Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

25 views4 - AIS Reviewer

4 - AIS Reviewer

Uploaded by

Aira Jaimee GonzalesThe document discusses internal controls and governance for organizations. It covers enterprise risk management, the COSO internal control framework, IT controls, codes of ethics, and corporate and IT governance. The COSO framework has 5 components: control environment, risk assessment, control activities, information and communication, and monitoring. IT governance focuses on aligning IT with business strategy, providing structures to implement strategies, and adopting control frameworks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- COSO ERM2017 - Main - (Vol - 1)Document120 pagesCOSO ERM2017 - Main - (Vol - 1)A R AdIL90% (10)

- COSO Fraud Risk Management Guide Executive SummaryDocument13 pagesCOSO Fraud Risk Management Guide Executive SummaryJosimar Gonzales TrigoNo ratings yet

- Accounting Gov ReviewerDocument19 pagesAccounting Gov ReviewerAira Jaimee GonzalesNo ratings yet

- Certified Sarbanes-Oxley Expert (CSOE) Distance Learning and Online Certification Program PDFDocument12 pagesCertified Sarbanes-Oxley Expert (CSOE) Distance Learning and Online Certification Program PDFApoorva BadolaNo ratings yet

- BEC 2015 AICPA Released QuestionDocument46 pagesBEC 2015 AICPA Released QuestionCA Akshay Garg100% (4)

- An Overview of Widely Used Risk Management Standards and Guidelines PDFDocument24 pagesAn Overview of Widely Used Risk Management Standards and Guidelines PDFNooni Rinyaphat67% (3)

- Internal Control Review The Practical ApproachDocument25 pagesInternal Control Review The Practical ApproachnurilNo ratings yet

- Audit Committee Toolkit PDFDocument18 pagesAudit Committee Toolkit PDFuserNo ratings yet

- Implementing an Integrated Management System (IMS): The strategic approachFrom EverandImplementing an Integrated Management System (IMS): The strategic approachRating: 5 out of 5 stars5/5 (2)

- GRC PWC IntegritydrivenperformanceDocument52 pagesGRC PWC IntegritydrivenperformanceDeepak YakkundiNo ratings yet

- SIA Kel 3 FinishDocument25 pagesSIA Kel 3 FinishNugraha HaritsNo ratings yet

- Romney Ais13 PPT 01Document42 pagesRomney Ais13 PPT 01Chesya Bintang CarolineNo ratings yet

- Note AisDocument9 pagesNote AisNUR ALEEYA MAISARAH BT MOHD NASIRNo ratings yet

- At.3209 - Internal Control ConsiderationsDocument12 pagesAt.3209 - Internal Control ConsiderationsDenny June CraususNo ratings yet

- 3 2018 L8 Gov.,Risk Management, ComplianceDocument13 pages3 2018 L8 Gov.,Risk Management, ComplianceTing Phin Yuan100% (1)

- Internal ControlsDocument5 pagesInternal ControlsAya PulidoNo ratings yet

- Isca Full Book01Document249 pagesIsca Full Book01U.S. SHUKLA & CO.No ratings yet

- Lecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020Document6 pagesLecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020MaeNo ratings yet

- Pre 3 Chap 3Document8 pagesPre 3 Chap 3Angelica Lianne BisnarNo ratings yet

- AIS Reviewer 4Document2 pagesAIS Reviewer 4DANIELLE TORRANCE ESPIRITUNo ratings yet

- 14 and 15 - Overview of Internal Control Fraud and ErrorDocument7 pages14 and 15 - Overview of Internal Control Fraud and ErrorNiña YastoNo ratings yet

- Components of Internal ControlDocument13 pagesComponents of Internal ControlGamers HubNo ratings yet

- Isca NotesDocument159 pagesIsca Notesaramsiva100% (2)

- 4 5850471109056532140Document59 pages4 5850471109056532140Yehualashet MulugetaNo ratings yet

- 05GeneralInternalControl NotesDocument13 pages05GeneralInternalControl NotesMussaNo ratings yet

- Ca Final IscaDocument130 pagesCa Final IscaKumar SwamyNo ratings yet

- Governance 13 16Document28 pagesGovernance 13 16Lea Lyn FuasanNo ratings yet

- Control and Accounting Information SystemDocument8 pagesControl and Accounting Information SystemAs17 As17No ratings yet

- AT.111 - Undestanding The Entity's Internal ControlDocument6 pagesAT.111 - Undestanding The Entity's Internal Controlandrew dacullaNo ratings yet

- 41126bos30870 SM cp1Document45 pages41126bos30870 SM cp1Ritunjay PandeyNo ratings yet

- Audit ch-4Document68 pagesAudit ch-4fekadegebretsadik478729No ratings yet

- Business Ethics (Chapt 13-17)Document30 pagesBusiness Ethics (Chapt 13-17)Hads LunaNo ratings yet

