Professional Documents

Culture Documents

Labor Law P.D. No. 442

Labor Law P.D. No. 442

Uploaded by

Aira Jaimee GonzalesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labor Law P.D. No. 442

Labor Law P.D. No. 442

Uploaded by

Aira Jaimee GonzalesCopyright:

Available Formats

LABOR LAW

P.D. No. 442

WHY STUDY LABOR LAW?

• Because our employment system is highly regulated.

• Because employees are favored by our laws.

• Because you need to be sure that you are getting the right kind of legal advice.

• Because you don’t want to get your business or company into trouble, especially if you have no

or little access to expert legal help.

• Because you want to deal with employees and their unions in the most effective way.

LABOR LAW

• It is the field of law that defines the relationship between employer and their employees, as well

as certain third parties, in connection with employment.

• It establishes the rights of each parties... and determines their duties and obligations.

• It also defines the role of government.

WHERE CAN YOU FIND LABOR LAW?

• Constitution

• Decisions of the Supreme Court (Jurisprudence) • Civil Code and Revised Penal Code

• Special statutes that are not yet codified

• American jurisprudence

• LABOR CODE

• Labor regulations

LABOR CODE

1. revolutionized our employment system on May 1, 1974.

2. It is a code, which is composed of numerous books.

PARTS OF THE LABOR CODE

• Book 1: Pre-Employment (with the Preliminary Title)

• Book 2: Human Resources Development Program

• Book 3: Conditions of Employment

• Book 4: Health, Safety and Social Welfare Benefits

• Book 5: Labor Relations

• Book 6: Post Employment

• Book 7: Transitory and Final Provisions

WHO ARE COVERED?

• Labor Law applies only if an employer-employee relationship exist.

• It applies to employers and their employees, as well as to certain third parties.

• Third Parties:

o Recruitment agencies in overseas contract workers cases.

o Indirect employer in job contracting arrangements.

WHO ARE EXEMPTED?

1. No employer-employee relationship:

a. The Principal and his Agent.

b. The Capitalist Partner and his Industrial Partner.

c. The Project Owner and his Contractor.

2. Rule No. 1: Labor Law applies only when there is an employer-employee relationship.

3. Exception to the Rule: Non-employment related.

TEST OF EMPLOYMENT: Four-fold Test (or the 4 Elements):

• SELECTION AND PLACEMENT

• PAYMENT OF WAGES

• POWER OF DISMISSAL

• POWER OF CONTROL – manner of doing the work

Management Prerogative

1. Employer has the right to regulate its own operation. provided it is within the bounds of law.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

CONTROL TEST

2. The power of one party to determine, not only the end result of the work, but also the manner

of doing the work is the POWER OF CONTROL.

3. Only an employer has the power of control over his employees.

4. Illustrations:

a. Job contracting arrangements.

b. Independent contracting arrangements.

CLASSIFICATION OF EMPLOYEES

• Based on Employer:

o Civil Service and non-Civil Service (including Private and Employees of GOCCs).

• Based on Security of Tenure:

o Regular and Non-Regular.

• Based on Function:

o Rank-and-file and Non-rank-and-file (including Managerial, Confidential & Supervisory).

• Based on Nature:

o Agricultural and Non-Agricultural.

• Based on Time and Motion:

o Field Personnel, Piece-Rate, Task-based, Domestic & Personal Assistants, etc.

LABOR STANDARDS

1. The minimum requirements of law with respect to hours of work, rates of pay, and other terms

and conditions of employment is Labor Standards.

2. Constitutional Right to Humane Conditions of Work and to a Living Wage.

a. Rule – It is prohibited to have terms and conditions of employment lower than what the

law provides.

LABOR STANDARDS BENEFITS

• Minimum Wage

• Holiday Pay

• Premium Pay

• Overtime Pay

• Night Shift Pay

• Service Charge Share

• Service Incentive Leave 8. Maternity Leave

• Paternity Leave

• Parental Leave

• Leave for VAWC

• Special Leave for Women

• 13th Month Pay

• Separation Pay

• Retirement Pay

• Employee Compensation (ECC) Benefits* 17. PhilHEALTH Benefits*

• SSS Benefits*

• PagIBIG Benefits*

MINIMUM WAGE LAW (R.A. No. 6727)

• National Wages and Productivity Commission (NWPC).

• Regional Tripartite Wage and Productivity Boards.

• Wage Order by Region and by Sector: Non-Agriculture, Agriculture (Plantation/Non-Plantation),

Cottage/Handicraft, Service/Retail, depending on number of workers or capitalization or gross

sales.

• Penalty for Violation:

o Imprisonment of 2 to 4 years (without probation benefits); or

o Fine of P25,000 to P100,000;

o or both.

o Plus DOUBLE INDEMNITY for the workers.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

• EXCEPTIONS:

o Reduced working hours, i.e Underemployed or those working less than 8-hours of work

per day.

o Reduced working days, i.e. Shortened workweek.

o Workers paid be results i.e. They should be paid not less than the minimum wage rate

proportionate to the number of working hours they actually rendered.

o Apprentices, Learners, and (unqualified) Disabled Workers: 75% of minimum wage.

RULES ON WAGES

• Across-the-Board Wage Increase might result to a wage distortion.

• What is the Rule on Payment of Wages?

o Paid in legal currency at or near the workplace.

o Frequency: 2x/month NOT exceeding 16 days interval.

• What is the Rule on Wage Deduction?

o Mandatory

§ Even without authorization from the employee, provided that they are mandatory

deduction.

o Non-mandatory: Written Authorization.

HOURS OF WORK: WHO ARE COVERED?

• All employees in all establishments, for profit or not.

