Professional Documents

Culture Documents

Financial Reporting and Analysis

Financial Reporting and Analysis

Uploaded by

VampireOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Reporting and Analysis

Financial Reporting and Analysis

Uploaded by

VampireCopyright:

Available Formats

FORE School of Management, New Delhi

Course Outline

Programme: PGDM FM 3

Name of the Course: Financial Reporting and Analysis Credit: 3.0

Term: III Academic Year: 2020-21

Faculty: Dr. Ambrish Gupta Office Contact No.: 41242434

Classes starting 27th January, 2021. Email: ambrish @ fsm.ac.in

Introduction

This course is an extension and advanced version of the financial accounting course taught in the 1 st

term. Financial Reporting today, globally, is no more limited to balance sheet, statement of profit and

loss and statement of cash flows. The growing pressure of the capital market and globalization of

financial reporting has virtually made the corporate public entities bare themselves in relation to

financial issues affecting the investors. This course seeks to sensitize the students with the

advancements in and emerging dimensions of financial reporting in India as well as internationally.

The course should enable them identify the strategic issues and more transparent disclosures to make

necessary decision making towards creating more value for the shareholders. The whole course is

based upon real life cases of leading Indian corporates. Even for illustrations, in most cases corporate

case lets have been used. The real life case studies are meant to ensure greater student engagement as

students in this course are coming with corporate experience.

Objective

At the end of this course the students should be able to:

1. Appreciate the vast gamut of advancements taking place in the field of corporate financial

reporting, its purpose, implications and impact on the businesses and their stakeholders.

2. Analyze the various financial reports and key management strategies for assessing their specific

impact on shareholder value.

3. Develop competencies in creating and enhancing the value of the enterprise both tangible as well

as intangible.

Text Book (TB):

Financial Accounting for Management: An Analytical Perspective by Dr. Ambrish Gupta, Pearson

Education, 6th edition 2018.

Kindle book: https://www.amazon.in/Financial-Accounting-Management-Gupta-Ambrish-

ebook/dp/B07FKP8N2S

References:

There is no single book available covering the entire curriculum. Therefore, large number of reference

material will be used from various sources, such as:

A. Books:

1. Soundview Executive Book Summaries (USA): The EVA Challenge by Joel M. Stern and

John S. Shiely (John Wiley).

2. Brand Valuation, John Murphy, Business Books Ltd., London.

B. Other publications:

1. Related IFRS converged Indian Accounting Standards (IND ASs) issued by the ICAI.

Available at www.mca.gov.in

2. Corporate Annual Reports, Financial/Qualitative reports published by Business Magazines,

Economic News Papers and Corporate Research Reports, etc.

3. Companies’ websites, Other websites: www.sternstewart.com, www.sebi.gov.in, www.nse-

india.com, www.bseindia.com, www.icai.org, www.mca.gov.in

4. A financial database as available in the library

Page 1 of 4, FRA, PGDM FM 3, 2020-21.

Pedagogy

A mix of Lectures, In-class illustrations with practice problems, Case studies, case Lets, Quizzes,

Presentations by the Students, Small-Group Assignments/ Projects and etc. Group learning highly

recommended. Students will be provided up-to-date handouts also on many topics.on

Evaluation Components and Weightage

Evaluation Components (tentative) Weightage in Marks

Quiz 1/Class presentation 10 %

Midterm exam 20%

Quiz 2 10%

Group project 20%

End Term Exam. 40 %

Total 100 Marks

Session Plan

Session Session Theme Additional Question to

No. Reading/Cases explore/Learning

outcome*

1 About this course……….Mandatory vs. Voluntary reporting

1-2 Unit 1: 1. Chapter 11 (TB) Reporting substance over form.