- 47 67Document3 pages47 67an scNo ratings yet

- Audit ch-4Document68 pagesAudit ch-4fekadegebretsadik478729No ratings yet

- Elective 2 ReviewerDocument7 pagesElective 2 Reviewerhipolitoyanna8No ratings yet

- Implementing The Five Key Internal Controls: PurposeDocument6 pagesImplementing The Five Key Internal Controls: PurposeRia GabsNo ratings yet

- AI-X-S4-G5-Arief Budi NugrohoDocument7 pagesAI-X-S4-G5-Arief Budi Nugrohoariefmatani73No ratings yet

- Whitepaper The Evolving Role of AuditDocument6 pagesWhitepaper The Evolving Role of AuditEmmelinaErnestineNo ratings yet

- Sistem Pengendalian InternalDocument18 pagesSistem Pengendalian InternalElizabeth PutriNo ratings yet

- Almendralejo Chap8 DiscussionDocument16 pagesAlmendralejo Chap8 DiscussionRhywen Fronda GilleNo ratings yet

- Auditing I Chapter FourDocument10 pagesAuditing I Chapter FourDere GurandaNo ratings yet

- MGT 209 - CH 13 NotesDocument6 pagesMGT 209 - CH 13 NotesAmiel Christian MendozaNo ratings yet

- Audit Theory 8Document3 pagesAudit Theory 8CattleyaNo ratings yet

- Outline BEC 1Document5 pagesOutline BEC 1govind raghavanNo ratings yet

- Chapter 6-8Document10 pagesChapter 6-8DeyNo ratings yet

- ISCA Chapter 1 Notes 1Document34 pagesISCA Chapter 1 Notes 1Kumar SwamyNo ratings yet

- Control: Chartered Institute of Internal AuditorsDocument5 pagesControl: Chartered Institute of Internal AuditorsGNo ratings yet

- Accounting 412 Chapter 6 Homework SolutionsDocument5 pagesAccounting 412 Chapter 6 Homework SolutionsxxxjungxzNo ratings yet

- Using Coso Framework To Establish Internal Control Over Sustainability ReportingDocument11 pagesUsing Coso Framework To Establish Internal Control Over Sustainability ReportingbadrianisgmailcomNo ratings yet

- Govbus - Chapter 13-16Document34 pagesGovbus - Chapter 13-16Gaza Jemi GadeNo ratings yet

- TOPIC 8 Internal Control Frameworks (E.g., COSO, COBIT)Document8 pagesTOPIC 8 Internal Control Frameworks (E.g., COSO, COBIT)kenl69784No ratings yet

- Chapter 2 - Audit Strategy, Planning & Programming: Stages of Audit ExecutionDocument17 pagesChapter 2 - Audit Strategy, Planning & Programming: Stages of Audit Executionmaulesh bhattNo ratings yet

- Module 5 Internal Control 2Document13 pagesModule 5 Internal Control 2genevaalcoberNo ratings yet

- Understanding The Entity'S InternalcontrolDocument44 pagesUnderstanding The Entity'S Internalcontrolgandara koNo ratings yet

- SAV ASSOCIATES - Approaches For Optimizing Your ICFR in The Context of The New COSODocument56 pagesSAV ASSOCIATES - Approaches For Optimizing Your ICFR in The Context of The New COSOSanjay ChadhaNo ratings yet

- Assurance Chapter-5 (04-09-2018)Document9 pagesAssurance Chapter-5 (04-09-2018)Shahid MahmudNo ratings yet

- COSO Executive SummaryDocument5 pagesCOSO Executive SummaryabekaforumNo ratings yet

- Sulaiha Wati - Chapter 8 NewDocument6 pagesSulaiha Wati - Chapter 8 Newsulaiha watiNo ratings yet

- Consideration of Internal ControlDocument43 pagesConsideration of Internal ControlDebbie Grace Latiban LinazaNo ratings yet

- Role of The Head of Internal AuditDocument28 pagesRole of The Head of Internal Auditsaiful2522No ratings yet

- ERM ReviewerDocument4 pagesERM ReviewerJA Pingol PaderonNo ratings yet

- Designing Effective Financial Controls - Leveraging The Internal Control Framework To Achieve Control ObjectivesDocument3 pagesDesigning Effective Financial Controls - Leveraging The Internal Control Framework To Achieve Control ObjectivesStephen G. LynchNo ratings yet

- Information System and Control Audit For Ca FinalDocument157 pagesInformation System and Control Audit For Ca FinalKhundrakpam SatyabartaNo ratings yet

- Assignment in Corporate GovernanceDocument2 pagesAssignment in Corporate GovernanceAleya MonteverdeNo ratings yet

- Internal Controls and Risk Management: Learning ObjectivesDocument24 pagesInternal Controls and Risk Management: Learning ObjectivesRamil SagubanNo ratings yet