• Exceptions –

o Government employees subject to Civil Service Law;

o Managerial employees and managerial staff;

o Domestic helpers and persons in the personal service of another;

o Workers paid by results;

o Field personnel and those whose time and performance are unsupervised; and

o Dependent family members of the Employer.

THE MANAGERIAL EMPLOYEES?

• Principal Duty – Management of the establishment in which they are employed, or a

department or division thereof.

• They customarily direct the work of 2 or more employees.

• They have authority to hire/fire, or their suggestions on this matter are given weight.

• They exercise Management Prerogative on behalf of the Employer.

THE MANAGERIAL STAFF

• Primary duty – Perform work directly related to management policies.

• They customarily exercise discretion and independent judgment.

• They regularly assist managerial employees.

• They do not devote more than 20% of their work time to activities not related to all the above.

NORMAL HOURS OF WORK

• Shall not exceed 8 hours/day.

• Rationale.

• Broken time or workday is lawful.

• Shortening of work week is lawful.

WHAT ARE HOURS WORKED?

• All time during which is required to be on duty or at a prescribed work place.

• All the time during which an employee is permitted or suffered to work.

PRINCIPLES TO DETERMINE HOURS WORKED

• All hours required, whether spent in productive labor or involve physical or mental exertion, are

hours worked.

• The rule on rest period.

• The rule on work interruptions.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

OTHER RULES ON WORK HOURS

• Waiting time – compensable if integral part of work.

• On call – compensable if time cannot be used for personal.

• Travel time – if part of work, yes. Home to work, no. Travel away from home, only if it cuts across

employee’s workday.

• Attendance to seminar – No if voluntary, outside of work hours, no productive work done.

• Power interruptions – yes, if less than 20 minutes. No if more, and employee leave premises.

• Union matters – no, unless CBA provides otherwise.

• Attendance at hearings – not compensable.

• Strike participation – NO.

MEAL PERIODS

• Required – not less than 60 minutes but not compensable.

• Shortening to less than 60 minutes – yes, but must be paid.

OVERTIME PAY

• Overtime Pay refers to the additional compensation for work performed beyond 8 hours per

day.

• Rule: Overtime work is NOT permitted.

• Exceptions:

o When there is an emergency or urgent situation.

o When completion or continuation after work hours is necessary to prevent prejudice to

business or operations.

o Rate

§ 125% of regular hourly rate on ordinary working days

§ 130% for overtime work on Rest Day

o COLA NOT included in computation.

WHEN IS OVERTIME WORK VALID & MUST BE PAID?

• Even if without prior permission:

o The work performed was necessary.

o The work benefited the Employer.

o Employee could NOT abandon his work at the end of normal working hours because

there is no replacement.

UNDERTIME NOT OFFSET BY OVERTIME

• Undertime work on any day shall NOT be offset by overtime work on any other day.

• Permission granted by the Employer for the Employee to go on leave on some other day shall

NOT exempt him from the payment of additional compensation for overtime work rendered.

• Valid overtime work is ALWAYS subject to Overtime Pay.

HOLIDAY PAY

• Holiday Pay refers to the payment of regular daily wage for any unworked Regular Holiday at

the rate of 100%.

o Regular Holiday - 200% of his daily wage rate (Basic Wage + COLA).

o 2 Regular Holidays fall on the same day - 300%.

• Exception: Same as before + Retail/Service Establishment regularly employing less than 10

workers.

RULES ON HOLIDAY PAYMENT

• Employees are entitled when they are present or on leave with pay on the preceding workday.

• Employees are NOT entitled if absent or on leave without pay on the preceding workday, unless

they work on such Regular Holiday, in which case they are entitled to 200%.

• When preceding day is non-work day or rest day, the Employee is entitled, if he worked on the

day before such non-work day or rest day.

• In case of successive Regular Holidays i.e. Holy Week, the Employee shall NOT be entitled to the

successive Regular Holidays if he is absent or on leave without pay on the preceding work day

(Wednesday), unless he worked on the first Holiday.

• Seasonal workers may NOT be paid during off season.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

• Those without regular working days are entitled.

• When company is on temporary or periodic shutdown not due to business reverses, the

employee is entitled. But when shutdown is due to business reverses, the employee is not

entitled.

• If a Regular Holiday falls on the same day, the Employee shall still be paid 100% for each days

or a total of 200%.

REGULAR HOLIDAYS

• EO 292, as amended by RA 9849.

• 12 Regular Holidays: New Year’s Day, Maundy Thursday, Good Friday, Araw ng Kagitingan,

Labor Day, Independence Day, National Heroes’ Day, Eidl Fitr, Eidl Adha, Bonifacio Day,

Christmas Day, Rizal Day.

• 4 Muslim Holidays observed in ARMM (for both Muslims and Non-Muslims) and applicable to all

Muslims outside ARMM.

SPECIAL DAYS

• EO 292, as amended by RA 9849.

• Special Days: Ninoy Aquino Day, All Saints Day, Last Day of the Year, Chinese New Year, and

Immaculate.

• The President or Congress may proclaim other days as Special Day.

• Unworked Special Day is NOT paid.

• Work performed on a Special Day is paid 130%.

• Special Work Day, on the other hand, is treated as an ordinary work day.

WEEKLY REST DAYS

• It is the duty of the Employer to provide a Rest Day of not less than 24 hours after 6 consecutive

working days.

o Old law: Rest Day is Sunday.

o New law: Rest Day is any day.

• Employer determines the Rest Day of the Employee, subject to agreement and rules of DOLE.

• Employees are given preference based on religion.

