Professional Documents

Culture Documents

Cambridge Assessment International Education: Principles of Accounts 7110/23 May/June 2018

Cambridge Assessment International Education: Principles of Accounts 7110/23 May/June 2018

Uploaded by

BEeNaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambridge Assessment International Education: Principles of Accounts 7110/23 May/June 2018

Cambridge Assessment International Education: Principles of Accounts 7110/23 May/June 2018

Uploaded by

BEeNaCopyright:

Available Formats

Cambridge Assessment International Education

Cambridge Ordinary Level

PRINCIPLES OF ACCOUNTS 7110/23

Paper 2 May/June 2018

MARK SCHEME

Maximum Mark: 120

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge International will not enter into discussions about these mark schemes.

Cambridge International is publishing the mark schemes for the May/June 2018 series for most

Cambridge IGCSE™, Cambridge International A and AS Level and Cambridge Pre-U components, and

some Cambridge O Level components.

IGCSE™ is a registered trademark.

This document consists of 14 printed pages.

© UCLES 2018 [Turn over

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Generic Marking Principles

These general marking principles must be applied by all examiners when marking candidate answers. They should be applied alongside the

specific content of the mark scheme or generic level descriptors for a question. Each question paper and mark scheme will also comply with these

marking principles.

GENERIC MARKING PRINCIPLE 1:

Marks must be awarded in line with:

• the specific content of the mark scheme or the generic level descriptors for the question

• the specific skills defined in the mark scheme or in the generic level descriptors for the question

• the standard of response required by a candidate as exemplified by the standardisation scripts.

GENERIC MARKING PRINCIPLE 2:

Marks awarded are always whole marks (not half marks, or other fractions).

GENERIC MARKING PRINCIPLE 3:

Marks must be awarded positively:

• marks are awarded for correct/valid answers, as defined in the mark scheme. However, credit is given for valid answers which go beyond the

scope of the syllabus and mark scheme, referring to your Team Leader as appropriate

• marks are awarded when candidates clearly demonstrate what they know and can do

• marks are not deducted for errors

• marks are not deducted for omissions

• answers should only be judged on the quality of spelling, punctuation and grammar when these features are specifically assessed by the

question as indicated by the mark scheme. The meaning, however, should be unambiguous.

GENERIC MARKING PRINCIPLE 4:

Rules must be applied consistently e.g. in situations where candidates have not followed instructions or in the application of generic level

descriptors.

© UCLES 2018 Page 2 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

GENERIC MARKING PRINCIPLE 5:

Marks should be awarded using the full range of marks defined in the mark scheme for the question (however; the use of the full mark range may

be limited according to the quality of the candidate responses seen).

GENERIC MARKING PRINCIPLE 6:

Marks awarded are based solely on the requirements as defined in the mark scheme. Marks should not be awarded with grade thresholds or

grade descriptors in mind.

© UCLES 2018 Page 3 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

1(a) (i) Sales ledger/Trade receivables ledger (1) 6

(ii) Sales invoice (1)

(iii) Cheque /Letter or email (if refund made electronically) (1)

(iv) Sales returns journal (1)

(v) Cash discount (1)

(vi) Current assets (1)

1(b) $6 × 100 2

= 4% (1)

$150 (1)

1(c)(i) Drawings account 5

Date Details $ Date Details $

April April

1 Balance b/d 6400 (1) 30 Capital (1) 7050 (1)OF

9 Bank 500 (1)

15 Insurance/Bank 150 (1)

7050 7050

1(c)(ii) Capital account 5

Date Details $ Date Details $

April April

30 Drawings 7 050 (1)OF 1 Balance b/d 9 000

7 Bank 2 500 (1)

Balance c/d 8 150 30 Income statement (1) 3 700 (1)

15 200 15 200

May

1 Balance b/d 8 150 (1)OF

1(d) Bookkeeping is the detailed recording of all the financial transactions of a business. (1) 2

Accounting uses the book-keeping records to prepare financial statements at regular intervals. (1)

© UCLES 2018 Page 4 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

2(a) Depreciation is an estimate of the loss in value of a non-current asset (1) over its expected working life. (1) 2

2(b) Physical deterioration/Wear and tear (1) 2

Economic reasons/Obsolete (1)

Accept other valid points.

