Professional Documents

Culture Documents

Problem 3-9 Determining The Effects of Transactions On The Accounting Equation

Problem 3-9 Determining The Effects of Transactions On The Accounting Equation

Uploaded by

Jaida CastilloCopyright:

Available Formats

You might also like

- STMT CASH 001 CANM002963 Feb2020-1Document10 pagesSTMT CASH 001 CANM002963 Feb2020-1Beto Ventura75% (4)

- Group - Assignment - 2 - Fall - 20214 MICHALDocument16 pagesGroup - Assignment - 2 - Fall - 20214 MICHALhalelz69No ratings yet

- Calculate The Balance of The Account, Greg Failla, CapitalDocument1 pageCalculate The Balance of The Account, Greg Failla, CapitalJaida Castillo0% (2)

- The Great Gatsby Ch. 1-5 Quiz Review GuideDocument2 pagesThe Great Gatsby Ch. 1-5 Quiz Review GuideJaida CastilloNo ratings yet

- Final Project Report On HDFC Mutual FundsDocument109 pagesFinal Project Report On HDFC Mutual FundsVishal Kapoor82% (22)

- 2013 Blackstone Investor Day PDFDocument165 pages2013 Blackstone Investor Day PDFph.alvinNo ratings yet

- Texas All Lines Self Study PKG Jan 10-12 2014 PDFDocument125 pagesTexas All Lines Self Study PKG Jan 10-12 2014 PDFrafi30067% (3)

- ACCO 3150 Tarea 1.1Document4 pagesACCO 3150 Tarea 1.1Mirelis QuiñonesNo ratings yet

- Bfar Chapter 8 Problems 6 7Document9 pagesBfar Chapter 8 Problems 6 7Rhoda Claire M. GansobinNo ratings yet

- Advanced Accounting by Antonio Dayag SolmanDocument230 pagesAdvanced Accounting by Antonio Dayag SolmanNorfaidah Didato Gogo100% (4)

- Money Time Relationships and Equivalence PDFDocument21 pagesMoney Time Relationships and Equivalence PDFTaga Phase 7No ratings yet

- Unit5 HW AnswersDocument23 pagesUnit5 HW Answerswnsamuel46No ratings yet

- Financial Reporting and Analysis 101Document10 pagesFinancial Reporting and Analysis 101Samrat KanitkarNo ratings yet

- Financial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Document20 pagesFinancial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Elafan storeNo ratings yet

- Assignment Print View 3.8Document5 pagesAssignment Print View 3.8Zach JaapNo ratings yet

- Abstracti ON: (Using Our Illustrative Problem, The Labahan Laundry Services, The FollowingDocument11 pagesAbstracti ON: (Using Our Illustrative Problem, The Labahan Laundry Services, The FollowingAkosi NoynoypiNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Us StatementDocument1 pageUs StatementadamaissaoubusinessNo ratings yet

- Saet Work Ans PDF Debits and Credits ExpenseDocument1 pageSaet Work Ans PDF Debits and Credits Expensegerald almencionNo ratings yet

- CH 08Document46 pagesCH 08NuryaniNo ratings yet

- Exercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Document15 pagesExercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Doan Chan PhongNo ratings yet

- Problem 3 FarDocument2 pagesProblem 3 FarRethelje Niña GurreaNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementLeanah TorioNo ratings yet

- Í R) :aè Avila Cynthiaââââââââ G Çm$"86Pî Mrs. Cynthia Galvan AvilaDocument3 pagesÍ R) :aè Avila Cynthiaââââââââ G Çm$"86Pî Mrs. Cynthia Galvan AvilaCynthiaNo ratings yet

- Training Financial AccountingDocument23 pagesTraining Financial AccountingSara PiccioliNo ratings yet

- Í Wpicè Villanueva Carlâgeneâ S Ç/VUHî Engr. Carl Gene Saludar VillanuevaDocument2 pagesÍ Wpicè Villanueva Carlâgeneâ S Ç/VUHî Engr. Carl Gene Saludar Villanuevaceegee14No ratings yet

