Professional Documents

Culture Documents

Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research Limited

Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research Limited

Uploaded by

Ankita ChauhanCopyright:

Available Formats

You might also like

- RDR2 OST - American VenomDocument28 pagesRDR2 OST - American VenomWolfgang Amadeus MozartNo ratings yet

- Assignment 1 GRAD 2019Document4 pagesAssignment 1 GRAD 2019RamonErnestoICNo ratings yet

- 8-Port Decimator Users Manual (126504 - Rev11)Document50 pages8-Port Decimator Users Manual (126504 - Rev11)Eduard LembaNo ratings yet

- Lab 4 Am & FM ModulationDocument46 pagesLab 4 Am & FM ModulationMimi Syuryani Binti NodinNo ratings yet

- Tata Teleservices NCD Issue INR500Cr RationaleDocument8 pagesTata Teleservices NCD Issue INR500Cr RationaleSatyam GaurNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- ICRA Credit Rating Rationale - KaruturiDocument7 pagesICRA Credit Rating Rationale - KaruturiTj BlogsNo ratings yet

- Reliance Communications LTDDocument4 pagesReliance Communications LTDSahil JainNo ratings yet

- Accounting System of Teletalk & GrameenphoneDocument17 pagesAccounting System of Teletalk & GrameenphoneFarhana Ahamed 1815237660No ratings yet

- Reliance CommunicationsDocument10 pagesReliance CommunicationsSubharaj ChakrabortyNo ratings yet

- Bharti Airtel: Performance, Upwardly Mobile: Stock DataDocument5 pagesBharti Airtel: Performance, Upwardly Mobile: Stock Datachirag_kamdarNo ratings yet

- Submitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)Document34 pagesSubmitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)vijaybaliyanNo ratings yet

- Directors' Report: Larsen & Toubro Infotech LimitedDocument33 pagesDirectors' Report: Larsen & Toubro Infotech LimitedNirmal Rintu RaviNo ratings yet

- Mirae Company Update 1Q24 TLKM 7 May 2024 Upgrade To Buy Lower TPDocument13 pagesMirae Company Update 1Q24 TLKM 7 May 2024 Upgrade To Buy Lower TPAndreas PaskalisNo ratings yet

- PT XL Axiata TBK: Digital FocusDocument8 pagesPT XL Axiata TBK: Digital FocusTeguh PerdanaNo ratings yet

- Bakrie Telecom: Entering The Maturity PhaseDocument6 pagesBakrie Telecom: Entering The Maturity PhasetswijayaNo ratings yet

- 12 HarshitKumarPandey Setco Automotive LTDDocument6 pages12 HarshitKumarPandey Setco Automotive LTDAnonymous 5HKVJoJ7rINo ratings yet

- Idea Cellular LTD: Key Financial IndicatorsDocument4 pagesIdea Cellular LTD: Key Financial IndicatorsGanesh DeshiNo ratings yet

- Fin317 Group Project Reliance Communication: Anil Dhirubhai Ambani GroupDocument20 pagesFin317 Group Project Reliance Communication: Anil Dhirubhai Ambani GroupflightdespatchNo ratings yet

- Bharat Electronics Limited AssignmentDocument10 pagesBharat Electronics Limited AssignmentAnusree SasidharanNo ratings yet

- Rakon Announcement 14 Feb 08Document6 pagesRakon Announcement 14 Feb 08Peter CorbanNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- Annual Report Telkomsel 2003Document44 pagesAnnual Report Telkomsel 2003jakabareNo ratings yet

- Report Q4 2023Document54 pagesReport Q4 2023Abdul JabbarNo ratings yet

- Investor Memo 1Q 2024pdfDocument6 pagesInvestor Memo 1Q 2024pdfidang94No ratings yet

- Tata Communications - Financial Analysis: Corporate Finance - Ii Project ReportDocument18 pagesTata Communications - Financial Analysis: Corporate Finance - Ii Project ReportSolanki JasbirNo ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- Resource Sharing For An Intelligent Future: Annual Report 2020Document176 pagesResource Sharing For An Intelligent Future: Annual Report 2020mailimailiNo ratings yet

- Bharti Airtel: Company FocusDocument5 pagesBharti Airtel: Company FocusthomsoncltNo ratings yet

- Ratio - Tesco AssignmentDocument11 pagesRatio - Tesco AssignmentaXnIkaran100% (1)

