Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

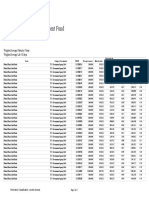

20 viewsPortfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Uploaded by

LjubiThis document provides a portfolio breakdown by investment type for the CREF Inflation-Linked Bond Account as of December 31, 2019. The largest allocation is to U.S. Treasury Inflation Indexed Bonds, totaling over $4.1 billion or 61.7% of net assets. Mortgage-backed securities represent $97.3 million or 1.5% of assets. The remainder is allocated to agency securities ($52 million, 0.8%) and government bonds ($52 million, 0.8%).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 2019 - Irs - Oid TableDocument141 pages2019 - Irs - Oid Table2PlusNo ratings yet

- Builders AddressDocument42 pagesBuilders AddressAshima Lamba0% (1)

- Status of Neem in SenegalDocument10 pagesStatus of Neem in SenegalVignesh MurthyNo ratings yet

- Fidelity MMFDocument8 pagesFidelity MMFOkan AladağNo ratings yet

- PIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsDocument15 pagesPIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsVijay KumarNo ratings yet

- Dimensional 2035 Target Date Retirement Income FundDocument394 pagesDimensional 2035 Target Date Retirement Income FundEdgar salvador Arreola valenciaNo ratings yet

- Save-A-Life Foundation (SALF) IL/federal Grants Spreadsheet by Lee Cary, 7/19/10Document3 pagesSave-A-Life Foundation (SALF) IL/federal Grants Spreadsheet by Lee Cary, 7/19/10Gordon T. PrattNo ratings yet

- Corporate US HYDocument5 pagesCorporate US HYtarja19761No ratings yet

- Corporate US IGDocument23 pagesCorporate US IGtarja19761No ratings yet

- IA Presentation Final1Document46 pagesIA Presentation Final1hellolauraNo ratings yet

- Delta Capital Bonds Feb2024 - 240208 - 092614Document6 pagesDelta Capital Bonds Feb2024 - 240208 - 092614Marvin RamirezNo ratings yet

- Kawanihan NG Ingatang-Yaman: Press ReleaseDocument2 pagesKawanihan NG Ingatang-Yaman: Press ReleasejessNo ratings yet

- 5004 Group ReportDocument15 pages5004 Group ReportSaruNo ratings yet

- IsinDocument3 pagesIsinLCR FINANCE PLCNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Whitehall & CompanyNo ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- Morning Report 10oct2014Document2 pagesMorning Report 10oct2014Joseph DavidsonNo ratings yet

- Morning Report 08sep2014Document2 pagesMorning Report 08sep2014Мөнхбат ДоржпүрэвNo ratings yet

- PDCF Collateral Report 20081110 - 20090514Document1,857 pagesPDCF Collateral Report 20081110 - 20090514reutersdotcomNo ratings yet

- MTM 239 2012-09-25Document2 pagesMTM 239 2012-09-25whitehall4883No ratings yet

- US Internal Revenue Service: 2007p1212 Sect I-IiiDocument206 pagesUS Internal Revenue Service: 2007p1212 Sect I-IiiIRSNo ratings yet

- NG Debt Press Release December 2018 - Ed 2 PDFDocument2 pagesNG Debt Press Release December 2018 - Ed 2 PDFROXAN magalingNo ratings yet

- Morning Report 01oct2014Document2 pagesMorning Report 01oct2014Joseph DavidsonNo ratings yet

- 2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Document2 pages2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Whitehall & CompanyNo ratings yet

- Support and Resistance 29.10.2015Document1 pageSupport and Resistance 29.10.2015ekarupNo ratings yet

- Morning Report 02oct2014Document2 pagesMorning Report 02oct2014Joseph DavidsonNo ratings yet

- Morning Report 05sep2014Document2 pagesMorning Report 05sep2014Мөнхбат ДоржпүрэвNo ratings yet

- E02h3loans RodriguezEstevanDocument3 pagesE02h3loans RodriguezEstevanAnonymous jP29U8Ic0No ratings yet

- Morning Report 04sep2014Document2 pagesMorning Report 04sep2014Мөнхбат ДоржпүрэвNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Whitehall & CompanyNo ratings yet

- Morning Report 02sep2014Document2 pagesMorning Report 02sep2014Мөнхбат ДоржпүрэвNo ratings yet

