Professional Documents

Culture Documents

Automobile - Indonesia

Automobile - Indonesia

Uploaded by

RizkyAdiPoetraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Automobile - Indonesia

Automobile - Indonesia

Uploaded by

RizkyAdiPoetraCopyright:

Available Formats

I n d o n e s i a D a i l y Wednesday, 17 March 2021

SECTOR UPDATE OVERWEIGHT

Automobile – Indonesia (Maintained)

Sharp Increase In Sales Volume Post Luxury Tax Cut

One week post implementation of a luxury tax cut, sales volumes of affected models ASII PE BAND CHART (BEST 12M FORWARD)

of Toyota, Daihatsu, Honda have risen by 100%+, 40% and 60% mom respectively. 25.0

The government is also studying the impact of extending the tax reduction to 20.0

vehicles with engine size below 2,500cc. Since about 50% of cars sold in Indonesia 15.0

are below 2,500cc and 1,500cc, the regulation should bode well for 2021 volume 10.0

sales. Maintain OVERWEIGHT on the sector, with ASII and UNTR as our top picks. 5.0

WHAT’S NEW ‐

Mar‐16 Mar‐17 Mar‐18 Mar‐19 Mar‐20 Mar‐21

Sharp increase in sales volume post luxury tax reduction on <1,500cc vehicle ‐2stdev 8.8x ‐1stdev 11.3x Average 13.8x

category. In the first week of March, sales volume of <1,500cc cars saw a sharp mom 1stdev 16.3x 2stdev 18.8x ASII Best PE

increase. Sales of Toyota Avanza, Sienta, Rush and Yaris rose by 95-155% mom in the Source: Bloomberg, UOB Kay Hian

first week of March. Daihatsu Xenia, Terios, Luxio, GrandMax Mini rose 40% mom. UNTR PE BAND CHART (BEST 12M FORWARD)

Daihatsu Ayla, Sigra, Siron, GrandMax Pikap, GrandMax Blind Van rose 20% mom. 20.0

Honda products benefitted from the reduction in luxury tax, and rose 60% mom, while

Nissan products only rose 5%. Suzuki is in the midst of tallying its sales. 15.0

The luxury tax reduction could be extended to cars up to 2,500cc with 70% local

10.0

content. The luxury tax reduction could be extended to cars with engines up to 2,500cc; 5.0

however, the car will need to have 70% local content. Currently, the luxury tax for a ‐

2,500cc domestically-made car is 20%. One could see a Rp80m reduction in Toyota Mar‐16 Mar‐17 Mar‐18 Mar‐19 Mar‐20 Mar‐21

Fortuner and Mitsubishi Pajero selling prices, and a Rp50-55m reduction in Kijang Inova ‐2stdev 4.4x ‐1stdev 7.7x Average 11x

selling prices. 1stdev 14.2x 2stdev 17.5x UNTR Best PE

Source: Bloomberg, UOB Kay Hian

Types of eligible cars with engine capacities of 1,500-2,500cc are: a) Toyota: Inova,

Fortuner, and Voxy b) Mitsubishi Pajero Sport Dakar, and Pajero Sport Exceed, c) Honda

CRV, HRV-Prestige and Odyssey Prestige, d) Mercedes C Class, E Class and some of

the S Class, e) BMW 330I, 530i, 730LI, X1 SDRIVE, and X3, and f) Hyundai H 1.

49,202 units sold in February, down a mere 7.0% mom. Feb 21’s car unit sales came

in at 49,202 units, down 7.0% mom. This is not a low figure and is encouraging,

considering the 40-150% mom growth in the first week of Mar 21 and the potential

expansion of the luxury tax reduction to cars with 2,500cc engines. We are expecting a

full-year unit sales of 800,000, which could be achieved.

ACTION

Maintain BUY on ASII with target price of Rp6,800. ASII’s share price has fallen from a

high of Rp6,925 to the current Rp5,550. It is now trading at an attractive below-average PE

with potential upside to sales volume coming from the favourable regulation. We also expect

the financial services division’s net income to rise alongside the increase in sales volume.

AALI should perform well with CPO price rising, and UNTR should do well with coal price

recovering. We expect a 50.7% yoy growth in ASII’s 2021F net income.

