Professional Documents

Culture Documents

ACCM01B - Module 1

ACCM01B - Module 1

Uploaded by

Lylanie Gustilo AlcantaraCopyright:

Available Formats

You might also like

- E-Book - Retail Marketing Management - Principles & Practice-Pearson (2015) - Helen Goworek PDFDocument369 pagesE-Book - Retail Marketing Management - Principles & Practice-Pearson (2015) - Helen Goworek PDFJerrielle CastroNo ratings yet

- Acc 310Document270 pagesAcc 310frankolett100% (3)

- Cost AccountingDocument31 pagesCost AccountingRayala SaisrinivasNo ratings yet

- Module 1 Introduction To Cost AccountingDocument21 pagesModule 1 Introduction To Cost AccountingLeslieNo ratings yet

- LVMH:: When Luxury Goes DigitalDocument4 pagesLVMH:: When Luxury Goes DigitalHaroon Z. ChoudhryNo ratings yet

- Ch01 Introduction To Cost AccountingDocument5 pagesCh01 Introduction To Cost AccountingRenelyn FiloteoNo ratings yet

- Cost Accounting I Module AUC MT Final 1 - Finall (1) HandoutDocument71 pagesCost Accounting I Module AUC MT Final 1 - Finall (1) HandoutMOLALIGNNo ratings yet

- Cost Accounting I Module AUC MT Final 1 - Finall (1) HandoutDocument71 pagesCost Accounting I Module AUC MT Final 1 - Finall (1) HandoutMOLALIGNNo ratings yet

- Cost Acctg Lesson 1Document13 pagesCost Acctg Lesson 1Scott AlilayNo ratings yet

- Chapter OneDocument15 pagesChapter OnefiraolmosisabonkeNo ratings yet

- Cost 2Document46 pagesCost 2Aksh GautamNo ratings yet

- Running Header: Managerial Accounting SummaryDocument10 pagesRunning Header: Managerial Accounting Summaryroshan giriNo ratings yet

- Background Reading Material: Elementary Basics ofDocument22 pagesBackground Reading Material: Elementary Basics ofSaloni MalhotraNo ratings yet

- Module 4 PDFDocument22 pagesModule 4 PDFJerin MathewNo ratings yet

- Theory Cost AccountingDocument11 pagesTheory Cost AccountingMrinmoy SahaNo ratings yet

- Definition of Cost and CostingDocument6 pagesDefinition of Cost and CostingNahidul Islam IUNo ratings yet

- Cost AccountingDocument31 pagesCost Accountingnvenu7434No ratings yet

- Module - 1 - Jai - PDF-1Document7 pagesModule - 1 - Jai - PDF-1Jibin JoseNo ratings yet

- CA Inter ICAI Study MaterialDocument842 pagesCA Inter ICAI Study MaterialDainika ShettyNo ratings yet

- Cost Accounting NotesDocument11 pagesCost Accounting Notesjombui2022No ratings yet

- 74744bos60489 cp1Document48 pages74744bos60489 cp1Kapil KumarNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingTofael MajumderNo ratings yet

- InternalllDocument2 pagesInternalllDev kumar ShawNo ratings yet

- Cost IntroductionDocument75 pagesCost Introductionkumaramit04052000No ratings yet

- HEI P U 0543 - SelfLearning - 20210723100028Document4 pagesHEI P U 0543 - SelfLearning - 20210723100028rbking15081999No ratings yet

- Business Accounting and Costing AssignmentDocument19 pagesBusiness Accounting and Costing AssignmentGaurav AnandNo ratings yet

- Weygandt, Kieso, & Kimmel: Managerial AccountingDocument56 pagesWeygandt, Kieso, & Kimmel: Managerial AccountingJerome MogaNo ratings yet

- Cost AccountingDocument22 pagesCost AccountingSiddharth KakaniNo ratings yet

- MOD 1 - Introduction On Cost AccountingDocument10 pagesMOD 1 - Introduction On Cost Accountingzach thomasNo ratings yet

- Accountancy Bbs 1st Year - Oweisme PDFDocument21 pagesAccountancy Bbs 1st Year - Oweisme PDFPratima Upreti100% (1)

- L2 Management AccountingDocument23 pagesL2 Management Accountingvidisha sharmaNo ratings yet