- TLKM 9M23 Info MemoDocument19 pagesTLKM 9M23 Info Memorudyjabbar23No ratings yet

- Company Profile: Customer Touchpoint SSS Countries of OperationsDocument7 pagesCompany Profile: Customer Touchpoint SSS Countries of OperationsShivani KelvalkarNo ratings yet

- Appendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Document21 pagesAppendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Anonymous 6tuR1hzNo ratings yet

- Toyota Pakistan Ibf WordDocument20 pagesToyota Pakistan Ibf Wordifrahri123No ratings yet

- DATEDocument10 pagesDATEbiancaftw90No ratings yet

- Info Memo Q2 2023Document6 pagesInfo Memo Q2 2023Roby SatriyaNo ratings yet

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCMadhusudan PartaniNo ratings yet

- GTL Analyst Presentation: Safe HarborDocument17 pagesGTL Analyst Presentation: Safe Harborvsekar_1No ratings yet

- Tata Technologies Equity Research ReportDocument14 pagesTata Technologies Equity Research ReportPuneet GirdharNo ratings yet

- Group 3 FM Project IT IndustryDocument13 pagesGroup 3 FM Project IT IndustryPS KannanNo ratings yet

- 435 FinalDocument16 pages435 FinalshakilnaimaNo ratings yet

- Bharti Airtel Annual ReportDocument9 pagesBharti Airtel Annual ReportRASHMI BHATT Jaipuria JaipurNo ratings yet

- Particulars Videocon MTS India TATA Communications Telenor IndiaDocument6 pagesParticulars Videocon MTS India TATA Communications Telenor IndiaNishi JariwalaNo ratings yet

- Tata C S: A Financial Analysis Management Accounting: Onsultancy ErvicesDocument30 pagesTata C S: A Financial Analysis Management Accounting: Onsultancy ErvicesRajat SikriNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceamitNo ratings yet

- Valuation of Intangible AssetsDocument23 pagesValuation of Intangible AssetsGaurav KumarNo ratings yet

- Net Phone ProjectDocument4 pagesNet Phone ProjectUyên TrầnNo ratings yet

- Mind TreeDocument10 pagesMind TreeGaurav JainNo ratings yet

- Telecommunication: OverweightDocument4 pagesTelecommunication: Overweightmuhamad fadzirNo ratings yet

- Hathway Press Release BSDocument3 pagesHathway Press Release BSAmol JadhaoNo ratings yet

- Fixed Line Telecom: Wateen Telecom Limited - Going For The ListingDocument4 pagesFixed Line Telecom: Wateen Telecom Limited - Going For The ListingjawadataNo ratings yet

- Intrep 2Document46 pagesIntrep 2mailimailiNo ratings yet

- 2010 Apr 12 - AMFraser - Thomson MedicalDocument4 pages2010 Apr 12 - AMFraser - Thomson MedicalKyithNo ratings yet

- Resource Sharing For An Intelligent Future: Interim Report 2021Document50 pagesResource Sharing For An Intelligent Future: Interim Report 2021mailimailiNo ratings yet

- Corporate Finance - Assignment Ceat Ltd. IntroductionDocument4 pagesCorporate Finance - Assignment Ceat Ltd. IntroductionSahil AhammedNo ratings yet

- Axiata Group BHD: Company ReportDocument6 pagesAxiata Group BHD: Company Reportlimml63No ratings yet

- Research Paper Study On Comparative Analysis Between Infosys and Tata Consultancy ServicesDocument5 pagesResearch Paper Study On Comparative Analysis Between Infosys and Tata Consultancy ServicesSaakshi TripathiNo ratings yet

- Investor Fact Sheet q3 Fy23Document16 pagesInvestor Fact Sheet q3 Fy23Anshul SainiNo ratings yet

- 51308-001-sd-02Document15 pages51308-001-sd-02VidyotmaNo ratings yet

- Nirmal Bang Dixon Technologies India Q2 FY24 Result UpdateDocument10 pagesNirmal Bang Dixon Technologies India Q2 FY24 Result UpdateyoursaaryaNo ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ice Melting Methods For Overhead LinesDocument28 pagesIce Melting Methods For Overhead LinesKirana Shree100% (1)

- Test Bank For Stuttering Foundations and Clinical Applications 0131573101Document24 pagesTest Bank For Stuttering Foundations and Clinical Applications 0131573101JimmyHaynessfmg100% (46)

