Professional Documents

Culture Documents

RAMIREZ, BSA Company

RAMIREZ, BSA Company

Uploaded by

Marie RamirezCopyright:

Available Formats

You might also like

- The 1 Minute Scalper: Downlaod All Russ Horn ProductsDocument11 pagesThe 1 Minute Scalper: Downlaod All Russ Horn ProductsQio Tensei100% (4)

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo71% (7)

- This Study Resource WasDocument4 pagesThis Study Resource Wasmonmon kim100% (4)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- Proof of Cash FormatDocument7 pagesProof of Cash FormatnathanlagdamenNo ratings yet

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Lecture Notes On Bank Reconciliation - Proof of Cash - 000Document1 pageLecture Notes On Bank Reconciliation - Proof of Cash - 000judel ArielNo ratings yet

- The Markstrat.7 Challenge 1 (MS7 SM B2C DG)Document35 pagesThe Markstrat.7 Challenge 1 (MS7 SM B2C DG)MuskaanNo ratings yet

- Adjusted Bank BalanceDocument2 pagesAdjusted Bank BalanceChristy HabelNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- 1.1 Cce To Proof of Cash Discussion ProblemsDocument3 pages1.1 Cce To Proof of Cash Discussion ProblemsGiyah UsiNo ratings yet

- Activity 2-IntaAcc1Document1 pageActivity 2-IntaAcc10322-1975No ratings yet

- Proof of Cash Syria CompanyDocument4 pagesProof of Cash Syria CompanyCJ alandy100% (1)

- CFAS - Prob. 3-4 and 7Document4 pagesCFAS - Prob. 3-4 and 7kookie bunnyNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanySr. Janet PereyraNo ratings yet

- Evelyn Bulan Culagbang BSBA FMDocument1 pageEvelyn Bulan Culagbang BSBA FMEvelyn Bulan CulagbangNo ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Assignment 1.3 Proof of CashDocument16 pagesAssignment 1.3 Proof of CashRya Miguel AlbaNo ratings yet

- AdasdDocument4 pagesAdasdPrime JavateNo ratings yet

- AuditingDocument5 pagesAuditingRochelle ManayaoNo ratings yet

- Activity For Sep 21 Sep 26Document2 pagesActivity For Sep 21 Sep 26Nick ivan AlvaresNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Proof of Cash - 02Document19 pagesProof of Cash - 02Royu BreakerNo ratings yet

- End of Chapter Problems 3-1 (Cash Count)Document3 pagesEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthNo ratings yet

- Proof of Cash MQM ComDocument5 pagesProof of Cash MQM ComCJ alandyNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneKyle BrianNo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Adadasd 2321Document4 pagesAdadasd 2321Prime JavateNo ratings yet

- Auditing For Cash SolmanDocument5 pagesAuditing For Cash SolmanJoseph FelipeNo ratings yet

- 02 Assignment 1Document2 pages02 Assignment 1Louise LelisNo ratings yet

- Applied AuditingDocument18 pagesApplied Auditing4295.montesNo ratings yet

- Audit of Cash and Cash: EquivalentDocument14 pagesAudit of Cash and Cash: EquivalentJoseph SalidoNo ratings yet

- Trugo - Assignment Proof of CashDocument3 pagesTrugo - Assignment Proof of CashmoreNo ratings yet

- Book To Bank MethodDocument3 pagesBook To Bank Methodelsana philipNo ratings yet

- Unadjusted Book Balance (1.) 504,000 (2.) 735,000 (3.) 700,000 (4.) 539,000Document2 pagesUnadjusted Book Balance (1.) 504,000 (2.) 735,000 (3.) 700,000 (4.) 539,000Quijano GpokskieNo ratings yet

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- Cce Prob DiscussionDocument6 pagesCce Prob DiscussionTrazy Jam BagsicNo ratings yet

- Proof of Cash Euro ComDocument6 pagesProof of Cash Euro ComCJ alandyNo ratings yet

- Proof of CashDocument2 pagesProof of CashDanie MNo ratings yet

- Auditing ExamDocument14 pagesAuditing ExamJericha GolezNo ratings yet

- CQ - Cash and Cash Equivalents SolutionDocument2 pagesCQ - Cash and Cash Equivalents SolutionRamirez Neña Receldiana CafeNo ratings yet