PREMIUM PAY (REST DAY/SPECIAL DAY PAY)

• Rule: Work on Rest Day (and Special Day) is NOT permitted.

• Exceptions (Rest Day):

o When there is an emergency or urgent situation.

o When work is necessary to prevent prejudice to business or operations.

• Rate: 130% of regular hourly rate on ordinary working days. 150% if Rest Day and Special Day fall

on the same day.

• COLA NOT included in the computation (unlike in Holiday Pay).

NIGHT SHIFT DIFFERENTIAL PAY

• NSD Pay refers to the the additional compensation for each hour of work performed between

10PM and 6AM.

• Rate: 110% of the regular hourly wage rate.

• Exception: Same as before + Retail/Service Establishment regularly employing less than 5

workers.

SERVICE INCENTIVE LEAVE

• The Employee is entitled to 5 days of leave with pay for every one year of service; provided

that he has served for 1 year already.

• If Employer grants vacation leave with pay of at least 5 days every year, then this is already

compliance with SIL.

• Commutable to cash and becomes SIL Pay.

• Part-time employees are also entitled to full service

• NO Labor Code provisions on vacation leave or sick leave.

• Exception: Same as before + Retail/Service Establishment regularly employing less than 10

workers.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

SERVICE CHARGES

• Employees are entitled to a share from the Service Charge being collected by the Employer

from his customers.

o Rank-and-file employee’s share: 85%

§ Rank-and-file employees shall receive equal share.

o Management’s share: 15%.

• If abolished, the share of the Rank-and-file employees shall be considered integrated to their

wages.

• If the Employer does NOT collect Service Charge, the pooled tips shall be treated the same way

as Service Charge.

• The purpose of a service charge is for breakages or damages so that the amount will not be

deducted directly on the wage of the employee.

RETIREMENT PAY

• Retirement age: 60 - 65 years old.

• Employee must also have worked for at least 5 years for the Employer.

• Rate: Equivalent to 22.5 days salary for every year of service payable by Employer.

• Distinct from the Retirement Benefits from SSS.

• Excluded: Government employees; and Retail/ Service/ Agricultural Establishments employing

not more than 10 workers.

SEPARATION PAY

• Employees terminated by the Employer on the basis of Authorized Causes are entitled to

Separation Pay.

• Retrenchment, Closure of Business, Serious Disease

o Rate: 1 Month or 1⁄2 Month Salary for every year of service

• Labor-saving device, Redundancy, and Impossible Reinstatement

o Rate: 1 Month or 1 Month Salary for every year of service

• Regular Allowance is included in the computation.

Just Cause – attributable to the employee

13TH MONTH PAY

• Rank-and-file employees are entitled to 13th month pay; provided they worked for at least 1

month.

• Rate: 1/12 of the total basic salary earned by an Employee in a year.

• Excluded: Government employees, Househelpers, Employees paid based on results, and

Managerial employees.

MATERNITY LEAVE

• All pregnant female workers are entitled to Maternity Leave subject to SSS Law.

• Normal birth or miscarriage

o 60 days of the average daily salary credit

o Republic Act No. 11210, or the “105-Day Expanded Maternity Leave Law,”

• Ceasarian section delivery

o 78 days of the average daily salary credit.

o Republic Act No. 11210, or the “105-Day Expanded Maternity Leave Law,”

• Employees can extend their leave by an additional 30 days without pay, subject to notifying

their employer 45 days before the end of the leave.

• Mothers who are single parents can request an additional 15 days’ leave with full pay.

• In case of a miscarriage or an emergency termination of pregnancy, the entitlement is 60 days

of paid maternity leave

• Requirements: Membership in the SSS with at least 3 months contributions prior to delivery or

miscarriage.

PATERNITY LEAVE

• All married male workers are entitled to Paternity Leave of 7 calendar days with pay for the first

4 deliveries (or miscarriage) of his lawful wife whom he is cohabiting with.

• Paternity Leave is NOT convertible to cash.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

PARENTAL LEAVE FOR SOLO PARENTS

• Parental Leave shall mean leave benefits granted to a solo parent to enable him or her to

perform parental duties and responsibilities where physical presence is required.

• The solo parent is entitled to 7 days leave with pay.

• Parental Leave is NOT convertible to cash.

• Requirements: At least 1 year of service and DSWD Solo Parents ID.

LEAVE FOR VICTIMS OF VAWC

• Female employees who are certified as victims under the “Anti-Violence Against Women and

their Children Act of 2004” are entitled to 10 days of leave with pay to enable her to attend to

medical and legal concerns.

• VAWC Leave is NOT convertible to cash.

• Requirements: Certification from the barangay, prosecutor, or clerk of court that a VAWC case

involving the victim female employee is pending.

SPECIAL LEAVE FOR WOMEN

• Female employees who has undergone surgery due to gynecological disorders are entitled to

2 months leave with pay to enable her to attend to medical and legal concerns.

• Special Leave is NOT convertible to cash.

• Requirements: Certification from physician, and employment service of at least 6 months within

the 12 month period prior to surgery.

EMPLOYEES’ COMPENSATION PROGRAM

• The ECP is designed to provide a compensation package to Employees and their dependents

in case of work-related sickness, injury, disability or death.

• Benefits: Loss of income benefit; Medical benefit; Rehabilitation services; Carer’s allowance;

and Death benefits.

• Workers in the formal sector are covered starting on day 1 of their employment.

PHILHEALTH BENEFITS

• The National Health Insurance Program, which is administered by PhilHEALTH, provides financial

assistance to member-Employees when they get hospitalized.

• All employees are required to be members.

• Benefits: Inpatient hospital care; and outpatient care based on a Schedule of Benefits.

