Professional Documents

Culture Documents

A Perception On E-Banking Services Towards Urban and Rural Educated Senior Citizens

A Perception On E-Banking Services Towards Urban and Rural Educated Senior Citizens

Uploaded by

rajeshwari konarCopyright:

Available Formats

You might also like

- Tutorial 5Document2 pagesTutorial 5Phan NhưNo ratings yet

- A View On Transformational Leadership: The Case of Jeff BezosDocument9 pagesA View On Transformational Leadership: The Case of Jeff BezosAkash BhatNo ratings yet

- (Libro) Arellano - Panel Data Econometrics 2003Document244 pages(Libro) Arellano - Panel Data Econometrics 2003Federico Vallejo MondragónNo ratings yet

- Level of Conceptualization For Leadership TheoriesDocument9 pagesLevel of Conceptualization For Leadership TheoriesUmair MansoorNo ratings yet

- Tests of SignificanceDocument103 pagesTests of Significancessckp86No ratings yet

- Archaeology of Early Byzantium Marlia MangoDocument12 pagesArchaeology of Early Byzantium Marlia MangoDavo Lo SchiavoNo ratings yet

- Customer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)Document10 pagesCustomer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)aurorashiva1No ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- PRJP - 1653Document9 pagesPRJP - 1653PraKhar PandeNo ratings yet

- A Comparative Study On Motives of Online and Offline Banking Consumers: A Case Study of Udaipur CityDocument5 pagesA Comparative Study On Motives of Online and Offline Banking Consumers: A Case Study of Udaipur Citybittu sahaNo ratings yet

- E-Banking in India: Current and Future Prospects: January 2016Document14 pagesE-Banking in India: Current and Future Prospects: January 2016Varsha GuptaNo ratings yet

- Research Repot (E-Banking)Document14 pagesResearch Repot (E-Banking)priyanshu palNo ratings yet

- Electronic Payment Current Scenario and Scope For ImprovementDocument8 pagesElectronic Payment Current Scenario and Scope For ImprovementM Goutham17% (6)

- Impact of E-Banking in India: Presented By-Shouvik Maji PGDM - 75Document11 pagesImpact of E-Banking in India: Presented By-Shouvik Maji PGDM - 75Nilanjan GhoshNo ratings yet

- E Banking in India A Case Study of KanDocument12 pagesE Banking in India A Case Study of KanPrathameshNo ratings yet

- E PaymentDocument59 pagesE PaymentRajesh BathulaNo ratings yet

- 1.Man-Online Banking Services and Customer Satisfaction-Dr Pallavi MehtaDocument6 pages1.Man-Online Banking Services and Customer Satisfaction-Dr Pallavi MehtaImpact JournalsNo ratings yet

- 03 - Literature ReviewDocument5 pages03 - Literature ReviewApeksha ArayanNo ratings yet

- E-Banking Challenges and Opportunities in The Indian Banking SectorDocument4 pagesE-Banking Challenges and Opportunities in The Indian Banking SectorMunni ChukkaNo ratings yet

- The Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaDocument27 pagesThe Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaKhristine Dela CruzNo ratings yet

- A Synoptic Note On P.HDDocument15 pagesA Synoptic Note On P.HDSubramanya DgNo ratings yet

- Changing of Pattern of Demand For E-Banking Services ProjectDocument42 pagesChanging of Pattern of Demand For E-Banking Services Projectrahulsahoo983No ratings yet

- Paper 14Document5 pagesPaper 14VDC CommerceNo ratings yet

- A Study On Customer Perception & Psychology Towards e - Banking With Reference To Mumbra RegionDocument8 pagesA Study On Customer Perception & Psychology Towards e - Banking With Reference To Mumbra RegionPooja Singh SolankiNo ratings yet

- Ijird,+3 +NOV15021Document8 pagesIjird,+3 +NOV15021Saroj KhadangaNo ratings yet

- INSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 7 No 3 July September 2021 Pages 66 To 68Document3 pagesINSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 7 No 3 July September 2021 Pages 66 To 68Sakina Khatoon 10No ratings yet

- The Influence of Perceived Ease of Use (Case Study Bni Kcu Jakarta Pusat)Document14 pagesThe Influence of Perceived Ease of Use (Case Study Bni Kcu Jakarta Pusat)galangaNo ratings yet

- A Study On Customer Awareness On E-Banking Services With Reference To Sbi Nethimedu, SalemDocument5 pagesA Study On Customer Awareness On E-Banking Services With Reference To Sbi Nethimedu, Salemsanthosh kumarNo ratings yet

- A Study On Customer Awareness Towards e Banking.. B. GopichandDocument11 pagesA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1No ratings yet

- Awareness of E-Banking Services Among Rural CustomersDocument10 pagesAwareness of E-Banking Services Among Rural CustomersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Customer Experience With Digital LendingDocument16 pagesCustomer Experience With Digital LendingYOGESH AGGARWALNo ratings yet

- Bharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)Document19 pagesBharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)nisha chopraNo ratings yet

