Professional Documents

Culture Documents

VRIO

VRIO

Uploaded by

rahul_mahajan100%(1)100% found this document useful (1 vote)

83 views1 pageThe document discusses Nestle's resources according to the VRIO framework. It finds that Nestle's financial resources, trained employees, patents, distribution network, and consumer confidence are valuable, rare, and difficult to imitate. It also analyzes that Nestle is well-organized to leverage these resources for sustained competitive advantage through strategic investments, managing risks, and using its distribution network to reach customers.

Original Description:

VRIO of nestle india

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses Nestle's resources according to the VRIO framework. It finds that Nestle's financial resources, trained employees, patents, distribution network, and consumer confidence are valuable, rare, and difficult to imitate. It also analyzes that Nestle is well-organized to leverage these resources for sustained competitive advantage through strategic investments, managing risks, and using its distribution network to reach customers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

83 views1 pageVRIO

VRIO

Uploaded by

rahul_mahajanThe document discusses Nestle's resources according to the VRIO framework. It finds that Nestle's financial resources, trained employees, patents, distribution network, and consumer confidence are valuable, rare, and difficult to imitate. It also analyzes that Nestle is well-organized to leverage these resources for sustained competitive advantage through strategic investments, managing risks, and using its distribution network to reach customers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Valuable Healthy financial resources of Nestle are highly valuable - help in investing

into opportunities, diversification, and new launches | thwart off external

threats.

Local flavoured food products - valued more by the consumers

Employees - lower attrition % - A significant portion of the workforce is

highly trained, and this leads to more productive output for the

organisation.

Distribution network - increase in direct reach from 1.3mn to 1.4mn

Penetration led growth | Higher based for New launch placement

Cost structure – healthy EBITDA with forward-looking double-digit growth

Research and development at Nestle is not a valuable resource. ROI is

lower.

Rare Trained Employees of Nestle are a rare resource. These employees are

highly trained and skilled, which is not the case with employees in other

firms. The better compensation and work environment ensure that these

employees do not leave for other firms.

Patents are a rare resource. These patents are not easily available and are

not possessed by competitors. This allows Nestle to use them without

interference from the competition.

Distribution network of Nestle is a rare resource. This is because

competitors would require a lot of investment and time to come up with a

better distribution network than that of Nestle. These are also possessed

by very few firms in the industry.

Consumer confidence is rare resource for Nestle in Baby foods and other

foods products.

Imitable Financial resources of Nestle - Are costly to imitate as identified by the

Nestle VRIO Analysis.

Patents of Nestle are very difficult to imitate. This is because it is not

legally allowed to imitate a patented product. Similar resources to be

developed and getting a patent for them is also a costly process.

Distribution network of Nestle is also very costly to imitate by

competition. This has been developed over the years gradually by Nestle.

Competitors would have to invest a significant amount if they are to

imitate a similar distribution system.

Consumer confidence is difficult to imitate easily. It needs significant

investment in influencer network and marketing spends.

Organisation Nestle has good top management to middle management who can drive

topline growth and deliver profits

Nestle has required process to manage business and statutory risks to

ensure sustainability of growth and profits.

Financial resources provide a sustained competitive advantage. Financial

resources of Nestle are organised to capture value. These resources are

used strategically to invest in the right places; making use of opportunities

and combatting threats.

Nestle uses its distribution network to reach out to its customers by

ensuring that products are available on all of its outlets. Therefore, these

resources prove to be a source of sustained competitive advantage for

Nestle.

You might also like

- Dwnload Full Financial Management Core Concepts 4th Edition Brooks Solutions Manual PDFDocument35 pagesDwnload Full Financial Management Core Concepts 4th Edition Brooks Solutions Manual PDFbenboydr8pl100% (15)

- Case #23 StarbucksDocument2 pagesCase #23 Starbuckssueysuey62No ratings yet

- Stability, Conglomerate Strategy and VariantsDocument13 pagesStability, Conglomerate Strategy and VariantssukruthiNo ratings yet

- LG Mobiles: Swot & Pestle AnalysisDocument4 pagesLG Mobiles: Swot & Pestle AnalysisHaseebPirachaNo ratings yet