• PhilHealth and beneficiaries have access to a comprehensive package of services, including

inpatient care, catastrophic coverage, ambulatory surgeries, deliveries, and outpatient

treatment for malaria and tuberculosis.

SOCIAL SECURITY BENEFITS

• The Social Security Program provides a package of benefits in the event of death, disability,

sickness, maternity, and old age. It provides replacement for income lost during these

contingencies.

• All employees in the private sector are mandatorily covered, including househelpers earning at

least P1,000/ month salary.

• Benefits: Sickness, Maternity, Disability, Retirement, Death & Funeral, based on a Schedule of

Benefits.

LOAN AND MISCELLANEOUS BENEFITS

• Socialized loans for emergency, housing and other purposes are available to employees who

are qualified members of the SSS and PagIBIG Fund.

• The duty of the Employer is to deduct and remit the Employees’ contributions as well as his

required contributions to SSS, PhilHEALTH, ECC, and PagIBIG.

• Failure on the part of the Employer to remit the mandatory contributions has serious

consequences.

OCCUPATIONAL SAFETY AND HEALTH STANDARDS

• Every covered Employer is required to keep and maintain his workplace free from work hazards

that are causing or likely to cause physical harm to the workers or damage to property.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

• The Occupational Safety and Health Standards, as amended, is the body of rules and

regulations that protect every worker against the dangers of injury, sickness or death through

safe and healthful working conditions.

SPECIAL PROTECTION

• Children.

• Physically-impaired.

• Women.

• Househelpers.

• Homeworkers and the informal sector.

• Filipino professionals and labor –versus- aliens.

COMPANY-INITIATED BENEFITS

1. Employers are not prohibited from, and in fact encouraged to, provide terms and conditions of

employment that are better or higher than Labor Standards.

2. Higher than Labor Standards Benefits are either initiated by the Employer, on its own, by request

of the Employees, or by demand of their Union or Association.

NON-DIMINUTION OF BENEFITS

1. The reduction or elimination of benefits provided under the law, agreement or voluntary

practice is prohibited.

2. EXCEPTIONS –

a. If circumstances no longer justify grant of benefits (Dislocation pay, relocation allowance,

per diem, supplements, etc.)

b. Rule on grant of bonus – management prerogative, but not if given as a salary

supplement and without conditions.

WHEN DOES AN ACT BECOME A PRACTICE?

3. If done for a long period of time (ex. Three years).

4. The act is done consistently and intentionally.

5. The act should NOT be a product of erroneous interpretation of law.

LABOR RELATIONS

• Right to Security of Tenure

• Right to Just Share in the Fruits of Production

• Right to Self-Organization

• Right to Bargain Collectively.

• Right to Strike and Other Peaceful Concerted Action

• Right Against Unfair Labor Practices

ROLE OF GOVERNMENT

1. Policy-Maker

2. Regulator

3. Program Administrator

4. Inspector

5. Conciliator and Mediator

6. Arbitrator or Arbiter or Adjudicator

7. Enforcer

LABOR ORGANIZATION

• any union or association of employees which exist in whole or in part for the purpose of

o (a) collective bargaining or

o (b) for dealing with employers concerning terms and conditions of employment.

“LEGITIMATE” LABOR ORGANIZATION

• one which is duly registered with the Department of Labor and Employment.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

WHAT DISTINGUISHES A LEGITIMATE LABOR ORGANIZATION?

1. Right to represent its members for purposes of collective bargaining.

2. Right to be certified as exclusive representative of all employees in bargaining unit for purposes

of col. Bargaining

3. To be furnished financial records

4. To sue and be sued in its registered name

5. To own property

6. To undertake programs to benefit the org/members

REQUIREMENTS FOR REGISTRATION

• Registration fee

• Names of officers, their addresses, the address of the org., minutes of org. meeting and list of

workers who participated.

• Names of all members who comprise 20% of all employees in the bargaining unit where it seeks

to operate.

• Annual financial records.

• Copies of constitution and by-laws

PURPOSE OF REGISTRATION REQUIREMENTS

• To prevent fraud

• To protect members from unscrupulous or fly by night unions.

IS THE REQUIREMENT FOR UNION REGISTRATION A VIOLATION OF THE FREEDOM TO ASSOCIATE?

• Any group of employees may organize into a union, even without registration.

• But registration is condition sine qua non for the exercise of privileges.

• A group may not register but they cannot avail of the rights of legitimate unions.

• Registration is an exercise of police powers by the state because union is invested with public

interest.

CRITICAL REQUIREMENTS TO BE ABLE TO REGISTER

• Membership must be at least 20% of all the employees in the bargaining unit.

BARGAINING UNIT

• It is a group or cluster of jobs or positions that supports the labor organization which is applying

for registration.

• Test whether the bargaining unit is appropriate

o if it will best assure to all employees the exercise of their collective bargaining rights.

EMPLOYER UNIT

• Refers to a case where there is only 1 bargaining unit for all the employees of the company.

• Purpose why the employer unit is encouraged by the state.

ANOTHER WAY OF ORGANIZING AS A LABOR UNION

• Affiliation as a chapter of an existing labor federation or a national union.

DUTY OF AN EMPLOYER WHEN WORKERS ORGANIZE

• Self-organization is a constitutional right. Therefore, the company must respect the right of

employees to organize.

PENALTY FOR INFRINGING ON THE RIGHT TO UNIONIZE

• Unfair labor practice is a prohibited act.

• It is considered a criminal offense.

• Penalty includes imprisonment and payment of fine.

WHAT HAPPENS WHEN A UNION IS ORGANIZED/REGISTERED?

• It becomes entitled to the privileges of a legitimate labor organization.