- Isa 315 GermicDocument3 pagesIsa 315 GermicDanica Christele AlfaroNo ratings yet

- Internal Controls and Shareholder Value GuideDocument20 pagesInternal Controls and Shareholder Value Guideahmed raoufNo ratings yet

- CG - 4Document4 pagesCG - 4Pillows GonzalesNo ratings yet

- Summary Notes On Law On ObligationsDocument2 pagesSummary Notes On Law On ObligationsAira Jaimee GonzalesNo ratings yet

- Chapter 22Document14 pagesChapter 22Aira Jaimee GonzalesNo ratings yet

- SW PT 1 - GonzalesDocument7 pagesSW PT 1 - GonzalesAira Jaimee GonzalesNo ratings yet

- Midterm Exam Strategic Cost Management 2ND Sem Ay 2020 2021 3RD Year Sisc ResourcesDocument44 pagesMidterm Exam Strategic Cost Management 2ND Sem Ay 2020 2021 3RD Year Sisc ResourcesAira Jaimee Gonzales100% (2)

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document7 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Problem 5 Compensatio N Expense For Period Cumulative Compensatio N ExpenseDocument3 pagesProblem 5 Compensatio N Expense For Period Cumulative Compensatio N ExpenseAira Jaimee GonzalesNo ratings yet

- Emmanuel David Sy (Quiz #2-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617705576543Document1 pageEmmanuel David Sy (Quiz #2-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617705576543Aira Jaimee GonzalesNo ratings yet

- Chapter 17 Auditors' Reports: Answer KeyDocument27 pagesChapter 17 Auditors' Reports: Answer KeyAira Jaimee GonzalesNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Stracoma Relevant Costing 06 Continue or Shut Down Temporarilypdf CompressDocument3 pagesStracoma Relevant Costing 06 Continue or Shut Down Temporarilypdf CompressAira Jaimee GonzalesNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- Angele Bartolome (Quiz #1-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617702931411Document2 pagesAngele Bartolome (Quiz #1-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617702931411Aira Jaimee GonzalesNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Finals ReviewerDocument9 pagesFinals ReviewerAira Jaimee GonzalesNo ratings yet

- Lesson 1-Relevant Cost Analysis-Strategic Cost Management-Sisc-Ay 2020-2021-Second Sem-Jason I. Trinidad, CpaDocument13 pagesLesson 1-Relevant Cost Analysis-Strategic Cost Management-Sisc-Ay 2020-2021-Second Sem-Jason I. Trinidad, CpaAira Jaimee Gonzales100% (1)

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document6 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Answer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationDocument21 pagesAnswer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationAira Jaimee GonzalesNo ratings yet

- Warranty Expense and Bonds PayableDocument3 pagesWarranty Expense and Bonds PayableAira Jaimee GonzalesNo ratings yet

- Chapter 20 Additional Assurance Services: Other Information: Answer KeyDocument15 pagesChapter 20 Additional Assurance Services: Other Information: Answer KeyAira Jaimee GonzalesNo ratings yet

- PrelimDocument12 pagesPrelimAira Jaimee GonzalesNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Problem 1: Gonzales, Aira Jaimee S. Bsa 3Document11 pagesProblem 1: Gonzales, Aira Jaimee S. Bsa 3Aira Jaimee GonzalesNo ratings yet

- Labor Law P.D. No. 442Document12 pagesLabor Law P.D. No. 442Aira Jaimee GonzalesNo ratings yet

- IPO R.A. No. 8293: WIPO (World Intellectual Property Organization)Document10 pagesIPO R.A. No. 8293: WIPO (World Intellectual Property Organization)Aira Jaimee GonzalesNo ratings yet

- Lifted From BAR Exam Questions & QuizzersDocument9 pagesLifted From BAR Exam Questions & QuizzersAira Jaimee GonzalesNo ratings yet

- 1 Which of The Following Best Explains The Relationship PDFDocument1 page1 Which of The Following Best Explains The Relationship PDFLet's Talk With HassanNo ratings yet

- ERM Introduction UnpadDocument30 pagesERM Introduction UnpadMuhammadRivaresNo ratings yet

- Risk Appetite and Internal AuditDocument15 pagesRisk Appetite and Internal Auditmuratandac33570% (1)

- Iata SafetyDocument61 pagesIata Safetygnana4u100% (1)

- Values and Ethics From Inception To PracticeDocument29 pagesValues and Ethics From Inception To PracticeAnonymous fE2l3DzlNo ratings yet

- 4 - AIS ReviewerDocument1 page4 - AIS ReviewerAira Jaimee GonzalesNo ratings yet

- ST Final New TewodrosDocument70 pagesST Final New TewodrosElfika Adewina SipayungNo ratings yet

