Professional Documents

Culture Documents

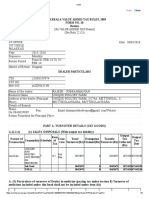

Mmco Tax Card 2021

Mmco Tax Card 2021

Uploaded by

Naeem Amjad.kalsiyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mmco Tax Card 2021

Mmco Tax Card 2021

Uploaded by

Naeem Amjad.kalsiyaCopyright:

Available Formats

UMAR MARKET, SHAHEENABAD, GUJRANWALA

TAX CARD FOR THE YEAR 2020-21 M: 0321-6472729 EMAIL: TAX@MMCO.PK

Website: https://www.mmco.pk

SALARY | Sec 149, Div I Part I 1 st Schedule Tax Rate Tax Rate

Nature of

Activity/ Nature of Payment Non- Nature of Tax Activity/ Nature of Payment

Taxable Income ATL ATL Non-ATL Tax

Rate of Tax ATL

From To

Up to 600,000 0% SUPPLY OF GOODS| S153(1)(a), Div. III P III 1 Sch, Cl 24A, 24C P II 2nd Schedule

st TAX COLLECTION BY NCCPL FROM STOCK EXCHANGE MEMBERS

600,000 1,200,000 5% on amount exceeding Rs. 600,000

Sale of rice, cottonseed oil & edible oil 1.5% 3% On financing of COT, margin financing,

1,200,001 1,800,000 30,000 10% on amount > Rs.1.2M Advance Tax margin trading or securities lending (U/s 10% Adv. Tax

+

Sale of cigarettes & pharma products by distributors & for Listed

1,800,001 2,500,000 90,000 15% on amount > Rs.1.8M 1% 2% 233AA, Div IIB Pt IV 1st Sch)

+

Large Import Houses companies and

2,500,001 3,500,000 195,000 17.5% on amount > Rs.2.5M Sale of sugar, cement & edible oil by dealers & sub- CNG STATIONS | Sec 234A, Div VIB Pt III 1st Schedule

+

0.25% 0.5% Companies

3,500,001 5,000,000 370,000 + 20% on amount > Rs.3.5M dealers Engaged in On the amount of gas bill 4% Min. Tax

5,000,001 8,000,000 670,000 22.5% on amount > Rs.5M Sale by Corporate FMCG distributors 2% 4% Manu-

+

facturing. ELECTRICITY CONSUMPTION | S235, Div IV Pt IV 1 Sch, Cl 66 P IV 2 nd Sch

st

8,000,001 12,000,000 1,345,000 25% on amount > Rs.8M Sale of goods by other (non-corporate) FMCG

+

2.5% 5% Minimum Electricity bill of commercial or industrial

27.5% on amount > Rs.12M

distributors Min. Tax for

12,000,001 30,000,000 2,345,000

+

Sale of other goods by companies Tax for other consumers | Exporters-cum-

4% 8% AOPs & Ind.

30,000,001 50,000,000 7,295,000 30% on amount > Rs.30M cases.

+

Sale of other goods by AOPs & Ind. manufacturers are exempt from this Various rates

for Bill Amt. up

4.5% 9% to Rs. 360K

50,000,001 75,000,000 13,295,000 32.5% on amount > Rs.50M collection

+

Note: No tax to be withheld in case of (a) where aggregate annual payment is below Rs 75,000/- (b) yarn Adv. Tax for

Above 75,000,000 21,420,000 35% on amount > Rs.75M

+

sold by traders to taxpayers specified in the sales tax zero-rated regime as per Clause (45A) of Pt IV of 2 nd other cases

Sched. AND (c) purchase of asset under lease & buy back agreement by modarabas, leasing/ banking

INDIVIDUAL & AOP (EXCEPT SALARIED PERSONS) - Sec 149, Div I Part I companies or financial institutions. DOMESTIC ELECTRICITY CONSUMP. | S 235A, DivXIX PIV 1st

1st Schedule Schedule

Taxable Income PAYMENTS FOR SERVICES | S 153(1)(b), 153(2), Div. III & Div IV P III 1 Sch. st

Monthly bill is below Rs. 75,000 0%

Rate of Tax Adv. Tax

From To Monthly bill is Rs. 75,000 and above 7.5%

Up to 400,000 0%

Advertising services (elec. & print media) 1.5% 3%

Transport, Freight forwarding, Air cargo services, TELEPHONE USERS | Sec 236, Div V Pt IV 1st Schedule

