Professional Documents

Culture Documents

Intermediate Accounting - Quiz 1 (Rejieando)

Intermediate Accounting - Quiz 1 (Rejieando)

Uploaded by

Rejie Ando0 ratings0% found this document useful (0 votes)

209 views3 pagesThe document contains adjusting entries that increase cash in bank and decrease accounts receivable or accounts payable. It also lists cash and cash equivalents on December 31, 2019 totaling $3,720,000 including cash in bank, time deposits, and petty cash. Items excluded from the total are a money market placement due in 2021, savings in a closed bank which is classified as a receivable, and a sinking fund for bonds not due until 2022.

Original Description:

Intermediate Accounting

Original Title

Intermediate Accounting_Quiz 1 (rejieando)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains adjusting entries that increase cash in bank and decrease accounts receivable or accounts payable. It also lists cash and cash equivalents on December 31, 2019 totaling $3,720,000 including cash in bank, time deposits, and petty cash. Items excluded from the total are a money market placement due in 2021, savings in a closed bank which is classified as a receivable, and a sinking fund for bonds not due until 2022.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

209 views3 pagesIntermediate Accounting - Quiz 1 (Rejieando)

Intermediate Accounting - Quiz 1 (Rejieando)

Uploaded by

Rejie AndoThe document contains adjusting entries that increase cash in bank and decrease accounts receivable or accounts payable. It also lists cash and cash equivalents on December 31, 2019 totaling $3,720,000 including cash in bank, time deposits, and petty cash. Items excluded from the total are a money market placement due in 2021, savings in a closed bank which is classified as a receivable, and a sinking fund for bonds not due until 2022.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

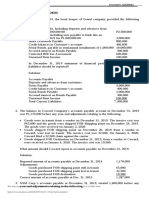

1.

Adjusting Entries

Accounts Receivable 200,000

Cash in Bank 200,000

Cash in Bank 250,000

Accounts Payable 250,000

Cash in Bank 100,000

Accounts Payable 100,000

Accounts Receivable 450,000

Cash in Bank 450,000

2. Total amount of cash and Cash equivalent on December 31, 2019

Cash in Bank P 3,000,000

Stale Customer Check (200,000)

Undelivered Creditor's Check 250,000

Post-dated creditor's check 100,000

2020 collection recorded in 2019 (450,000)

Total P 2,700,000

Time Deposit-30 days 1,000,000

Petty cash Fund 20,000

Cash and cash equivalent P3,720,000

3. Presentation of Items excluded

1. Money market placement due on June 30, 2021

This is not included because this is a short term investment.

2. Saving Deposit in closed bank

This is not included because this can be classified as receivable.

Since the bank is already closed, the money cannot be used immediately

whenever the owner decide to use it for the business.

3. Sinking fund for bond payable due June 30, 2022

The fund will yet due on June 30, 2022

You might also like

- Problems 1-1Document2 pagesProblems 1-1Jane Villanueva71% (7)

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Ramos - Cash and Cash EquiDocument11 pagesRamos - Cash and Cash EquiLeafriser Keigh Muron RamosNo ratings yet

- Far (Q)Document14 pagesFar (Q)Jee Pare100% (1)

- This Study Resource Was: (Stale Check)Document2 pagesThis Study Resource Was: (Stale Check)Lyca Mae CubangbangNo ratings yet

- Cash and Cash Equivalents Quizzer 1Document5 pagesCash and Cash Equivalents Quizzer 1yna kyleneNo ratings yet

- Prelim ReviewDocument41 pagesPrelim ReviewKrisan Rivera100% (1)

- Cash and Cash Equivalents: Intermediate Accounting 1Document3 pagesCash and Cash Equivalents: Intermediate Accounting 1Hershey GalvezNo ratings yet

- Cash and Cash Equivalents Problem SetDocument3 pagesCash and Cash Equivalents Problem Setmarinel pioquidNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- Acctg 102 Prelim Quiz 1 With SolutionDocument9 pagesAcctg 102 Prelim Quiz 1 With SolutionYsabel ApostolNo ratings yet

