Professional Documents

Culture Documents

H05.FA2-01 Trade & Other Payables - Hernandez

H05.FA2-01 Trade & Other Payables - Hernandez

Uploaded by

Bea GarciaCopyright:

Available Formats

You might also like

- UCC 1 Financing Statement-B. BryantDocument1 pageUCC 1 Financing Statement-B. BryantTiyemerenaset Ma'at El77% (13)

- Case Brief For Abdul Shukoor vs. Arji Papa RaoDocument4 pagesCase Brief For Abdul Shukoor vs. Arji Papa Raosandhya gaur25% (4)

- A Case Study of Microsoft Corporation 1Document21 pagesA Case Study of Microsoft Corporation 1Bea GarciaNo ratings yet

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- BLTDocument4 pagesBLTJaylord PidoNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Cost Accounting - Exercise 1Document2 pagesCost Accounting - Exercise 1Anna MaglinteNo ratings yet

- Chapter 2 FUNCTIONS - Microsoft Excel Tutorial #1Document3 pagesChapter 2 FUNCTIONS - Microsoft Excel Tutorial #1Bea GarciaNo ratings yet

- Rugged Terrain by LumberaDocument1 pageRugged Terrain by LumberaBea Garcia100% (1)

- Pre Qualification WorksheetDocument1 pagePre Qualification WorksheetVictoria BoreingNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- (Odd) Acc 101 LT#2B PDFDocument5 pages(Odd) Acc 101 LT#2B PDF有福No ratings yet

- 1.20PP Partnership Formation and DissolutionDocument16 pages1.20PP Partnership Formation and DissolutionMarcley BataoilNo ratings yet

- 2014 3016 Midterm Departmental ExamDocument14 pages2014 3016 Midterm Departmental ExamPatrick ArazoNo ratings yet

- Quiz 1B - Cash and Cash Equivalents, Bank ReconciliationDocument9 pagesQuiz 1B - Cash and Cash Equivalents, Bank ReconciliationLorence IbañezNo ratings yet

- Discussion 2 CHAPDocument4 pagesDiscussion 2 CHAPHannah LegaspiNo ratings yet

- Practice Problems - Transfer TaxesDocument2 pagesPractice Problems - Transfer Taxesuchishai100% (1)

- Chapter 1 - Introduction To Cost AccountingDocument29 pagesChapter 1 - Introduction To Cost AccountingLala SalvatoreNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Migriño - Quizzer 2 - Employee Benefits Part 1Document13 pagesMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNo ratings yet

- Partnership-Accounting NotesDocument30 pagesPartnership-Accounting NotesCarl Dhaniel Garcia SalenNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- INSTALLMENTDocument3 pagesINSTALLMENTEdison L. ChuNo ratings yet

- PUP Review Handout 1 OfficialDocument3 pagesPUP Review Handout 1 OfficialDonalyn CalipusNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Solution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Document3 pagesSolution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Christian Clyde Zacal ChingNo ratings yet

- Financial Accounting and ReportingDocument15 pagesFinancial Accounting and Reportingjoyce KimNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- Ifrs 9 Debt Investment IllustrationDocument9 pagesIfrs 9 Debt Investment IllustrationVatchdemonNo ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- 1Document6 pages1Marinel FelipeNo ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- HHHHDocument2 pagesHHHHdean subbie0% (2)

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- KEY Level 2 QuestionsDocument5 pagesKEY Level 2 QuestionsDarelle Hannah MarquezNo ratings yet

- Week 5 Problem 15Document2 pagesWeek 5 Problem 15Rachelle RodriguezNo ratings yet

- ACCO 3026 Final ExamDocument11 pagesACCO 3026 Final ExamClarisseNo ratings yet

- BALIMBIN TBLTpg83-94Document14 pagesBALIMBIN TBLTpg83-94mariyha Palanggana0% (1)

- AuditingDocument60 pagesAuditingarianasNo ratings yet

- Answer Value 800000Document1 pageAnswer Value 800000Kath LeynesNo ratings yet

- Interbranch Transactions Interbranch Transactions: John Paul G. Dantes John Paul G. DantesDocument13 pagesInterbranch Transactions Interbranch Transactions: John Paul G. Dantes John Paul G. DantesElla Mae TuratoNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Cost Acctg. Problems 1Document8 pagesCost Acctg. Problems 1Cheese ButterNo ratings yet