- A Study On The Consumer Perception Towards Mobile Banking Services of State Bank of India"-With Special Reference To Kollam District "Document8 pagesA Study On The Consumer Perception Towards Mobile Banking Services of State Bank of India"-With Special Reference To Kollam District "Priya GaneshpriyaNo ratings yet

- 8 Malika Rani A Study On The Customers Perception Towards E-BankingDocument11 pages8 Malika Rani A Study On The Customers Perception Towards E-BankingNukeshwar PandeyNo ratings yet

- JPSP - 2022 - 698Document10 pagesJPSP - 2022 - 698hifeztobgglNo ratings yet

- A Study On Customers Attitude Towards Mobile Banking in Kollam DistrictDocument10 pagesA Study On Customers Attitude Towards Mobile Banking in Kollam DistrictSebi JohnnNo ratings yet

- Safety and Security of Digital Transactions of Banking Sector: An Analytical StudyDocument12 pagesSafety and Security of Digital Transactions of Banking Sector: An Analytical StudyKartik KNo ratings yet

- Ijesrr V-2-3-2Document4 pagesIjesrr V-2-3-2Pearl LenonNo ratings yet

- IJRBM - Review of The Literature On The Electronic Banking Adoption Bankers PerspectiveDocument10 pagesIJRBM - Review of The Literature On The Electronic Banking Adoption Bankers PerspectiveImpact JournalsNo ratings yet

- Term Paper ON: "Study To Analyse Customer's Take On E-Banking Services"Document8 pagesTerm Paper ON: "Study To Analyse Customer's Take On E-Banking Services"atul_rockstarNo ratings yet

- A Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictDocument8 pagesA Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictIOSRjournalNo ratings yet

- Synopsis Vaishnavi.. 1Document12 pagesSynopsis Vaishnavi.. 1Aniruddha BorkarNo ratings yet

- Users' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenDocument6 pagesUsers' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenOmotayo AkinpelumiNo ratings yet

- Literature Review: (S.Vignesh, 2014)Document2 pagesLiterature Review: (S.Vignesh, 2014)Manish RavatNo ratings yet

- 748pm - 6.EPRA JOURNALS-6642Document3 pages748pm - 6.EPRA JOURNALS-6642Prince GuptaNo ratings yet

- Rashmi Sharma - 11505Document29 pagesRashmi Sharma - 11505Kanika TandonNo ratings yet

- BRM Cce-2Document8 pagesBRM Cce-2Akshat PandeNo ratings yet

- A Study On Customer Satisfaction On Sbi Yono With Reference To Stonehouse Pet, Nellore.Document27 pagesA Study On Customer Satisfaction On Sbi Yono With Reference To Stonehouse Pet, Nellore.mohdmujeebahmed01No ratings yet

- 13 Growth of e Banking Challenges and Opportunities in IndiaDocument5 pages13 Growth of e Banking Challenges and Opportunities in IndiaAyesha Asif100% (1)

- Review of LiteratureDocument4 pagesReview of Literaturemaha lakshmiNo ratings yet

- Research Proposal On Mobile Banking PDFDocument12 pagesResearch Proposal On Mobile Banking PDFKhalid de CancNo ratings yet

- Research Proposal On Mobile Banking - PDF 2 PDFDocument12 pagesResearch Proposal On Mobile Banking - PDF 2 PDFCRING VEDIONo ratings yet

- Factors Influencing The Customer Preference Towards E-Banking Services in Cuddalore DistrictDocument8 pagesFactors Influencing The Customer Preference Towards E-Banking Services in Cuddalore DistrictAshish KaushalNo ratings yet

- Consumer Awareness On The Usage of E-Banking ThroughDocument11 pagesConsumer Awareness On The Usage of E-Banking Throughgobindapandit1213No ratings yet

- Problems Faced by Consumers While Using Internet Banking Services A SurveyDocument12 pagesProblems Faced by Consumers While Using Internet Banking Services A Surveyarcherselevators0% (1)

- A Comparative Study of Internet Banking in Pakistan.': Presented by Nabil Ur Rehman Siddiqui (2210)Document14 pagesA Comparative Study of Internet Banking in Pakistan.': Presented by Nabil Ur Rehman Siddiqui (2210)nrsiddiquipkNo ratings yet

- Customers' Demographic Profile and Satisfaction in E-Banking Services: A Study of Indian BanksDocument12 pagesCustomers' Demographic Profile and Satisfaction in E-Banking Services: A Study of Indian BanksChayan GargNo ratings yet

- 1..research Paper FebDocument18 pages1..research Paper FebABHISHEK CHATTERJEENo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebShivangi SinghNo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebPooja AdhikariNo ratings yet

- BEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYFrom EverandBEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYNo ratings yet

- TRUSTING MOBILE PAYMENT: HOW THE TRUST-FACTOR FORMS THE MOBILE PAYMENT PROCESSFrom EverandTRUSTING MOBILE PAYMENT: HOW THE TRUST-FACTOR FORMS THE MOBILE PAYMENT PROCESSNo ratings yet

- Cookbook for Mobile Robotic Platform Control: With Internet of Things And Ti Launch PadFrom EverandCookbook for Mobile Robotic Platform Control: With Internet of Things And Ti Launch PadNo ratings yet

