Professional Documents

Culture Documents

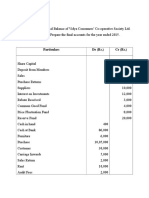

Balance Sheet

Balance Sheet

Uploaded by

Shubham TiwariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet

Balance Sheet

Uploaded by

Shubham TiwariCopyright:

Available Formats

1. Following is the Trial Balance of Kalpana Traders as on 31st march 2009.

9. You are required to prepare Trading and Profit &

Loss Account for the year ended 31st march 2009 and Balance sheet as on that date.

Trial Balance as on 31st March, 2009

Particulars Amount (Rs.) Particulars Amount (Rs.)

Stock on 1-4-2008 30,000 Capital 35,500

Purchases 85,000 Discount Received 1,500

Return Inward 2,500 Sales 1,27,500

Wages 5,300 Return outward 1,000

Salaries 6,600 Creditors 15,000

Carriage Inward 1,200 Bills Payable 5,000

Carriage Outward 200

Power & Fuel 700

Advertisement 1,300

Office Expenses 400

Printing & Stationery 800

Commission 1,000

Furniture 8,500

Machinery 30,000

Cash in Hand 1,200

Drawings 800

Debtors 7,500

Bill Receivable 2,500

1,85,500 1,85,500

Closing stock was valued at cost RS. 32,000

(Stateboard XI, 319, 4)

2. The following is the trial Balance of Sanford at 31st March, 2013. Draw the final accounts from the balances therefrom:

Particulars Debit (Rs.) Credit (Rs.)

Capital 1,50,000

Stock on 1-04-2012 30,000

Cash at Bank 10,000

Cash in hand 5,000

Machinery 1,00,000

Furniture 13,000

Purchases 2,00,000

Wages 50,000

Carriage 33,000

Salaries 70,000

Discount Allowed 4,000

Discount received 5,000

Advertising 50,000

Office Expenses 40,000

Sales 5,00,000

Sundry Debtors 90,000

Sundry Creditors 40,000

6,95,000 6,95,000

Value of Closing stock on 31st March, 2013 was Rs. 50,000.

(ISC XI, T. S. Grewal, 19.29, 15)

3. Given below is the Trial balance of Mrs. Vandana as on 31st March, 2010

Debit Balances Amount Credit Balances Amount

(Rs.) (Rs.)

Cash in Hand 6,000 Bank Loan 20,000

Sundry Debtors 23,300 Sundry Creditors 15,000

Bills Receivable 10,000 Sales 65,800

Opening Stock 16,000 Purchase returns 3,700

Purchases 37,900 Bills Payable 8,000

Sales Returns 800 Discount 2,500

Received

Salaries 11,000 Capital 55,000

Wages 2,000

Advertisement 3,200

Discount Allowed 1,000

Machinery 40,000

Carriage 2,500

Insurance 1,800

Drawings 2,500

Octroi Duty 800

Furniture 8,000

Office Rent 3,200

1,70,000 1,70,000

Adjustments:

1. Closing stock of goods on 31.3.2010 was valued at RS. 21,000

2. Depreciation to be charged on Furniture by 5% and Machinery by 10% p.a.

3. Outstanding salary Rs. 1,000 and Wages Rs. 500

4. Prepaid Insurance Rs. 300

Prepare Trading and Profit & Loss account for the year ending 31st March 2010 and balance Sheet as on date.

(Stateboard XI, 320, 5)

4. Following is the Trial Balance of Kalyani, you are required to prepare Trading and Profit and Loss account for the year ended

31st march 2010 and balance sheet as on date.

Particulars Debit Amount (Rs.) Credit Amount (Rs.)

Capital 90000

Drawings 3,000

Stock on 1-4-2009 45,000

Octroi duty 800

Purchases & Sales 2,00,000 3,12,000

Returns 6,000 2,000

Salaries 10000

Carriage outward 1,400

Wages 14,000

Insurance 2,000

Discount received 600

Postage 800

Debtors & Creditors 60,000 64,000

Furniture 35,000

Cash in hand 10,000

Machinery 80,000

Rent & Taxes 6,000

Printing & Stationary 2,000

Bank Overdraft 7,400

Total 4,76,000 4,76,000

Adjustments:

1. Closing Stock was valued at cost Rs. 40,000 while its market price is Rs. 45,000

2. Depreciation on Machinery by 5% per annum.

3. Salary of Rs. 2000 and wages of Rs. 1000 were outstanding

4. Insurance of Rs. 500 was prepaid

(Stateboard XI, 344, 2 G.P.: 87,200, N.P.: 60,100, B/s: 221500)

5. The following Trial Balance is extracted from the books of Nikesh as at 31st March, 2013

Debit Balances Amount (Rs.) Credit Balances Amount (Rs.)