- "The Pro-Cyclical Production of Risk - What Is To Be Done?": Susan M. WachterDocument21 pages"The Pro-Cyclical Production of Risk - What Is To Be Done?": Susan M. Wachterapi-26091012No ratings yet

- 12e Chart For AllDocument1 page12e Chart For AllMrNoa NoaNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- Morning Report 10sep2014Document2 pagesMorning Report 10sep2014Joseph DavidsonNo ratings yet

- FIN 511 - Quiz 3 AnswersDocument32 pagesFIN 511 - Quiz 3 AnswersAsma AyedNo ratings yet

- Federal Housing Finance AgencyDocument30 pagesFederal Housing Finance AgencyRenée HendrixNo ratings yet

- Unemployment Insurance Weekly Claims For Thursday, January 20, 2022Document10 pagesUnemployment Insurance Weekly Claims For Thursday, January 20, 2022Katie CrolleyNo ratings yet

- Morning Report 16oct2014Document2 pagesMorning Report 16oct2014Joseph DavidsonNo ratings yet

- Quiz 2Document6 pagesQuiz 2GwynethNo ratings yet

- Analysis of State Budget Finances 2023Document9 pagesAnalysis of State Budget Finances 2023Manasee RatnakarNo ratings yet

- Row Dividend ChampionsDocument998 pagesRow Dividend ChampionsMadcarioNo ratings yet

- LankaDocument151 pagesLankapoornimaNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 26 (July 22, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 26 (July 22, 2015)Whitehall & CompanyNo ratings yet

- Morning Report 29oct2014Document2 pagesMorning Report 29oct2014Joseph DavidsonNo ratings yet

- FI DailyDocument3 pagesFI DailyEnrique BadenesNo ratings yet

- Beginning Book Value 11/30/06 Additions/ Changes For Period Ending Book Value 02/28/07 Beginning Market Value 11/30/06Document11 pagesBeginning Book Value 11/30/06 Additions/ Changes For Period Ending Book Value 02/28/07 Beginning Market Value 11/30/06Navarro CollegeNo ratings yet

- CICC DCM Weekly Market Update - 20230624 - VSDocument28 pagesCICC DCM Weekly Market Update - 20230624 - VSNgocduc NgoNo ratings yet

- Economics UKDocument8 pagesEconomics UKnishantashahiNo ratings yet

- Morning Report 09oct2014Document2 pagesMorning Report 09oct2014Joseph DavidsonNo ratings yet

- SIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)Document2 pagesSIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)DeepakNo ratings yet

- Trabajo Aula (Grupo-02) - 18-11-2022Document6 pagesTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNo ratings yet

- Morning Report 26sep2014Document2 pagesMorning Report 26sep2014Joseph DavidsonNo ratings yet

- Liquid Assets Monthly HoldingsDocument3 pagesLiquid Assets Monthly HoldingsRobert CastilloNo ratings yet

- May 2021 Jobs ReportDocument12 pagesMay 2021 Jobs ReportAustin DeneanNo ratings yet

- MBF14e Chap08 Interest Rate Derviatives PbmsDocument16 pagesMBF14e Chap08 Interest Rate Derviatives PbmsVũ Trần Nhật ViNo ratings yet

- 05:20:21 Jobless ClaimsDocument12 pages05:20:21 Jobless ClaimsKatie CrolleyNo ratings yet

- NYSE Bonds Ex Clearing SecuritiesDocument29 pagesNYSE Bonds Ex Clearing SecuritiesAchilleas ManousakisNo ratings yet

- Morning Report 15oct2014Document2 pagesMorning Report 15oct2014Joseph DavidsonNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Statements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019Document1 pageStatements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNo ratings yet

- Group Project Bing WajibDocument2 pagesGroup Project Bing WajibNOOR SYIFANo ratings yet

- Thomas and Hardy 2011Document10 pagesThomas and Hardy 2011Rodrigo GiorgiNo ratings yet

- Bartender Instalation GuideDocument24 pagesBartender Instalation GuideDioniisosNo ratings yet

- Open Position SchlumbergerDocument2 pagesOpen Position SchlumbergerAnkit SharmaNo ratings yet