400,000 600,000 5% on amount exceeding Rs. 400,000

Courier, Manpower outsourcing, Hotel, Security Mobile phone bills & prepaid cards 12.5%

600,001 1,200,000 10,000 10% on amount > Rs.0.6M

+

guard, Software development, IT and IT enabled Landline bills exceeding Rs. 1,000 10% Adv. Tax

1,200,001 2,400,000 70,000 15% on amount > Rs.1.2M

+

services [as defined u/c (133) of Pt I of 2 Sch.], Tracking

nd Postpaid internet & prepaid net cards 12.5%

2,400,001 3,000,000 250,000 20% on amount > Rs.2.4M

+

services, Advertising (other than by print or electronic 3% 6% SALE BY AUCTION | Sec 236A, Div VIII Pt IV 1st Schedule

3,000,001 4,000,000 370,000 25% on amount > Rs.3.0M media), Share registrar services, Engineering services, Minimum

+

Sale price of any property or goods sold

30% on amount > Rs.4.0M Car rental, Building maintenance, Services of PSX & Tax 10% 20%

4,000,001 6,000,000 620,000 Adv. Tax

+

by auction

Above 6,000,000 1,220,000 35% on amount > Rs.6.0M PMEL, Inspection, Certification, Testing & Training Sale of Immovable property sold by 5% 10%

+

services

Tax Rate Companies providing other services DOMESTIC AIR TICKETS | Sec 236B, Div IX Part IV 1st Schedule

8% 16%

Activity/ Nature of Payment Non- Nature of Tax

ATL AOPs & Ind. providing other services On routes for Baluchistan coastal belt,

10% 20% Not Applicable

ATL AJ&K, FATA, Gilgit-Baltistan & Chitral

Stitching, dying, printing, embroidery, washing, sizing &

IMPORTS | Section 148 & Part II 1st Schedule 1% 2% Other routes 5% Adv. Tax

weaving for Exporters

Persons importing goods classified in Part I Note: No tax to be withheld for payments in case where payments made against services rendered is less than SALE/ TRANSFER OF IMMOVABLE PROPERTY | S236C, DvX PIV 1st

Rs. 30,000/- in aggregate, during a financial year. Schedule

of the Twelfth Schedule Advance Tax:

To be collected from Up to 4 Years 1% 2%

1% 2% - Import of Goods on EXECUTION OF CONTRACTS | Sec 153(1)(c), Div III Pt III 1 Sch st

Manufacturers covered under SRO Seller/ Transferor, Adv. Tax

which tax deduction Not Applicable

1125(I)/2011 dated December 31, 2011 (as Received by Listed Companies Adv. Tax where Holding Period is: Above 4 Years

rate is 1% or 2% by 7% 14%

it stood on June 28, 2019) an industrial Received by Other Companies TAX ON SALES TO DISTRIBUTORS, DEALERS & WHOLESALERS |

Minimum

Persons importing goods classified in Part II undertaking for its Received by sportspersons 10% 20% Sec 236G, Div XIV Pt IV 1 st Sch

2% 4% Tax On sale of fertilizers 0.7% 1.4%

of the Twelfth Schedule own use Received by others 7.5% 15%

Minimum Tax: On sale of electronics, sugar, cement,

Persons importing goods classified in Part

5.5% 11% - Import of Goods ROYALTY TO RESIDENT PERSONS | Sec 153B, Div, IIIB Pt III 1 st Sch iron & steel products, motorcycles, Adv. Tax

III of the Twelfth Schedule 0.1% 0.2%

otherwise then pesticides, cigarettes, glass, textile,

Persons importing finished pharmaceutical Gross amount of royalty 15% 30% Adv. Tax

mentioned above beverages, paint, batteries or foam

that are not manufactured in Pakistan, as 4% 8%

certified by DRAP EXPORTS | Sec 154, Div IV Pt III 1 st Sch, Cl 47C Pt IV 2 nd Sch TAX ON SALES TO RETAILERS | Sec 236H, Div XV Pt IV 1 st Sch