- Jihad Najib - CV PDFDocument1 pageJihad Najib - CV PDFTaghzout MehdiNo ratings yet

- Do Plants Have Feelings PDFDocument7 pagesDo Plants Have Feelings PDFapi-340951588No ratings yet

- Readers Theatre Cassies JourneyDocument2 pagesReaders Theatre Cassies Journeyapi-253215615No ratings yet

- MR July-Aug 2020Document161 pagesMR July-Aug 2020minthuhtunNo ratings yet

- Free Mastic G 316Document5 pagesFree Mastic G 316Kelly RobertsNo ratings yet

- ICC ESR 4266 KB TZ2 Expansion Anchor Concrete ApprovalDocument16 pagesICC ESR 4266 KB TZ2 Expansion Anchor Concrete Approvalעמי עמרניNo ratings yet

- WWW Mytechnosoft Com Tibco Difference-between-bw5-And-bw6 PHPDocument3 pagesWWW Mytechnosoft Com Tibco Difference-between-bw5-And-bw6 PHPsabarin_72No ratings yet

- B.A. (Gen. English)Document156 pagesB.A. (Gen. English)sandiNo ratings yet

- Chapter IwarDocument20 pagesChapter IwartamilNo ratings yet

- RGP Fitting ReviewDocument4 pagesRGP Fitting ReviewSulki HanNo ratings yet

- Space FactorDocument5 pagesSpace FactorRafael Yap GNo ratings yet

- Codo2D MatlabDocument2 pagesCodo2D Matlabargenis bonillaNo ratings yet

- Phy110 Lab Report 1Document1 pagePhy110 Lab Report 1Khalila KhalishaNo ratings yet

- Irrigation and Water Power Engineering by Dr. B. C. Punmia - Dr. Pande Brij Basi Lal - Ashok Kumar Jain - Arun Kumar JainDocument187 pagesIrrigation and Water Power Engineering by Dr. B. C. Punmia - Dr. Pande Brij Basi Lal - Ashok Kumar Jain - Arun Kumar JainSaritha Reddy85% (85)

- Post Tensioning System July 2018Document12 pagesPost Tensioning System July 2018pandianNo ratings yet

- Textile Trade in BangladeshDocument5 pagesTextile Trade in BangladeshSanghamitra DasNo ratings yet

- Nonverbal CommunicationDocument23 pagesNonverbal CommunicationNaman Agarwal100% (1)

- Lesson Plan in ScienceDocument3 pagesLesson Plan in ScienceJesza May JuabanNo ratings yet

- Management Control System MODULE IDocument17 pagesManagement Control System MODULE IDr Linda Mary Simon100% (1)

- Comparison Subpart Q Vs New FTL 030314Document20 pagesComparison Subpart Q Vs New FTL 030314TomaszUchańskiNo ratings yet

- Teacher Quality StandardsDocument9 pagesTeacher Quality StandardsPaulina WilkersonNo ratings yet

- Aptitude Test InfosysDocument216 pagesAptitude Test InfosysJose PrakashNo ratings yet

- Overview of SAP CRM ModuleDocument13 pagesOverview of SAP CRM ModulesunilNo ratings yet

Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research Limited

Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research Limited

Uploaded by

Ankita ChauhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research Limited

Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research Limited

Uploaded by

Ankita ChauhanCopyright:

Available Formats

TATA COMMUNICATIONS LTD

Short Term Debt issue PR1+

Rating

CARE has assigned a ‘PR1+’ [PR One Plus] rating to the proposed short term debt

issue of Rs.500 crore of Tata Communications Limited (TCL). Instruments with this

rating would have strong capacity for timely payment of short-term debt obligations and

carry lowest credit risk. Within this category, instruments with relatively better credit

characteristics are assigned PR1+ rating.

The rating derives strength from the strong position of the company in wholesale data

communication segment, experienced management supported by strong promoter

group, good execution capabilities, increasing contribution of high margin businesses like

carrier and enterprise data and broadband internet to the total revenues, low gearing

levels and high level of liquid investments.

Impact of increasing competition in the Indian telecom sector, the performance of the

loss making subsidiaries and the quantum of corporate guarantees given on their behalf

are the key rating sensitivities.

Background

Tata Communications Ltd (TCL), a part of the $37.58 billion Tata Group, is the new

name of the erstwhile Videsh Sanchar Nigam Ltd. (VSNL) with effect from January 28,

2008. The company has history of more than 135 years. Tata group started in 1868 in

handling the international telecommunications needs of the country. In February 2002,

the Government of India, as per its disinvestment plan, sold 25% of their holding in the

company to the strategic partner. Consequently, the company was bought under the

administrative control of Tatas.