• But it is NOT automatically a bargaining agent or majority representative.

• To be a bargaining agent, it needs to be certified that it is the exclusive bargaining agent.

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

WHAT IS NEEDED TO BE CERTIFIED AS A BARGAINING AGENT?

• It must win a certification election; or,

• It is voluntarily recognized by the employer; or,

• It is selected by the employees through a consent election.

CERTIFICATION ELECTION (CE)

• It is a process by which the members of a bargaining unit choose one among contending unions

to be its exclusive bargaining agent.

• Non-adversarial

• Fact-Finding

• Administered by DOLE

Who can participate in Certification Election?

• Role of Employer in a Certification Election: Neutral Observer.

When a union fights in a CE and loses, does it mean that it does not have any more duty to its members?

• It continues to represent its members but it does NOT have the right to engage in collective

bargaining.

What is the importance of being a bargaining agent?

• A bargaining agent possesses the right, by law, to demand from the employer that it negotiates

with it (union) terms and conditions of employment, including wages, hours of work, and rates

of pay.

PRODUCT OF BARGAINING

• A collective bargaining agreement or CBA, if the union is able to have an agreement with the

employer about its proposed terms and conditions of employment.

RECOURSE OF UNION IN THE EVENT OF FAILED NEGOTIATIONS

• It can engage in strike.

• It can engage in other concerted activities.

• All of which are protected by law if no criminal act attends the holding of said actions.

WIN-WIN LABOR RELATIONS

1. Master the Basic Principles of Labor Relations.

2. Observe the Golden Rule of Human Relations.

3. Documentation, Documentation, Documentation!

4. Write Clearly.

5. Consult the Experts.

6. Use Best Practices.

7. Be Open-minded.

8. Negotiate, Negotiate, Negotiate!

The employment relationship is governed by human and labor relations.

• Industry, Employer, Workers + Productivity

WHERE DOES THE EMPLOYER- EMPLOYEE RELATIONSHIP START?

• Contract of Employment

THE 4-POINT TEST OF AN EMPLOYER- EMPLOYEE RELATIONSHIP

1. selection of employees

2. payment of wages

3. power to dismiss

4. power to control employee’s conduct, output and means of delivering the output

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

RIGHTS OF THE EMPLOYEE

1. Right to self

2. Right to join a union or disaffiliate from it

3. Right to collective bargaining and negotiation

4. Right to Strike

5. Right to be given an opportunity to be heard in disciplinary cases

RIGHTS OF THE EMPLOYER

1. Right to reasonable returns on investments, expansion, & growth

2. Right to select person to be hired

3. Right to adopt, implement, modify, amend, or revoke reasonable employment regulations

4. Right to transfer employees

5. To determine work assignments, working methods, time , place, & manner of work, tools to be

used and processes to be followed (TERMS & CONDITIONS OF EMPLOYMENT)

6. Right to determine standard of work and levels of efficiency

7. To introduce new or improved methods, facilities and devices e.g. labor saving devices

8. To create, merge, divide, reclassify & abolish positions in the company

9. Right to sell or close business

10. Right to lockout in a labor dispute

11. Right to suspend or terminate employees

TERMINATION OF EMPLOYMENT

1. By the Employee

2. By the Employer

a. Actual (Termination)

b. Constructive (Constructive Dismissal)

JUST CAUSES FOR TERMINATION

1. Serious Misconduct

2. Gross and Habitual Neglect of Duty

3. Fraud or Willful Breach of Trust; Loss of Confidence

4. Commission of a Crime or Offense by Employee

5. Other Analogous Cases

AUTHORIZED CAUSES FOR TERMINATION

1. Redundancy –

a. employees’ positions are “superfluous” because their work is duplicated or unnecessary

(e.g. installation of labor saving devices, merger of two companies, streamlining of

operations

2. Retrenchment

a. serious and imminent losses force the employer to let some employees go

3. Closure/Cessation of Business

a. the employer stops doing business

IF TERMINATION IS OF AUTHORIZED CAUSE:

• Payment of separation pay

• Provide written notice to concerned employee thirty (30) days before the effectivity of the

termination

• Notice of Termination to DOLE thirty (30) days prior effectivity

Pursuant to Art. 279 LC, when an employee is illegally terminated, he has the right to:

1. Reinstatement

2. Backwages

3. Damages

4. Attorney’s Fees

By Aira Jaimee S. Gonzales – BSA3

LABOR LAW

P.D. No. 442

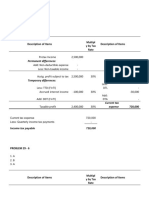

Question: Does basic pay include, ECOLA? How much is the COLA and ECOLA?

Answer: Basic Pay does NOT include ECOLA. (20 + 30 pesos = 50 pesos)

Question: Does overtime pay include, ECOLA?

Answer: Overtime pay does not include ECOLA, only just the basic pay.

Question: What is the maximum childbirth in claiming maternity leave?

Answer: Under the new expanded maternity leave, there is no maximum childbirth, delivery,

miscarriage.

Question: Can you claim both miscarriage leave and child birth leave in one year?

Answer: In cases of overlapping, you can claim both.

Question: If the father is working overseas, can he claim for paternal leave?

Answer: The rationale for the paternal leave is to lend a hand to the mother. Thus, the father cannot

claim for paternal leave.

Question: How can one claim for solo parent leave?

Answer: There must be a legal relationship whether by affinity or consanguinity.

