Professional Documents

Culture Documents

Jamna Auto Industries Limited

Jamna Auto Industries Limited

Uploaded by

polo0 ratings0% found this document useful (0 votes)

21 views1 pageThis document is the unaudited financial results for Jamna Auto Industries Limited for the quarter ended September 30, 2009. It shows the company's consolidated and standalone income, expenditures, profits/losses, and other financial details. For the quarter, the company reported a consolidated net profit of Rs. 525.75 lacs and a standalone net profit of Rs. 145.48 lacs. On a year-to-date basis, the consolidated net profit was Rs. 630.94 lacs while the standalone profit was Rs. 73.48 lacs. The paid up equity share capital of the company was Rs. 3,653.20 lacs.

Original Description:

Original Title

b4d22cb4-773f-4714-9862-ff71e9e7845d-A

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is the unaudited financial results for Jamna Auto Industries Limited for the quarter ended September 30, 2009. It shows the company's consolidated and standalone income, expenditures, profits/losses, and other financial details. For the quarter, the company reported a consolidated net profit of Rs. 525.75 lacs and a standalone net profit of Rs. 145.48 lacs. On a year-to-date basis, the consolidated net profit was Rs. 630.94 lacs while the standalone profit was Rs. 73.48 lacs. The paid up equity share capital of the company was Rs. 3,653.20 lacs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views1 pageJamna Auto Industries Limited

Jamna Auto Industries Limited

Uploaded by

poloThis document is the unaudited financial results for Jamna Auto Industries Limited for the quarter ended September 30, 2009. It shows the company's consolidated and standalone income, expenditures, profits/losses, and other financial details. For the quarter, the company reported a consolidated net profit of Rs. 525.75 lacs and a standalone net profit of Rs. 145.48 lacs. On a year-to-date basis, the consolidated net profit was Rs. 630.94 lacs while the standalone profit was Rs. 73.48 lacs. The paid up equity share capital of the company was Rs. 3,653.20 lacs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

JAMNA AUTO INDUSTRIES LIMITED

Registered Office: Jai Spring Road,Yamna Nagar, Haryana -135001

UN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED ON 30 SEPTEMBER 2009

(Rs. in lacs)

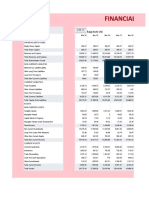

Sl. No. Particulars 3 months 3 months 3 months 3 months 6 months 6 months 6 months 6 months Year ended Year ended

ended 30.09.09 ended 30.09.09 ended 30.09.08 ended 30.09.08 ended 30.09.09 ended 30.09.09 ended 30.09.08 ended 30.09.08 31.03.09 31.03.09

Consolidated Standalone Consolidated Standalone Consolidated Standalone Consolidated Standalone Consolidated Standalone

Un-audited Un-audited Un-audited Un-audited Un-audited Un-audited Un-audited Un-audited Audited Audited

1 Gross Sales 16,424.84 15,007.71 15,851.28 15,851.28 27,440.87 25,060.61 34,343.64 34,343.64 52,062.08 51,378.17

Less :Excise Duty 1,148.41 1,148.41 2,042.97 2,042.97 1,907.05 1,907.05 4,470.03 4,470.03 6,132.87 6,132.87

Net Sales/Income from Operations 15,276.43 13,859.30 13,808.30 13,808.31 25,533.82 23,153.56 29,873.61 29,873.61 45,929.21 45,245.30

Other Operating Income - - - - - - - -

Total Operating Income 15,276.43 13,859.30 13,808.30 13,808.30 25,533.82 23,153.56 29,873.61 29,873.61 45,929.21 45,245.30

2 Expenditure :

a Decrease/(Increase) in stocks 549.16 703.13 (467.59) (467.59) (697.63) (543.66) (1,237.97) (1,237.97) 228.27 683.14

b Consumption of Raw Material 9,040.17 8,694.47 9,372.35 9,372.35 16,634.57 16,360.53 19,988.89 19,988.89 30,792.87 30,792.88

c Employees Cost 610.65 605.46 672.06 672.06 1,294.67 1,135.18 1,348.81 1,348.81 2,235.12 2,155.93

d Power & Fuel 747.38 744.85 798.95 798.95 1,214.68 1,208.18 1,756.56 1,756.56 2,250.80 2,246.65

e Depreciation 359.46 351.82 279.90 279.90 604.12 591.60 559.63 559.63 947.27 940.57

f Other Expenditure 2,401.32 1,622.46 2,167.00 2,167.00 4,024.86 2,732.60 4,998.66 4,998.66 7,475.08 6,907.84

g Total Expenditure 13,708.14 12,722.20 12,822.67 12,822.67 23,075.26 21,484.42 27,414.58 27,414.58 43,929.41 43,727.01