- Dockers Inc Proof of CashDocument1 pageDockers Inc Proof of CashJoemar LegresoNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- 112.BankReconciliation and Proof of CashDocument1 page112.BankReconciliation and Proof of CashPrincess Escovidal50% (2)

- ConsolidatedDocument18 pagesConsolidatedjikee11No ratings yet

- 2016-06 ICMAB FL 001 PAC Year Question JUNE 2016Document4 pages2016-06 ICMAB FL 001 PAC Year Question JUNE 2016Mohammad ShahidNo ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- MidtermDocument19 pagesMidtermRhyna Vergara SumaoyNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Project For Midterm: Case Problem No. 1Document4 pagesProject For Midterm: Case Problem No. 1Leanne Joyce QuintoNo ratings yet

- Bank Recon and CC and PCF ProblemsDocument5 pagesBank Recon and CC and PCF ProblemsCruxzelle BajoNo ratings yet

- Cash and Cash Equivalents-StudentDocument2 pagesCash and Cash Equivalents-StudentJerome_JadeNo ratings yet

- Intacct1 Pt1 ProblemsDocument26 pagesIntacct1 Pt1 ProblemsMarie MagallanesNo ratings yet

- Cash Problems SolutionDocument3 pagesCash Problems SolutionMagadia Mark JeffNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- With Great Power Comes With Great ResponsibilityDocument1 pageWith Great Power Comes With Great ResponsibilityMarie RamirezNo ratings yet

- Sci-Tech ArticleDocument1 pageSci-Tech ArticleMarie RamirezNo ratings yet

- Annual Council Meeting 2021 February 20, 2021 Election RulesDocument1 pageAnnual Council Meeting 2021 February 20, 2021 Election RulesMarie RamirezNo ratings yet

- Oriental Mindoro Council: Gov. Ignacio ST, Camilmil, Calapan City Tel: (043) - 288-7252Document1 pageOriental Mindoro Council: Gov. Ignacio ST, Camilmil, Calapan City Tel: (043) - 288-7252Marie RamirezNo ratings yet

- Region Iv-Mimaropa Division of Oriental Mindoro Naujan South DistrictDocument3 pagesRegion Iv-Mimaropa Division of Oriental Mindoro Naujan South DistrictMarie RamirezNo ratings yet

- Solution:: 1. Let A and B Be Two Finite Sets Such That N (A) 20, N (B) 28 and N (A B) 36, Find N (A B)Document9 pagesSolution:: 1. Let A and B Be Two Finite Sets Such That N (A) 20, N (B) 28 and N (A B) 36, Find N (A B)Marie RamirezNo ratings yet

- RAMIREZ - Christine Marie T. - Bsa 2201 - Activity 1Document3 pagesRAMIREZ - Christine Marie T. - Bsa 2201 - Activity 1Marie RamirezNo ratings yet

- Intellectual Revolutions That Defined SocietyDocument28 pagesIntellectual Revolutions That Defined SocietyMarie RamirezNo ratings yet

- Explain The Rationale of Rizal LawDocument1 pageExplain The Rationale of Rizal LawMarie RamirezNo ratings yet

- Fa1 2012Document303 pagesFa1 2012Marie RamirezNo ratings yet

- RAMIREZ, Christine Marie T. - Activity 5Document2 pagesRAMIREZ, Christine Marie T. - Activity 5Marie RamirezNo ratings yet

- Perencanaan Perawatan Rubber Tyred Gantry Menggunakan Metode Reliability Centered Maintenance (RCM) IiDocument6 pagesPerencanaan Perawatan Rubber Tyred Gantry Menggunakan Metode Reliability Centered Maintenance (RCM) IiUntuk KegiatanNo ratings yet

- I.T.C. Limited RM ProjectsDocument29 pagesI.T.C. Limited RM ProjectsViraj Pisal0% (1)

- LESSON 10 Business TransactionsDocument8 pagesLESSON 10 Business TransactionsUnamadable UnleomarableNo ratings yet

- WiFi900 SampleRequirementsSpecification v5 20151231Document24 pagesWiFi900 SampleRequirementsSpecification v5 20151231Sharif HasanNo ratings yet

- Securitization Is IllegalDocument34 pagesSecuritization Is IllegalCharlton ButlerNo ratings yet

- MGT1500 HI AssignmentDocument1 pageMGT1500 HI Assignmentishaankakade21No ratings yet