- Dmgt202 Cost and Management AccountingDocument269 pagesDmgt202 Cost and Management AccountingRoaster 2100% (2)

- Distinction Betweeen Cost Accounting and Management AccountingDocument9 pagesDistinction Betweeen Cost Accounting and Management Accountingbhaskaranbalamurali100% (1)

- Intro To Management AcctgDocument46 pagesIntro To Management AcctgpotatookunNo ratings yet

- Cost Accounting Session 1Document38 pagesCost Accounting Session 1Minto MathewNo ratings yet

- Introduction To Cost and Management Accounting: Learning OutcomesDocument33 pagesIntroduction To Cost and Management Accounting: Learning OutcomesThiruNo ratings yet

- Costing-ICAI Canotes PDFDocument21 pagesCosting-ICAI Canotes PDFVenkataRajuNo ratings yet

- Costing-ICAI Canotes PDFDocument21 pagesCosting-ICAI Canotes PDFVenkataRajuNo ratings yet

- Cost Accounting IDocument60 pagesCost Accounting Isamuel debebe50% (2)

- Cost and Managerial Accounting L Chap 1Document34 pagesCost and Managerial Accounting L Chap 1fekadegebretsadik478729No ratings yet

- Introduction To Cost Accounting Module 1Document49 pagesIntroduction To Cost Accounting Module 1Godliving J LyimoNo ratings yet

- CLA 2 Account 627626789Document13 pagesCLA 2 Account 627626789roshan giriNo ratings yet

- 5 THDocument4 pages5 THrohanNo ratings yet

- CA IPCC Costing & FM Quick Revision NotesDocument21 pagesCA IPCC Costing & FM Quick Revision NotesChandreshNo ratings yet

- Ans.1) (Chapter 1) : Management Accounting Is The Process of Identification, Measurement, Accumulation, AnalysisDocument27 pagesAns.1) (Chapter 1) : Management Accounting Is The Process of Identification, Measurement, Accumulation, AnalysisAnshuNo ratings yet

- Management AccountingDocument20 pagesManagement AccountingPraveen KumarNo ratings yet

- Costing NotesDocument227 pagesCosting Noteschitkarashelly100% (1)

- AccountsDocument13 pagesAccountsFake AccountNo ratings yet

- Module 1 ACCO 018Document26 pagesModule 1 ACCO 018easiroy23No ratings yet

- B.Cost Accounting 2 BBA3Document6 pagesB.Cost Accounting 2 BBA3Shivam Kumar ThakurNo ratings yet

- Difference Between Cost Accounting and Management AccountingDocument4 pagesDifference Between Cost Accounting and Management Accountingritu paudelNo ratings yet

- Cost Management and Financial Management Theory Compilation: For CMA Inter Group 2Document32 pagesCost Management and Financial Management Theory Compilation: For CMA Inter Group 2Mehak KaushikkNo ratings yet

- Strategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionDocument9 pagesStrategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionWinoah HubaldeNo ratings yet

- Course Title: Cost & Management Accounting Course Code:ACC 205Document37 pagesCourse Title: Cost & Management Accounting Course Code:ACC 205Ishita GuptaNo ratings yet

- Cost Accounting PresentationDocument21 pagesCost Accounting Presentationgoffers534No ratings yet

- CH 1 IntroductionDocument20 pagesCH 1 IntroductionKashish BhutadaNo ratings yet

- Management Accounting Unit No 1st BBA 5th SemesterDocument4 pagesManagement Accounting Unit No 1st BBA 5th SemesterDrVivek SansonNo ratings yet

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- HR Budget PresentationDocument11 pagesHR Budget PresentationShivam TrivediNo ratings yet

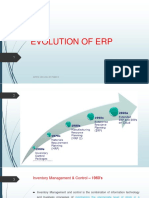

- Evolution of ErpDocument32 pagesEvolution of ErpJeffrin MichaelNo ratings yet

- The Purpose of The Complex Document Is ToDocument2 pagesThe Purpose of The Complex Document Is TonawarprasannaNo ratings yet

- Marketing Has Often Been Defined in Terms of Satisfying Customers' Needs and WantsDocument6 pagesMarketing Has Often Been Defined in Terms of Satisfying Customers' Needs and WantsTiffany WongNo ratings yet