- Be 20210413Document6 pagesBe 20210413Raileigh ReyesNo ratings yet

- Solution QUIZ Partnership LiquidationDocument6 pagesSolution QUIZ Partnership Liquidationchezyl cadinongNo ratings yet

- PArtnership FormationDocument6 pagesPArtnership FormationJasmine ActaNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- AccountingDocument24 pagesAccountingAmmad Ud Din SabirNo ratings yet

- Roderickudavid : 775baaostreet Westbicutan 1630taguigcityDocument4 pagesRoderickudavid : 775baaostreet Westbicutan 1630taguigcityDavid RoderickNo ratings yet

- Trial BalDocument1 pageTrial Balvihanjangid223No ratings yet

- Accounting AssignmentDocument8 pagesAccounting AssignmentSimran LakhwaniNo ratings yet

- JulsDocument2 pagesJulsjhon KrizpNo ratings yet

- Glam Hair Statement FebDocument1 pageGlam Hair Statement Febraheemtimo1No ratings yet

- AE13 Final ActivityDocument5 pagesAE13 Final ActivityWenjunNo ratings yet

- General DescriptionDocument7 pagesGeneral Description11A Ol MonorothNo ratings yet

- 08 Single Entry System PDFDocument19 pages08 Single Entry System PDFSamuel Jilowa100% (2)

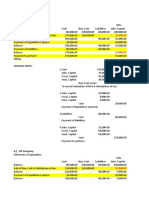

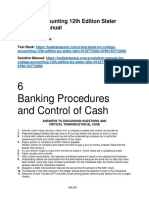

- College Accounting 12th Edition Slater Solutions Manual DownloadDocument35 pagesCollege Accounting 12th Edition Slater Solutions Manual DownloadRicardo Rivera100% (27)

- Í Wpicè Villanueva Carlâgeneâ S Ç/V'55Gî Engr. Carl Gene Saludar VillanuevaDocument2 pagesÍ Wpicè Villanueva Carlâgeneâ S Ç/V'55Gî Engr. Carl Gene Saludar Villanuevaceegee14No ratings yet

- Akl Kelompok 4Document15 pagesAkl Kelompok 4Sry WahyuniNo ratings yet

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- Acc Vol 1 Chap 4 SolDocument78 pagesAcc Vol 1 Chap 4 Solkhushichandak07No ratings yet

- Google Sheets - Transaction Analysis SheetDocument3 pagesGoogle Sheets - Transaction Analysis Sheetramenr227No ratings yet

- Google Sheets - Transaction Analysis SheetDocument3 pagesGoogle Sheets - Transaction Analysis Sheetramenr227No ratings yet

- Unid. 5 Act. 3Document1 pageUnid. 5 Act. 3siliefrancis19No ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.No ratings yet

- 第一次作業Document8 pages第一次作業fionamatchlessNo ratings yet

- Josephinecrey : Zone1Baculud Iguig 3504cagayanDocument4 pagesJosephinecrey : Zone1Baculud Iguig 3504cagayanJerome ReyNo ratings yet

- 2nd Training Session 2022 03 14 18 41 46Document24 pages2nd Training Session 2022 03 14 18 41 46Sara PiccioliNo ratings yet

- Nature and Formation of A PartnershipDocument10 pagesNature and Formation of A PartnershipHans ManaliliNo ratings yet

- Adobe Scan 29 Aug 2022Document9 pagesAdobe Scan 29 Aug 2022kumardeepak5242No ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Parcoac Chapter 17 Prob 5 PracticeDocument7 pagesParcoac Chapter 17 Prob 5 Practicekris salacNo ratings yet