Reporting and Analyzing 2. IND AS 116/17

Off balance sheet items: 3. Case: TeleVista

Leases. Mobile Ltd. (Case

center)

3 Unit 2: 1. Chapter 13 (TB) Fair value gain/loss on

Advanced issues in fair 2. IND AS 109 derivatives (cash flow hedges)

value reporting of 3. Case lets on and impairment of financial

financial instruments: impairment: ----CEAT,: assets as per fair value

1. Impairment of Asian Pints, Ashok measurement.

financial assets

Leyland

2. Gains/losses on

Derivatives

4-5 Unit 3: 1. Chapter 15/16 (TB) 1. Purpose, interlinkages and

Quality of reported 2. Cases: significance of these

earnings: Window Pawan Hans (Case reports.

dressing and analyst Centre) 2. Understanding window

Havells India dressing and its

adjustments.

significance in evaluating

1. Auditors’ report, 9 new cases

financial reports.

2. Directors’ report, 3. Case lets:

Indo-Rama (Ch. 15)

Liberty Shoes (Ch. 16)

Others from Ch. 15/16

6 Unit 4: 1. Chapter 15 (TB) Purpose, interlinkages and

Management’s discussion 2. Case: significance of these

and analysis report, Havells India report/statement.

Chairman’s Statement

7 Unit 5: 1. Chapter 15 (TB) Understanding Financial frauds

Financial frauds and 2. Case: Nestle and role of Corporate

Corporate governance 3. Case let: Sun Pharma governance in ensuring

report financial discipline

8 Unit 6: 1. Chapter 15 (TB) Understanding social

Page 2 of 4, FRA, PGDM FM 3, 2020-21.

Corporate social 2. Case: Havells India responsibility of business and

responsibility reporting its financial implications

QUIZ 1

9-10 Unit 7: 1. Chapter 23 (TB) Analyzing group performance

Consolidated financial 2. IND AS 28, 110, as a single unit

reporting: Expansion and Cases: Reliance

diversification through Industries (Case

subsidiary companies Centre), ICICI Bank

associates and joint

ventures

MID TERM EXAM

11-12 Unit 8: 1. IND AS 108 Individual analysis of

Operating segments 2. Case-ITC (case performance of different

reporting: Operations Centre), Titan business lines

diversification

13 Unit 9: 1. IND AS 34 Keeping reporting to the

Interim financial 2. Case-Bharat investors on a continual basis:

reporting: Continuous Electronics, Colgate information symmetry

evaluation through

quarterly results

14 Unit 10: 1. IND AS 24 Assessment of the impact of

Reporting related party 2. Case: Nestle RPTs on financial performance

transactions and position

15-16 Unit 11: 1. Social media: Company Going beyond the published

Corporate financial websites

communication: Investor 2. Cases: ITC. Reliance,

presentations/earnings Colgate,

call/ Media releases

/interactive analysis tool

QUIZ 2

17-18 Unit 12: 1. Chapter 24 (TB) 1. Understand and appreciate

Emerging dimensions of 2. The EVA Challenge the trends in voluntary

corporate voluntary 1. Case: Hindustan reporting practices.

reporting: Unilever (Case Centre). 2. Understand and analyze

Shareholder value: 2. Case on IR implications of EVA for

Economic value added, shareholder value and

Enterprise value, MVA, related issues

Total shareholder return,

Integrated Reporting,

19-20 Unit 13: 1. Chapter 24 (TB) Ascertainment of brand value

Emerging dimensions of 2. Brand Valuation, John in financial terms and its impact

corporate voluntary Murphy on financial reporting

reporting: 3. Case: on select

Valuation and reporting corporate.

of brands

20 Debriefing

Note: Chapter numbers refer to those in the text book.

Page 3 of 4, FRA, PGDM FM 3, 2020-21.

For official use: -

As Benchmarked with course content in previous year, the contents of this course: (Please mark the

right option below)

(a) Is totally new

(b) Has not changed at all

Has undergone less than/equal to 20% change

(c) Has undergone more than 20% change

Faculty Signature: ______Dr. Ambrish Gupta_________8th January, 20221

Area Chair Signature: _____________

Page 4 of 4, FRA, PGDM FM 3, 2020-21.