- Chapter 7 MARKETING RESEARCH (Vocabulary and Exercises)Document10 pagesChapter 7 MARKETING RESEARCH (Vocabulary and Exercises)Jung Ho SeokNo ratings yet

- Bangabandhu Sheikh Mujibur Rahman Science and Technology UniversityDocument10 pagesBangabandhu Sheikh Mujibur Rahman Science and Technology UniversityTanverNo ratings yet

- Neptune Readymix A Iimk ReportDocument11 pagesNeptune Readymix A Iimk Reportjoseph vinoyNo ratings yet

- PEX Europe: Creating An Enterprise ArchitectureDocument32 pagesPEX Europe: Creating An Enterprise ArchitecturechrysobergiNo ratings yet

- 17IB321 - Revitalizing DellDocument2 pages17IB321 - Revitalizing DellRAHUL LALJIBHAI PANCHOLI-IBNo ratings yet

- PeopleSoft ExpensesDocument27 pagesPeopleSoft ExpensesNIHUNo ratings yet

- Business Environment 1 For BBMDocument10 pagesBusiness Environment 1 For BBMProf. MadhavanNo ratings yet

- Ba5011 2marks PDFDocument134 pagesBa5011 2marks PDFs.muthuNo ratings yet

- Accounts 11th Class Sample PaperDocument8 pagesAccounts 11th Class Sample PaperVineet SinghNo ratings yet

- United Spirits: Performance HighlightsDocument11 pagesUnited Spirits: Performance HighlightsAngel BrokingNo ratings yet

- TQM Module 6Document3 pagesTQM Module 6Rafols AnnabelleNo ratings yet

- IT Governance For SMEDocument37 pagesIT Governance For SMEAlan Mudary100% (1)

- Finals: University of Santo Tomas Faculty of Engineering Mechanical Engineering DepartmentDocument2 pagesFinals: University of Santo Tomas Faculty of Engineering Mechanical Engineering DepartmentSecret SecretNo ratings yet

- Budget Preparation: Lesson 3.2Document24 pagesBudget Preparation: Lesson 3.2Tin CabosNo ratings yet

- Cost Sheet As On .: Particulars Amount TotalDocument2 pagesCost Sheet As On .: Particulars Amount TotalSheena ShahnawazNo ratings yet

- Ramada Marketing Report (Full)Document9 pagesRamada Marketing Report (Full)Haider SaleemNo ratings yet

- Job Description - MCS HeadDocument1 pageJob Description - MCS HeadjenbachNo ratings yet

- (Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsDocument22 pages(Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsNouran MohamedNo ratings yet

- 4O00165Document216 pages4O00165gupta pradeepNo ratings yet

- Snow Itsm OvervDocument5 pagesSnow Itsm OvervmanedeepNo ratings yet

- Cima E1 Notes Organisational ManagementDocument120 pagesCima E1 Notes Organisational ManagementLamar BrownNo ratings yet

- Implementation of Business Marketing StrategyDocument43 pagesImplementation of Business Marketing StrategyMubashir Ali BeighNo ratings yet

- Engg 520 Chapter 2 PresentationDocument27 pagesEngg 520 Chapter 2 PresentationKiah TaliwanNo ratings yet

- 20 Lean InnovationDocument36 pages20 Lean InnovationNisha RaniNo ratings yet

ACCM01B - Module 1

ACCM01B - Module 1

Uploaded by

Lylanie Gustilo AlcantaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCM01B - Module 1

ACCM01B - Module 1

Uploaded by

Lylanie Gustilo AlcantaraCopyright:

Available Formats

MODULE 1

Costing and Pricing

Session Topic: Introduction to managerial and cost accounting

Learning Objectives:

The following specific learning objectives are expected to be realized at the end of the session;

1. Distinguish the difference between cost accounting and management accounting

2. Define cost accounting

3. Discuss the functions of cost accounting

4. Define direct costs and indirect costs

5. Define fixed costs, variable costs and semi-variable costs

6. Define management accounting?

7. Discuss the importance of management accounting in business

Key Points

Cost Accounting Management Accounting Direct Costs

Indirect Costs Fixed Costs Variable Costs

Core Content

____________________________________________________________________

Introduction

Module 1 covers the definition of cost accounting and management accounting, the functions of cost

accounting, the definition of direct costs, indirect costs, fixed costs, variable costs and semi-variable costs and the

importance of management accounting in business.