- Hazellynnuytan : 92ncarpiostunit1208 Howardtower6Thavegrace 1406parkcaloocancityDocument6 pagesHazellynnuytan : 92ncarpiostunit1208 Howardtower6Thavegrace 1406parkcaloocancityVahn TanNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Basic Accounting Equation Readings - 1095409783Document11 pagesBasic Accounting Equation Readings - 1095409783GwenNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Globe Bill 09178380052 PDFDocument3 pagesGlobe Bill 09178380052 PDFBub BinNo ratings yet

- Answer KeyDocument10 pagesAnswer KeyEvelina Del RosarioNo ratings yet

- CH 3 Work PacketDocument8 pagesCH 3 Work Packetana sosaNo ratings yet

- Chapter 2 ActivityDocument10 pagesChapter 2 ActivityBELARMINO LOUIE A.No ratings yet

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- PROBLEM 3-4 Classifying AccountsvDocument1 pagePROBLEM 3-4 Classifying AccountsvJaida CastilloNo ratings yet

- #6 For Quiz 4.2 - Sheet1Document1 page#6 For Quiz 4.2 - Sheet1Jaida CastilloNo ratings yet

- Muscle-Fatigue-Lab VidsDocument2 pagesMuscle-Fatigue-Lab VidsJaida CastilloNo ratings yet

- Problem 3-1 Balancing The Accounting Equation Determine The Missing Dollar Amount For Each of The Following Accounting EquationsDocument1 pageProblem 3-1 Balancing The Accounting Equation Determine The Missing Dollar Amount For Each of The Following Accounting EquationsJaida CastilloNo ratings yet

- Mutual Fund Insight HD April 2024Document108 pagesMutual Fund Insight HD April 2024barundasaNo ratings yet

- IRakyat - Account OverviewDocument3 pagesIRakyat - Account Overviewمحمد فخرالنظام بن جوراميNo ratings yet

- Financial Markets and Institutions: EthiopianDocument35 pagesFinancial Markets and Institutions: Ethiopianyebegashet88% (24)

- Thesis On Credit Risk Management in Ghanaian BanksDocument6 pagesThesis On Credit Risk Management in Ghanaian Banksafktmcyddtthol100% (1)

- Intermediate Financial Accounting Model DirDocument14 pagesIntermediate Financial Accounting Model Dirmelkamu tesfayNo ratings yet

- Double Entry SystemDocument4 pagesDouble Entry SystemmuhammedNo ratings yet

- Top 25 Banking European Edition 2010Document271 pagesTop 25 Banking European Edition 2010Nick EwenNo ratings yet

- Asm 1Document28 pagesAsm 1Thuy QuynhNo ratings yet

- KTT Final Contract HCF - PRESTIGE (REVISION) - 25102023Document12 pagesKTT Final Contract HCF - PRESTIGE (REVISION) - 25102023dorie tanNo ratings yet

- Account Statement From 1 Jun 2018 To 31 May 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jun 2018 To 31 May 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceArjun VermaNo ratings yet

- Chapter 2-Audits of Financial Statements PDFDocument23 pagesChapter 2-Audits of Financial Statements PDFCaryll Joy BisnanNo ratings yet

- Travel InsuranceDocument4 pagesTravel Insurancevisainfo238No ratings yet

- Letter From Allied Irish BankDocument1 pageLetter From Allied Irish Bankmtighe2100% (1)

- Ch5 - Time Value of MoneyDocument52 pagesCh5 - Time Value of MoneyAneeqah EssaNo ratings yet

- Mas 9404 Product CostingDocument11 pagesMas 9404 Product CostingEpfie SanchesNo ratings yet

- Mission and Vision 2020Document4 pagesMission and Vision 2020paschal makoyeNo ratings yet

- Ark Innovation Etf: Why Invest in Arkk? Fund DetailsDocument2 pagesArk Innovation Etf: Why Invest in Arkk? Fund DetailsHeyu PermanaNo ratings yet

- Lesson 3 Analysis and Interpretation NotesDocument8 pagesLesson 3 Analysis and Interpretation NotesoretshwanetsemosielengNo ratings yet