You might also like

- AWWA-AWWA Standard C530-12 Pilot Operated Control Valves-American Water Works Association (2012)Document32 pagesAWWA-AWWA Standard C530-12 Pilot Operated Control Valves-American Water Works Association (2012)virtech100% (1)

- Introduction To Financial Statements 1Document22 pagesIntroduction To Financial Statements 1Sarbani Mishra100% (1)

- Financialreportingdevelopments bb1616 Businesscombinations 7february2018-V2 PDFDocument442 pagesFinancialreportingdevelopments bb1616 Businesscombinations 7february2018-V2 PDFJenie Diotusme100% (1)

- Management AccountingDocument2 pagesManagement AccountingVampire0% (1)

- Build Your Own Recumbent TrikeDocument242 pagesBuild Your Own Recumbent TrikeArte Colombiano100% (4)

- Unit 1. Merchant Banking Indian Financial SystemDocument91 pagesUnit 1. Merchant Banking Indian Financial SystemVENKATESAN R-2020No ratings yet

- Product Guides - Trade & ForexDocument32 pagesProduct Guides - Trade & ForexRishitha AryaniNo ratings yet

- MBA Financial ManagementDocument30 pagesMBA Financial ManagementAngel PowerNo ratings yet

- The Accounting Cycle:: Accruals and DeferralsDocument41 pagesThe Accounting Cycle:: Accruals and Deferralsmahtab_rasheedNo ratings yet

- CA Final SFM Notes For Foreign Exchange RiskDocument9 pagesCA Final SFM Notes For Foreign Exchange Riskqamaraleem1_25038318No ratings yet

- Course Outline Advanced Corporate Finance 2019Document8 pagesCourse Outline Advanced Corporate Finance 2019Ali Shaharyar ShigriNo ratings yet

- Chapter - 20 Cash and Liquidity ManagementDocument17 pagesChapter - 20 Cash and Liquidity ManagementBayem BusukNo ratings yet

- Chapter 13 PDFDocument73 pagesChapter 13 PDFMUKESH KUMARNo ratings yet

- Shubham Hedge FundDocument71 pagesShubham Hedge FundfgersgtesrtgeNo ratings yet

- AFM Chapter 5 Revenue Recognition MergeDocument60 pagesAFM Chapter 5 Revenue Recognition MergeSarah Shahnaz IlmaNo ratings yet

- Bank Financing As An Incentive For Earnings Management in Business Start-UpsDocument41 pagesBank Financing As An Incentive For Earnings Management in Business Start-UpsShakeel AhmadNo ratings yet

- FOREX & Interest RiskDocument11 pagesFOREX & Interest Riskpercy mapetereNo ratings yet

- BCOM 1ST YR Commercial Bank - Unit IDocument12 pagesBCOM 1ST YR Commercial Bank - Unit IUrvi KaleNo ratings yet

- Vayana NetworkDocument8 pagesVayana NetworkSai ChandanNo ratings yet

- Financial Statement Analysis of Icici BankDocument24 pagesFinancial Statement Analysis of Icici BankPadmavati UdechaNo ratings yet

- Lecture 2 Behavioural Finance and AnomaliesDocument15 pagesLecture 2 Behavioural Finance and AnomaliesQamarulArifin100% (1)

- MusharakaDocument29 pagesMusharakaNauman AminNo ratings yet

- Financial FormationDocument60 pagesFinancial FormationSandeep Soni100% (1)

- FM (3 Files Merged)Document43 pagesFM (3 Files Merged)Priyanka MahajanNo ratings yet

- Cash FlowDocument15 pagesCash Flowken philipsNo ratings yet

- MSCO Firm's ProfileDocument19 pagesMSCO Firm's ProfileSalman LatifNo ratings yet

- Liquidity and Cash ManagementDocument9 pagesLiquidity and Cash ManagementSharath MenonNo ratings yet

- General Instructions: Provide Answers To The Requirements in The Best of Your Ability. Should You Have QuestionsDocument7 pagesGeneral Instructions: Provide Answers To The Requirements in The Best of Your Ability. Should You Have QuestionsJanna Lane FaunillanNo ratings yet