- Chapter VI. Independent Demand Inventory SystemsDocument12 pagesChapter VI. Independent Demand Inventory Systemssimi1690No ratings yet

- Correlation and RegressionDocument50 pagesCorrelation and Regression5240110014No ratings yet

- Neogen - Effective Testing Components of An Environmental Monitoring Program PDFDocument12 pagesNeogen - Effective Testing Components of An Environmental Monitoring Program PDFAngga PrasetyoNo ratings yet

- Reclamation Safety and Health StandardsDocument9 pagesReclamation Safety and Health StandardsDonald Joshua BanaagNo ratings yet

- Espiritu vs. Cipriano and CA, G.R. No. L-32743 February 15, 1974Document4 pagesEspiritu vs. Cipriano and CA, G.R. No. L-32743 February 15, 1974Anasor Go100% (1)

- NCP AppendectomyDocument10 pagesNCP Appendectomy100lNo ratings yet

- Imperial Pacific International Holdings Limited: Interim Results For The Six Months Ended 30 June 2020Document26 pagesImperial Pacific International Holdings Limited: Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- Math 6-Q4-Module-5Document20 pagesMath 6-Q4-Module-5REYIA LUMONTADNo ratings yet

- OOAD Interview Questions-Answers NewDocument6 pagesOOAD Interview Questions-Answers NewUtsav ShahNo ratings yet

- Banas Vs Asia Pacific FinanceDocument6 pagesBanas Vs Asia Pacific FinanceNovo FarmsNo ratings yet

- 0HowToExcel Ebook - 50 Tips To Master Excel 2017-04-23Document38 pages0HowToExcel Ebook - 50 Tips To Master Excel 2017-04-23Santiago Tuesta100% (1)

- Teams and Team WorkingDocument10 pagesTeams and Team WorkingRose DumayacNo ratings yet

- CV Isabel Ortiz Sep 2016 PDFDocument12 pagesCV Isabel Ortiz Sep 2016 PDFAnna Sophia YorkNo ratings yet

- Week 2 Practice 111Document16 pagesWeek 2 Practice 111Angel BtNo ratings yet

- Architects Council Europe Bim IntroDocument18 pagesArchitects Council Europe Bim IntroTamas FodorNo ratings yet

- dlamcCqiDef EASTDocument5 pagesdlamcCqiDef EASTAdhi atmaNo ratings yet

- 1984 01 Web PDFDocument52 pages1984 01 Web PDFBrian-Marti BoatrightNo ratings yet

- Ra 9275 Clean Water ActDocument20 pagesRa 9275 Clean Water Actleyrie100% (1)

- Source Approval Kataline Part 1Document11 pagesSource Approval Kataline Part 1Arun KumarNo ratings yet

- Tlprlp434a Tlprlp418aDocument1 pageTlprlp434a Tlprlp418aOVALLEPANo ratings yet

- Winco HPS9000 EDocument16 pagesWinco HPS9000 EW WidmerNo ratings yet

- EGR System Design and FunctionDocument5 pagesEGR System Design and Functionhugosffs100% (2)

- Ncm111 Lec - Week 1Document7 pagesNcm111 Lec - Week 1Stefhanie Mae LazaroNo ratings yet

- Ane Publish Ahead of Print 10.1213.ane.0000000000005043Document13 pagesAne Publish Ahead of Print 10.1213.ane.0000000000005043khalisahnNo ratings yet

Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Uploaded by

Ljubi0 ratings0% found this document useful (0 votes)

20 views1 pageThis document provides a portfolio breakdown by investment type for the CREF Inflation-Linked Bond Account as of December 31, 2019. The largest allocation is to U.S. Treasury Inflation Indexed Bonds, totaling over $4.1 billion or 61.7% of net assets. Mortgage-backed securities represent $97.3 million or 1.5% of assets. The remainder is allocated to agency securities ($52 million, 0.8%) and government bonds ($52 million, 0.8%).