2(c) Profit on the sale 1

14 000 – 5040 – $9500 = $540 profit (1)

2(d) General Journal 6

Debit Credit

$ $

Disposal 14 000 (1)

Motor vehicle 14 000 (1)

Provision for depreciation – motor vehicle 5 040 (1)

Disposal 5 040 (1)

X Garage 9 500 (1)

Disposal 9 500 (1)

© UCLES 2018 Page 5 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

2(e) Depreciation for the year ended 31 March 2018 3

Cost 30 000 – 14 000 + 18 000 = 34 000 (1)

Less Accumulated depreciation 10 800 – 5040 = 5 760 (1)

28 240 × 20%

Annual depreciation 5 648 (1)OF

OR

Motor A Cost (30 000 – 14 000) 16 000

Depreciation to date (10 800 – 5 040) 5 760 (1)

10 240

Depreciation for year 20% x 10 240 2 048 (1)

Motor C Depreciation for year 20% × 18 000 3 600

Total depreciation for year 5 648 (1)OF

2(f) capital capital revenue revenue 3

expenditure receipt expenditure receipt

sale of Motor vehicle B 9(1)

purchase of Motor vehicle C 9(1)

insurance for Motor vehicle C 9(1)

2(g) (i) Buildings Straight-line (1) 3

(ii) Loose tools Revaluation (1)

(iii) Computers Diminishing (reducing) balance (1)

3(a) Assets $ 2

Motor vehicle 5 000

Inventory 8 000

13 000

Less Liabilities

5 year bank loan (4 000) (1)

Capital 9 000 (1)

© UCLES 2018 Page 6 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

3(b) Komile 6

Statement of Affairs at 31 March 2018

$ $

Non-current assets

Motor vehicle 4 200 (1)

Current assets

Inventory 9 500

Trade receivables 11 400

Other receivables 600 (1)

Bank 1 500

23 000 (1)

Total Assets 27 200

Capital 11 700 (1)OF

Non-current liability

5 year bank loan 4 000 (1)

Current liabilities

Trade payables 10 100

Other payables 1 400

11 500

Total Capital and Liabilities 27 200

Alternative presentation acceptable

3(c) $ 3

Capital 30 March 2018 11 700 OF

Capital 1 April 2017 (9 000) OF

2 700 (1)OF

Plus Drawings 3 500 (1)

6 200 (1)OF

Alternative presentation acceptable

© UCLES 2018 Page 7 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

3(d) Can establish the profit 3

Easier to make decisions

Can establish income or expenditure on an activity

Can refer to trade receivable or trade payable account for details

Any valid point (1) × 3 points

Accept other valid points.

3(e) (i) Income tax 2

Social security/national insurance

(1) For valid statutory deduction

(ii) Pension contribution

Subscription to trade union or a social club

Donation to charity

(1) For valid non-statutory deduction

© UCLES 2018 Page 8 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

3(f) $ 2

(i) Gross pay 160 hours × $6 960

20 hours × $9 180

5 hours × $12 60

1 200 (1)

Less Deductions 220

Net pay 980 (1)

$

(ii) Gross pay 1 200

Employer’s 150 2

contributions

Total cost 1 350 (1)OF

Question Answer Marks

4(a) 1 Prudence/Matching/Accrual (1) 4

2 Historical cost (1)

3 Matching/accruals (1)

4 Consistency (1)

4(b)(i) Gross profit 50 000 – 2000 (1) – 6000 (1) = 42 000 (1)OF 3

4(b)(ii) Profit for the year 3

42 000 OF – (14 000 – 1800 + 700) (1) – 20 000 (1) = 9100 (1)OF

© UCLES 2018 Page 9 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

4(c) Workings 31 March 2018 6

42000

Gross profit/sales (Gross profit margin) (1) of × 100 = 35.00% (1)OF

120 000

Profit for the year/sales 9100

(1) of × 100 = 7.58% (1) OF

(Net profit margin) 120 000

9100 of × 100

Percentage return on capital employed = 3.96% (1) OF

(150 000 + 80 000) (1)

4(d) Gross profit/sales Max 4

This has improved (1) which may be the result of increased prices, decreased cost of sales or change in sales mix. (1)

Profit for the year/sales

This has deteriorated (1)which may be due to increased expenses. (1)

Percentage return on capital employed

This has improved (1)because one of the bank loans is no longer long term which has reduced the capital employed. (1)

Minimum (1) for each ratio.

Own figure rule applies.

Accept other valid points.

