Professional Documents

Culture Documents

2207

2207

Uploaded by

Vanesa Diaz0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

20210314-2207

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

8 views2 pages2207

2207

Uploaded by

Vanesa DiazCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

Portland, MEO4I03 Newmarket, NH 03857

WHITE. wwiitinn Tava’ “Statitaee

COMPANY

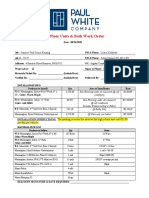

ACH Authorization Form

\ here by authorize Paul G, White Tile Co, nc. to initiate account payeble payments through automatic bank

deposits and, if necessary, adjustments to my account for payments made in eor.

‘COMMERCIAL RETAIL ‘COMMERCIAL

TH 444 Riverside industrial 50 Allen Avenue 11 Forbes Rd.

Bank information and Authorization for ACH

Company name: inlerslale Floors conlragfor Ie

Company phone number: W727 3422

[Company remit address: 24. SleVenSon koas_Killery HEO3904

Name of Bank: [TD bank

Name on the Account: Eeicson Hiche| pasananto Sancher

Bank address: 208% wWoshbury ave, Newinafon Mi o3eo1 |

Bank phone number: G03 433 2801

Account Type: business checking, accounl

Account number: 4243160215

Routing number: O119000F1

(Company contact: Michael! Sanchex

Title: Owner

‘Contact phone number: Fit F241 322.

Contact email address: wnlecsHoors@.amail.com

Date: o3/i

Authorized Signature:

you have any question regarding the ACH outhorz To accountng ot 207-797-7349

Please be sure to email the completed ACH authorization form to accountspayable@paulwhitecompany.com ,

Fax to 207-797-0222, or mail it too:

Paul G, White Tile Co,, Inc

444 Riverside Industrial Parkway

Portland, ME 04103,

Please note this form will have sensitive information please try emailing or faxing first

to keep the information as safe as possible,

mn We

(Rev. October 2018)

iret 0 eas

‘havens ere

ie u ic |N

Request for Taxpayer

Identification Number and Certification

>> co to wm.ire.govFormW0 for instructions and the latest information.

“Rar as SSO GVO HS ae ot] Rare eae OTA dort onve Ts re Ba

Give Form to the

requester. Do not

‘send to the IRS.

Fotewing seven boxes

shgemerber Lie

Print oF type.

See Specie instructions on page 3.

| 7 omer ee nrctons

Adress grbr, Set and ail oF aa ro | Seana

Zt Slevenson ed Apl 2

"ak apropae boxer oor ax Gascon ol hm psn whose ares ened ante 1, Check ory one othe

EF cannon ptscree Ch comonten Clscapenion C] remain

*Baretane ode oy ye

Feructons on pape 3:

Di ranvostate

Exar pay code a)

[Dita ity company Enter the ox lsat (0-C copain, SS corporation, P=Panneren] >

Note: Gneck he appropri ox nthe ne abo rhe ax laafeaton fhe sngle-rabar owner. 09 csi

IED the Lc casted ea a angn-ramber LC tat i lragudd or the ower uous te owner of te LL.

‘ett {LS fat sna derogarog or fe nar or US fda tx purses, tari, a sgerbe LC ta

{Fctregarde rm he owner Sous check te aporoprate box rte tax casitoaten sown.

Exarton from FATCA reporting

code far

| nsscmmanaser ti)

goa a a acarse atonal

0 904

Sen gan etre

Kittery re

ee

[EI __Taxpayer identification Number (HN)

Enter your TIN in the appropriate box. The TIN provided must match the name given on ine 1 Yo avoid

beckup withheding, For individuals this generally your social secu numer (SSN). However, fora

Fesident aie. sole proprietor, or regard entity, se te instructions for Part later. For other -|

ntti, itis your employer entiication number (EN) Mf you do nat have a umber. see How to get a

TWN, ate.