Original Description:

Original Title

CREF_ar-page69

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a portfolio breakdown by investment type for the CREF Inflation-Linked Bond Account as of December 31, 2019. The largest allocation is to U.S. Treasury Inflation Indexed Bonds, totaling over $4.1 billion or 61.7% of net assets. Mortgage-backed securities represent $97.3 million or 1.5% of assets. The remainder is allocated to agency securities ($52 million, 0.8%) and government bonds ($52 million, 0.8%).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views1 pagePortfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Uploaded by

LjubiThis document provides a portfolio breakdown by investment type for the CREF Inflation-Linked Bond Account as of December 31, 2019. The largest allocation is to U.S. Treasury Inflation Indexed Bonds, totaling over $4.1 billion or 61.7% of net assets. Mortgage-backed securities represent $97.3 million or 1.5% of assets. The remainder is allocated to agency securities ($52 million, 0.8%) and government bonds ($52 million, 0.8%).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

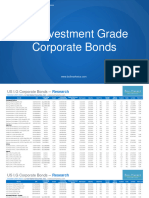

Portfolio of investments

CREF Inflation-Linked Bond Account ■ December 31, 2019

Value % of net

Principal Issuer (000) assets

GOVERNMENT BONDS

AGENCY SECURITIES

$ 4,200,000 Crowley Conro LLC 4.181%, 08/15/43 $ 4,689 0.1%

17,310,000 Montefiore Medical Center 2.895%, 04/20/32 17,838 0.3

3,500,000 Private Export Funding Corp (PEFCO) 2.300%, 09/15/20 3,516 0.1

3,000,000 PEFCO 3.250%, 06/15/25 3,194 0.0

4,276,316 Reliance Industries Ltd 2.444%, 01/15/26 4,345 0.1

3,500,000 Ukraine Government AID International Bonds 1.847%, 05/29/20 3,504 0.0

15,000,000 Ukraine Government AID International Bonds 1.471%, 09/29/21 14,941 0.2

52,027 0.8

MORTGAGE BACKED

23,319,126 Government National Mortgage Association (GNMA) 3.600%, 09/15/31 24,523 0.4

11,523,399 GNMA 3.650%, 02/15/32 12,024 0.2

2,489,652 GNMA 3.380%, 07/15/35 2,597 0.0

3,195,867 GNMA 3.870%, 10/15/36 3,383 0.1

55,393,200 h GNMA 2.750%, 01/15/45 54,801 0.8

97,328 1.5

U.S. TREASURY SECURITIES

81,096,880 k United States Treasury Inflation Indexed Bonds 1.125%, 01/15/21 81,847 1.2

318,121,820 k United States Treasury Inflation Indexed Bonds 0.125%, 04/15/21 317,459 4.8

292,054,534 k United States Treasury Inflation Indexed Bonds 0.625%, 07/15/21 295,324 4.5

359,247,141 k United States Treasury Inflation Indexed Bonds 0.125%, 01/15/22 359,044 5.4

279,870,095 k United States Treasury Inflation Indexed Bonds 0.125%, 04/15/22 279,448 4.2

326,745,080 k United States Treasury Inflation Indexed Bonds 0.125%, 07/15/22 328,098 4.9

333,334,170 k United States Treasury Inflation Indexed Bonds 0.125%, 01/15/23 333,287 5.0

235,165,190 k United States Treasury Inflation Indexed Bonds 0.625%, 04/15/23 238,794 3.6

237,183,375 k United States Treasury Inflation Indexed Bonds 0.375%, 07/15/23 240,449 3.6

153,570,470 k United States Treasury Inflation Indexed Bonds 0.625%, 01/15/24 156,813 2.4

167,327,560 k United States Treasury Inflation Indexed Bonds 0.500%, 04/15/24 170,024 2.6

139,259,305 k United States Treasury Inflation Indexed Bonds 0.125%, 07/15/24 140,080 2.1

135,400,950 k United States Treasury Inflation Indexed Bonds 0.125%, 10/15/24 136,173 2.1

177,089,720 k United States Treasury Inflation Indexed Bonds 0.250%, 01/15/25 178,651 2.7

269,289,489 k United States Treasury Inflation Indexed Bonds 2.375%, 01/15/25 300,100 4.5

117,191,880 k United States Treasury Inflation Indexed Bonds 0.375%, 07/15/25 119,571 1.8

159,196,590 k United States Treasury Inflation Indexed Bonds 0.625%, 01/15/26 164,062 2.5

214,993,771 k United States Treasury Inflation Indexed Bonds 2.000%, 01/15/26 238,958 3.6

148,147,140 k United States Treasury Inflation Indexed Bonds 0.125%, 07/15/26 148,602 2.2