3 Profit from operations before Other Income, Interest & Exceptional Items 1,568.29 1,137.10 985.64 985.64 2,458.56 1,669.14 2,459.03 2,459.03 1,999.80 1,518.29

4 Other Income 17.83 17.22 53.48 53.48 59.00 57.65 60.08 60.08 797.06 795.58

5 Profit before Interest & Exceptional Items 1,586.12 1,154.32 1,039.12 1,039.12 2,517.56 1,726.79 2,519.11 2,519.11 2,796.86 2,313.87

6 Interest 610.92 581.86 843.47 843.47 1,193.46 1,157.11 1,659.78 1,659.78 3,554.26 3,548.17

7 Profit after Interest but before Exceptional Items 975.20 572.46 195.65 195.65 1,324.10 569.68 859.33 859.33 (757.40) (1,234.30)

8 Exceptional Items - - - - - - - - -

Deferred Revenue Expenditure w/off 292.00 267.04 177.14 177.14 516.06 466.06 315.19 315.19 850.68 799.97

9 Profit/(Loss) before Tax 683.19 305.42 18.51 18.51 808.04 103.62 544.14 544.14 (1,608.08) (2,034.27)

10 Provision For Taxation -

- Income Tax - - - - - - - - 5.90 0.78

- Fringe benefit Tax - - 14.77 14.77 - - 24.86 24.86 39.85 34.50

- Deferred Tax (70.99) (68.49) (148.18) (148.18) (51.33) (51.33) 36.69 36.69 (396.69) (430.07)

11 Profit/(Loss) after Tax 754.18 373.91 151.91 151.91 859.37 154.95 482.59 482.59 (1,257.14) (1,639.48)

12 Adjustment related to earlier years loss (+)/profit (-) 228.43 228.43 54.39 54.39 228.43 228.43 139.20 139.20 706.39 706.43

13 Profit/(Loss) for the period 525.75 145.48 97.53 97.53 630.94 (73.48) 343.38 343.38 (1,963.53) (2,345.91)

14 Paid up Equity Share Capital (Face Value-Rs.10/-each) 3,653.20 3,653.20 3,387.58 3,387.58 3,653.20 3,653.20 3,387.58 3,387.58 3,653.20 3,653.20

15 Reserves excluding revaluation reserve - - - - - 3,098.18 2,712.78

16 Earning per share (in Rs.) for the period

a Before Extraordinary Items

Basic 2.06 1.02 0.45 0.45 2.35 0.42 1.42 1.42 (3.59) (4.69)

Diluted 2.06 1.02 0.40 0.40 2.35 0.42 1.27 1.27 (3.59) (4.69)

b After Extraordinary Items

Basic 1.44 0.40 0.29 0.29 1.73 (0.20) 1.01 1.01 (5.61) (6.70)

Diluted 1.44 0.40 0.26 0.26 1.73 (0.20) 0.91 0.91 (5.61) (6.70)

17 Public shareholding

- Number of shares 20,173,450 20,173,450 17,753,235 17,753,235 20,173,450 20,173,450 17,753,235 17,753,235 20,173,450 20,173,450

- percentage of shareholding 55.22% 55.22% 52.41% 52.41% 55.22% 55.22% 52.41% 52.41% 55.22% 55.22%

18 Promoters and Promoter Group Shareholding

a) Pledged/ Encumbered

- Number of shares 15,603,006 11,068,192 15,603,006 11,068,192 11,949,802

- percentage of shares (as a % of the total shareholding of promoter and promoter group) 95.38% 68.65% 95.38% 68.65% 73.05%

- percentage of shares (as a % of the total share capital of the company) 32.70% 32.67% 32.70% 32.67% 32.71%

b) Non Encumbered

- Number of shares 755,591 5,054,365 755,591 5,054,365 4,408,795

- percentage of shares (as a % of the total shareholding of promoter and promoter group) 4.62% 31.35% 4.62% 31.35% 26.95%

- percentage of shares (as a % of the total share capital of the company) 2.06% 14.92% 2.06% 14.92% 12.07%

Note :

1 The consolidated un-audited financial results include results of the company and its wholly owned subsidiary i.e. Jai Suspension Systems Limited.

