument13 pagesDA Vs NLRCJona ReyesNo ratings yet

- Dreamwork Construction V JaniolaDocument2 pagesDreamwork Construction V JaniolaCedricNo ratings yet

- Tolentino v. COMELECDocument1 pageTolentino v. COMELECSheena Reyes-BellenNo ratings yet

- State Immunity Case DigestsDocument35 pagesState Immunity Case DigestsA Paula Cruz Francisco100% (1)

- Ondoy Vs IgnacioDocument1 pageOndoy Vs IgnacioAly RzNo ratings yet

- Francisco vs. House of Representatives, G.R. No. 160261, Nov. 10, 2003Document34 pagesFrancisco vs. House of Representatives, G.R. No. 160261, Nov. 10, 2003Inez PadsNo ratings yet

- Lyons V US DigestDocument2 pagesLyons V US DigestEmrys PendragonNo ratings yet

- Syquia V Almeda LopezDocument1 pageSyquia V Almeda LopezJolo RomanNo ratings yet

- CONSTI DIGEST - Concept of The StateDocument5 pagesCONSTI DIGEST - Concept of The StateKim ZayatNo ratings yet

- Case Digest HOWDocument6 pagesCase Digest HOWCar JoNo ratings yet

- Javellana Vs Executive SecretaryDocument2 pagesJavellana Vs Executive SecretaryLeitz Camyll Ang-AwNo ratings yet

- Macalintal Vs PETDocument10 pagesMacalintal Vs PETVina LangidenNo ratings yet

- Choa Vs BeldiaDocument2 pagesChoa Vs BeldiaKoko KwikKwakNo ratings yet

- Lambino Vs COMELECDocument2 pagesLambino Vs COMELECDianne ComonNo ratings yet

- Case Digest ConstiDocument120 pagesCase Digest ConstidanecjvNo ratings yet

- Consti Batch 2 Case DigestDocument55 pagesConsti Batch 2 Case Digestayasue100% (2)

- PVTA Vs CIRDocument1 pagePVTA Vs CIRRochelle Ann ReyesNo ratings yet

- Ruiz Vs CabahugDocument4 pagesRuiz Vs CabahugDiane UyNo ratings yet

- Kawanakoa v. Polybank, 205 US 349Document2 pagesKawanakoa v. Polybank, 205 US 349norzeNo ratings yet

- Consti CasesDocument25 pagesConsti CasesAGLD100% (3)

- Book Iv Obligations and Contracts Title. I. - Obligations General ProvisionsDocument149 pagesBook Iv Obligations and Contracts Title. I. - Obligations General ProvisionsDak KoykoyNo ratings yet

- MANILA PRINCE HOTEL vs. GSISDocument3 pagesMANILA PRINCE HOTEL vs. GSISJen75% (4)

- CYNTHIA BOLOS V DANILO BOLOSDocument2 pagesCYNTHIA BOLOS V DANILO BOLOSNichole Lustica100% (1)

- 43 Scra 360 - Amigable Vs CuencaDocument6 pages43 Scra 360 - Amigable Vs CuencaMj GarciaNo ratings yet

- Laurel vs. Misa (G.R. No.L-409) (January 30, 1947)Document1 pageLaurel vs. Misa (G.R. No.L-409) (January 30, 1947)Benedicto PintorNo ratings yet

- Magallona vs. Ermita G.R. No 187167Document23 pagesMagallona vs. Ermita G.R. No 187167ChristianneDominiqueGravosoNo ratings yet

- Art XVI Notes From Fr. BDocument5 pagesArt XVI Notes From Fr. BMandy Mercado AndersonNo ratings yet

- Accfa VS Cugco Case DigestDocument17 pagesAccfa VS Cugco Case DigestJey Rhy100% (1)

- Sevilla v. Cardenas, GR 167684Document7 pagesSevilla v. Cardenas, GR 167684Peter RojasNo ratings yet

- Merritt V Government of The Philippine IslandsDocument2 pagesMerritt V Government of The Philippine IslandsAngelie FloresNo ratings yet

- Salonga v. FarralesDocument4 pagesSalonga v. FarralesKim LaguardiaNo ratings yet

- Digest Lozano v. NogralesDocument1 pageDigest Lozano v. NogralesAbby EvangelistaNo ratings yet