- Quiz-1 Cash and Cash EquivalentsDocument1 pageQuiz-1 Cash and Cash EquivalentsPanda ErarNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaKyrie Gwynette OlarveNo ratings yet

- Cash and Cash Equivalents: Problem 1Document4 pagesCash and Cash Equivalents: Problem 1Hannah SalcedoNo ratings yet

- Assignment 1 PDFDocument8 pagesAssignment 1 PDFRose Aubrey A CordovaNo ratings yet

- Assignment 1 PDFDocument8 pagesAssignment 1 PDFRose Aubrey A CordovaNo ratings yet

- Illustrative Example 2Document3 pagesIllustrative Example 2Hannah Shane TamayosaNo ratings yet

- UNIT 1 Discussion ProblemsDocument13 pagesUNIT 1 Discussion ProblemsMarynelle Labrador SevillaNo ratings yet

- 1 - Review Materials - Cash and Cash EquivalentsDocument8 pages1 - Review Materials - Cash and Cash EquivalentsHyunjin MinotozakiNo ratings yet

- Acctg 102 Prelim Quiz 1 With SolutionDocument8 pagesAcctg 102 Prelim Quiz 1 With SolutionMariane OracionNo ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- Cash Part 1Document2 pagesCash Part 1Mike MikeNo ratings yet

- ACCTG 102 (Cash and Cash Equivalent)Document4 pagesACCTG 102 (Cash and Cash Equivalent)Yoonah KimNo ratings yet

- Exercises: LESSON 1: Cash and Cash Equivalents and Petty Cash FundDocument4 pagesExercises: LESSON 1: Cash and Cash Equivalents and Petty Cash FundRiza Zaira MateoNo ratings yet

- 8 Audit of LiabilitiesDocument4 pages8 Audit of LiabilitiesCarieza CardenasNo ratings yet

- Cpa Review School of The Philippines ManilaDocument14 pagesCpa Review School of The Philippines ManilaVanessa Anne Acuña DavisNo ratings yet

- Composition of Cash Petty CashDocument7 pagesComposition of Cash Petty CashRyou ShinodaNo ratings yet

- Cash-And-Cash-Equivalents CashDocument30 pagesCash-And-Cash-Equivalents CashCaballero, Charlotte MichaellaNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Illustration Cash and Cash EquivalentsDocument2 pagesIllustration Cash and Cash EquivalentsRiyhu DelamercedNo ratings yet

- 7017 - Preweek Lecture FAR ProblemsDocument8 pages7017 - Preweek Lecture FAR ProblemsJohn Paul ArrozaNo ratings yet

- BAICC2X-Solution Supplementary - Week 1docxDocument7 pagesBAICC2X-Solution Supplementary - Week 1docxMitchie FaustinoNo ratings yet

- Prelim Review Docx 427399963 Prelim ReviewDocument42 pagesPrelim Review Docx 427399963 Prelim ReviewMarjorie PalmaNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Ap 9002-2 LiabilitiesDocument6 pagesAp 9002-2 LiabilitiesSirNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- Auditing - Problem 1Document2 pagesAuditing - Problem 1Hiyakishu SanNo ratings yet

- FAR Preweek (B44)Document10 pagesFAR Preweek (B44)Haydy AntonioNo ratings yet

- Audit of Cash and Cash EquivalentsDocument3 pagesAudit of Cash and Cash EquivalentsRandy ManzanoNo ratings yet

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionDJ NicartNo ratings yet

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- Quizzer Cash and Cash EquivalentsDocument10 pagesQuizzer Cash and Cash EquivalentsJoshua TorillaNo ratings yet

- Current Liabilities Quiz No. 1 (September 10, 2020)Document5 pagesCurrent Liabilities Quiz No. 1 (September 10, 2020)Carlo De VeraNo ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- Auditing Problems: First PreboardDocument8 pagesAuditing Problems: First PreboardCarlo AgravanteNo ratings yet

