Professional Documents

Culture Documents

Becsr 3

Becsr 3

Uploaded by

PATANJALI NAYAK0 ratings0% found this document useful (0 votes)

29 views2 pagesThe relationship managers at the bank failed to meet ethical standards in their dealings with Enron. [1] They had an obligation to act in the best interests of clients, maintain independence and objectivity, and avoid conflicts of interest. [2] However, their actions prioritized profits over these duties. They used utilitarian, rights-based, and justice-based ethical frameworks but did not properly apply them to make choices that considered all stakeholders in a balanced way. [3] Overall, the relationship managers did not conduct themselves according to the code of ethics for their profession.

Original Description:

Original Title

BECSR 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe relationship managers at the bank failed to meet ethical standards in their dealings with Enron. [1] They had an obligation to act in the best interests of clients, maintain independence and objectivity, and avoid conflicts of interest. [2] However, their actions prioritized profits over these duties. They used utilitarian, rights-based, and justice-based ethical frameworks but did not properly apply them to make choices that considered all stakeholders in a balanced way. [3] Overall, the relationship managers did not conduct themselves according to the code of ethics for their profession.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

29 views2 pagesBecsr 3

Becsr 3

Uploaded by

PATANJALI NAYAKThe relationship managers at the bank failed to meet ethical standards in their dealings with Enron. [1] They had an obligation to act in the best interests of clients, maintain independence and objectivity, and avoid conflicts of interest. [2] However, their actions prioritized profits over these duties. They used utilitarian, rights-based, and justice-based ethical frameworks but did not properly apply them to make choices that considered all stakeholders in a balanced way. [3] Overall, the relationship managers did not conduct themselves according to the code of ethics for their profession.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

BECSR ASSIGNMENT

1.What responsibilities did David Duncan owe to Arthur Andersen? To

Enron’s management? To Enron’s stockholders? To the accounting

profession? Explain.

David Duncan had been Arthur Andersen's former partner for 20 years, and had been the lead

partner of the company on the Enron account. He was later fired from Andersen in 2002 and

charged with obstruction of justice for ordering Andersen's personnel to shred over a ton of

Enron-related papers.

Duncan had obligations to all of the mentioned parties and he failed in due diligence, was

accused of behaving carelessly and displayed utter lack of integrity in his association with

Enron. As the head auditor, Duncan was responsible for maintaining the highest professional

accounting and auditing ethics, and leading the audit team responsibly and impartially.

Duncan as well as all auditors must retain an impartial approach and they must also keep a

healthy measure of cynicism, recognizing that there might be deception and errors, but not

evaluating without the supporting proof that may come from a thorough audit, which is

another aspect that Duncan has never provided.

He was accountable for supplying his client, Arthur Andersen, with the finest technical

support he could provide. Duncan also had a duty to the management of Enron which was to

perform a comprehensive, secure audit. Auditors don't audit corporations to the company's

advantage; they audit companies to stakeholders 'benefit.

He also had the responsibility of providing clean report to shareholders, which should have

revealed that the stockholders lost revenue. It was really significant enough, as Enron failed,

to affect the industry and the economy. When Duncan had intervened, that may have been

mitigated sooner.

David's duty to the accounting profession was governed by ethical standards upholding of

integrity and reliability. In fact, it was the auditor's duty to preserve a decent picture of the

accounting practice.

2.Evaluate the conduct of the relationship manager(s) with reference to

standard code of ethical conduct.

Each entity, particularly the partnership bankers, are required to perform their company in

compliance with the highest ethical principles to achieve and retain the full faith and

confidence of their clients and the public in general. In this situation, though, bank

relationship managers participated in disreputable activities that culminated in the bank itself

being in conflict of interest.

This methodology incorporates four frameworks of ethical reasoning — rights and

responsibilities, utilitarianism, fairness, and justice approach — in a system that lets

administrators and representatives navigate into a cycle of critical thinking to figure out the

ethical aspects of a complex and potentially contradictory situation.

Utilitarian approach:

Another method of thinking about a philosophical dilemma is to use utilitarian evaluation to

consider the greater value with the maximum number. That method of cost-benefit is a very

popular approach to strategy, although as the concept implies, it might not be an appropriate

justification for making an ethical action in a moral dispute by itself.

Right approach:

Rights are justifiable representations or entitlements that allow persons to follow their own

desires, often based on legislation or other authoritative documents, such as agreements and

foreign declarations. Rights may be defined as the good stuff individuals are entitled to do,

but they often come together with an obverse aspect, in the form of responsibilities or

commitments that go alongside the privileges. The relationship manager would also have

expanded the Probability of the capital spent in comparison to the positive gain.