ACCM01B Costing and Pricing

**For use as instructional materials only 1

In-text Activities

Definition of cost accounting and management accounting.

Cost accounting revolves around cost computation, cost control and cost reduction.

Management accounting helps management make effective decisions about business.

Cost Accounting vs Management Accounting

There are many differences between cost accounting vs management accounting. Let’s glance at these distinctions:

Difference Cost Accounting Management Accounting

Cost accounting revolves around Management accounting helps

Inherent Meaning cost computation, cost control and management make effective

cost reduction. decisions about business.

Cost accounting prevents a Management accounting offers a big

Application business from incurring cost picture of how management should

beyond budget. strategize.

Scope Scope is much narrow Scope is much broader

Measuring grid Quantitative Both quantitative and qualitative

Cost accounting is one of the many

Management accounting itself is

Sub-set sub-sets of management

pretty vast.

accounting.

Basis of decision Historic information is basis of Historic and predictive information are

making decision making basis of decision making

Statutory audit of cost accounting

Statutory Audit of management accounting has

is a requirement in big business

requirement no statutory requirement.

houses.

Management accounting is

Cost accounting isn't dependent on

dependent on both cost and financial

Dependence management accounting to be

accounting for successful

successfully implemented.

implementation.

Management, shareholder and

Used for Only for management

vendors

ACCM01B Costing and Pricing

**For use as instructional materials only 2

What is Cost Accounting?

Cost accounting comes down to two words – “cost” and “accounting”.

First, let’s understand what “cost” is. Then we will look at “accounting”.

What is “cost”?

Cost is an expense incurred to a particular unit. In another way, the cost is what the business sacrifices in order to

produce one unit of product.

What is “accounting”?

Accounting is the art and science of recording, classifying, summarizing, and analyzing inputs to make a sense of

the information related to financial, management, or cost.

What is “cost accounting”?

Cost accounting is the art and science of recording, classifying, summarizing, and analyzing costs to help

management make prudent business decisions.

Functions of Cost Accounting

There are basically three functions of cost accounting –

Cost control: The first function of cost accounting is to control the cost within the budgetary constraints

management has set for a particular product or service. This is important since management allocates limited

resources to particular projects or production processes.

Cost computation: This is the main function of cost accounting and this is the source of all other functions of cost

accounting. In the section below, we will see how we can calculate the cost of sales per unit for a particular

product.

Cost reduction: Cost computation helps the company reduce costs on projects and processes. Reduction in

costs means more profits since the margin will naturally increase.

Direct Costs & Indirect Costs

Direct costs are directly involved in producing goods. That means direct costs can be directly identified as being used

in the production of goods. For example, we can talk about direct material and direct labor that is used in producing

goods. These costs we can identify as direct costs.

ACCM01B Costing and Pricing

**For use as instructional materials only 3

Indirect costs, on the other hand, are costs that can’t be identified easily. The reason these costs can’t be identified

separately because these costs assist in functioning multiple activities. For example, the renting business pays for

running a production operation would be called indirect costs since we can’t identify how much portion of the rent is

used for the production of goods, how much is used for preparing the raw material, how much is used to install the

simulation systems that can train the workers.

Understanding these two types of costs is important since we would be using these costs in the computation of the

cost of sales per unit for a particular product.

Fixed Costs, Variable Costs, & Semi-variable Costs

Fixed costs are costs that don’t change with the increase or decrease of production units. That means these costs

remain similar within a broad range of the spectrum. Plus, the per-unit fixed cost changes as the production increases

or decreases. For example, rent is a fixed cost. Even if the production increases or decreases, the business needs to

pay the same rent month in and month out.

Variable cost is the exact opposite of fixed cost. Variable cost changes as per the increase or decrease of production

units. But even if the total variable cost changes, per unit cost per unit, remain same irrespective of changes in

production units. For example, the cost of raw material is a variable cost. The total cost of raw material changes if the

production increases or decreases. But the per-unit cost of raw material remains the same even if the production

increases or decreases.