- Systematic Layout PlanningDocument9 pagesSystematic Layout PlanningchirpynikNo ratings yet

- Teacher Leadership in Public Schools in The Philippines: Carmela Canlas OracionDocument205 pagesTeacher Leadership in Public Schools in The Philippines: Carmela Canlas Oracionrobertoii_suarezNo ratings yet

- Marchi Friction PaperDocument201 pagesMarchi Friction PaperRoger Lahoud100% (1)

- 1.farah Mastura Noor AzmanDocument18 pages1.farah Mastura Noor Azmanzulikah89No ratings yet

- Amelita N. Tupaz PHD MathEd Educ 302 Assignment 2Document3 pagesAmelita N. Tupaz PHD MathEd Educ 302 Assignment 2Amelita TupazNo ratings yet

- Condition Monitoring of CablesDocument89 pagesCondition Monitoring of CablesJack WeaverNo ratings yet

- Survey of Labs in AustraliaDocument77 pagesSurvey of Labs in Australiaeduman9949No ratings yet

- Conversation Piece Why Exhibition Histo PDFDocument3 pagesConversation Piece Why Exhibition Histo PDFMirtes OliveiraNo ratings yet

- Article Review Price MohammedDocument5 pagesArticle Review Price MohammedGudina GeletaNo ratings yet

- Architectural Design Process Case Study: Making Building From A Formal TypeDocument11 pagesArchitectural Design Process Case Study: Making Building From A Formal TypeHafiz Amirrol100% (3)

- Community-Based Approach For Dengue Prevention and Control in Sta. Cruz, Laguna, PhilippinesDocument8 pagesCommunity-Based Approach For Dengue Prevention and Control in Sta. Cruz, Laguna, PhilippinesRosalinda Saquing-GuingabNo ratings yet

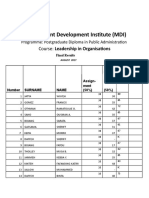

- Mdi Postgraduate Diploma Public Administration Results August 2017Document4 pagesMdi Postgraduate Diploma Public Administration Results August 2017Mr DamphaNo ratings yet

- Accuracy of Digital Impressions For Implant-Supported Complete-Arch ProsthesisDocument23 pagesAccuracy of Digital Impressions For Implant-Supported Complete-Arch ProsthesisValeria CrespoNo ratings yet

- Module 1 Introduction To Building and Enhancing NewDocument29 pagesModule 1 Introduction To Building and Enhancing NewDanilo de la CruzNo ratings yet

- SixsigDocument90 pagesSixsigHokuto No KenNo ratings yet

- Value at RiskDocument7 pagesValue at Riskmba departmentNo ratings yet

- Review of Related Literature and StudiesDocument7 pagesReview of Related Literature and StudiesLexie Jamir CerezoNo ratings yet

- How To Do Action ResearchDocument33 pagesHow To Do Action ResearchAmmi Sirhc TeeNo ratings yet

- Barangay Profile History 2 2016Document14 pagesBarangay Profile History 2 2016Leo Buquiran Acabal100% (1)

- Week 3 Standard Consistency, Setting Time & Fineness of CementDocument6 pagesWeek 3 Standard Consistency, Setting Time & Fineness of CementFareez SedakaNo ratings yet

- Hotel Management Thesis SampleDocument6 pagesHotel Management Thesis Samplebk1svxmr100% (2)

- An Investigation of The Relationship Between Impulsive Buying and Post Purchase Buyer's Dissonance at Retail ShopsDocument16 pagesAn Investigation of The Relationship Between Impulsive Buying and Post Purchase Buyer's Dissonance at Retail ShopsmahmudaNo ratings yet

- University of Helsinki Helsinki, Finland 31.8.-4.9. 2015Document13 pagesUniversity of Helsinki Helsinki, Finland 31.8.-4.9. 2015Diana Lcvn LcvnNo ratings yet

- Weekly Schedule of MBA 2016 SIIIA Week 1Document12 pagesWeekly Schedule of MBA 2016 SIIIA Week 1aadinNo ratings yet

A Perception On E-Banking Services Towards Urban and Rural Educated Senior Citizens

A Perception On E-Banking Services Towards Urban and Rural Educated Senior Citizens

Uploaded by

rajeshwari konarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Perception On E-Banking Services Towards Urban and Rural Educated Senior Citizens

A Perception On E-Banking Services Towards Urban and Rural Educated Senior Citizens

Uploaded by

rajeshwari konarCopyright:

Available Formats

A JOURNAL OF COMPOSITION THEORY ISSN : 0731-6755

“A Perception on E-Banking services towards Urban and Rural Educated

Senior citizens”

Lakshman K Research Scholar, Department of Business Administration, Annamalai University, Chidambaram, Tamil

Nadu

Dr. N.Sulaiman Assistant Professor, Department of Business Administration, Annamalai University, Chidambaram,

