Professional Documents

Culture Documents

Chapter 8 Government Intervention in International Business

Chapter 8 Government Intervention in International Business

Uploaded by

divyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 8 Government Intervention in International Business

Chapter 8 Government Intervention in International Business

Uploaded by

divyaCopyright:

Available Formats

lOMoARcPSD|6143759

Chapter 8- Government Intervention in International Business

International Business (University of Waterloo)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Divya Patil (scorpidiu@gmail.com)

lOMoARcPSD|6143759

Chapter 8: Government Intervention in International Business

The Nature of Government Intervention

Governments intervene in trade and investment to achieve political, social, or

economic objectives

Governments impose trade and investment barriers that benefit interest groups

-> such as domestic firms, industries, labor unions

Government intervention alters the competitive landscape by hindering or

helping the ability of firms to compete internationally

Government intervention is an important dimension of country risk

Government intervention is motivated by:

o Protectionism

National economic policies that restrict free trade -> intended to

raise revenue or protect domestic industries from foreign

competition

Typically manifested by tariffs, nontariff barriers such as quotas

Tariff- a tax imposed by a government on imported

products which increases the cost of acquisition for the

customer

Nontariff trade barrier- a government policy, regulation,

or procedure that hinders trade through means other

than explicit tariffs -> regulations, policies

Quota- a quantitative restriction placed on imports of a

specific product over a specified period of time

Types of Government Intervention:

o Tariff

Harmonized code- standardized worldwide system that

determines tariff amount

o Quota

o Local content requirements

Requirement that firms include a minimum percentage of locally

sourced inputs in the production of given products or services ->

higher costs

o Regulations and technical standards

Safety, health, or technical regulations

o Administrative and bureaucratic procedures

Complex procedures or requirements imposed on importers or

foreign investors that hinder trade and investment

o FDI and ownership restrictions

Rules that limit the ability of foreign firms to invest in certain

industries or acquire local firms

o Subsidy

Financing or other resources that a government grants to a firm

or group of firms to ensure their survival or success -> include

cash, tax breaks

Downloaded by Divya Patil (scorpidiu@gmail.com)

lOMoARcPSD|6143759

o Countervailing duty

Duties imposed on products imported into a country to offset

subsidies given to producers in the exporting country

o Anti-dumping duty

Tax charged on an imported product whose price is below usual

prices in the local market or below the cost to manufacture the

product -> reduces competitive advantage

Rationale for Government Intervention

Why does a government intervene in trade and investment activities? There are four

main motives…

1) Tariffs and other forms of intervention can generate substantial revenue

2) Intervention can ensure the safety, security, and welfare of citizens

o Government pass laws to prevent the import of harmful products

3) Intervention is a means for governments to pursue economic, political, or

social objectives through policies that promote job growth and economic

development

4) Intervention can help better serve the interests of the nation’s firms and

industries

o Governments may devise regulations to stimulate development of home-

grown industries

Defensive/ Offensive Rationale

-> Government impose defensive barriers to safeguard industries, workers, and special

interest groups and to promote national security

->Governments impose offensive barriers to pursue strategic or public policy

objectives, such as increasing employment or generating tax revenues

Trade and investment barriers can be considered either defensive or offensive:

Defensive Rational for Government intervention

o Protection of the national economy

Weak or young economics sometimes need protection from

foreign competitors

Firms in advanced economies cant compete with those in

developing countries that employ low-cost labor \

India imposed barriers to shield its huge agricultural sector,

which employs millions

o Protection of an infant industry

A young industry may need protection, to give it a chance to

grow and succeed

Governments can ensure that young firms gain a large share of

the domestic market

o National security

Countries impose trade restrictions on products viewed as

critical to national defense and security, such as military

Downloaded by Divya Patil (scorpidiu@gmail.com)

