Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsDeal

Deal

Uploaded by

jammy AgnoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Rules On Gross Income TaxationDocument15 pagesRules On Gross Income TaxationEar TanNo ratings yet

- Income and Withholding TaxesDocument67 pagesIncome and Withholding TaxesPo EllaNo ratings yet

- As 19Document4 pagesAs 19gowriNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Capital Gains TaxDocument6 pagesCapital Gains Taxnadj72576No ratings yet

- CH 3 Leasing (M.Y.Khan)Document11 pagesCH 3 Leasing (M.Y.Khan)Harshit SrivastavNo ratings yet

- IFRS Chapter 16 LeasingDocument24 pagesIFRS Chapter 16 LeasingEbru Y.yiğitNo ratings yet

- HK IRD Tax GuideDocument34 pagesHK IRD Tax GuideAlex LimNo ratings yet

- Essay On Passive IncomeDocument10 pagesEssay On Passive IncomeJithesh ViswanadhNo ratings yet

- Capital Gains TaxationDocument44 pagesCapital Gains TaxationPrince Anton DomondonNo ratings yet

- Accounting Periods and Methods of AccountingDocument11 pagesAccounting Periods and Methods of Accountingmhilet_chiNo ratings yet

- Individuals Income TaxDocument25 pagesIndividuals Income TaxNestor III Dela CruzNo ratings yet

- Hong Kong Taxation Reform: From An Offshore Financial Center PerspectiveDocument10 pagesHong Kong Taxation Reform: From An Offshore Financial Center Perspectivegp8hohohoNo ratings yet

- Vat at A GlanceDocument19 pagesVat at A GlanceABHIJIT MONDAL100% (1)

- ACC311 3rd Exam CoverageDocument108 pagesACC311 3rd Exam CoverageHilarie JeanNo ratings yet

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89No ratings yet

- P - 3 Taxation-Kavitha Que.&AnsDocument48 pagesP - 3 Taxation-Kavitha Que.&AnsPrabhat TejaNo ratings yet

- Summary On As 11Document2 pagesSummary On As 11Jean BrooksNo ratings yet

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostreNo ratings yet

- 10 42 Vat at GlanceDocument19 pages10 42 Vat at Glanceemmanuel JohnyNo ratings yet

- Optional Standard DeductionDocument3 pagesOptional Standard DeductionYuvia Keithleyre100% (1)

- M4 P3 Inclusion Students Copy 1Document33 pagesM4 P3 Inclusion Students Copy 1Aaron BuendiaNo ratings yet

- Inclusion of Gross IncomeDocument24 pagesInclusion of Gross IncomeAce ReytaNo ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- Direct Tax Code: Kunal Vora Bhavik BhanderiDocument11 pagesDirect Tax Code: Kunal Vora Bhavik BhanderiBhavik BhanderiNo ratings yet

- Lease Agreement Between COC and CODDocument5 pagesLease Agreement Between COC and CODAntonieto BNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Final Withholding Tax FWT and CapitalDocument39 pagesFinal Withholding Tax FWT and CapitalJessa HerreraNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationZehra LeeNo ratings yet

- Other Percentage TaxDocument19 pagesOther Percentage TaxChristine AceronNo ratings yet

- Module 5 Philippine Income Taxation CorporationDocument63 pagesModule 5 Philippine Income Taxation CorporationFlameNo ratings yet

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Chapter 6 TaxDocument17 pagesChapter 6 TaxAngelika OlarteNo ratings yet

- Real Estate TaxesDocument5 pagesReal Estate TaxesJorgeNo ratings yet

- Lecture Notes Allowable DeductionsDocument51 pagesLecture Notes Allowable DeductionsRaymond MedinaNo ratings yet

- Regular Income Tax: Inclusion in Gross IncomeDocument9 pagesRegular Income Tax: Inclusion in Gross IncomeE.D.JNo ratings yet

- Chapter 4-Final Income TaxationDocument17 pagesChapter 4-Final Income TaxationPrincesa RoqueNo ratings yet

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanNo ratings yet

- Taxation of Derivatives - Taxguru - inDocument4 pagesTaxation of Derivatives - Taxguru - inpksNo ratings yet

- Fit Chap011Document59 pagesFit Chap011goodfella00975% (4)

- The Taxes Involved in A Sale of Real Estate PropertyDocument7 pagesThe Taxes Involved in A Sale of Real Estate PropertyJessa CaberteNo ratings yet

- Cir Vs SeagateDocument3 pagesCir Vs Seagatemsu7070No ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Dealings in Property-Income TaxationDocument70 pagesDealings in Property-Income TaxationKana Lou Cassandra Besana67% (3)