- SABILLON Et Al (2017) A Comprehensive Cybersecurity Audit Model To Improve Cybersecurity AssuranceDocument7 pagesSABILLON Et Al (2017) A Comprehensive Cybersecurity Audit Model To Improve Cybersecurity AssuranceRobertoNo ratings yet

- IIARF CBOK Who Owns Risk 2015 Oct UpdateDocument32 pagesIIARF CBOK Who Owns Risk 2015 Oct Updategeneralcpcr7648No ratings yet

- COSO ERM Presentation September 2017Document32 pagesCOSO ERM Presentation September 2017Alex De JesusNo ratings yet

- Auditor Resume ExampleDocument8 pagesAuditor Resume Exampleafjwfoffvlnzyy100% (2)

- Risk Management Project For JamaaDocument21 pagesRisk Management Project For JamaaPeter GoldbergNo ratings yet

- Effective Technical Report Writing 05 - 06 October 2016 Dubai, UAEDocument4 pagesEffective Technical Report Writing 05 - 06 October 2016 Dubai, UAE360 BSINo ratings yet

- Using Coso Framework To Establish Internal Control Over Sustainability ReportingDocument11 pagesUsing Coso Framework To Establish Internal Control Over Sustainability ReportingbadrianisgmailcomNo ratings yet

- The Effect of Erp Systems On Internal Control Systems in Revenue Process of Manufacturing CompaniesDocument74 pagesThe Effect of Erp Systems On Internal Control Systems in Revenue Process of Manufacturing Companiesdob14No ratings yet

- An Overview of Information Security StandardsDocument19 pagesAn Overview of Information Security StandardsdarcelNo ratings yet

- SIP ReportDocument38 pagesSIP ReportPatel JigarNo ratings yet

- CH 01 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State UniversityDocument21 pagesCH 01 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State UniversitySjifa Aulia80% (10)

- Coso SampleDocument4 pagesCoso SampleGS Cloud ServicesNo ratings yet

- Analytical AnalisisDocument69 pagesAnalytical Analisisjohnson leeNo ratings yet

- An Overview:: COSO's Guidance On Monitoring Internal ControlsDocument21 pagesAn Overview:: COSO's Guidance On Monitoring Internal ControlsArsalan Ahmad KhanNo ratings yet

- 4 - COSO ERM and More - Protiviti - Bob HirthDocument70 pages4 - COSO ERM and More - Protiviti - Bob HirthRena Rose MalunesNo ratings yet

- 4729-Article Text-12430-1-10-20180628Document12 pages4729-Article Text-12430-1-10-20180628Especialista ContabilidadNo ratings yet

4 - AIS Reviewer

4 - AIS Reviewer

Uploaded by

Aira Jaimee Gonzales0 ratings0% found this document useful (0 votes)

25 views1 pageThe document discusses internal controls and governance for organizations. It covers enterprise risk management, the COSO internal control framework, IT controls, codes of ethics, and corporate and IT governance. The COSO framework has 5 components: control environment, risk assessment, control activities, information and communication, and monitoring. IT governance focuses on aligning IT with business strategy, providing structures to implement strategies, and adopting control frameworks.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses internal controls and governance for organizations. It covers enterprise risk management, the COSO internal control framework, IT controls, codes of ethics, and corporate and IT governance. The COSO framework has 5 components: control environment, risk assessment, control activities, information and communication, and monitoring. IT governance focuses on aligning IT with business strategy, providing structures to implement strategies, and adopting control frameworks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views1 page4 - AIS Reviewer

4 - AIS Reviewer

Uploaded by

Aira Jaimee GonzalesThe document discusses internal controls and governance for organizations. It covers enterprise risk management, the COSO internal control framework, IT controls, codes of ethics, and corporate and IT governance. The COSO framework has 5 components: control environment, risk assessment, control activities, information and communication, and monitoring. IT governance focuses on aligning IT with business strategy, providing structures to implement strategies, and adopting control frameworks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

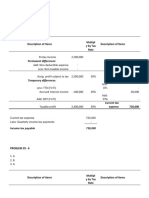

Week 4: THE INTERNAL CONTROL STRUCTURE OF ORGANIZATIONS

examines policies and procedures; how security is

I. Enterprise Risk Management (ERM) implemented and even the plans organization have in

place to manage continuity

a process, effected by an entity’s board of directors, 4. Outsourcing

management and other personnel, applied in strategy evaluating how well management are communicating

setting and across the enterprise, designed to identify and how well needs are being met ensures money is

potential events that may affect the entity, and being spent wisely and that the organization gets the

manage risk to be within its risk appetite best possible ROI for its outsourcing investments

Internal Environment 5. Monitoring

encompasses the tone of an organization that sets the establishing the conditions organizations want to

basis for how risk is viewed and addressed by an work in and the policies that the team needs to use is

entity’s people an ideal start, but unless the management monitors

Objective Setting and evaluate processes, they won’t be able to keep up

a must exist before management can identify with the changes

potential events affecting their achievement.