On sale of electronics 1% 2%

DIVIDEND | S 150, 236S, Div. I Pt III 1 Sch. & Cl. 11B Part IV 2 Schedule

st nd Realization of export proceeds [Exemption to cooking oil or Final Tax On sale of sugar, cement, iron & steel

vegetable ghee exported to Afghanistan if tax u/s 148 is paid] Exporters

Dividend from Independent Power products, motorcycles, pesticides, Adv. Tax

Inland back-to-back LC by exporter on sale of goods may opt for 0.5% 1%

Purchasers, being a pass-through item cigarettes, glass, textile, beverages,

1%

under Implementation/ Power/ Energy 7.5% 15% under an arrangement prescribed by FBR Minimum paint, batteries or foam

Purch. Agreement, required to be Export of goods by EPZ units Tax Regime TAX ON SALES OF PETROLEUM PRODUCTS | S 236HA, DivXVA

reimbursed by CPPA-G Payment for a firm contract by direct exporters reg. at the time of PIV 1 st Sch

Final Tax

Dividend if no tax is payable by the Co. due under DTRE Rules, 2001, to indirect exporters filing of On supply of petroleum products to a

25% 50% 0.5% 1% Adv. Tax

to exemption, c/f loss, tax credits Realization of proceeds on account of commission to return petrol pump operator or distributer

5%

Other cases, including mutual funds & indenting agent COLLECTION OF TAX BY EDUCATIONAL INSTITUTIONS WHERE

repatriation of after-tax profits by branches 15% 30% PROPERTY INCOME/ RENTALS | Sec 155, Div V Pt III 1st Schedule FEE EXCEEDS RS. 200,000/- | Sec 236I, Div XVI Pt IV 1st Schedule

of foreign companies From residents 5% of Fee

Where recipient is a company 15% Adv. Tax Adv. Tax

Inter-corp. divid. under group taxation Not Applicable From non-residents Not Applicable

Other recipients Advance Tax

PURCHASE OF IMMOVABLE PROPERTY | S236K, DivXVIII Pt IV 1st

INVESTMENT IN SUKUKS | Sec. 150A, Div. IB Pt III 1st Schedule

Annual Rent (Rs.) Schedule

Received by Company 25% 50% Adv. Tax Rate of Tax (Sec. 155, Div V, Pt III 1st Schedule) On fair market value 1% 2% Adv. Tax

From To

Received by individuals or AOPs and the

12.5% 25% Up to 200,000 NIL

profit is above Rs. 1M INTERNATIONAL AIR TICKETS | Sec 236L, Div XX Pt IV 1st Schedule

Final Tax

Received by individuals or AOPs and the 200,001 600,000 5% of the amount exceeding 200,000

10% 20% First/ executive class Rs.16,000

profit is up to Rs. 1M 600,001 1,000,000 20,000 10% of the amount above 0.6M Adv. Tax

+

Others, excluding economy Rs.12,000

1,000,001 2,000,000 60,000 15% of the amount above 1M

+

Economy NIL

PAYMENTS TO NON-RESIDENTS | S152, Div. IV Pt. I, Div. II Pt. III 1st Schedule

2,000,001 4,000,000 210,000 20% of the amount above 2M

+

NON-CASH BANKING TRANSACTIONS | Sec 236P, Div XXI Pt IV 1st

Royalty or fee for technical services 15% 15% 4,000,001 6,000,000 610,000 25% of the amount above 4M

+

Schedule

Fee for offshore digital services 5% 5% 6,000,001 8,000,000 1,110,000 30% of the amount above 6M

+

Non-cash payment transactions (all types) N/A 0.6% Adv. Tax

Contracts or related services 7% 7% Above 8,000,000 1,710,000 35% of the amount above 8M

+

RENT OR PAYMENT FOR RIGHT TO USE MACHINERY &

Insurance or re-insurance premium 5% 5% Minimum Tax

PRIZES AND WINNINGS | Sec 156, Div VI Pt III 1st Schedule EQUIPMENT | S 236Q, Div XXIII Pt IV 1 ST Sch

Advertisement services 10% 10%

On prize bonds & crossword puzzle 15% 30% To be collected for industrial, commercial Minimum

Execution of contract by sportspersons 10% 10% Final Tax

10%

Raffle, lottery, winning quiz & prizes on sales and scientific equipment & machinery Tax

Other payments 20% 20% 20% 40%

promotion schemes Note: WHT deduction shall not be applicable in the following cases:

Capital Gain on SCRA 10% 10% Final Tax a. Agricultural machinery; and

PETROLEUM PRODUCTS | Sec 156A, Div VIA Pt III 1st Schedule

b. Machinery owned and leased by leasing companies, investment banks, modarabas,

PAYMENTS TO PE OF NON-RESIDENTS (NR) | S 152, Div. II Pt III 1st Schedule Commission/ discount to petrol pump operators on scheduled banks or DFIs