- Consignment Sales ProblemsDocument1 pageConsignment Sales ProblemsAkako MatsumotoNo ratings yet

- Albert I. Rivera, CPA, MBA, CRA 1Document6 pagesAlbert I. Rivera, CPA, MBA, CRA 1Reina EvangelistaNo ratings yet

- The Amount To Be Capitalized by Lessee To Right of Use AssetDocument1 pageThe Amount To Be Capitalized by Lessee To Right of Use Assetmax pNo ratings yet

- 05 Comprehensive Income PDFDocument2 pages05 Comprehensive Income PDFMimi YayaNo ratings yet

- Practice Exercise 1.5Document3 pagesPractice Exercise 1.5leshz zynNo ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- ACC117-CON09 Module 3 ExamDocument16 pagesACC117-CON09 Module 3 ExamMarlon LadesmaNo ratings yet

- Franchise PDFDocument1 pageFranchise PDFJonathan VidarNo ratings yet

- Armhyla Olivar FM Taxation 8Document4 pagesArmhyla Olivar FM Taxation 8Grace Umbaña YangaNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Learning Resource 12 Lesson 3Document7 pagesLearning Resource 12 Lesson 3Vianca Marella SamonteNo ratings yet

- RFA 2 Part 2Document26 pagesRFA 2 Part 2Kristelle OngNo ratings yet

- 2.6. Retained EarningsDocument5 pages2.6. Retained EarningsKPoPNyx Edits100% (1)

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Strategic Cost Accounting: MBA-First YearDocument99 pagesStrategic Cost Accounting: MBA-First YearNada YoussefNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- TradesDocument3 pagesTradesAlber Howell MagadiaNo ratings yet

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- Bank Secrecy ActDocument9 pagesBank Secrecy ActBea GarciaNo ratings yet

- Pdic LawDocument15 pagesPdic LawBea GarciaNo ratings yet

- Truth in Lending ActDocument7 pagesTruth in Lending ActBea GarciaNo ratings yet

- SSRN Id4353923Document32 pagesSSRN Id4353923Bea GarciaNo ratings yet

- CASEANALYSISFORMATDocument15 pagesCASEANALYSISFORMATBea GarciaNo ratings yet

- Audit of Banks - July 8, 2022Document29 pagesAudit of Banks - July 8, 2022Bea Garcia100% (1)

- 04.1 - Lecture Notes - M4 - Audit Objectives, Procedures, Evidence, and Documentation (Feb 23)Document58 pages04.1 - Lecture Notes - M4 - Audit Objectives, Procedures, Evidence, and Documentation (Feb 23)Bea GarciaNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- 13 - Law On InsuranceDocument11 pages13 - Law On InsuranceBea GarciaNo ratings yet

- TFAR2303 - Investment in Debt Securities (With Answers)Document4 pagesTFAR2303 - Investment in Debt Securities (With Answers)Bea GarciaNo ratings yet

- q2 Advacc1 PDF FreeDocument3 pagesq2 Advacc1 PDF FreeBea GarciaNo ratings yet

- Strategic Management: Jpmorgan Chase & CoDocument16 pagesStrategic Management: Jpmorgan Chase & CoBea Garcia100% (1)

- Standards To Bank OnDocument13 pagesStandards To Bank OnBea GarciaNo ratings yet

- Quiz 2 - SolutionsDocument19 pagesQuiz 2 - SolutionsBea GarciaNo ratings yet

- Task Performance MS and Verizons 02Document24 pagesTask Performance MS and Verizons 02Bea GarciaNo ratings yet

- Quiz No. 2: Law On SalesDocument20 pagesQuiz No. 2: Law On SalesBeatrice TehNo ratings yet

- Short-Term Employee BenefitsDocument4 pagesShort-Term Employee BenefitsBea Garcia100% (2)

- Cost Accounting QuestionsDocument47 pagesCost Accounting QuestionsBea GarciaNo ratings yet

- 2.3G Homework (Questionnaire)Document4 pages2.3G Homework (Questionnaire)Bea GarciaNo ratings yet