Still positive on UNTR. We continue to be positive on UNTR on the back of: a) the rally in

coal price to over US$80/tonne could translate into higher demand for Komatsu units in

2021; b) a higher coal price in 2021 is unlikely to lead to a decline in overburden removal

volume, while there will be less pressure to give discounts, unlike the US$150m discount ANALYST(S)

given in 2020; c) new earnings contribution from its power plant; and d) UNTR is trading at Stevanus Juanda

below average historical 5-year PE. Maintain BUY with a target price of Rp29,500. +6221 2993 3845

stevanusjuanda@uobkayhian.com

PEER COMPARISON

Price Target Potential Market 3M Avg --------- PE --------- --------- P/B --------- -------- ROE -------- Net

16-Mar-21 Price Upside Cap Turnover 2021F 2022F 2021F 2022F 2021F 2022F Gearing

Company Ticker Rec (Rp) (Rp) (%) (US$m) (US$m) (x) (x) (x) (x) (%) (%) (%)

ASTRA INTERNATIONAL ASII BUY 5,550 6,800 22.5% 15,578 25.8 12.6 10.0 1.3 1.2 11.3 13.4 15.9

UNITED TRACTORS UNTR BUY 21,175 29,500 39.3% 5,476 9.8 7.9 6.2 1.2 1.1 15.4 17.4 (12.8)

Source: Bloomberg, UOB Kay Hian

Refer to last page for important disclosures. 1

I n d o n e s i a D a i l y Wednesday, 17 March 2021

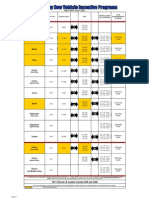

With the luxury tax relaxation being reduced to cars below 1,500 cc and a planned extension

to cars with engines below 2,500cc, this should bode well for 2021 car sales volume as about

half of the cars sold in Indonesia fall within this category.

SALES OF DOMESTICALLY-MADE CARS YTD BELOW 1,500 CC SALES OF DOMESTICALLY-MADE CARS YTD 1,501– 2,500CC

Brand Jan‐21 Feb‐21 Jan‐21 Feb‐21 Brand Jan‐21 Feb‐21 Jan‐21 Feb‐21

Toyota 6,953 4,284 32.9% 33.7%

Honda 4,504 2,748 21.3% 21.6% Toyota 4,355 4,765 78.1% 79.7%

Daihatsu 2,785 2,237 13.2% 17.6% Mitsubishi 908 828 16.3% 13.9%

Mitsubishi 3,469 1,764 16.4% 13.9%

Suzuki 2,435 1,056 11.5% 8.3%

Honda 157 172 2.8% 2.9%

Wuling 808 534 3.8% 4.2% BMW 44 131 0.8% 2.2%

DSFK 46 50 0.2% 0.4%

Mercedes 93 61 1.7% 1.0%

Nissan 100 17 0.5% 0.1%

Volkwagen 28 16 0.1% 0.1% Hyundai ‐ HIM 16 20 0.3% 0.3%

Grand Total 21,128 12,706 100.0% 100.0% Grand Total 5,573 5,977 100.0% 100.0%

Total Domestic Car Sales 52,909 49,202

% of Domestic made car

Total Domestic Car Sales 52,909 49,202

below 1500cc 39.9% 25.8% % of Domestic made car 10.5% 12.1%

Source: Bloomberg, UOB Kay Hian Source: Bloomberg, UOB Kay Hian

Most cars sold in Indonesia are multi-purpose vehicles (MPV) with an engine size below 1,500

cc. Pick-ups, low-cost green cars (LCGC) and cars with engine size below 2,500cc also

contribute a sizeable portion of volume sales.

