Professional Documents

Culture Documents

Capital Gains Illustration

Capital Gains Illustration

Uploaded by

Sarvar PathanCopyright:

Available Formats

You might also like

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- Salaries NotesDocument48 pagesSalaries Notesbhatiasanjay89No ratings yet

- New Product DevelopmentDocument18 pagesNew Product DevelopmentSarvar PathanNo ratings yet

- Exempt IncomeDocument18 pagesExempt IncomeSarvar PathanNo ratings yet

- Sale Agreement of Immovable Property For Rs.Document6 pagesSale Agreement of Immovable Property For Rs.Anjanikumar BojjanapalliNo ratings yet

- Gift DeedDocument3 pagesGift DeedHamid Ali ArainNo ratings yet

- Documentary Stamp Tax PDFDocument5 pagesDocumentary Stamp Tax PDFMark Rainer Yongis LozaresNo ratings yet

- Capital Gain Sums With SolutionDocument10 pagesCapital Gain Sums With Solutionkomil bogharaNo ratings yet

- Problems On Taxable Salary Income Additional PDFDocument24 pagesProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068No ratings yet

- Income From Other Sources IllustrationDocument5 pagesIncome From Other Sources IllustrationSarvar PathanNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- 2.3 Solutions Module - 2 PDFDocument9 pages2.3 Solutions Module - 2 PDFArpita Artani100% (1)

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Cost & Finance RTP Nov 15Document41 pagesCost & Finance RTP Nov 15Aaquib ShahiNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Chapter 2 - Income From House Property - NotesDocument27 pagesChapter 2 - Income From House Property - NotesRahul Tiwari50% (2)

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Working Capital Mgt. - Unit 5Document23 pagesWorking Capital Mgt. - Unit 5DrShailesh Singh Thakur100% (2)

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- House Property 1Document14 pagesHouse Property 1Sarvar Pathan100% (3)

- Consignment - SolutionDocument18 pagesConsignment - Solution203 596 Reuben RoyNo ratings yet

- Introduction To Cost and Management Accounting: Question-1Document32 pagesIntroduction To Cost and Management Accounting: Question-1Alvarez StarNo ratings yet

- Module 6Document50 pagesModule 6rohit saini75% (4)

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- UNIT 3 Income From House PropertyDocument104 pagesUNIT 3 Income From House Propertydob BoysNo ratings yet

- Chapter 11 Hire Purchase and Instalment Sale Transactions PDFDocument52 pagesChapter 11 Hire Purchase and Instalment Sale Transactions PDFEswari GkNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Study Note 4.4 Page (264-289)Document26 pagesStudy Note 4.4 Page (264-289)s4sahith75% (24)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Unit2: Treatment of Goodwill in Partnership AccountsDocument27 pagesUnit2: Treatment of Goodwill in Partnership AccountsJavid QuadirNo ratings yet

- Income From Other SourcesDocument11 pagesIncome From Other Sourcessrocky2000100% (1)

- Problems On Internal ReconstructionDocument24 pagesProblems On Internal ReconstructionYashodhan Mithare100% (5)

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- CG Extra SumsDocument19 pagesCG Extra SumsPruthil Monpariya50% (2)

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- CHAP - 5 SalaryDocument44 pagesCHAP - 5 Salarypriya chauhanNo ratings yet

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeeNo ratings yet

- Chapter 12 Service CostingDocument3 pagesChapter 12 Service CostingMS Raju100% (1)

- Holding Companies: Problems and Solutions - AccountingDocument17 pagesHolding Companies: Problems and Solutions - AccountingVaibhav MaheshwariNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- IT AY 23-24 Probs On Cap GainDocument5 pagesIT AY 23-24 Probs On Cap Gainlokeshwarareddy1999No ratings yet

- Mi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverDocument2 pagesMi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverSarvar PathanNo ratings yet

- E-Way Bill System PDFDocument1 pageE-Way Bill System PDFSarvar PathanNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- Facility LocationDocument22 pagesFacility LocationSarvar PathanNo ratings yet

- 1b. Production SystemsDocument13 pages1b. Production SystemsSarvar PathanNo ratings yet

- 5b. Capacity PlanningDocument21 pages5b. Capacity PlanningSarvar PathanNo ratings yet

- 1c.OM - Strategy-Rev-2020 - BVRMDocument24 pages1c.OM - Strategy-Rev-2020 - BVRMSarvar PathanNo ratings yet

- SalaryDocument29 pagesSalarySarvar PathanNo ratings yet

- Asian Paints (Rakesh Painter)Document2 pagesAsian Paints (Rakesh Painter)Sarvar PathanNo ratings yet

- Acknowledgement of Online Application For Services On Existing DLDocument1 pageAcknowledgement of Online Application For Services On Existing DLSarvar PathanNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Residential StatusDocument4 pagesResidential StatusSarvar PathanNo ratings yet

- Residential Status True or FalseDocument2 pagesResidential Status True or FalseSarvar PathanNo ratings yet

- Residential Status FibDocument1 pageResidential Status FibSarvar PathanNo ratings yet

- House Property 1Document14 pagesHouse Property 1Sarvar Pathan100% (3)

- Income From Other Sources IllustrationDocument5 pagesIncome From Other Sources IllustrationSarvar PathanNo ratings yet

- Residential StatusDocument17 pagesResidential StatusSarvar PathanNo ratings yet

- Important Theory Questions: Tripathi Online EducareDocument1 pageImportant Theory Questions: Tripathi Online EducareSarvar PathanNo ratings yet

- Income From Other SourcesDocument10 pagesIncome From Other SourcesSarvar PathanNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesSarvar PathanNo ratings yet