- Activity 4 - Job Order CostingDocument2 pagesActivity 4 - Job Order CostingBea GarciaNo ratings yet

- Prudential Bank v. AlviaDocument2 pagesPrudential Bank v. AlviaGrace Ann TamboonNo ratings yet

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- Role Play MpuDocument2 pagesRole Play MpukebayanmenawanNo ratings yet

- Differences Between A Central Bank and Commercial BankDocument4 pagesDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifNo ratings yet

- California Bus Lines, Inc. vs. State Investment House, Inc.Document3 pagesCalifornia Bus Lines, Inc. vs. State Investment House, Inc.Jenine QuiambaoNo ratings yet

- Mortgage DeedDocument8 pagesMortgage DeedLakhan WankhadeNo ratings yet

- Icici Bank Rar 2014Document54 pagesIcici Bank Rar 2014Moneylife FoundationNo ratings yet

- Publication 4491 Examples and CasesDocument54 pagesPublication 4491 Examples and CasesNorma WahnonNo ratings yet

- DB Motion With EndDocument13 pagesDB Motion With EndAC FieldNo ratings yet

- CH 14 MCDocument38 pagesCH 14 MCElaine Lingx100% (1)

- Classes of Insurance: Fire What Is Included in Fire Insurance?Document4 pagesClasses of Insurance: Fire What Is Included in Fire Insurance?Andrei ArkovNo ratings yet

- Role of Microfinance InstitutionsDocument1 pageRole of Microfinance InstitutionsSimon SimbakkyNo ratings yet

- Chester Babst vs. CA (GR 99398, Jan. 26, 2001, 350 SCRA)Document9 pagesChester Babst vs. CA (GR 99398, Jan. 26, 2001, 350 SCRA)Fides DamascoNo ratings yet

- Moot PDFDocument15 pagesMoot PDFRachit MunjalNo ratings yet

- LandtDocument182 pagesLandtYogesh VyasNo ratings yet

- Domingo Vs GarlitosDocument5 pagesDomingo Vs GarlitosJimi SolomonNo ratings yet

- Credit Transaction Reviewer Arts. 1933 - 1961Document13 pagesCredit Transaction Reviewer Arts. 1933 - 1961Eileen Makatangay Manaloto100% (3)

- Isa 570Document15 pagesIsa 570baabasaamNo ratings yet

- Appendix I - On Whether Honest Banking Can Cause Business CyclesDocument5 pagesAppendix I - On Whether Honest Banking Can Cause Business CyclesdtuurNo ratings yet

- List of Variables To Be Used in CapstoneDocument2 pagesList of Variables To Be Used in CapstoneErn TNo ratings yet

- Bank of The Philippine Islands v. YuDocument2 pagesBank of The Philippine Islands v. YucelestialfishNo ratings yet

- Land Revenue Code and RulesDocument310 pagesLand Revenue Code and Rulessav999No ratings yet

- 7 Lizaso V Amante G.R. No. 2019Document6 pages7 Lizaso V Amante G.R. No. 2019John JurisNo ratings yet

- CH 13 TestbankDocument45 pagesCH 13 Testbanknervon100% (1)

- Personal Loans in UAE and Dubai Compare Personal Loan Quotes in UAE and Dubai Souqalmal PDFDocument1 pagePersonal Loans in UAE and Dubai Compare Personal Loan Quotes in UAE and Dubai Souqalmal PDFa ashifaNo ratings yet

- Declaration Violations at Highline MeadowsDocument4 pagesDeclaration Violations at Highline MeadowsJoe OwnerNo ratings yet

H05.FA2-01 Trade & Other Payables - Hernandez

H05.FA2-01 Trade & Other Payables - Hernandez

Uploaded by

Bea GarciaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

H05.FA2-01 Trade & Other Payables - Hernandez

H05.FA2-01 Trade & Other Payables - Hernandez

Uploaded by

Bea GarciaCopyright:

Available Formats

01 Current Liabilities – Trade & Other Payable

Trade Accounts Payable

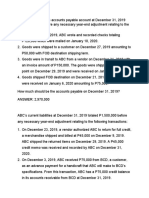

1) Krillin, Inc. is preparing its financial statements for the year ended December 31, 2019. Accounts payable amounted

to P200,000 before any necessary year-end adjustment related to the following:

• At December 31, 2019, Krillin has a P50,000 debit balance in its accounts payable to Vegito, a supplier,

resulting from a P50,000 advance payment for goods to be manufactured to Krillin specifications.