- Momentum PinpallDocument4 pagesMomentum Pinpallduyphung1234No ratings yet

- DA NIL AlterationDocument3 pagesDA NIL AlterationDaniel Anthony CabreraNo ratings yet

- Your Future in Forex! The SECRET Is Yours 1453750681forexDocument214 pagesYour Future in Forex! The SECRET Is Yours 1453750681forexdanadamsfxNo ratings yet

- List of In-Principle ApprovalsDocument9 pagesList of In-Principle ApprovalsManasvi MehtaNo ratings yet

- An Exploration of Accounting Conservatism Practise: Empirical Evidence From Developing CountryDocument8 pagesAn Exploration of Accounting Conservatism Practise: Empirical Evidence From Developing CountryYohana Eka Pratiwi IINo ratings yet

- DifferentiationDocument9 pagesDifferentiationMohammad RobinNo ratings yet

- Tech Mahindra Ltd.Document10 pagesTech Mahindra Ltd.Poonan SahooNo ratings yet

- ASME Head PDFDocument2 pagesASME Head PDFMohamed KilanyNo ratings yet

- QNet 2 Compensation PlanDocument16 pagesQNet 2 Compensation PlanLahiru WijethungaNo ratings yet

- Figuera v. Ang Case DigestDocument2 pagesFiguera v. Ang Case DigestCyrine Calagos100% (1)

- Assurance and InsuranceDocument5 pagesAssurance and InsuranceShubham GuptaNo ratings yet

- Working Capital Management inDocument10 pagesWorking Capital Management inVauntedNo ratings yet

- 1.-TABANGAO Vs Pilipinas ShellDocument1 page1.-TABANGAO Vs Pilipinas ShellMaggieNo ratings yet

- Should Cost Analysis A Key Tool For Sourcing and Product DesignersDocument10 pagesShould Cost Analysis A Key Tool For Sourcing and Product DesignersshitangshumaityNo ratings yet

- Kunci Jawab - Soal - A - 2018Document31 pagesKunci Jawab - Soal - A - 2018cinta watiNo ratings yet

- Raymond ProjectDocument23 pagesRaymond ProjectManoj DiwakaranNo ratings yet

- SMU Marketing Research Ch-3 Nidhi SharmaDocument25 pagesSMU Marketing Research Ch-3 Nidhi Sharmanidhi140286100% (1)

- 2007 - Jun - QUS CAT T3Document10 pages2007 - Jun - QUS CAT T3asad19No ratings yet

- (WWW - Entrance-Exam - Net) - ICFAI University MBA International Marketing (MB3H1M) Sample Paper 1Document27 pages(WWW - Entrance-Exam - Net) - ICFAI University MBA International Marketing (MB3H1M) Sample Paper 1Purushothaman KesavanNo ratings yet

- How To Use AdEspressoDocument115 pagesHow To Use AdEspressoJoanna Zabanal100% (1)

- Market RiskDocument72 pagesMarket RiskSudhansuSekharNo ratings yet

- Kyc For FidelityDocument2 pagesKyc For FidelitySanj BossNo ratings yet

RAMIREZ, BSA Company

RAMIREZ, BSA Company

Uploaded by

Marie RamirezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RAMIREZ, BSA Company

RAMIREZ, BSA Company

Uploaded by

Marie RamirezCopyright:

Available Formats

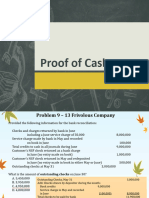

BSA Company provided the following data for the month of December:

Nov 30 Dec 31

Cash in bank account balance……………………………...2,032,000 3,160,000

Bank statement balance…………………………………….1,890,000 2,900,000

Bank debits……………………………………………………………………….1,080,000

Bank credits……………………………………………………………………… ?

Book debits………………………………………………………………………. ?