- Author Ayan Ahmed Blog Capital Gain in FranceDocument5 pagesAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- Northern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomeDocument16 pagesNorthern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomePauline EchanoNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Self Employed: TRN Requirements For Sole ProprietorsDocument14 pagesSelf Employed: TRN Requirements For Sole ProprietorsAnonymous imWQ1y63No ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Gains and Losses From Dealings in PropertiesDocument29 pagesGains and Losses From Dealings in PropertiesCj Garcia100% (1)

- Optional Standard Deduction OSDDocument28 pagesOptional Standard Deduction OSDLes EvangeListaNo ratings yet

- Philippine Income Taxation - IncomeDocument48 pagesPhilippine Income Taxation - IncomeJenny Malabrigo, MBANo ratings yet

- Remic Guide As Explained To Investors - Easy To UnderstandDocument7 pagesRemic Guide As Explained To Investors - Easy To Understand83jjmackNo ratings yet

- Vat Tax CasesDocument24 pagesVat Tax CasesEller-JedManalacMendozaNo ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- The Cost of Quality and Accounting For Production LossesDocument19 pagesThe Cost of Quality and Accounting For Production Lossesjammy AgnoNo ratings yet

- Chapter 8: Home Office, Branch, and Agency AccountingDocument32 pagesChapter 8: Home Office, Branch, and Agency Accountingjammy Agno50% (2)

- Home Office Branch and Agency Accounting AnswersDocument25 pagesHome Office Branch and Agency Accounting Answersjammy AgnoNo ratings yet

- A Lease Agreement Will Qualify As A Finance Lease If One of These Conditions OccurDocument1 pageA Lease Agreement Will Qualify As A Finance Lease If One of These Conditions Occurjammy AgnoNo ratings yet

Deal

Deal

Uploaded by

jammy Agno0 ratings0% found this document useful (0 votes)

6 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageDeal

Deal

Uploaded by

jammy AgnoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

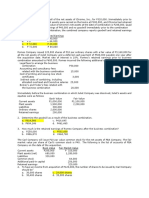

The profit on a finance lease transaction for lessors who are manufacturers or dealers

should *

1 point

Not be recognized separately from finance income

Be recognized in the normal way on the transaction

Only be recognized at the end of the lease term

Be allowed on a straight-line basis over the life of the lease

All of the following must be disclosed separately, except *

1 point

The aggregate amount of current and deferred tax relating to items recognized directly in equity.

Analysis of the beginning and ending balance of deferred tax asset and deferred tax liability.

The applicable tax rate, th6666e basis on which the tax rate is applied and explanation for any

change in tax rate.

The tax bases of all items on which deferred tax has been calculated.

You might also like

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Rules On Gross Income TaxationDocument15 pagesRules On Gross Income TaxationEar TanNo ratings yet

- Income and Withholding TaxesDocument67 pagesIncome and Withholding TaxesPo EllaNo ratings yet

- As 19Document4 pagesAs 19gowriNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Capital Gains TaxDocument6 pagesCapital Gains Taxnadj72576No ratings yet

- CH 3 Leasing (M.Y.Khan)Document11 pagesCH 3 Leasing (M.Y.Khan)Harshit SrivastavNo ratings yet

- IFRS Chapter 16 LeasingDocument24 pagesIFRS Chapter 16 LeasingEbru Y.yiğitNo ratings yet

- HK IRD Tax GuideDocument34 pagesHK IRD Tax GuideAlex LimNo ratings yet

- Essay On Passive IncomeDocument10 pagesEssay On Passive IncomeJithesh ViswanadhNo ratings yet

- Capital Gains TaxationDocument44 pagesCapital Gains TaxationPrince Anton DomondonNo ratings yet

- Accounting Periods and Methods of AccountingDocument11 pagesAccounting Periods and Methods of Accountingmhilet_chiNo ratings yet

- Individuals Income TaxDocument25 pagesIndividuals Income TaxNestor III Dela CruzNo ratings yet

- Hong Kong Taxation Reform: From An Offshore Financial Center PerspectiveDocument10 pagesHong Kong Taxation Reform: From An Offshore Financial Center Perspectivegp8hohohoNo ratings yet

- Vat at A GlanceDocument19 pagesVat at A GlanceABHIJIT MONDAL100% (1)

- ACC311 3rd Exam CoverageDocument108 pagesACC311 3rd Exam CoverageHilarie JeanNo ratings yet