Tamil Nadu

Abstract

The objective of this research paper is to study behaviour of urban and rural educated senior citizens about e banking

services. The government of India provides various concessions and facilities to its senior citizens in India. The banking

industry is also providing various schemes to senior citizens like senior citizens savings scheme, senior citizens club account,

tax saving schemes, senior citizens fixed deposits schemes etc. Banks are also marketing themselves as best bank for senior

citizens. Banking institutions started providing online services to their customers but these services cannot be said to be user-

friendly for senior citizens. It is also possible that websites will be designed for easy use by the elderly in the future. As

educated senior citizens are the major segment using banking services it becomes necessary to study the awareness, usage,

ease of using and satisfaction level of e banking services among them. The researcher has used descriptive research design

and non-probability convenience sampling method for this study. Survey method is used to collect the data from 160

respondents by using well-structured questionnaire. This research will help the banking system to know awareness, usage,

ease of using and level of satisfaction about e banking services for urban and rural educated senior citizens. And this will lead

to develop specific schemes and strategies for this group of customers.

Keywords: E-banking, Internet banking, Senior citizen, Awareness, Usage, Ease of use, Satisfaction.

Introduction

The banking sector plays an important role in the development of an Indian economy. E-banking became an essential part

of the banking system; use of e banking helps banks to increase the work efficiency. E-banking provides both efficient and

effective ways of doing banking transactions. E-Banking is the medium of delivery of banking services, it has gained wide

acceptance in India. In the near future banking operations will be highly operated by information technology. Now a day’s

Mobile-banking is playing a significant role in the banking sector and the some bankers are providing more and more services

on mobile rather than in bank. The services like balance enquiry, a request for cheque book, change password, request for a

Demand Draft, etc. The use of electronic funds transfer has been also increased. Banks have launched their apps for providing

the banking services to their customers and most of the educated customers especially youth has started using e banking

services through mobile apps. Internet banking provides many facilities to bank customers like money transfer (RTGS, IMPS),

bill payments etc. Debit /Credit cards services of banks have seen the highest growth in last two decades in India. The plastic

money also made inroads into the Indian economy especially for the all classes of customer. The debit and credit cards are

playing very important role in the daily activity of almost every individual, due to the debit/credit card doing bill payment of

products becomes very easy. Internet penetration in India is the biggest innovation in the banking sector in the last three

decades. According to the law, “a senior citizen means any person being a citizen of India, who has attained the age of sixty

years or above”. And these users encounter many barriers that arise from aging when they attempt online banking.

Literature Review

Sylvia E. Peacock (2007), in his research paper, “Senior Citizens and Internet Technology: Reasons and Correlates of Access

versus Non Access in European Comparative Perspective”, he discussed the influence of cultural and socioeconomic back

ground on the internet access of senior citizens. He also identified that motivational indifference and deficient knowledge are

the major factors of low usage of internet technology amongst senior citizens. Vijay M. Kumbhar (2011), in his research paper

“Factors affecting the Customer Satisfaction in e-Banking: Some Evidences Form Indian Banks” he evaluates major factors

affecting on customers’ satisfaction in e-banking service settings. This study also evaluates the influence of service quality on

brand perception, perceived value and satisfaction in e- banking. Jayshree Chavan (2013), in her research paper “Internet

Banking- Benefits and Challenges in an Emerging Economy” She identified that information technology has taken imperative

place in the future expansion of financial services, especially banking sector conversion are affected more than any other

financial provider groups. She also mentioned that for banking transactions and international trading requires more

concentration towards e-banking security against deceptive activities. Shannak, R. O. (2013), in his research paper “Key Issues

in E-Banking Strengths and Weaknesses: The Case of Two Jordanian Banks” he suggested to enhance the e banking sector we

have to focus more on mobile functionalities and internet services. He also suggested that e banking services must be trusted

Volume XII Issue X OCTOBER 2019 Page No: 21

A JOURNAL OF COMPOSITION THEORY ISSN : 0731-6755

by its users then only it will grow drastically. Bhavesh Parmar, et.al. (2013), in their research paper “Rural banking through

internet: A study on use of internet banking among rural consumers” they identified that customers are using e banking

services because they are time saving and provides the facilities which are important in for customers. And they also suggested

that, there is a need to make internet banking user friendly and safe. Shaza W. Ezzi (2014), in her research paper titled “A

Theoretical Model for Internet Banking: Beyond Perceived Usefulness and Ease of Use” she tried to inquire different types of

electronic banking like ATM’s, telephone banking, electronic funds transfer and Internet banking. Rakesh H. M. & Ramya T.

J. (2014), in their research paper “A Study on Factors Influencing Consumer Adoption of Internet Banking in India” they tried

to examine the factors that influence internet banking adoption. Dr. Dhiraj Sharma and Namita Singla, (2016) in their research

paper “E-Banking in India: Bankers' Problems Perspective”, they observed that Indian private banks are ahead of public sector

banks in providing e banking services to customers and in coming era customer relationship management will be highly

maintained with the help of e banking services.