In semi-variable costs, both components are present. Semi-variable costs are a combination of fixed costs and variable

costs. Let’s say that you pay $1000 per month as fixed salary to all your workers and the workers who produce more

than 50 units of toys every month, they get an additional $5 for every additional unit produced. This sort of wages will

be called semi-variable wages.

What is Management Accounting?

Management accounting is the process of collecting, analyzing, and understanding the financial statements, statistical,

and qualitative information to make sense of how the business is going and what to do in the near future.

Management accounting helps to make short term decisions and also helps strategize for future big events. The idea

behind management accounting is to prepare periodical reports which can educate and inform the managers of the

company to make effective decisions.

ACCM01B Costing and Pricing

**For use as instructional materials only 4

Even if management accounting is much different than financial accounting and cost accounting (cost accounting is

one of the sub-sets of management accounting), it gathers information from both of these accounting in producing

periodical reports for management.

What can we expect to find in those periodical reports?

The exact motto of these reports is to help management get all the information at their fingertips and use the

information to make effective decisions for the business.

Since there is no statutory requirement, these reports are articulated as per the need of the management.

Here are the characteristics of these reports –

Quantitative and qualitative data points: Financial accounting and cost accounting solely revolves around

quantitative data. But only quantitative information isn’t able to portray the whole picture of the business. Rather

we should also look at qualitative information to make sense of what’s happening within the business. For

example, the absenteeism rate doesn’t depend on any quantitative information; rather it’s purely psychological.

Management accounting looks at all aspects of the business – both quantitative and qualitative data points to

create reports.

Predictive information: If you look at financial accounting and cost accounting, you will see that these whole two

accounting systems are based on historical information. But in the case of management accounting, the focus is

both on historical and predictive information. Since historical information only solves part of the problem,

estimated information helps management see the big picture and makes financial statements forward-looking.

That’s why in management accounting reports, predictive information is one of the biggest circle-in areas.

Used for the internal purpose: These reports contain very sensitive information about the business and

management. That’s why it is only provided to the management to make effective use of these reports and

strategize based on the information provided in these reports.

Importance of Management Accounting in Business

Since we know that management accounting periodical reports serve a great purpose in making effective decisions for

management, we need to know the importance of management accounting in business. Here are the top-most factors

–

Forecast the future: As mentioned earlier, the sole focus of management accounting is not on the past, but

toward the future. Management accounting propels management to ask – “What company should do in the near

future – should it buy more plants? Or should it acquire a few small companies which are experts in producing the

raw materials for the company?” Management accounting helps to answer these valid questions and assists to

start approaching the decision.

ACCM01B Costing and Pricing

**For use as instructional materials only 5

Forecast cash-flow: Without cash-flow business can’t move molehills, forget about the mountains. So

understanding and predicting how much cash-flow the company would be able to generate in the near future is

critical. Management accounting helps with budgeting, trend charts to estimate the future cash-flow for business.

Return on investment: One of the main functions of management accounting is to see how much return it could

produce on the investments it has made earlier. Looking at the past gives management an idea about where they

went wrong and what to correct in the next investments.

Understanding performance variances: Since management accounting is more about predictive analysis,

naturally there will be variances. Variances are the differences between estimated costs/profits and actual

costs/profits. The purpose of management accounting is always to create positive variances and try to learn from

the negative variances.

Create/outsource decision: This is an important question for every business these days – whether to create raw

materials/a part of the product or outsource it to a third party. Management accounting helps to see the costs and

profits of both of these options and choose the best one among the two.

SUMMARY:

Both cost accounting vs management accounting help management makes effective decisions. But their scope and

tools are completely different. As management accounting depends a lot on cost accounting to prepare reports, cost

accounting happens to be a sub-set of management accounting. But if we look at the usage, estimation process, data

points used, and utility, cost accounting has a much narrower scope than management accounting.

At the same time, to understand management accounting, it is imperative that you understand cost accounting well.

That’s why it is important to understand the contrast between cost accounting and management accounting.

References

See the references listed in the syllabus of the subject.

ACCM01B Costing and Pricing

**For use as instructional materials only 6

Name: Section:

Instructor: Date:

ACTIVITY 1-PRELIM

PART I. ESSAY

1. Describe management accounting and cost accounting. (10 points)

2. Is cost accounting or management accounting more useful to an operations manager? Why?

(10 points)

3. Briefly describe how managers make use of management accounting information. (10 points)

PART II. PROBLEM

A. Identification of Variable, Fixed, and Semivariable Costs. Place a check mark in the

appropriate column to indicate whether the following costs are variable, fixed, or semivariable.