TCL’s portfolio includes transmission, IP, converged voice, mobility, managed network

connectivity, hosted data center, communications solutions and business transformation

services to global and Indian enterprises & service providers as well as broadband and

content services to Indian consumers. TCL serves its customers from its offices in 80

cities in 40 countries worldwide. The Company’s customer base includes approximately

1,500 global carriers, 450 mobile operators, 10,000 enterprises, 500,000 broadband and

internet subscribers and 300 Wi-Fi public hotspots.

Operations of the company

The Company, through itself and its operating subsidiaries, is primarily engaged in the

communications solutions business globally. The Company is a facilities based provider

CREDIT ANALYSIS & RESEARCH LIMITED

of a broad range of integrated communication services categorized by the following lines

of business: Wholesale Voice, Enterprise and Carrier Data and Others.

Wholesale Voice Business – This comprises International Long Distance (ILD)

and National Long Distance (NLD). The Company owns and operates one of the

largest international networks with coverage to more than 240 countries and

territories, as well as maintaining over 415 direct and bilateral relationships with

leading international voice telecommunication providers. Traffic into and out of

India continues to represent a significant portion of the company’s wholesale voice

business and the company maintains market leadership in terms of the volume of

inbound termination of calls to India.

Carrier and Enterprise Data Business – The Company is one of the world’s

largest providers of data services, primarily focusing on International Private

Leased Circuit (IPLC) services and IP Transit services. The Company supplies some

of the world’s largest international telecom companies with transmission backbone

services across the Atlantic, the Pacific, and into and out of India. As a Tier 1 ISP,

the Company also operates one of the largest IP networks in the world with points

of presence around the globe.

Others- TCL also provides broadband connectivity, dial up internet connections,

wireless Internet and net facilities through cybercafés.

Major Developments in FY08-09

1) In August, 2008, the Arbitration Tribunal (Tribunal) of the International Chamber of

Commerce, Hague handed down a final award in the arbitration proceedings brought

by Reliance Globalcom Limited (Reliance), formerly known as ‘FLAG Telecom’, against

TCL relating to the Flag Europe Asia Cable System. The Tribunal directed TCL to pay

Rs. 95.60 crores (US$ 21.45 million) as final settlement against US$ 385 million

claimed by Reliance. The amount of Rs. 95.60 crores has been charged to P&L

account and has been disclosed as an exceptional item in FY09.

2) In terms of the agreements entered into between Tata Teleservices Ltd. (TTSL), Tata

Sons Ltd. (TSL) and NTT DoCoMo, Inc. of Japan, TSL gave an option to TCL to sell

3.65 crore equity shares in TTSL to NTT DoCoMo. Accordingly, TCL realised

Rs.424.22 crore on sale of these shares resulting in a profit of Rs 346.65 crore which

has been reflected as an exceptional item in the P&L account for the current year

FY09.

Financial Results

During FY 09, the total income had increased mainly due to increase in revenue from

enterprise and carrier data division. The PBILDT for the same period has also shown an

CREDIT ANALYSIS & RESEARCH LIMITED 2

increase of about 32% as a result of this. However, there has been a drastic increase in

the interest cost during FY09 to Rs.144 crore from Rs.46.67 crore in FY08, mainly due to

the NCD issue of Rs.1,250 crore for expansion in network related services. Consequently

interest coverage has also fallen sharply. Depreciation had increased during the FY09 by

about 41% as compared to FY08 due to addition in fixed assets of Rs.1,640 crore during

the period. PAT for FY09 shows an increase of about 68% as compared to FY 08 due to

profits from sale of stake in TTSL of Rs.346.65 crore. The profitability margins have

therefore improved substantially. The overall gearing ratio has increased from 0.12x as

on March 31, 2008 to 0.34x as on March 31, 2009 due to issue of new NCDs in FY09,

however it is still comfortable.