12% 24% Final Tax

petroleum products

For supplies by PE of NR Companies 4% 8% EXTRACTION OF MINERALS | Sec 236V, Div XXVI Pt IV 1st Schedule

For supplies by PE of other NR 4.5% 9% CASH WITHDRAWALS FROM BANKS | S 231A, Div VI P IV 1 st Sch, Cl 28B P II 2 nd Sch

To be collected by provincial revenue

For services by PE of NR Companies 8% 16% Cash amount withdrawn by a person not appearing in authority/ board on value of minerals

N/A 0.6% Adv. Tax extracted, produced, dispatched & carried

For services by PE of other NR 10% 20% active taxpayer list 5% 10% Adv. Tax

Transport, Freight forwarding, Air cargo away from licensed or leased

TRANSACTIONS IN BANK | Sec 231AA, Div VIA Pt IV 1st Schedule

services, Courier, Manpower outsourcing, areas of mines

All transactions by a person not appearing in active N/A 0.6% Adv. Tax

Hotel, Security guard, Software REMITTANCE ABROAD THROUGH CREDIT, DEBIT OR PREPAID

development, IT and IT enabled services TAX ON MOTOR VEHICLES | S 231B&234, Div VII, Div III Pt IV 1st Schedule CARDS | Sec 236Y, Division XVXVII Pt IV 1st Schedule

Minimum Tax

[as defined u/c (133) of Pt I of 2 Sch.], Tracking

nd

Based on Eng. Gross amount remitted to abroad 1% 2% Adv. Tax

Purchase/ transfer of motor vehicles Cap.

services, Advertising (other than by print or 3% 6% Adv. Tax PAYMENT FOR FOREIGN PRODUCED COMMERCIALS | Section 152A

electronic media), Share registrar services, Leasing on Vehicle (based on value) N/A 4%

Engineering services, Car rental, Building Foreign produced commercials 20% 40% Final Tax

BROKERAGE & COMMISSION | Sec 233, Div II Pt IV 1st Schedule

maintenance, Services of PSX & PMEL,

Inspection, Certification, Testing & Training Advertising commission 10% 20% PROFIT ON DEBT | Section 151, Div. IA Part III 1st Schedule

Minimum

services Life Insur. Comm. up to Rs. 0.5M p.a. 8% 16% Where yield is up to Rs. 500,000 10%

Tax Final Tax

For other contracts 7% 14% Others 12% 24% Where yield is above Rs. 500,000 15% 30%

You might also like

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- TAXATION ON INDIVIDUALS Lecture NotesDocument4 pagesTAXATION ON INDIVIDUALS Lecture NotesLucille Rose MamburaoNo ratings yet

- For Holders: Automated Income Tax CalculationDocument16 pagesFor Holders: Automated Income Tax Calculationmaruf048No ratings yet

- SGV and Co Presentation On TRAIN LawDocument48 pagesSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- Rent - Sai VikasDocument2 pagesRent - Sai VikasBalaji GNo ratings yet

- Tax Rates For The Tax Year 2020: Amar AssociatesDocument2 pagesTax Rates For The Tax Year 2020: Amar AssociatesZeeshanNo ratings yet

- WHT Tax CardDocument2 pagesWHT Tax CardAsim JavedNo ratings yet

- SWHCC Tax Card - Ty 2019Document1 pageSWHCC Tax Card - Ty 2019Muhammad HaseebNo ratings yet

- Tax Rates - For The Tax Year - 2019Document5 pagesTax Rates - For The Tax Year - 2019nomanjavid88No ratings yet

- TaxRateCard 2022-23Document7 pagesTaxRateCard 2022-23Anas KhanNo ratings yet

- SHCC Tax Card - Ty 2021Document1 pageSHCC Tax Card - Ty 2021Muhammad AdeelNo ratings yet

- Tax Rate Card For Tax Year 2023 24Document10 pagesTax Rate Card For Tax Year 2023 24srismailNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDocument18 pagesIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNo ratings yet

- Advanced Taxation (United Kingdom) : Monday 2 June 2008Document14 pagesAdvanced Taxation (United Kingdom) : Monday 2 June 2008Hassan BilalNo ratings yet