(1 point each)

Item Variable Fixed Semivariable

1.Small tools

2.Patent amortization

3.Health and accident insurance

4.Heat, light, and power

5.Straight-line depreciation

6.Maintenance of buildings and

grounds

7.Royalties

8.Materials handling

ACCM01B Costing and Pricing

**For use as instructional materials only 7

9.Property and liability insurance

10.Maintenance of factory equipment

B. Butler Hospital wants to estimate the cost for each patient stay. It is a general health care

facility offering only basic services and not specialized services such as organ transplants. (2

points each)

Required:

a. Classify each of the following costs as either direct or indirect with respect to each

patient.

b. Classify each of the following costs as either fixed or variable with respect to hospital

costs per day.

Direct Indirect Fixed Variable

1. Electronic monitoring ______ ______ ______ ______

2. Meals for patients ______ ______ ______ ______

3. Nurses' salaries ______ ______ ______ ______

4. Parking maintenance ______ ______ ______ ______

5. Security ______ ______ ______ ______

ACCM01B Costing and Pricing

**For use as instructional materials only 8

You might also like

- E-Book - Retail Marketing Management - Principles & Practice-Pearson (2015) - Helen Goworek PDFDocument369 pagesE-Book - Retail Marketing Management - Principles & Practice-Pearson (2015) - Helen Goworek PDFJerrielle CastroNo ratings yet

- Acc 310Document270 pagesAcc 310frankolett100% (3)

- Cost AccountingDocument31 pagesCost AccountingRayala SaisrinivasNo ratings yet

- Module 1 Introduction To Cost AccountingDocument21 pagesModule 1 Introduction To Cost AccountingLeslieNo ratings yet

- LVMH:: When Luxury Goes DigitalDocument4 pagesLVMH:: When Luxury Goes DigitalHaroon Z. ChoudhryNo ratings yet

- Ch01 Introduction To Cost AccountingDocument5 pagesCh01 Introduction To Cost AccountingRenelyn FiloteoNo ratings yet

- Cost Accounting I Module AUC MT Final 1 - Finall (1) HandoutDocument71 pagesCost Accounting I Module AUC MT Final 1 - Finall (1) HandoutMOLALIGNNo ratings yet

- Cost Accounting I Module AUC MT Final 1 - Finall (1) HandoutDocument71 pagesCost Accounting I Module AUC MT Final 1 - Finall (1) HandoutMOLALIGNNo ratings yet

- Cost Acctg Lesson 1Document13 pagesCost Acctg Lesson 1Scott AlilayNo ratings yet

- Chapter OneDocument15 pagesChapter OnefiraolmosisabonkeNo ratings yet

- Cost 2Document46 pagesCost 2Aksh GautamNo ratings yet

- Running Header: Managerial Accounting SummaryDocument10 pagesRunning Header: Managerial Accounting Summaryroshan giriNo ratings yet

- Background Reading Material: Elementary Basics ofDocument22 pagesBackground Reading Material: Elementary Basics ofSaloni MalhotraNo ratings yet

- Module 4 PDFDocument22 pagesModule 4 PDFJerin MathewNo ratings yet

- Theory Cost AccountingDocument11 pagesTheory Cost AccountingMrinmoy SahaNo ratings yet

- Definition of Cost and CostingDocument6 pagesDefinition of Cost and CostingNahidul Islam IUNo ratings yet

- Cost AccountingDocument31 pagesCost Accountingnvenu7434No ratings yet

- Module - 1 - Jai - PDF-1Document7 pagesModule - 1 - Jai - PDF-1Jibin JoseNo ratings yet

- CA Inter ICAI Study MaterialDocument842 pagesCA Inter ICAI Study MaterialDainika ShettyNo ratings yet

- Cost Accounting NotesDocument11 pagesCost Accounting Notesjombui2022No ratings yet

- 74744bos60489 cp1Document48 pages74744bos60489 cp1Kapil KumarNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingTofael MajumderNo ratings yet

- InternalllDocument2 pagesInternalllDev kumar ShawNo ratings yet

- Cost IntroductionDocument75 pagesCost Introductionkumaramit04052000No ratings yet

