Professional Documents

Culture Documents

Managing Financial Risk: Exible ST

Managing Financial Risk: Exible ST

Uploaded by

mm1881Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing Financial Risk: Exible ST

Managing Financial Risk: Exible ST

Uploaded by

mm1881Copyright:

Available Formats

LEXIBLE STR

$

F UCTURE

MANAGING

$

FINANCIAL RISK

by Simon Jegher

n my 10 years managing finance/trea- tions and investment bankers point to the fact

I

sury departments, I have spent consid- that, other than in financial institutions, a uni-

erable effort addressing the financial fied and comprehensive financial risk manage-

imperatives of two of Canada’s largest ment focus is likely an exception.

corporations: cash management, The objective of such a process is, first and

including banking and committed lines foremost, to address the key policies relating to

of credit; external financings, averaging financial risk exposures. For example, credit

$1 billion per year, in the global capital mar- ratings are too often seen as simply the fallout

kets; early calls of publicly held debt; deriva- of financial performance, not the result of poli-

tives; pension funds; debt rating agencies; and cies tailored to attaining a specific rating that

all the other associated functions that are the addresses a firm’s long-term capital require-

bread and butter of our daily corporate finance ments. A credit rating policy can set up other

lives. Yet, I always felt a need for a greater capital structure strategies and an appropriate

structure that would bring together these func- fixed/floating composition of the debt portfolio.

tions and the people who implement them—a Another objective of a unified process is to

flexible structure that would encourage the foster a consolidated perspective of financial

innovation required to create financial benefits risk—not only the risk to the company itself,

and shareholder value. but its subsidiaries and parent, where applica-

While on vacation two years ago on a peace- ble. Similarly, for companies with defined bene-

ful, somewhat remote, island off the west coast fit pension plans, the plan’s assets and liabilities

of Florida, I spent a few evenings churning out must also be incorporated into this consolidated

concepts, financial instruments, risks and func- perspective, recognizing that financial risks

tions as they randomly occurred to me. Before I affecting off-balance-sheet items can have signif-

knew it an entire wall was blanketed with yel- icant impacts on cash flows and net income.

low notes. The next few evenings were spent Finally, a comprehensive process brings to light

rearranging the ideas and concepts into a struc- the dynamics between disciplines, thus focusing

ture. While none of the parts of the process are various operating units on common objectives.

innovative on their own, my subsequent dis- For example, liquidity policy will affect the tim-

cussions with both Canadian and U.S. corpora- ing of capital market transactions just as foreign

JANUARY 1999 / RISK MANAGEMENT 29

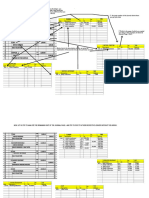

A FLEXIBLE STRUCTURE

Portfolio and Exposure Management

RISK CATEGORY

-1-

Foreign Interest Counterparty/

Risk Liquidity

Exchange Rates Credit Exposure

Identification

-2-

Policy Development

•Short and Longer Term Business and Financial Plans

Risk

•Pension Fund Exposure

Quantification

Business Review Budgeting Forecasts: Cost of equity, asset cash flow matching, subsidiaries,

pension fund, business cycle correlation

-3-

Operating

Operating Environment: External financing requirements, tax (current and forecasted rate),

Environment economic and capital markets

Assessment

Rating Agencies: Rating outlook, debt capacity, view of financial instruments

FINANCIAL PROCESS

-4-

Development of Acceptable Risk Tolerances: e.g., budget variances, rating implication,

Risk cash flow variances, trust indenture

Tolerances

Communication

• Executive approval

-5- Development of Policies and Objectives Counterparty Policy

• credit rating • Board approval

Policies • Target credit rating

• institutions

& • Capital structure and dividend policy

• notional limits

Objectives • Duration and fixed-floating mix of debt • swap agreements

Portfolio Management Approach

Review and analyze risk reduction/elimination strategies and instruments

Strategy Implementation & Evaluation

Portfolio Software

• evaluation

• implementation

• caps

-6-

• commercial paper • floors

Strategy program • collars • fixed-floating ratio consolidated counter-

& • maturity distribution • forwards • duration party exposure model

Implementation • lines of credit • swaps

• etc.