© UCLES 2018 Page 10 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

5(a) Athula and Bhulo 18

Income Statement and Appropriation Account for the year ended 30 April 2018

$ $

Revenue 590 000

Returns inwards (15 800)

574 200 (1)

Inventory at 1 May 2017 42 000 *

Purchases 295 000

Carriage inwards 8 820 (1)

345 820

Returns outwards (19 500) (1)

326 320

Inventory at 30 April 2018 (51 000) * (1)for both

Cost of sales (275 320) (1)OF

Gross profit 298 880

Wages and salaries (91 000 – 7500) 83 500 (1)

Advertising (30 000 – 1400) 28 600 (1)

General expenses 109 000

Equipment maintenance (11 800 + 2500) 14 300 (1)

Loan interest to Athula 2 000 (1)

Bank loan interest (4000 + 2400) 6 400 (1)

Bad debt 4 000

Increase in provision for doubtful debts 1 300

Provisions for depreciation –

Buildings 2 000 (1)

Equipment 7 000 (1)

Office fixtures 3 300 (1)

(261 400)

Profit for the year 37 480

Interest on drawings:

Athula 960 (1)

Bhulo 560 (1)

1 520

39 000

© UCLES 2018 Page 11 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

5(a) Interest on capital:

Athula 3 000

Bhulo 2 000

5 000 (1)Both

Partner’s salary:

Bhulo 7 500 (1)

12 500

26 500

Share of profit:

Athula 15 900 (1)OF

Bhulo 10 600

26 500

5(b) Current accounts 7

Athula Bhulo Athula Bhulo

Date Details $ $ Date Details $ $

2017 2017

1 May Balance b/d 3 800 1 May Balance b/d 1 800

2018 2018 Loan interest 2 000 (1)

30 April Drawings 12 000 7 000 (1)* 30 April Inter’t on cap 3 000 2 000 (1)OF*

Salary drawn 7 500 (1) Salary 7 500

Int’t on draw’g 960 560 (1)OF* Profit share 15 900 10 600 (1)OF*

Balance c/d 4 140 6 840 _____ _____

20 900 21 900 20 900 21 900

1 May Balance b/d 4 140 6 840 (1)OF*

*Mark for both figures

© UCLES 2018 Page 12 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

5(c) Athula and Bhulo 15

Statement of Financial Position at 30 April 2018

Non-current assets Cost Accumulated Book value

depreciation

$ $ $

Land and buildings 150 000 14 000 136 000 (1)OF

Equipment 60 000 32 000 28 000 (1)OF

Office fixtures 33 000 (1) 20 300 12 700 (1)OF

243 000 66 300 176 700

Current assets

Inventory 51 000 (1)

Trade receivables (42 000 – 4000) 38 000 (1)

Provision for doubtful debts (3 400)

34 600 (1)OF

Other receivables 1 400 (1)

Bank (9 000 (1) – 6 000(1)) 3 000

90 000

Total Assets 266 700

Capital accounts

Athula 60 000

Bhulo 40 000

100 000

Current accounts:

Athula 4 140

Bhulo 6 840

10 980 (1)OF

Non-current liabilities

5% Loan from Athula (repayable 2020)

8% loan (repayable 2024) 40 000

80 000

120 000 (1)

© UCLES 2018 Page 13 of 14

7110/23 Cambridge O Level – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

Current liabilities

Trade payables 30 820 (1)

Other payables (2500(1) + 2400 (1)) 4 900

35 720

Total Capital and Liabilities 266 700

Suitable alternative layouts accepted

© UCLES 2018 Page 14 of 14

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accrued Expenses: Practice Question # 1Document4 pagesAccrued Expenses: Practice Question # 1Shoaib AslamNo ratings yet

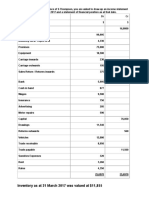

- Inventory As at 31 March 2017 Was Valued at $11,855Document2 pagesInventory As at 31 March 2017 Was Valued at $11,855Shoaib AslamNo ratings yet

- Scan 0002Document1 pageScan 0002Shoaib AslamNo ratings yet

- Solution: 14.8 Advantages and Uses of Control AccountsDocument1 pageSolution: 14.8 Advantages and Uses of Control AccountsShoaib AslamNo ratings yet

- Control Accounts: Example 5Document1 pageControl Accounts: Example 5Shoaib AslamNo ratings yet

- Sample of Revision Plan - 10-cDocument3 pagesSample of Revision Plan - 10-cShoaib AslamNo ratings yet

- As Level Accounting Topic 1 OddDocument45 pagesAs Level Accounting Topic 1 OddShoaib AslamNo ratings yet

- Time Table IX M CrimsonDocument2 pagesTime Table IX M CrimsonShoaib AslamNo ratings yet

