Professional Documents

Culture Documents

Be Creative in Tough Economic Times

Be Creative in Tough Economic Times

Uploaded by

John SnowOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Be Creative in Tough Economic Times

Be Creative in Tough Economic Times

Uploaded by

John SnowCopyright:

Available Formats

Be creative in tough economic times

As a principal analyst at Informa Telecoms & Media, Dr. Malik Kamal-Saadi provides thought leadership across different

sectors of the global telecommunications industry including Devices, Networks & Infrastructure, and Multimedia Services.

COMMUNICATE caught up with Dr. Kamal-Saadi at 2009 Huawei Global Analyst Summit and shared his views on some

of the hot topics in the mobile telecom industry.

By Julia Yao

COMMUNICATE: How do you or reduce the decline of these revenues. 2G and 3G+ network operations, which

believe the financial downturn will not only enables bandwidth management,

impact the telecom market both in COMMUNICATE: In your opinion, but also power management shared across

the short and long term? Specifically, what technologies have most viability different technologies. That is the key

how does it effect operators’ network for mobile operators, and what are the important differentiator compared to your

deployment? adoption trends of those? competitors.

Dr. Malik Kamal-Saadi: So far the Dr. Malik Kamal-Saadi: I will talk

telecom industry seems to be more about solutions instead of technology. In COMMUNICATE: Beyond

resilient to the economic downturn than fact, operators are looking for solutions technologies, what are the creative

any other business. Having said that, the that could help them maintain the models and solutions for mobile

investor community judges operators on balance between reducing the total cost of network deployment in the industry?

their ability to generate free cash flow at ownership (TCO) and keeping up with Dr. Malik Kamal-Saadi: I will talk

country rates. For that reason, operators innovation to answer their subscribers’ about three creative models right now.

are quite vigilant and are trying to better needs in terms of future generation These are not technology related, but are

control their CAPEX and OPEX. They services. So in current economic slowdown, more business models. Network sharing

are currently putting contingency plans keeping that balance is key for operators to is one of them. There is a huge trend in

in place to protect their cash flow in make their buying decision. Good example Europe towards shared networks. Here, I

case of economic headwind. They are is the success of your own SingleRAN can see SingleRAN playing a great role in

well prepared to reduce the TCO if solutions. I am personally impressed about facilitating the roaming across different

their margins are threatened by revenue what it has been demonstrated to me shared networks. Managed Services is

weakness or an inflationary cost base. while at Huawei Global Industry Analyst another huge trend, happening again

A number of operators have already Summit. In addition, from the feedback I in Europe but also in other parts of the

reduced their CAPEX and OPEX spending have heard, SingleRAN is indeed providing world. The last trend is towards integration

this year by 10% to up to 30% in some the right balance between reducing the rather than deploying separate equipment

cases and the trend will continue in 2010 TCO and helping operators to keep up to support different networks. Integration

and maybe beyond. Operators are slowing with innovation. is a trend, because it provides a lot of

down their spending mainly on next cost savings throughout product lifecycle

generation networks’ equipment but they COMMUNICATE: What is your compared with modular solutions. In

seem to be willing to spend in any solution ranking and forecast of Huawei’s addition, integrated solutions seem to

that will enable them to better control SingleRAN solution? significantly reduce power consumption

CAPEX and OPEX now and in the future. Dr. Malik Kamal-Saadi: There are and product footprint, necessary points for

The slowdown of operators’ capital different approaches to SingleRAN. A reducing the OPEX.

expenditure has already affected the number of other vendors are also offering

equipment market. Some vendors, mainly SingleRAN solutions. Clearly from the COMMUNICATE: How do you

Western vendors, seem to be affected numbers I have got from you, in terms comment on the deployment trends of

more than their Chinese counterparts. of shipments of SingleRAN solutions, LTE across global markets?