- HEI P U 0543 - SelfLearning - 20210723100028Document4 pagesHEI P U 0543 - SelfLearning - 20210723100028rbking15081999No ratings yet

- Business Accounting and Costing AssignmentDocument19 pagesBusiness Accounting and Costing AssignmentGaurav AnandNo ratings yet

- Weygandt, Kieso, & Kimmel: Managerial AccountingDocument56 pagesWeygandt, Kieso, & Kimmel: Managerial AccountingJerome MogaNo ratings yet

- Cost AccountingDocument22 pagesCost AccountingSiddharth KakaniNo ratings yet

- MOD 1 - Introduction On Cost AccountingDocument10 pagesMOD 1 - Introduction On Cost Accountingzach thomasNo ratings yet

- Accountancy Bbs 1st Year - Oweisme PDFDocument21 pagesAccountancy Bbs 1st Year - Oweisme PDFPratima Upreti100% (1)

- L2 Management AccountingDocument23 pagesL2 Management Accountingvidisha sharmaNo ratings yet

- Dmgt202 Cost and Management AccountingDocument269 pagesDmgt202 Cost and Management AccountingRoaster 2100% (2)

- Distinction Betweeen Cost Accounting and Management AccountingDocument9 pagesDistinction Betweeen Cost Accounting and Management Accountingbhaskaranbalamurali100% (1)

- Intro To Management AcctgDocument46 pagesIntro To Management AcctgpotatookunNo ratings yet

- Cost Accounting Session 1Document38 pagesCost Accounting Session 1Minto MathewNo ratings yet

- Introduction To Cost and Management Accounting: Learning OutcomesDocument33 pagesIntroduction To Cost and Management Accounting: Learning OutcomesThiruNo ratings yet

- Costing-ICAI Canotes PDFDocument21 pagesCosting-ICAI Canotes PDFVenkataRajuNo ratings yet

- Costing-ICAI Canotes PDFDocument21 pagesCosting-ICAI Canotes PDFVenkataRajuNo ratings yet

- Cost Accounting IDocument60 pagesCost Accounting Isamuel debebe50% (2)

- Cost and Managerial Accounting L Chap 1Document34 pagesCost and Managerial Accounting L Chap 1fekadegebretsadik478729No ratings yet

- Introduction To Cost Accounting Module 1Document49 pagesIntroduction To Cost Accounting Module 1Godliving J LyimoNo ratings yet

- CLA 2 Account 627626789Document13 pagesCLA 2 Account 627626789roshan giriNo ratings yet

- 5 THDocument4 pages5 THrohanNo ratings yet

- CA IPCC Costing & FM Quick Revision NotesDocument21 pagesCA IPCC Costing & FM Quick Revision NotesChandreshNo ratings yet

- Ans.1) (Chapter 1) : Management Accounting Is The Process of Identification, Measurement, Accumulation, AnalysisDocument27 pagesAns.1) (Chapter 1) : Management Accounting Is The Process of Identification, Measurement, Accumulation, AnalysisAnshuNo ratings yet

- Management AccountingDocument20 pagesManagement AccountingPraveen KumarNo ratings yet

- Costing NotesDocument227 pagesCosting Noteschitkarashelly100% (1)

- AccountsDocument13 pagesAccountsFake AccountNo ratings yet

- Module 1 ACCO 018Document26 pagesModule 1 ACCO 018easiroy23No ratings yet

- B.Cost Accounting 2 BBA3Document6 pagesB.Cost Accounting 2 BBA3Shivam Kumar ThakurNo ratings yet

- Difference Between Cost Accounting and Management AccountingDocument4 pagesDifference Between Cost Accounting and Management Accountingritu paudelNo ratings yet

- Cost Management and Financial Management Theory Compilation: For CMA Inter Group 2Document32 pagesCost Management and Financial Management Theory Compilation: For CMA Inter Group 2Mehak KaushikkNo ratings yet

- Strategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionDocument9 pagesStrategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionWinoah HubaldeNo ratings yet

- Course Title: Cost & Management Accounting Course Code:ACC 205Document37 pagesCourse Title: Cost & Management Accounting Course Code:ACC 205Ishita GuptaNo ratings yet