Event Identification IV. IT Controls

internal and external events affecting achievement of an organization must institute controls to limit these

an entity’s objectives must be identified, with risks in IT systems

distinction made between risks and opportunities

Risk Assessment Categories of IT Controls

risks are analyzed by likelihood and impact, as a

basis for determining how they should be managed General Controls

risks are assessed on both an inherent and a residual a apply overall to the IT accounting system; they are

basis, meaning that the likelihood of errors is not restricted to any particular accounting application

considered both before and after the application of Application Controls

controls are used specifically in accounting applications to

Risk Response control inputs, processing, and output

management selects risk responses— avoiding,

accepting, reducing, or sharing risk—by developing V. Corporate Governance

a set of actions to align risks with the entity’s risk an elaborate system of checks and balances whereby

tolerances and risk appetite a company’s leadership is held accountable for

Control Activities building shareholder value and creating confidence in

policies and procedures are established and the financial reporting processes

implemented to help ensure that the risk responses

are effectively carried out VI. IT Governance

Information and Communication

the leadership, organizational structure, and processes

relevant information is identified, captured, and that ensure that the enterprise achieve(s) its goals by

communicated in a form and a time frame that enable adding value while balancing risk versus return over

people to carry out their responsibilities; effective IT and its processes

communication also occurs in a broader sense,

flowing down, across, and up the entity To fulfill the management obligations that are inherent in

Monitoring IT governance, management must focus on the following

is accomplished through ongoing management aspects:

activities (including internal auditing), separate

1. Aligning IT strategy with the business

evaluations (such as those performed by external

strategy

auditors), or both

2. Cascading strategy and goals down into the

enterprise

II. Code of Ethics 3. Providing organizational structures that

facilitate the implementation of strategies

should reduce opportunities for managers or and goals

employees to conduct fraud. This will only be true, 4. Insisting that an IT control framework be

however, if top management emphasizes this code of adopted and implemented

ethics and disciplines or discharges those who violate

it

III. COSO Accounting Internal Control Structure

Committee of Sponsoring Organizations of the

Treadway Commission (COSO)

is a voluntary, private‐sector organization that was

originally formed in 1985 to sponsor the National

Commission on Fraudulent Financial Reporting

it sponsors and disseminates frameworks and

guidance based on in‐depth research, analysis, and

best practices in the areas of enterprise risk

management, internal controls, and fraud deterrence

5 Components of the COSO Framework

1. The Control Environment

this component encompasses leadership, mission,

goals and desired outcomes

2. Risk Assessment and Management

this directly targets threats and weaknesses and

allows management to fully understand risks

3. Control Activities

You might also like

- COSO ERM2017 - Main - (Vol - 1)Document120 pagesCOSO ERM2017 - Main - (Vol - 1)A R AdIL90% (10)

- COSO Fraud Risk Management Guide Executive SummaryDocument13 pagesCOSO Fraud Risk Management Guide Executive SummaryJosimar Gonzales TrigoNo ratings yet

- Accounting Gov ReviewerDocument19 pagesAccounting Gov ReviewerAira Jaimee GonzalesNo ratings yet

- Certified Sarbanes-Oxley Expert (CSOE) Distance Learning and Online Certification Program PDFDocument12 pagesCertified Sarbanes-Oxley Expert (CSOE) Distance Learning and Online Certification Program PDFApoorva BadolaNo ratings yet

- BEC 2015 AICPA Released QuestionDocument46 pagesBEC 2015 AICPA Released QuestionCA Akshay Garg100% (4)

- An Overview of Widely Used Risk Management Standards and Guidelines PDFDocument24 pagesAn Overview of Widely Used Risk Management Standards and Guidelines PDFNooni Rinyaphat67% (3)

- Internal Control Review The Practical ApproachDocument25 pagesInternal Control Review The Practical ApproachnurilNo ratings yet

- Audit Committee Toolkit PDFDocument18 pagesAudit Committee Toolkit PDFuserNo ratings yet

- Implementing an Integrated Management System (IMS): The strategic approachFrom EverandImplementing an Integrated Management System (IMS): The strategic approachRating: 5 out of 5 stars5/5 (2)

- GRC PWC IntegritydrivenperformanceDocument52 pagesGRC PWC IntegritydrivenperformanceDeepak YakkundiNo ratings yet

- SIA Kel 3 FinishDocument25 pagesSIA Kel 3 FinishNugraha HaritsNo ratings yet

- Romney Ais13 PPT 01Document42 pagesRomney Ais13 PPT 01Chesya Bintang CarolineNo ratings yet

- Note AisDocument9 pagesNote AisNUR ALEEYA MAISARAH BT MOHD NASIRNo ratings yet

- At.3209 - Internal Control ConsiderationsDocument12 pagesAt.3209 - Internal Control ConsiderationsDenny June CraususNo ratings yet