Research Methodology

Objectives of the Study

1. To study the awareness of e banking services amongst urban and rural educated senior citizens.

2. To study the usage of e banking services amongst urban and rural educated senior citizens.

3. To study the ease of using e banking services amongst urban and rural educated senior citizens.

4. To study the satisfaction level of e banking services amongst urban and rural educated senior citizens.

Scope of the study

The study deals with awareness, usage, ease of using and satisfaction level of e banking services only about educated

senior citizens in Bangalore urban and Bangalore rural area. As from the previous studies and literature review it is observed

that the number of uneducated senior citizens using e banking services is very negligible. Sometimes they operate e banking

services through private and government agencies or from their educated family members. So this study deals with only

educated senior citizens. The researcher has selected five professions under the segment of educated senior citizens for the

study; Teachers, Doctors, Lawyers, Engineers and Management Professionals (working as well as retired).

Sampling Method

The researcher has selected non-probability convenience sampling method for selecting 160 respondents as sample size

(80 from Bangalore urban and 80 from Bangalore rural).

Methods of Data collection

Primary data is collected using the questionnaire prepared and all relevant secondary data is collected from various

sources like Internet, Books, Magazines, and Articles etc. For primary data the researcher has visited urban and rural area in

Bangalore and collected data from the respondents.

Method of Analysis and Statistical tools

The researcher has prepared the master chart from the data collected and analyse the data with the help of IBM Statistical

Package for the Social Sciences (SPSS)-20

Reliability and Validity

A reliability test was carried out using SPSS. The Cronbach’s Alpha observed is 0.795, which is more than 0.700, so the

questionnaire is considered to be reliable. The researcher has used content validity and identified the research instrument is

valid for the present research study.

Research Design

Table 1: Research design

Type of Research Descriptive Research Design

Design

Population Educated senior citizens in

Bangalore urban and Bangalore rural

Sampling Non-Probability Convenience

Technique Sampling

Sampling Area Bangalore urban& Bangalore rural

Sample Size 160 (80 Bangalore urban& 80

Bangalore rural)

Primary Data Well-structured questionnaire

Volume XII Issue X OCTOBER 2019 Page No: 22

A JOURNAL OF COMPOSITION THEORY ISSN : 0731-6755

Secondary Data Research papers, Articles, Books,

Journals etc.

Data Analysis MS-Excel, SPSS-20

Data Analysis

Table 2: Gender of respondents

Respondents Percentage (%)

Urban Rural Urban Rural

Male 54 63 67.5 78.75

Female 26 17 32.5 21.25

Table 3: Occupation of respondents

Occupation Urban Rural

No. % No. %

Teachers 25 31 32 40

Doctors 13 16 10 12

Lawyers 6 8 4 5

Engineers 19 24 19 24

Management 17 21 15 19

Professionals

Total 80 100 80 100

Table 4: Awareness and usage of e banking services (%)

Awareness (%) Usage (%)

Urban Rural Urban Rural

Debit card 100 100 100 94

Credit Card 92 82 21 16

Mobile Banking 100 100 74 52

Mobile Apps 72 58 12 05

Internet Banking 95 86 23 11

Table 5: Rating method used in research

1 2 3 4 5

Awareness Very low Low awareness Moderate High Very high awareness

awareness awareness awareness

Usage Very low usage Low usage Moderate High Very high usage

usage usage

Ease of Use Very Difficult Difficult Moderate Easy Very easy

Satisfaction Highly dissatisfied Dissatisfied Neutral Satisfied Highly satisfied

Table 6: Awareness, usage, ease of use and satisfaction of e banking services

Awareness Usage Ease of Use Satisfaction

Mean Mean Mean Mean

U R U R U R U R

Debit Card 4.8 4.2 3.8 3.1 4.6 4.5 4.2 4.6

Credit card 4.4 4.1 2.4 1.8 3.1 2.3 3.5 3.7

Mobile Banking 3.4 3.1 2.8 2.6 3.1 2.9 3.9 4.2

Mobile Apps 3.1 3.1 3.2 2.8 2.1 1.6 4.2 4.6

Internet Banking 4.2 3.9 2.8 2.7 1.8 1.4 2.3 2.8

*U – Urban, R- Rural

Volume XII Issue X OCTOBER 2019 Page No: 23

A JOURNAL OF COMPOSITION THEORY ISSN : 0731-6755

Conclusion

Awareness of e banking services amongst educated senior citizens is high and as compared to rural citizens it

is slightly higher in urban citizens. Amongst all e-banking services awareness, usage, ease of using and

satisfaction level is very high for debit cards. Awareness, usage and ease of using e banking services is higher in

urban citizens as compared to rural citizens but satisfaction level is higher in rural citizens as compared to urban

citizens. Usage of mobile apps, credit cards and internet banking is low. Both urban and rural educated senior

citizens find it difficult to use mobile apps and internet banking. The Govt. of India and Indian banking system

needs to take more initiatives to educate and develop e-banking services especially for educated senior citizens.

Conflict of Interest: None.

References

1. Sylvia E. Peacock, Senior Citizens and Internet Technology: Reasons and Correlates of

Access versus Non Access in European Comparative Perspective. Eur J Ageing 2007;1.

2. Vijay M. Kumbhar. Factors Affecting the Customer satisfaction In E-Banking: Some

evidences Form Indian Banks. Manag Res Pract 2011;3(4).