• On December 27, 2019, Krillin wrote and recorded checks to creditors totaling P30,000 that were mailed on

January 10, 2020.

• Checks in the amount of P25,000 were written to vendors and recorded on December 29, 2019. The checks

were dated January 5, 2020.

What amount should Krillin report as accounts payable in its December 31, 2019 statement of financial position?

Balance as on Dec 31, 2019 200,000

Advance received from the customer 50,000

Checks that is written but not yet posted 30,000

Post dated checks 25,000

Total Accounts Payable for December 31, 2019 305,000

2) The balance in Denver Company’s accounts payable account at December 31, 2019 was P1,100,000 before any

adjustments relating to the following:

• Goods were in transit to Denver Company on December 31, 2019. The invoice cost was P150,000, FOB

shipping point on December 29, 2019. The goods were received on January 2, 2020.

• Goods shipped FOB shipping point on December 20, 2019 from a vendor to Denver Company, were lost in

transit. The invoice cost was P100,000. On January 5, 2020, Denver Company filed an P100,000 claim against

the common carrier.

• Goods shipped FOB destination on December 21, 2019, from a vendor to Denver Company, were received on

January 6, 2020. The invoice cost was P195,000.

• On December 28, 2019, Denver Company wrote and recorded checks totaling P70,000 which were mailed on

January 8, 2020.

The amount that Denver Company report as accounts payable on its December 31, 2019 balance sheet

is

Unadjusted Accounts Payable 1,100,000

Goods in transit FOB shipping point 150,000

Goods in FOB shipping lost in transit 100,000

Intermediate Accounting 2 | Bernadette L. Baul Page 1 of 5

Goods in transit FOB destination 0

Check issued by Denver Company (70,000)

Accounts Payable on December 31, 2019 1,420,000

Various Accrued Expenses

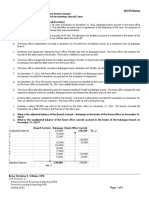

3) Tatay Company is preparing its December 31, 2019 financial statements. The following information was gathered:

• The bill for December’s utility cost of P30,000 was received and paid on January 10, 2020.

• A P20,000 advertising bill was received on January 2, 2020. Of the total billing, P15,000 pertain to

advertisements in December 2019 and P5,000 pertain to advertisements in January 2020.

• A lease, effective December 16, 2018, calls for a fixed rent of P100,000 per month, payable one month after the

commencement of the lease and every month after thereafter. In addition, rent equal to 5% of net sales over

P1,000,000 per year is payable on January 31 of the following year.

• Total cash sales and collections on accounts amounted to P1,000,000. Accounts receivable has a net increase

of P200,000. Commissions of 15% of sales are paid on the same day cash is received from customers.

What is the accrued liabilities on December 31, 2019?

December’s Utility Bill 30,000

Advertisement Bill 15,000

Rent 50,000

(200,000 x 15%) 30,000

10,000

Accrued Liabilities for December 31, 2019 135,000

Accrued Expenses – Bonus Payable

Numbers 4, 5, 6 and 7

Adhere Company grants its managerial employees bonus in the form of profit sharing. Information on operations in 2019

is shown below:

Profit before bonus & tax 4,000,000

Bonus rate or percentage 10%

Income tax rate 30%

4) How much is the bonus “before bonus and before tax”? 400,000

B= BR(P)

B= 10% (4,000,000)

B= 400,000

5) How much is the bonus “after bonus and before tax”? 363,636

B=BR(P-B)

B= 10% (4,000,000 – B)

Intermediate Accounting 2 | Bernadette L. Baul Page 2 of 5

B= 400,000 - 0.13

B+0.13 = 400,000

1.13=400,000/1.13

6) How much is the bonus “before bonus and after tax”? 288,660

B=BR(P-T)

T=TR(P-B)

T= 30% (400,000 – B)

B= 10% [4,000,000 – 0.30 (4M – B)]

B= 0.10 [4,000,000 – 1.2M + 0.30 B]