- 3 2018 L8 Gov.,Risk Management, ComplianceDocument13 pages3 2018 L8 Gov.,Risk Management, ComplianceTing Phin Yuan100% (1)

- Internal ControlsDocument5 pagesInternal ControlsAya PulidoNo ratings yet

- Isca Full Book01Document249 pagesIsca Full Book01U.S. SHUKLA & CO.No ratings yet

- Lecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020Document6 pagesLecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020MaeNo ratings yet

- Pre 3 Chap 3Document8 pagesPre 3 Chap 3Angelica Lianne BisnarNo ratings yet

- AIS Reviewer 4Document2 pagesAIS Reviewer 4DANIELLE TORRANCE ESPIRITUNo ratings yet

- 14 and 15 - Overview of Internal Control Fraud and ErrorDocument7 pages14 and 15 - Overview of Internal Control Fraud and ErrorNiña YastoNo ratings yet

- Components of Internal ControlDocument13 pagesComponents of Internal ControlGamers HubNo ratings yet

- Isca NotesDocument159 pagesIsca Notesaramsiva100% (2)

- 4 5850471109056532140Document59 pages4 5850471109056532140Yehualashet MulugetaNo ratings yet

- 05GeneralInternalControl NotesDocument13 pages05GeneralInternalControl NotesMussaNo ratings yet

- Ca Final IscaDocument130 pagesCa Final IscaKumar SwamyNo ratings yet

- Governance 13 16Document28 pagesGovernance 13 16Lea Lyn FuasanNo ratings yet

- Control and Accounting Information SystemDocument8 pagesControl and Accounting Information SystemAs17 As17No ratings yet

- AT.111 - Undestanding The Entity's Internal ControlDocument6 pagesAT.111 - Undestanding The Entity's Internal Controlandrew dacullaNo ratings yet

- 41126bos30870 SM cp1Document45 pages41126bos30870 SM cp1Ritunjay PandeyNo ratings yet

- Audit ch-4Document68 pagesAudit ch-4fekadegebretsadik478729No ratings yet

- Business Ethics (Chapt 13-17)Document30 pagesBusiness Ethics (Chapt 13-17)Hads LunaNo ratings yet

- 47 67Document3 pages47 67an scNo ratings yet

- Audit ch-4Document68 pagesAudit ch-4fekadegebretsadik478729No ratings yet

- Elective 2 ReviewerDocument7 pagesElective 2 Reviewerhipolitoyanna8No ratings yet

- Implementing The Five Key Internal Controls: PurposeDocument6 pagesImplementing The Five Key Internal Controls: PurposeRia GabsNo ratings yet

- AI-X-S4-G5-Arief Budi NugrohoDocument7 pagesAI-X-S4-G5-Arief Budi Nugrohoariefmatani73No ratings yet

- Whitepaper The Evolving Role of AuditDocument6 pagesWhitepaper The Evolving Role of AuditEmmelinaErnestineNo ratings yet

- Sistem Pengendalian InternalDocument18 pagesSistem Pengendalian InternalElizabeth PutriNo ratings yet

- Almendralejo Chap8 DiscussionDocument16 pagesAlmendralejo Chap8 DiscussionRhywen Fronda GilleNo ratings yet

- Auditing I Chapter FourDocument10 pagesAuditing I Chapter FourDere GurandaNo ratings yet

- MGT 209 - CH 13 NotesDocument6 pagesMGT 209 - CH 13 NotesAmiel Christian MendozaNo ratings yet

- Audit Theory 8Document3 pagesAudit Theory 8CattleyaNo ratings yet

- Outline BEC 1Document5 pagesOutline BEC 1govind raghavanNo ratings yet

- Chapter 6-8Document10 pagesChapter 6-8DeyNo ratings yet

- ISCA Chapter 1 Notes 1Document34 pagesISCA Chapter 1 Notes 1Kumar SwamyNo ratings yet

- Control: Chartered Institute of Internal AuditorsDocument5 pagesControl: Chartered Institute of Internal AuditorsGNo ratings yet

- Accounting 412 Chapter 6 Homework SolutionsDocument5 pagesAccounting 412 Chapter 6 Homework SolutionsxxxjungxzNo ratings yet

- Using Coso Framework To Establish Internal Control Over Sustainability ReportingDocument11 pagesUsing Coso Framework To Establish Internal Control Over Sustainability ReportingbadrianisgmailcomNo ratings yet

- Govbus - Chapter 13-16Document34 pagesGovbus - Chapter 13-16Gaza Jemi GadeNo ratings yet

- TOPIC 8 Internal Control Frameworks (E.g., COSO, COBIT)Document8 pagesTOPIC 8 Internal Control Frameworks (E.g., COSO, COBIT)kenl69784No ratings yet