However, 3G launches in emerging market Huawei is leading that market. Your Dr. Malik Kamal-Saadi: LTE has

mainly in China and India will represent a products have some key differentiating got a lot of benefits compared to the

fantastic opportunity for some equipment elements compared to competitors’. One existing technologies. The cost-per-bit

manufacturers to maintain revenue growth of them is the integrated approach between is more effective compared with existing

33 MAY 2009 . ISSUE 49

INTERVIEW

Dr. Malik Kamal-Saadi is the principal analyst at Informa Telecoms & Media and a frequent speaker

at international conferences on mobile telecommunications. He has over 13 years experience in the

telecommunications market as a technology expert, forecaster, and industry commentator. He has

also played a key role in a number of European and Government projects. Malik has a PhD degree

from Groupe d'Etude des Semiconducteurs (GES, France), specialising in Semiconductor Devices and

Materials, Design and Engineering.

and alternative technologies. However, likely to be deployed as hotspot rather than down quite significantly.

although LTE could enable operators to as a network. There are some exceptions to

create bigger pipes, it is still not clear how that, for example the case of TeliaSonera COMMUNICATE: How would you

can they monetize these pipes and how can for which Huawei is the main equipment comment on Huawei’s performance

they get their return on investment. provider. The operator will deploy LTE in 2008, particularly in the wireless

So what’s the strategic motivation as network city-wide, which means LTE market?

behind deploying LTE at the moment? services could be accessed anywhere in the Dr. Malik Kamal-Saadi: In the wireless

The initial battle for LTE started with the city in conjunction with existing networks market, while almost all equipment

pressure from competition, mainly from using SAE architecture. The rational vendors are currently burned by the

the WiMAX camp. But now the pressure behind this move is explained by the economic downturn, it is very interesting

is easing since WiMAX is struggling to operator ambition to gain edge in terms to see Huawei continue its pace to a strong

become the 4th standard of 3G+. Then of innovation. That is very important growth. The result of last financial year

operators are now no longer in rush; they for market positioning vis-à-vis LTE in a proves that while competitors see their

have got now enough time to think about longer term. revenues growth declining, Huawei still

LTE rollout and strengthen the business As for the timeline of LTE deployment, poses a strong growth momentum.

case for its deployment. They will likely to we are likely to see some pilot projects

deploy LTE in a progressive manner rather launched even in 2009, but Informa COMMUNICATE: What impressed

than in a large-scale rollout from the first does not expect LTE to be a large-scale you most in the Huawei Analyst

day. deployment before 2013. Meeting?

Before making any decision to deploy Dr. Malik Kamal-Saadi: Two things

LTE, one has to study data traffic trend in COMMUNICATE: LTE aside, how impressed me in this year’s summit. The

order to evaluate the need of rolling-out would you predict the growth and life first one is the shift from product-focus

LTE at large scale. If you do map the traffic cycle of 2G and 3G across different to more solution-focus that is in line with

across wireless networks, actually you will regional markets? the interest of your customers: operators.

find out heavy traffic is localized in specific Dr. Malik Kamal-Saadi: I’m afraid I’m You are now interacting well with your

geographies and this traffic is generated not specialized in that field. But definitely customers to provide them with the right

only by a small number of heavy users. there is still room for 2G to be deployed solutions for their networks. That is one

So rolling-out a nation-wide or city-wide through equipment replacement and thing that has impressed me and my

LTE network for addressing the needs of for 3G deployment to grow mainly in colleagues.

only a few customers, who are abusing the merging markets. For 2G, actually Informa The second thing that personally

network in some hotzone areas, does not predicts that 2G networks will not be impressed me on the summit is the breadth

make sense and could not be financially switched off before 2017, and probably of innovation across your entire product

justified. For that reason, it will make sense these networks will still be around until portfolio. In particular, SingleRAN

to deploy LTE- as hotspot not as network- 2020. Launches of 3G in some key certainly is a creative solution and again

in hotzone areas first and then gradually emerging markets such as China and India the adoption level of SingleRAN and the

upgrade to cover other areas where the will represent a key opportunity for some way operators are swapping their existing

capacity is needed. As demand increases, equipment manufacturers, mainly Chinese equipment for SingleRAN is a proof of the

then deploying LTE as network nation manufacturers and this within the next success of such a solution.

wide or city wide will be more justified. two-three years, after which equipment

That is to say, for early deployment, LTE is revenues from 3G networks will slow Editor: Gao Xianrui sally@huawei.com

MAY 2009 . ISSUE 49 34

You might also like

- Resolution of Transfer of Shares & Share Transfer Instrument DocumentDocument2 pagesResolution of Transfer of Shares & Share Transfer Instrument DocumentBernard Chung Wei Leong91% (11)

- Helium10 Elite Slides PDFDocument325 pagesHelium10 Elite Slides PDFYash S50% (2)

- Buch Future Telco Reloaded E 06 2015Document212 pagesBuch Future Telco Reloaded E 06 2015dobojNo ratings yet

- LTE and the Evolution to 4G Wireless: Design and Measurement ChallengesFrom EverandLTE and the Evolution to 4G Wireless: Design and Measurement ChallengesMoray RumneyRating: 5 out of 5 stars5/5 (1)