YTD CAR SALES BY ENGINE SIZE YTD CAR SALES BY TYPES OF CARS

Engine Size Jan‐21 Feb‐21 Jan‐21 Feb‐21 Type of Car Jan‐21 Feb‐21 Jan‐21 Feb‐21

All CC 557 1,003 1.1% 2.0% 4X2 MPV 21,392 13,464 40.4% 27.4%

cc<1200 9,765 11,891 18.5% 24.2%

LCGC 9,765 11,891 18.5% 24.2%

CC<1500 21,544 13,692 40.7% 27.8%

CC 1501‐2500 6,253 7,421 11.8% 15.1% Pick Up 9,977 9,877 18.9% 20.1%

CC 1501‐3000 149 127 0.3% 0.3% 4x3 MPV 5,983 6,968 11.3% 14.2%

CC 2501‐3000 78 150 0.1% 0.3% Truck 4,511 4,904 8.5% 10.0%

CC > 3001 12 67 0.0% 0.1% Double Cabin 557 1,003 1.1% 2.0%

GVW < 5 Ton 9,977 9,877 18.9% 20.1%

Sedan 473 637 0.9% 1.3%

GVW > 24 Ton ‐ 1 0.0% 0.0%

GVW 10‐24 Ton 937 1,178 1.8% 2.4%

4X4 188 388 0.4% 0.8%

GVW 5‐10 tons 3,637 3,795 6.9% 7.7% Bus 63 70 0.1% 0.1%

Grand Total 52,909 49,202 100.0% 100.0% Grand Total 52,909 49,202 100.0% 100.0%

Source: Bloomberg, UOB Kay Hian Source: Bloomberg, UOB Kay Hian

MONTHLY CAR SALES

Source: Gaikindo, ASII

Refer to last page for important disclosures. 2

I n d o n e s i a D a i l y Wednesday, 17 March 2021

Disclosures/Disclaimers

This report is prepared by PT UOB Kay Hian Sekuritas (“PT UOBKH”), a licensed broker dealer registered in the Republic of Indonesia

and a member of the Indonesia Stock Exchange (“IDX”)

This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an

advice or a recommendation with respect to such securities.

This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the

particular needs of any recipient hereof. Advice should be sought from a financial adviser regarding the suitability of the investment

product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product.

This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this

report to any other person without the prior written consent of PT UOBKH. This report is not directed to or intended for distribution to or

use by any person or any entity who is a citizen or resident of or located in any locality, state, country or any other jurisdiction as PT

UOBKH may determine in its absolute discretion, where the distribution, publication, availability or use of this report would be contrary to

applicable law or would subject PT UOBKH and its associates and its officers, employees and representatives to any registration, licensing

or other requirements within such jurisdiction.

The information or views in the report (“Information”) has been obtained or derived from sources believed by PT UOBKH to be reliable.

However, PT UOBKH makes no representation as to the accuracy or completeness of such sources or the Information and PT UOBKH

accepts no liability whatsoever for any loss or damage arising from the use of or reliance on the Information PT UOBKH and its associate

may have issued other reports expressing views different from the Information and all views expressed in all reports of PT UOBKH and its

connected persons are subject to change without notice. PT UOBKH reserves the right to act upon or use the Information at any time,

including before its publication herein.

Except as otherwise indicated below, (1) PT UOBKH, its associates and its officers, employees and representatives may, to the extent

permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit business

from, the subject corporation(s) referred to in this report; (2) PT UOBKH, its associate and its officers, employees and representatives may

also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business from, other persons in

respect of dealings in the securities referred to in this report or other investments related thereto; (3) the officers, employees and

representatives of PT UOBKH may also serve on the board of directors or in trustee positions with the subject corporation(s) referred to in

this report. (All of the foregoing is hereafter referred to as the “Subject Business”); and (4) PT UOBKH may otherwise have an interest

(including a proprietary interest) in the subject corporation(s) referred to in this report.

As of the date of this report, no analyst responsible for any of the content in this report has any proprietary position or material interest in

the securities of the corporation(s) which are referred to in the content they respectively author or are otherwise responsible for.

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report is prepared by PT UOBKH, a company authorized, as noted above, to engage in securities activities in Indonesia. PT

UOBKH is not a registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of

research reports and the independence of research analysts. This research report is provided for distribution by PT UOBKH (whether

directly or through its US registered broker dealer affiliate named below) to “major U.S. institutional investors” in reliance on the exemption

from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). All US persons

that receive this document by way of distribution from or which they regard as being from PT UOBKH by their acceptance thereof

represent and agree that they are a major institutional investor and understand the risks involved in executing transactions in securities.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on

the information provided in this research report should do so only through UOB Kay Hian (U.S.) Inc (“UOBKHUS”), a registered broker-

dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell

securities or related financial instruments through PT UOBKH.