- Heads of IncomeDocument1 pageHeads of IncomeSarvar PathanNo ratings yet

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- Business IncomeDocument15 pagesBusiness IncomeSarvar PathanNo ratings yet

- DeductionsDocument9 pagesDeductionsSarvar PathanNo ratings yet

- Everything You Wanted To Know About Stamp Duty: Article No. Description of InstrumentDocument8 pagesEverything You Wanted To Know About Stamp Duty: Article No. Description of InstrumentAbhishek YadavNo ratings yet

- 1014 - Law of RegistrationDocument22 pages1014 - Law of Registrationbhavitha birdalaNo ratings yet

- Form No. 9 Release of A LegacyDocument1 pageForm No. 9 Release of A LegacySudeep SharmaNo ratings yet

- Sale DeedDocument33 pagesSale DeedSofia KaushalNo ratings yet

- Deed of Covenant To Accompany Statutory Mortgage of Ship: Form No. 5Document7 pagesDeed of Covenant To Accompany Statutory Mortgage of Ship: Form No. 5Sudeep SharmaNo ratings yet

- Rectification of Registered DeedDocument2 pagesRectification of Registered DeedRajesh GhoseNo ratings yet

- BIR Ruling (DA - (C-338) 819-09) Ellimac Prime Holdings, IncDocument5 pagesBIR Ruling (DA - (C-338) 819-09) Ellimac Prime Holdings, IncKriszan ManiponNo ratings yet

- Letter of Intent To BuyDocument4 pagesLetter of Intent To BuyBrenner BolasocNo ratings yet

- BIR EscrowDocument20 pagesBIR Escrowlorkan19No ratings yet

- Commissioner of Internal Revenue vs. LA Tondeña Distillers, Inc. (LTDI (Now Ginebra San Miguel) ) - GR No. 175188 - Jul. 15, 2015Document8 pagesCommissioner of Internal Revenue vs. LA Tondeña Distillers, Inc. (LTDI (Now Ginebra San Miguel) ) - GR No. 175188 - Jul. 15, 2015Kristel Anne LiwagNo ratings yet

- Idbi Bank Office Premises RequiredDocument16 pagesIdbi Bank Office Premises RequiredJashanNo ratings yet

- Special Permits Granted in The Field of Industry and TradeDocument37 pagesSpecial Permits Granted in The Field of Industry and TradeBadar-Uugan GantumurNo ratings yet

- Important Provisions of Stamp Duty and RegistrationDocument39 pagesImportant Provisions of Stamp Duty and Registrationvidya adsuleNo ratings yet

- Process of 26QBDocument15 pagesProcess of 26QBthetrilight2023No ratings yet

- E-Auction Sonipat 21.10.2019Document15 pagesE-Auction Sonipat 21.10.2019Ashish DixitNo ratings yet

- Home LoanDocument130 pagesHome LoanAnkit ButtoliaNo ratings yet

- Contract To SellDocument4 pagesContract To SellPaulo HernandezNo ratings yet

- LONG TEST in FABM 2 1Document2 pagesLONG TEST in FABM 2 1Jannah Apple VillegasNo ratings yet

- Advance Receipt BlankDocument1 pageAdvance Receipt BlankRajesh VermaNo ratings yet

- Commissioner of Internal Revenue v. Pilipinas Shell Petroleum Corp.Document5 pagesCommissioner of Internal Revenue v. Pilipinas Shell Petroleum Corp.Carl IlaganNo ratings yet

- Moving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingDocument1 pageMoving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingAshraful IslamNo ratings yet

- 5Document33 pages5MirafelNo ratings yet

- AEC 215 MidFinals ExamDocument8 pagesAEC 215 MidFinals ExamHazel Seguerra BicadaNo ratings yet

- Mid-Term Test Tax517 June 2022Document8 pagesMid-Term Test Tax517 June 2022FeahRafeah KikiNo ratings yet

- A Global Guide To M&A - India: by Vivek Gupta and Rohit BerryDocument14 pagesA Global Guide To M&A - India: by Vivek Gupta and Rohit BerryvinaymathewNo ratings yet

- Adrian AGREEMENT FOR SALE FINAL Errol Thorne (1) .Doc - 0.odtDocument4 pagesAdrian AGREEMENT FOR SALE FINAL Errol Thorne (1) .Doc - 0.odtchalsieNo ratings yet

- Sadat Individal Assement. (Land)Document14 pagesSadat Individal Assement. (Land)nyamutoka rukiaNo ratings yet

Capital Gains Illustration

Capital Gains Illustration

Uploaded by

Sarvar PathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gains Illustration

Capital Gains Illustration

Uploaded by

Sarvar PathanCopyright:

Available Formats

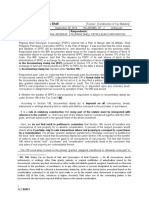

Q.1) Mr. Gavaskar purchased a residential house on 01/06/1979 for Rs.1,00,000.

He incurred

expenses of Rs.50,000 towards cost of improvement on 02/07/1983. The fair market value of

the house on 01/04/1981 was Rs.1,50,000. He sold the house on 10/10/2015 for Rs.30,00,000.

The cost inflation index for F.Y. 1981-82 is 100, for F.Y. 1983-84 IS 116 and for F.Y. 2015-16 is

1081.

You are required to compute his Capital Gain for Assessment Year 2016-17.