• securities buyback

• interest rate hedging arbitrage • medium-term

• option monetization note program • swap agreements

• early calls efficiency

analysis

• Funds control, monitoring and processing

Controls:

-7- • Segregation of implementation and monitoring Communication

Risk • Board of Directors

• Audit Committee

Controls

• Financing Committee

& Monthly and Quarterly Capital Portfolio Reporting:

• CFO

Trust Indenture

Reporting • Rating Agencies

Dividend Certificate

• Subsidiaries

Economic/market developments, monitoring, reporting, sensitivity analysis

-8-

Performance

Development and Measurement of Benchmark Portfolio and Risks

Measurement

& Evaluation

exchange policy will affect the nature of deriva- management process is the identification of the

tive strategies. various risks.

Liquidity Risk—Even companies with a

Policy Development highly tuned focus on customer and sharehold-

The first step in creating an active financial er value can go bankrupt because they lack

30 RISK MANAGEMENT / JANUARY 1999

DOLLAR RISKS

short-term liquidity. Short- and longer-term any exposures that undoubtedly exist in the

cash forecasts, combined with worst-case busi- pension fund’s equity and debt portfolios.

ness and economic scenarios, are vital for the Given the publicity surrounding their occasion-

development of a corporate liquidity policy. In al abuse, the use of derivatives might be seen as

turn, this policy will drive ceiling short-term a hard sell to a board of directors. My experi-

debt levels, the size and term of committed ence has shown that boards are receptive to

bank lines of credit and the timing of fixed, derivative use if there is a clear objective of

long-term financings. restricting their use to managing, controlling

Foreign Exchange Risk—A question: Unless and reducing risk combined with appropriate

your company is a financial institution, why are internal controls and reporting.

you taking any foreign exchange risk at all?

Corporate risks should be taken in areas of the Quantification

company’s core expertise. However, analyzing Having identified the firm’s financial risks, the

your corporation’s FX exposure will raise some next step in the process is to quantify the dollar

interesting questions. What exposures are built risk associated with each of them. This requires

into the supply procurement process? If you a dynamic financial model that incorporates the

have a defined benefit pension fund, what is firm’s consolidated financials, long-term busi-

the potential impact of currency exposures? ness plans and off-balance-sheet items such as

While currency risk is integral to the pension pension fund assets and liabilities, leases,

fund’s investment diversification strategy, an derivatives in place and securitization transac-

FX gain or loss could impact the sponsor cor- tions such as the sale of receivables.

poration’s cash contributions to the pension Quantification will require a risk assessment

fund. These and other questions particular to based on various business and economic sce-

your firm’s operations will raise policy issues narios.

that might otherwise go unaddressed.

Interest Rate Risk—The key policy issue that Assessment

determines a firm’s interest rate risk is capital The next step in the process involves a thor-

structure. Thereafter, the primary measure of a ough assessment of the business and operating

company’s debt portfolio interest risk should be environment. For example, how is the firm’s

duration, which is driven by cash flows, as business correlated to the economic cycle? A

opposed to simply utilizing the average life of high correlation might imply that the firm is

the portfolio. Ideally, the duration of the debt capable of assuming higher interest rate risk,

portfolio should be equal to the duration of the assuming rates increase as the economy heats

firm’s assets—an objective that is difficult to up. Similarly, a firm whose markets are aggres-

apply to most companies unless they are finan- sively under attack and whose base technology

cial institutions. Having established a duration is undergoing rapid change should consider

policy, the key implementation decision is taking relatively lower financial risks. (While

determining a fixed/floating mix of debt that sat- this sounds obvious, too many firms groping to

isfies both liquidity and interest rate policies. At be competitive attempt to reduce financial costs

Bell Canada, we have assessed a number of the- by making short-term capital market bets.)

oretical, custom-designed studies, all of which Another aspect that requires assessment is the

point to an approximate 80 percent to 20 per- firm’s prospective view of its long-term debt

cent mix of fixed/floating debt as being the most credit ratings. This total environmental assess-

effective over the longer term. ment determines the appropriate level of finan-

Counterparty/Credit Exposure—A key cial risk.

