Professional Documents

Culture Documents

ACCT - Ch2 Accounting Problems

ACCT - Ch2 Accounting Problems

Uploaded by

shigeka0 ratings0% found this document useful (0 votes)

57 views3 pagesThis document provides accounting problems and questions for a chapter on accounting principles. It includes journal entries to record transactions for Leonard Matson's financial services practice throughout December. It also includes account balances for Mike's Maintenance Co. and requests a trial balance be prepared. Finally, it provides a trial balance for Sal's Beauty Shop and asks for an income statement, statement of owner's equity, and balance sheet to be prepared.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides accounting problems and questions for a chapter on accounting principles. It includes journal entries to record transactions for Leonard Matson's financial services practice throughout December. It also includes account balances for Mike's Maintenance Co. and requests a trial balance be prepared. Finally, it provides a trial balance for Sal's Beauty Shop and asks for an income statement, statement of owner's equity, and balance sheet to be prepared.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

57 views3 pagesACCT - Ch2 Accounting Problems

ACCT - Ch2 Accounting Problems

Uploaded by

shigekaThis document provides accounting problems and questions for a chapter on accounting principles. It includes journal entries to record transactions for Leonard Matson's financial services practice throughout December. It also includes account balances for Mike's Maintenance Co. and requests a trial balance be prepared. Finally, it provides a trial balance for Sal's Beauty Shop and asks for an income statement, statement of owner's equity, and balance sheet to be prepared.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Principles of Accounting

Chapter 2 Accounting Problems

Due: Sunday 11:55PM (Only accept Word, Excel, or PDF file in blackboard)

159. Leonard Matson completed these transactions during December of the current year:

Dec. 1 Began a financial services practice by investing $15,000 cash and

office equipment having a $5,000 value.

2 Purchased $1,200 of office equipment on credit.

3 Purchased $300 of office supplies on credit.

4 Completed work for a client and immediately received a payment

of $900 cash.

8 Completed work for Acme Loan Co. on credit, $1,700.

10 Paid for the supplies purchased on credit on December 3.

14 Paid for the annual $960 premium on an insurance policy.

18 Received payment in full from Acme Loan Co. for the work

completed on December 8.

27 Leonard withdrew $650 cash from the practice to pay personal

expenses.

30 Paid $175 cash for the December utility bills.

30 Received $2,000 from a client for financial services to be rendered next year.

Prepare journal entries to record these transactions. Please see the answer of December 1st

journal entry and follow the same format.

Answer:

Dec. 1 Cash......................................................................... 15,000

Office Equipment.................................................... 5,000

L Matson, Capital......................................... 20,000

Owner invested in business.

Please continue your journal entry…

170. The balances for the accounts of Mike's Maintenance Co. for the year ended December 31

are shown below. Each account shown had a normal balance.

Accounts Wages

payable….. $ 6,500 expense……… 36,000

Accounts Rent

receivable... 7,000 expense………... 6,000

Cash………………

… 9,500

Maintenance

supplies. 1,200

Building…………

…. 125,000

Supplies Land………………

expense…… 21,500 …. 50,000

Unearned

maintenance

Mike

Capital……….. 118,700 fees………………… 4,000

Maintenance Mike,

revenue. 175,000 Withdrawals….. 48,000

Please prepare a trial balance.

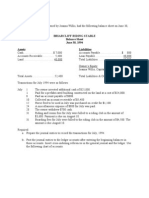

174. Based on the following trial balance for Sal's Beauty Shop, prepare an income statement,

statement of owner's equity, and a balance sheet. Sal made no additional investments in the

company during the year.

Sal's Beauty Shop

Trial Balance

December 31

You might also like

- CH 2 ExercisesDocument4 pagesCH 2 ExercisesAnonymous Jf9PYY2E80% (1)

- Strategy Implementation - Anne MulcahyDocument61 pagesStrategy Implementation - Anne Mulcahynknishant100% (10)

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- ACCT215 Principles of Accounting I - First Exam Part II QuestionsDocument4 pagesACCT215 Principles of Accounting I - First Exam Part II QuestionsshigekaNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- Tugas 4 Dasar AkuntansiDocument20 pagesTugas 4 Dasar AkuntansiAji Surya Wijaya75% (4)

- Conta FinancieraDocument21 pagesConta FinancieraAdrian TajmaniNo ratings yet

- FORMS OF BUSINESS ORGANIZATION (Accounting 1)Document46 pagesFORMS OF BUSINESS ORGANIZATION (Accounting 1)Lyne MampustiNo ratings yet

- ZYNGA-INCDocument5 pagesZYNGA-INCSyeda Ayesha ShahrinaNo ratings yet

- Hansson Case "Hints" FBE 529 Hansson Private Label Group CaseDocument3 pagesHansson Case "Hints" FBE 529 Hansson Private Label Group CaseShuNo ratings yet

- EMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Document4 pagesEMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Sheraz KhalilNo ratings yet

- An-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmDocument4 pagesAn-Najah N. University Faculty of Eng. & IT (MIS Dept.) Final Assignment Principle of Accounting and Finance 17/5/2020 9 - 11 AmHiba ShalbeNo ratings yet

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- Assignment 4 SolutionDocument5 pagesAssignment 4 SolutionBracu 2023No ratings yet

- Epler Consulting ServicesDocument3 pagesEpler Consulting ServicesAmmad Ud Din SabirNo ratings yet

- Solution Manual For Financial Accounting Canadian 6Th Edition by Harrison Isbn 0134141091 978013414109 Full Chapter PDFDocument36 pagesSolution Manual For Financial Accounting Canadian 6Th Edition by Harrison Isbn 0134141091 978013414109 Full Chapter PDFcarmen.hall969100% (11)

- AccountingDocument3 pagesAccountingvic18204No ratings yet

- Review Questions: Chart of AccountsDocument4 pagesReview Questions: Chart of AccountsHasan NajiNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- Cebu Cpar Practical Accounting 1 Cash Flow - UmDocument9 pagesCebu Cpar Practical Accounting 1 Cash Flow - UmJomarNo ratings yet

- Accounting Process With AnsDocument6 pagesAccounting Process With AnsMichael BongalontaNo ratings yet

- Accounting Chapter 3 William HakaDocument6 pagesAccounting Chapter 3 William HakaBilal AhmadNo ratings yet

- Financial MGTDocument2 pagesFinancial MGTSohail Liaqat AliNo ratings yet

- FA Mid Term Exam Dec 2022Document3 pagesFA Mid Term Exam Dec 2022ha90665No ratings yet

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Document7 pagesACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Arid Agriculture University, Rawalpindi: Final Exam / FALL-2020 (Paper Duration 24 Hours) To Be Filled by TeacherDocument6 pagesArid Agriculture University, Rawalpindi: Final Exam / FALL-2020 (Paper Duration 24 Hours) To Be Filled by TeachernabeelNo ratings yet

- 5.1.2. Corporate LiquidationDocument14 pages5.1.2. Corporate LiquidationPaulina DocenaNo ratings yet

- Chapter 2 Questions and SolutionsDocument6 pagesChapter 2 Questions and SolutionsKhem Raj GyawaliNo ratings yet

- COVER PAGE-final-1 TDocument1 pageCOVER PAGE-final-1 Tquyenb2206588No ratings yet

- Kunci Jawaban Ak Peng 1Document64 pagesKunci Jawaban Ak Peng 1Golddia JegesNo ratings yet

- Marking) - Encircle The Right Answer in Multiple Choice QuestionsDocument4 pagesMarking) - Encircle The Right Answer in Multiple Choice QuestionsI.E. Business SchoolNo ratings yet

- Assignment 1Document6 pagesAssignment 1Haider Chelsea KhanNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- Ch1 - ExercisesDocument2 pagesCh1 - ExercisesAfon 03No ratings yet

- Transaction & Tabular AnalysisDocument18 pagesTransaction & Tabular AnalysisMahmudul Hassan RohidNo ratings yet

- Financial Accounts With AdjustmentsDocument24 pagesFinancial Accounts With Adjustmentsshrutichoudhary436No ratings yet

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanoloveNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Problem 1-1 Charles Company Balance Sheet As of December 31, - Assets Liabilities and Owners' EquityDocument6 pagesProblem 1-1 Charles Company Balance Sheet As of December 31, - Assets Liabilities and Owners' Equityankit4allNo ratings yet

- Orie 3150 HW1 Fa17Document5 pagesOrie 3150 HW1 Fa17Carl WeinfieldNo ratings yet

- Accounts Accounts Cash + Receivable + Supplies + Equipment Payable +Document4 pagesAccounts Accounts Cash + Receivable + Supplies + Equipment Payable +greysonNo ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- Final Term PaperDocument3 pagesFinal Term PaperUmerNo ratings yet

- Chapter 9.docpart 1 FinalDocument15 pagesChapter 9.docpart 1 FinalRabie HarounNo ratings yet

- Cover PageDocument1 pageCover PagePhat NguyenNo ratings yet

- Third QuizDocument6 pagesThird Quizibrahim haniNo ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- New Principle Exercise Trial BalanceDocument2 pagesNew Principle Exercise Trial BalancetotiNo ratings yet

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- Chapter 12 DrillsDocument4 pagesChapter 12 DrillsBaderNo ratings yet

- Acco EquationDocument4 pagesAcco EquationAsima ZubairNo ratings yet

- Good Shepherd International School, Ooty: Winter Holiday HomeworkDocument12 pagesGood Shepherd International School, Ooty: Winter Holiday Homework6969 RithvikNo ratings yet