- Emergent Strategy Can Be Designed To Address ProblemsDocument9 pagesEmergent Strategy Can Be Designed To Address ProblemsGift SimauNo ratings yet

- Late 19th Century Industrial Era Work Welfare++21Document5 pagesLate 19th Century Industrial Era Work Welfare++21eslam sbaaeiNo ratings yet

- Examples of Strategy Consulting Firm Client PresentationsDocument2 pagesExamples of Strategy Consulting Firm Client PresentationsmaxangelicdemonNo ratings yet

- I634 Sess16Document2 pagesI634 Sess16Faria AlamNo ratings yet

- BCG GE Grand StrategyDocument5 pagesBCG GE Grand StrategyvaidehiNo ratings yet

- Unit 7 - Case Study (Kellogs) - Workplace Through MotivationDocument4 pagesUnit 7 - Case Study (Kellogs) - Workplace Through MotivationRavi Kumar100% (1)

- Assignment II - Wulan YSDocument3 pagesAssignment II - Wulan YSWulan Yulia SariNo ratings yet

- Accelerate Business GrowthDocument5 pagesAccelerate Business GrowthShowri Raju AddagatlaNo ratings yet

- Business Strategy Case StudyDocument7 pagesBusiness Strategy Case StudyreginexiaoNo ratings yet

- Estimating Business GrowthDocument34 pagesEstimating Business GrowthDele AwosileNo ratings yet

- Mba - Material - BharathiyarDocument19 pagesMba - Material - Bharathiyarlgs201No ratings yet

- Cage ModelDocument25 pagesCage ModelLaura Gómez100% (1)

- Chapter 9 - Strategic AlliancesDocument22 pagesChapter 9 - Strategic AlliancesHitesh NaikNo ratings yet

- A Critique of Competitive AdvantageDocument12 pagesA Critique of Competitive AdvantagePhilippe HittiNo ratings yet

- Sri Lanka Telecom PLC - Annual Report 2020Document234 pagesSri Lanka Telecom PLC - Annual Report 2020niradhNo ratings yet

- Corporate StrategyDocument3 pagesCorporate StrategyAyaz Ali100% (1)

- Alice in WonderlandDocument1 pageAlice in WonderlandSethNo ratings yet

- 21st Century ManagementDocument2 pages21st Century ManagementLoreana Cobos ArroyoNo ratings yet

- TOWS Matrix: Sachin UdhaniDocument12 pagesTOWS Matrix: Sachin Udhaniamittaneja28No ratings yet

- Ashridge Portfolio MatrixDocument8 pagesAshridge Portfolio MatrixYakshya ThapaNo ratings yet

- Pres2 PDFDocument13 pagesPres2 PDFjjasdNo ratings yet

- BIF ChecklistDocument7 pagesBIF ChecklistMayank UpadhyayNo ratings yet

- Strategic Management of MitsubishiDocument17 pagesStrategic Management of Mitsubishishailaja reddyNo ratings yet

- Amazon Case StudyDocument3 pagesAmazon Case StudyJana Franzel TaboadaNo ratings yet

- Accenture Africa Market EntryDocument16 pagesAccenture Africa Market EntrySubhajit SahooNo ratings yet

- Objective of Competitor Analysis: - Answer To The Following QuestionsDocument24 pagesObjective of Competitor Analysis: - Answer To The Following QuestionsJoydeep Chakraborty100% (1)

- 2011 - 3M's Open Innovation (Baker)Document5 pages2011 - 3M's Open Innovation (Baker)Saba KhanNo ratings yet

- Chap 4 - Coca Cola VRIO AnalysisDocument2 pagesChap 4 - Coca Cola VRIO AnalysisChu ChangNo ratings yet

- Strategic Management Assignment 3Document14 pagesStrategic Management Assignment 3Djimajor Robert TettehNo ratings yet

- Pursuing Success: The Strategic Dimension The Strategic DimensionDocument17 pagesPursuing Success: The Strategic Dimension The Strategic DimensionAdarsh KumarNo ratings yet