Book credits………………………………………………… 1,440,000

Outstanding checks………………………………………… 180,000 592,000

Deposit in transit……………………………………………. 80,000 498,000

Bank service charge……………………………………….. 2,000 4,000

Check erroneously charged by bank against entity’s

Account and corrected in subsequent month 40,000 50,000

Note recorded as cash receipt by entity when placed with

bank for collection & note is actually collected by bank in

subsequent month & credited by bank to

entity’s account in same month 200,000 300,000

Required:

a. Prepare a four column reconciliation using adjusted balances

b. Prepare the necessary journal entries

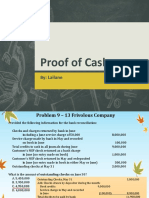

BSA Company

Proof of Cash

For the Month of December

November 30 Receipts Disbursements December 31

Cash in bank balance P 2,032,000 P 2,568,000 P 1,440,000 P 3,160,000

Note recorded as cash

receipt by entity when

placed with bank for

collection

November (200,000) 200,000

December (300,000) (300,000)

Bank Service Charge

November (2,000) (2,000)

December 4,000 (4,000)

Adjusted Book Balance P 1,830,000 P 2,468,000 P 1,442,000 P 2,856,000

November 30 Receipts Disbursements December 31

Bank Statement Balance P 1,890,000 P 2,090,000 P 1,080,000 P 2,900,000

Deposit in Transit

November 80,000 (80,000)

December 498,000 498,000

Erroneous Check

November 40,000 (40,000)

December (50,000) 50,000

Outstanding Check

November (180,000) (180,000)

December 592,000 (592,000)

Adjusted Bank Balance P 1,830,000 P 2,468,000 P 1,442,000 P 2,856,000

Adjusting Entries:

Dec.31 Notes Receivable P 300,000

Bank Service Charge 4,000

Cash in Bank P 304,000

You might also like

- The 1 Minute Scalper: Downlaod All Russ Horn ProductsDocument11 pagesThe 1 Minute Scalper: Downlaod All Russ Horn ProductsQio Tensei100% (4)

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo71% (7)

- This Study Resource WasDocument4 pagesThis Study Resource Wasmonmon kim100% (4)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- Proof of Cash FormatDocument7 pagesProof of Cash FormatnathanlagdamenNo ratings yet

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Lecture Notes On Bank Reconciliation - Proof of Cash - 000Document1 pageLecture Notes On Bank Reconciliation - Proof of Cash - 000judel ArielNo ratings yet

- The Markstrat.7 Challenge 1 (MS7 SM B2C DG)Document35 pagesThe Markstrat.7 Challenge 1 (MS7 SM B2C DG)MuskaanNo ratings yet

- Adjusted Bank BalanceDocument2 pagesAdjusted Bank BalanceChristy HabelNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- 1.1 Cce To Proof of Cash Discussion ProblemsDocument3 pages1.1 Cce To Proof of Cash Discussion ProblemsGiyah UsiNo ratings yet

- Activity 2-IntaAcc1Document1 pageActivity 2-IntaAcc10322-1975No ratings yet

- Proof of Cash Syria CompanyDocument4 pagesProof of Cash Syria CompanyCJ alandy100% (1)

- CFAS - Prob. 3-4 and 7Document4 pagesCFAS - Prob. 3-4 and 7kookie bunnyNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanySr. Janet PereyraNo ratings yet

- Evelyn Bulan Culagbang BSBA FMDocument1 pageEvelyn Bulan Culagbang BSBA FMEvelyn Bulan CulagbangNo ratings yet

- Proof of Cash123Document5 pagesProof of Cash123rufamaegarcia07No ratings yet

- Assignment 1.3 Proof of CashDocument16 pagesAssignment 1.3 Proof of CashRya Miguel AlbaNo ratings yet

- AdasdDocument4 pagesAdasdPrime JavateNo ratings yet

- AuditingDocument5 pagesAuditingRochelle ManayaoNo ratings yet

- Activity For Sep 21 Sep 26Document2 pagesActivity For Sep 21 Sep 26Nick ivan AlvaresNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Proof of Cash - 02Document19 pagesProof of Cash - 02Royu BreakerNo ratings yet

- End of Chapter Problems 3-1 (Cash Count)Document3 pagesEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthNo ratings yet

- Proof of Cash MQM ComDocument5 pagesProof of Cash MQM ComCJ alandyNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneKyle BrianNo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Adadasd 2321Document4 pagesAdadasd 2321Prime JavateNo ratings yet

- Auditing For Cash SolmanDocument5 pagesAuditing For Cash SolmanJoseph FelipeNo ratings yet

- 02 Assignment 1Document2 pages02 Assignment 1Louise LelisNo ratings yet

- Applied AuditingDocument18 pagesApplied Auditing4295.montesNo ratings yet

- Audit of Cash and Cash: EquivalentDocument14 pagesAudit of Cash and Cash: EquivalentJoseph SalidoNo ratings yet