- CAIIB Questions Case StudiesDocument18 pagesCAIIB Questions Case StudiesSreejith BhattathiriNo ratings yet

- New Amfi MaterialDocument146 pagesNew Amfi MaterialPritam PaulNo ratings yet

- Financial Accounting Chapter 4Document59 pagesFinancial Accounting Chapter 4abhinav2018No ratings yet

- Lesson 4Document114 pagesLesson 4Quyen Thanh NguyenNo ratings yet

- Credit RatingDocument42 pagesCredit Ratingshivakumar N100% (3)

- Advanced Management AccountingDocument10 pagesAdvanced Management AccountingKhalid AhmedNo ratings yet

- Technical Guide On Stock and Receivables Audit - IASBDocument158 pagesTechnical Guide On Stock and Receivables Audit - IASBMudit Kothari100% (2)

- FRTB 0719 4Document28 pagesFRTB 0719 4Ashish Kansal100% (1)

- BEST PPT On Behavioural FinanceDocument43 pagesBEST PPT On Behavioural FinanceDebasish PahiNo ratings yet

- Behavioral Bias Among Professionals With Respect To Investment in Mutual FundsDocument6 pagesBehavioral Bias Among Professionals With Respect To Investment in Mutual FundsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Substantive Procedures For Sales RevenueDocument5 pagesSubstantive Procedures For Sales RevenuePubg DonNo ratings yet

- Meaning and Importance of Liquidity: Financial AccountingDocument3 pagesMeaning and Importance of Liquidity: Financial AccountingrakeshgantiNo ratings yet

- Comparative Discussion Among BASEL I, BASEL II & BASEL IIIDocument4 pagesComparative Discussion Among BASEL I, BASEL II & BASEL IIIRajesh PaulNo ratings yet

- RBI Credit PolicyDocument1 pageRBI Credit Policysangya01No ratings yet

- 6may IIBF ALMDocument62 pages6may IIBF ALMmevrick_guyNo ratings yet

- Introduction To Accounting and Business: Instructor Le Ngoc Anh KhoaDocument66 pagesIntroduction To Accounting and Business: Instructor Le Ngoc Anh KhoaThien TranNo ratings yet

- CFAs Code of Ethics and Standards of Professional ConductDocument2 pagesCFAs Code of Ethics and Standards of Professional ConductHeidi DaoNo ratings yet

- Entrepreneur FinanceDocument30 pagesEntrepreneur FinanceNekoChanNo ratings yet

- Series-V-A: Mutual Fund Distributors Certification ExaminationDocument218 pagesSeries-V-A: Mutual Fund Distributors Certification ExaminationAjithreddy BasireddyNo ratings yet

- Par Forward-Average Rate ForwardDocument3 pagesPar Forward-Average Rate ForwardNarayan SetharamanNo ratings yet

- What Is Cash FlowDocument31 pagesWhat Is Cash FlowSumaira BilalNo ratings yet

- What Is The Indirect MethodDocument3 pagesWhat Is The Indirect MethodHsin Wua ChiNo ratings yet

- 5 Red Flags - : How To Find The Big ShortDocument6 pages5 Red Flags - : How To Find The Big Shortaznxrom3o714No ratings yet

- (Lecture 19 & 20) - Interest Rate RiskDocument6 pages(Lecture 19 & 20) - Interest Rate RiskAjay Kumar TakiarNo ratings yet

- Getting Smarter Series Fund of FundsDocument6 pagesGetting Smarter Series Fund of Fundskishore13No ratings yet

- Fundamental of Foreign Exchange MarketDocument42 pagesFundamental of Foreign Exchange MarketkopnasjayaNo ratings yet

- Consolidation PDFDocument3 pagesConsolidation PDFMjhayeNo ratings yet

- Are You Identifying and Managing The Key Tax Risks in TMT M&A?Document1 pageAre You Identifying and Managing The Key Tax Risks in TMT M&A?CcapealNo ratings yet

