Professional Documents

Culture Documents

What Is The Basis For Computing Capital Gain? 2. - Explain The Following: A) Sec 54 B) Sec 54EC C) Sec 54F D) Sec 54 G

What Is The Basis For Computing Capital Gain? 2. - Explain The Following: A) Sec 54 B) Sec 54EC C) Sec 54F D) Sec 54 G

Uploaded by

yesmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is The Basis For Computing Capital Gain? 2. - Explain The Following: A) Sec 54 B) Sec 54EC C) Sec 54F D) Sec 54 G

What Is The Basis For Computing Capital Gain? 2. - Explain The Following: A) Sec 54 B) Sec 54EC C) Sec 54F D) Sec 54 G

Uploaded by

yesmanCopyright:

Available Formats

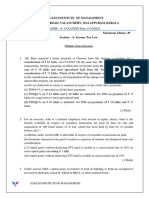

GURU NANAK COLLEGE(AUTONOMOUS)

DEPARTMENT OF COMMERCE(A&F)

INTERNAL ASSESSMENT - II

INCOME TAX LAW AND PRACTICE-II

MARKS-50

Section-A

Answer all the Questions (5x10=50)

1. What is the basis for computing capital gain?

2. . Explain the following:

a) Sec 54

b) Sec 54EC

c) Sec 54F

d) Sec 54 G

3. Mr Z has sold a residential house property and the capital gains is Rs 25,00,000/- in June

2019, it was purchased during 2007-08(551).He paid brokerage worth Rs.10000. In October

2019(289), Mr Z purchased a new residential house property of Rs 30,00,000/-. And deposit

Rs10,00,000 in CGA scheme. Compute taxable capital Gain.

4. Mr. Avtar Singh purchased a plot in 2002-03 for Rs 400,000 and it was sold on 15-1-20 for Rs

14,80,000 . He paid Rs 20,000 as brokerage charges. He invested Rs 200,000 in bonds issued by

NHAI on 31-3-20 and Rs 310,000 in Bonds issued by Rural electrification corporation on 1-6-

2019 ( Both notified u/s 54 EC) Compute the taxable amount of capital gain if CII for 2002-03 is

105 and for 2019-20 is 289.

5.Mr. Z acquired a plot of land on 30-6-2006 [ CII = 122] for Rs 750,000 and spent Rs 28,500 on

its registration and brokerage ,etc. This plot was sold for Rs 21,00,000 on 30-6-2019 [ CII =

289]. He had purchased a house for Rs 400,000 on 1-8-2017 for his own residence. He had paid

Rs 5,000 as ground rent for the plot held by him. Compute the amount of taxable capital gain for

the assessment year 2020-21.

*******

You might also like

- Direct Tax (Capital Gain)Document4 pagesDirect Tax (Capital Gain)SHRIKANT SAHUNo ratings yet

- Direct Tax (Capital Gain) PDFDocument4 pagesDirect Tax (Capital Gain) PDFSHRIKANT SAHUNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Guideline Answers: Professional ProgrammeDocument131 pagesGuideline Answers: Professional ProgrammeArham SoganiNo ratings yet

- 21MBA331 Direct TaxDocument4 pages21MBA331 Direct TaxManoj B.JNo ratings yet

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871No ratings yet

- Tax Old Q Mtp1 Ipc Oct21Document10 pagesTax Old Q Mtp1 Ipc Oct21abhishankar2904No ratings yet

- Eco 11Document4 pagesEco 11ps5927510No ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- FPDocument20 pagesFPRadhika ParekhNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- MTP 10 17 Questions 1694188914Document11 pagesMTP 10 17 Questions 1694188914luvkumar3532No ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Ca-Inter Nov.'21 Batch Test of Taxation Topic Covered: PGBPDocument5 pagesCa-Inter Nov.'21 Batch Test of Taxation Topic Covered: PGBPshettymihir9No ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- POA2TSDocument3 pagesPOA2TSMazin AminNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- IDT 2 New Question PaperDocument13 pagesIDT 2 New Question PaperSagar Deep MsdNo ratings yet

- Rise Tax Mock QP With SolutionDocument18 pagesRise Tax Mock QP With SolutionEmperor YasuoNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Indirect Tax Prelim-II - Question PaperDocument7 pagesIndirect Tax Prelim-II - Question Paperhitendrapatil6778No ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Tax Mock Test PaperDocument17 pagesTax Mock Test Papermanyagoyall20No ratings yet

- Tax Mid Term (Q) S24Document5 pagesTax Mid Term (Q) S24abdulazeem_cfeNo ratings yet

- Taxation - English Question 27.01.2023Document12 pagesTaxation - English Question 27.01.2023harish jangidNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Test Series - Set 5 - Ay 20-21Document16 pagesTest Series - Set 5 - Ay 20-21Urusi TeklaNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha MamDocument9 pagesAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaNo ratings yet

- Alhamd Taxation Tests and SolutionDocument35 pagesAlhamd Taxation Tests and Solutionshahnawaz243No ratings yet

- UntitledDocument158 pagesUntitledSakshi KhandelwalNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Caf 6 Tax Autumn 2015Document4 pagesCaf 6 Tax Autumn 2015ملک محمد کاشف شہزاد اعوانNo ratings yet

- (April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument12 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- Capital Gain & IFOS - PaperDocument3 pagesCapital Gain & IFOS - Papermshivam617No ratings yet

- Paper - 7: Direct Taxes QuestionsDocument33 pagesPaper - 7: Direct Taxes QuestionsArjun GopalakrishnaNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- CTFP Unit 2 CG ProblemsDocument3 pagesCTFP Unit 2 CG ProblemsKshitishNo ratings yet

- Salary - PaperDocument5 pagesSalary - PaperVenkataRajuNo ratings yet

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- Sem 3rd INTERNAl - Income Tax Law & PracticeDocument2 pagesSem 3rd INTERNAl - Income Tax Law & PracticeAdarsh SinghNo ratings yet

- Eco - 02 e 2013-14Document3 pagesEco - 02 e 2013-14Mayur GoyalNo ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- Basics & House Property - PaperDocument4 pagesBasics & House Property - Papervishwajeetpatil0542No ratings yet

- Taxation Class Test 6Document5 pagesTaxation Class Test 6ap.quatrroNo ratings yet

- Taxation Class Test 6Document5 pagesTaxation Class Test 6ap.quatrroNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- QP - TaxDocument4 pagesQP - Taxcommercetrek21No ratings yet

- Paper - 4: Taxation Section A: Income Tax Law: DebitsDocument27 pagesPaper - 4: Taxation Section A: Income Tax Law: DebitsUdit KaushikNo ratings yet

- Bosmtpinterp 4 QDocument12 pagesBosmtpinterp 4 QUrvi MishraNo ratings yet