- Tax Card 2024-25Document2 pagesTax Card 2024-25inam.khosaNo ratings yet

- Customer Receipt: Being Amount Paid For On Just DialDocument2 pagesCustomer Receipt: Being Amount Paid For On Just DialSurinder GhattauraNo ratings yet

- H. Other Percentage TaxesDocument32 pagesH. Other Percentage TaxesMaha CastroNo ratings yet

- F6uk 2010 Dec Q PDFDocument10 pagesF6uk 2010 Dec Q PDFInsia AhmedNo ratings yet

- ZJC Tax Rates Tables - Tax Year 2023Document11 pagesZJC Tax Rates Tables - Tax Year 2023Mux ConsultantNo ratings yet

- JanuaryDocument8 pagesJanuaryRohama TullaNo ratings yet

- Acca 08Document11 pagesAcca 08anon-854895No ratings yet

- Presentation ON: Goods and Service Tax: Applicability, Itc and ReturnsDocument31 pagesPresentation ON: Goods and Service Tax: Applicability, Itc and ReturnsSonal AggarwalNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- FeburaryDocument8 pagesFeburaryRohama TullaNo ratings yet

- (Train) : Taxchanges U Need To KnowDocument27 pages(Train) : Taxchanges U Need To KnowNoel DomingoNo ratings yet

- Tax Reform For Acceleraction and INclusion LawDocument1 pageTax Reform For Acceleraction and INclusion LawFarNo ratings yet

- Tax Rates Card 2023 GC - 220819 - 230837Document5 pagesTax Rates Card 2023 GC - 220819 - 230837smnomanNo ratings yet

- India Chartbook: GST - Getting Simplified TaxationDocument49 pagesIndia Chartbook: GST - Getting Simplified TaxationnitroglyssNo ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- P6uk 2008 Dec QDocument14 pagesP6uk 2008 Dec QHassan BilalNo ratings yet

- Mukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884Document1 pageMukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884lucky dudeNo ratings yet

- Malaysia Duties Taxes On Motor VehiclesDocument1 pageMalaysia Duties Taxes On Motor VehiclesnickgomezNo ratings yet

- Monetary Limit - Rates To Remember in GSTDocument15 pagesMonetary Limit - Rates To Remember in GSTtholsjk14No ratings yet

- Tax Impact - 11.10.2022Document12 pagesTax Impact - 11.10.2022ajith garNo ratings yet

- Team PRTC 1stPB May 2024 - TAXDocument7 pagesTeam PRTC 1stPB May 2024 - TAXAnne Marie SositoNo ratings yet

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaNo ratings yet

- Tax Rates For Tax Year 2020Document5 pagesTax Rates For Tax Year 2020Ghulam MuhiuddinNo ratings yet

- Tax Card 23-24Document1 pageTax Card 23-24humag143No ratings yet

- P6uk 2007 Dec Q PDFDocument12 pagesP6uk 2007 Dec Q PDFHassan BilalNo ratings yet

- Account Summary For Account Number 194417376-7: Electric BillDocument2 pagesAccount Summary For Account Number 194417376-7: Electric BillBrian SantosNo ratings yet

- Provision of Train Law UpdatedDocument91 pagesProvision of Train Law UpdatedAldrich De VeraNo ratings yet

- Lesson 5 Income Tax On CorporationDocument20 pagesLesson 5 Income Tax On CorporationReino CabitacNo ratings yet

- KSA VAT Rate Increase Webinar PresentationDocument24 pagesKSA VAT Rate Increase Webinar PresentationAhmedNo ratings yet

- RR 12-2007Document9 pagesRR 12-2007Aris Basco DuroyNo ratings yet

- Input - Output TaxDocument23 pagesInput - Output TaxLipu MohapatraNo ratings yet

- 1 - TRAIN On Govt Agencies - NMT - 03.06.2018Document26 pages1 - TRAIN On Govt Agencies - NMT - 03.06.2018NISREEN WAYANo ratings yet

- Income Tax 2008circluar06Document8 pagesIncome Tax 2008circluar06Qamar TanauliNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Quotation: Customer Code: 81063 Information VAT Number - 300055945410003Document1 pageQuotation: Customer Code: 81063 Information VAT Number - 300055945410003Marcial Jr. MilitanteNo ratings yet

- MarchDocument7 pagesMarchRohama TullaNo ratings yet

- Changes in Income-Tax - 2020-21 PDFDocument32 pagesChanges in Income-Tax - 2020-21 PDFmir makarim ahsanNo ratings yet