- Imbong V ComelecDocument3 pagesImbong V ComelecDong OnyongNo ratings yet

- Aisporna V CA DigestDocument3 pagesAisporna V CA DigestJRMNo ratings yet

- II C Agustin V Court of Appeals 338 Phil 171 1997Document2 pagesII C Agustin V Court of Appeals 338 Phil 171 1997Kristell FerrerNo ratings yet

- IMBONG vs. COMELEC 35 SCRA 28 G.R No. L-32432, SEPTEMBER 11, 1970Document15 pagesIMBONG vs. COMELEC 35 SCRA 28 G.R No. L-32432, SEPTEMBER 11, 1970EriyunaNo ratings yet

- 45 - Oposa v. Factoran - BacinaDocument4 pages45 - Oposa v. Factoran - BacinaChaNo ratings yet

- Digest-Statcon Sept 23, 2017Document7 pagesDigest-Statcon Sept 23, 2017Anthony Arcilla PulhinNo ratings yet

- De Haber Vs Queen of PortugalDocument2 pagesDe Haber Vs Queen of PortugalthesarahkristinNo ratings yet

- Sanders Vs Veridiano G R No l-46930Document2 pagesSanders Vs Veridiano G R No l-46930Aina SyNo ratings yet

- 5 Sanidad v. Comelec 1976Document1 page5 Sanidad v. Comelec 1976Carlota Nicolas VillaromanNo ratings yet

- 3 Lambino v. Comelec DigestDocument2 pages3 Lambino v. Comelec DigestArianneParalisanNo ratings yet

- State Immunity - Day 3 - DigestsDocument17 pagesState Immunity - Day 3 - DigestsDEAN JASPERNo ratings yet

- Poli Rev - GarciaVsDrilonDocument2 pagesPoli Rev - GarciaVsDrilonKarolM.No ratings yet

- G.R. No. 178160Document5 pagesG.R. No. 178160Joshua Buenaobra CapispisanNo ratings yet

- BCDA v. COA (G.R. No. 178160)Document7 pagesBCDA v. COA (G.R. No. 178160)shallyNo ratings yet

- 003 - BCDA v. COA (2009)Document8 pages003 - BCDA v. COA (2009)Cheska VergaraNo ratings yet

- Republic Represented by DAR Vs CA and Green City Estate and Development Corporation (GR No. 139592, October 5, 2000)Document1 pageRepublic Represented by DAR Vs CA and Green City Estate and Development Corporation (GR No. 139592, October 5, 2000)audrich carlo agustinNo ratings yet

- 9 GPI Vs Monte de PiedadDocument1 page9 GPI Vs Monte de Piedadaudrich carlo agustinNo ratings yet

- BFAR Employees Union Issued Resolution No. 01 Requesting The BFAR CentralDocument1 pageBFAR Employees Union Issued Resolution No. 01 Requesting The BFAR Centralaudrich carlo agustinNo ratings yet

- Soriano Vs Laguardia G.R. No. 164785, 29 April 2009 FactsDocument1 pageSoriano Vs Laguardia G.R. No. 164785, 29 April 2009 Factsaudrich carlo agustinNo ratings yet

- 14 LLBP Vs AquinoDocument1 page14 LLBP Vs Aquinoaudrich carlo agustinNo ratings yet

- Audrich Carlo R. AgustinDocument3 pagesAudrich Carlo R. Agustinaudrich carlo agustinNo ratings yet

- Chapter 2 Lesson 2 (Part 1)Document3 pagesChapter 2 Lesson 2 (Part 1)audrich carlo agustinNo ratings yet

- Ex Post Facto Law - Case 5 TITLE: FRANK MEKIN, Petitioner and Appellee, vs. GEORGE N. WOLFE, Respondent and AppellantDocument6 pagesEx Post Facto Law - Case 5 TITLE: FRANK MEKIN, Petitioner and Appellee, vs. GEORGE N. WOLFE, Respondent and Appellantaudrich carlo agustinNo ratings yet

- Case Digest Crim 1Document8 pagesCase Digest Crim 1audrich carlo agustinNo ratings yet

- California Judicial Conduct Handbook Excerpt: David M. Rothman California Judges Association - California Commission On Judicial Performance - California Supreme CourtDocument24 pagesCalifornia Judicial Conduct Handbook Excerpt: David M. Rothman California Judges Association - California Commission On Judicial Performance - California Supreme CourtCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Oblicon Reviewer (Final Exam)Document4 pagesOblicon Reviewer (Final Exam)von vidorNo ratings yet

- Apostille (Format) Word and PicDocument2 pagesApostille (Format) Word and PicBee ValentineNo ratings yet