- Sunita Co-Op. Housing Society LTD.: Piot No. 6 & 8, Opp. Nakhva High School, Tilak Road, THANE (East) - 400 603Document1 pageSunita Co-Op. Housing Society LTD.: Piot No. 6 & 8, Opp. Nakhva High School, Tilak Road, THANE (East) - 400 603vinayak tiwariNo ratings yet

- Employer Benefit - Part 2Document9 pagesEmployer Benefit - Part 2Julian Adam PagalNo ratings yet

- Neeru 2Document7 pagesNeeru 2Taniya XhettriNo ratings yet

- Gr11 ACC P2 (ENG) June 2022 Answer BookDocument10 pagesGr11 ACC P2 (ENG) June 2022 Answer Bookora mashaNo ratings yet

- Experian Corporate Report: Particulars of The Subject Provided by YouDocument6 pagesExperian Corporate Report: Particulars of The Subject Provided by YouIman AzimNo ratings yet

- Financial Reporting and Accounting StandardsDocument24 pagesFinancial Reporting and Accounting StandardsAnnissa Nuur CahyaniNo ratings yet

Problem 3-9 Determining The Effects of Transactions On The Accounting Equation

Problem 3-9 Determining The Effects of Transactions On The Accounting Equation

Uploaded by

Jaida CastilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 3-9 Determining The Effects of Transactions On The Accounting Equation

Problem 3-9 Determining The Effects of Transactions On The Accounting Equation

Uploaded by

Jaida CastilloCopyright:

Available Formats

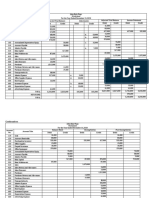

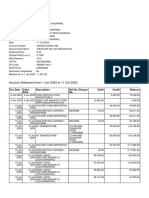

Problem 3-9 Determining the Effects of Transactions on the Accounting Equation

Juanita Ortega is the owner of a professional guide service called Outback Guide Service.

Date Transactions

Jan 3 1. Ms. Ortega, the owner, opened a checking account for the business by depositing

$60,000 of her personal funds.

6 2. Paid by check the monthly rent of $3,000.

8 3. Bought hiking equipment for the business by writing a check for $3,000.

9 4. Purchased $24,000 of rafting equipment by writing a check.

11 5. Purchased office equipment on account for $4,000.

15 6. Received payment for guide services, $2,500.

18 7. Ms. Ortega contributed a desk valued at $450 to the business.

21 8. Withdrew $3,000 cash from the business for personal use.

26 9. Wrote a check to a creditor as partial payment on account, $1,500.

30 10. Took a group on a tour and agreed to accept payment later, $1,200.

1. For each of the above transactions:

• Identify the accounts affected.

• Write the amount of the increase or decrease under each account

affected. Enclose in parentheses amounts that decrease account

balances.

• Determine the new balance for each account.

Owner

Liabiliti

’s

Assets es

Equity

Juanit

Account a

Cash Hiking Rafting Office Accoun

Transacti s Orteg

in Equipme Equipme Equipme = ts +

on Receiva a,

Bank nt nt nt Payable

ble Capit

al

$60,0 $60,0

1.

00 00

60,00 60,00

Balance = +

0 0

You might also like

- STMT CASH 001 CANM002963 Feb2020-1Document10 pagesSTMT CASH 001 CANM002963 Feb2020-1Beto Ventura75% (4)

- Group - Assignment - 2 - Fall - 20214 MICHALDocument16 pagesGroup - Assignment - 2 - Fall - 20214 MICHALhalelz69No ratings yet

- Calculate The Balance of The Account, Greg Failla, CapitalDocument1 pageCalculate The Balance of The Account, Greg Failla, CapitalJaida Castillo0% (2)

- The Great Gatsby Ch. 1-5 Quiz Review GuideDocument2 pagesThe Great Gatsby Ch. 1-5 Quiz Review GuideJaida CastilloNo ratings yet