- Declaration 1220129149789Document4 pagesDeclaration 1220129149789hizbullahjantankNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document187 pagesTax Reform For Acceleration and Inclusion (TRAIN)Janna GunioNo ratings yet

- Train LawDocument25 pagesTrain LawMariel Mangalino BautistaNo ratings yet

- Madu 2307 Computation April 2022Document3 pagesMadu 2307 Computation April 2022MADU WATER TANK MANUFACTURINGNo ratings yet

- Tax Card 2024 (Updated)Document2 pagesTax Card 2024 (Updated)Mansoor AhmadNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1rakxnachandran96No ratings yet

- CP 1 - Asian Cons V CADocument16 pagesCP 1 - Asian Cons V CATtlrpqNo ratings yet

- Awp Examination Guide For Exams From 1 May 2016 Up To 30 April 2017Document22 pagesAwp Examination Guide For Exams From 1 May 2016 Up To 30 April 2017Piere Christofer Salas HerreraNo ratings yet

- Alfanta Vs NoelDocument22 pagesAlfanta Vs NoelShiva0% (1)

- Move-Out Notice and Clearance Form: Item NoDocument1 pageMove-Out Notice and Clearance Form: Item NoJohn Basil ManuelNo ratings yet

- In The Matter of Brooke PintoDocument7 pagesIn The Matter of Brooke PintojonsteingartNo ratings yet

- Adalin Vs CADocument8 pagesAdalin Vs CADeric MacalinaoNo ratings yet

- CHFS QuestionnaireDocument102 pagesCHFS QuestionnaireNameNo ratings yet

- Lease Residence - BlankDocument5 pagesLease Residence - BlankMichael Kenneth AsbanNo ratings yet

- Contract of Lease Know All Men by These PresentsDocument3 pagesContract of Lease Know All Men by These PresentsToby RogersNo ratings yet

- FA1 Chapter 1 EngDocument21 pagesFA1 Chapter 1 EngYong ChanNo ratings yet

- Robert Matthew Park StatementDocument4 pagesRobert Matthew Park Statementagincourt1No ratings yet

- Rental AgreementDocument4 pagesRental AgreementAntony SheenNo ratings yet

- Sales Syllabus Parts I and IIDocument9 pagesSales Syllabus Parts I and IIJerome LeañoNo ratings yet

- AD Iver Nion AD Iver NionDocument17 pagesAD Iver Nion AD Iver NionMad River UnionNo ratings yet

- Real Estate ManagementDocument3 pagesReal Estate ManagementRubina HannureNo ratings yet

- Equipment Lease Agreement 11Document3 pagesEquipment Lease Agreement 11Jun-d SelloteNo ratings yet

- Commercial Lease Letter of IntentDocument2 pagesCommercial Lease Letter of IntentMiriam M. Ramirez100% (1)

- Taxation Law Mock BarDocument8 pagesTaxation Law Mock BarKC ManglapusNo ratings yet

- Kilos Bayan Vs GingonaDocument4 pagesKilos Bayan Vs GingonaGeraldine Gallaron - CasipongNo ratings yet

- II Obligations of The AgentDocument171 pagesII Obligations of The Agentbiancamille17No ratings yet

- Digest Datalift Movers, Inc. Vs Belgravia RealtyDocument2 pagesDigest Datalift Movers, Inc. Vs Belgravia Realtyleizle funa100% (1)

- Profe03 - Chapter 1 Business Combinations Recognition and MeasurementDocument19 pagesProfe03 - Chapter 1 Business Combinations Recognition and MeasurementSteffany Roque100% (1)

- Income Tax Practice QuestionsDocument18 pagesIncome Tax Practice QuestionsNuman Rox0% (2)

- Desk Review & Planning-SSDADocument5 pagesDesk Review & Planning-SSDARiya RoyNo ratings yet

- PPF REALTY Final Interview ScriptDocument5 pagesPPF REALTY Final Interview ScriptDexter MecaresNo ratings yet

- MR Sibeko ContractDocument2 pagesMR Sibeko ContractmajortradingzNo ratings yet

- FinalDocument2 pagesFinalJessica FordNo ratings yet

- Business Plan TemplateDocument19 pagesBusiness Plan Templateloganathan89No ratings yet

- CA IPCC ExamDocument9 pagesCA IPCC ExamTushar BhattacharyyaNo ratings yet