- BCG - Facing Up To The FutureDocument13 pagesBCG - Facing Up To The FutureddubyaNo ratings yet

- The Telco Cloud ManifestoDocument13 pagesThe Telco Cloud ManifestotmaillistNo ratings yet

- Huawei Rotating CEO Eric Xu On Enabling Telco TransformationDocument8 pagesHuawei Rotating CEO Eric Xu On Enabling Telco TransformationMohamed AliNo ratings yet

- 06-Perspectives - Telco Development Trends & StrategiesDocument4 pages06-Perspectives - Telco Development Trends & StrategiesHamza ZoulaineNo ratings yet

- 2013 TIME Report Cloud From TelcosDocument20 pages2013 TIME Report Cloud From TelcosdogiparthyNo ratings yet

- VisionMobile Telco Innovation Toolbox Dec 2012Document34 pagesVisionMobile Telco Innovation Toolbox Dec 2012ruadangyeuNo ratings yet

- Report ExtractDocument11 pagesReport ExtractAnshul DyundiNo ratings yet

- Examining The Case For Volte & Rich Media Communications: White PaperDocument0 pagesExamining The Case For Volte & Rich Media Communications: White PaperabcdefNo ratings yet

- Essential Reading 5Document20 pagesEssential Reading 5Rahul AwtansNo ratings yet

- CTRM - The Next GenerationDocument8 pagesCTRM - The Next GenerationCTRM CenterNo ratings yet

- Telecom Separation BrochureDocument4 pagesTelecom Separation BrochureaikianoNo ratings yet

- ADL StrategicChoiceDocument56 pagesADL StrategicChoiceABCDNo ratings yet

- 2012 Gartner Magic Quadrant For LTE Network InfrastructureDocument9 pages2012 Gartner Magic Quadrant For LTE Network Infrastructurenm7713No ratings yet

- Huawei TechnologiesDocument4 pagesHuawei TechnologiesChirag DaveNo ratings yet

- Why Is LTE Essential?: Operators' Challenges A Framework For Strategy DevelopmentDocument24 pagesWhy Is LTE Essential?: Operators' Challenges A Framework For Strategy DevelopmentOsama El MesalawyNo ratings yet

- Disruptive Technologies A 2021 UpdateDocument37 pagesDisruptive Technologies A 2021 UpdateCTRM CenterNo ratings yet

- Accedian 5G Tech Primer 2015 2QDocument7 pagesAccedian 5G Tech Primer 2015 2QglocallNo ratings yet

- McKinsey Telecoms. RECALL No. 17, 2011 - Transition To Digital in High-Growth MarketsDocument76 pagesMcKinsey Telecoms. RECALL No. 17, 2011 - Transition To Digital in High-Growth MarketskentselveNo ratings yet

- ICT Business Models - 0Document16 pagesICT Business Models - 0Vivas PyasiNo ratings yet

- TMF ODAsoftwaremarket v3Document18 pagesTMF ODAsoftwaremarket v3Abdullah hussienNo ratings yet

- The Network Punning ProblemDocument11 pagesThe Network Punning ProblemXavier EduardoNo ratings yet

- Redefining Mobile: Capgemini Mobile World Congress Show Special E-BookDocument30 pagesRedefining Mobile: Capgemini Mobile World Congress Show Special E-BookCapgeminiTMENo ratings yet

- A Few Myths About Telco and OTT Models: Emmanuel Bertin Noel Crespi Michel L'HostisDocument5 pagesA Few Myths About Telco and OTT Models: Emmanuel Bertin Noel Crespi Michel L'Hostisapi-192935904No ratings yet

- 5G Course MaterialDocument15 pages5G Course MaterialRao ENo ratings yet

- Research From The BlueprintDocument4 pagesResearch From The BlueprintMAHIPAL SINGH RAONo ratings yet

- SCF050 - Market-Status - Jul 2020Document29 pagesSCF050 - Market-Status - Jul 2020Abhishek BudhawaniNo ratings yet

- Future Telco 2014 enDocument324 pagesFuture Telco 2014 enVladimir PodshivalovNo ratings yet

- DNB 5GDocument20 pagesDNB 5GKeith Michael TaylorNo ratings yet

- M Commerce NotesDocument16 pagesM Commerce NotesSalmon Prathap SinghNo ratings yet