advantage to derivatives as a risk management

tool is that they allow for the modulation of Risk Tolerance

duration without necessarily increasing liquidi- The level of risk tolerances that a corporation is

ty risk. The best example is borrowing prepared to accept should encompass the

long/fixed and swapping into floating. aggregate of all the identified financial risks and

Similarly, derivatives can be a cost-effective and is dependent on a number of factors. How

flexible vehicle for implementing a foreign much variance in budgeted earnings and cash

exchange policy. Their use, however, comes at flows is tolerable to management, the board

a price. Derivatives result in counterparty credit and the shareholders/capital markets? What

exposure which itself requires a clear policy will be the reaction of the rating agencies to dif-

and operating controls. This policy should ferent levels of earnings and cash flow volatili-

address credit criteria and specific credit limits ties? How much room for variance exists in the

on a consolidated corporate basis, including company’s debt trust indenture tests?

32 RISK MANAGEMENT / JANUARY 1999

These are just a few of the questions that directors. This role for the board is appropriate

will need to be answered in arriving at the and consistent with recent studies and recom-

next step: developing the core financial poli- mendations on the subject of corporate gover-

cies that make up the foundation of the pro- nance. In a study entitled “Where Were the

cess leading toward strategy development and Directors? Guidelines for Improved Corporate

implementation. Governance in Canada,” the Toronto Stock

(A point of clarification: The process should Exchange identified five stewardship responsi-

not be misinterpreted to imply that bilities for a board of directors. The proposed

$

finance/treasury should be a profit center. On

the contrary, the process is focused on hedging

versus speculation. Its operating philosophy is

to reduce both risk and cost. It does require

management to take certain views on market

movements; but doing nothing to develop risk

tolerance policies is in fact speculating with the

company’s current financial exposures.)

Implementation

Having developed a set of financial risk policies

approved by the board of directors, the next

step is implementation and assuring that poli-

cies are adhered to. The intellectual foundation

must be one of managing the entire lower right

hand side of the balance sheet as a single port-

folio that finances the corporation’s operations,

with the focus on cash flows generated from

both sides of the balance sheet.

Strategy implementation is the more familiar

of corporate financial operations and calls for a

financial risk management process specifically

addresses two of the five:

1. the identification of the principal risks of

the corporation’s business and ensuring the

implementation of appropriate systems to

manage these risks

2. ensuring the integrity of the corpora-

tion’s control and management information

systems

Thus, obtaining approval from the board of

directors with respect to adopting the suggested

risk management process should be consistent

with the board’s own view of its managing

responsibilities.

Similarly, communication should be integral

to the operational risk management control

process. The audience for this communication

varies in terms of both the information provid-

ed and the frequency of the reporting. From a

comprehensive array of tools. The key tool is corporate governance perspective, the key

the development, or purchase, of a financial audience is the board of directors or its audit

model for the corporation’s portfolio of out- committee. The implementation of a compre-

standing debt, preferred shares and equity. This hensive financial risk management process

model should be capable of dynamically simu- might also justify the creation of a finance com-

lating the impact of various scenarios on the mittee of the board.

portfolio and the various financial risks, thus Finally, I believe that the debt rating agen-

ensuring constant adherence to policy. It must cies should be apprised of these key financial

be capable of measuring counterparty exposure risk policies and the process in place to actively

and assessing the impact of various derivative manage and control them. The very fact that

strategies. My experience has shown that senior management and the board are taking

investment banking firms are in the best posi- ongoing interest in addressing the very risks

tion to assist in the development of this model. that are uppermost in the minds of the rating

Other vital tools in managing the capital agencies conveys a positive signal respecting

portfolio include both a commercial paper pro- the quality of the earnings and cash flows that

gram and a medium-term note program. The support the corporation’s outstanding debt and

key advantage of these vehicles is the flexibility interest obligations.