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89No ratings yet

- P - 3 Taxation-Kavitha Que.&AnsDocument48 pagesP - 3 Taxation-Kavitha Que.&AnsPrabhat TejaNo ratings yet

- Summary On As 11Document2 pagesSummary On As 11Jean BrooksNo ratings yet

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostreNo ratings yet

- 10 42 Vat at GlanceDocument19 pages10 42 Vat at Glanceemmanuel JohnyNo ratings yet

- Optional Standard DeductionDocument3 pagesOptional Standard DeductionYuvia Keithleyre100% (1)

- M4 P3 Inclusion Students Copy 1Document33 pagesM4 P3 Inclusion Students Copy 1Aaron BuendiaNo ratings yet

- Inclusion of Gross IncomeDocument24 pagesInclusion of Gross IncomeAce ReytaNo ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- Direct Tax Code: Kunal Vora Bhavik BhanderiDocument11 pagesDirect Tax Code: Kunal Vora Bhavik BhanderiBhavik BhanderiNo ratings yet

- Lease Agreement Between COC and CODDocument5 pagesLease Agreement Between COC and CODAntonieto BNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Final Withholding Tax FWT and CapitalDocument39 pagesFinal Withholding Tax FWT and CapitalJessa HerreraNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationZehra LeeNo ratings yet

- Other Percentage TaxDocument19 pagesOther Percentage TaxChristine AceronNo ratings yet

- Module 5 Philippine Income Taxation CorporationDocument63 pagesModule 5 Philippine Income Taxation CorporationFlameNo ratings yet

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Chapter 6 TaxDocument17 pagesChapter 6 TaxAngelika OlarteNo ratings yet

- Real Estate TaxesDocument5 pagesReal Estate TaxesJorgeNo ratings yet

- Lecture Notes Allowable DeductionsDocument51 pagesLecture Notes Allowable DeductionsRaymond MedinaNo ratings yet

- Regular Income Tax: Inclusion in Gross IncomeDocument9 pagesRegular Income Tax: Inclusion in Gross IncomeE.D.JNo ratings yet

- Chapter 4-Final Income TaxationDocument17 pagesChapter 4-Final Income TaxationPrincesa RoqueNo ratings yet

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanNo ratings yet

- Taxation of Derivatives - Taxguru - inDocument4 pagesTaxation of Derivatives - Taxguru - inpksNo ratings yet

- Fit Chap011Document59 pagesFit Chap011goodfella00975% (4)

- The Taxes Involved in A Sale of Real Estate PropertyDocument7 pagesThe Taxes Involved in A Sale of Real Estate PropertyJessa CaberteNo ratings yet

- Cir Vs SeagateDocument3 pagesCir Vs Seagatemsu7070No ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Dealings in Property-Income TaxationDocument70 pagesDealings in Property-Income TaxationKana Lou Cassandra Besana67% (3)

- Author Ayan Ahmed Blog Capital Gain in FranceDocument5 pagesAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- Northern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomeDocument16 pagesNorthern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomePauline EchanoNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Self Employed: TRN Requirements For Sole ProprietorsDocument14 pagesSelf Employed: TRN Requirements For Sole ProprietorsAnonymous imWQ1y63No ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Gains and Losses From Dealings in PropertiesDocument29 pagesGains and Losses From Dealings in PropertiesCj Garcia100% (1)

- Optional Standard Deduction OSDDocument28 pagesOptional Standard Deduction OSDLes EvangeListaNo ratings yet

- Philippine Income Taxation - IncomeDocument48 pagesPhilippine Income Taxation - IncomeJenny Malabrigo, MBANo ratings yet

- Remic Guide As Explained To Investors - Easy To UnderstandDocument7 pagesRemic Guide As Explained To Investors - Easy To Understand83jjmackNo ratings yet

- Vat Tax CasesDocument24 pagesVat Tax CasesEller-JedManalacMendozaNo ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- The Cost of Quality and Accounting For Production LossesDocument19 pagesThe Cost of Quality and Accounting For Production Lossesjammy AgnoNo ratings yet

- Chapter 8: Home Office, Branch, and Agency AccountingDocument32 pagesChapter 8: Home Office, Branch, and Agency Accountingjammy Agno50% (2)

- Home Office Branch and Agency Accounting AnswersDocument25 pagesHome Office Branch and Agency Accounting Answersjammy AgnoNo ratings yet

- A Lease Agreement Will Qualify As A Finance Lease If One of These Conditions OccurDocument1 pageA Lease Agreement Will Qualify As A Finance Lease If One of These Conditions Occurjammy AgnoNo ratings yet