- Understanding The Unified Communications Market in Latin AmericaDocument15 pagesUnderstanding The Unified Communications Market in Latin AmericaZX LeeNo ratings yet

- LTEOutlook Aug13 LowresDocument64 pagesLTEOutlook Aug13 LowressombatseNo ratings yet

- Ibasis - Report - VoLTE - Why, When and HowDocument12 pagesIbasis - Report - VoLTE - Why, When and HowZeljko VrankovicNo ratings yet

- EXTRACT - How Mobile Operators Can Build Winning 5G Business Models - September 2020Document9 pagesEXTRACT - How Mobile Operators Can Build Winning 5G Business Models - September 2020Tarek AhmedNo ratings yet

- Roland Berger TAB Lean Telco 20140731Document16 pagesRoland Berger TAB Lean Telco 20140731Shaunak DeyNo ratings yet

- Iot Platforms: Chasing Value in A Maturing MarketDocument25 pagesIot Platforms: Chasing Value in A Maturing Marketrajeshtripathi20040% (1)

- What Is Wrong With The 5G VisionDocument5 pagesWhat Is Wrong With The 5G VisionRakha Panji AdinegoroNo ratings yet

- LTE Market, Technology, Products: DR Nick Johnson, CTO, Issue 1.1, Ip - Access, February 2012Document30 pagesLTE Market, Technology, Products: DR Nick Johnson, CTO, Issue 1.1, Ip - Access, February 2012FLRFMANAGERNo ratings yet

- FulltextDocument28 pagesFulltextBrianNo ratings yet

- To The Future Predictions For 2023 in The Telco IndustryDocument13 pagesTo The Future Predictions For 2023 in The Telco IndustrysartikaNo ratings yet

- Six Iot Models: Which Should Telcos Choose?Document5 pagesSix Iot Models: Which Should Telcos Choose?alda_abazaj8353No ratings yet

- Current Analysis Best Practices in M2M Operator PerspectiveDocument11 pagesCurrent Analysis Best Practices in M2M Operator PerspectiveRishi PatelNo ratings yet

- Mobile CommerceDocument10 pagesMobile CommerceAbel JacobNo ratings yet

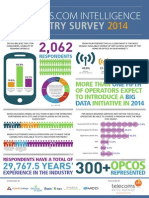

- Industry Survey: More Than of Operators Expect To Introduce A Initiative inDocument40 pagesIndustry Survey: More Than of Operators Expect To Introduce A Initiative intanveerameenNo ratings yet

- Extending The Competitive Advantage in Telecom: Chapter 1: Applying AIDocument12 pagesExtending The Competitive Advantage in Telecom: Chapter 1: Applying AIAmar Kaidi100% (1)

- Transform Telecom: A Data-Driven Strategy For Digital TransformationDocument16 pagesTransform Telecom: A Data-Driven Strategy For Digital TransformationSharavi Ravi ChanderNo ratings yet

- How Companies Become Platform LeaderDocument4 pagesHow Companies Become Platform Leaderbadal50% (2)

- An Innovation Strategy For LGDocument22 pagesAn Innovation Strategy For LGiSandy19No ratings yet

- Mobile Edge Computing A Key Technology Towards 5G - Patrick DurandDocument16 pagesMobile Edge Computing A Key Technology Towards 5G - Patrick DurandJohnny GoodeNo ratings yet

- 2015 - OTT Butterflies EffectDocument24 pages2015 - OTT Butterflies EffectRavi PrasadNo ratings yet

- MTC Annual Report 2013Document72 pagesMTC Annual Report 2013Tarek ElsafraniNo ratings yet

- 5G - Role of TelcoDocument36 pages5G - Role of Telcotbelinga100% (1)

- WP PLM TelecomDocument17 pagesWP PLM TelecomEduardo LopesNo ratings yet

- Telco Trends WhitepaperDocument14 pagesTelco Trends Whitepaperemanuele.deangelisNo ratings yet

- HUAWEI CommunicateDocument64 pagesHUAWEI CommunicategorkemyeniadresNo ratings yet

- Future Telco: Successful Positioning of Network Operators in the Digital AgeFrom EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselNo ratings yet

- LTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencyFrom EverandLTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencySeppo HämäläinenNo ratings yet

- Analysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingFrom EverandAnalysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingNo ratings yet

- Coso Erm 2017Document11 pagesCoso Erm 2017RAFAEL MOTAVITANo ratings yet

- Relative Strength Index, MACD, Average True Range, EMA & Historical VolatilityDocument18 pagesRelative Strength Index, MACD, Average True Range, EMA & Historical VolatilityВиктор ЗиновьевNo ratings yet