- Strategic Perspective On Merger-AcquistionsDocument17 pagesStrategic Perspective On Merger-AcquistionsTubagus Donny SyafardanNo ratings yet

- A Critique On Accounting For Murabaha Contract A Comparative Analysis of IFRS and AAOIFI Accounting Standards PDFDocument13 pagesA Critique On Accounting For Murabaha Contract A Comparative Analysis of IFRS and AAOIFI Accounting Standards PDFAhmad BaehaqiNo ratings yet

- Management Accounting Systems inDocument9 pagesManagement Accounting Systems inanashj2No ratings yet

- Swap Chapter 1Document18 pagesSwap Chapter 1sudhakarhereNo ratings yet

- Reporting and Analyzing ReceivablesDocument72 pagesReporting and Analyzing ReceivablesRishabh JainNo ratings yet

- FORE School of Management Course Outline & Session PlanDocument4 pagesFORE School of Management Course Outline & Session PlanAru RanjanNo ratings yet

- Course Outline - Financial Accounting - FMG 27, IMG 12 & FM 1 - Prof. Vandana Gupta, Prof. Ambrish Gupta and Prof. HarshitaDocument3 pagesCourse Outline - Financial Accounting - FMG 27, IMG 12 & FM 1 - Prof. Vandana Gupta, Prof. Ambrish Gupta and Prof. HarshitaVineetNo ratings yet

- Data Analysis PortfolioDocument10 pagesData Analysis PortfolioVampireNo ratings yet

- 6 - Manufacturing Processes - Dec 2020Document17 pages6 - Manufacturing Processes - Dec 2020VampireNo ratings yet

- 7 Corporate Finance - Prof. Gagan SharmaDocument4 pages7 Corporate Finance - Prof. Gagan SharmaVampireNo ratings yet

- Floxus WorkshopDocument169 pagesFloxus WorkshopVampireNo ratings yet

- Price Crime - Rate Resid - Area Air - Qual Room - NumDocument48 pagesPrice Crime - Rate Resid - Area Air - Qual Room - NumVampireNo ratings yet

- Data Analyst Working SheetDocument368 pagesData Analyst Working SheetVampireNo ratings yet

- 11 Solver RegDocument38 pages11 Solver RegVampireNo ratings yet

- Regression: Analysis Toolpak Add-InDocument19 pagesRegression: Analysis Toolpak Add-InVampireNo ratings yet

- Regression Statistics: ResidualsDocument5 pagesRegression Statistics: ResidualsVampireNo ratings yet

- HR QuestionsDocument5 pagesHR QuestionsVampireNo ratings yet

- All SubjectsDocument1 pageAll SubjectsVampireNo ratings yet

- Price Crime - Rate Resid - Area Air - Qual Room - NumDocument50 pagesPrice Crime - Rate Resid - Area Air - Qual Room - NumVampireNo ratings yet

- Excel PraticeDocument7 pagesExcel PraticeVampireNo ratings yet

- Machine Learning With PythonDocument4 pagesMachine Learning With PythonVampireNo ratings yet

- Data VisualizationDocument3 pagesData VisualizationVampireNo ratings yet

- Financial Markets, Institutions and Services (SAPR)Document4 pagesFinancial Markets, Institutions and Services (SAPR)VampireNo ratings yet

- Macroeconomics and PolicyDocument3 pagesMacroeconomics and PolicyVampireNo ratings yet

- Ranneeti Slide 1Document1 pageRanneeti Slide 1VampireNo ratings yet

- Atmadeep Das: Presented byDocument27 pagesAtmadeep Das: Presented byVampire100% (1)

- WR WQ Pub Design Criteria Ch5Document10 pagesWR WQ Pub Design Criteria Ch5Teena AlawadNo ratings yet

- PDBA Operations Course OutlineDocument12 pagesPDBA Operations Course OutlineQasim AbrahamsNo ratings yet

