Professional Documents

Culture Documents

CBRE 2008 - Ratios

CBRE 2008 - Ratios

Uploaded by

Matthew Tinkelman0 ratings0% found this document useful (0 votes)

11 views2 pagesThis document provides financial metrics and ratios for years 2008, 2007, and 2006 for a company. Some key metrics include:

- Return on assets (ROA) was -16.5% in 2008, up from 8.1% in 2007.

- Current ratio was 1.02 in 2008, down from 0.96 in 2007, indicating the company barely had enough current assets to cover current liabilities.

- Days receivables turnover was 82 days in 2008, up from 67 days in 2007, meaning receivables were being collected more slowly.

- Leverage, as measured by long-term debt to equity, was 2.28 in 2008, up from 1.53 in 2007, indicating

Original Description:

Original Title

CBRE 2008 - Ratios (2)

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial metrics and ratios for years 2008, 2007, and 2006 for a company. Some key metrics include:

- Return on assets (ROA) was -16.5% in 2008, up from 8.1% in 2007.

- Current ratio was 1.02 in 2008, down from 0.96 in 2007, indicating the company barely had enough current assets to cover current liabilities.

- Days receivables turnover was 82 days in 2008, up from 67 days in 2007, meaning receivables were being collected more slowly.

- Leverage, as measured by long-term debt to equity, was 2.28 in 2008, up from 1.53 in 2007, indicating

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views2 pagesCBRE 2008 - Ratios

CBRE 2008 - Ratios

Uploaded by

Matthew TinkelmanThis document provides financial metrics and ratios for years 2008, 2007, and 2006 for a company. Some key metrics include:

- Return on assets (ROA) was -16.5% in 2008, up from 8.1% in 2007.

- Current ratio was 1.02 in 2008, down from 0.96 in 2007, indicating the company barely had enough current assets to cover current liabilities.

- Days receivables turnover was 82 days in 2008, up from 67 days in 2007, meaning receivables were being collected more slowly.

- Leverage, as measured by long-term debt to equity, was 2.28 in 2008, up from 1.53 in 2007, indicating

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 2

Return On Assets (ROA) 2008 2007 2006

Total Assets 4,726,414 6,242,573 5,944,631 pg before pg 76 & pg 78

Average Assets 5,484,494 6,093,602 5,944,631

Revenue 5,128,817 6,034,249 4,032,027 pg 79

Net (loss) income -1,012,066 390,505 318,571 pg 79

Interest expense 167,156 162,991 45,007 pg 79

Given tax rate 35%

After tax interst expense 108,651 105,944 29,255

Adj Net Income = NI + After Tax Interest (Costs) -903,415 496,449 347,826

ROA (Adj NI/Average Assets) -16.5% 8.1% 5.9%

Profit Margin (Adj NI/Revenue) -17.6% 8.2% 8.6%

Asset Turnover (Revenue/Average Assets) 93.5% 99.0% 67.8%

ROA Verification (PM X Asset TO) -16.5% 8.1% 5.9%

Return on Common Equity 2008 2007 2006

Average Assets 5,484,494 6,093,602 5,944,631

Revenue 5,128,817 6,034,249 4,032,027 pg 79

Stockholders' Equity 114,686 988,543 1,181,641 pg before pg 76 & pg 78

Minority interest 231,037 263,613 78,136 pg before pg 76 & pg 78

Total Stockholders' Equity (SE + MI) 345,723 1,252,156 1,259,777

Average Equity 798,940 1,255,967 1,259,777

Net (loss) income -1,012,066 390,505 318,571 pg 79

ROE (NI/Average SE) -126.7% 31.1% 25.3%

Profit Margin (Net Income/Revenue) -19.7% 6.5% 7.9%

Asset Turnover (Revenue/Average Assets) 93.5% 99.0% 67.8%

Leverage (Average Assets/SE) 686.5% 485.2% 471.9%

ROE Verification (PM X Asset TO X Leverage) -126.7% 31.1% 25.3%

Quick and Current Ratios 2008 2007 2006

Total Current Assets 1,915,533 2,325,568 2,335,012

Total Current Liabilities 1,872,845 2,423,811 1,954,662

Current Ratio (CA/CL) 1.02 0.96 1.19

Cash and cash equivalents 158,823 342,874 244,476

Receivables, less allowance for doubtful accounts of $56,3 751,940 1,081,653 880,809