Solution:

Name of Assessee : Mr. Gavaskar

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Sale Consideration 30,00,000

Less: Index Cost of Acquisition (1,50,000 x 1081/100) 16,21,500

Less: Index Cost of Improvement (50,000 x 1081/116) 4,65,948

Long Term Capital Gain 9,12,552

Q.2) Mr. A purchased a house in December, 1975 for Rs.50,000. This property was gifted to his

friend Mr. B in July, 1985. The following expenses were incurred by Mr. A and Mr. B on

additions to the house.

1. Addition of one room by Mr. A in 1978-79 Rs.45,000.

2. Addition of two rooms by Mr. A in 1982-83 Rs.1,00,000.

3. Addition of three rooms by Mr. B in 1990-91 Rs.2,00,000.

Fair Market Value of the house on 1st April, 1981 was Rs.1,00,000. The property was sold for

Rs.40,00,000 in November, 2015.

Compute the taxable Capital Gains in the hands of Mr. B for the Assessment Year 2016-17.

Cost Inflation Index is as follows:

F.Y. 2015-16: 1081, F.Y. 1982-83: 109, F.Y. 1985-86: 133, F.Y. 1990-91: 182.

Solution:

Name of Assessee : Mr. A

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Tripathi Online Educare

1

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Sale Consideration 40,00,000

Less: Index Cost of Acquisition (1,00,000 x 1081/133) 8,12,782

Less: Index Cost of Improvement -

● 1982-83 (1,00,000 X 1081/109)

● 1990-91 (2,00,000 X 1081/182) 21,79,655

Long Term Capital Gain 10,07,563

Note: Expenditure before April 1, 1981 Rs. 45,000 (to be ignored).

Q.3) Mr. Kamlesh purchased a house property for Rs.1,00,000 on 27 August, 1978. He made

the following additions/ alterations to the house property.

1. Cost of construction of 1st floor in Financial Year 1983-84 - Rs.3,00,000

2. Cost of construction of 2nd floor in Financial Year 1990-91 - Rs.4,00,000

Fair Market Value of the property on 01/04/1981 was Rs.5,00,000. He sold the property on 20th

October, 2015 for Rs. 1,95,00,000. He paid the brokerage of Rs.55,000 for the sale transaction.

The Cost Inflation Index for F.Y.1981-82 is 100, F.Y.1983-84 is 116, F.Y.1990-91 is 182 and for

Financial Year 2015-16 is 1081.

Compute the Capital Gain of Mr. Kamlesh chargeable to tax for the Assessment Year 2016-17.

Solution:

Name of Assessee : Mr. Kamlesh

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Sale Consideration 1,95,00,000

Less: Expenses on Transfer (Brokerage) 55,000

Less: Index Cost of Acquisition (5,00,000 x 1081/100) 54,05,000

Less: Index Cost of Improvement -

● 1983-84 (3,00,000 X 1081/116) 27,95,690

● 1990-91 (4,00,000 X 1081/182) 23,75,824 51,71,514

Long Term Capital Gain 88,68,486

Q.4) Mr. Parag purchased a residential flat on 02/05/2014 for Rs.10,00,000. He paid on the

same day the stamp duty and registration charges of Rs.48,750 on purchase of flat. He sold the

Tripathi Online Educare

2

said flat on 17/03/2016 for Rs.12,00,000. The Cost Inflation Index for F.Y.2013-14 is 939 and for

F.Y. 2015-16 is 1081. Compute his Capital Gain Chargeable to tax for assessment year

2016-17.

Solution:

Name of Assessee : Mr. Parag

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (STCA):

Full Value of Sale Consideration 12,00,000

Less: Expenses on Transfer (Stamp Duty & Registration) 48,750

Less: Purchase Price 10,00,000

Short Term Capital Gain 1,51,250

Note: Since the capital asset is held for less than 36 months, it is short term capital asset hence

cost inflation index is not applicable.

Q.5) Mr. Dinesh Kamble purchased a house property for Rs.1,25,000 on 16 August 1971. He

made the following addition to the house property. Cost of construction of 1st floor in financial

year 1985-86 is Rs.2,25,000.The fair market value of the property on 01/04/1981 was

Rs.3,50,000. He sold the property on 15 September 2015 for Rs.85,00,000. He paid brokerage

of Rs.25,000 for the sale transaction.The cost inflation index for Financial Year 1981-82 is 100,

for Financial Year 1985-86 is 133 and Financial Year 2015-16 is 1081.

Compute the capital gains Mr. Dinesh Kamble chargeable to tax for Assessment Year 2016-17.

Solution:

Name of Assessee : Mr. Dinesh Kamble

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Sale Consideration 85,00,000

Less: Expenses on Transfer (Brokerage) 25,000

Less: Indexed Cost of Acquisition (3,50,000 x 1081/100) 37,83,500

Less: Indexed Cost of Improvement (2,25,000 x 1081/133) 18,28,759

Tripathi Online Educare

3

Long Term Capital Gain 28,62,741

Q.6) Ramesh purchased a vacant site for Rs.3,00,000 in April 1990. He constructed a

residential building during the year 2004-05 in the said site for Rs.15,00,000. He carried out

some further extension of a construction in the year 2007-08 for Rs.5,00,000. Dinesh sold the

residential building for Rs.65,00,000 in January 2016. Compute his long term capital gain, for

the assessment year 2016-17 based on the above information. The cost inflation index are as

follows:

Financial Year Cost Inflation Index

1990-91 182

2002-03 447

2004-05 480

2007-08 551

2015-16 1081

Solution:

Name of Assessee : Mr. Ramesh

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

Residential Building (LTCA):

Full Value of Sale Consideration 65,00,000

Less: Indexed Cost of Acquisition (3,00,000 x 1081/182) 17,81,868

Less: Indexed Cost of Improvement

● 2004-05 (15,00,000 x 1081/480) 33,78,125

● 2007-08 (5,00,000 x 1081/551) 9,80,944 43,59,069

Long Term Capital Gain 3,59,063

Q.7) Mr. Rakesh purchased a house property on 14 April, 1979 for Rs.50,000. Later on, he

gifted the house property to his friend Mr. A on 15th June, 1986. Following renovations were

carried out by Mr. Rakesh and Mr. A to the house property.