- Final Project Report On HDFC Mutual FundsDocument109 pagesFinal Project Report On HDFC Mutual FundsVishal Kapoor82% (22)

- 2013 Blackstone Investor Day PDFDocument165 pages2013 Blackstone Investor Day PDFph.alvinNo ratings yet

- Texas All Lines Self Study PKG Jan 10-12 2014 PDFDocument125 pagesTexas All Lines Self Study PKG Jan 10-12 2014 PDFrafi30067% (3)

- ACCO 3150 Tarea 1.1Document4 pagesACCO 3150 Tarea 1.1Mirelis QuiñonesNo ratings yet

- Bfar Chapter 8 Problems 6 7Document9 pagesBfar Chapter 8 Problems 6 7Rhoda Claire M. GansobinNo ratings yet

- Advanced Accounting by Antonio Dayag SolmanDocument230 pagesAdvanced Accounting by Antonio Dayag SolmanNorfaidah Didato Gogo100% (4)

- Money Time Relationships and Equivalence PDFDocument21 pagesMoney Time Relationships and Equivalence PDFTaga Phase 7No ratings yet

- Unit5 HW AnswersDocument23 pagesUnit5 HW Answerswnsamuel46No ratings yet

- Financial Reporting and Analysis 101Document10 pagesFinancial Reporting and Analysis 101Samrat KanitkarNo ratings yet

- Financial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Document20 pagesFinancial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Elafan storeNo ratings yet

- Assignment Print View 3.8Document5 pagesAssignment Print View 3.8Zach JaapNo ratings yet

- Abstracti ON: (Using Our Illustrative Problem, The Labahan Laundry Services, The FollowingDocument11 pagesAbstracti ON: (Using Our Illustrative Problem, The Labahan Laundry Services, The FollowingAkosi NoynoypiNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Us StatementDocument1 pageUs StatementadamaissaoubusinessNo ratings yet

- Saet Work Ans PDF Debits and Credits ExpenseDocument1 pageSaet Work Ans PDF Debits and Credits Expensegerald almencionNo ratings yet

- CH 08Document46 pagesCH 08NuryaniNo ratings yet

- Exercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Document15 pagesExercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Doan Chan PhongNo ratings yet

- Problem 3 FarDocument2 pagesProblem 3 FarRethelje Niña GurreaNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementLeanah TorioNo ratings yet

- Í R) :aè Avila Cynthiaââââââââ G Çm$"86Pî Mrs. Cynthia Galvan AvilaDocument3 pagesÍ R) :aè Avila Cynthiaââââââââ G Çm$"86Pî Mrs. Cynthia Galvan AvilaCynthiaNo ratings yet

- Training Financial AccountingDocument23 pagesTraining Financial AccountingSara PiccioliNo ratings yet

- Í Wpicè Villanueva Carlâgeneâ S Ç/VUHî Engr. Carl Gene Saludar VillanuevaDocument2 pagesÍ Wpicè Villanueva Carlâgeneâ S Ç/VUHî Engr. Carl Gene Saludar Villanuevaceegee14No ratings yet

- Be 20210413Document6 pagesBe 20210413Raileigh ReyesNo ratings yet

- Solution QUIZ Partnership LiquidationDocument6 pagesSolution QUIZ Partnership Liquidationchezyl cadinongNo ratings yet

- PArtnership FormationDocument6 pagesPArtnership FormationJasmine ActaNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- AccountingDocument24 pagesAccountingAmmad Ud Din SabirNo ratings yet

- Roderickudavid : 775baaostreet Westbicutan 1630taguigcityDocument4 pagesRoderickudavid : 775baaostreet Westbicutan 1630taguigcityDavid RoderickNo ratings yet

- Trial BalDocument1 pageTrial Balvihanjangid223No ratings yet

- Accounting AssignmentDocument8 pagesAccounting AssignmentSimran LakhwaniNo ratings yet