3. Shannak, R. O. Key Issues in E-Banking Strengths and Weaknesses: The Case of Two

Jordanian Banks. Eur Sci J 2013;9(7).

4. Bhavesh Parmar, Darshan Ranpura, Chirag Patel, Naineshkumar Patel. Rural banking

through internet: A study on use of internet banking among rural consumers. Asian J

Manag Res 2013;3(2).

5. Jayshree Chavan. Internet Banking- Benefits and challenges in an Emerging Economy. Int J

Res Business Manag 2013;1(1).

6. Shaza W. Ezzi, in her research paper titled A Theoretical Model for Internet Banking:

Beyond Perceived Usefulness and Ease of Use. Arch Business Res 2014;2(2).

7. Rakesh H M & Ramya T J. Int J Business Gen Manag 2014;3.

8. Dhiraj Sharma, Namita Singla. E-Banking in India: Bankers' Problems Perspective. Int J

Computer Sci Technol 2016;7(1).

9. Rampal M. K. and Gupta S.L. (2005), “Services Marketing Concepts, Applications and

Cases”, Galgotia Publishing Company, New Delhi, Third Edition.

10. Kotler Philip and Armstrong Gary. Principles of Marketing”, Prentice Hall of India Pvt.

Ltd., New Delhi, Eleventh Edition 2005.

Volume XII Issue X OCTOBER 2019 Page No: 24

You might also like

- Tutorial 5Document2 pagesTutorial 5Phan NhưNo ratings yet

- A View On Transformational Leadership: The Case of Jeff BezosDocument9 pagesA View On Transformational Leadership: The Case of Jeff BezosAkash BhatNo ratings yet

- (Libro) Arellano - Panel Data Econometrics 2003Document244 pages(Libro) Arellano - Panel Data Econometrics 2003Federico Vallejo MondragónNo ratings yet

- Level of Conceptualization For Leadership TheoriesDocument9 pagesLevel of Conceptualization For Leadership TheoriesUmair MansoorNo ratings yet

- Tests of SignificanceDocument103 pagesTests of Significancessckp86No ratings yet

- Archaeology of Early Byzantium Marlia MangoDocument12 pagesArchaeology of Early Byzantium Marlia MangoDavo Lo SchiavoNo ratings yet

- Customer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)Document10 pagesCustomer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)aurorashiva1No ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- PRJP - 1653Document9 pagesPRJP - 1653PraKhar PandeNo ratings yet

- A Comparative Study On Motives of Online and Offline Banking Consumers: A Case Study of Udaipur CityDocument5 pagesA Comparative Study On Motives of Online and Offline Banking Consumers: A Case Study of Udaipur Citybittu sahaNo ratings yet

- E-Banking in India: Current and Future Prospects: January 2016Document14 pagesE-Banking in India: Current and Future Prospects: January 2016Varsha GuptaNo ratings yet

- Research Repot (E-Banking)Document14 pagesResearch Repot (E-Banking)priyanshu palNo ratings yet

- Electronic Payment Current Scenario and Scope For ImprovementDocument8 pagesElectronic Payment Current Scenario and Scope For ImprovementM Goutham17% (6)

- Impact of E-Banking in India: Presented By-Shouvik Maji PGDM - 75Document11 pagesImpact of E-Banking in India: Presented By-Shouvik Maji PGDM - 75Nilanjan GhoshNo ratings yet

- E Banking in India A Case Study of KanDocument12 pagesE Banking in India A Case Study of KanPrathameshNo ratings yet

- E PaymentDocument59 pagesE PaymentRajesh BathulaNo ratings yet

- 1.Man-Online Banking Services and Customer Satisfaction-Dr Pallavi MehtaDocument6 pages1.Man-Online Banking Services and Customer Satisfaction-Dr Pallavi MehtaImpact JournalsNo ratings yet

- 03 - Literature ReviewDocument5 pages03 - Literature ReviewApeksha ArayanNo ratings yet

- E-Banking Challenges and Opportunities in The Indian Banking SectorDocument4 pagesE-Banking Challenges and Opportunities in The Indian Banking SectorMunni ChukkaNo ratings yet

- The Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaDocument27 pagesThe Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaKhristine Dela CruzNo ratings yet

- A Synoptic Note On P.HDDocument15 pagesA Synoptic Note On P.HDSubramanya DgNo ratings yet

- Changing of Pattern of Demand For E-Banking Services ProjectDocument42 pagesChanging of Pattern of Demand For E-Banking Services Projectrahulsahoo983No ratings yet

- Paper 14Document5 pagesPaper 14VDC CommerceNo ratings yet

- A Study On Customer Perception & Psychology Towards e - Banking With Reference To Mumbra RegionDocument8 pagesA Study On Customer Perception & Psychology Towards e - Banking With Reference To Mumbra RegionPooja Singh SolankiNo ratings yet

- Ijird,+3 +NOV15021Document8 pagesIjird,+3 +NOV15021Saroj KhadangaNo ratings yet

- INSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 7 No 3 July September 2021 Pages 66 To 68Document3 pagesINSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 7 No 3 July September 2021 Pages 66 To 68Sakina Khatoon 10No ratings yet