1. By Mr. Rakesh during F.Y. 1979-80 Rs.10,000

2. By Mr. Rakesh during F.Y. 1983-84 Rs.50,000

3. By Mr. A during F.Y. 1993-94 Rs.1,90,000

The fair market value of the property as on 01/04/1981 is Rs.70,000. The house was sold by Mr.

A to Mr. Sanjay on 2nd January, 2016 for a consideration of Rs.25,00,000. Compute the capital

gains of Mr. A for the assessment year 2016-17. Cost Inflation Indices are as under:

Financial Year Cost Inflation Index

1981-81 100

Tripathi Online Educare

4

1983-84 116

1986-87 140

1993-94 244

2015-16 1081

Solution:

Name of Assessee : Mr. Rakesh

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Sale Consideration 25,00,000

Less: Indexed Cost of Acquisition (70,000 x 1081/140) 5,40,500

Less: Indexed Cost of Improvement

● 1983-84 (50,000 x 1081/116) 4,65,948

● 1993-94 (1,90,000 x 1081/244) 8,41,762 13,07,710

Long Term Capital Gain 6,51,790

Q.8) Mr. Thomas inherited a house in Jaipur under will of his father in May, 2003. The house

was purchased by his father in January, 1981 for Rs.2,50,000. He invested an amount of

Rs.7,00,000 in construction of one more floor in this house in June, 2005. The house was sold

by him in November, 2015 for Rs.47,25,000. Brokerage Rs.37,500 was paid by Mr. Thomas to

Mr. Sunil. The market value of house as on 01/04/1981 was Rs.2,70,000.

You are required to compute the amount of capital gain chargeable to tax for A.Y.2016-17 with

the help of given information and by taking CII for F.Y.2015-16 as 1081, F.Y.2003-04 as 463

and for F.Y.2005-06 as 497.

Solution:

Name of Assessee : Mr. Thomas

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Sale Consideration 47,25,000

Less: Expenses on Transfer (Brokerage) 37,500

Tripathi Online Educare

5

Less: Indexed Cost of Acquisition (2,70,000 x 1081/100) 29,18,700

Less: Indexed Cost of Improvement (7,00,000 x 1081/497) 15,22,535

Long Term Capital Gain 2,46,265

Note: The house was inherited by Mr. Thomas under the will of his father and therefore the cost

incurred by the previous owner shall be taken as the cost. Value as on 01/04/1981 accordingly

shall be adopted as the cost of acquisition of the house property.

Q.9) M Ltd. has a residential property in Navi Mumbai (Cost of acquisition in 1982-83 is

Rs.1,00,000). This is compulsorily acquired by the Government of Maharashtra on December

15, 1989. The State Government of Maharashtra pays Rs.5,00,000 on March 23, 2016 as

compensation under an award. Determine the amount of capital gains chargeable to tax.

Solution:

Name of Assessee : Mr. M

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Compensation from the Government (received on 23/03/2016) 5,00,000

Less: Indexed Cost of Acquisition (1,00,000 x 172/109) 1,57,798

Long Term Capital Gain 3,42,202

Q.10) The Central Government acquires the property of Mr. Jayakishan on 1/6/1998. It was

purchased by him on 1/1/1992 for Rs.3,98,000. He had incurred expenses of Rs.99,500 on

making capital alterations to it during May 1997.

A compensation of Rs.10,00,000 was awarded to Mr. Jayakishan, which he received on

1/6/1998. He filed a suit against the Government for increasing the amount of compensation.

The High Court increased the compensation by Rs.2,00,000 on 01/01/2001 which was actually

received by Mr. Jayakishan on 1/1/2016. He had incurred Rs.10,000 as legal expenses in this

connection.

Calculate the amount of taxable capital gains.

Cost Inflation Index; 1991-92:199, 1997-98: 331, 1998-99: 351, 1999-2000: 389, 2000-01: 406,

and 2015-16: 1081).

Solution:

Name of Assessee : Mr. Jayakishan

Assessment Year : 1999-00

Previous Year : 1998-99

Tripathi Online Educare

6

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

Compulsory Acquisition:

Initial Compensation (received on 01/06/1998) 10,00,000

Less: Indexed Cost of Acquisition (3,98,000 x 351/199) 7,02,000

Less: Indexed Cost of Improvement (99,500 x 351/331) 1,05,512

Long Term Capital Gain 1,92,488

Name of Assessee : Mr. Jayakishan

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

Compulsory Acquisition:

Enhanced Compensation (received on 01/01/2016) 2,00,000

Less: Expenses incurred for obtaining enhanced compensation 10,000

Less: Cost of Acquisition NIL

Less: Cost of Improvement NIL

_______

Long Term Capital Gain 1,90,000

Q.11) Shri Ram Narayan owns a residential house which he purchased on 25/06/1978 for

Rs.1,50,000. He incurred expenses of Rs.50,000 towards Cost of Improvement on 20/08/1983

on this residential house. The fair market value of the house on 01/04/1981 was Rs.2,00,000.

He sold this house on 12/12/2015 for Rs.95,00,000. He purchased a new residential house for

Rs.25,00,000 on 20/03/2016.