- JulsDocument2 pagesJulsjhon KrizpNo ratings yet

- Glam Hair Statement FebDocument1 pageGlam Hair Statement Febraheemtimo1No ratings yet

- AE13 Final ActivityDocument5 pagesAE13 Final ActivityWenjunNo ratings yet

- General DescriptionDocument7 pagesGeneral Description11A Ol MonorothNo ratings yet

- 08 Single Entry System PDFDocument19 pages08 Single Entry System PDFSamuel Jilowa100% (2)

- College Accounting 12th Edition Slater Solutions Manual DownloadDocument35 pagesCollege Accounting 12th Edition Slater Solutions Manual DownloadRicardo Rivera100% (27)

- Í Wpicè Villanueva Carlâgeneâ S Ç/V'55Gî Engr. Carl Gene Saludar VillanuevaDocument2 pagesÍ Wpicè Villanueva Carlâgeneâ S Ç/V'55Gî Engr. Carl Gene Saludar Villanuevaceegee14No ratings yet

- Akl Kelompok 4Document15 pagesAkl Kelompok 4Sry WahyuniNo ratings yet

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- Acc Vol 1 Chap 4 SolDocument78 pagesAcc Vol 1 Chap 4 Solkhushichandak07No ratings yet

- Google Sheets - Transaction Analysis SheetDocument3 pagesGoogle Sheets - Transaction Analysis Sheetramenr227No ratings yet

- Google Sheets - Transaction Analysis SheetDocument3 pagesGoogle Sheets - Transaction Analysis Sheetramenr227No ratings yet

- Unid. 5 Act. 3Document1 pageUnid. 5 Act. 3siliefrancis19No ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.No ratings yet

- 第一次作業Document8 pages第一次作業fionamatchlessNo ratings yet

- Josephinecrey : Zone1Baculud Iguig 3504cagayanDocument4 pagesJosephinecrey : Zone1Baculud Iguig 3504cagayanJerome ReyNo ratings yet

- 2nd Training Session 2022 03 14 18 41 46Document24 pages2nd Training Session 2022 03 14 18 41 46Sara PiccioliNo ratings yet

- Nature and Formation of A PartnershipDocument10 pagesNature and Formation of A PartnershipHans ManaliliNo ratings yet

- Adobe Scan 29 Aug 2022Document9 pagesAdobe Scan 29 Aug 2022kumardeepak5242No ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Parcoac Chapter 17 Prob 5 PracticeDocument7 pagesParcoac Chapter 17 Prob 5 Practicekris salacNo ratings yet

- Hazellynnuytan : 92ncarpiostunit1208 Howardtower6Thavegrace 1406parkcaloocancityDocument6 pagesHazellynnuytan : 92ncarpiostunit1208 Howardtower6Thavegrace 1406parkcaloocancityVahn TanNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Basic Accounting Equation Readings - 1095409783Document11 pagesBasic Accounting Equation Readings - 1095409783GwenNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Globe Bill 09178380052 PDFDocument3 pagesGlobe Bill 09178380052 PDFBub BinNo ratings yet

- Answer KeyDocument10 pagesAnswer KeyEvelina Del RosarioNo ratings yet

- CH 3 Work PacketDocument8 pagesCH 3 Work Packetana sosaNo ratings yet

- Chapter 2 ActivityDocument10 pagesChapter 2 ActivityBELARMINO LOUIE A.No ratings yet

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- PROBLEM 3-4 Classifying AccountsvDocument1 pagePROBLEM 3-4 Classifying AccountsvJaida CastilloNo ratings yet

- #6 For Quiz 4.2 - Sheet1Document1 page#6 For Quiz 4.2 - Sheet1Jaida CastilloNo ratings yet

- Muscle-Fatigue-Lab VidsDocument2 pagesMuscle-Fatigue-Lab VidsJaida CastilloNo ratings yet