lOMoARcPSD|6143759

technologies and computer that help maintain domestic

production in security related products

o National culture and identity

In most countries, certain occupations, industries and public

assets are seen as central to national culture and identity

Governments may impose trade barriers to restrict imports of

products or services seen to threaten such national assets

The US did not allow the Japanese to purchase the Seattle

Mariners baseball team

Offensive Rational for Government intervention

o National Strategic priorities

Protection helps ensure the development of industries that

bolster the nations economy

Countries create better jobs and higher tax revenues when they

support high value-adding industries, such as IT, automotive,

pharmaceuticals, or financial services

o Increase employment

Protection helps preserve domestic jobs -> in the short term

Protected industries become less competitive over time,

especially in global markets, leading to job loss in the long run

Governments impose import barriers to protect employment in

designated industries -> Protecting domestic firms from foreign

competition stimulated national output, leading to more jobs in

the protected industries

Consequences of Government Intervention

Reduced supply of goods to buyers

Reduced variety -> fewer choices available to buyers

Reduced industrial competitiveness

Various adverse unintended consequences -> while the home country dithers,

other countries can race ahead

Import Substitution cs. Export led development

Import substitution

o A policy of restricting imports in order to protect home-country firms

Export- led development

o Encourages development of export-intensive industries

o Proved very successful and led to rapid economic growth and high living

standard

Evolution of Government Intervention

A century ago, trade barriers were high

Trading environment worsened through two world wars & great depression

In 1983, the US passed the Smooth-Hawley Tariff Act, which raised US tariffs

more than 50%

Downloaded by Divya Patil (scorpidiu@gmail.com)

lOMoARcPSD|6143759

US government began to reduce tariffs

In 1947, 23 nations signed the General Agreement on Tariffs and Trade (GATT)

o GATT reduced tariffs via continuous worldwide trade negotiations

o GATT created an agency to supervise world trade

o GATT created a forum for resolving trade disputes

o The GATT introduced the concept of most favored nation -> by which

each member nation agreed to extend the tariff reductions covered in a

trade agreement with one country to all countries

o In 1995, World trade organization took the place of GATT

Consequences of Intervention

Economic freedom- the absence of government pressure so that people can

work, produce consume, and invest however they want

Virtually all advanced economies are “free”

Emerging markets are either “free” or “mostly free”

Most developing economies are “mostly unfree” or “repressed”

Market Liberalization in China

• In 1949, China established communism and centralized economic planning.

• Agriculture and manufacturing were controlled by inefficient state-run

industries.

• The country was long closed to international trade.

• In the 1980s, China liberalized its

economy.

• In 2001, China joined the WTO.

• China is now a key member of the world trading system.

Market Liberalization in India

• Following independence from Britain in 1947, India adopted a quasi-socialist

model of isolationism and government control.

• High trade barriers, state intervention, a large public sector, and central

planning resulted in poor economic performance.

• In the 1990s, markets opened to foreign trade and investment; state enterprises

were privatized.

• Protectionism has declined, but high tariffs (averaging 20%) and FDI

limitations remain.

Intervention and the Global Financial Crisis

Global recession and financial crisis raised questions about government role in

business

The crisis arose largely from inadequate regulation and enforcement of current

regulations in the banking and finance sectors

In response, governments around the world are increasing regulation and

examining ways to improve enforcement

o Ex. US government increased power of its Treasury Department

o Ex. Russia raised tariffs on cars -> governments increased protectionism

Downloaded by Divya Patil (scorpidiu@gmail.com)

lOMoARcPSD|6143759

o Ex. Governments increased subsidies

How firms can respond to Government Intervention

Research and father knowledge

o Understand trade and investment barriers abroad. Scan the business

environment to identify the nature of government intervention

Choose the most appropriate entry strategies

o Most firms choose exporting as their initial strategy, but if high tariffs

are present, other strategies should be considered -> licensing, FDI, Joint

ventures

Take advantage of foreign trade zones

o FTZ- areas within a country where imports are not subject to duties,

taxes or quotas, until the products made from them enter into the non-

FTZ zone

o Ex- in US, Japanese carmakers store vehicles at the port of Florida

without having to pay duties until the cars are shipped to US dealerships

Seek favorable customs classifications for exported products

o Reduce exposure to trade barriers by ensuring that products are

classified property

o Many products can be classified in two or more categories ->

telecommunications equipment -> can be electric machinery,

electronics, measuring devices

o Manufacturer should analyze the trade barriers on differing categories

to ensure exported products are classified under the lowest tariff code

Take advantage of investment incentives and other government support

programs

Downloaded by Divya Patil (scorpidiu@gmail.com)

You might also like

- Final Exam Sample Questions Attempt Review 5Document9 pagesFinal Exam Sample Questions Attempt Review 5leieparanoico100% (1)