2 The above results were reviewed by the Audit Committee and thereafter taken on record by the Board of Directors at their meeting held on October 24, 2009 at New Delhi. Limited review, as required by clause 41 of the Listing Agreement, has been carried out by the auditors for the

standalone financial results of the company.

3 The company manufactures only Parabolic/ Tapered Springs (Auto Components) hence Segment Reporting does not apply.

4 Status of Investor complaints received by the company is as follows :

Pending at the beginning of the quarter: Nil Received during the quarter: 3

Resolved during the quarter: 3 Pending at the end of the quarter : Nil

5 Previous period figures have been regrouped wherever necessary to conform to the current period classification.

For Jamna Auto Industries Limited

Date: 24.10.2009 (Randeep Jauhar)

Place: New Delhi CEO & Executive Director

You might also like

- Exercises:: Record The Following Allotments, Obligations and Disbursements To Its Respective RegistriesDocument3 pagesExercises:: Record The Following Allotments, Obligations and Disbursements To Its Respective RegistriesJireh Rivera0% (1)

- Summer Internship PresentationDocument16 pagesSummer Internship PresentationGunjan KumarNo ratings yet

- S1-Residence and Sources of IncomeDocument59 pagesS1-Residence and Sources of IncomeMoud Khalfani100% (1)

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Link From Other Wsheet: InputDocument31 pagesLink From Other Wsheet: Inputferry fadlyNo ratings yet

- Q3 20 - DhunseriDocument3 pagesQ3 20 - Dhunserica.anup.kNo ratings yet

- Marico Combined FinalDocument9 pagesMarico Combined FinalAbhay Kumar SinghNo ratings yet

- Reg30LODR QFR LRReport 31dec2020 WebsiteDocument15 pagesReg30LODR QFR LRReport 31dec2020 WebsiteAnveshNo ratings yet

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDocument4 pagesPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorNo ratings yet

- Profit and LossDocument2 pagesProfit and LossSourav RajeevNo ratings yet

- Q2 20 & 6 Months DhunseriDocument7 pagesQ2 20 & 6 Months Dhunserica.anup.kNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financialsjayashankar4355No ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- 21 To 17 P and L AccountDocument1 page21 To 17 P and L AccountMehnaz AshrafNo ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- MoneyDocument1 pageMoneySashi TamizhaNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- Consolidated Profit CanarabankDocument1 pageConsolidated Profit CanarabankMadhav LuthraNo ratings yet

- Tata Motors PLDocument2 pagesTata Motors PLSravani BotchaNo ratings yet

- Verana Exhibit and SchedsDocument45 pagesVerana Exhibit and SchedsPrincess Dianne MaitelNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- IciciDocument9 pagesIciciChirdeep PareekNo ratings yet

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Document6 pagesChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- JSW Steel: PrintDocument2 pagesJSW Steel: PrintSpuran RamtejaNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- Ratio Analysis TanyaDocument10 pagesRatio Analysis Tanyatanya chauhanNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintUTSAVNo ratings yet

- Wipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundDocument4 pagesWipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundManikantha PatnaikNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 9S-2B Corporation Forecasted Income StatementDocument5 pages9S-2B Corporation Forecasted Income StatementFlora Fil GutierrezNo ratings yet

- Tata Motors: PrintDocument2 pagesTata Motors: Printprathamesh tawareNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Bharti Airtel LTDDocument7 pagesBharti Airtel LTDNanvinder SinghNo ratings yet

- Tech MahindraDocument11 pagesTech MahindraDakshNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- Bajaj Aut1Document2 pagesBajaj Aut1Rinku RajpootNo ratings yet

- MahindraDocument5 pagesMahindraworkf17hoursformeNo ratings yet

- Jammu and Kashmir Bank: PrintDocument1 pageJammu and Kashmir Bank: PrintMehnaz AshrafNo ratings yet

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsBhawani CreationsNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- Corporate Finance: Assignment - 1Document12 pagesCorporate Finance: Assignment - 1Ashutosh SharmaNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshNo ratings yet

- Standalone Result Sep, 17Document4 pagesStandalone Result Sep, 17Varun SidanaNo ratings yet

- Hero Motocorp: PrintDocument2 pagesHero Motocorp: PrintPhuntru PhiNo ratings yet

- q1 Results FinalDocument1 pageq1 Results Finalmixedbag100% (1)