- LQ - Cash and ReceivablesDocument1 pageLQ - Cash and ReceivablesWawex DavisNo ratings yet

- 6883 - Statement of Financial PositionDocument2 pages6883 - Statement of Financial PositionMaximusNo ratings yet

- FAR - Level 1 TestDocument3 pagesFAR - Level 1 TestRay Joseph LealNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- 7078 - Single Entry and Error CorrectionDocument2 pages7078 - Single Entry and Error CorrectionaceNo ratings yet

- Audit of Cash Consolidated Valix ProblemsDocument7 pagesAudit of Cash Consolidated Valix ProblemsJulie Mae Caling MalitNo ratings yet

- Quizbee Practice IntaccDocument21 pagesQuizbee Practice IntaccCharles Kevin MinaNo ratings yet

- Questions - Level 1Document2 pagesQuestions - Level 1didiaenNo ratings yet

- Midterm Answer KeyDocument9 pagesMidterm Answer Keylil mixNo ratings yet

- AP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsDocument4 pagesAP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsMonica mangobaNo ratings yet

- Week 1 Output-KingDocument4 pagesWeek 1 Output-KingAlexis KingNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- World Bank East Asia and Pacific Economic Update, Spring 2022: Risks and OpportunitiesFrom EverandWorld Bank East Asia and Pacific Economic Update, Spring 2022: Risks and OpportunitiesNo ratings yet

- Mathematics As A Language (Short Reflection - Ando BSA 1)Document1 pageMathematics As A Language (Short Reflection - Ando BSA 1)Rejie AndoNo ratings yet

- Polya's Problem Solving Strategy - Real-Life Problem - AndoDocument2 pagesPolya's Problem Solving Strategy - Real-Life Problem - AndoRejie AndoNo ratings yet

- Intermediate Accounting - Quiz No. 2Document3 pagesIntermediate Accounting - Quiz No. 2Rejie AndoNo ratings yet

- Tocino MakingDocument3 pagesTocino MakingRejie AndoNo ratings yet

- CFAS (Chapter 3) - AndoDocument1 pageCFAS (Chapter 3) - AndoRejie AndoNo ratings yet

- PRELIM IN ECONOMIC DEVELOPMENT - Ando (BSA 1)Document3 pagesPRELIM IN ECONOMIC DEVELOPMENT - Ando (BSA 1)Rejie AndoNo ratings yet

- CFAS (Chapter 2) - AndoDocument1 pageCFAS (Chapter 2) - AndoRejie AndoNo ratings yet

- Management Science Prelim - Ando RejieDocument3 pagesManagement Science Prelim - Ando RejieRejie AndoNo ratings yet

- Assignment in Chapter 2 - Ando, RejieDocument2 pagesAssignment in Chapter 2 - Ando, RejieRejie AndoNo ratings yet

- Rejie N. Ando Grade 12-ABM-B Business Ethics Case Analysis # 1Document2 pagesRejie N. Ando Grade 12-ABM-B Business Ethics Case Analysis # 1Rejie AndoNo ratings yet

- Community Image ImprovementDocument2 pagesCommunity Image ImprovementRejie AndoNo ratings yet

- CHAPTERs 1-3 FinalDocument21 pagesCHAPTERs 1-3 FinalRejie AndoNo ratings yet

- An Adapted Survey Sample From The Study: UPSHOTS OF EARLY CLASS-HOUR SYSTEMDocument1 pageAn Adapted Survey Sample From The Study: UPSHOTS OF EARLY CLASS-HOUR SYSTEMRejie AndoNo ratings yet

- Upshots of Sleep Deprivation Due To Early Class-Hour SystemDocument68 pagesUpshots of Sleep Deprivation Due To Early Class-Hour SystemRejie AndoNo ratings yet

- Summary, Conclusions and RecommendationsDocument3 pagesSummary, Conclusions and RecommendationsRejie AndoNo ratings yet