UOBKHUS accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is

delivered to and intended to be received by a U.S. person other than a major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry

Regulatory Authority (“FINRA”) and may not be an associated person of UOBKHUS and, therefore, may not be subject to applicable

restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research

analyst account.

Refer to last page for important disclosures. 3

I n d o n e s i a D a i l y Wednesday, 17 March 2021

Analyst Certification/Regulation AC

Each research analyst of PT UOBKH who produced this report hereby certifies that (1) the views expressed in this report accurately reflect

his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by

him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of PT UOBKH or any other person, any of the Subject

Business involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not

receive any compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any

sales, trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the

compensation received by each such research analyst is based upon various factors, including PT UOBKH total revenues, a portion of

which are generated from PT UOBKH business of dealing in securities.

Reports are distributed in the respective countries by the respective entities and are subject to the additional restrictions listed in the

following table.

General This report is not intended for distribution, publication to or use by any person or entity who is a citizen or resident of or

located in any country or jurisdiction where the distribution, publication or use of this report would be contrary to

applicable law or regulation.

Hong Kong This report is distributed in Hong Kong by UOB Kay Hian (Hong Kong) Limited ("UOBKHHK"), which is regulated by the

Securities and Futures Commission of Hong Kong. Neither the analyst(s) preparing this report nor his associate, has

trading and financial interest and relevant relationship specified under Para. 16.4 of Code of Conduct in the listed

corporation covered in this report. UOBKHHK does not have financial interests and business relationship specified under

Para. 16.5 of Code of Conduct with the listed corporation covered in this report. Where the report is distributed in Hong

Kong and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKHHK (and not the relevant foreign research house) in Hong

Kong in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Hong Kong

who is not a professional investor, or institutional investor, UOBKHHK accepts legal responsibility for the contents of the

analyses or reports only to the extent required by law.

Indonesia This report is distributed in Indonesia by PT UOB Kay Hian Sekuritas, which is regulated by Financial Services Authority

of Indonesia (“OJK”). Where the report is distributed in Indonesia and contains research analyses or reports from a

foreign research house, please note recipients of the analyses or reports are to contact PT UOBKH (and not the relevant

foreign research house) in Indonesia in respect of any matters arising from, or in connection with, the analysis or report.

Malaysia Where the report is distributed in Malaysia and contains research analyses or reports from a foreign research house, the

recipients of the analyses or reports are to contact UOBKHM (and not the relevant foreign research house) in Malaysia,

at +603-21471988, in respect of any matters arising from, or in connection with, the analysis or report as UOBKHM is the

registered person under CMSA to distribute any research analyses in Malaysia.

Singapore This report is distributed in Singapore by UOB Kay Hian Private Limited ("UOBKH"), which is a holder of a capital

markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore. Where the

report is distributed in Singapore and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKH (and not the relevant foreign research house) in Singapore

in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore

who is not an accredited investor, expert investor or institutional investor, UOBKH accepts legal responsibility for the

contents of the analyses or reports only to the extent required by law.

Thailand This report is distributed in Thailand by UOB Kay Hian Securities (Thailand) Public Company Limited, which is regulated

by the Securities and Exchange Commission of Thailand.

United This report is being distributed in the UK by UOB Kay Hian (U.K.) Limited, which is an authorised person in the meaning

Kingdom of the Financial Services and Markets Act and is regulated by The Financial Conduct Authority. Research distributed in

the UK is intended only for institutional clients.

United This report cannot be distributed into the U.S. or to any U.S. person or entity except in compliance with applicable U.S.

States of laws and regulations. It is being distributed in the U.S. by UOB Kay Hian (US) Inc, which accepts responsibility for its

America contents. Any U.S. person or entity receiving this report and wishing to effect transactions in any securities referred to in

(‘U.S.’) the report should contact UOB Kay Hian (US) Inc. directly.