- Trugo - Assignment Proof of CashDocument3 pagesTrugo - Assignment Proof of CashmoreNo ratings yet

- Book To Bank MethodDocument3 pagesBook To Bank Methodelsana philipNo ratings yet

- Unadjusted Book Balance (1.) 504,000 (2.) 735,000 (3.) 700,000 (4.) 539,000Document2 pagesUnadjusted Book Balance (1.) 504,000 (2.) 735,000 (3.) 700,000 (4.) 539,000Quijano GpokskieNo ratings yet

- Quiz 1 - Audit of Cash SolutionDocument9 pagesQuiz 1 - Audit of Cash SolutionmillescaasiNo ratings yet

- Cce Prob DiscussionDocument6 pagesCce Prob DiscussionTrazy Jam BagsicNo ratings yet

- Proof of Cash Euro ComDocument6 pagesProof of Cash Euro ComCJ alandyNo ratings yet

- Proof of CashDocument2 pagesProof of CashDanie MNo ratings yet

- Auditing ExamDocument14 pagesAuditing ExamJericha GolezNo ratings yet

- CQ - Cash and Cash Equivalents SolutionDocument2 pagesCQ - Cash and Cash Equivalents SolutionRamirez Neña Receldiana CafeNo ratings yet

- Dockers Inc Proof of CashDocument1 pageDockers Inc Proof of CashJoemar LegresoNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- 112.BankReconciliation and Proof of CashDocument1 page112.BankReconciliation and Proof of CashPrincess Escovidal50% (2)

- ConsolidatedDocument18 pagesConsolidatedjikee11No ratings yet

- 2016-06 ICMAB FL 001 PAC Year Question JUNE 2016Document4 pages2016-06 ICMAB FL 001 PAC Year Question JUNE 2016Mohammad ShahidNo ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- MidtermDocument19 pagesMidtermRhyna Vergara SumaoyNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Project For Midterm: Case Problem No. 1Document4 pagesProject For Midterm: Case Problem No. 1Leanne Joyce QuintoNo ratings yet

- Bank Recon and CC and PCF ProblemsDocument5 pagesBank Recon and CC and PCF ProblemsCruxzelle BajoNo ratings yet

- Cash and Cash Equivalents-StudentDocument2 pagesCash and Cash Equivalents-StudentJerome_JadeNo ratings yet

- Intacct1 Pt1 ProblemsDocument26 pagesIntacct1 Pt1 ProblemsMarie MagallanesNo ratings yet

- Cash Problems SolutionDocument3 pagesCash Problems SolutionMagadia Mark JeffNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- With Great Power Comes With Great ResponsibilityDocument1 pageWith Great Power Comes With Great ResponsibilityMarie RamirezNo ratings yet

- Sci-Tech ArticleDocument1 pageSci-Tech ArticleMarie RamirezNo ratings yet

- Annual Council Meeting 2021 February 20, 2021 Election RulesDocument1 pageAnnual Council Meeting 2021 February 20, 2021 Election RulesMarie RamirezNo ratings yet

- Oriental Mindoro Council: Gov. Ignacio ST, Camilmil, Calapan City Tel: (043) - 288-7252Document1 pageOriental Mindoro Council: Gov. Ignacio ST, Camilmil, Calapan City Tel: (043) - 288-7252Marie RamirezNo ratings yet

- Region Iv-Mimaropa Division of Oriental Mindoro Naujan South DistrictDocument3 pagesRegion Iv-Mimaropa Division of Oriental Mindoro Naujan South DistrictMarie RamirezNo ratings yet

- Solution:: 1. Let A and B Be Two Finite Sets Such That N (A) 20, N (B) 28 and N (A B) 36, Find N (A B)Document9 pagesSolution:: 1. Let A and B Be Two Finite Sets Such That N (A) 20, N (B) 28 and N (A B) 36, Find N (A B)Marie RamirezNo ratings yet

- RAMIREZ - Christine Marie T. - Bsa 2201 - Activity 1Document3 pagesRAMIREZ - Christine Marie T. - Bsa 2201 - Activity 1Marie RamirezNo ratings yet

- Intellectual Revolutions That Defined SocietyDocument28 pagesIntellectual Revolutions That Defined SocietyMarie RamirezNo ratings yet

- Explain The Rationale of Rizal LawDocument1 pageExplain The Rationale of Rizal LawMarie RamirezNo ratings yet