- The Influence of Perceived Ease of Use (Case Study Bni Kcu Jakarta Pusat)Document14 pagesThe Influence of Perceived Ease of Use (Case Study Bni Kcu Jakarta Pusat)galangaNo ratings yet

- A Study On Customer Awareness On E-Banking Services With Reference To Sbi Nethimedu, SalemDocument5 pagesA Study On Customer Awareness On E-Banking Services With Reference To Sbi Nethimedu, Salemsanthosh kumarNo ratings yet

- A Study On Customer Awareness Towards e Banking.. B. GopichandDocument11 pagesA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1No ratings yet

- Awareness of E-Banking Services Among Rural CustomersDocument10 pagesAwareness of E-Banking Services Among Rural CustomersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Customer Experience With Digital LendingDocument16 pagesCustomer Experience With Digital LendingYOGESH AGGARWALNo ratings yet

- Bharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)Document19 pagesBharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)nisha chopraNo ratings yet

- A Study On The Consumer Perception Towards Mobile Banking Services of State Bank of India"-With Special Reference To Kollam District "Document8 pagesA Study On The Consumer Perception Towards Mobile Banking Services of State Bank of India"-With Special Reference To Kollam District "Priya GaneshpriyaNo ratings yet

- 8 Malika Rani A Study On The Customers Perception Towards E-BankingDocument11 pages8 Malika Rani A Study On The Customers Perception Towards E-BankingNukeshwar PandeyNo ratings yet

- JPSP - 2022 - 698Document10 pagesJPSP - 2022 - 698hifeztobgglNo ratings yet

- A Study On Customers Attitude Towards Mobile Banking in Kollam DistrictDocument10 pagesA Study On Customers Attitude Towards Mobile Banking in Kollam DistrictSebi JohnnNo ratings yet

- Safety and Security of Digital Transactions of Banking Sector: An Analytical StudyDocument12 pagesSafety and Security of Digital Transactions of Banking Sector: An Analytical StudyKartik KNo ratings yet

- Ijesrr V-2-3-2Document4 pagesIjesrr V-2-3-2Pearl LenonNo ratings yet

- IJRBM - Review of The Literature On The Electronic Banking Adoption Bankers PerspectiveDocument10 pagesIJRBM - Review of The Literature On The Electronic Banking Adoption Bankers PerspectiveImpact JournalsNo ratings yet

- Term Paper ON: "Study To Analyse Customer's Take On E-Banking Services"Document8 pagesTerm Paper ON: "Study To Analyse Customer's Take On E-Banking Services"atul_rockstarNo ratings yet

- A Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictDocument8 pagesA Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictIOSRjournalNo ratings yet

- Synopsis Vaishnavi.. 1Document12 pagesSynopsis Vaishnavi.. 1Aniruddha BorkarNo ratings yet

- Users' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenDocument6 pagesUsers' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenOmotayo AkinpelumiNo ratings yet

- Literature Review: (S.Vignesh, 2014)Document2 pagesLiterature Review: (S.Vignesh, 2014)Manish RavatNo ratings yet

- 748pm - 6.EPRA JOURNALS-6642Document3 pages748pm - 6.EPRA JOURNALS-6642Prince GuptaNo ratings yet

- Rashmi Sharma - 11505Document29 pagesRashmi Sharma - 11505Kanika TandonNo ratings yet

- BRM Cce-2Document8 pagesBRM Cce-2Akshat PandeNo ratings yet

- A Study On Customer Satisfaction On Sbi Yono With Reference To Stonehouse Pet, Nellore.Document27 pagesA Study On Customer Satisfaction On Sbi Yono With Reference To Stonehouse Pet, Nellore.mohdmujeebahmed01No ratings yet

- 13 Growth of e Banking Challenges and Opportunities in IndiaDocument5 pages13 Growth of e Banking Challenges and Opportunities in IndiaAyesha Asif100% (1)

- Review of LiteratureDocument4 pagesReview of Literaturemaha lakshmiNo ratings yet

- Research Proposal On Mobile Banking PDFDocument12 pagesResearch Proposal On Mobile Banking PDFKhalid de CancNo ratings yet

- Research Proposal On Mobile Banking - PDF 2 PDFDocument12 pagesResearch Proposal On Mobile Banking - PDF 2 PDFCRING VEDIONo ratings yet

- Factors Influencing The Customer Preference Towards E-Banking Services in Cuddalore DistrictDocument8 pagesFactors Influencing The Customer Preference Towards E-Banking Services in Cuddalore DistrictAshish KaushalNo ratings yet

- Consumer Awareness On The Usage of E-Banking ThroughDocument11 pagesConsumer Awareness On The Usage of E-Banking Throughgobindapandit1213No ratings yet

- Problems Faced by Consumers While Using Internet Banking Services A SurveyDocument12 pagesProblems Faced by Consumers While Using Internet Banking Services A Surveyarcherselevators0% (1)