By Aira Jaimee S. Gonzales – BSA3

You might also like

- Accounting Gov ReviewerDocument19 pagesAccounting Gov ReviewerAira Jaimee GonzalesNo ratings yet

- NFPA 13 PRESSURE TEST PROCEDURES (Fire Pro)Document2 pagesNFPA 13 PRESSURE TEST PROCEDURES (Fire Pro)Mechanical Engineer33% (3)

- ATPL Fragen 1Document18 pagesATPL Fragen 1martinNo ratings yet

- Royal Philips Case Study - Presentation (Group 5)Document3 pagesRoyal Philips Case Study - Presentation (Group 5)Suryakant100% (1)

- Stoichiometry Worksheet6-1Document6 pagesStoichiometry Worksheet6-1Von AmoresNo ratings yet

- Employment Standards AssignmentDocument5 pagesEmployment Standards Assignmentapi-366148829100% (1)

- Fair Labor Practice 2Document64 pagesFair Labor Practice 2ineedpptsNo ratings yet

- LABOR STANDARDS: Working Conditions and Working PeriodDocument4 pagesLABOR STANDARDS: Working Conditions and Working Periodchisel_159No ratings yet

- What Is A PsychopathDocument30 pagesWhat Is A Psychopathmarinel june100% (1)

- Sir MarkDocument18 pagesSir MarkMichael LabosNo ratings yet

- LL PDFDocument36 pagesLL PDFr_respicioNo ratings yet

- Workplace Rights and ResponsiblitiesDocument22 pagesWorkplace Rights and ResponsiblitiesYael Sanchez0% (1)

- Updates On Labor Law and Jurisprudence: Atty. Apollo X.C.S. SangalangDocument97 pagesUpdates On Labor Law and Jurisprudence: Atty. Apollo X.C.S. SangalangAnonymous 8ReEhZgNo ratings yet

- SHRM-CP Study Guide (Revised)Document68 pagesSHRM-CP Study Guide (Revised)Phuong Linh NguyenNo ratings yet

- Coverage of Midterm Examination in Labor LawDocument3 pagesCoverage of Midterm Examination in Labor LawjoliwanagNo ratings yet

- Labor Law of The PhilippinesDocument16 pagesLabor Law of The PhilippinesRio MayNo ratings yet

- Report On Labor Code of The PhilippinesDocument74 pagesReport On Labor Code of The PhilippinesRara AlonzoNo ratings yet

- Conditions of EmploymentDocument7 pagesConditions of EmploymentHermay BanarioNo ratings yet

- 5.2 Laws On Wages and Working Hours in The PhilippinesDocument19 pages5.2 Laws On Wages and Working Hours in The PhilippinesMark Vincent CondelosanoNo ratings yet

- Labor Law and LegislationDocument4 pagesLabor Law and LegislationKristine GalenzogaNo ratings yet

- Labor Relations On Management Prerogative and Post EmploymentDocument48 pagesLabor Relations On Management Prerogative and Post EmploymentMal Tac100% (1)

- Directors - Briefing - Employment Law The BasicsDocument4 pagesDirectors - Briefing - Employment Law The Basicsh_20No ratings yet

- LaborlawupdatesDocument129 pagesLaborlawupdatesAngel UrbanoNo ratings yet

- Orientation On LS and LR October 2022 Edited 1Document81 pagesOrientation On LS and LR October 2022 Edited 1Jeliza ManaligodNo ratings yet

- Employer Employee RelationshipDocument12 pagesEmployer Employee RelationshipApple Ple21No ratings yet

- NCM120Document6 pagesNCM120Mae Arra Lecobu-anNo ratings yet

- Labor 1 - Module 5 - Conditions of Employment - Working Conditions and Rest Periods-1Document101 pagesLabor 1 - Module 5 - Conditions of Employment - Working Conditions and Rest Periods-1LoNo ratings yet

- Module+2 LS2022Document44 pagesModule+2 LS2022Caryl SequitinNo ratings yet

- Study Unit 4 - BCEA - Self-Study - 3Document35 pagesStudy Unit 4 - BCEA - Self-Study - 3christiaanbester87No ratings yet

- Employment LawDocument28 pagesEmployment LawAjmal HaziqNo ratings yet

- Basic Labor Law Affecting Employer Employee RelationshipsDocument38 pagesBasic Labor Law Affecting Employer Employee RelationshipsCharity SolatorioNo ratings yet

- General Labor Standards: Social Legislation Law UpdatesDocument75 pagesGeneral Labor Standards: Social Legislation Law UpdatesDiyames RamosNo ratings yet

- HR Midterm Lesson Part 2Document35 pagesHR Midterm Lesson Part 2mica yeppeoNo ratings yet

- Egyptian Labor LawDocument29 pagesEgyptian Labor LawFady Nagy BotrosNo ratings yet

- Employment Law in Malaysia What You Need To KnowDocument3 pagesEmployment Law in Malaysia What You Need To KnowJiana NasirNo ratings yet

- Labor Standards NotesDocument12 pagesLabor Standards NotesJohn Sowp MacTavishNo ratings yet

- ENTREP414 - Module 6 - S22023-2024Document3 pagesENTREP414 - Module 6 - S22023-2024gasstationbdmpcNo ratings yet

- Understanding The Pillars of Responsible SourcingDocument59 pagesUnderstanding The Pillars of Responsible SourcingariefNo ratings yet

- Labor Laws of Small BusinessDocument25 pagesLabor Laws of Small Businesssjsarabia28No ratings yet

- 6 Conditions of Work PDFDocument47 pages6 Conditions of Work PDFkeirahlaviegnaNo ratings yet

- Employment and Security of Tenure Part 1Document22 pagesEmployment and Security of Tenure Part 1joann pauraNo ratings yet

- A Guide To Start A JobDocument9 pagesA Guide To Start A JobBinus Center BandungNo ratings yet