- Fa1 2012Document303 pagesFa1 2012Marie RamirezNo ratings yet

- RAMIREZ, Christine Marie T. - Activity 5Document2 pagesRAMIREZ, Christine Marie T. - Activity 5Marie RamirezNo ratings yet

- Perencanaan Perawatan Rubber Tyred Gantry Menggunakan Metode Reliability Centered Maintenance (RCM) IiDocument6 pagesPerencanaan Perawatan Rubber Tyred Gantry Menggunakan Metode Reliability Centered Maintenance (RCM) IiUntuk KegiatanNo ratings yet

- I.T.C. Limited RM ProjectsDocument29 pagesI.T.C. Limited RM ProjectsViraj Pisal0% (1)

- LESSON 10 Business TransactionsDocument8 pagesLESSON 10 Business TransactionsUnamadable UnleomarableNo ratings yet

- WiFi900 SampleRequirementsSpecification v5 20151231Document24 pagesWiFi900 SampleRequirementsSpecification v5 20151231Sharif HasanNo ratings yet

- Securitization Is IllegalDocument34 pagesSecuritization Is IllegalCharlton ButlerNo ratings yet

- MGT1500 HI AssignmentDocument1 pageMGT1500 HI Assignmentishaankakade21No ratings yet

- Momentum PinpallDocument4 pagesMomentum Pinpallduyphung1234No ratings yet

- DA NIL AlterationDocument3 pagesDA NIL AlterationDaniel Anthony CabreraNo ratings yet

- Your Future in Forex! The SECRET Is Yours 1453750681forexDocument214 pagesYour Future in Forex! The SECRET Is Yours 1453750681forexdanadamsfxNo ratings yet

- List of In-Principle ApprovalsDocument9 pagesList of In-Principle ApprovalsManasvi MehtaNo ratings yet

- An Exploration of Accounting Conservatism Practise: Empirical Evidence From Developing CountryDocument8 pagesAn Exploration of Accounting Conservatism Practise: Empirical Evidence From Developing CountryYohana Eka Pratiwi IINo ratings yet

- DifferentiationDocument9 pagesDifferentiationMohammad RobinNo ratings yet

- Tech Mahindra Ltd.Document10 pagesTech Mahindra Ltd.Poonan SahooNo ratings yet

- ASME Head PDFDocument2 pagesASME Head PDFMohamed KilanyNo ratings yet

- QNet 2 Compensation PlanDocument16 pagesQNet 2 Compensation PlanLahiru WijethungaNo ratings yet

- Figuera v. Ang Case DigestDocument2 pagesFiguera v. Ang Case DigestCyrine Calagos100% (1)

- Assurance and InsuranceDocument5 pagesAssurance and InsuranceShubham GuptaNo ratings yet

- Working Capital Management inDocument10 pagesWorking Capital Management inVauntedNo ratings yet

- 1.-TABANGAO Vs Pilipinas ShellDocument1 page1.-TABANGAO Vs Pilipinas ShellMaggieNo ratings yet

- Should Cost Analysis A Key Tool For Sourcing and Product DesignersDocument10 pagesShould Cost Analysis A Key Tool For Sourcing and Product DesignersshitangshumaityNo ratings yet

- Kunci Jawab - Soal - A - 2018Document31 pagesKunci Jawab - Soal - A - 2018cinta watiNo ratings yet

- Raymond ProjectDocument23 pagesRaymond ProjectManoj DiwakaranNo ratings yet

- SMU Marketing Research Ch-3 Nidhi SharmaDocument25 pagesSMU Marketing Research Ch-3 Nidhi Sharmanidhi140286100% (1)

- 2007 - Jun - QUS CAT T3Document10 pages2007 - Jun - QUS CAT T3asad19No ratings yet

- (WWW - Entrance-Exam - Net) - ICFAI University MBA International Marketing (MB3H1M) Sample Paper 1Document27 pages(WWW - Entrance-Exam - Net) - ICFAI University MBA International Marketing (MB3H1M) Sample Paper 1Purushothaman KesavanNo ratings yet

- How To Use AdEspressoDocument115 pagesHow To Use AdEspressoJoanna Zabanal100% (1)

- Market RiskDocument72 pagesMarket RiskSudhansuSekharNo ratings yet

- Kyc For FidelityDocument2 pagesKyc For FidelitySanj BossNo ratings yet