- Principles of Accounts: GCE Ordinary Level (2017) (Syllabus 7175)Document48 pagesPrinciples of Accounts: GCE Ordinary Level (2017) (Syllabus 7175)Shoaib AslamNo ratings yet

- RTP Group 1Document129 pagesRTP Group 1sandhya vNo ratings yet

- S1.16 - Receivable Financing - StudentDocument8 pagesS1.16 - Receivable Financing - StudentCyndy Villapando100% (1)

- Indigo ProspectusDocument557 pagesIndigo Prospectusvbt999123yahoo100% (1)

- On IFRS, US GAAP and Indian GAAPDocument64 pagesOn IFRS, US GAAP and Indian GAAPrishipath100% (1)

- FR MCQs - Ind AS Puzzlers - Module 1Document8 pagesFR MCQs - Ind AS Puzzlers - Module 1CA8512No ratings yet

- InventoriesDocument64 pagesInventoriesJoey WassigNo ratings yet

- Business Finance 1st WeekDocument11 pagesBusiness Finance 1st WeekErleNo ratings yet

- 3.6 ExercisesDocument8 pages3.6 ExercisesGeorgios MilitsisNo ratings yet

- SOCPA IFRS Transition ProjectDocument51 pagesSOCPA IFRS Transition ProjectArslan Zafar0% (1)

- DSP Mutual FundDocument5 pagesDSP Mutual FundSarika AroteNo ratings yet

- Executive Compensation in World's Largest Corporations Increases by 5.5%Document2 pagesExecutive Compensation in World's Largest Corporations Increases by 5.5%Dumitru ErhanNo ratings yet

- IOI Properties Group Berhad Annual Report 2016 (Front Cover - Page 29)Document31 pagesIOI Properties Group Berhad Annual Report 2016 (Front Cover - Page 29)Jamuna BatumalaiNo ratings yet

- UTS Aplikasi Manajemen Keuangan Take HomeDocument10 pagesUTS Aplikasi Manajemen Keuangan Take HomeRifan Herwandi FauziNo ratings yet

- FAR 3MC The Conceptual Framework of Financial ReportingDocument4 pagesFAR 3MC The Conceptual Framework of Financial ReportingJoy Dhemple LambacoNo ratings yet

- Income Taxation NotesDocument15 pagesIncome Taxation NotesJustin Andre SiguanNo ratings yet

- Test 1-Unit-18 (SV)Document8 pagesTest 1-Unit-18 (SV)Phan Ha MyNo ratings yet

- Accounting For Receivables: Both AR and NR Are Called Trade ReceivablesDocument7 pagesAccounting For Receivables: Both AR and NR Are Called Trade ReceivablesKhaled Abo YousefNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosJEANNo ratings yet

- Pami Equity Index Fund: Value of P5,000 Invested Since InceptionDocument1 pagePami Equity Index Fund: Value of P5,000 Invested Since InceptionNoah BrionesNo ratings yet

- Profile of Sonali BankDocument24 pagesProfile of Sonali BankRahi RebaNo ratings yet

- Public Alert Unregistered Soliciting EntitiesDocument9 pagesPublic Alert Unregistered Soliciting EntitiesForkLogNo ratings yet

- Capital Budgeting: An Insight ToDocument26 pagesCapital Budgeting: An Insight Torjrahuljain100% (2)

- Problem Set 1 Answer KeyDocument8 pagesProblem Set 1 Answer KeyVicNo ratings yet

- Mauboussin - Does The M&a Boom Mean Anything For The MarketDocument6 pagesMauboussin - Does The M&a Boom Mean Anything For The MarketRob72081No ratings yet

- PT Metro Healthcare Indonesia TBK 31 December 2022Document91 pagesPT Metro Healthcare Indonesia TBK 31 December 2022Fanniya Dyah PrameswariNo ratings yet

- FNSACC507 7 Task 2 - Case Study and Practical AssessmentDocument3 pagesFNSACC507 7 Task 2 - Case Study and Practical AssessmentnattyNo ratings yet

- Bentuk Bentuk Badan Usaha-1Document28 pagesBentuk Bentuk Badan Usaha-1y_fihartiniNo ratings yet

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- American International University - Bangladesh: Q $45,000 Q Jewelry StoreDocument5 pagesAmerican International University - Bangladesh: Q $45,000 Q Jewelry StoreWahidul Alam SrijonNo ratings yet

- Income Statement and Financial PerformanceDocument29 pagesIncome Statement and Financial PerformancePetrinaNo ratings yet