- Essay Chp7Document8 pagesEssay Chp7barrettm82a1No ratings yet

- MODULE 3 - Chapter 6 (Trade Protectionism) PDFDocument7 pagesMODULE 3 - Chapter 6 (Trade Protectionism) PDFAangela Del Rosario CorpuzNo ratings yet

- Political Economy of International Trade Chapter - 5Document22 pagesPolitical Economy of International Trade Chapter - 5Suman BhandariNo ratings yet

- Angelyn Lucido Dailine Gequillo: ReportersDocument42 pagesAngelyn Lucido Dailine Gequillo: ReportersPhero MorsNo ratings yet

- International Business: The New Realities: Fifth EditionDocument49 pagesInternational Business: The New Realities: Fifth EditionEswari PerisamyNo ratings yet

- 10 +Government+InterventionDocument11 pages10 +Government+InterventionБекзат АсановNo ratings yet

- Economics The Global Economy Topic 1 HSCDocument16 pagesEconomics The Global Economy Topic 1 HSCAnna BuiNo ratings yet

- Team 8-IB AssignmentDocument15 pagesTeam 8-IB AssignmentShanyaRastogiNo ratings yet

- Goverment InfluenceDocument41 pagesGoverment InfluenceAshish kumar ThapaNo ratings yet

- IBT ReviewerDocument15 pagesIBT ReviewerMary Ellen LuceñaNo ratings yet

- Summary of Chap 7 8Document6 pagesSummary of Chap 7 8Bea DatingNo ratings yet

- Lecture 5Document30 pagesLecture 5exotic trendsNo ratings yet

- Management Entrepreneurship and Development Notes 15ES51Document142 pagesManagement Entrepreneurship and Development Notes 15ES51Amogha b94% (18)

- International Business Trade Lesson 1Document25 pagesInternational Business Trade Lesson 1Kristen IjacoNo ratings yet

- Chapter V (Ibt)Document16 pagesChapter V (Ibt)くど しにちNo ratings yet

- Economic Management in International TradeDocument2 pagesEconomic Management in International TradeSharessa FraserNo ratings yet

- The Political Economy of International TradeDocument8 pagesThe Political Economy of International TradeAsfikRahmanNo ratings yet

- International Business 14th Edition Daniels Solutions ManualDocument13 pagesInternational Business 14th Edition Daniels Solutions Manuallendablefloordpq7r100% (37)

- International Business 14th Edition Daniels Solutions ManualDocument38 pagesInternational Business 14th Edition Daniels Solutions Manualrococosoggy74yw6m100% (15)

- Advanced Economics ProtectionismDocument24 pagesAdvanced Economics ProtectionismArlan BelenNo ratings yet

- Group7 Government Policy and International TradeDocument32 pagesGroup7 Government Policy and International TradeKiri KroemNo ratings yet

- MKT 100 PPT Global MarketDocument21 pagesMKT 100 PPT Global MarketbrandinoNo ratings yet

- Inbustra - Political EconomyDocument8 pagesInbustra - Political EconomyShinichii KuudoNo ratings yet

- Unit 4 Current Affairs - Global Business EnvironmentDocument28 pagesUnit 4 Current Affairs - Global Business Environmentca.himanshutyagiNo ratings yet

- Ch.7 PPT ReportDocument38 pagesCh.7 PPT ReportblingpacmaNo ratings yet

- Ibt 5Document4 pagesIbt 5tenyente gimoNo ratings yet

- Module 3 - Part 2 - Business Government RelationsDocument20 pagesModule 3 - Part 2 - Business Government RelationsKareem RasmyNo ratings yet

- The Polotical Economy of International TradeDocument13 pagesThe Polotical Economy of International Traderittik sarkerNo ratings yet

- Government Intervention in International Business: Gary Knight Willamette University, USADocument2 pagesGovernment Intervention in International Business: Gary Knight Willamette University, USARavi ShankarNo ratings yet

- Chapter Seven Governmental Influence On Trade: ObjectivesDocument12 pagesChapter Seven Governmental Influence On Trade: ObjectivesSweatcha PoodiNo ratings yet

- International Business: Governmental Influence On TradeDocument18 pagesInternational Business: Governmental Influence On TradeUrstruly ChakriNo ratings yet

- The Polotical Economy of International TradeDocument13 pagesThe Polotical Economy of International Tradeabir hasanNo ratings yet