The Cost Inflation Index for financial year 1981-82 is 100, for financial year 1983-84 is 116 and

for financial year 2015-16 is 1081.

You are required to compute the Taxable Capital Gain for the Assessment Year 2016-17.

Solution:

Name of Assessee : Shri Ram Narayan

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Tripathi Online Educare

7

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 95,00,000

Less: Indexed Cost of Acquisition (2,00,000 x 1081/100) 21,62,000

Less: Indexed Cost of Improvement (50,000 x 1081/116) 4,65,948

68,72,052

Less: Exemption u/s 54 for purchase of new residential house 25,00,000

Long Term Capital Gain 43,72,052

Q.12) Mr. Shanti Bhushan owns a house property which he acquired in April 1976 for Rs.

2,50,000. The cost of improvement incurred for this property in August 1996 was Rs.2,80,000.

He sold this property in October 2015 for Rs.94,00,000. He acquired a new house property

during January 2016 for Rs.5,00,000.

Compute the taxable Capital Gain for the Assessment Year 2016-17 on the assumption that the

fair market value of the property as on 01/04/1981 was Rs.7,00,000.

The cost inflation index of financial year 1981-82 is 100 for financial year 1996-97 is 305 and

financial year 2015-16 is 1081.

Solution:

Name of Assessee : Mr. Shanti Bhushan

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 94,00,000

Less: Indexed Cost of Acquisition (7,00,000 x 1081/100) 75,67,000

Less: Indexed Cost of Improvement (2,80,000 x 1081/305) 9,92,393

8,40,607

Less: Exemption u/s 54 for purchase of new house 5,00,000

Long Term Capital Gain 3,40,607

Q.13) Mr. Prakash Shetya purchased a house property for Rs.15,00,000 on 5th October, 1972.

He constructed a first floor during the financial year 1986-87 for Rs.5,50,000. He made further

Tripathi Online Educare

8

improvement in the financial year 1992-93 for Rs.8,00,000. He constructed 2nd floor during the

financial year 2003-04 for Rs.12,00,000. He sold the property on 01/02/2016 for Rs.350 lakhs.

He paid brokerage of Rs.50,000 for the sale transaction. Fair market value of property as on

01/04/1981 was 16,00,000. Investment in new house property was Rs.25 lakhs on 10/03/2016.

Compute his capital Gain for the Assessment year 2016-17.

Relevant cost inflation indices are as follows:

Financial Year Cost Inflation Index

1981-82 100

1986-87 140

1992-93 223

2003-04 463

2015-16 1081

Solution:

Name of Assessee : Mr. Prakash Shetya

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 3,50,00,000

Less: Expenses on Transfer (Brokerage) 50,000

Less: Indexed Cost of Acquisition (16,00,000 x 1081/100) 1,72,96,000

Less: Indexed Cost of Improvement

● 1986-87 (5,50,000 x 1081/140) 42,46,786

● 1992-93 (8,00,000 x 1081/223) 38,78,027

● 2003-04 (12,00,000 x 1081/463) 28,01,728 2,82,72,540

67,27,460

Less: Exemption u/s 54 for purchase of new house 25,00,000

Long Term Capital Gain 42,27,460

Q.14) Ms. Vimla sold a residential building at Jodhpur for Rs.35,00,000 on 01/07/2015. The

building was acquired for Rs.1,50,000 on 01/06/1996. She paid brokerage Rs.30,000 at the time

of sale of the building. She invested Rs.7 lakhs in purchase of a residential building in

December 2015. Compute her taxable Capital Gain.

Solution:

Name of Assessee : Ms. Vimla

Assessment Year : 2016-17

Previous Year : 2015-16

Tripathi Online Educare

9

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

Residential Building (LTCA):

Full Value of Consideration 35,00,000

Less: Expenses on Transfer (Brokerage) 30,000

Less: Indexed Cost of Acquisition (1,50,000 x 1081/305) 5,31,639

29,38,361

Less: Exemption u/s 54 for purchase of new residential building 7,00,000

Long Term Capital Gain 22,38,361

Q.15) Mr. Sunder furnishes the following particulars for the previous year ending 31/03/2016

and requests you to compute the taxable capital gain:

1. He had a residential house, inherited from father in March 1990, the fair market value of

which as on 01/04/1981 is Rs.5 lakhs. It was acquired by his father in 1970.

2. In the year 1992-93, further construction and improvements cost Rs.6 lakhs.

3. On 10/05/2015 the house was sold for Rs.90 lakhs. Expenditure in connection with

transfer Rs.50,000.

4. On 20/12/2015, he purchased a residential house for Rs.15 lakhs.

Cost Inflation Index:

1981-81: 100

1989-90: 172

1992-93: 223

2015-16: 1081

Solution:

Name of Assessee : Mr. Sunder

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 90,00,000

Less: Expenses on Transfer (Brokerage) 50,000

Less: Indexed Cost of Acquisition (5,00,000 x 1081/172) 31,42,442

Less: Indexed Cost of Improvement (6,00,000 x 1081/223) 29,08,520

Tripathi Online Educare

10

28,99,038

Less: Exemption u/s 54 for purchase of new house 15,00,000

Long Term Capital Gain 13,99,038

Q.16) Mr. Vinod Mohite purchased a residential house on 01/06/1979 for Rs.1,00,000. He

incurred expenses of Rs.50,000 towards cost of improvement on 02/07/1983 on this house. The

fair market value of the house on 01/04/1981 was Rs.1,50,000. He sold the house on

10/10/2015 for Rs.70,00,000. He purchased a new residential house for Rs. 20,00,000 on

15/03/2016.