- C6 - Vodafone Egypt (B), Managing Corporate Cultural Change and Organizational PerformanceDocument12 pagesC6 - Vodafone Egypt (B), Managing Corporate Cultural Change and Organizational PerformancexczcNo ratings yet

- The Journey by ..: By: Abhay Yadav Jamshid Melvin Nitesh Nigam Rahul Jain Vinod RichardsDocument10 pagesThe Journey by ..: By: Abhay Yadav Jamshid Melvin Nitesh Nigam Rahul Jain Vinod Richardsrahul_njain100% (1)

- The Strategic Radar Model-Business EthicsDocument5 pagesThe Strategic Radar Model-Business EthicsNjorogeNo ratings yet

- Strategic Management - M & ADocument42 pagesStrategic Management - M & AEvanNo ratings yet

- Traditional Consolidation End-Game Framework - v1.0Document12 pagesTraditional Consolidation End-Game Framework - v1.0batrarishu123No ratings yet

- Customer MarketDocument13 pagesCustomer MarketYasir Ahmed SiddiquiNo ratings yet

- Product Portfolio AnalysisDocument44 pagesProduct Portfolio AnalysisSanchi SurveNo ratings yet

- Global Strategy SyllabusDocument28 pagesGlobal Strategy SyllabusjulioruizNo ratings yet

- Assignment Internal and ExternalDocument5 pagesAssignment Internal and ExternalSaad MajeedNo ratings yet

- Blue Ocean Strategy: Prepared by SupervisionDocument16 pagesBlue Ocean Strategy: Prepared by Supervisionabu3alyNo ratings yet

- Strategic Marketing Planning: Graham Hooley - Nigel F. Piercy - Brigette NicoulaudDocument40 pagesStrategic Marketing Planning: Graham Hooley - Nigel F. Piercy - Brigette NicoulaudZeeshan AhmadNo ratings yet

- John Keells Case StudyDocument4 pagesJohn Keells Case StudyheshanNo ratings yet

- Strategic ManagementDocument11 pagesStrategic ManagementClara SthNo ratings yet

- A Scenario-Based Approach To Strategic Planning - Tool Description - Scenario MatrixDocument24 pagesA Scenario-Based Approach To Strategic Planning - Tool Description - Scenario Matrixtaghavi1347No ratings yet

- TOWS Matrix For UCBDocument2 pagesTOWS Matrix For UCBAnkita RaghuvanshiNo ratings yet

- Medd's Cafe - Group Assignment DraftDocument20 pagesMedd's Cafe - Group Assignment DraftB UNo ratings yet

- The Seven Domains Model - JabDocument27 pagesThe Seven Domains Model - JabpruthirajpNo ratings yet

- Growth Strategy Process Flow A Complete Guide - 2020 EditionFrom EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionNo ratings yet

- Strategy LensesDocument1 pageStrategy Lensesnawalbakou100% (2)

- Case Ethix - NIKE ShoesDocument1 pageCase Ethix - NIKE ShoesGrishma Jain100% (1)

- Strategic Planning For Emerging Growth CompaniesDocument73 pagesStrategic Planning For Emerging Growth CompaniesrmdecaNo ratings yet

- Business Model: "Skate To Where The Money Will Be, Not Where It Is Now" - ChristiansenDocument43 pagesBusiness Model: "Skate To Where The Money Will Be, Not Where It Is Now" - ChristiansenMonisha ParekhNo ratings yet

- General Electric Case Study: Succession Planning at GE: Powerpoint Templates Powerpoint TemplatesDocument14 pagesGeneral Electric Case Study: Succession Planning at GE: Powerpoint Templates Powerpoint TemplatesPankaj Singh PariharNo ratings yet

- Culture in Strategy ExecutionDocument41 pagesCulture in Strategy ExecutionMatata MuthokaNo ratings yet

- A Comprehensive Sales Plan Intended For Lipton Herbal Tea UnileverDocument13 pagesA Comprehensive Sales Plan Intended For Lipton Herbal Tea UnileverRakib ChowdhuryNo ratings yet

- Chapter - 2 Marketing ManagementDocument16 pagesChapter - 2 Marketing Managementciara WhiteNo ratings yet