- Chapter 2 - Audit Strategy, Planning & Programming: Stages of Audit ExecutionDocument17 pagesChapter 2 - Audit Strategy, Planning & Programming: Stages of Audit Executionmaulesh bhattNo ratings yet

- Module 5 Internal Control 2Document13 pagesModule 5 Internal Control 2genevaalcoberNo ratings yet

- Understanding The Entity'S InternalcontrolDocument44 pagesUnderstanding The Entity'S Internalcontrolgandara koNo ratings yet

- SAV ASSOCIATES - Approaches For Optimizing Your ICFR in The Context of The New COSODocument56 pagesSAV ASSOCIATES - Approaches For Optimizing Your ICFR in The Context of The New COSOSanjay ChadhaNo ratings yet

- Assurance Chapter-5 (04-09-2018)Document9 pagesAssurance Chapter-5 (04-09-2018)Shahid MahmudNo ratings yet

- COSO Executive SummaryDocument5 pagesCOSO Executive SummaryabekaforumNo ratings yet

- Sulaiha Wati - Chapter 8 NewDocument6 pagesSulaiha Wati - Chapter 8 Newsulaiha watiNo ratings yet

- Consideration of Internal ControlDocument43 pagesConsideration of Internal ControlDebbie Grace Latiban LinazaNo ratings yet

- Role of The Head of Internal AuditDocument28 pagesRole of The Head of Internal Auditsaiful2522No ratings yet

- ERM ReviewerDocument4 pagesERM ReviewerJA Pingol PaderonNo ratings yet

- Designing Effective Financial Controls - Leveraging The Internal Control Framework To Achieve Control ObjectivesDocument3 pagesDesigning Effective Financial Controls - Leveraging The Internal Control Framework To Achieve Control ObjectivesStephen G. LynchNo ratings yet

- Information System and Control Audit For Ca FinalDocument157 pagesInformation System and Control Audit For Ca FinalKhundrakpam SatyabartaNo ratings yet

- Assignment in Corporate GovernanceDocument2 pagesAssignment in Corporate GovernanceAleya MonteverdeNo ratings yet

- Internal Controls and Risk Management: Learning ObjectivesDocument24 pagesInternal Controls and Risk Management: Learning ObjectivesRamil SagubanNo ratings yet

- Isa 315 GermicDocument3 pagesIsa 315 GermicDanica Christele AlfaroNo ratings yet

- Internal Controls and Shareholder Value GuideDocument20 pagesInternal Controls and Shareholder Value Guideahmed raoufNo ratings yet

- CG - 4Document4 pagesCG - 4Pillows GonzalesNo ratings yet

- Summary Notes On Law On ObligationsDocument2 pagesSummary Notes On Law On ObligationsAira Jaimee GonzalesNo ratings yet

- Chapter 22Document14 pagesChapter 22Aira Jaimee GonzalesNo ratings yet

- SW PT 1 - GonzalesDocument7 pagesSW PT 1 - GonzalesAira Jaimee GonzalesNo ratings yet

- Midterm Exam Strategic Cost Management 2ND Sem Ay 2020 2021 3RD Year Sisc ResourcesDocument44 pagesMidterm Exam Strategic Cost Management 2ND Sem Ay 2020 2021 3RD Year Sisc ResourcesAira Jaimee Gonzales100% (2)

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document7 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Problem 5 Compensatio N Expense For Period Cumulative Compensatio N ExpenseDocument3 pagesProblem 5 Compensatio N Expense For Period Cumulative Compensatio N ExpenseAira Jaimee GonzalesNo ratings yet

- Emmanuel David Sy (Quiz #2-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617705576543Document1 pageEmmanuel David Sy (Quiz #2-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617705576543Aira Jaimee GonzalesNo ratings yet

- Chapter 17 Auditors' Reports: Answer KeyDocument27 pagesChapter 17 Auditors' Reports: Answer KeyAira Jaimee GonzalesNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Stracoma Relevant Costing 06 Continue or Shut Down Temporarilypdf CompressDocument3 pagesStracoma Relevant Costing 06 Continue or Shut Down Temporarilypdf CompressAira Jaimee GonzalesNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- Angele Bartolome (Quiz #1-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617702931411Document2 pagesAngele Bartolome (Quiz #1-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617702931411Aira Jaimee GonzalesNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Finals ReviewerDocument9 pagesFinals ReviewerAira Jaimee GonzalesNo ratings yet

- Lesson 1-Relevant Cost Analysis-Strategic Cost Management-Sisc-Ay 2020-2021-Second Sem-Jason I. Trinidad, CpaDocument13 pagesLesson 1-Relevant Cost Analysis-Strategic Cost Management-Sisc-Ay 2020-2021-Second Sem-Jason I. Trinidad, CpaAira Jaimee Gonzales100% (1)