- AOF - Orcs v2.50Document2 pagesAOF - Orcs v2.50Emilio Domingo RodrigoNo ratings yet

- 4 PsDocument5 pages4 PsRaj Vardhan GaurNo ratings yet

- Hf7/Hf9 Front Axle Spare Parts Catalog: SinotrukDocument9 pagesHf7/Hf9 Front Axle Spare Parts Catalog: SinotrukSamuel WilliamsNo ratings yet

- 1.1 Nanomaterials and NanoparticlesDocument2 pages1.1 Nanomaterials and NanoparticlesDuyen75% (4)

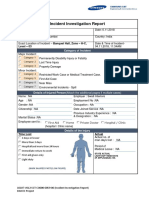

- Incident Investigation Report - Fire Incedent - 04-11-2018 Swati InteriorsDocument4 pagesIncident Investigation Report - Fire Incedent - 04-11-2018 Swati InteriorsMobin Thomas AbrahamNo ratings yet

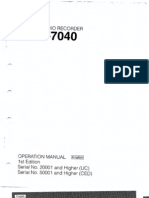

- Sony PCM-7040 1st EdDocument81 pagesSony PCM-7040 1st EdnicureddogsfloNo ratings yet

- SQL Exercise 1&2Document3 pagesSQL Exercise 1&2Ken 07No ratings yet

- (Book) Zero EnergyDocument155 pages(Book) Zero EnergycacaNo ratings yet

- Case Study Overhead Costs AnalysisDocument13 pagesCase Study Overhead Costs AnalysisTon SyNo ratings yet

- Balance of Payment - Chapter1 - IED - AssignmentDocument4 pagesBalance of Payment - Chapter1 - IED - Assignmentavika jainNo ratings yet

- English 4 Q1 WK1Document3 pagesEnglish 4 Q1 WK1Ace B. SilvestreNo ratings yet

- ArcUri - Organe de Masini OMDocument18 pagesArcUri - Organe de Masini OMCîrstea BökiNo ratings yet

- AHF Thesis - CorrectedDocument146 pagesAHF Thesis - CorrectedAlasdair FikourasNo ratings yet

- Multi-Threading Processes: The ConceptDocument5 pagesMulti-Threading Processes: The ConceptNenad KiticNo ratings yet

- BSR455 - Group 9 - Building Inspection - 3aDocument22 pagesBSR455 - Group 9 - Building Inspection - 3aMuhammad IdzhamNo ratings yet

- Research Methodology - 9Document12 pagesResearch Methodology - 9OmeYadavNo ratings yet

- EXD2010 EX200: Compact Ex D Electro-Hydraulic Positioning and Monitoring SystemDocument8 pagesEXD2010 EX200: Compact Ex D Electro-Hydraulic Positioning and Monitoring SystemKelvin Anthony OssaiNo ratings yet

- VCR Science Seminar BrochureDocument2 pagesVCR Science Seminar BrochureBonnie guptaNo ratings yet

- Semprof SweetinaDocument20 pagesSemprof SweetinaSweetina MerkusiNo ratings yet

- Unit-14 Maintenance BookDocument57 pagesUnit-14 Maintenance Bookrama_subbuNo ratings yet

- 4 P's of RolexDocument27 pages4 P's of RolexDaniel Carroll50% (10)

- 2023 Nfhs Track and Field Field Events Diagrams FinalDocument8 pages2023 Nfhs Track and Field Field Events Diagrams FinalpughalendiranNo ratings yet

- Bernard Stanley Hoyes: RAG DrawingsDocument29 pagesBernard Stanley Hoyes: RAG Drawingsapi-258238272No ratings yet

- Atomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response CompositeDocument16 pagesAtomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response Compositedmcook3No ratings yet

- Welcome To Everest Insurance CoDocument2 pagesWelcome To Everest Insurance Cosrijan consultancyNo ratings yet

- Chapter 5 - Object-Oriented Database ModelDocument9 pagesChapter 5 - Object-Oriented Database Modelyoseffisseha12No ratings yet