Justice approach:

Justice values represent a third direction in which executives should think for ethical choices.

Just judgments involve justice, equality and neutrality on the part of judgment-makers,

especially with regard to the ultimate burdens and benefits that the judgment may carry.

Because of certain commissionable strategies with big yields and high risk, the fund manager

will describe both forms of investing. He should encourage Suchitra Krishnamoorthi to select

her investment according to her risk tolerance, rather than offering his opinion.

You might also like

- Test Bank For Auditing A Practical Approach 3rd Canadian Edition by Robyn MoroneyDocument35 pagesTest Bank For Auditing A Practical Approach 3rd Canadian Edition by Robyn MoroneyNitin100% (1)

- Audit and Assurance: AnswersDocument20 pagesAudit and Assurance: AnswersLauren McMahonNo ratings yet

- Social Audit Working Doc Report SampleDocument5 pagesSocial Audit Working Doc Report SampleShiena Lou B. Amodia-Rabacal100% (5)

- Ethics in InsuranceDocument19 pagesEthics in InsuranceDruti Jaiswal80% (5)

- Case Study EnronDocument5 pagesCase Study EnronFerl Diane SiñoNo ratings yet

- Easa-Q 2000 0403Document126 pagesEasa-Q 2000 0403Dee FormeeNo ratings yet

- Sas 9.0 Manual PDFDocument1,861 pagesSas 9.0 Manual PDFALTernativoNo ratings yet

- Ieee STD 730 Sqa PlansDocument17 pagesIeee STD 730 Sqa PlansPatricia LlallicoNo ratings yet

- Case #2.1 - Enron: Independence: I. Technical Audit GuidanceDocument9 pagesCase #2.1 - Enron: Independence: I. Technical Audit GuidanceDaniel HunksNo ratings yet

- Part 3, 4Document7 pagesPart 3, 4Rashid Mahmood ArqamNo ratings yet

- Activity 7 - EthicsDocument4 pagesActivity 7 - EthicsMarc Lawrence Tiglao INo ratings yet

- Ethics Powerpoints Lecture #2Document89 pagesEthics Powerpoints Lecture #2Fei WangNo ratings yet

- Enron ScandalDocument7 pagesEnron ScandalDavies Ngugi MNo ratings yet

- Discussion Unit 2 (Enron and Anderson)Document2 pagesDiscussion Unit 2 (Enron and Anderson)mooon RNo ratings yet

- Enron CaseDocument3 pagesEnron CaseLaya Isabelle SulartaNo ratings yet

- C10 GovernanceDocument7 pagesC10 GovernanceBernice CheongNo ratings yet

- Assignment EnronDocument4 pagesAssignment EnronMuhammad Umer100% (2)

- Chapter Twelve Role of Various Agencies in Ensuring Ethics in CorporationsDocument51 pagesChapter Twelve Role of Various Agencies in Ensuring Ethics in CorporationsMuhammad TariqNo ratings yet

- Comprehensive Case A.1 - EnronDocument33 pagesComprehensive Case A.1 - EnronYismawNo ratings yet

- Comprehensive Case A.1 - EnronDocument33 pagesComprehensive Case A.1 - EnronYismawNo ratings yet

- Group 1 - FRCG PresentationDocument13 pagesGroup 1 - FRCG Presentationbikku meherNo ratings yet

- Arthur Andersen CaseDocument10 pagesArthur Andersen CaseSakub Amin Sick'L'No ratings yet

- 4 JawapanDocument5 pages4 JawapanNad Adenan100% (1)

- Auditing Is A Systematic Process of Obtaining and Examining The Transparency and Truth of Financial Records of A Business Entity or The GovernmentDocument3 pagesAuditing Is A Systematic Process of Obtaining and Examining The Transparency and Truth of Financial Records of A Business Entity or The GovernmentAsif RahmanNo ratings yet

- Auditing Chapter2Document7 pagesAuditing Chapter2Getachew JoriyeNo ratings yet

- Ethical LeadershipDocument23 pagesEthical LeadershipzaidNo ratings yet

- Internal ControlDocument5 pagesInternal ControlGabriel Nyl Madronero CasiñoNo ratings yet

- Mai Moyo Prac 2 Company LawDocument7 pagesMai Moyo Prac 2 Company Lawmarvadomarvellous67No ratings yet

- Three Major ConsiderationsDocument9 pagesThree Major ConsiderationsHooriya AhmadNo ratings yet