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document6 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Answer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationDocument21 pagesAnswer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationAira Jaimee GonzalesNo ratings yet

- Warranty Expense and Bonds PayableDocument3 pagesWarranty Expense and Bonds PayableAira Jaimee GonzalesNo ratings yet

- Chapter 20 Additional Assurance Services: Other Information: Answer KeyDocument15 pagesChapter 20 Additional Assurance Services: Other Information: Answer KeyAira Jaimee GonzalesNo ratings yet

- PrelimDocument12 pagesPrelimAira Jaimee GonzalesNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Problem 1: Gonzales, Aira Jaimee S. Bsa 3Document11 pagesProblem 1: Gonzales, Aira Jaimee S. Bsa 3Aira Jaimee GonzalesNo ratings yet

- Labor Law P.D. No. 442Document12 pagesLabor Law P.D. No. 442Aira Jaimee GonzalesNo ratings yet

- IPO R.A. No. 8293: WIPO (World Intellectual Property Organization)Document10 pagesIPO R.A. No. 8293: WIPO (World Intellectual Property Organization)Aira Jaimee GonzalesNo ratings yet

- Lifted From BAR Exam Questions & QuizzersDocument9 pagesLifted From BAR Exam Questions & QuizzersAira Jaimee GonzalesNo ratings yet

- 1 Which of The Following Best Explains The Relationship PDFDocument1 page1 Which of The Following Best Explains The Relationship PDFLet's Talk With HassanNo ratings yet

- ERM Introduction UnpadDocument30 pagesERM Introduction UnpadMuhammadRivaresNo ratings yet

- Risk Appetite and Internal AuditDocument15 pagesRisk Appetite and Internal Auditmuratandac33570% (1)

- Iata SafetyDocument61 pagesIata Safetygnana4u100% (1)

- Values and Ethics From Inception To PracticeDocument29 pagesValues and Ethics From Inception To PracticeAnonymous fE2l3DzlNo ratings yet

- 4 - AIS ReviewerDocument1 page4 - AIS ReviewerAira Jaimee GonzalesNo ratings yet

- ST Final New TewodrosDocument70 pagesST Final New TewodrosElfika Adewina SipayungNo ratings yet

- SABILLON Et Al (2017) A Comprehensive Cybersecurity Audit Model To Improve Cybersecurity AssuranceDocument7 pagesSABILLON Et Al (2017) A Comprehensive Cybersecurity Audit Model To Improve Cybersecurity AssuranceRobertoNo ratings yet

- IIARF CBOK Who Owns Risk 2015 Oct UpdateDocument32 pagesIIARF CBOK Who Owns Risk 2015 Oct Updategeneralcpcr7648No ratings yet

- COSO ERM Presentation September 2017Document32 pagesCOSO ERM Presentation September 2017Alex De JesusNo ratings yet

- Auditor Resume ExampleDocument8 pagesAuditor Resume Exampleafjwfoffvlnzyy100% (2)

- Risk Management Project For JamaaDocument21 pagesRisk Management Project For JamaaPeter GoldbergNo ratings yet

- Effective Technical Report Writing 05 - 06 October 2016 Dubai, UAEDocument4 pagesEffective Technical Report Writing 05 - 06 October 2016 Dubai, UAE360 BSINo ratings yet

- Using Coso Framework To Establish Internal Control Over Sustainability ReportingDocument11 pagesUsing Coso Framework To Establish Internal Control Over Sustainability ReportingbadrianisgmailcomNo ratings yet

- The Effect of Erp Systems On Internal Control Systems in Revenue Process of Manufacturing CompaniesDocument74 pagesThe Effect of Erp Systems On Internal Control Systems in Revenue Process of Manufacturing Companiesdob14No ratings yet

- An Overview of Information Security StandardsDocument19 pagesAn Overview of Information Security StandardsdarcelNo ratings yet

- SIP ReportDocument38 pagesSIP ReportPatel JigarNo ratings yet

- CH 01 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State UniversityDocument21 pagesCH 01 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State UniversitySjifa Aulia80% (10)

- Coso SampleDocument4 pagesCoso SampleGS Cloud ServicesNo ratings yet

- Analytical AnalisisDocument69 pagesAnalytical Analisisjohnson leeNo ratings yet

- An Overview:: COSO's Guidance On Monitoring Internal ControlsDocument21 pagesAn Overview:: COSO's Guidance On Monitoring Internal ControlsArsalan Ahmad KhanNo ratings yet

- 4 - COSO ERM and More - Protiviti - Bob HirthDocument70 pages4 - COSO ERM and More - Protiviti - Bob HirthRena Rose MalunesNo ratings yet

- 4729-Article Text-12430-1-10-20180628Document12 pages4729-Article Text-12430-1-10-20180628Especialista ContabilidadNo ratings yet