they provide in managing the duration of the

capital portfolio. Commercial paper can be an A Continuous Process

important tool in attaining a target floating debt Every process that strives for excellence is cir-

level and medium-term notes are perfectly suit- cular—after implementation, performance

ed to slotting in debt maturities in years where must be measured against the objectives origi-

room exists based on liquidity policy. This flex- nally defined and the entire process evaluated

ibility is further enhanced when combined with for continuous improvement. A corporation’s

interest or cross currency swaps. financial policies and the capital portfolio that

was the outcome of those policies must be

Communication reevaluated based on changing corporate objec-

In policy development, the decision-making tives combined with altered business and eco-

and approving body should be the board of nomic circumstances. RM

JANUARY 1999 / RISK MANAGEMENT 33

You might also like

- Data Analysis ProcedureDocument5 pagesData Analysis Procedureabebelema100% (9)

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideDocument9 pagesCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesNo ratings yet

- 03 Bain HealthDocument6 pages03 Bain HealthT LiuNo ratings yet

- Stephen H. Penman-Financial Statement Analysis and Security Valuation-McGraw Hill (2013) - 700-710Document11 pagesStephen H. Penman-Financial Statement Analysis and Security Valuation-McGraw Hill (2013) - 700-710Walm Kety0% (1)

- Risk Appetite FrameworkDocument12 pagesRisk Appetite Frameworkjagat4u100% (5)

- 1 CAS Project Nomination of SupervisorDocument3 pages1 CAS Project Nomination of SupervisorSmke TimesNo ratings yet

- A Comprehensive Risk Appetite Framework For Banks enDocument12 pagesA Comprehensive Risk Appetite Framework For Banks enRachael Misan-Ruppee100% (2)

- Comparision BRC IFS QMS 22K From BV PDFDocument44 pagesComparision BRC IFS QMS 22K From BV PDFAhmedElSayedNo ratings yet

- Fiinratings Corporate Credit Rating MethodologyDocument14 pagesFiinratings Corporate Credit Rating MethodologyVinitaNo ratings yet

- Week 13 Chapter 23Document35 pagesWeek 13 Chapter 23Dương Thanh HuyềnNo ratings yet

- Credit Analysis and Framewok - MODULE 1Document9 pagesCredit Analysis and Framewok - MODULE 1Boci & Company Services LimitedNo ratings yet

- Credit Analysis and Distress PredictionDocument57 pagesCredit Analysis and Distress Predictionrizki nurNo ratings yet

- A Goldmine For Financial RatiosDocument12 pagesA Goldmine For Financial RatiossaaderaamaNo ratings yet

- Credit Rating FmsDocument16 pagesCredit Rating Fmsdurgesh choudharyNo ratings yet

- Credit RiskDocument14 pagesCredit RiskPRANSHU VERMANo ratings yet

- Presented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Document31 pagesPresented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Lalitha RamaswamyNo ratings yet

- Credit Risk Management in BanksDocument34 pagesCredit Risk Management in BanksDhiraj K DalalNo ratings yet

- CCFA Lecture 01 of S4 Risk ManagementDocument63 pagesCCFA Lecture 01 of S4 Risk ManagementmonirNo ratings yet

- CRM 1Document41 pagesCRM 1Arjun PadmanabhanNo ratings yet

- NYIF Williams Credit Risk Analysis II 2018Document106 pagesNYIF Williams Credit Risk Analysis II 2018jojozie100% (1)

- What Is Credit and Its Risk Management ProcessDocument15 pagesWhat Is Credit and Its Risk Management ProcessJorge NANo ratings yet

- Cbo Credit Manual Jul 21Document295 pagesCbo Credit Manual Jul 21prashanth100% (1)

- CRISILs Approach To Financial RatiosDocument13 pagesCRISILs Approach To Financial RatiosNishant JhaNo ratings yet

- Financial RatiosDocument13 pagesFinancial RatiosNishant JhaNo ratings yet

- Advanced International Corporate Finance-InSEADDocument6 pagesAdvanced International Corporate Finance-InSEADSalman ParkerNo ratings yet

- Credit RatingDocument3 pagesCredit Ratingsanjay parmar100% (4)

- Chapter 1 New - FIN201Document12 pagesChapter 1 New - FIN201Shahinul KabirNo ratings yet

- Credit Rating ArticleDocument2 pagesCredit Rating ArticleLaweesh KumarNo ratings yet

- Credit Rating SR Methodology 20september2016 PublicDocument9 pagesCredit Rating SR Methodology 20september2016 PublicAbhinav AgrawalNo ratings yet