- Accounting ProcessDocument3 pagesAccounting Processabernardino.forschoolNo ratings yet

- TUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Document24 pagesTUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Samuel PurbaNo ratings yet

- Individual Assignment OneDocument3 pagesIndividual Assignment OnefeyselNo ratings yet

- Solution To Chap 1 Accounting 26e WarrenDocument55 pagesSolution To Chap 1 Accounting 26e WarrenKhánh Linh Nguyễn NgọcNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Adjustments Financial Accounting IOBMDocument46 pagesAdjustments Financial Accounting IOBMWahaj noor SiddiqueNo ratings yet

- Spring Semester 2019 Final Exam Closed Notes: INSTRUCTOR: Marios MavridesDocument4 pagesSpring Semester 2019 Final Exam Closed Notes: INSTRUCTOR: Marios MavridesyandaveNo ratings yet

- 20.0 NAS 7 - SetPasswordDocument8 pages20.0 NAS 7 - SetPasswordDhruba AdhikariNo ratings yet

- Question Text: Partially Correct Mark 6.00 Out of 8.00Document3 pagesQuestion Text: Partially Correct Mark 6.00 Out of 8.00Nor-izzah Robles UgalinganNo ratings yet

- PT Garuda Indonesia PT Garuda Indonesia: Equity ResearchDocument10 pagesPT Garuda Indonesia PT Garuda Indonesia: Equity ResearchJonathanGunawanSNo ratings yet

- Capital BudgetingDocument26 pagesCapital BudgetingTisha SosaNo ratings yet

- Siva 2Document2 pagesSiva 2sriram2011No ratings yet

- NCLT, Ahmedabad TP 198 of 2016 (CP 3 of 2015) (JP Financial Vs Golden Tobacco)Document3 pagesNCLT, Ahmedabad TP 198 of 2016 (CP 3 of 2015) (JP Financial Vs Golden Tobacco)masoom shahNo ratings yet

- Ankit PDFDocument5 pagesAnkit PDFAditi AwasthiNo ratings yet

- Fundraising: StartupsDocument141 pagesFundraising: StartupsPavan Kumar NNo ratings yet

- Venture Investing - Rules of SuccessDocument100 pagesVenture Investing - Rules of SuccessSrikrishna Sharma KashyapNo ratings yet

- Accounting For Non-AccountantsDocument39 pagesAccounting For Non-AccountantsAlexander Kim Waing100% (1)

- COMM308 Intro To Corporate Finance: Midterm 2 Practice Problems Fall 2021Document45 pagesCOMM308 Intro To Corporate Finance: Midterm 2 Practice Problems Fall 2021WinnieNo ratings yet

- Infinite Possible Returns With Minimal RiskDocument64 pagesInfinite Possible Returns With Minimal RiskEnrique Blanco67% (3)

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DDaniel HunksNo ratings yet

- Strategic PaperDocument46 pagesStrategic PaperMay Yaranon100% (3)

- Ucal Fuel AR 2018Document144 pagesUcal Fuel AR 2018Puneet367No ratings yet

- Cyber Scam RecoveryDocument6 pagesCyber Scam RecoveryPeter BrightNo ratings yet

- Finance E2-E3-Financial ManagementDocument39 pagesFinance E2-E3-Financial Managementpintu_dyNo ratings yet

- Chapter 19Document2 pagesChapter 19Michael CarlayNo ratings yet

- Trading Chart Patterns - Trading Guides - CMC MarketsDocument12 pagesTrading Chart Patterns - Trading Guides - CMC MarketsRohit PurandareNo ratings yet

- MC Persuasive Letter OfficialDocument2 pagesMC Persuasive Letter OfficialJerryJoshuaDiazNo ratings yet

- FinShiksha Course Outline Financial Modelling v2 PDFDocument6 pagesFinShiksha Course Outline Financial Modelling v2 PDFyogesh patilNo ratings yet

- POWERPOINT PRESENTATTION - SUKA - Ni - PEDRO - OL - ZION - GAAS&SALVANIADocument24 pagesPOWERPOINT PRESENTATTION - SUKA - Ni - PEDRO - OL - ZION - GAAS&SALVANIAMickey Mae RetardoNo ratings yet

- Wayne A. Thorp - Testing Trading Success PDFDocument5 pagesWayne A. Thorp - Testing Trading Success PDFSrinivasNo ratings yet

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- A Study On Various Investment Options in IndiaDocument169 pagesA Study On Various Investment Options in IndiaLeena NaikNo ratings yet

- Ambit - Strategy Errgrp - Forensic Accounting Identifying The Zone of Trouble'Document39 pagesAmbit - Strategy Errgrp - Forensic Accounting Identifying The Zone of Trouble'shahavNo ratings yet