The cost inflation index for financial year 1981-82 is 100, for financial year 1983-84 is 116 and

for financial year 2015-16 is 1081.

You are required to compute his income from Capital Gain for the assessment year 2016-17.

Solution:

Name of Assessee : Mr. Vinod

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 70,00,000

Less: Indexed Cost of Acquisition (1,50,000 x 1081/100) 16,21,500

Less: Indexed Cost of Improvement (50,000 x 1081/116) 4,65,948

49,12,552

Less: Exemption u/s 54 for purchase of new house 20,00,000

Long Term Capital Gain 29,12,552

Q.17) Mr. Selvan, acquired a residential house in January, 2000 for Rs.10,00,000 and made

some improvements by way of additional construction to the house, incurring expenditure of

2,00,000 in October, 2004. He sold the house property in October, 2015 for Rs.80,00,000. He

acquired a residential house in January, 2016 for Rs.25,00,000. Compute the capital gain

chargeable to tax for the assessment year 2016-17.

Cost Inflation Index: financial year 1999-00 = 389, financial year 2004-05 = 480, financial year

2010-11 = 711, financial year 2015-16 = 1081.

Solution:

Name of Assessee : Mr. Selvan

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Tripathi Online Educare

11

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 80,00,000

Less: Indexed Cost of Acquisition (10,00,000 x 1081/389) 27,78,920

Less: Indexed Cost of Improvement (2,00,000 x 1081/480) 4,50,417

47,70,663

Less: Exemption u/s 54 for purchase of new house 25,00,000

Long Term Capital Gain 22,70,663

Q.18) Mr. Chandru transferred his residential house property on 28/10/2015 for Rs.100 lakhs.

The site was acquired for Rs.9,99,300 on 30/06/2000. He deposited Rs.50 lakhs in eligible

bonds issued by Rural Electrification Corporation (REC) on 20/03/2016. Again, he deposited

Rs.20 lakhs in eligible bonds issued by National Highways Authority of India (NHAI) on

16/04/2016. Compute Capital Gains of Mr. Chandru for the assessment year 2016-17.

Solution:

Name of Assessee : Mr. Chandru

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 1,00,00,000

Less: Indexed Cost of Acquisition (9,99,300 x 1081/406) 26,60,698

73,39,002

Less: Exemption u/s 54 EC

● RECL Bonds 50,00,000

● NHAI Bonds (Not Allowed) NIL 50,00,000

Long Term Capital Gain 23,39,302

Note:

1. In order to claim exemption u/s 54 EC, Mr. Chandru has to invest in specified bonds of

RECL or NHAI within a period of 6 months from the date of transfer of the asset.

2. However, investment made in such bonds by an assessee during this and the next

financial year cannot exceed Rs.50 lakhs.

3. In this case, Mr. Chandru has invested Rs. 50 lakhs in RECL bonds in the financial year

2015-16 and Rs. 20 lakhs in NHAI bonds in the financial year 2016-17.

Tripathi Online Educare

12

4. He is eligible to claim exemption of only Rs.50 lakhs u/s 54 EC.

Q.19) Mr. Ram, working as a CEO with ABC Ltd., furnishes the following particulars of assets

transferred by him during the P.Y. 2015-16.

Particulars Date of Rs.

Transfer

1. A residential house in Bangalore which he had

purchased in February, 2000 at a cost of Rs.15,56,000. 13/01/2016 1,45,00,000

2. Listed shares of Indian companies purchased in May

2012 at a cost of Rs.1 lakh. 14/02/2016 2,00,000

3. Unlisted shares purchased in May 2012 at a cost of

Rs.50,000. 14/02/2016 75,000

4. Units of Equity oriented fund purchased in May 2015 at

a cost of Rs.30,000. 14/02/2016 65,000

5. Units of debt oriented fund purchased in January 2010

at a cost of Rs.31,600. 14/02/2016 75,000

Mr. Ram made the following investment, out of the capital gains arising on sale of residential

house.

1. Purchased a residential flat in Pune on 21/05/2016 Rs.35,00,000.

2. Purchased a residential flat in Madurai on 14/07/2016 Rs.25,00,000.

3. 3 year bonds of NHAI on 20/03/2016 Rs.40,00,000.

4. 3 year bonds of RECL on 15/05/2016 Rs.30,00,000.

Compute the capital gains chargeable to tax of Mr. Ram for A.Y. 2016-17.

Cost inflation index of financial year 1999-2000: 389, financial year 2009-10: 632, financial year

2012-13: 852, financial year 2015-16: 1081.

Solution:

Name of Assessee : Mr. Ram

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs. Rs.

House Property (LTCA):

Full Value of Consideration 1,45,00,000

Less: Indexed Cost of Acquisition (15,56,000 x

1081/389) 43,24,000

1,01,76,000

Less: Exemption u/s 54

● Investment in one residential house (it is

Tripathi Online Educare

13

more beneficial to claim exemption in respect

of investment in residential flat at Pune) 35,00,00

● Investment in bonds of NHAI/RECL 0

(aggregate investment to be restricted to

Rs.50 lakh) 85,00,000

Long Term Capital Gain 50,00,00 16,76,000

0

Unlisted Shares (STCA):

Full Value of Consideration 75,000

Less: Cost of Acquisition 50,000

Short Term Capital Gain 25,000

Units of Debt-oriented Fund (LTCA):

Full Value of Consideration 75,000

Less: Indexed Cost of Acquisition(31,600 x 54,050

1081/632) 20,950

Long Term Capital Gain

Note: Capital gain on sale of listed equity shares and units of equity oriented fund held for more

than 12 months is long term capital gain and hence exempt u/s 10(38).