B= 400,000 – 120,000 + 0.03B

0.973 = 280,000/0.973

7) How much is the bonus “after bonus and after tax”? 261,682

B= BR(P-B-T)

T=TR(P-B)

T= 30% (4,000,000 – B)

B= 10% [4,000,000 – B – 30% (4,000,000 – B)]

B=0.10 (4,000,000 – B – 1.2M + 30B)

B= 400,000 – 0.10B – 170,000 + 0.03B

1.07B = 280,000/1.07B

Unearned Income – Unearned Revenue

Numbers 8, 9, 10 and 11

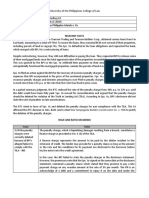

Dunne Company sells equipment service contracts that cover two-year period. The sale price of each contract is P600.

The past experience is that, of the total peso spent for repairs on service contracts, 40% is incurred evenly during the

first contract year and 60% evenly during the second contract year. The entity sold 1,000 contract evenly throughout

2019.

8) What is the contract revenue for 2019? = 120,000 (600,000 x 20%)

9) What amount should be reported as deferred service revenue on December 31, 2019? =480,000

(600,000 – 120,000)

10) What is the contract revenue for 2020? =300,000 (600,000 x 50%)

11) What is the contract revenue for 2021? =180,000 (600,000 x 30%)

Intermediate Accounting 2 | Bernadette L. Baul Page 3 of 5

Unearned Income – Gift Certificates

12) Raditz Company sells gift certificates redeemable only when merchandise is purchased. The certificates have an

expiration date two years after issuance date. Upon redemption or expiration, Raditz recognizes the unearned

revenue as realized. Data for 2021 are as follows:

Unearned revenue, January 1 1,500,000

Gift certificate sold 5,000,000

Gift certificate redeemed 4,000,000

Expired gift certificates 300,000 Cost of goods sold 60%

At December 31, 2021, Raditz Company should report unearned revenue at

Unearned Revenue 1/1/21 1,500,000

Gift certificate sold 5,000,000

Gift certificate redeemed (4,000,000)

Expired gift certificate (300,000)

COGS 60%

Unearned revenue at December 31, 2021 2,200,000

Escrow Liability

13) On the first day of each month, Denise Company received from a customer an escrow deposit of P500,000 for real

estate tax. The entity recorded the P500,000 in escrow account. The customer’s real estate tax is P5,600,000,

payable in equal installments of the first day of each calendar quarter. On January 1, 2019, the balance of the

escrow account was P600,000. On September 30, 2019, what amount should be reported as escrow liability?

Beginning Balance 600,000

Add: 9 months pay (500,000 x 9) 4,500,000

Less: 3 quarter of property

tax installment (5,600,000/4*3) 4,200,000

Escrow Liability on September 30, 2019 900,000

14) Summer Company maintains escrow accounts for various mortgage entities. The entity collects the receipts and

pays real estate taxes on behalf of mortgage customers. Escrow funds are kept in interest-bearing account. Interest,

less a 10% service fee, is credited to the mortgagee’s account and used to reduce future escrow payments.

Escrow account liability – beginning of year 700,000

Escrow receipts during the year 1,600,000

Real estate taxes paid during the year 1,700,000

Interest earned on escrow funds 50,000

What is the escrow accounts liability at year-end?

Beginning Balance 700,000

Intermediate Accounting 2 | Bernadette L. Baul Page 4 of 5

Add: Escrow receipts during the year 1,600,000

Less: Real Estate taxes paid 1,700,000

Add: Interest earned during the year 50,000

Less: Maintenance fee charged to

mortgage customer (50,000 x 10%) 5,000

Escrow liability at the year end 645,000

Liability Classification

15) 49ers Company provided the following information on December 31, 2019:

Accounts payable, net of creditors’ debit balances P200,000 2,000,000

Accrued expenses 800,000

Bonds payable due December 31, 2020 2,500,000

Premium on bonds payable 300,000

Deferred tax liability 500,000

Income tax payable 1,100,000

Cash dividend payable 600,000

Share dividend payable 400,000

Note payable – 6%, due March 1, 2020 1,500,000

Note payable – 8%, due October 1, 2020 1,000,000

The financial statements for 2019 were issued on March 31, 2020. On December 31, 2019, the 6% note payable

was refinanced on a long-term basis. Under the loan agreement for the 8% note payable, the entity has the

discretion to refinance the obligation for at least twelve months after December 31, 2019.

