Professional Documents

Culture Documents

53 Copy of 18 Tax Comp Calculation

53 Copy of 18 Tax Comp Calculation

Uploaded by

Abhilash KumbleCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- United Pass Travel Guide 2015 - Edited July 2015Document4 pagesUnited Pass Travel Guide 2015 - Edited July 2015taptico100% (2)

- Impact of GST On Small and Medium EnterprisesDocument5 pagesImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- PAN Changes or CorrectionDocument2 pagesPAN Changes or Correctionsolanki7585No ratings yet

- Audit Special All Expenses Detail FormatsDocument31 pagesAudit Special All Expenses Detail Formatssolanki7585No ratings yet

- Allowable Dedcutions - Estate TaxDocument1 pageAllowable Dedcutions - Estate TaxJorel DiocolanoNo ratings yet

- 2019 Ust Pre Week Taxation LawDocument36 pages2019 Ust Pre Week Taxation Lawdublin80% (20)

- DocBuilder InvoiceDocument1 pageDocBuilder InvoiceNayem Al ImranNo ratings yet

- SAP - SD - Whitepaper-Down Payment Request With Billing PlanDocument3 pagesSAP - SD - Whitepaper-Down Payment Request With Billing Plansmiti84No ratings yet

- WHT Chart Subj Wise TY - 2022Document8 pagesWHT Chart Subj Wise TY - 2022Anam IqbalNo ratings yet

- Important Points On International TaxationDocument3 pagesImportant Points On International TaxationPadma Charan SahuNo ratings yet

- CH - 01 Introduction, Overview and Evolution of GST - MCQDocument5 pagesCH - 01 Introduction, Overview and Evolution of GST - MCQSanket MhetreNo ratings yet

- Trial Balance TIARA IQLIMAH XII AKL1Document1 pageTrial Balance TIARA IQLIMAH XII AKL1Tiara IqlimahNo ratings yet

- Invoice20 11 20RDocument1 pageInvoice20 11 20Rhendra eka putraNo ratings yet

- Cash Flow 1st QuarterDocument3 pagesCash Flow 1st Quarterslipjay16No ratings yet

- Lucky Tiger Casino Card Authentication: XX XXXXDocument1 pageLucky Tiger Casino Card Authentication: XX XXXXบ่จัก ดอกNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- TEMPLATE PO 1.xlsx CV - MerdekaDocument5 pagesTEMPLATE PO 1.xlsx CV - Merdekahusen alhusadaNo ratings yet

- Fatima Hassan PDFDocument1 pageFatima Hassan PDFHassan ImranNo ratings yet

- Etextbook 978 0134105857 Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates TrustsDocument62 pagesEtextbook 978 0134105857 Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates Trustslashawn.fain938100% (60)

- Climax TextDocument2 pagesClimax TextRajkumarNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- Attributes or Essential Characteristics (SLEP)Document11 pagesAttributes or Essential Characteristics (SLEP)Carina Amor ClaveriaNo ratings yet

- Sang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial StatementsDocument2 pagesSang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial Statementssangryul anNo ratings yet

- Additional Withdrawal Firing and RappellingDocument3 pagesAdditional Withdrawal Firing and RappellingPSBRC ZEROTWONo ratings yet

- SAP Automatic Payment ProgramDocument13 pagesSAP Automatic Payment Programmpsingh1122No ratings yet

- Developments: .,',LJL .TDocument12 pagesDevelopments: .,',LJL .Thassan benqaddourNo ratings yet

- KRW - South Korean Won: Top KRW Exchange RatesDocument2 pagesKRW - South Korean Won: Top KRW Exchange RatesFriktNo ratings yet

- URSP - Billing Invoice - Homeworld Surveillance 2021Document1 pageURSP - Billing Invoice - Homeworld Surveillance 2021Julie Ann TolosaNo ratings yet

- 2021 - Robinhood Securities 1099Document8 pages2021 - Robinhood Securities 1099Estranged GedNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Income Taxation Final Exam Please Show Solution (If Necessary)Document5 pagesIncome Taxation Final Exam Please Show Solution (If Necessary)E. RobertNo ratings yet

53 Copy of 18 Tax Comp Calculation

53 Copy of 18 Tax Comp Calculation

Uploaded by

Abhilash KumbleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

53 Copy of 18 Tax Comp Calculation

53 Copy of 18 Tax Comp Calculation

Uploaded by

Abhilash KumbleCopyright:

Available Formats

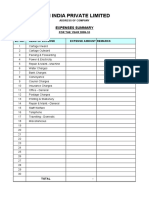

AY 2009 - 2010.