Q.20) Mr. Martin sold his residential house property on 08/06/2015 for Rs.80 lakhs which was

purchased by him for Rs.20 lakhs on 05/05/2005. He paid Rs.1 lakh as brokerage for the sale of

said property. He bought another House Property on 25/12/2015 for Rs.25 lakhs. He deposited

Rs.10 lakhs on 10/11/2015 in the Capital Gain Bond of National Highway Authority of India

(NHAI).

Compute Income under the head “Capital Gain: for assessment year 2016-17 as per Income

Tax Act 1961. Cost Inflation Index for financial year 2005-06 = 497 and 2015-16 = 1081.

Solution:

Name of Assessee : Mr. Martin

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Capital Gain

Particulars Rs. Rs.

House Property (LTCA):

Full Value of Consideration 80,00,000

Less: Expenses on Transfer 1,00,000

Less: Indexed Cost of Acquisition (20,00,000 x 1081/497) 43,50,100

35,49,900

Less: Exemption u/s 54 (Purchase of New House) 25,00,000

Less: Exemption u/s 54EC (Investment in NHAI bond, is

Tripathi Online Educare

14

eligible as made within 6 months from date of transfer) 10,00,000 35,00,000

Long Term Capital Gain 49,900

Tripathi Online Educare

15

You might also like

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- Salaries NotesDocument48 pagesSalaries Notesbhatiasanjay89No ratings yet

- New Product DevelopmentDocument18 pagesNew Product DevelopmentSarvar PathanNo ratings yet

- Exempt IncomeDocument18 pagesExempt IncomeSarvar PathanNo ratings yet

- Sale Agreement of Immovable Property For Rs.Document6 pagesSale Agreement of Immovable Property For Rs.Anjanikumar BojjanapalliNo ratings yet

- Gift DeedDocument3 pagesGift DeedHamid Ali ArainNo ratings yet

- Documentary Stamp Tax PDFDocument5 pagesDocumentary Stamp Tax PDFMark Rainer Yongis LozaresNo ratings yet

- Capital Gain Sums With SolutionDocument10 pagesCapital Gain Sums With Solutionkomil bogharaNo ratings yet

- Problems On Taxable Salary Income Additional PDFDocument24 pagesProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068No ratings yet

- Income From Other Sources IllustrationDocument5 pagesIncome From Other Sources IllustrationSarvar PathanNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- 2.3 Solutions Module - 2 PDFDocument9 pages2.3 Solutions Module - 2 PDFArpita Artani100% (1)

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Cost & Finance RTP Nov 15Document41 pagesCost & Finance RTP Nov 15Aaquib ShahiNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Chapter 2 - Income From House Property - NotesDocument27 pagesChapter 2 - Income From House Property - NotesRahul Tiwari50% (2)

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Working Capital Mgt. - Unit 5Document23 pagesWorking Capital Mgt. - Unit 5DrShailesh Singh Thakur100% (2)

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- House Property 1Document14 pagesHouse Property 1Sarvar Pathan100% (3)

- Consignment - SolutionDocument18 pagesConsignment - Solution203 596 Reuben RoyNo ratings yet

- Introduction To Cost and Management Accounting: Question-1Document32 pagesIntroduction To Cost and Management Accounting: Question-1Alvarez StarNo ratings yet

- Module 6Document50 pagesModule 6rohit saini75% (4)

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- UNIT 3 Income From House PropertyDocument104 pagesUNIT 3 Income From House Propertydob BoysNo ratings yet

- Chapter 11 Hire Purchase and Instalment Sale Transactions PDFDocument52 pagesChapter 11 Hire Purchase and Instalment Sale Transactions PDFEswari GkNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Study Note 4.4 Page (264-289)Document26 pagesStudy Note 4.4 Page (264-289)s4sahith75% (24)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Unit2: Treatment of Goodwill in Partnership AccountsDocument27 pagesUnit2: Treatment of Goodwill in Partnership AccountsJavid QuadirNo ratings yet

- Income From Other SourcesDocument11 pagesIncome From Other Sourcessrocky2000100% (1)

- Problems On Internal ReconstructionDocument24 pagesProblems On Internal ReconstructionYashodhan Mithare100% (5)

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- CG Extra SumsDocument19 pagesCG Extra SumsPruthil Monpariya50% (2)

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- CHAP - 5 SalaryDocument44 pagesCHAP - 5 Salarypriya chauhanNo ratings yet

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeeNo ratings yet

- Chapter 12 Service CostingDocument3 pagesChapter 12 Service CostingMS Raju100% (1)

- Holding Companies: Problems and Solutions - AccountingDocument17 pagesHolding Companies: Problems and Solutions - AccountingVaibhav MaheshwariNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- IT AY 23-24 Probs On Cap GainDocument5 pagesIT AY 23-24 Probs On Cap Gainlokeshwarareddy1999No ratings yet

- Mi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverDocument2 pagesMi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverSarvar PathanNo ratings yet

- E-Way Bill System PDFDocument1 pageE-Way Bill System PDFSarvar PathanNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- Facility LocationDocument22 pagesFacility LocationSarvar PathanNo ratings yet

- 1b. Production SystemsDocument13 pages1b. Production SystemsSarvar PathanNo ratings yet

- 5b. Capacity PlanningDocument21 pages5b. Capacity PlanningSarvar PathanNo ratings yet

- 1c.OM - Strategy-Rev-2020 - BVRMDocument24 pages1c.OM - Strategy-Rev-2020 - BVRMSarvar PathanNo ratings yet