- Problem 3-1 Balancing The Accounting Equation Determine The Missing Dollar Amount For Each of The Following Accounting EquationsDocument1 pageProblem 3-1 Balancing The Accounting Equation Determine The Missing Dollar Amount For Each of The Following Accounting EquationsJaida CastilloNo ratings yet

- Mutual Fund Insight HD April 2024Document108 pagesMutual Fund Insight HD April 2024barundasaNo ratings yet

- IRakyat - Account OverviewDocument3 pagesIRakyat - Account Overviewمحمد فخرالنظام بن جوراميNo ratings yet

- Financial Markets and Institutions: EthiopianDocument35 pagesFinancial Markets and Institutions: Ethiopianyebegashet88% (24)

- Thesis On Credit Risk Management in Ghanaian BanksDocument6 pagesThesis On Credit Risk Management in Ghanaian Banksafktmcyddtthol100% (1)

- Intermediate Financial Accounting Model DirDocument14 pagesIntermediate Financial Accounting Model Dirmelkamu tesfayNo ratings yet

- Double Entry SystemDocument4 pagesDouble Entry SystemmuhammedNo ratings yet

- Top 25 Banking European Edition 2010Document271 pagesTop 25 Banking European Edition 2010Nick EwenNo ratings yet

- Asm 1Document28 pagesAsm 1Thuy QuynhNo ratings yet

- KTT Final Contract HCF - PRESTIGE (REVISION) - 25102023Document12 pagesKTT Final Contract HCF - PRESTIGE (REVISION) - 25102023dorie tanNo ratings yet

- Account Statement From 1 Jun 2018 To 31 May 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jun 2018 To 31 May 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceArjun VermaNo ratings yet

- Chapter 2-Audits of Financial Statements PDFDocument23 pagesChapter 2-Audits of Financial Statements PDFCaryll Joy BisnanNo ratings yet

- Travel InsuranceDocument4 pagesTravel Insurancevisainfo238No ratings yet

- Letter From Allied Irish BankDocument1 pageLetter From Allied Irish Bankmtighe2100% (1)

- Ch5 - Time Value of MoneyDocument52 pagesCh5 - Time Value of MoneyAneeqah EssaNo ratings yet

- Mas 9404 Product CostingDocument11 pagesMas 9404 Product CostingEpfie SanchesNo ratings yet

- Mission and Vision 2020Document4 pagesMission and Vision 2020paschal makoyeNo ratings yet

- Ark Innovation Etf: Why Invest in Arkk? Fund DetailsDocument2 pagesArk Innovation Etf: Why Invest in Arkk? Fund DetailsHeyu PermanaNo ratings yet

- Lesson 3 Analysis and Interpretation NotesDocument8 pagesLesson 3 Analysis and Interpretation NotesoretshwanetsemosielengNo ratings yet

- Sunita Co-Op. Housing Society LTD.: Piot No. 6 & 8, Opp. Nakhva High School, Tilak Road, THANE (East) - 400 603Document1 pageSunita Co-Op. Housing Society LTD.: Piot No. 6 & 8, Opp. Nakhva High School, Tilak Road, THANE (East) - 400 603vinayak tiwariNo ratings yet

- Employer Benefit - Part 2Document9 pagesEmployer Benefit - Part 2Julian Adam PagalNo ratings yet

- Neeru 2Document7 pagesNeeru 2Taniya XhettriNo ratings yet

- Gr11 ACC P2 (ENG) June 2022 Answer BookDocument10 pagesGr11 ACC P2 (ENG) June 2022 Answer Bookora mashaNo ratings yet

- Experian Corporate Report: Particulars of The Subject Provided by YouDocument6 pagesExperian Corporate Report: Particulars of The Subject Provided by YouIman AzimNo ratings yet

- Financial Reporting and Accounting StandardsDocument24 pagesFinancial Reporting and Accounting StandardsAnnissa Nuur CahyaniNo ratings yet