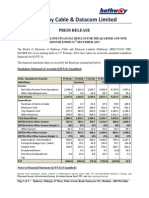

Financial Results:

Y.E. / as on March 31, 2007 2008 2009

Working results (Rs. in crore)

Net Sales 4,042 3,283 3,749

Total Operating Income 4,116 3,302 3,760

PBILDT 1,010 648 856

Interest 2 47 144

Depreciation 391 301 425

PBT 718 452 714

PAT (after deferred tax) 474 306 516

Gross Cash Accruals 874 634 983

Financial Position (Rs. in crore)

Equity Share Capital 285 285 285

Networth 6,360 6,547 6,931

Total capital employed 6,629 7,409 9,259

Investment: 2,674 2,104 2,724

- in subsidiaries 714 714 1,129

- in mutual funds/FMP 926 349 632

- in joint venture/group companies 1,034 1,041 963

Key Ratios

Growth

Growth in Total Income (%) 7.89 (19.78) 13.87

Growth in PAT [after D.Tax] (%) 1.10 (35.32) 68.42

Profitability

PBILDT/Total Op income (%) 24.54 19.62 22.76

PAT/Total income (%) 11.65 9.06 13.73

ROCE (%) 11.19 7.10 10.36

Average cost of borrowing (%) 1.24 9.57 9.28

Solvency

Long Term Debt Equity ratio (times) 0.00 0.05 0.25

Overall gearing ratio (times) 0.04 0.13 0.34

Interest coverage (times) 336.39 7.43 2.99

CREDIT ANALYSIS & RESEARCH LIMITED 3

Y.E. / as on March 31, 2007 2008 2009

Term debt/Gross Cash accruals (years) 0.23 1.23 2.37

Liquidity

Current ratio 1.13 1.50 1.38

Quick ratio 1.13 1.50 1.38

Turnover

Average Collection Period (days) 75 111 115

Average Creditors (days) 101 137 187

Industry

The Indian domestic telecommunications network has grown rapidly since 2000. As of

March 2009, the Indian telephone system comprised 429.72 million telephones in service

consisting of 37.96 million of the fixed line subscribers and 391.76 million mobile

subscribers. The penetration of India’s domestic telephone network increased to 33.71

telephone subscribers per 100 inhabitants as of March 2009 from 14.4 per 100 in July

2006. Broadband connections have also continued to grow in 2009. At the end of March

2009, total Broadband connections in India touched 6.22 million as against 1.35 million

in March 2006. However, the growth in Broadband connections has been relatively low

due to limited availability of last mile access. The incumbent wire line operators

dominate the broadband market because they retain control over the fixed line copper

network, in the absence of local loop unbundling.

Subsequent to liberalization of ILD and NLD licenses in 2002, companies like Bharti

Airtel, Rcom etc. have aggressively expanded their presence in wholesale data transfer

segment. This has led to continuous pressure on tariffs, which have come down

significantly. At the same time, volumes have grown because of the heightened business

activities and rapid globalization of Indian companies.

Major risks associated with the industry are slowdown in economic activities at global

level, large capital expenditure associated with major infrastructure and significant

reduction in tariffs due to competitive environment.

August 2009

Disclaimer

CARE’s ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or recall

the concerned bank facilities or to buy, sell or hold any security. CARE has based its ratings on information

obtained from sources believed by it to be accurate and reliable. CARE does not, however, guarantee the accuracy,

adequacy or completeness of any information and is not responsible for any errors or omissions or for the results

obtained from the use of such information. Most entities whose bank facilities/Facilities are rated by CARE have

paid a credit rating fee, based on the amount and type of bank facilities/Facilities.

CREDIT ANALYSIS & RESEARCH LIMITED 4

CARE is headquartered in Mumbai, with Offices all over India. The office addresses and

contact numbers are given below:

HEAD OFFICE: MUMBAI

Mr. D.R. Dogra Mr. Rajesh Mokashi

Managing Director Dy. Managing Director

Cell : +91-98204 16002 Cell : +91-98204 16001

E-mail : dr.dogra@careratings.com E-mail: rajesh.mokashi@careratings.com

Mr. Ankur Sachdeva

Head - Business Development

Cell : +91-9819698985

E-mail: ankur.sachdeva@careratings.com

4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway,

Sion (East), Mumbai 400 022 Tel.: (022) 67543456 Fax: (022) 67543457

Website: www.careratings.com

OFFICES

Mr.Mehul Pandya Mr.Sundara Vathanan

Regional Manager Regional Manager

307, III Floor, Iscon Mall, No.G1, Canopy Royal Manor,

Near Jodhpur Cross Road, Near Manipal Hospital,

Satellite, Rustombagh, Off Airport Road,

Ahmedabad - 380 015. Bangalore - 560 017.