- D Business Combinations - IFRS 3 (Revised)Document10 pagesD Business Combinations - IFRS 3 (Revised)Brook KongNo ratings yet

- Dissertation Proposal On E-CommerceDocument8 pagesDissertation Proposal On E-CommerceCustomWritingPapersCanada100% (1)

- In The Matter of Lenrick Sales, Inc., A Pennsylvania Corporation, Bankrupt. James Talcott, Inc., Shapiro Bros. Factors Corp. and Crompton-Richmond Co., Inc., Factors, 369 F.2d 439, 3rd Cir. (1967)Document6 pagesIn The Matter of Lenrick Sales, Inc., A Pennsylvania Corporation, Bankrupt. James Talcott, Inc., Shapiro Bros. Factors Corp. and Crompton-Richmond Co., Inc., Factors, 369 F.2d 439, 3rd Cir. (1967)Scribd Government DocsNo ratings yet

- Determinants of Small Business Performance in Oye Local Government, Ekiti State, NigeriaDocument7 pagesDeterminants of Small Business Performance in Oye Local Government, Ekiti State, NigeriaAJHSSR JournalNo ratings yet

- Cosmetic Manufacturers in India - Private Label Skin CareDocument10 pagesCosmetic Manufacturers in India - Private Label Skin CareCosmetifyNo ratings yet

- Fall Semester - 2020 2021 Assignment IV - DepreciationDocument1 pageFall Semester - 2020 2021 Assignment IV - DepreciationJayagokul SaravananNo ratings yet

- Function Sub Function BandDocument10 pagesFunction Sub Function BandKaran WasanNo ratings yet

- Brochure SolapurDocument4 pagesBrochure Solapurkt200234No ratings yet

- Chapter 1Document16 pagesChapter 1Sheri DeanNo ratings yet

- Examination Fee ReceiptDocument1 pageExamination Fee ReceiptKushal Pratap RajawatNo ratings yet

- Visual Merchandising ReebokDocument39 pagesVisual Merchandising ReebokRavi Prakash Dwivedi MBA LU100% (3)

- R1508D933901 Assessment Point 2Document5 pagesR1508D933901 Assessment Point 2Rue Spargo Chikwakwata0% (1)

- Constructionchemicalindustryinindia 140327003953 Phpapp02Document22 pagesConstructionchemicalindustryinindia 140327003953 Phpapp02Sarjerao PatilNo ratings yet

- Commercial Promotion ContractDocument3 pagesCommercial Promotion ContractadminNo ratings yet

- GeM Bidding 3677608Document6 pagesGeM Bidding 3677608asdd sNo ratings yet

- Free Powerpoint Template Made by Nicolas BoucherDocument14 pagesFree Powerpoint Template Made by Nicolas BoucherFeNo ratings yet

- A Matter of JusticeDocument44 pagesA Matter of JusticeJose Carlos Thissen MogrovejoNo ratings yet

- Mohamed Cross-Border Livestok MarketingDocument88 pagesMohamed Cross-Border Livestok Marketingbalj balhNo ratings yet

- Standard-Bank-The-African-Wealth-Report-2020 Entrepreneuriat PDFDocument77 pagesStandard-Bank-The-African-Wealth-Report-2020 Entrepreneuriat PDFHermesNo ratings yet

- U by Kotex Case StudyDocument1 pageU by Kotex Case StudyVictor TamayoNo ratings yet

- Chapter 14: Firms in Competitive Markets Principles of Economics, 8 Edition N. Gregory MankiwDocument3 pagesChapter 14: Firms in Competitive Markets Principles of Economics, 8 Edition N. Gregory Mankiwdev PatelNo ratings yet

- DFM - Sheet Metal Design PDFDocument14 pagesDFM - Sheet Metal Design PDFSivaiah AdikiNo ratings yet

- New Research File Complete PDFDocument42 pagesNew Research File Complete PDFTesslene Claire SantosNo ratings yet

- Company Law and Corporate Governance - Cia 3Document12 pagesCompany Law and Corporate Governance - Cia 3harjas singhNo ratings yet

- Porters Five For NikeDocument3 pagesPorters Five For NikedishaNo ratings yet

- Integrating Security in Major Projects - Principles and Guidelines (2014 APR)Document16 pagesIntegrating Security in Major Projects - Principles and Guidelines (2014 APR)Htoo Htoo KyawNo ratings yet