- Compensation Law, Policies and RegulationsDocument3 pagesCompensation Law, Policies and RegulationsRodelia OpadaNo ratings yet

- Provisions of Employment Law That Employers Should Know: Presentation To Members of The Barclays Bank Business ClubDocument5 pagesProvisions of Employment Law That Employers Should Know: Presentation To Members of The Barclays Bank Business ClubKatherinebooksNo ratings yet

- Final Presentation - Workers' Rights Act (05.11.19)Document41 pagesFinal Presentation - Workers' Rights Act (05.11.19)Yohan LimNo ratings yet

- 1.6salaries and WagesDocument45 pages1.6salaries and WagesJes SitNo ratings yet

- Industrial Relations and Personnel Management (ECN 410) : Lecture 4: Social Organisation of WorkDocument21 pagesIndustrial Relations and Personnel Management (ECN 410) : Lecture 4: Social Organisation of Workmistura idrisNo ratings yet

- Chapter 2 - Legal Aspect in HRM - Updated2020Document52 pagesChapter 2 - Legal Aspect in HRM - Updated2020Kogiyn MGMNo ratings yet

- II. Labor LawsDocument45 pagesII. Labor Lawsjarretkhan75No ratings yet

- PPT17 Employment RelationshipDocument26 pagesPPT17 Employment RelationshipDonald Cobra Pako-MoremaNo ratings yet

- The Workers Basic RightsDocument4 pagesThe Workers Basic RightsGurudatt KamatNo ratings yet

- Fair Work Information StatementDocument3 pagesFair Work Information Statementmargaux.vincartNo ratings yet

- Labor Law in NepalDocument48 pagesLabor Law in NepalsuprememandalNo ratings yet

- IBM Supplier Conduct GuidelineDocument21 pagesIBM Supplier Conduct Guidelinesid.deguzman.idgNo ratings yet

- Labor StandardsDocument129 pagesLabor StandardsChristine angela NuqueNo ratings yet

- Labor Laws and Labor Relations Reviewer (Part 1)Document12 pagesLabor Laws and Labor Relations Reviewer (Part 1)JustineNo ratings yet

- I:o MidtermsDocument8 pagesI:o MidtermsRenz San MiguelNo ratings yet

- Workforce Reductions: Policies and Practices: 22nd Annual ConferenceDocument31 pagesWorkforce Reductions: Policies and Practices: 22nd Annual Conferencesunildude07No ratings yet

- Labor Standards Finals ReviewerDocument12 pagesLabor Standards Finals ReviewersakilogicNo ratings yet

- Formulation of Employee S HandbookDocument5 pagesFormulation of Employee S HandbookMohammad AzharNo ratings yet

- Compensation & Reward Management: PGDM Third Semester: Elective Course Facilitator: Neelam Saraswat (Lecturer, DSPSR)Document28 pagesCompensation & Reward Management: PGDM Third Semester: Elective Course Facilitator: Neelam Saraswat (Lecturer, DSPSR)prynkaryaNo ratings yet

- Employment Law 1Document16 pagesEmployment Law 1Elli KhaleelaNo ratings yet

- Payroll 1Document18 pagesPayroll 1Ganya SalujaNo ratings yet

- Leaves PolicyDocument8 pagesLeaves Policymdmoosasohail8No ratings yet

- 2024 COMPS Order #39 Poster English (Accessible)Document1 page2024 COMPS Order #39 Poster English (Accessible)ahmedzahi964No ratings yet

- CHAPTER 2 Terms and Conditions of Employment AGR255 PART 1Document82 pagesCHAPTER 2 Terms and Conditions of Employment AGR255 PART 1Aisyah AzizNo ratings yet

- How To Employ Your Own Boss THE ULTIMATE GUIDE How To Move From Being An Employee to EmployerFrom EverandHow To Employ Your Own Boss THE ULTIMATE GUIDE How To Move From Being An Employee to EmployerNo ratings yet

- Summary Notes On Law On ObligationsDocument2 pagesSummary Notes On Law On ObligationsAira Jaimee GonzalesNo ratings yet

- Chapter 22Document14 pagesChapter 22Aira Jaimee GonzalesNo ratings yet

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document6 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Emmanuel David Sy (Quiz #2-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617705576543Document1 pageEmmanuel David Sy (Quiz #2-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617705576543Aira Jaimee GonzalesNo ratings yet

- SW PT 1 - GonzalesDocument7 pagesSW PT 1 - GonzalesAira Jaimee GonzalesNo ratings yet

- Problem 5 Compensatio N Expense For Period Cumulative Compensatio N ExpenseDocument3 pagesProblem 5 Compensatio N Expense For Period Cumulative Compensatio N ExpenseAira Jaimee GonzalesNo ratings yet

- Midterm Exam Strategic Cost Management 2ND Sem Ay 2020 2021 3RD Year Sisc ResourcesDocument44 pagesMidterm Exam Strategic Cost Management 2ND Sem Ay 2020 2021 3RD Year Sisc ResourcesAira Jaimee Gonzales100% (2)

- Angele Bartolome (Quiz #1-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617702931411Document2 pagesAngele Bartolome (Quiz #1-Scm-3rd Year-Ay 2020-2021-Second Sem) 1617702931411Aira Jaimee GonzalesNo ratings yet

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document7 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Finals ReviewerDocument9 pagesFinals ReviewerAira Jaimee GonzalesNo ratings yet

