Professional Documents

Culture Documents

Audit Liability 14 Chapter 7

Audit Liability 14 Chapter 7

Uploaded by

Ma Teresa B. Cerezo0 ratings0% found this document useful (0 votes)

26 views2 pagesThe document provides a list of transactions from Batur Inc.'s voucher register for December 2010 and January 2011. It includes purchases and sales of inventory, prepaid expenses, payroll, utilities, and other operating expenses. Journal entries are needed to adjust various accounts at December 31, 2010, including prepaid insurance, prepaid dues, accounts payable, inventory, accrued liabilities, and dividends payable. The solution provides the necessary adjusting journal entries to properly reflect the accounts at year end.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a list of transactions from Batur Inc.'s voucher register for December 2010 and January 2011. It includes purchases and sales of inventory, prepaid expenses, payroll, utilities, and other operating expenses. Journal entries are needed to adjust various accounts at December 31, 2010, including prepaid insurance, prepaid dues, accounts payable, inventory, accrued liabilities, and dividends payable. The solution provides the necessary adjusting journal entries to properly reflect the accounts at year end.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views2 pagesAudit Liability 14 Chapter 7

Audit Liability 14 Chapter 7

Uploaded by

Ma Teresa B. CerezoThe document provides a list of transactions from Batur Inc.'s voucher register for December 2010 and January 2011. It includes purchases and sales of inventory, prepaid expenses, payroll, utilities, and other operating expenses. Journal entries are needed to adjust various accounts at December 31, 2010, including prepaid insurance, prepaid dues, accounts payable, inventory, accrued liabilities, and dividends payable. The solution provides the necessary adjusting journal entries to properly reflect the accounts at year end.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

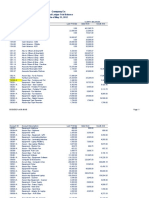

PROBLEM 7-14

Analyzing Various Transactions Involving Liabilities

In conjunction with your firm’s examination of the financial

statements of BATUR< INC. as of December 31,2010, you obtained

the information from the company’s voucher register shown in the

work paper below.

Item Entry Voucher

No. Date Reference Description Amount Account

Charged

1 12/18/10 12-200 Supplies, shipped FOB destination,

12/15/10; received 12/17/10 P15,000 Supplies

on hand

2 12/18/10 12-203 Auto insurance,12/15/10-12/15/11 22,000 Prepaid

insurance

3 12/21/10 12-209 Repairs services;received 12/20/10 19,000 Repairs &

maintenance

4 12/26/10 12-212 Merchandise, shipped FOB shipping

point, 12/20/10; received 12/24/10 123,000 Inventory

5 12/21/10 12-210 Payroll, 12/7/10-12/21/10

(12 working days) 69,000 Salaries

and wages

6 12/21/10 12-234 Subscription to industry magazine

for 2011 5,000 Dues &

subscriptions

expense

7 12/28/10 12-236 Utilities for December 2010 24,000 Utilities

expense

8 12/28/10 12-241 Merchandise, shipped FOB

destination, 12/24/10; received

1/2/11 84,000 Inventory

9 12/28/10 12-242 Merchandise, shipped FOB

destination, 12/24/10; received

1/2/11 84,000 Inventory

10 1/2/11 1-1 Legal services;received 12/28/1046,000 Legal and

professional

fees

expense

11 1/2/11 1-2 Medical services for employees

for December 2010 25,000 Medical

expenses

12 1/5/11 1-3 Merchandise, shipped FOB

shipping point, 12/29/10;

received 1/4/11 15,000 Inventory

13 1/10/11 1-4 Payroll, 12/21/10-1/5/11(12 working

days in total, 4 working days in Jan.2011)72,000 Salaries

and wages

14 1/10/11 1-6 Merchandise, shipped FOB shipping

point, 1/2/11; received 1/6/11 64,000 Inventory

15 1/12/11 1-8 Merchandise, shipped FOB

destination, 1/3/11;

received 1/10/11 38,000 Inventory

16 1/13/11 1-9 Maintenance services;

received 1/9/11 9,000 Repairs &

maintenance

17 1/14/11 1-10 Interest on bank loan,10/10/10-1/10/11 30,000 Interest

expenses

18 1/15/11 1-11 Manufacturing equipment; installed

12/29/10 254,000 Machinery

& equipment

19 1/15/11 1-12 Dividend declared/ 12/15/10 160,000 Dividends

payable

Accrued liabilities as of December 31,2010, were as follows:

Accrued payroll P48,000

Accrued interest payable 26,666

Dividends payable 100,000

The accrued payroll and accrued interest payable were reversed

effective January 1,2011.

Review the given data above and prepare journal entries to adjust

the accounts on December 31, 2010. Assume that the company

follows FOB terms for recording inventory purchases.

SOLUTION 7-14

ADJUSTING JOURNAL ENTRIES

December 31,2010

1. Insurance expense 917

Prepaid insurance 917

(P22,000 x 5/12)

2. Prepaid dues and subscriptions 5,000

Dues and subscriptions expense 5,000

3. Accounts payable 111,500

Inventory

111,500

4. Accounts payable 84,000

Inventory

84,000

5. Legal and professional fees expense 46,000

Accounts payable

46,000

6. Medical expenses 25,000

Accounts payable

25,000

7. Inventory 55,000

Accounts payable

55,000

8. Machinery and equipment 254,000

Accounts payable

254,000

You might also like

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Ulidsonlen 5Document11 pagesUlidsonlen 5api-239547380100% (5)

- Peachtree Accounting Practical ExerciseDocument15 pagesPeachtree Accounting Practical ExerciseRACHEL KEDIR75% (4)

- Accoun1 SpaceDocument25 pagesAccoun1 SpacePerlas Flordeliza100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- La Consolacion College - Manila Auditing Problem Final Quiz # 1Document6 pagesLa Consolacion College - Manila Auditing Problem Final Quiz # 1NJ SyNo ratings yet

- 6 ProblemsDocument6 pages6 ProblemsAzelAnnAlibinNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Standard Tender Document For Procurement of Insurance ServicesDocument44 pagesStandard Tender Document For Procurement of Insurance ServicesAccess to Government Procurement Opportunities100% (2)

- Acupuncture Clinic-Acupuncture and Acupressure Services Business PlanDocument1 pageAcupuncture Clinic-Acupuncture and Acupressure Services Business PlansolomonNo ratings yet

- 6018 P3 Lembar Jawaban Kosong AkuntansiDocument54 pages6018 P3 Lembar Jawaban Kosong AkuntansiEvanya Rachma OctavyaNo ratings yet

- Aol 7-16Document4 pagesAol 7-16chowchow123No ratings yet

- UntitledDocument12 pagesUntitledMaykel BolañosNo ratings yet

- AUDITING-Audit of LiabilitiesDocument9 pagesAUDITING-Audit of LiabilitiesJamhel MarquezNo ratings yet

- Fpi 1ST QTRDocument30 pagesFpi 1ST QTRMarife GaaNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesMenacexgNo ratings yet

- Practice Set 2Document4 pagesPractice Set 2Mylene CandidoNo ratings yet

- Accounting For Warranties and PremiumsDocument8 pagesAccounting For Warranties and Premiumsalcazar rtuNo ratings yet

- Problem 1. ASHTA Company Has The Following TransactionsDocument2 pagesProblem 1. ASHTA Company Has The Following TransactionsJhunNo ratings yet

- Assignment Front Sheet: BusinessDocument13 pagesAssignment Front Sheet: BusinessHassan AsgharNo ratings yet

- AP QuizzerDocument9 pagesAP QuizzerAngel TumamaoNo ratings yet

- CV Gumarang Jaya LestariDocument44 pagesCV Gumarang Jaya LestariMaulynda Arifah RNo ratings yet

- Week 6 - Solutions (Some Revision Questions)Document13 pagesWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- Ap Prob 2Document2 pagesAp Prob 2jhobsNo ratings yet