What amount should be reported as total current liabilities?

CURRENT NON-CURRENT

Adjusted Accounts Payable 2,200,000

Accrued Expenses 800,000

Bond Payable current maturing 2,800,000

Deferred tax liability 500,000

Income Tax Payable 1,100,000

Cash Dividend Payable 600,000

Share Dividend -

Note Payable – 6% 1,500,000

Note Payable – 8 1,000,000

TOTAL: 7,500,000 3,000,000

--- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- [End] --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ ---

Intermediate Accounting 2 | Bernadette L. Baul Page 5 of 5

You might also like

- UCC 1 Financing Statement-B. BryantDocument1 pageUCC 1 Financing Statement-B. BryantTiyemerenaset Ma'at El77% (13)

- Case Brief For Abdul Shukoor vs. Arji Papa RaoDocument4 pagesCase Brief For Abdul Shukoor vs. Arji Papa Raosandhya gaur25% (4)

- A Case Study of Microsoft Corporation 1Document21 pagesA Case Study of Microsoft Corporation 1Bea GarciaNo ratings yet

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- BLTDocument4 pagesBLTJaylord PidoNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Cost Accounting - Exercise 1Document2 pagesCost Accounting - Exercise 1Anna MaglinteNo ratings yet

- Chapter 2 FUNCTIONS - Microsoft Excel Tutorial #1Document3 pagesChapter 2 FUNCTIONS - Microsoft Excel Tutorial #1Bea GarciaNo ratings yet

- Rugged Terrain by LumberaDocument1 pageRugged Terrain by LumberaBea Garcia100% (1)

- Pre Qualification WorksheetDocument1 pagePre Qualification WorksheetVictoria BoreingNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- (Odd) Acc 101 LT#2B PDFDocument5 pages(Odd) Acc 101 LT#2B PDF有福No ratings yet

- 1.20PP Partnership Formation and DissolutionDocument16 pages1.20PP Partnership Formation and DissolutionMarcley BataoilNo ratings yet

- 2014 3016 Midterm Departmental ExamDocument14 pages2014 3016 Midterm Departmental ExamPatrick ArazoNo ratings yet

- Quiz 1B - Cash and Cash Equivalents, Bank ReconciliationDocument9 pagesQuiz 1B - Cash and Cash Equivalents, Bank ReconciliationLorence IbañezNo ratings yet

- Discussion 2 CHAPDocument4 pagesDiscussion 2 CHAPHannah LegaspiNo ratings yet

- Practice Problems - Transfer TaxesDocument2 pagesPractice Problems - Transfer Taxesuchishai100% (1)

- Chapter 1 - Introduction To Cost AccountingDocument29 pagesChapter 1 - Introduction To Cost AccountingLala SalvatoreNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Migriño - Quizzer 2 - Employee Benefits Part 1Document13 pagesMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNo ratings yet

- Partnership-Accounting NotesDocument30 pagesPartnership-Accounting NotesCarl Dhaniel Garcia SalenNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- INSTALLMENTDocument3 pagesINSTALLMENTEdison L. ChuNo ratings yet

- PUP Review Handout 1 OfficialDocument3 pagesPUP Review Handout 1 OfficialDonalyn CalipusNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Solution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Document3 pagesSolution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Christian Clyde Zacal ChingNo ratings yet

- Financial Accounting and ReportingDocument15 pagesFinancial Accounting and Reportingjoyce KimNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- Ifrs 9 Debt Investment IllustrationDocument9 pagesIfrs 9 Debt Investment IllustrationVatchdemonNo ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- 1Document6 pages1Marinel FelipeNo ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- HHHHDocument2 pagesHHHHdean subbie0% (2)

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- KEY Level 2 QuestionsDocument5 pagesKEY Level 2 QuestionsDarelle Hannah MarquezNo ratings yet

- Week 5 Problem 15Document2 pagesWeek 5 Problem 15Rachelle RodriguezNo ratings yet