Warehouse receivables 210,473 255,777

Trading securities 355,503

Available for sale securities 237 1,212 371

Total "Quick" Assets 1,121,473 1,681,516 1,481,159

Quick Ratio ('Quick' Assets/CL) 0.60 0.69 0.76

Turnover Ratios 2008 2007 2006

Net receivables 751,940 1,081,653 880,809

Warehouse receivables 210,473 255,777 0

Total Receivables 962,413 1,337,430 880,809

Average Receivables 1,149,922 1,109,120 880,809

Revenue 5,128,817 6,034,249 4,032,027

Receivables Turnover (Sales / Avg Receivables) 4.46 5.44 4.58

Days Receivables Turnover (365/Rec Turnover) 82 67 80

Real estate under development 56,322 78,388 9,906

Real estate and other assets held for sale 40,434 165,078 239,343

Total inventory 96,756 243,466 249,249

Average Inventory 170,111 246,358 249,249

Cost of services 2,926,721 3,200,718 2,110,512

Inventory Turnover (Cost of services/Avg Inventory) 17.20 12.99 8.47

Days Inventory Turnover (365/Inv Turnover) 21 28 43

Accounts Payables 395,658 488,341 477,781

Average Accounts Payables 442,000 483,061 477,781

Total Inventory 96,756 243,466 249,249 249249

Cost of services 2,926,721 3,200,718 2,110,512

Purchases (= End Inv - Beg Inv + Cost of Services) 2,780,011 3,194,935 2,110,512

Acc Payables Turnover (Purchases/Avg Payables) 6.29 6.61 4.42

Days Payables Turnover (365/Payables Turnover) 58 55 83

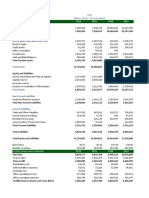

Leverage Ratios 2008 2007 2006

Total Long-Term Debt 1,866,759 1,777,352 2,066,673

Average LT Debt 1,822,056 1,922,013 2,066,673

Total Stockhodlers' Equity 345,723 1,252,156 1,259,777

Average Stockholders' Equity 798,940 1,255,967 1,259,777

LT Debt/Equity (Average) 2.28 1.53 1.64

LT Debt/Equity (no average) 5.40 1.42 1.64

Total short-term borrowings 246,065 538,680 126,208

Current maturities of long-term debt 210,662 11,374 11,836

Notes payable on real estate (Current) 176,372 127,706 43,856

Notes payable on real estate (LT) 420,242 218,873 118,477

Total Debt (Total LT Debt plus short term borrowings etc) 2,920,100 2,673,985 2,367,050

Average Total Debt 2,797,043 2,520,518 2,367,050

Total Debt/Equity (Average) 3.50 2.01 1.88

Total Debt/Equity (no average) 8.45 2.14 1.88

Assets to Equity (Avg Total Assets/Avg Total Equity) 6.86 4.85 4.72

Interest Expense 167,156 162,991 45,007

Operating (loss) income -788,469 698,971 550,139

Interest Coverage -4.72 4.29 12.22

You might also like

- Corporate Finance Canadian Edition 4 More Prof Stephen A Ross Author Full ChapterDocument67 pagesCorporate Finance Canadian Edition 4 More Prof Stephen A Ross Author Full Chapterrobert.coleman246No ratings yet

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- Member Guide.: Superannuation and Personal Super PlanDocument128 pagesMember Guide.: Superannuation and Personal Super PlanJaysonNo ratings yet

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- Case 2 - Q5 Group 5Document4 pagesCase 2 - Q5 Group 5Shaarang Begani0% (2)

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- TDbank Letter To ClientDocument1 pageTDbank Letter To ClientMelanie J. CoulsonNo ratings yet

- Dows ExcelDocument18 pagesDows ExcelJaydeep SheteNo ratings yet

- Paramount Student SpreadsheetDocument12 pagesParamount Student Spreadsheetanshu sinhaNo ratings yet

- Prospective Analysis - FinalDocument7 pagesProspective Analysis - FinalMAYANK JAINNo ratings yet

- Prospective Analysis - FinalDocument7 pagesProspective Analysis - Finalsanjana jainNo ratings yet

- Prospective Analysis 2Document7 pagesProspective Analysis 2MAYANK JAINNo ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- LDG - Financial TemplateDocument20 pagesLDG - Financial TemplateQuan LeNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- Ratio Analysis Template 2Document3 pagesRatio Analysis Template 2pradhan13No ratings yet

- Alk Bird1Document5 pagesAlk Bird1evel streetNo ratings yet

- Research Problem Michael Franco AccountingDocument5 pagesResearch Problem Michael Franco AccountingMichael FrancoNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisGg JjNo ratings yet

- RanbaxyDocument9 pagesRanbaxyMOHD.ARISHNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Yates Case Study - LT 11Document23 pagesYates Case Study - LT 11JerryJoshuaDiazNo ratings yet

- WA2Document3 pagesWA2Ahmed HassaanNo ratings yet

- Ratio Analysis of TATA MOTORSDocument8 pagesRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANNo ratings yet

- ABB Power Systems & Automation CompanyDocument13 pagesABB Power Systems & Automation CompanyMohamed SamehNo ratings yet

- Case 3Document53 pagesCase 3ShirazeeNo ratings yet

- Caso HertzDocument32 pagesCaso HertzJORGE PUENTESNo ratings yet

- Andhra Petrochemicals LTD.: Profitability RatioDocument13 pagesAndhra Petrochemicals LTD.: Profitability RatioDäzzlîñg HärîshNo ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Prospective Analysis 1Document5 pagesProspective Analysis 1MAYANK JAINNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Bajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeDocument25 pagesBajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeRohan NimkarNo ratings yet