- Chapter 1 What Is AssuranceDocument12 pagesChapter 1 What Is AssuranceNeil Ryan CatagaNo ratings yet

- Unit 123Document22 pagesUnit 123Khushal GargNo ratings yet

- The Enron - Ans 2Document3 pagesThe Enron - Ans 2Chitra WadhwaNo ratings yet

- FC ProjectDocument25 pagesFC ProjectRaut BalaNo ratings yet

- A&a Unit 2 NotesDocument8 pagesA&a Unit 2 NotesMohanrajNo ratings yet

- SoxyDocument14 pagesSoxyClarence FernandoNo ratings yet

- Strategic Cost Management Prelim SummaryDocument5 pagesStrategic Cost Management Prelim Summaryamorashella5No ratings yet

- Ethics and GovernanceDocument5 pagesEthics and GovernanceChinmay PatelNo ratings yet

- Auditing I CH 2Document36 pagesAuditing I CH 2Hussien AdemNo ratings yet

- CH-1 BeDocument17 pagesCH-1 BeABAYNESH BIRARANo ratings yet

- 5th Sem Malji Sir NotesDocument14 pages5th Sem Malji Sir Notesyatinmehta358No ratings yet

- Acc701 Tut 2 SolutionsDocument6 pagesAcc701 Tut 2 SolutionsUshra Khan0% (1)

- Dinesh AuditDocument6 pagesDinesh AuditNishtha ChhabraNo ratings yet

- Meeting 6Document6 pagesMeeting 6p aloaNo ratings yet

- Arthur AndersenDocument5 pagesArthur AndersenWill KaneNo ratings yet

- Busines Ethics Chapter FiveDocument7 pagesBusines Ethics Chapter Fivedro landNo ratings yet

- At The End of The Lesson, The Learners Will Be Able ToDocument3 pagesAt The End of The Lesson, The Learners Will Be Able ToAries Venlym TanolaNo ratings yet

- Business - Ethics, Governance & RiskDocument5 pagesBusiness - Ethics, Governance & RiskPrashant AhujaNo ratings yet

- Ethics in Insurance SectorDocument24 pagesEthics in Insurance Sectorvishnusharma454No ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- Audit and Review: Exam FocusDocument12 pagesAudit and Review: Exam FocusPhebieon MukwenhaNo ratings yet

- Ethics Case (Pramod)Document13 pagesEthics Case (Pramod)Prabin PaudelNo ratings yet

- Ch7 - Accounnting - Finance Ethics - SVDocument21 pagesCh7 - Accounnting - Finance Ethics - SVThu AnhNo ratings yet

- Chap 4-5. Aulia RahmayantiDocument8 pagesChap 4-5. Aulia Rahmayantiahmad RifaiNo ratings yet

- EthicsDocument7 pagesEthicsdominicNo ratings yet

- 2.1. What Is Auditing Standard?: General Standards Standards of Fieldwork Standards of ReportingDocument56 pages2.1. What Is Auditing Standard?: General Standards Standards of Fieldwork Standards of ReportingFackallofyouNo ratings yet

- Ethics and Business Decision Making: W C I ADocument14 pagesEthics and Business Decision Making: W C I Arguha1986100% (1)

- Case 4.4 Waste ManagementDocument6 pagesCase 4.4 Waste ManagementNurul SyahirahNo ratings yet

- 310 Corporate GovernanceDocument24 pages310 Corporate GovernanceManojNo ratings yet

- Ahmed Mustafa EnronDocument3 pagesAhmed Mustafa EnronAhmed HassanNo ratings yet

- Auditing 1 L2 Professional EthicsDocument32 pagesAuditing 1 L2 Professional EthicsvictoriaNo ratings yet

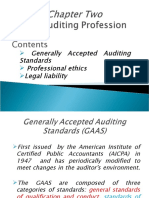

- Generally Accepted Auditing Standards Professional Ethics Legal LiabilityDocument16 pagesGenerally Accepted Auditing Standards Professional Ethics Legal LiabilityyebegashetNo ratings yet

- Handout 2 - Business Ethics and Social ResponsibilityDocument4 pagesHandout 2 - Business Ethics and Social ResponsibilityFJ AldeaNo ratings yet

- Chapter 8Document16 pagesChapter 8Genanew AbebeNo ratings yet

- Business Valuation and Forensic Accounting: For Resolving Disputes in HawaiiFrom EverandBusiness Valuation and Forensic Accounting: For Resolving Disputes in HawaiiNo ratings yet