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- NYIF Williams Credit Risk Analysis I Aug-2016Document117 pagesNYIF Williams Credit Risk Analysis I Aug-2016victor andrésNo ratings yet

- Credit RiskDocument5 pagesCredit RiskANNA BIEN DELA CRUZNo ratings yet

- AnalytixWise - Risk Analytics Unit 1 IntroductionDocument45 pagesAnalytixWise - Risk Analytics Unit 1 IntroductionUrvashi Singh100% (1)

- M5 Handout Dislocation AnalysisDocument52 pagesM5 Handout Dislocation AnalysisStanley WangNo ratings yet

- Credit Risk Management - Axis-2018Document71 pagesCredit Risk Management - Axis-2018Mohdmehraj PashaNo ratings yet

- Credit Risk S1Document33 pagesCredit Risk S1tanmaymehta24No ratings yet

- Credit Rating: - Kanika KhuranaDocument40 pagesCredit Rating: - Kanika KhuranaAnunay AroraNo ratings yet

- Bos 48771 Finalp 2Document35 pagesBos 48771 Finalp 2guptaharsh51090No ratings yet

- Unit 59 - Fundamentals of Credit Analysis - 2013Document12 pagesUnit 59 - Fundamentals of Credit Analysis - 2013amish ganatraNo ratings yet

- Banking Credit and Risk Management Program: Executive EducationDocument12 pagesBanking Credit and Risk Management Program: Executive EducationMaria TaniusNo ratings yet

- Complete Book FM PDFDocument245 pagesComplete Book FM PDFRam IyerNo ratings yet

- Board of Governors of The Federal Reserve System Federal Deposit Insurance Corporation Office of The Comptroller of The CurrencyDocument15 pagesBoard of Governors of The Federal Reserve System Federal Deposit Insurance Corporation Office of The Comptroller of The CurrencytrantuanlinhNo ratings yet

- Risk Management in Commercial BanksDocument43 pagesRisk Management in Commercial BanksDave92% (12)

- Rose Hudgins Bank Management and FinanciDocument42 pagesRose Hudgins Bank Management and FinancisaadNo ratings yet

- Meena CsiDocument11 pagesMeena CsiMohmmed KhayyumNo ratings yet

- Types of Risks in Banking Sector: DR - SMDocument30 pagesTypes of Risks in Banking Sector: DR - SMPriya DharshiniNo ratings yet

- Managing The Finance FunctionDocument33 pagesManaging The Finance FunctionPaulo Autida67% (3)

- Credit RatingDocument50 pagesCredit RatingUniq ManjuNo ratings yet

- Q1) Rating Methodology Adopted by Credit Rating Anency/ Icra Rating Scale of Corporate GovernanceDocument20 pagesQ1) Rating Methodology Adopted by Credit Rating Anency/ Icra Rating Scale of Corporate GovernanceNikhilNo ratings yet

- Achieving A Holistic View of Risk in Times of CrisisDocument1 pageAchieving A Holistic View of Risk in Times of CrisisАсия ГильфановаNo ratings yet

- Risk Appetite in Banking: Steve Townsend Tesco BankDocument15 pagesRisk Appetite in Banking: Steve Townsend Tesco BankrakhalbanglaNo ratings yet

- Credit Union Commercial Lending: Mitigating Risk Through Recording, Monitoring, and ReportingDocument56 pagesCredit Union Commercial Lending: Mitigating Risk Through Recording, Monitoring, and ReportingYosaphat YossmuddantNo ratings yet

- Credit RatingDocument33 pagesCredit RatingPALLAVI DUREJANo ratings yet

- Financial Risk Management For Banks Responding To Challenges Presented by Covid 19 PDFDocument6 pagesFinancial Risk Management For Banks Responding To Challenges Presented by Covid 19 PDFshama shoukatNo ratings yet

- Credit Risk ManagementDocument3 pagesCredit Risk Managementamrut_bNo ratings yet

- UT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)Document6 pagesUT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)UT Dallas Provost's Technology GroupNo ratings yet

- 7389 RA Treasury Risk ManagementDocument14 pages7389 RA Treasury Risk ManagementZainSamiNo ratings yet