- Cost Accounting PresentationDocument21 pagesCost Accounting Presentationgoffers534No ratings yet

- CH 1 IntroductionDocument20 pagesCH 1 IntroductionKashish BhutadaNo ratings yet

- Management Accounting Unit No 1st BBA 5th SemesterDocument4 pagesManagement Accounting Unit No 1st BBA 5th SemesterDrVivek SansonNo ratings yet

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- HR Budget PresentationDocument11 pagesHR Budget PresentationShivam TrivediNo ratings yet

- Evolution of ErpDocument32 pagesEvolution of ErpJeffrin MichaelNo ratings yet

- The Purpose of The Complex Document Is ToDocument2 pagesThe Purpose of The Complex Document Is TonawarprasannaNo ratings yet

- Marketing Has Often Been Defined in Terms of Satisfying Customers' Needs and WantsDocument6 pagesMarketing Has Often Been Defined in Terms of Satisfying Customers' Needs and WantsTiffany WongNo ratings yet

- Chapter 7 MARKETING RESEARCH (Vocabulary and Exercises)Document10 pagesChapter 7 MARKETING RESEARCH (Vocabulary and Exercises)Jung Ho SeokNo ratings yet

- Bangabandhu Sheikh Mujibur Rahman Science and Technology UniversityDocument10 pagesBangabandhu Sheikh Mujibur Rahman Science and Technology UniversityTanverNo ratings yet

- Neptune Readymix A Iimk ReportDocument11 pagesNeptune Readymix A Iimk Reportjoseph vinoyNo ratings yet

- PEX Europe: Creating An Enterprise ArchitectureDocument32 pagesPEX Europe: Creating An Enterprise ArchitecturechrysobergiNo ratings yet

- 17IB321 - Revitalizing DellDocument2 pages17IB321 - Revitalizing DellRAHUL LALJIBHAI PANCHOLI-IBNo ratings yet

- PeopleSoft ExpensesDocument27 pagesPeopleSoft ExpensesNIHUNo ratings yet

- Business Environment 1 For BBMDocument10 pagesBusiness Environment 1 For BBMProf. MadhavanNo ratings yet

- Ba5011 2marks PDFDocument134 pagesBa5011 2marks PDFs.muthuNo ratings yet

- Accounts 11th Class Sample PaperDocument8 pagesAccounts 11th Class Sample PaperVineet SinghNo ratings yet

- United Spirits: Performance HighlightsDocument11 pagesUnited Spirits: Performance HighlightsAngel BrokingNo ratings yet

- TQM Module 6Document3 pagesTQM Module 6Rafols AnnabelleNo ratings yet

- IT Governance For SMEDocument37 pagesIT Governance For SMEAlan Mudary100% (1)

- Finals: University of Santo Tomas Faculty of Engineering Mechanical Engineering DepartmentDocument2 pagesFinals: University of Santo Tomas Faculty of Engineering Mechanical Engineering DepartmentSecret SecretNo ratings yet

- Budget Preparation: Lesson 3.2Document24 pagesBudget Preparation: Lesson 3.2Tin CabosNo ratings yet

- Cost Sheet As On .: Particulars Amount TotalDocument2 pagesCost Sheet As On .: Particulars Amount TotalSheena ShahnawazNo ratings yet

- Ramada Marketing Report (Full)Document9 pagesRamada Marketing Report (Full)Haider SaleemNo ratings yet

- Job Description - MCS HeadDocument1 pageJob Description - MCS HeadjenbachNo ratings yet

- (Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsDocument22 pages(Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsNouran MohamedNo ratings yet

- 4O00165Document216 pages4O00165gupta pradeepNo ratings yet

- Snow Itsm OvervDocument5 pagesSnow Itsm OvervmanedeepNo ratings yet

- Cima E1 Notes Organisational ManagementDocument120 pagesCima E1 Notes Organisational ManagementLamar BrownNo ratings yet

- Implementation of Business Marketing StrategyDocument43 pagesImplementation of Business Marketing StrategyMubashir Ali BeighNo ratings yet

- Engg 520 Chapter 2 PresentationDocument27 pagesEngg 520 Chapter 2 PresentationKiah TaliwanNo ratings yet

- 20 Lean InnovationDocument36 pages20 Lean InnovationNisha RaniNo ratings yet