- ACCO 3026 Final ExamDocument11 pagesACCO 3026 Final ExamClarisseNo ratings yet

- BALIMBIN TBLTpg83-94Document14 pagesBALIMBIN TBLTpg83-94mariyha Palanggana0% (1)

- AuditingDocument60 pagesAuditingarianasNo ratings yet

- Answer Value 800000Document1 pageAnswer Value 800000Kath LeynesNo ratings yet

- Interbranch Transactions Interbranch Transactions: John Paul G. Dantes John Paul G. DantesDocument13 pagesInterbranch Transactions Interbranch Transactions: John Paul G. Dantes John Paul G. DantesElla Mae TuratoNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Cost Acctg. Problems 1Document8 pagesCost Acctg. Problems 1Cheese ButterNo ratings yet

- Consignment Sales ProblemsDocument1 pageConsignment Sales ProblemsAkako MatsumotoNo ratings yet

- Albert I. Rivera, CPA, MBA, CRA 1Document6 pagesAlbert I. Rivera, CPA, MBA, CRA 1Reina EvangelistaNo ratings yet

- The Amount To Be Capitalized by Lessee To Right of Use AssetDocument1 pageThe Amount To Be Capitalized by Lessee To Right of Use Assetmax pNo ratings yet

- 05 Comprehensive Income PDFDocument2 pages05 Comprehensive Income PDFMimi YayaNo ratings yet

- Practice Exercise 1.5Document3 pagesPractice Exercise 1.5leshz zynNo ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- ACC117-CON09 Module 3 ExamDocument16 pagesACC117-CON09 Module 3 ExamMarlon LadesmaNo ratings yet

- Franchise PDFDocument1 pageFranchise PDFJonathan VidarNo ratings yet

- Armhyla Olivar FM Taxation 8Document4 pagesArmhyla Olivar FM Taxation 8Grace Umbaña YangaNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Learning Resource 12 Lesson 3Document7 pagesLearning Resource 12 Lesson 3Vianca Marella SamonteNo ratings yet

- RFA 2 Part 2Document26 pagesRFA 2 Part 2Kristelle OngNo ratings yet

- 2.6. Retained EarningsDocument5 pages2.6. Retained EarningsKPoPNyx Edits100% (1)

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Strategic Cost Accounting: MBA-First YearDocument99 pagesStrategic Cost Accounting: MBA-First YearNada YoussefNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Questions p2Document15 pagesQuestions p2Let it be100% (1)

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- TradesDocument3 pagesTradesAlber Howell MagadiaNo ratings yet

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- Bank Secrecy ActDocument9 pagesBank Secrecy ActBea GarciaNo ratings yet

- Pdic LawDocument15 pagesPdic LawBea GarciaNo ratings yet

- Truth in Lending ActDocument7 pagesTruth in Lending ActBea GarciaNo ratings yet

- SSRN Id4353923Document32 pagesSSRN Id4353923Bea GarciaNo ratings yet

- CASEANALYSISFORMATDocument15 pagesCASEANALYSISFORMATBea GarciaNo ratings yet

- Audit of Banks - July 8, 2022Document29 pagesAudit of Banks - July 8, 2022Bea Garcia100% (1)

- 04.1 - Lecture Notes - M4 - Audit Objectives, Procedures, Evidence, and Documentation (Feb 23)Document58 pages04.1 - Lecture Notes - M4 - Audit Objectives, Procedures, Evidence, and Documentation (Feb 23)Bea GarciaNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- 13 - Law On InsuranceDocument11 pages13 - Law On InsuranceBea GarciaNo ratings yet

- TFAR2303 - Investment in Debt Securities (With Answers)Document4 pagesTFAR2303 - Investment in Debt Securities (With Answers)Bea GarciaNo ratings yet

- q2 Advacc1 PDF FreeDocument3 pagesq2 Advacc1 PDF FreeBea GarciaNo ratings yet

- Strategic Management: Jpmorgan Chase & CoDocument16 pagesStrategic Management: Jpmorgan Chase & CoBea Garcia100% (1)

- Standards To Bank OnDocument13 pagesStandards To Bank OnBea GarciaNo ratings yet