224,241,440 k United States Treasury Inflation Indexed Bonds 0.375%, 01/15/27 227,624 3.4

122,753,124 k United States Treasury Inflation Indexed Bonds 2.375%, 01/15/27 141,675 2.1

121,500,225 k United States Treasury Inflation Indexed Bonds 0.375%, 07/15/27 123,923 1.9

214,381,710 k United States Treasury Inflation Indexed Bonds 0.500%, 01/15/28 219,900 3.3

211,760,644 k United States Treasury Inflation Indexed Bonds 1.750%, 01/15/28 237,864 3.6

113,000,065 k United States Treasury Inflation Indexed Bonds 3.625%, 04/15/28 144,535 2.2

131,217,920 k United States Treasury Inflation Indexed Bonds 0.750%, 07/15/28 138,030 2.1

212,993,990 k United States Treasury Inflation Indexed Bonds 0.875%, 01/15/29 226,154 3.4

141,307,866 k United States Treasury Inflation Indexed Bonds 2.500%, 01/15/29 170,281 2.6

203,631,178 k United States Treasury Inflation Indexed Bonds 3.875%, 04/15/29 271,672 4.1

See notes to financial statements College Retirement Equities Fund ■ 2019 Annual Report 69

You might also like

- 2019 - Irs - Oid TableDocument141 pages2019 - Irs - Oid Table2PlusNo ratings yet

- Builders AddressDocument42 pagesBuilders AddressAshima Lamba0% (1)

- Status of Neem in SenegalDocument10 pagesStatus of Neem in SenegalVignesh MurthyNo ratings yet

- Fidelity MMFDocument8 pagesFidelity MMFOkan AladağNo ratings yet

- PIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsDocument15 pagesPIMCO Funds Emerging Markets Bond Fund Portfolio HoldingsVijay KumarNo ratings yet

- Dimensional 2035 Target Date Retirement Income FundDocument394 pagesDimensional 2035 Target Date Retirement Income FundEdgar salvador Arreola valenciaNo ratings yet

- Save-A-Life Foundation (SALF) IL/federal Grants Spreadsheet by Lee Cary, 7/19/10Document3 pagesSave-A-Life Foundation (SALF) IL/federal Grants Spreadsheet by Lee Cary, 7/19/10Gordon T. PrattNo ratings yet

- Corporate US HYDocument5 pagesCorporate US HYtarja19761No ratings yet

- Corporate US IGDocument23 pagesCorporate US IGtarja19761No ratings yet

- IA Presentation Final1Document46 pagesIA Presentation Final1hellolauraNo ratings yet

- Delta Capital Bonds Feb2024 - 240208 - 092614Document6 pagesDelta Capital Bonds Feb2024 - 240208 - 092614Marvin RamirezNo ratings yet

- Kawanihan NG Ingatang-Yaman: Press ReleaseDocument2 pagesKawanihan NG Ingatang-Yaman: Press ReleasejessNo ratings yet

- 5004 Group ReportDocument15 pages5004 Group ReportSaruNo ratings yet

- IsinDocument3 pagesIsinLCR FINANCE PLCNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Whitehall & CompanyNo ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- Morning Report 10oct2014Document2 pagesMorning Report 10oct2014Joseph DavidsonNo ratings yet

- Morning Report 08sep2014Document2 pagesMorning Report 08sep2014Мөнхбат ДоржпүрэвNo ratings yet

- PDCF Collateral Report 20081110 - 20090514Document1,857 pagesPDCF Collateral Report 20081110 - 20090514reutersdotcomNo ratings yet

- MTM 239 2012-09-25Document2 pagesMTM 239 2012-09-25whitehall4883No ratings yet

- US Internal Revenue Service: 2007p1212 Sect I-IiiDocument206 pagesUS Internal Revenue Service: 2007p1212 Sect I-IiiIRSNo ratings yet

- NG Debt Press Release December 2018 - Ed 2 PDFDocument2 pagesNG Debt Press Release December 2018 - Ed 2 PDFROXAN magalingNo ratings yet

- Morning Report 01oct2014Document2 pagesMorning Report 01oct2014Joseph DavidsonNo ratings yet