Stock on 1-4-2012 50,000 Capital 3,20,000

Furniture 16,000 Creditors 80,000

Building 1,60,000 Purchase returns 2,000

Debtors 60,000 Commission 1,000

You might also like

- Amazon Stock RSU Global Agreement PDFDocument27 pagesAmazon Stock RSU Global Agreement PDFlindytindylindtNo ratings yet

- TMDTDocument3 pagesTMDTDiệu QuỳnhNo ratings yet

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- Financial StatementsDocument3 pagesFinancial StatementsSoumendra RoyNo ratings yet

- And Profit and Loss Account and Balance Sheet On 31st December, 2019Document2 pagesAnd Profit and Loss Account and Balance Sheet On 31st December, 2019Prabhleen KaurNo ratings yet

- Jayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsDocument2 pagesJayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsJayalakshmi Institute of TechnologyNo ratings yet

- Accounts Assignment Class 11 CandE 20220111131012374Document5 pagesAccounts Assignment Class 11 CandE 20220111131012374Jithu EmmanuelNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Numerical On Final AccountDocument7 pagesNumerical On Final AccountVikas giri100% (1)

- Problems On Final Accounts-Sole ProprietorshipDocument12 pagesProblems On Final Accounts-Sole ProprietorshipRishiShuklaNo ratings yet

- The Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberDocument3 pagesThe Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberyogeshNo ratings yet

- Final Account ExamplesDocument4 pagesFinal Account Examplespranaylanjewar644No ratings yet

- Final Acc Numericals1Document3 pagesFinal Acc Numericals1Asvag OndaNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Final AccountsDocument15 pagesFinal AccountsVaishnavi VyapariNo ratings yet

- Assignment Bballb BDocument4 pagesAssignment Bballb BTavnish SinghNo ratings yet

- Company Final AccountDocument2 pagesCompany Final AccountYashi710No ratings yet

- Sole Prop SumsDocument6 pagesSole Prop SumsSidhant KothriwalNo ratings yet

- Assigt Fin Accounting Sem 1 2019 FWDDocument1 pageAssigt Fin Accounting Sem 1 2019 FWDSsengondoNo ratings yet

- Debit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsDocument4 pagesDebit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsM JEEVARATHNAM NAIDUNo ratings yet

- Additional Questions AcctsDocument3 pagesAdditional Questions AcctsDEV NANKANINo ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- C.A. Foundation Final Accounts For Sole Proprietorship QuestionsDocument2 pagesC.A. Foundation Final Accounts For Sole Proprietorship Questionsgpgaming1693No ratings yet

- AnswerDocument3 pagesAnswerRE GHANo ratings yet

- Foreign Branch As 12Document8 pagesForeign Branch As 12Sakshi NagotkarNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Particulars Rs. Particulars RsDocument2 pagesParticulars Rs. Particulars RsAman RajNo ratings yet

- Accounting Activity 6Document2 pagesAccounting Activity 6Kae Abegail GarciaNo ratings yet

- Abd Question Paper BankDocument96 pagesAbd Question Paper BankRahul Ghosale100% (1)

- Practice Questions-IAS-1Document2 pagesPractice Questions-IAS-1Ayyan AzeemNo ratings yet

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- Accounting Fundamentals - PWS - 7Document11 pagesAccounting Fundamentals - PWS - 7Meet PatelNo ratings yet

- Final Accounts QuestionDocument12 pagesFinal Accounts Questionadityatiwari122006No ratings yet

- Ac 11 ProjectsDocument8 pagesAc 11 ProjectsJagdish sanjotNo ratings yet

- Final Accounts Example - MBA WPDocument6 pagesFinal Accounts Example - MBA WPJIJONo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- Numerical On Companies Final AccountsDocument7 pagesNumerical On Companies Final Accountsmohit sharmaNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Problem 6 7Document1 pageProblem 6 7tushar1007singhNo ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- Final Accounts Subjective QuestionsDocument3 pagesFinal Accounts Subjective QuestionsPARAG BHAWANINo ratings yet

- Adobe Scan 07-Jul-2022Document2 pagesAdobe Scan 07-Jul-2022Accounting HelpNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Sole Trading Final AccountDocument5 pagesSole Trading Final AccountARJIT KULSHRESTHA100% (1)

- Manan Aggarwal - FINAL ACCOUNT-questionsDocument10 pagesManan Aggarwal - FINAL ACCOUNT-questionsManan AggarwalNo ratings yet

- Cap IDocument26 pagesCap IDristi SaudNo ratings yet

- Income StatementDocument13 pagesIncome StatementShakir IsmailNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Final Account of Sole Trading ConcernDocument7 pagesFinal Account of Sole Trading ConcernAMIN BUHARI ABDUL KHADER50% (2)

- Financial Reporting, Statement & Analysis - Assignment1Document5 pagesFinancial Reporting, Statement & Analysis - Assignment1sumanNo ratings yet

- Final AccountDocument12 pagesFinal AccountarulkarvaishnaviNo ratings yet

- Unknown Document NameDocument5 pagesUnknown Document NameAnonymous T0RQWuiNo ratings yet

- Project 3 Problem 5 and 6Document4 pagesProject 3 Problem 5 and 6Jaquilyn JavierNo ratings yet

- TradingDocument2 pagesTradingKalyani ParmalNo ratings yet

- Intro To Final Acc. ProblemsDocument11 pagesIntro To Final Acc. ProblemsDheer BhanushaliNo ratings yet