- A Comparative Study of Internet Banking in Pakistan.': Presented by Nabil Ur Rehman Siddiqui (2210)Document14 pagesA Comparative Study of Internet Banking in Pakistan.': Presented by Nabil Ur Rehman Siddiqui (2210)nrsiddiquipkNo ratings yet

- Customers' Demographic Profile and Satisfaction in E-Banking Services: A Study of Indian BanksDocument12 pagesCustomers' Demographic Profile and Satisfaction in E-Banking Services: A Study of Indian BanksChayan GargNo ratings yet

- 1..research Paper FebDocument18 pages1..research Paper FebABHISHEK CHATTERJEENo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebShivangi SinghNo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebPooja AdhikariNo ratings yet

- BEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYFrom EverandBEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYNo ratings yet

- TRUSTING MOBILE PAYMENT: HOW THE TRUST-FACTOR FORMS THE MOBILE PAYMENT PROCESSFrom EverandTRUSTING MOBILE PAYMENT: HOW THE TRUST-FACTOR FORMS THE MOBILE PAYMENT PROCESSNo ratings yet

- Cookbook for Mobile Robotic Platform Control: With Internet of Things And Ti Launch PadFrom EverandCookbook for Mobile Robotic Platform Control: With Internet of Things And Ti Launch PadNo ratings yet

- Systematic Layout PlanningDocument9 pagesSystematic Layout PlanningchirpynikNo ratings yet

- Teacher Leadership in Public Schools in The Philippines: Carmela Canlas OracionDocument205 pagesTeacher Leadership in Public Schools in The Philippines: Carmela Canlas Oracionrobertoii_suarezNo ratings yet

- Marchi Friction PaperDocument201 pagesMarchi Friction PaperRoger Lahoud100% (1)

- 1.farah Mastura Noor AzmanDocument18 pages1.farah Mastura Noor Azmanzulikah89No ratings yet

- Amelita N. Tupaz PHD MathEd Educ 302 Assignment 2Document3 pagesAmelita N. Tupaz PHD MathEd Educ 302 Assignment 2Amelita TupazNo ratings yet

- Condition Monitoring of CablesDocument89 pagesCondition Monitoring of CablesJack WeaverNo ratings yet

- Survey of Labs in AustraliaDocument77 pagesSurvey of Labs in Australiaeduman9949No ratings yet

- Conversation Piece Why Exhibition Histo PDFDocument3 pagesConversation Piece Why Exhibition Histo PDFMirtes OliveiraNo ratings yet

- Article Review Price MohammedDocument5 pagesArticle Review Price MohammedGudina GeletaNo ratings yet

- Architectural Design Process Case Study: Making Building From A Formal TypeDocument11 pagesArchitectural Design Process Case Study: Making Building From A Formal TypeHafiz Amirrol100% (3)

- Community-Based Approach For Dengue Prevention and Control in Sta. Cruz, Laguna, PhilippinesDocument8 pagesCommunity-Based Approach For Dengue Prevention and Control in Sta. Cruz, Laguna, PhilippinesRosalinda Saquing-GuingabNo ratings yet

- Mdi Postgraduate Diploma Public Administration Results August 2017Document4 pagesMdi Postgraduate Diploma Public Administration Results August 2017Mr DamphaNo ratings yet

- Accuracy of Digital Impressions For Implant-Supported Complete-Arch ProsthesisDocument23 pagesAccuracy of Digital Impressions For Implant-Supported Complete-Arch ProsthesisValeria CrespoNo ratings yet

- Module 1 Introduction To Building and Enhancing NewDocument29 pagesModule 1 Introduction To Building and Enhancing NewDanilo de la CruzNo ratings yet

- SixsigDocument90 pagesSixsigHokuto No KenNo ratings yet

- Value at RiskDocument7 pagesValue at Riskmba departmentNo ratings yet

- Review of Related Literature and StudiesDocument7 pagesReview of Related Literature and StudiesLexie Jamir CerezoNo ratings yet

- How To Do Action ResearchDocument33 pagesHow To Do Action ResearchAmmi Sirhc TeeNo ratings yet

- Barangay Profile History 2 2016Document14 pagesBarangay Profile History 2 2016Leo Buquiran Acabal100% (1)

- Week 3 Standard Consistency, Setting Time & Fineness of CementDocument6 pagesWeek 3 Standard Consistency, Setting Time & Fineness of CementFareez SedakaNo ratings yet

- Hotel Management Thesis SampleDocument6 pagesHotel Management Thesis Samplebk1svxmr100% (2)

- An Investigation of The Relationship Between Impulsive Buying and Post Purchase Buyer's Dissonance at Retail ShopsDocument16 pagesAn Investigation of The Relationship Between Impulsive Buying and Post Purchase Buyer's Dissonance at Retail ShopsmahmudaNo ratings yet

- University of Helsinki Helsinki, Finland 31.8.-4.9. 2015Document13 pagesUniversity of Helsinki Helsinki, Finland 31.8.-4.9. 2015Diana Lcvn LcvnNo ratings yet

- Weekly Schedule of MBA 2016 SIIIA Week 1Document12 pagesWeekly Schedule of MBA 2016 SIIIA Week 1aadinNo ratings yet