Tel – 079 6631 1821/22 Tel – 080 2520 5575

Mobile - 98242 56265 Mobile – 98803 60878

E-mail: E-mail: sundara.vathanan@careratings.com

mehul.pandya@careratings.com

Mr.Ashwini Jani Mr. Rahul Patni

Regional Manager Regional Manager

Unit No. O-509/C, Spencer Plaza, 302, `Priya Arcade’

5th Floor, No. 769, 8-3-826, Yellareddyguda,

Anna Salai, Srinagar Colony,

Chennai 600 002 Hyderabad - 500 073.

Tel: 2849 7812/2849 0811 Tel – 040 6675 8386

Mobile – 91766 47599 Mobile – 91600 04563

E-mail :ashwini.jani@careratings.com E-mail: rahul.patni@careratings.com

Mr. Sukanta Nag Ms.Swati Agrawal

Regional Manager Regional Manager

3rd Floor, Prasad Chambers 710 Surya Kiran,

(Shagun Mall Building) 19 K.G. Road,

10A, Shakespeare Sarani New Delhi - 110 001.

Kolkata - 700 071. Tel – 011 2331 8701/2371 6199

Tel – 033 2283 1800/1803 Mobile – 98117 45677

Mobile – 98311 70075 E-mail :swati.agrawal@careratings.com

E- mail: sukanta.nag@careratings.com

CREDIT ANALYSIS & RESEARCH LIMITED 5

You might also like

- RDR2 OST - American VenomDocument28 pagesRDR2 OST - American VenomWolfgang Amadeus MozartNo ratings yet

- Assignment 1 GRAD 2019Document4 pagesAssignment 1 GRAD 2019RamonErnestoICNo ratings yet

- 8-Port Decimator Users Manual (126504 - Rev11)Document50 pages8-Port Decimator Users Manual (126504 - Rev11)Eduard LembaNo ratings yet

- Lab 4 Am & FM ModulationDocument46 pagesLab 4 Am & FM ModulationMimi Syuryani Binti NodinNo ratings yet

- Tata Teleservices NCD Issue INR500Cr RationaleDocument8 pagesTata Teleservices NCD Issue INR500Cr RationaleSatyam GaurNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- ICRA Credit Rating Rationale - KaruturiDocument7 pagesICRA Credit Rating Rationale - KaruturiTj BlogsNo ratings yet

- Reliance Communications LTDDocument4 pagesReliance Communications LTDSahil JainNo ratings yet

- Accounting System of Teletalk & GrameenphoneDocument17 pagesAccounting System of Teletalk & GrameenphoneFarhana Ahamed 1815237660No ratings yet

- Reliance CommunicationsDocument10 pagesReliance CommunicationsSubharaj ChakrabortyNo ratings yet

- Bharti Airtel: Performance, Upwardly Mobile: Stock DataDocument5 pagesBharti Airtel: Performance, Upwardly Mobile: Stock Datachirag_kamdarNo ratings yet

- Submitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)Document34 pagesSubmitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)vijaybaliyanNo ratings yet

- Directors' Report: Larsen & Toubro Infotech LimitedDocument33 pagesDirectors' Report: Larsen & Toubro Infotech LimitedNirmal Rintu RaviNo ratings yet

- Mirae Company Update 1Q24 TLKM 7 May 2024 Upgrade To Buy Lower TPDocument13 pagesMirae Company Update 1Q24 TLKM 7 May 2024 Upgrade To Buy Lower TPAndreas PaskalisNo ratings yet

- PT XL Axiata TBK: Digital FocusDocument8 pagesPT XL Axiata TBK: Digital FocusTeguh PerdanaNo ratings yet

- Bakrie Telecom: Entering The Maturity PhaseDocument6 pagesBakrie Telecom: Entering The Maturity PhasetswijayaNo ratings yet

- 12 HarshitKumarPandey Setco Automotive LTDDocument6 pages12 HarshitKumarPandey Setco Automotive LTDAnonymous 5HKVJoJ7rINo ratings yet

- Idea Cellular LTD: Key Financial IndicatorsDocument4 pagesIdea Cellular LTD: Key Financial IndicatorsGanesh DeshiNo ratings yet

- Fin317 Group Project Reliance Communication: Anil Dhirubhai Ambani GroupDocument20 pagesFin317 Group Project Reliance Communication: Anil Dhirubhai Ambani GroupflightdespatchNo ratings yet