- Chapter 7 SummaryDocument6 pagesChapter 7 SummaryMabel LokNo ratings yet

- Import Substitution and Export Promotion - EconomicsDocument14 pagesImport Substitution and Export Promotion - EconomicsrezsxNo ratings yet

- Torreliza Cortuna Rendon ReportDocument52 pagesTorreliza Cortuna Rendon ReportVidal Angel Glory Borj A.No ratings yet

- LECTURE 6 Trade ProtectionismDocument28 pagesLECTURE 6 Trade ProtectionismAllen DizonNo ratings yet

- 6 Government Intervention and Regional Economic IntegrationDocument47 pages6 Government Intervention and Regional Economic Integrationاحمد حسانNo ratings yet

- International Trade ReportDocument24 pagesInternational Trade ReportPerlaz Mimi AngconNo ratings yet

- Govt. InterventionDocument20 pagesGovt. InterventionRadhika IyerNo ratings yet

- Chapter 7 Trade and NTB Bariers OnlyDocument26 pagesChapter 7 Trade and NTB Bariers OnlyJulio Cesar Vargas MillanNo ratings yet

- Trade RestrictionsDocument23 pagesTrade RestrictionsNamita patilNo ratings yet

- Daniels15 06 Governmental Influence On TradeDocument13 pagesDaniels15 06 Governmental Influence On TradeLaraine Shawa100% (1)

- Chap005 The Political Economy of International TradeDocument21 pagesChap005 The Political Economy of International TradeJaycel BayronNo ratings yet

- Political Economy of Trade and InvestmentDocument57 pagesPolitical Economy of Trade and InvestmentMarina AntonovaNo ratings yet

- 7.government Policy and International TradeDocument16 pages7.government Policy and International Tradechhavi nahataNo ratings yet

- Kuliah 6 Bisnis InternasionalDocument21 pagesKuliah 6 Bisnis InternasionalWahyu NurlatifahNo ratings yet

- Stage of International BusinessDocument25 pagesStage of International Businesssibayanrizaldy12No ratings yet

- Trade and Investment PoliciesDocument24 pagesTrade and Investment PoliciesSarsal6067No ratings yet

- Ib Group 10Document42 pagesIb Group 10Usama vlogsNo ratings yet

- Trade Policy in Developing CountriesDocument4 pagesTrade Policy in Developing CountriesCarolina MinghettiNo ratings yet

- Beige Brown Vintage Group Project Presentation - 20240302 - 132433 - 0000Document15 pagesBeige Brown Vintage Group Project Presentation - 20240302 - 132433 - 0000Vidal Angel Glory Borj A.No ratings yet

- Internationl TradeDocument12 pagesInternationl TradeIneshkaNo ratings yet

- International Business Module 2Document36 pagesInternational Business Module 2Saidi BuyeraNo ratings yet

- INB 372 Topic-6 The Political Economy of Inernational TradeDocument26 pagesINB 372 Topic-6 The Political Economy of Inernational TradeFatema Akter MishaNo ratings yet

- G) ProtectionismDocument3 pagesG) ProtectionismDavidsarneyNo ratings yet

- 2 - Governments Regulation of ImportsDocument34 pages2 - Governments Regulation of ImportsLinto SophieNo ratings yet

- Ibt ReviewerDocument9 pagesIbt ReviewerCatherine AntineroNo ratings yet

- Global BusinessDocument78 pagesGlobal BusinessSIVA RAMA KRISHNANo ratings yet

- 2000 CHP 7 Political Economy of Intl TradeDocument28 pages2000 CHP 7 Political Economy of Intl Tradeoutkast32No ratings yet

- DP AssignmentDocument107 pagesDP AssignmentdivyaNo ratings yet

- E-Grocery SynopsisDocument3 pagesE-Grocery SynopsisdivyaNo ratings yet

- Entrepreneurship Management: A Project OnDocument19 pagesEntrepreneurship Management: A Project OndivyaNo ratings yet

- Mock 1 Strategic ManagementDocument12 pagesMock 1 Strategic ManagementdivyaNo ratings yet

- Block DiaDocument2 pagesBlock DiadivyaNo ratings yet

- Foreign Exchange NoteDocument37 pagesForeign Exchange NoteAtia IbnatNo ratings yet