- Nilkamal - AdwaithaDocument4 pagesNilkamal - AdwaithaSuraj PatelNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Tata Steel: PrintDocument1 pageTata Steel: PrintSEHWAG MATHAVANNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionMisbah SajidNo ratings yet

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchNo ratings yet

- Income StatementDocument2 pagesIncome StatementNatalia Casas CorderoNo ratings yet

- New Swet Baraha Unik Krishi: KavreDocument6 pagesNew Swet Baraha Unik Krishi: KavreJRaj DeujaNo ratings yet

- GAIL INDIA's P&L StatementDocument2 pagesGAIL INDIA's P&L StatementAtul AnandNo ratings yet

- Barcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023Document1 pageBarcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023JCNo ratings yet

- Quiz 2 Bookkeeping-1Document6 pagesQuiz 2 Bookkeeping-1John Vincent D. ReyesNo ratings yet

- Wasting Assets Impairment of AssetsDocument15 pagesWasting Assets Impairment of AssetsJc MarayagNo ratings yet

- New Horizon Business Proposal FinalDocument20 pagesNew Horizon Business Proposal FinalCHARRYSAH TABAOSARESNo ratings yet

- Akuntansi Manajemen Lanjutan: Job Order Costing Dan Process CostingDocument16 pagesAkuntansi Manajemen Lanjutan: Job Order Costing Dan Process Costingsilvia gynaNo ratings yet

- Acc501 Assignment SolutionDocument2 pagesAcc501 Assignment Solution2myofficesheetNo ratings yet

- 08 Recording Business TransactionsDocument10 pages08 Recording Business TransactionsRewsEn0% (1)

- Txrus 2019 Dec QDocument15 pagesTxrus 2019 Dec QKAH MENG KAMNo ratings yet

- WCM PresentationDocument52 pagesWCM PresentationJeffrey S. RequisoNo ratings yet

- BCG MatrixDocument4 pagesBCG MatrixAzwad ChowdhuryNo ratings yet

- COSTAC Quiz 1 Font 10 1st YrDocument2 pagesCOSTAC Quiz 1 Font 10 1st YrRikka TakanashiNo ratings yet

- Financial Statement Analysis of Microsoft Corporation (Revised)Document7 pagesFinancial Statement Analysis of Microsoft Corporation (Revised)Adhikansh SinghNo ratings yet

- Examiners' Report Principal Examiner Feedback October 2019Document5 pagesExaminers' Report Principal Examiner Feedback October 2019DURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- An Analysis of The Strategic ChallengesDocument33 pagesAn Analysis of The Strategic ChallengespragadeeshwaranNo ratings yet

- MGT201 Financial Management Formulas Lect 1 To 22Document13 pagesMGT201 Financial Management Formulas Lect 1 To 22Farhan UL HaqNo ratings yet

- Management Development Institute Gurgaon: InstructionsDocument2 pagesManagement Development Institute Gurgaon: Instructionspgpm20 SANCHIT GARGNo ratings yet

- PastillasDocument6 pagesPastillasJessa Caringal100% (3)

- Prelim/Advisory Exam: ACC 311 Managerial Accounting 1Document3 pagesPrelim/Advisory Exam: ACC 311 Managerial Accounting 1Dexter Joseph CuevasNo ratings yet

- Ignite Business Plan TemplateDocument24 pagesIgnite Business Plan TemplateAvi SikkaNo ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Sources of Data (2) Purposes of Financial Analysis (For Making Decisions) How To Analyze Financial DataDocument5 pagesSources of Data (2) Purposes of Financial Analysis (For Making Decisions) How To Analyze Financial DataĐinh AnhNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearrandhawagurbirkaurNo ratings yet

- ACCA F8 SlidesDocument58 pagesACCA F8 SlidesopentuitionID100% (4)

- Vce Summmer Internship Program ( - Stock Market)Document21 pagesVce Summmer Internship Program ( - Stock Market)Annu KashyapNo ratings yet

- Fill in The Blanks by Using The Words or Phrases Given BelowDocument8 pagesFill in The Blanks by Using The Words or Phrases Given BelowhokageNo ratings yet

- Ebook Concepts in Federal Taxation 2016 23Rd Edition Murphy Solutions Manual Full Chapter PDFDocument67 pagesEbook Concepts in Federal Taxation 2016 23Rd Edition Murphy Solutions Manual Full Chapter PDFbeckhamquangi9avb100% (13)

- Analysis of Investments in Debt Instrument8Document2 pagesAnalysis of Investments in Debt Instrument8Jan ryanNo ratings yet