- Bharat Electronics Limited AssignmentDocument10 pagesBharat Electronics Limited AssignmentAnusree SasidharanNo ratings yet

- Rakon Announcement 14 Feb 08Document6 pagesRakon Announcement 14 Feb 08Peter CorbanNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- Annual Report Telkomsel 2003Document44 pagesAnnual Report Telkomsel 2003jakabareNo ratings yet

- Report Q4 2023Document54 pagesReport Q4 2023Abdul JabbarNo ratings yet

- Investor Memo 1Q 2024pdfDocument6 pagesInvestor Memo 1Q 2024pdfidang94No ratings yet

- Tata Communications - Financial Analysis: Corporate Finance - Ii Project ReportDocument18 pagesTata Communications - Financial Analysis: Corporate Finance - Ii Project ReportSolanki JasbirNo ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- Resource Sharing For An Intelligent Future: Annual Report 2020Document176 pagesResource Sharing For An Intelligent Future: Annual Report 2020mailimailiNo ratings yet

- Bharti Airtel: Company FocusDocument5 pagesBharti Airtel: Company FocusthomsoncltNo ratings yet

- Ratio - Tesco AssignmentDocument11 pagesRatio - Tesco AssignmentaXnIkaran100% (1)

- TLKM 9M23 Info MemoDocument19 pagesTLKM 9M23 Info Memorudyjabbar23No ratings yet

- Company Profile: Customer Touchpoint SSS Countries of OperationsDocument7 pagesCompany Profile: Customer Touchpoint SSS Countries of OperationsShivani KelvalkarNo ratings yet

- Appendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Document21 pagesAppendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Anonymous 6tuR1hzNo ratings yet

- Toyota Pakistan Ibf WordDocument20 pagesToyota Pakistan Ibf Wordifrahri123No ratings yet

- DATEDocument10 pagesDATEbiancaftw90No ratings yet

- Info Memo Q2 2023Document6 pagesInfo Memo Q2 2023Roby SatriyaNo ratings yet

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCMadhusudan PartaniNo ratings yet

- GTL Analyst Presentation: Safe HarborDocument17 pagesGTL Analyst Presentation: Safe Harborvsekar_1No ratings yet

- Tata Technologies Equity Research ReportDocument14 pagesTata Technologies Equity Research ReportPuneet GirdharNo ratings yet

- Group 3 FM Project IT IndustryDocument13 pagesGroup 3 FM Project IT IndustryPS KannanNo ratings yet

- 435 FinalDocument16 pages435 FinalshakilnaimaNo ratings yet

- Bharti Airtel Annual ReportDocument9 pagesBharti Airtel Annual ReportRASHMI BHATT Jaipuria JaipurNo ratings yet

- Particulars Videocon MTS India TATA Communications Telenor IndiaDocument6 pagesParticulars Videocon MTS India TATA Communications Telenor IndiaNishi JariwalaNo ratings yet

- Tata C S: A Financial Analysis Management Accounting: Onsultancy ErvicesDocument30 pagesTata C S: A Financial Analysis Management Accounting: Onsultancy ErvicesRajat SikriNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceamitNo ratings yet

- Valuation of Intangible AssetsDocument23 pagesValuation of Intangible AssetsGaurav KumarNo ratings yet

- Net Phone ProjectDocument4 pagesNet Phone ProjectUyên TrầnNo ratings yet

- Mind TreeDocument10 pagesMind TreeGaurav JainNo ratings yet

- Telecommunication: OverweightDocument4 pagesTelecommunication: Overweightmuhamad fadzirNo ratings yet

- Hathway Press Release BSDocument3 pagesHathway Press Release BSAmol JadhaoNo ratings yet

- Fixed Line Telecom: Wateen Telecom Limited - Going For The ListingDocument4 pagesFixed Line Telecom: Wateen Telecom Limited - Going For The ListingjawadataNo ratings yet

- Intrep 2Document46 pagesIntrep 2mailimailiNo ratings yet

- 2010 Apr 12 - AMFraser - Thomson MedicalDocument4 pages2010 Apr 12 - AMFraser - Thomson MedicalKyithNo ratings yet

- Resource Sharing For An Intelligent Future: Interim Report 2021Document50 pagesResource Sharing For An Intelligent Future: Interim Report 2021mailimailiNo ratings yet