- 2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Document2 pages2.20 Whitehall: Monitoring The Markets Vol. 2 Iss. 20 (May 15, 2012)Whitehall & CompanyNo ratings yet

- Support and Resistance 29.10.2015Document1 pageSupport and Resistance 29.10.2015ekarupNo ratings yet

- Morning Report 02oct2014Document2 pagesMorning Report 02oct2014Joseph DavidsonNo ratings yet

- Morning Report 05sep2014Document2 pagesMorning Report 05sep2014Мөнхбат ДоржпүрэвNo ratings yet

- E02h3loans RodriguezEstevanDocument3 pagesE02h3loans RodriguezEstevanAnonymous jP29U8Ic0No ratings yet

- Morning Report 04sep2014Document2 pagesMorning Report 04sep2014Мөнхбат ДоржпүрэвNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Whitehall & CompanyNo ratings yet

- Morning Report 02sep2014Document2 pagesMorning Report 02sep2014Мөнхбат ДоржпүрэвNo ratings yet

- "The Pro-Cyclical Production of Risk - What Is To Be Done?": Susan M. WachterDocument21 pages"The Pro-Cyclical Production of Risk - What Is To Be Done?": Susan M. Wachterapi-26091012No ratings yet

- 12e Chart For AllDocument1 page12e Chart For AllMrNoa NoaNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- Morning Report 10sep2014Document2 pagesMorning Report 10sep2014Joseph DavidsonNo ratings yet

- FIN 511 - Quiz 3 AnswersDocument32 pagesFIN 511 - Quiz 3 AnswersAsma AyedNo ratings yet

- Federal Housing Finance AgencyDocument30 pagesFederal Housing Finance AgencyRenée HendrixNo ratings yet

- Unemployment Insurance Weekly Claims For Thursday, January 20, 2022Document10 pagesUnemployment Insurance Weekly Claims For Thursday, January 20, 2022Katie CrolleyNo ratings yet

- Morning Report 16oct2014Document2 pagesMorning Report 16oct2014Joseph DavidsonNo ratings yet

- Quiz 2Document6 pagesQuiz 2GwynethNo ratings yet

- Analysis of State Budget Finances 2023Document9 pagesAnalysis of State Budget Finances 2023Manasee RatnakarNo ratings yet

- Row Dividend ChampionsDocument998 pagesRow Dividend ChampionsMadcarioNo ratings yet

- LankaDocument151 pagesLankapoornimaNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 26 (July 22, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 26 (July 22, 2015)Whitehall & CompanyNo ratings yet

- Morning Report 29oct2014Document2 pagesMorning Report 29oct2014Joseph DavidsonNo ratings yet

- FI DailyDocument3 pagesFI DailyEnrique BadenesNo ratings yet

- Beginning Book Value 11/30/06 Additions/ Changes For Period Ending Book Value 02/28/07 Beginning Market Value 11/30/06Document11 pagesBeginning Book Value 11/30/06 Additions/ Changes For Period Ending Book Value 02/28/07 Beginning Market Value 11/30/06Navarro CollegeNo ratings yet

- CICC DCM Weekly Market Update - 20230624 - VSDocument28 pagesCICC DCM Weekly Market Update - 20230624 - VSNgocduc NgoNo ratings yet

- Economics UKDocument8 pagesEconomics UKnishantashahiNo ratings yet

- Morning Report 09oct2014Document2 pagesMorning Report 09oct2014Joseph DavidsonNo ratings yet

- SIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)Document2 pagesSIP Mantra - HDFC Flexi Cap Fund (Aprt 2023)DeepakNo ratings yet

- Trabajo Aula (Grupo-02) - 18-11-2022Document6 pagesTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNo ratings yet

- Morning Report 26sep2014Document2 pagesMorning Report 26sep2014Joseph DavidsonNo ratings yet

- Liquid Assets Monthly HoldingsDocument3 pagesLiquid Assets Monthly HoldingsRobert CastilloNo ratings yet

- May 2021 Jobs ReportDocument12 pagesMay 2021 Jobs ReportAustin DeneanNo ratings yet

- MBF14e Chap08 Interest Rate Derviatives PbmsDocument16 pagesMBF14e Chap08 Interest Rate Derviatives PbmsVũ Trần Nhật ViNo ratings yet