No

‘Number To Give the Requester for guidelines on whose number to enter.

the aoccunt i in mors than ono name, $99 the instructions fre 1. Also see What Name and

[Sasi aay namiber |

(LEnotyerionineation name

36] -2ialolobk bb

[EM —Corication

‘Under penalties of perry, |coriy tat

1. The number shown on this form is my comect taxpayer identification number (or | am waiting for a number to be Issued ome}; and

2 Lam not subject to backup witmhokding because (a am exempt om backup withholding, or 2) | have pot been notified bythe Intl Revenue

‘Senos (RS) that | am subject to backup withholding asa result of fale te report all interest or dividends, orc} the IRS has noted me that | am

ro longer subject to backup witinoaing a

3.1m a US. czen or other U.S. person (defined below); and

4. The FATCA codes) entered on this form any) Inccating that am exempt am FATCA reporting is comact

CCeritcaton instructions. You must ross out 2 above you have been notes by the IRS that Yu ae curently subject o backup withholding because

{you nove faled to report al narest and ivsends on yout ax run, For rel esate ansactons, tan 2 doesnot apply. Fr mortgage interes ai,

‘auton abandonment sects ropa, arelaln of bi, cero oan ncaa raanert arargrer (RA ad oral, ayn

Sign 5

Here _| Ox seme oar 03/15 / 202.|

General Instructions * Frm 1090-DV (iden, ning those frm teks or maa

Section references ae othe Intornal Revenue Code uness otherwise

ted

Future dew Fr the latest information about developments

related to Form W-9 and its instructions, such as legion enacted

‘tor they were published, go to ww. gow/FormW

Purpose of Form

‘An individual or entity (For W-9 requester) who is required to fle an

Information return with the IRS must obtain your comect taxpayer

‘entiication number (IN) which may be your social security number

(SSN), alvidual taxpayer entiation number (TN), adoption

{axpayer ldentfication number (ATIN), of employer Identification number

(BN), to report on an information retum the amount paid Yo you or ther

frount reportable on an Information retun_ Examples of information

Tetum include, but are rot ited to, the folowing.

‘+ Form 1099:INT (interest eared or paid)

‘unds)

‘+ Form 1098-MISC (various types of income, prizes, awards, or gross

proceeds)

+ Form 1088-8 (stock or mutual fund sales and certain other

transactions by brokers)

+ Form 1099-S (proceeds rom real estate transactions)

+ Form 1099- (merchant card and third party network transactions)

* Form 1098 (home mortgage interest), 1098-€ student ian intrest,

$1088. tuiton)

+ For 1098- (canceled debt)

‘+ Form 1098-A facquistion or abandonment of secured property)

Use Form W-9 only i you are a U.S. person fnclucing a resicent

‘lo, to provide your correct TW

If yu donot ret Form W-9 othe requester with a TIN, you might

‘be subject 0 backyp witnhokting. See What ls backup withholding,

ator

Ga Na 10287"

Farm WB fev 10258)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Batalla de Nuestro InteriorDocument2 pagesBatalla de Nuestro InteriorVanesa Diaz80% (5)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ilicitos TributariosDocument32 pagesIlicitos TributariosVanesa DiazNo ratings yet

- Procedimiento Tribunal FiscalDocument31 pagesProcedimiento Tribunal FiscalVanesa DiazNo ratings yet

- Definición y Componentes de La Política PúblicaDocument6 pagesDefinición y Componentes de La Política PúblicaVanesa DiazNo ratings yet

- Estado de Flujo de EfectivoDocument8 pagesEstado de Flujo de EfectivoVanesa DiazNo ratings yet

- 2nd Floor Units & BathsDocument1 page2nd Floor Units & BathsVanesa DiazNo ratings yet

- Definición de Los Componentes Del Comportamiento OrganizacionalDocument3 pagesDefinición de Los Componentes Del Comportamiento OrganizacionalVanesa DiazNo ratings yet

- La Gestión PúblicaDocument20 pagesLa Gestión PúblicaVanesa Diaz100% (1)

- Seguridad PsicológicaDocument7 pagesSeguridad PsicológicaVanesa DiazNo ratings yet

- Conceptos Básicos de La Organización y Administración de EmpresaDocument6 pagesConceptos Básicos de La Organización y Administración de EmpresaVanesa DiazNo ratings yet

- Cautiverio FelizDocument4 pagesCautiverio FelizVanesa DiazNo ratings yet