- Target International ExpansionDocument48 pagesTarget International ExpansionxebraNo ratings yet

- GK Capsule For Sbi Clerk 2014 ExamDocument36 pagesGK Capsule For Sbi Clerk 2014 Exama0mittal7No ratings yet

- Exercise Process CostingDocument5 pagesExercise Process Costingshahadat hossainNo ratings yet

- Annual Report of IOCL 185Document1 pageAnnual Report of IOCL 185Nikunj ParmarNo ratings yet

- Andrew Carnegie Biography PDFDocument9 pagesAndrew Carnegie Biography PDFOluwole Jedidiah OlusolaNo ratings yet

- 0450 Business Studies: MARK SCHEME For The October/November 2013 SeriesDocument11 pages0450 Business Studies: MARK SCHEME For The October/November 2013 SeriesMeng LeakNo ratings yet

- Damodaran - Value CreationDocument27 pagesDamodaran - Value Creationishuch24No ratings yet

- Essay - IH - 15 - 01 - 2024Document5 pagesEssay - IH - 15 - 01 - 2024Thanusri Vasanth kumar IBNo ratings yet

- Mohd Iman B.hajar (9.7 Tutorial)Document5 pagesMohd Iman B.hajar (9.7 Tutorial)astroneNo ratings yet

- Easy Trade Manager Forex RobotDocument10 pagesEasy Trade Manager Forex RobotPinda DhanoyaNo ratings yet

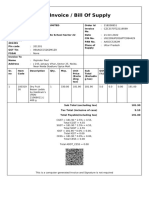

- View BillDocument1 pageView BillSuraj SoniNo ratings yet

- London School of Economics and Political Science: MSC in China in Comparative Perspective 2017/2018Document34 pagesLondon School of Economics and Political Science: MSC in China in Comparative Perspective 2017/2018PojPhetlorlianNo ratings yet

- CA Rest and Meal Break Training 2022Document12 pagesCA Rest and Meal Break Training 2022Nichole FishNo ratings yet

- Joint Product by Product QuestionsDocument7 pagesJoint Product by Product QuestionsShibin XavierNo ratings yet

- DepositSlip 10068722031011441572339Document1 pageDepositSlip 10068722031011441572339Jehad Ur RahmanNo ratings yet

- There Is No Elegy For The American CenturyDocument35 pagesThere Is No Elegy For The American CenturyThinh DoNo ratings yet

- Strategic Management-Collaborative and Network-Based Forms of StrategyDocument19 pagesStrategic Management-Collaborative and Network-Based Forms of StrategyNoemi G.No ratings yet

- Deal List 9 30 10Document6 pagesDeal List 9 30 10jhoppenNo ratings yet

- Part 4: Absorption and Variable Costing/Product Costing: Melziel A. Emba University of The East - ManilaDocument129 pagesPart 4: Absorption and Variable Costing/Product Costing: Melziel A. Emba University of The East - Manilarodell pabloNo ratings yet

- In A Bind Peak Sealing Technologies' Product Line Extension DilemmaDocument2 pagesIn A Bind Peak Sealing Technologies' Product Line Extension DilemmaAryan GargNo ratings yet

- aCTIVITY Entrep q2Document4 pagesaCTIVITY Entrep q2Jhon Laurence DumendengNo ratings yet

- How To Make FriendsDocument1 pageHow To Make FriendsJust Chill100% (1)

- (Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Document223 pages(Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Felippe RochaNo ratings yet

- BA8018 PA Revision QuestionsDocument6 pagesBA8018 PA Revision QuestionsShah ReenNo ratings yet

- Jul 2022 Performance ReportDocument3 pagesJul 2022 Performance ReportMyles PiniliNo ratings yet

- Inb 480 - Aci Internationalization ProcessDocument25 pagesInb 480 - Aci Internationalization ProcessFaiyazKhanTurzoNo ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplyCruise Films ProductionsNo ratings yet

- Artigo JEP 5Document27 pagesArtigo JEP 5qawerdnNo ratings yet

- T1 - KMLT 2015 - ThanhDocument35 pagesT1 - KMLT 2015 - ThanhCavipsotNo ratings yet