Income Tax computation For Males

I Income From Salary -

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000) -

Let Out Property

Rent Received

Less: Municipal Taxes

GAV -

Less:30% deduction -

Less: Interest paid (No limit) - -

III Income from Business/Profession

Net surplus

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses -

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition - -

V Income From other sources

Bank Interest

Any other -

Gross Total Income -

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments -

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U -

Net Total Income -

Rounded of Income -

Tax on Short term gains - -

Tax on Long term gains (with Indexation) - -

Tax on Normal Income - 0 -

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess -

Total Tax Liability -

Less: TDS -

Advance Tax

Self assesment Tax -

Tax Payable/ (refund) -

AY 2009 - 2010.

Income Tax computation For Females

I Income From Salary 0

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000)

Let Out Property

Rent Received

Less: Municipal Taxes

GAV 0

Less:30% deduction 0

Less: Interest paid (No limit) 0 0

III Income from Business/Profession

Net surplus

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses 0

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition 0 0

V Income From other sources

Bank Interest

Any other 0

Gross Total Income 0

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 0

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U 0

Net Total Income 0

Rounded of Income 0

Tax on Short term gains 0 0

Tax on Long term gains (with Indexation) 0 0

Tax on Normal Income 0 0 0

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess 0

Total Tax Liability 0

Less: TDS 0

Advance Tax

Self assesment Tax 0

Tax Payable/ (refund) 0

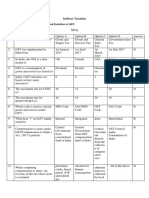

AY 2010-11

Income Tax computation For Males

I Income From Salary 384,519

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000) -

Let Out Property

Rent Received

Less: Municipal Taxes

GAV -

Less:30% deduction -

Less: Interest paid (No limit) - -

III Income from Business/Profession

Net surplus -

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses -

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition - -

V Income From other sources

Bank Interest

Any other -

Gross Total Income 384,519

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 50,000

(Upto Rs100,000)

U/s 80 D 150,000

Mediclaim 25,000

Other 80G, 80E, 80U 225,000

Net Total Income 159,519

Rounded of Income 159,520

Tax on Short term gains - -

Tax on Long term gains (with Indexation) - -

Tax on Normal Income 159,520 0 -

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess -

Total Tax Liability -

Less: TDS -

Advance Tax

Self assesment Tax -

Tax Payable/ (refund) -

AY 2010-11

Income Tax computation For Females

I Income From Salary 0

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000)

Let Out Property

Rent Received

Less: Municipal Taxes

GAV 0

Less:30% deduction 0

Less: Interest paid (No limit) 0 0

III Income from Business/Profession

Net surplus

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses 0

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition 0 0

V Income From other sources

Bank Interest

Any other 0

Gross Total Income 0

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 0

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U 0

Net Total Income 0

Rounded of Income 0

Tax on Short term gains 0 0

Tax on Long term gains (with Indexation) 0 0

Tax on Normal Income 0 0 0

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess 0

Total Tax Liability 0

Less: TDS 0

Advance Tax

Self assesment Tax 0

Tax Payable/ (refund) 0

AY 2010 - 2011.