- Customer ChurnDocument8 pagesCustomer ChurnPATANJALI NAYAKNo ratings yet

- Pom2 Project Topic: Forecasting of TCS Share Prices For The Next 6 Months. Member Name: Shuvom Prakash Sahu-19202040Document2 pagesPom2 Project Topic: Forecasting of TCS Share Prices For The Next 6 Months. Member Name: Shuvom Prakash Sahu-19202040PATANJALI NAYAKNo ratings yet

- Becsr Assignment: Your Star Sales Person Lied: Should He Get A Second Chance?Document4 pagesBecsr Assignment: Your Star Sales Person Lied: Should He Get A Second Chance?PATANJALI NAYAKNo ratings yet

- Becsr AssignmentDocument2 pagesBecsr AssignmentPATANJALI NAYAKNo ratings yet

- Becsr Assignment: 1. What Ethical Issues Emerge From The Conduct of Nestle India With Reference To Marketing of Maggi?Document2 pagesBecsr Assignment: 1. What Ethical Issues Emerge From The Conduct of Nestle India With Reference To Marketing of Maggi?PATANJALI NAYAKNo ratings yet

- BRM Assignment: Who's Fishing?Document2 pagesBRM Assignment: Who's Fishing?PATANJALI NAYAKNo ratings yet

- Pgsus 31122020 enDocument96 pagesPgsus 31122020 enÇağhan EraymanNo ratings yet

- Capacity Building of Accounts and Internal Audit StaffDocument22 pagesCapacity Building of Accounts and Internal Audit StaffFakhar QureshiNo ratings yet

- Identifying Shariah Governance and ConstructionDocument13 pagesIdentifying Shariah Governance and ConstructionFatikhatun NajikhahNo ratings yet

- Payroll Audit ProgramsDocument6 pagesPayroll Audit ProgramsMirage100% (1)

- Research Proposal Role of Internal Audit in Effective Management of Organizations A Study of The Petroleum Retail IndustryDocument4 pagesResearch Proposal Role of Internal Audit in Effective Management of Organizations A Study of The Petroleum Retail Industrykennedy gikunjuNo ratings yet

- Department of Accounting Acc 316: Principles & Practice of AuditingDocument7 pagesDepartment of Accounting Acc 316: Principles & Practice of AuditingFreeman AbuNo ratings yet

- Aue2602 Homework 3 MemoDocument13 pagesAue2602 Homework 3 MemoNISSIBETINo ratings yet

- Separate Bank Account-RERADocument9 pagesSeparate Bank Account-RERAvivekNo ratings yet

- Dabur NepalDocument19 pagesDabur Nepalbajracharyasandeep100% (1)

- A Guide To ISO 50001 2018 Energy Management SystemsDocument6 pagesA Guide To ISO 50001 2018 Energy Management Systemsphamxtien374133% (3)

- Auditing: T I C A PDocument3 pagesAuditing: T I C A Psecret studentNo ratings yet

- Glossary AuditingDocument16 pagesGlossary AuditingElvie Abulencia-BagsicNo ratings yet

- At Audit PlanningDocument7 pagesAt Audit PlanningRey Joyce AbuelNo ratings yet

- Draft Concession Agrement VISL PDFDocument295 pagesDraft Concession Agrement VISL PDFDshNo ratings yet

- MHRA Questions and Answers For Specials Manufacturer's Con326474 PDFDocument44 pagesMHRA Questions and Answers For Specials Manufacturer's Con326474 PDFSharma PokkuluriNo ratings yet

- 18 - Gender and DevelopmentDocument59 pages18 - Gender and DevelopmentRatsel IsmeNo ratings yet

- Presentation by MEMDDocument117 pagesPresentation by MEMDGCICNo ratings yet

- Chapter 5 Inventory and Warehousing Cyle AuditDocument24 pagesChapter 5 Inventory and Warehousing Cyle AuditDawit WorkuNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentLAKSHMANNo ratings yet

- Employee Health Insurance Claims Audit ProgramDocument2 pagesEmployee Health Insurance Claims Audit ProgramCheick AbdoulNo ratings yet

- BASF Report 2018Document290 pagesBASF Report 2018Dridi BadreddineNo ratings yet

- Internal Control and Risk Assessment: Introductory Scenario: Suggested Solutions To QuestionsDocument18 pagesInternal Control and Risk Assessment: Introductory Scenario: Suggested Solutions To QuestionsKenneth MallariNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- 2013A IP QuestionDocument49 pages2013A IP QuestionJohn AngolluanNo ratings yet

- Study Notes AuditDocument2 pagesStudy Notes AuditKidz ki DuniyaNo ratings yet