- Project Credit Rating & Risk Based PricingDocument13 pagesProject Credit Rating & Risk Based Pricingrupeshmba2018No ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument32 pagesRisk Management Systems in Banks Genesis, Significance and Implementationmahajan87No ratings yet

- Unit 13 Credit Rating AgenciesDocument18 pagesUnit 13 Credit Rating AgenciesSuganya VenurajNo ratings yet

- Creditors: FoundationsDocument17 pagesCreditors: FoundationseragornNo ratings yet

- Axis Investor Deck v2.4Document20 pagesAxis Investor Deck v2.4Puneet GoelNo ratings yet

- Risk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryFrom EverandRisk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryRating: 5 out of 5 stars5/5 (1)

- Models of Corporate Social Responsibility: A Comparative UnderstandingDocument17 pagesModels of Corporate Social Responsibility: A Comparative UnderstandingNandikaNo ratings yet

- Lecture 2 Values, Mission, Vision and ObjectivesDocument61 pagesLecture 2 Values, Mission, Vision and ObjectivesDavid Abbam AdjeiNo ratings yet

- Posting To LedgerDocument2 pagesPosting To LedgerKaye VillaflorNo ratings yet

- GodrejDocument4 pagesGodrejSheetanshu Agarwal MBA 2016-18No ratings yet

- Module No. 5 Labor Standards and Social Legislation Academic Year 2020-2021Document5 pagesModule No. 5 Labor Standards and Social Legislation Academic Year 2020-2021lawNo ratings yet

- Personalized Services in Hotel IndustryDocument20 pagesPersonalized Services in Hotel IndustryReza Abdul RashidNo ratings yet

- Impact of Internet On BusinessDocument11 pagesImpact of Internet On Businessusman5555380100% (1)

- Corporation Law Divina LMTDocument595 pagesCorporation Law Divina LMTjoliwanagNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument10 pagesUnit 2: Ledgers: Learning Outcomesaditi anandNo ratings yet

- MBA-405 - Topic 8 - Relevant Cost For Decision MakingDocument6 pagesMBA-405 - Topic 8 - Relevant Cost For Decision MakingHanna Vi B. PolidoNo ratings yet

- Diamond Sea GlazeDocument2 pagesDiamond Sea Glazejoroma58No ratings yet

- Concept of PricingDocument21 pagesConcept of PricingVipina GangadharanNo ratings yet

- Ongc AnalysisDocument7 pagesOngc AnalysisPratik SinghaniaNo ratings yet

- TRIDENT CIO - SrinivasDuttPallampati PDFDocument3 pagesTRIDENT CIO - SrinivasDuttPallampati PDFKPNo ratings yet

- Human Resource Development in It Industry: Prasanna Laxmi. NDocument11 pagesHuman Resource Development in It Industry: Prasanna Laxmi. Nshwetauttam0056296No ratings yet

- Deemed ExportDocument9 pagesDeemed ExportRavula RekhanathNo ratings yet

- General LedgerDocument1 pageGeneral Ledgersubham deyNo ratings yet

- Fs 2018 NardaDocument13 pagesFs 2018 NardaMelanie GaledoNo ratings yet

- Imt Case Journal Volum 5 No.1Document91 pagesImt Case Journal Volum 5 No.1Nikhil BalajiNo ratings yet

- Earned-Value-Analysis SheetDocument5 pagesEarned-Value-Analysis SheetJAZPAKNo ratings yet

- Mercy Sitienei Attachment ReportDocument28 pagesMercy Sitienei Attachment ReportKerry HugginsNo ratings yet

- Ali HusseinDocument64 pagesAli Husseinbalu100% (1)

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocument28 pagesDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNo ratings yet

- IPCA+ Master Quest FullScope Airbus CONVERT v1.1Document34 pagesIPCA+ Master Quest FullScope Airbus CONVERT v1.1MagninNo ratings yet

- CHAPTER 2 The Marketing Environment and Market AnalysisDocument36 pagesCHAPTER 2 The Marketing Environment and Market AnalysisJojobaby51714No ratings yet

- Operations ManagementDocument17 pagesOperations ManagementRose LacabaNo ratings yet