- Poultry Sector Master PlanDocument11 pagesPoultry Sector Master PlanMakhekhe MokoenaNo ratings yet

- Ipu Indian Economic DevelopmentDocument48 pagesIpu Indian Economic DevelopmentAsfiyaNo ratings yet

- Impact of GST in Automobile Sector 1,2,3,4,5Document78 pagesImpact of GST in Automobile Sector 1,2,3,4,5Yashas KumarNo ratings yet

- Prof Elec 4Document4 pagesProf Elec 4ralfgerwin inesaNo ratings yet

- CMO 39-2015 E-Processing of Certificate of OriginDocument6 pagesCMO 39-2015 E-Processing of Certificate of OriginPortCallsNo ratings yet

- ProposalDocument11 pagesProposalBriliant Tri Anatantya LestariNo ratings yet

- BRS TableDocument3 pagesBRS TableDibyani DashNo ratings yet

- Foreign Exchange Operational Guidelines 2020 Department of Foreign Exchange and Reserve ManagementDocument31 pagesForeign Exchange Operational Guidelines 2020 Department of Foreign Exchange and Reserve ManagementLungten PhuentshoNo ratings yet

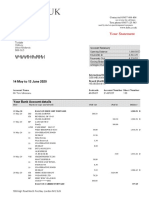

- Your Statement: Account SummaryDocument7 pagesYour Statement: Account SummaryToni MirosanuNo ratings yet

- Foreign Exchange Management - An Overview of Current Account TransactionsDocument50 pagesForeign Exchange Management - An Overview of Current Account Transactionsrebalap15No ratings yet

- BPP F3 KitDocument7 pagesBPP F3 KitMuhammad Ubaid UllahNo ratings yet

- 90 Fa 5 D 62071 D 65 C 8Document23 pages90 Fa 5 D 62071 D 65 C 8racha saNo ratings yet

- The Dynamics of Inflation in NigeriaDocument106 pagesThe Dynamics of Inflation in NigeriaJiboye OlaoyeNo ratings yet

- Lecture (Monetary Theory & Policy)Document12 pagesLecture (Monetary Theory & Policy)simraNo ratings yet

- PolycabDocument24 pagesPolycabg_sivakumarNo ratings yet

- Air Waybill Fedex: Panama Geisha Finca Esmeralda 250 Boquete, ChiriquíDocument2 pagesAir Waybill Fedex: Panama Geisha Finca Esmeralda 250 Boquete, ChiriquíNelsy Cuevas BocharelNo ratings yet

- T4 Exercises QuestDocument11 pagesT4 Exercises QuestXin XiuNo ratings yet

- Week 1 .06 - Revised Chart of AccountsDocument19 pagesWeek 1 .06 - Revised Chart of AccountsElaineJrV-IgotNo ratings yet

- AHG US Dollar in A Digital WorldDocument8 pagesAHG US Dollar in A Digital WorldkurtNo ratings yet

- Melammu - The Ancient World in An Age of Globalization PDFDocument397 pagesMelammu - The Ancient World in An Age of Globalization PDFEdwin Jude100% (1)

- Macro-Chapter 13 - UnlockedDocument9 pagesMacro-Chapter 13 - UnlockedTrúc LinhNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument12 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesWin TambongNo ratings yet

- GST NotesDocument121 pagesGST NotesVikram KatariaNo ratings yet

- Financial Reporting 3rd Edition - (CHAPTER 23 Foreign Currency Transactions and Forward Exchange Contract... )Document46 pagesFinancial Reporting 3rd Edition - (CHAPTER 23 Foreign Currency Transactions and Forward Exchange Contract... )Jacx 'sNo ratings yet

- Top Down Pricing Template: Notes Your Costing Example (Unit Cost) Estimated Mark-Ups or Unit RatesDocument2 pagesTop Down Pricing Template: Notes Your Costing Example (Unit Cost) Estimated Mark-Ups or Unit RatesshashanksaranNo ratings yet

- International Trade in BangladehDocument5 pagesInternational Trade in BangladehRatul MahmudNo ratings yet

- First AssignmentDocument1 pageFirst Assignmentbea savellanoNo ratings yet

- A4v Discharge Real Estate Mortgage NetworkDocument13 pagesA4v Discharge Real Estate Mortgage NetworkJohnson Damita100% (1)