- AP Pakyo CompanyDocument8 pagesAP Pakyo CompanyKristin Zoe Newtonxii PaezNo ratings yet

- Audit Fot Liability Problem #2Document3 pagesAudit Fot Liability Problem #2Ma Teresa B. CerezoNo ratings yet

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- Pick - Up Medical Supplies & Services Trial Balance As of November 30, 2012Document2 pagesPick - Up Medical Supplies & Services Trial Balance As of November 30, 2012JT GalNo ratings yet

- CH 03Document4 pagesCH 03vivien50% (2)

- Audit of LiabsDocument2 pagesAudit of LiabsRommel Royce CadapanNo ratings yet

- MR Santos JournalizeDocument8 pagesMR Santos JournalizeEron Roi Centina-gacutan100% (5)

- Comprehensive Problem 2Document3 pagesComprehensive Problem 2Manal ElkhoshkhanyNo ratings yet

- Abc Company Trial Balance For The Year End: December 31, 2010Document8 pagesAbc Company Trial Balance For The Year End: December 31, 2010JT GalNo ratings yet

- MB0041Document23 pagesMB0041Kumar GauravNo ratings yet

- MB0041Document26 pagesMB0041Saurav KumarNo ratings yet

- 10000016855Document9 pages10000016855Chapter 11 DocketsNo ratings yet

- Pod 6 Quiz 3Document23 pagesPod 6 Quiz 3fdepianoNo ratings yet

- Accounts PGDMDocument48 pagesAccounts PGDMMeghali BarmanNo ratings yet

- AccountingPrinciples Group08Document12 pagesAccountingPrinciples Group08Truong Ngoc Tho B2206548No ratings yet

- Accounting Cycle Upto Trial BalanceDocument61 pagesAccounting Cycle Upto Trial BalanceHottie-Hot SoniNo ratings yet

- Accounting Cycle Illustrated JDCDocument90 pagesAccounting Cycle Illustrated JDCjiiNo ratings yet

- SAP - Systems Applications and Products in Data Processing: German - 1972 Sap R1 Sap R2 Sap R3 Sap R3 - ErpDocument46 pagesSAP - Systems Applications and Products in Data Processing: German - 1972 Sap R1 Sap R2 Sap R3 Sap R3 - ErpGissy ShibuNo ratings yet

- RDocument2 pagesRjhevesNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument18 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Instruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresDocument6 pagesInstruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresstillwinmsNo ratings yet

- Transaction Review RKPL, Draft ReportDocument13 pagesTransaction Review RKPL, Draft ReportJoni alauddinNo ratings yet

- Audit of LiabilitiesDocument6 pagesAudit of LiabilitiesEdmar HalogNo ratings yet

- AP.m 1401 Correction of ErrorsDocument12 pagesAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- Accounting Cycle Upto Trial BalanceDocument60 pagesAccounting Cycle Upto Trial Balanceyenebeb tariku100% (1)

- Pretestl1 Sportingsgoods2 PDFDocument5 pagesPretestl1 Sportingsgoods2 PDFKrisna BayuNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachDocument2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 6Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 6Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Document4 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Document2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Ma Teresa B. CerezoNo ratings yet

- Incremental Analysis QiuzzerDocument4 pagesIncremental Analysis QiuzzerMa Teresa B. CerezoNo ratings yet

- Company Ex - Trial Balance - 2012Document7 pagesCompany Ex - Trial Balance - 2012Ma Teresa B. CerezoNo ratings yet

- Statement of CF Company Ex - 2012Document3 pagesStatement of CF Company Ex - 2012Ma Teresa B. CerezoNo ratings yet

- Account ID Account Description: Company ExDocument14 pagesAccount ID Account Description: Company ExMa Teresa B. CerezoNo ratings yet

- Cranes AccidentsDocument16 pagesCranes AccidentsGogyNo ratings yet

- Registered O Ce: @: Aegon Life InsuranceDocument1 pageRegistered O Ce: @: Aegon Life Insuranceabhinov saikiaNo ratings yet