- Shri Ramdeobaba College of Engineering and ManagementDocument9 pagesShri Ramdeobaba College of Engineering and ManagementShubham TiwariNo ratings yet

- An Approach To Implement Lean Concepts in Supply Chain of Steel IndustryDocument33 pagesAn Approach To Implement Lean Concepts in Supply Chain of Steel IndustryShubham TiwariNo ratings yet

- An Approach To Implement Lean Concepts in Supply Chain of Steel IndustryDocument33 pagesAn Approach To Implement Lean Concepts in Supply Chain of Steel IndustryShubham TiwariNo ratings yet

- An Approach To Implement Lean Concepts in Supply Chain of Steel IndustryDocument34 pagesAn Approach To Implement Lean Concepts in Supply Chain of Steel IndustryShubham TiwariNo ratings yet

- Goodafternoon Everyone, My Topic For Todays Presentation Is Lean ManufacturingDocument2 pagesGoodafternoon Everyone, My Topic For Todays Presentation Is Lean ManufacturingShubham TiwariNo ratings yet

- Inward and Outward Supply Chain of IndustryDocument3 pagesInward and Outward Supply Chain of IndustryShubham TiwariNo ratings yet

- Salary Slip FormatDocument8 pagesSalary Slip Formatshrija nairNo ratings yet

- Psa 120Document14 pagesPsa 120Kimberly LimNo ratings yet

- Final STL City Use of Tax Incentives Report May 2016Document198 pagesFinal STL City Use of Tax Incentives Report May 2016Megan-Ellyia GreenNo ratings yet

- PRTC HOs ListDocument4 pagesPRTC HOs ListArianne May AmosinNo ratings yet

- Chapter 5 Inflation Its Causes Effects and Social CostsDocument10 pagesChapter 5 Inflation Its Causes Effects and Social CostsMD. ABDULLAH KHANNo ratings yet

- DownloadDocument92 pagesDownloadJitendra PanwarNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Project Finance ModellingDocument7 pagesProject Finance ModellingAriel SobralNo ratings yet

- IIM Sambalpur ExampleDocument2 pagesIIM Sambalpur ExampledebojyotiNo ratings yet

- Review Questions On Standard-1Document4 pagesReview Questions On Standard-1George Adjei100% (1)

- Basics of Aircraft Market Analysis v1Document30 pagesBasics of Aircraft Market Analysis v1avianovaNo ratings yet

- Breaking Up: Is Good To DoDocument12 pagesBreaking Up: Is Good To DoAnuroop BethuNo ratings yet

- Barclays The FX Quantitative AnalyzerDocument22 pagesBarclays The FX Quantitative AnalyzerCynthia SerraoNo ratings yet

- New Chandigarh CaseDocument96 pagesNew Chandigarh CaseOjaswa PathakNo ratings yet

- Corn ProductionDocument158 pagesCorn ProductionarnoldalejadoNo ratings yet

- NMB Bhawan, Babarmahal G.P.O. Box: 11543, Kathmandu, Nepal Phone: +977-1-4246160 Fax: +977-1-4246156Document53 pagesNMB Bhawan, Babarmahal G.P.O. Box: 11543, Kathmandu, Nepal Phone: +977-1-4246160 Fax: +977-1-4246156Sujan TumbapoNo ratings yet

- I888 Food Catering Payslip & AttendanceDocument5 pagesI888 Food Catering Payslip & AttendanceMark LopezNo ratings yet

- p9 SlutsDocument1 pagep9 Slutsyonah olupauNo ratings yet

- Top Secret - The Chinese Envoy's Briefing Paper On The Economic Outlook For The Great Southern Province of China by Satyajit DasDocument8 pagesTop Secret - The Chinese Envoy's Briefing Paper On The Economic Outlook For The Great Southern Province of China by Satyajit Dasapi-90504428No ratings yet

- FIN 254 - Chapter 1Document23 pagesFIN 254 - Chapter 1habibNo ratings yet

- Accruals Q1Document3 pagesAccruals Q1Riyu RimmyNo ratings yet

- E - 20201002 - RFUMSV50 Reverse Charge Tax Code SupportDocument15 pagesE - 20201002 - RFUMSV50 Reverse Charge Tax Code SupportRangabashyamNo ratings yet

- ACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsDocument5 pagesACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsNatalie Laurent SiaNo ratings yet

- Bethany's Bicycle CorporationDocument15 pagesBethany's Bicycle CorporationKailash Kumar100% (2)

- SEBI Grade A All Information Page EduTapDocument1 pageSEBI Grade A All Information Page EduTapnitish kumarNo ratings yet

- Test, FMDocument61 pagesTest, FMNeeraj GuptaNo ratings yet

- (L) Chapter 5 Accounting Concepts - ConventionsDocument6 pages(L) Chapter 5 Accounting Concepts - ConventionsCHZE CHZI CHUAHNo ratings yet

- ITP Application FormDocument2 pagesITP Application Formalauddinalo100% (1)