- Stracoma Relevant Costing 06 Continue or Shut Down Temporarilypdf CompressDocument3 pagesStracoma Relevant Costing 06 Continue or Shut Down Temporarilypdf CompressAira Jaimee GonzalesNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- Lesson 1-Relevant Cost Analysis-Strategic Cost Management-Sisc-Ay 2020-2021-Second Sem-Jason I. Trinidad, CpaDocument13 pagesLesson 1-Relevant Cost Analysis-Strategic Cost Management-Sisc-Ay 2020-2021-Second Sem-Jason I. Trinidad, CpaAira Jaimee Gonzales100% (1)

- Chapter 17 Auditors' Reports: Answer KeyDocument27 pagesChapter 17 Auditors' Reports: Answer KeyAira Jaimee GonzalesNo ratings yet

- Warranty Expense and Bonds PayableDocument3 pagesWarranty Expense and Bonds PayableAira Jaimee GonzalesNo ratings yet

- Problem 1: Gonzales, Aira Jaimee S. Bsa 3Document11 pagesProblem 1: Gonzales, Aira Jaimee S. Bsa 3Aira Jaimee GonzalesNo ratings yet

- Answer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationDocument21 pagesAnswer Key: Chapter 19 Additional Assurance Services: Historical Financial InformationAira Jaimee GonzalesNo ratings yet

- Chapter 20 Additional Assurance Services: Other Information: Answer KeyDocument15 pagesChapter 20 Additional Assurance Services: Other Information: Answer KeyAira Jaimee GonzalesNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Lifted From BAR Exam Questions & QuizzersDocument9 pagesLifted From BAR Exam Questions & QuizzersAira Jaimee GonzalesNo ratings yet

- PrelimDocument12 pagesPrelimAira Jaimee GonzalesNo ratings yet

- IPO R.A. No. 8293: WIPO (World Intellectual Property Organization)Document10 pagesIPO R.A. No. 8293: WIPO (World Intellectual Property Organization)Aira Jaimee GonzalesNo ratings yet

- New Hanover County School Service Animal Policy 2012-2019Document2 pagesNew Hanover County School Service Animal Policy 2012-2019Ben SchachtmanNo ratings yet

- Course Code ME-325: Engineering EconomicsDocument36 pagesCourse Code ME-325: Engineering EconomicsGet-Set-GoNo ratings yet

- Geriatric Nursing: Feature ArticleDocument5 pagesGeriatric Nursing: Feature ArticleBryan NguyenNo ratings yet

- Chemical ReactionsDocument41 pagesChemical ReactionsJeffreyNo ratings yet

- Municipal Trial Court: Page 1 of 2Document2 pagesMunicipal Trial Court: Page 1 of 2unjustvexationNo ratings yet

- Image Processing Methods For Food InspectionDocument69 pagesImage Processing Methods For Food InspectionFemilNo ratings yet

- Foodlog Date 2-7-23 - Daily IntakeDocument1 pageFoodlog Date 2-7-23 - Daily Intakeapi-657949413No ratings yet

- Foods San DiegoDocument2 pagesFoods San DiegoKeith KingNo ratings yet

- Introduction To Fluid Mechanics Lab Equipment PDFDocument7 pagesIntroduction To Fluid Mechanics Lab Equipment PDFAbdul Rasa MastoiNo ratings yet

- Tle 7 - Q1.W1Document2 pagesTle 7 - Q1.W1Pia DelaCruz100% (2)

- RobotsDocument12 pagesRobotsArim ArimNo ratings yet

- Ganon Baker ShootingDocument4 pagesGanon Baker ShootingAmar Košpa ZahirovićNo ratings yet

- Risk Management in Commercial BanksDocument37 pagesRisk Management in Commercial BanksRavi DepaniNo ratings yet

- Kami Export - Kevin Farina - Gizmos MusclesBonesSE 2021Document7 pagesKami Export - Kevin Farina - Gizmos MusclesBonesSE 2021Kevin FarinaNo ratings yet

- EVERYDAY CHECKLIST 车间每日安全检查表Workshop Daily Safety Checklist-doneDocument32 pagesEVERYDAY CHECKLIST 车间每日安全检查表Workshop Daily Safety Checklist-donesitam_nitj4202No ratings yet

- Chapter 1: The Human Body: An Orientation: Anatomy - The Study of StructureDocument7 pagesChapter 1: The Human Body: An Orientation: Anatomy - The Study of StructureptldhrbNo ratings yet

- SMEA2402 - Manufacturing Processes LabDocument15 pagesSMEA2402 - Manufacturing Processes LabPurusothamanManiNo ratings yet

- Why You Should Be RunningDocument1 pageWhy You Should Be Runningapi-428628528No ratings yet

- EMS14 EMS Products Only Catalogue 2022 V17 FINAL ScreenDocument20 pagesEMS14 EMS Products Only Catalogue 2022 V17 FINAL ScreenAbdallah MohamedNo ratings yet

- L - 15 Agriculture - WorksheetDocument7 pagesL - 15 Agriculture - Worksheetvro hamzaNo ratings yet

- LEVOXIN eDocument1 pageLEVOXIN ejim_corbet1211No ratings yet

- Next Step Advanced Medical Coding and Auditing 2017 2018 Edition 1st Edition Buck Test BankDocument7 pagesNext Step Advanced Medical Coding and Auditing 2017 2018 Edition 1st Edition Buck Test Bankqueeningalgatestrq0100% (30)

- Nizam'S Institute of Medical Vs Prasanth S Dhananka Ors On 14 May 2009Document26 pagesNizam'S Institute of Medical Vs Prasanth S Dhananka Ors On 14 May 2009Saket SubhamNo ratings yet

- Porn and Sex Education Porn As Sex EducationDocument13 pagesPorn and Sex Education Porn As Sex EducationMathilde MoureauNo ratings yet