Copyright 2021, PT UOB Kay Hian Sekuritas. All rights reserved.

http://research.uobkayhian.com

Refer to last page for important disclosures. 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- How To Manually Decode A Land Rover VINDocument5 pagesHow To Manually Decode A Land Rover VINtzskojevacNo ratings yet

- 03 2566Document382 pages03 2566Luis Enrique PeñaNo ratings yet

- CR1277BDocument1 pageCR1277BJefferson González MoralesNo ratings yet

- A604 04 WDocument10 pagesA604 04 WRoméo Lai Fao100% (1)

- Triton 4x4 PMDocument10 pagesTriton 4x4 PMFirdaus BaharuddinNo ratings yet

- Avu BFQ 1 6 RusDocument121 pagesAvu BFQ 1 6 RusЮлия МайбородаNo ratings yet

- Continental Timing Belt InstallationDocument4 pagesContinental Timing Belt InstallationStuart WickensNo ratings yet

- Hyundai Accent L 1995 3Document26 pagesHyundai Accent L 1995 3Ranses RodriguezNo ratings yet

- Training Pivot + VlookupDocument9 pagesTraining Pivot + VlookupTraining ImoraNo ratings yet

- 3 BMW Motorrad Price March 2021.PDF - Asset.1616655326065Document2 pages3 BMW Motorrad Price March 2021.PDF - Asset.1616655326065AnilNo ratings yet

- Honda Civic FN2 CircuitDocument13 pagesHonda Civic FN2 CircuitNic RoddaNo ratings yet

- Chapter 4 Accessing The CAN Bus NewDocument8 pagesChapter 4 Accessing The CAN Bus NewLizien Wild EngineNo ratings yet

- 07 - M Performance ControlsDocument14 pages07 - M Performance ControlswasthanapolNo ratings yet

- Toyota Etios 387Document12 pagesToyota Etios 387Jitendra KumarNo ratings yet

- 330c-330c L (Gag, Haa, BTM, RBH)Document1,140 pages330c-330c L (Gag, Haa, BTM, RBH)servimaquinados plazas sas100% (1)

- Motor de Vendas Fortlub 13 08 21Document44 pagesMotor de Vendas Fortlub 13 08 21Tatiane LudtkeNo ratings yet

- Toyota of Palo Alto Finance Incentives Rebates 0% Financing Corolla CamryDocument1 pageToyota of Palo Alto Finance Incentives Rebates 0% Financing Corolla CamryToyota of Palo AltoNo ratings yet

- Mazdacx8 Price (W) PDFDocument1 pageMazdacx8 Price (W) PDFNicolas NgNo ratings yet

- Ee Bornes Cas - 8572651 (4046)Document7 pagesEe Bornes Cas - 8572651 (4046)HIMNo ratings yet

- QDD 30 S 45 SDocument4 pagesQDD 30 S 45 SfaniNo ratings yet

- Catalogue Europe LV IsaDocument12 pagesCatalogue Europe LV IsaDinifaanNo ratings yet

- Evaporadoras Tipo Casette FXFSQ - AVM - DatasheetDocument7 pagesEvaporadoras Tipo Casette FXFSQ - AVM - DatasheetjaimegutierrezlinganNo ratings yet

- NOS Honda Parts Alphabetical 2.23.17Document60 pagesNOS Honda Parts Alphabetical 2.23.17Andrés GaleottiNo ratings yet

- Automobile DaciaDocument11 pagesAutomobile DaciaMehdi Colopi100% (1)

- 95 Tahoe Oils Standards and QuantityDocument5 pages95 Tahoe Oils Standards and QuantitySandman614No ratings yet

- Laporan Stock Idk CemaraDocument10 pagesLaporan Stock Idk Cemaraintan widya asmaraNo ratings yet

- LTO Application Drivers LicenseDocument2 pagesLTO Application Drivers LicenseAngel Agustine O. Japitan IINo ratings yet

- Kohler John Deere 80ROZJ SN 389014 As ShippedDocument1 pageKohler John Deere 80ROZJ SN 389014 As ShippedDewisNo ratings yet

- Case Study: Soichiro Honda - Leader For Innovation: The Forge of A Creative MindDocument4 pagesCase Study: Soichiro Honda - Leader For Innovation: The Forge of A Creative MindNina AnnisaNo ratings yet

- Starex TQFLDocument1 pageStarex TQFLAmirul Amin IVNo ratings yet