- Millat Tractors - Final (Sheraz)Document20 pagesMillat Tractors - Final (Sheraz)Adeel SajidNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- 9722 Fujita Kanko Inc CompanyFinancialSummary 20180314222612Document5 pages9722 Fujita Kanko Inc CompanyFinancialSummary 20180314222612DamTokyoNo ratings yet

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- Case 9Document11 pagesCase 9Nguyễn Thanh PhongNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- MiniScribe Corporation - FSDocument5 pagesMiniScribe Corporation - FSNinaMartirezNo ratings yet

- Financial+Statement+Analysis SolvedDocument5 pagesFinancial+Statement+Analysis SolvedMary JoyNo ratings yet

- Jollibee Foods Corporation: Consolidated Statements of IncomeDocument9 pagesJollibee Foods Corporation: Consolidated Statements of Incomearvin cleinNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- FIN254 Project NSU (Excel File)Document6 pagesFIN254 Project NSU (Excel File)Sirazum SaadNo ratings yet

- Beximco Pharmaceuticals LimitedDocument4 pagesBeximco Pharmaceuticals Limitedsamia0akter-228864No ratings yet

- Ajanta Pharma LTD.: LiquidityDocument4 pagesAjanta Pharma LTD.: LiquidityDeepak DashNo ratings yet

- Accounts AssignDocument9 pagesAccounts AssigngauravdangeNo ratings yet

- Havells Balance Sheet (4 Years)Document15 pagesHavells Balance Sheet (4 Years)Tamoghna MaitraNo ratings yet

- BerauDocument2 pagesBerauluhutsituNo ratings yet

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocument2 pagesKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNo ratings yet

- Firstsem SPCL DC2016Document138 pagesFirstsem SPCL DC2016Gelo LeañoNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument6 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage Examinationduniya t vNo ratings yet

- 4.2 Forex PDFDocument4 pages4.2 Forex PDFGuru RaghuNo ratings yet

- Capital Markets - EDHEC Risk InstituteDocument386 pagesCapital Markets - EDHEC Risk InstituteRicky Rick100% (1)

- ACC 203 Module 2 Conceptual FrameworkDocument26 pagesACC 203 Module 2 Conceptual FrameworkMitch Giezcel DrizNo ratings yet

- Ambika Cotton Mills LimitedDocument68 pagesAmbika Cotton Mills LimitedSriNo ratings yet

- Washington MutualDocument20 pagesWashington Mutualyud4No ratings yet

- Welcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesDocument23 pagesWelcome To Our Presentation: Topic: Management of Cash & Marketable SecuritiesAkash BhowmikNo ratings yet

- Financial Aspect Feasibility StudyDocument33 pagesFinancial Aspect Feasibility StudyDark ShadowNo ratings yet

- Cash Flow Estimation MbaDocument27 pagesCash Flow Estimation MbaViolets n' DaisiesNo ratings yet

- AUD339 - OBE Lesson Plan 1Document11 pagesAUD339 - OBE Lesson Plan 1MUHAMMAD AMIR HAMZAH NURZAFILNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Kenya PDFDocument76 pagesKenya PDFrobenas.abrieNo ratings yet

- Equity Investment 2 - ValuationDocument34 pagesEquity Investment 2 - Valuationnur syahirah bt ab.rahmanNo ratings yet

- HBLDocument28 pagesHBLMalik Farasat AliNo ratings yet

- Atms (Automated Teller Machine)Document2 pagesAtms (Automated Teller Machine)shabukrNo ratings yet

- KFT Accounting Solutions: Instructions For TestDocument10 pagesKFT Accounting Solutions: Instructions For TestKanika Sharma100% (1)

- Schwab Fact SheetDocument11 pagesSchwab Fact SheetthiagoNo ratings yet

- EMBA - T4 - SAPM-Assignment-3 - Rahul MJDocument7 pagesEMBA - T4 - SAPM-Assignment-3 - Rahul MJMujeeb Ur RahmanNo ratings yet

- Fabm Module 6Document4 pagesFabm Module 6Ruvie Mae Paglinawan100% (1)

- Contoh Tugasan AccountDocument20 pagesContoh Tugasan AccountMuhammad IddinNo ratings yet

- Online Banking System Asp .Net C SourceDocument4 pagesOnline Banking System Asp .Net C Sourcemanjunath rmNo ratings yet

- Project Report Metlife InsuranceDocument82 pagesProject Report Metlife InsuranceYaadrahulkumar Moharana100% (1)

- EAR Versus APRDocument2 pagesEAR Versus APRebebebyayayaNo ratings yet

- FINS2624 Problem Set 5Document3 pagesFINS2624 Problem Set 5IsyNo ratings yet

- Credit Control in India - WikipediaDocument20 pagesCredit Control in India - WikipediapranjaliNo ratings yet

- Frequently Asked Questions - Maybank Visa DebitDocument4 pagesFrequently Asked Questions - Maybank Visa DebitholaNo ratings yet