- Quiz 2 - SolutionsDocument19 pagesQuiz 2 - SolutionsBea GarciaNo ratings yet

- Task Performance MS and Verizons 02Document24 pagesTask Performance MS and Verizons 02Bea GarciaNo ratings yet

- Quiz No. 2: Law On SalesDocument20 pagesQuiz No. 2: Law On SalesBeatrice TehNo ratings yet

- Short-Term Employee BenefitsDocument4 pagesShort-Term Employee BenefitsBea Garcia100% (2)

- Cost Accounting QuestionsDocument47 pagesCost Accounting QuestionsBea GarciaNo ratings yet

- 2.3G Homework (Questionnaire)Document4 pages2.3G Homework (Questionnaire)Bea GarciaNo ratings yet

- Activity 4 - Job Order CostingDocument2 pagesActivity 4 - Job Order CostingBea GarciaNo ratings yet

- Prudential Bank v. AlviaDocument2 pagesPrudential Bank v. AlviaGrace Ann TamboonNo ratings yet

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- Role Play MpuDocument2 pagesRole Play MpukebayanmenawanNo ratings yet

- Differences Between A Central Bank and Commercial BankDocument4 pagesDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifNo ratings yet

- California Bus Lines, Inc. vs. State Investment House, Inc.Document3 pagesCalifornia Bus Lines, Inc. vs. State Investment House, Inc.Jenine QuiambaoNo ratings yet

- Mortgage DeedDocument8 pagesMortgage DeedLakhan WankhadeNo ratings yet

- Icici Bank Rar 2014Document54 pagesIcici Bank Rar 2014Moneylife FoundationNo ratings yet

- Publication 4491 Examples and CasesDocument54 pagesPublication 4491 Examples and CasesNorma WahnonNo ratings yet

- DB Motion With EndDocument13 pagesDB Motion With EndAC FieldNo ratings yet

- CH 14 MCDocument38 pagesCH 14 MCElaine Lingx100% (1)

- Classes of Insurance: Fire What Is Included in Fire Insurance?Document4 pagesClasses of Insurance: Fire What Is Included in Fire Insurance?Andrei ArkovNo ratings yet

- Role of Microfinance InstitutionsDocument1 pageRole of Microfinance InstitutionsSimon SimbakkyNo ratings yet

- Chester Babst vs. CA (GR 99398, Jan. 26, 2001, 350 SCRA)Document9 pagesChester Babst vs. CA (GR 99398, Jan. 26, 2001, 350 SCRA)Fides DamascoNo ratings yet

- Moot PDFDocument15 pagesMoot PDFRachit MunjalNo ratings yet

- LandtDocument182 pagesLandtYogesh VyasNo ratings yet

- Domingo Vs GarlitosDocument5 pagesDomingo Vs GarlitosJimi SolomonNo ratings yet

- Credit Transaction Reviewer Arts. 1933 - 1961Document13 pagesCredit Transaction Reviewer Arts. 1933 - 1961Eileen Makatangay Manaloto100% (3)

- Isa 570Document15 pagesIsa 570baabasaamNo ratings yet

- Appendix I - On Whether Honest Banking Can Cause Business CyclesDocument5 pagesAppendix I - On Whether Honest Banking Can Cause Business CyclesdtuurNo ratings yet

- List of Variables To Be Used in CapstoneDocument2 pagesList of Variables To Be Used in CapstoneErn TNo ratings yet

- Bank of The Philippine Islands v. YuDocument2 pagesBank of The Philippine Islands v. YucelestialfishNo ratings yet

- Land Revenue Code and RulesDocument310 pagesLand Revenue Code and Rulessav999No ratings yet

- 7 Lizaso V Amante G.R. No. 2019Document6 pages7 Lizaso V Amante G.R. No. 2019John JurisNo ratings yet

- CH 13 TestbankDocument45 pagesCH 13 Testbanknervon100% (1)

- Personal Loans in UAE and Dubai Compare Personal Loan Quotes in UAE and Dubai Souqalmal PDFDocument1 pagePersonal Loans in UAE and Dubai Compare Personal Loan Quotes in UAE and Dubai Souqalmal PDFa ashifaNo ratings yet

- Declaration Violations at Highline MeadowsDocument4 pagesDeclaration Violations at Highline MeadowsJoe OwnerNo ratings yet