- 05:20:21 Jobless ClaimsDocument12 pages05:20:21 Jobless ClaimsKatie CrolleyNo ratings yet

- NYSE Bonds Ex Clearing SecuritiesDocument29 pagesNYSE Bonds Ex Clearing SecuritiesAchilleas ManousakisNo ratings yet

- Morning Report 15oct2014Document2 pagesMorning Report 15oct2014Joseph DavidsonNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Statements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019Document1 pageStatements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNo ratings yet

- Group Project Bing WajibDocument2 pagesGroup Project Bing WajibNOOR SYIFANo ratings yet

- Thomas and Hardy 2011Document10 pagesThomas and Hardy 2011Rodrigo GiorgiNo ratings yet

- Bartender Instalation GuideDocument24 pagesBartender Instalation GuideDioniisosNo ratings yet

- Open Position SchlumbergerDocument2 pagesOpen Position SchlumbergerAnkit SharmaNo ratings yet

- Chapter VI. Independent Demand Inventory SystemsDocument12 pagesChapter VI. Independent Demand Inventory Systemssimi1690No ratings yet

- Correlation and RegressionDocument50 pagesCorrelation and Regression5240110014No ratings yet

- Neogen - Effective Testing Components of An Environmental Monitoring Program PDFDocument12 pagesNeogen - Effective Testing Components of An Environmental Monitoring Program PDFAngga PrasetyoNo ratings yet

- Reclamation Safety and Health StandardsDocument9 pagesReclamation Safety and Health StandardsDonald Joshua BanaagNo ratings yet

- Espiritu vs. Cipriano and CA, G.R. No. L-32743 February 15, 1974Document4 pagesEspiritu vs. Cipriano and CA, G.R. No. L-32743 February 15, 1974Anasor Go100% (1)

- NCP AppendectomyDocument10 pagesNCP Appendectomy100lNo ratings yet

- Imperial Pacific International Holdings Limited: Interim Results For The Six Months Ended 30 June 2020Document26 pagesImperial Pacific International Holdings Limited: Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- Math 6-Q4-Module-5Document20 pagesMath 6-Q4-Module-5REYIA LUMONTADNo ratings yet

- OOAD Interview Questions-Answers NewDocument6 pagesOOAD Interview Questions-Answers NewUtsav ShahNo ratings yet

- Banas Vs Asia Pacific FinanceDocument6 pagesBanas Vs Asia Pacific FinanceNovo FarmsNo ratings yet

- 0HowToExcel Ebook - 50 Tips To Master Excel 2017-04-23Document38 pages0HowToExcel Ebook - 50 Tips To Master Excel 2017-04-23Santiago Tuesta100% (1)

- Teams and Team WorkingDocument10 pagesTeams and Team WorkingRose DumayacNo ratings yet

- CV Isabel Ortiz Sep 2016 PDFDocument12 pagesCV Isabel Ortiz Sep 2016 PDFAnna Sophia YorkNo ratings yet

- Week 2 Practice 111Document16 pagesWeek 2 Practice 111Angel BtNo ratings yet

- Architects Council Europe Bim IntroDocument18 pagesArchitects Council Europe Bim IntroTamas FodorNo ratings yet

- dlamcCqiDef EASTDocument5 pagesdlamcCqiDef EASTAdhi atmaNo ratings yet

- 1984 01 Web PDFDocument52 pages1984 01 Web PDFBrian-Marti BoatrightNo ratings yet

- Ra 9275 Clean Water ActDocument20 pagesRa 9275 Clean Water Actleyrie100% (1)

- Source Approval Kataline Part 1Document11 pagesSource Approval Kataline Part 1Arun KumarNo ratings yet

- Tlprlp434a Tlprlp418aDocument1 pageTlprlp434a Tlprlp418aOVALLEPANo ratings yet

- Winco HPS9000 EDocument16 pagesWinco HPS9000 EW WidmerNo ratings yet

- EGR System Design and FunctionDocument5 pagesEGR System Design and Functionhugosffs100% (2)

- Ncm111 Lec - Week 1Document7 pagesNcm111 Lec - Week 1Stefhanie Mae LazaroNo ratings yet

- Ane Publish Ahead of Print 10.1213.ane.0000000000005043Document13 pagesAne Publish Ahead of Print 10.1213.ane.0000000000005043khalisahnNo ratings yet