- Corporate Finance - Assignment Ceat Ltd. IntroductionDocument4 pagesCorporate Finance - Assignment Ceat Ltd. IntroductionSahil AhammedNo ratings yet

- Axiata Group BHD: Company ReportDocument6 pagesAxiata Group BHD: Company Reportlimml63No ratings yet

- Research Paper Study On Comparative Analysis Between Infosys and Tata Consultancy ServicesDocument5 pagesResearch Paper Study On Comparative Analysis Between Infosys and Tata Consultancy ServicesSaakshi TripathiNo ratings yet

- Investor Fact Sheet q3 Fy23Document16 pagesInvestor Fact Sheet q3 Fy23Anshul SainiNo ratings yet

- 51308-001-sd-02Document15 pages51308-001-sd-02VidyotmaNo ratings yet

- Nirmal Bang Dixon Technologies India Q2 FY24 Result UpdateDocument10 pagesNirmal Bang Dixon Technologies India Q2 FY24 Result UpdateyoursaaryaNo ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ice Melting Methods For Overhead LinesDocument28 pagesIce Melting Methods For Overhead LinesKirana Shree100% (1)

- Test Bank For Stuttering Foundations and Clinical Applications 0131573101Document24 pagesTest Bank For Stuttering Foundations and Clinical Applications 0131573101JimmyHaynessfmg100% (46)

- Jihad Najib - CV PDFDocument1 pageJihad Najib - CV PDFTaghzout MehdiNo ratings yet

- Do Plants Have Feelings PDFDocument7 pagesDo Plants Have Feelings PDFapi-340951588No ratings yet

- Readers Theatre Cassies JourneyDocument2 pagesReaders Theatre Cassies Journeyapi-253215615No ratings yet

- MR July-Aug 2020Document161 pagesMR July-Aug 2020minthuhtunNo ratings yet

- Free Mastic G 316Document5 pagesFree Mastic G 316Kelly RobertsNo ratings yet

- ICC ESR 4266 KB TZ2 Expansion Anchor Concrete ApprovalDocument16 pagesICC ESR 4266 KB TZ2 Expansion Anchor Concrete Approvalעמי עמרניNo ratings yet

- WWW Mytechnosoft Com Tibco Difference-between-bw5-And-bw6 PHPDocument3 pagesWWW Mytechnosoft Com Tibco Difference-between-bw5-And-bw6 PHPsabarin_72No ratings yet

- B.A. (Gen. English)Document156 pagesB.A. (Gen. English)sandiNo ratings yet

- Chapter IwarDocument20 pagesChapter IwartamilNo ratings yet

- RGP Fitting ReviewDocument4 pagesRGP Fitting ReviewSulki HanNo ratings yet

- Space FactorDocument5 pagesSpace FactorRafael Yap GNo ratings yet

- Codo2D MatlabDocument2 pagesCodo2D Matlabargenis bonillaNo ratings yet

- Phy110 Lab Report 1Document1 pagePhy110 Lab Report 1Khalila KhalishaNo ratings yet

- Irrigation and Water Power Engineering by Dr. B. C. Punmia - Dr. Pande Brij Basi Lal - Ashok Kumar Jain - Arun Kumar JainDocument187 pagesIrrigation and Water Power Engineering by Dr. B. C. Punmia - Dr. Pande Brij Basi Lal - Ashok Kumar Jain - Arun Kumar JainSaritha Reddy85% (85)

- Post Tensioning System July 2018Document12 pagesPost Tensioning System July 2018pandianNo ratings yet

- Textile Trade in BangladeshDocument5 pagesTextile Trade in BangladeshSanghamitra DasNo ratings yet

- Nonverbal CommunicationDocument23 pagesNonverbal CommunicationNaman Agarwal100% (1)

- Lesson Plan in ScienceDocument3 pagesLesson Plan in ScienceJesza May JuabanNo ratings yet

- Management Control System MODULE IDocument17 pagesManagement Control System MODULE IDr Linda Mary Simon100% (1)

- Comparison Subpart Q Vs New FTL 030314Document20 pagesComparison Subpart Q Vs New FTL 030314TomaszUchańskiNo ratings yet

- Teacher Quality StandardsDocument9 pagesTeacher Quality StandardsPaulina WilkersonNo ratings yet

- Aptitude Test InfosysDocument216 pagesAptitude Test InfosysJose PrakashNo ratings yet

- Overview of SAP CRM ModuleDocument13 pagesOverview of SAP CRM ModulesunilNo ratings yet