- SalaryDocument29 pagesSalarySarvar PathanNo ratings yet

- Asian Paints (Rakesh Painter)Document2 pagesAsian Paints (Rakesh Painter)Sarvar PathanNo ratings yet

- Acknowledgement of Online Application For Services On Existing DLDocument1 pageAcknowledgement of Online Application For Services On Existing DLSarvar PathanNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Residential StatusDocument4 pagesResidential StatusSarvar PathanNo ratings yet

- Residential Status True or FalseDocument2 pagesResidential Status True or FalseSarvar PathanNo ratings yet

- Residential Status FibDocument1 pageResidential Status FibSarvar PathanNo ratings yet

- House Property 1Document14 pagesHouse Property 1Sarvar Pathan100% (3)

- Income From Other Sources IllustrationDocument5 pagesIncome From Other Sources IllustrationSarvar PathanNo ratings yet

- Residential StatusDocument17 pagesResidential StatusSarvar PathanNo ratings yet

- Important Theory Questions: Tripathi Online EducareDocument1 pageImportant Theory Questions: Tripathi Online EducareSarvar PathanNo ratings yet

- Income From Other SourcesDocument10 pagesIncome From Other SourcesSarvar PathanNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesSarvar PathanNo ratings yet

- Heads of IncomeDocument1 pageHeads of IncomeSarvar PathanNo ratings yet

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- Business IncomeDocument15 pagesBusiness IncomeSarvar PathanNo ratings yet

- DeductionsDocument9 pagesDeductionsSarvar PathanNo ratings yet

- Everything You Wanted To Know About Stamp Duty: Article No. Description of InstrumentDocument8 pagesEverything You Wanted To Know About Stamp Duty: Article No. Description of InstrumentAbhishek YadavNo ratings yet

- 1014 - Law of RegistrationDocument22 pages1014 - Law of Registrationbhavitha birdalaNo ratings yet

- Form No. 9 Release of A LegacyDocument1 pageForm No. 9 Release of A LegacySudeep SharmaNo ratings yet

- Sale DeedDocument33 pagesSale DeedSofia KaushalNo ratings yet

- Deed of Covenant To Accompany Statutory Mortgage of Ship: Form No. 5Document7 pagesDeed of Covenant To Accompany Statutory Mortgage of Ship: Form No. 5Sudeep SharmaNo ratings yet

- Rectification of Registered DeedDocument2 pagesRectification of Registered DeedRajesh GhoseNo ratings yet

- BIR Ruling (DA - (C-338) 819-09) Ellimac Prime Holdings, IncDocument5 pagesBIR Ruling (DA - (C-338) 819-09) Ellimac Prime Holdings, IncKriszan ManiponNo ratings yet

- Letter of Intent To BuyDocument4 pagesLetter of Intent To BuyBrenner BolasocNo ratings yet

- BIR EscrowDocument20 pagesBIR Escrowlorkan19No ratings yet

- Commissioner of Internal Revenue vs. LA Tondeña Distillers, Inc. (LTDI (Now Ginebra San Miguel) ) - GR No. 175188 - Jul. 15, 2015Document8 pagesCommissioner of Internal Revenue vs. LA Tondeña Distillers, Inc. (LTDI (Now Ginebra San Miguel) ) - GR No. 175188 - Jul. 15, 2015Kristel Anne LiwagNo ratings yet

- Idbi Bank Office Premises RequiredDocument16 pagesIdbi Bank Office Premises RequiredJashanNo ratings yet

- Special Permits Granted in The Field of Industry and TradeDocument37 pagesSpecial Permits Granted in The Field of Industry and TradeBadar-Uugan GantumurNo ratings yet

- Important Provisions of Stamp Duty and RegistrationDocument39 pagesImportant Provisions of Stamp Duty and Registrationvidya adsuleNo ratings yet

- Process of 26QBDocument15 pagesProcess of 26QBthetrilight2023No ratings yet

- E-Auction Sonipat 21.10.2019Document15 pagesE-Auction Sonipat 21.10.2019Ashish DixitNo ratings yet

- Home LoanDocument130 pagesHome LoanAnkit ButtoliaNo ratings yet

- Contract To SellDocument4 pagesContract To SellPaulo HernandezNo ratings yet

- LONG TEST in FABM 2 1Document2 pagesLONG TEST in FABM 2 1Jannah Apple VillegasNo ratings yet

- Advance Receipt BlankDocument1 pageAdvance Receipt BlankRajesh VermaNo ratings yet

- Commissioner of Internal Revenue v. Pilipinas Shell Petroleum Corp.Document5 pagesCommissioner of Internal Revenue v. Pilipinas Shell Petroleum Corp.Carl IlaganNo ratings yet

- Moving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingDocument1 pageMoving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingAshraful IslamNo ratings yet

- 5Document33 pages5MirafelNo ratings yet

- AEC 215 MidFinals ExamDocument8 pagesAEC 215 MidFinals ExamHazel Seguerra BicadaNo ratings yet

- Mid-Term Test Tax517 June 2022Document8 pagesMid-Term Test Tax517 June 2022FeahRafeah KikiNo ratings yet

- A Global Guide To M&A - India: by Vivek Gupta and Rohit BerryDocument14 pagesA Global Guide To M&A - India: by Vivek Gupta and Rohit BerryvinaymathewNo ratings yet

- Adrian AGREEMENT FOR SALE FINAL Errol Thorne (1) .Doc - 0.odtDocument4 pagesAdrian AGREEMENT FOR SALE FINAL Errol Thorne (1) .Doc - 0.odtchalsieNo ratings yet

- Sadat Individal Assement. (Land)Document14 pagesSadat Individal Assement. (Land)nyamutoka rukiaNo ratings yet