- Company Law RESEARCH PAPERDocument17 pagesCompany Law RESEARCH PAPERKislay TarunNo ratings yet

- Do Patents Matter For Commercialization - SSRN-id3952317Document34 pagesDo Patents Matter For Commercialization - SSRN-id3952317Alex ENo ratings yet

- Asian Terminal v. Simon Enterprises (177116)Document6 pagesAsian Terminal v. Simon Enterprises (177116)Josef MacanasNo ratings yet

- Isl V League RulesDocument3 pagesIsl V League Rulesron samanteNo ratings yet

- Case Digests For Atty. Ranada's ATAP ClassDocument106 pagesCase Digests For Atty. Ranada's ATAP ClassAntonio DelgadoNo ratings yet

- Curt Meltzer v. Kentucky High-Tech Greenhouses, Et Al. - Defendants' Memorandum of Law in OppositionDocument25 pagesCurt Meltzer v. Kentucky High-Tech Greenhouses, Et Al. - Defendants' Memorandum of Law in OppositionLOPRESTI PLLCNo ratings yet

- Calida Petition Vs Senate ProbeDocument39 pagesCalida Petition Vs Senate ProbeNami Buan100% (1)

- Property, Plant and EquipmentDocument45 pagesProperty, Plant and EquipmentRiyah ParasNo ratings yet

- Math9 Q4mod6 SineLaw Gey-Steve Ana-Ao Bgo v2Document25 pagesMath9 Q4mod6 SineLaw Gey-Steve Ana-Ao Bgo v2benjamingapayNo ratings yet

- Subject: Instructions For Submitting Expenditure Reports For NGIRI IGNITE Funded ProjectsDocument1 pageSubject: Instructions For Submitting Expenditure Reports For NGIRI IGNITE Funded Projectsiffi khanNo ratings yet

- Francisco Lao Lim vs. CA GR No. 87407, Oct 31, 1990Document7 pagesFrancisco Lao Lim vs. CA GR No. 87407, Oct 31, 1990Charles BayNo ratings yet

- Salient Changes Under The Revised Corporation Code - Cruz Marcelo & TenefranciaDocument4 pagesSalient Changes Under The Revised Corporation Code - Cruz Marcelo & TenefranciaCorey RemetreNo ratings yet

- U.S Culture Key TermsDocument2 pagesU.S Culture Key Termslinae0830No ratings yet

- In The Matter of The South China Sea ArbitrationDocument5 pagesIn The Matter of The South China Sea ArbitrationCiara De Leon100% (1)

- E-Governance Police Prison PSUsDocument4 pagesE-Governance Police Prison PSUssh LaksNo ratings yet

- OCA Circular No. 157-2023Document2 pagesOCA Circular No. 157-2023Melford MirasolNo ratings yet

- Case of Cuban Pyjamas at Wal-Mart Stores in CanadaDocument2 pagesCase of Cuban Pyjamas at Wal-Mart Stores in CanadaJubin PradhanNo ratings yet

- AutomobileDocument3 pagesAutomobileSivaji Kakarla KNo ratings yet

- Keaapplicationpd KPJC1106500 18072022 120323Document2 pagesKeaapplicationpd KPJC1106500 18072022 120323pavanNo ratings yet

- Name: Charlotte Cabading Subject: ENG 111 Course/Year/Set: BSDRM SET ADocument10 pagesName: Charlotte Cabading Subject: ENG 111 Course/Year/Set: BSDRM SET AJudeza Jaira B. LabadanNo ratings yet

- People V Adriano GR 205228 CDDocument2 pagesPeople V Adriano GR 205228 CDLester Fiel Panopio100% (1)

- Q94. Sycamore Vs Metropolitan BankDocument2 pagesQ94. Sycamore Vs Metropolitan BankCarmz SumileNo ratings yet

- Chrisimm Sentimo Kumon Accounting and Bookkeeping ServicesDocument7 pagesChrisimm Sentimo Kumon Accounting and Bookkeeping ServicesHannahbea LindoNo ratings yet

- Capital Gains Tax Acknowledgment ReceiptDocument1 pageCapital Gains Tax Acknowledgment ReceiptDavid MugambiNo ratings yet

- STATCON Case ListDocument6 pagesSTATCON Case ListJj SantosNo ratings yet

- Velarde vs. Social Justice SocietyDocument16 pagesVelarde vs. Social Justice SocietyMarife Tubilag ManejaNo ratings yet