- Bajaj Allianz Life Insurance Company.Document19 pagesBajaj Allianz Life Insurance Company.HaniaSadia100% (1)

- Roque Vs IACDocument8 pagesRoque Vs IACBLNNo ratings yet

- Mayur Manch MATERIAL/ALOP - 1463295927671Document3 pagesMayur Manch MATERIAL/ALOP - 1463295927671Thanglianlal TonsingNo ratings yet

- CESCEDocument12 pagesCESCERoberto Darcourt RiveraNo ratings yet

- Unexpired ReserveDocument16 pagesUnexpired ReservePreethaNo ratings yet

- Transport Contract EXAMPLE: This Sample Agreement Is Provided For Informational Purposes ONLYDocument7 pagesTransport Contract EXAMPLE: This Sample Agreement Is Provided For Informational Purposes ONLYMuhammad NadeemNo ratings yet

- 1718 2nds FX Govt AcctgDocument8 pages1718 2nds FX Govt AcctgAveryl Lei Sta.Ana100% (1)

- Letter of Appoinment For The Position of Beverage Manager'Document4 pagesLetter of Appoinment For The Position of Beverage Manager'Azhar SudiroNo ratings yet

- BimaLab Ethiopia Mentors Program PackDocument11 pagesBimaLab Ethiopia Mentors Program Packግሩም ሽ.No ratings yet

- Institute and Faculty of Actuaries: Subject SA3 - General Insurance Specialist ApplicationsDocument23 pagesInstitute and Faculty of Actuaries: Subject SA3 - General Insurance Specialist Applicationsdickson phiriNo ratings yet

- Siemens Group Medical Insurance Guideline 2015-16Document34 pagesSiemens Group Medical Insurance Guideline 2015-16Vani ShriNo ratings yet

- Case Digest Agency Trust Partnership 2020 2021Document92 pagesCase Digest Agency Trust Partnership 2020 2021Eliza Den100% (1)

- International Exchange Bank D.Document3 pagesInternational Exchange Bank D.MarielNo ratings yet

- MBTC Vs BA Finance Corp. (G.R. No. 179952 December 4, 2009)Document8 pagesMBTC Vs BA Finance Corp. (G.R. No. 179952 December 4, 2009)Ann ChanNo ratings yet

- Notes For CBSEDocument11 pagesNotes For CBSEBinoy TrevadiaNo ratings yet

- PDFDocument280 pagesPDFbonat07No ratings yet

- Pli & RpliDocument5 pagesPli & RpliUma MaheswararaoNo ratings yet

- MasterCard Debit Card Benefits BrochureDocument7 pagesMasterCard Debit Card Benefits BrochureENUNo ratings yet

- Acme Galvanizing Co. v. Fireman's Fund Ins. Co. (1990) : CounselDocument9 pagesAcme Galvanizing Co. v. Fireman's Fund Ins. Co. (1990) : Counselomar_ortiz87No ratings yet

- The Atlas Series: Thank You!Document8 pagesThe Atlas Series: Thank You!Leicel cuevasNo ratings yet

- IllustrationDocument3 pagesIllustrationjavedhazariNo ratings yet

- Export Import ProceduresDocument18 pagesExport Import ProceduresManan SinghNo ratings yet

- Covid19 Protect-BrochureDocument6 pagesCovid19 Protect-BrochureM Sajjad IshaqNo ratings yet

- Lease or Purchase of AircraftDocument2 pagesLease or Purchase of AircraftmehakNo ratings yet

- CA APP Blank FormDocument4 pagesCA APP Blank FormChristine Irish GoyenaNo ratings yet

- Sun Life Assurance Company of Canada Mail - For Review and Confirmation - Your Sun Life Application PackageRacelisDocument1 pageSun Life Assurance Company of Canada Mail - For Review and Confirmation - Your Sun Life Application PackageRacelisWilson Joseph BuschmanNo ratings yet