Income Tax computation For Senior Citizens

I Income From Salary 384,519

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000)

Let Out Property

Rent Received

Less: Municipal Taxes

GAV 0

Less:30% deduction 0

Less: Interest paid (No limit) 0 0

III Income from Business/Profession

Net surplus 0

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses 0

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition 0 0

V Income From other sources

Bank Interest

Any other 0

Gross Total Income 384,519

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 0

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U 0

Net Total Income 384,519

Rounded of Income 384,520

Tax on Short term gains 0 0

Tax on Long term gains (with Indexation) 0 0

Tax on Normal Income 384,520 22,904 22,904

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess 687

Total Tax Liability 23,591

Less: TDS 0

Advance Tax

Self assesment Tax 0

Tax Payable/ (refund) 23,591

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- United Pass Travel Guide 2015 - Edited July 2015Document4 pagesUnited Pass Travel Guide 2015 - Edited July 2015taptico100% (2)

- Impact of GST On Small and Medium EnterprisesDocument5 pagesImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- PAN Changes or CorrectionDocument2 pagesPAN Changes or Correctionsolanki7585No ratings yet

- Audit Special All Expenses Detail FormatsDocument31 pagesAudit Special All Expenses Detail Formatssolanki7585No ratings yet

- Allowable Dedcutions - Estate TaxDocument1 pageAllowable Dedcutions - Estate TaxJorel DiocolanoNo ratings yet

- 2019 Ust Pre Week Taxation LawDocument36 pages2019 Ust Pre Week Taxation Lawdublin80% (20)

- DocBuilder InvoiceDocument1 pageDocBuilder InvoiceNayem Al ImranNo ratings yet

- SAP - SD - Whitepaper-Down Payment Request With Billing PlanDocument3 pagesSAP - SD - Whitepaper-Down Payment Request With Billing Plansmiti84No ratings yet

- WHT Chart Subj Wise TY - 2022Document8 pagesWHT Chart Subj Wise TY - 2022Anam IqbalNo ratings yet

- Important Points On International TaxationDocument3 pagesImportant Points On International TaxationPadma Charan SahuNo ratings yet

- CH - 01 Introduction, Overview and Evolution of GST - MCQDocument5 pagesCH - 01 Introduction, Overview and Evolution of GST - MCQSanket MhetreNo ratings yet

- Trial Balance TIARA IQLIMAH XII AKL1Document1 pageTrial Balance TIARA IQLIMAH XII AKL1Tiara IqlimahNo ratings yet

- Invoice20 11 20RDocument1 pageInvoice20 11 20Rhendra eka putraNo ratings yet

- Cash Flow 1st QuarterDocument3 pagesCash Flow 1st Quarterslipjay16No ratings yet

- Lucky Tiger Casino Card Authentication: XX XXXXDocument1 pageLucky Tiger Casino Card Authentication: XX XXXXบ่จัก ดอกNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- TEMPLATE PO 1.xlsx CV - MerdekaDocument5 pagesTEMPLATE PO 1.xlsx CV - Merdekahusen alhusadaNo ratings yet

- Fatima Hassan PDFDocument1 pageFatima Hassan PDFHassan ImranNo ratings yet

- Etextbook 978 0134105857 Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates TrustsDocument62 pagesEtextbook 978 0134105857 Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates Trustslashawn.fain938100% (60)

- Climax TextDocument2 pagesClimax TextRajkumarNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- Attributes or Essential Characteristics (SLEP)Document11 pagesAttributes or Essential Characteristics (SLEP)Carina Amor ClaveriaNo ratings yet

- Sang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial StatementsDocument2 pagesSang Ryul Paradise Beach Resort, Inc.: Statement of Management'S Responsibility For Financial Statementssangryul anNo ratings yet

- Additional Withdrawal Firing and RappellingDocument3 pagesAdditional Withdrawal Firing and RappellingPSBRC ZEROTWONo ratings yet

- SAP Automatic Payment ProgramDocument13 pagesSAP Automatic Payment Programmpsingh1122No ratings yet

- Developments: .,',LJL .TDocument12 pagesDevelopments: .,',LJL .Thassan benqaddourNo ratings yet

- KRW - South Korean Won: Top KRW Exchange RatesDocument2 pagesKRW - South Korean Won: Top KRW Exchange RatesFriktNo ratings yet

- URSP - Billing Invoice - Homeworld Surveillance 2021Document1 pageURSP - Billing Invoice - Homeworld Surveillance 2021Julie Ann TolosaNo ratings yet

- 2021 - Robinhood Securities 1099Document8 pages2021 - Robinhood Securities 1099Estranged GedNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Income Taxation Final Exam Please Show Solution (If Necessary)Document5 pagesIncome Taxation Final Exam Please Show Solution (If Necessary)E. RobertNo ratings yet